China Unicom Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Unicom Bundle

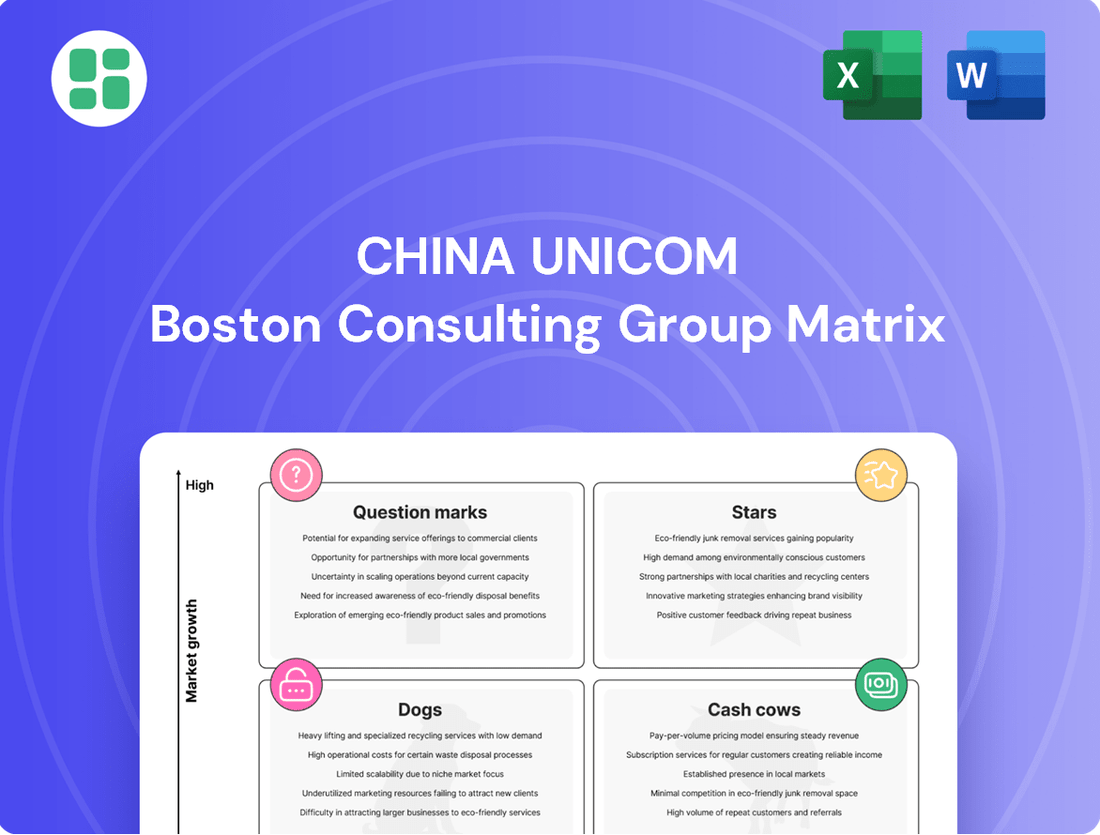

Curious about China Unicom's strategic positioning? Our BCG Matrix preview offers a glimpse into how their diverse portfolio stacks up in the competitive telecom landscape. Understand which services are driving growth and which might need a strategic rethink.

Don't settle for a partial view. Purchase the full China Unicom BCG Matrix to unlock detailed quadrant analysis, revealing their Stars, Cash Cows, Dogs, and Question Marks with actionable insights. Empower your investment and product development decisions with this comprehensive report.

Stars

China Unicom is making significant strides in its 5G-Advanced (5G-A) deployment, with plans to achieve continuous coverage in key areas across 300 cities by the close of 2025. This aggressive rollout of next-generation technology, offering enhanced mobile broadband and new service capabilities, firmly places the company as a leader in network evolution. The substantial investments being poured into 5G-A infrastructure highlight its considerable growth potential and its critical role in securing future revenue.

China Unicom is significantly boosting its intelligent computing and AI infrastructure, with a planned 28% surge in computing power spending for 2025. This strategic move involves exploring a massive 100,000-GPU cluster deployment.

The company aims to achieve 45 EFLOPS of computing power by the close of 2025, demonstrating a strong commitment to expanding its AI capabilities. These investments in AI-optimized data centers are crucial for capturing growth in a market with escalating demand for advanced computing resources.

Unicom Cloud Services is a shining star within China Unicom's portfolio, demonstrating robust growth. In 2024, its revenue climbed an impressive 17.1% year-on-year, reaching RMB 68.6 billion. This momentum continued into the first quarter of 2025, with revenue hitting RMB 19.72 billion.

The company is strategically capturing market share in critical sectors, including government clouds, medical clouds, and the cloudification of state-owned enterprises. This expansion, coupled with significant growth in intelligent computing, solidifies Unicom Cloud's position as a high-potential, star performer.

5G + Industrial Internet Projects

China Unicom is making significant strides in the 5G + Industrial Internet space, a sector poised for substantial growth. By the end of 2024, the company had deployed over 30,000 projects and established more than 7,500 5G factories, demonstrating its commitment and execution capability in this advanced technology integration.

The demand for virtual 5G industry private networks is robust, with a continuously increasing customer base. This trend highlights China Unicom's success in capturing a leading position within this specialized, high-growth enterprise market segment.

- Market Leadership: China Unicom leads in 5G + Industrial Internet deployments.

- Project Scale: Over 30,000 projects and 7,500 5G factories established by end of 2024.

- Customer Growth: Steady increase in customers utilizing virtual 5G industry private networks.

- Segment Focus: Strong performance in the specialized, high-growth enterprise sector.

Internet of Things (IoT) Connections

China Unicom's Internet of Things (IoT) segment is a significant growth driver, reflecting its strategic focus on expanding connectivity solutions. The company reported a substantial 663 million IoT connections as of Q1 2025, indicating robust expansion in this sector.

The company added a remarkable 130 million net new IoT connections throughout 2024, underscoring its aggressive market penetration and service adoption. This growth trajectory positions IoT as a key pillar in China Unicom's overall business strategy, capitalizing on the increasing demand for connected devices and services across various industries.

Within the broader IoT landscape, China Unicom demonstrates particular strength in the Internet of Vehicles (IoV) segment. Its IoV connections surpassed 76 million, highlighting a leading position in a rapidly evolving and high-potential market.

- IoT Connections: 663 million (Q1 2025)

- Net IoT Additions (2024): 130 million

- Internet of Vehicles (IoV) Connections: Over 76 million

- Market Position: Strong, bolstered by scale and strategic partnerships in IoT.

Unicom Cloud Services is a definite star performer, showing exceptional revenue growth. Its revenue reached RMB 68.6 billion in 2024, a 17.1% increase year-on-year, and continued strongly into Q1 2025 with RMB 19.72 billion. The company is successfully expanding in government, medical, and state-owned enterprise cloud markets, reinforcing its high-potential status.

The 5G + Industrial Internet sector is another star, with China Unicom leading deployments. By the end of 2024, over 30,000 projects and 7,500 5G factories were established. The increasing demand for virtual 5G industry private networks further solidifies this segment's strong growth potential and market leadership.

China Unicom's Internet of Things (IoT) segment, particularly its Internet of Vehicles (IoV) sub-segment, is a significant growth engine. The company reported 663 million IoT connections by Q1 2025, adding 130 million net new connections in 2024. Its IoV connections exceeding 76 million highlight a leading position in a rapidly expanding market.

| Business Segment | Growth Indicator | Key Metric (as of latest data) | Market Position |

|---|---|---|---|

| Unicom Cloud Services | Revenue Growth | RMB 68.6 billion (2024), +17.1% YoY | Star Performer, strong in government, medical, SOE sectors |

| 5G + Industrial Internet | Deployment Scale | 30,000+ projects, 7,500+ 5G factories (end of 2024) | Market Leader, high demand for private networks |

| Internet of Things (IoT) | Connection Volume | 663 million IoT connections (Q1 2025) | Significant Growth Driver, strong in IoV |

| Internet of Vehicles (IoV) | Segment Specifics | Over 76 million IoV connections | Leading position in a high-potential market |

What is included in the product

This BCG Matrix analysis highlights China Unicom's strategic positioning, identifying growth opportunities and areas for resource allocation.

A clear BCG Matrix visual for China Unicom's units offers a pain-point reliever by simplifying complex portfolio decisions.

Cash Cows

China Unicom's traditional mobile connectivity, covering 4G and consumer 5G, is a strong Cash Cow. The company's mobile user base reached 349 million in Q1 2025, demonstrating continued growth.

This segment, with a total mobile and broadband subscriber base of 470 million in 2024, operates in a mature market. High penetration rates ensure stable and substantial revenue generation for China Unicom.

China Unicom's fixed-line broadband services are a clear Cash Cow. With 124 million fixed broadband users as of Q1 2025, building on over 120 million in 2024, the company commands a significant presence in a mature market. This established user base, supported by ongoing fiber network expansion and a focus on gigabit speeds, generates reliable, high-margin revenue streams.

China Unicom's basic data center (IDC) services are a cornerstone of its digital intelligence offerings, functioning as a classic Cash Cow. In the first quarter of 2025, this segment achieved RMB 7.22 billion in revenue, marking an 8.8% increase compared to the same period in the previous year. For the entirety of 2024, the data center business brought in RMB 25.9 billion.

This consistent performance is driven by the mature nature of the IDC market and Unicom's established infrastructure. The extensive network and existing enterprise client relationships ensure stable revenue streams and healthy profit margins, making it a reliable contributor to the company's overall financial health.

Traditional Voice and SMS Services

Traditional voice and SMS services, while not growth engines for China Unicom, are essential to its core business. These services benefit from the company's established, widespread network infrastructure and a large existing customer base. They generate consistent, though diminishing, cash flow with very little need for further capital expenditure.

In 2024, China Unicom's traditional services continue to represent a stable revenue stream. Although the overall market for voice and SMS is mature, the sheer volume of users ensures ongoing contributions to the company's financial stability. This stability allows for the reallocation of resources towards more dynamic growth areas.

- Foundational Offering: Voice and SMS are crucial for China Unicom's 'Ubiquitous Connectivity' strategy, providing a reliable base service.

- Stable Cash Flow: Despite low growth, these services generate predictable revenue with minimal ongoing investment needs.

- Leveraging Infrastructure: Existing extensive network assets and a substantial subscriber base support the continued viability of these traditional services.

International Business Services

China Unicom's International Business Services is positioned as a Cash Cow within its BCG Matrix. This segment experienced robust growth, with revenues hitting RMB 12.5 billion in 2024, marking a significant 15.2% year-on-year increase.

The segment's strength lies in its ability to generate stable, recurring revenue by capitalizing on established global network assets and strategic partnerships. These mature overseas markets and extensive roaming services contribute consistently to China Unicom's overall financial health, acting as a reliable source of cash flow.

- Revenue Growth: 15.2% year-on-year increase in 2024.

- 2024 Revenue: RMB 12.5 billion.

- Key Drivers: Global network assets, international partnerships, mature overseas markets, and roaming services.

- Financial Contribution: Provides stable, recurring revenue and acts as a reliable cash generator.

China Unicom's core mobile connectivity, encompassing 4G and consumer 5G, stands as a robust Cash Cow. The company's mobile subscriber base reached 349 million in Q1 2025, building on a total mobile and broadband user base of 470 million in 2024. This segment operates in a mature market with high penetration rates, ensuring consistent and substantial revenue generation.

The fixed-line broadband services are another significant Cash Cow, serving 124 million users as of Q1 2025, an increase from over 120 million in 2024. This established user base, supported by ongoing fiber expansion, generates reliable, high-margin revenue, solidifying its position as a stable contributor.

China Unicom's basic data center (IDC) services are a prime example of a Cash Cow, with revenues reaching RMB 7.22 billion in Q1 2025, an 8.8% increase year-on-year, and RMB 25.9 billion for the entirety of 2024. The maturity of the IDC market and Unicom's existing infrastructure and client relationships ensure stable revenue streams and healthy profit margins.

Traditional voice and SMS services, while not growth drivers, are essential Cash Cows due to their established network and large user base. These services generate predictable revenue with minimal capital expenditure needs, contributing to overall financial stability and allowing resource reallocation to growth areas.

| Segment | 2024 Revenue (RMB Billions) | Q1 2025 Update | Market Maturity | Cash Flow Generation |

| Mobile Connectivity (4G/5G) | N/A | 349M subscribers | Mature | Stable & Substantial |

| Fixed-line Broadband | N/A | 124M users | Mature | Reliable & High-Margin |

| Basic Data Center (IDC) | 25.9 | RMB 7.22B (Q1 2025) | Mature | Consistent & Healthy |

| Voice & SMS | N/A | Established Base | Mature | Predictable & Minimal Capex |

Delivered as Shown

China Unicom BCG Matrix

The China Unicom BCG Matrix preview you are seeing is the complete, unwatermarked document you will receive immediately upon purchase. This meticulously crafted analysis provides a clear, actionable framework for understanding China Unicom's business portfolio, allowing for immediate strategic decision-making without any further editing or revisions. You are viewing the exact, professionally formatted report that will be yours to download and utilize for your business planning and competitive insights.

Dogs

China Unicom's 2G/3G legacy mobile services are clearly in the Dogs quadrant. These older technologies are seeing a sharp decline in usage as customers increasingly adopt 4G and 5G. For instance, by the end of 2023, China's 5G connections had surpassed 3.37 billion, a significant jump that directly impacts the relevance of 2G/3G.

The market for 2G/3G is shrinking, with very few new customers signing up and the costs to maintain these aging networks are rising disproportionately to the revenue they generate. This situation makes them a prime candidate for eventual divestment or a planned shutdown, as the company focuses resources on more advanced and profitable network technologies.

Traditional fixed-line telephone services for China Unicom are firmly in the Dogs quadrant of the BCG Matrix. This segment has seen a consistent decrease in subscriber numbers, a pattern mirrored globally in the telecommunications industry.

With a very low market share and minimal growth prospects, this service contributes little to China Unicom's overall revenue. In fact, it often represents a net cost due to ongoing maintenance expenses for a diminishing user base.

China Unicom's legacy value-added services, like basic ringback tones and simple SMS/MMS, are struggling. These offerings are losing out to more advanced digital services and over-the-top (OTT) internet applications, which provide richer user experiences.

These older services hold a low market share and show no real growth potential. In 2023, revenue from traditional VAS for many Chinese telecom operators saw a decline, with a significant portion of user engagement shifting to platforms like WeChat and Douyin for communication and entertainment.

Despite their declining relevance, these services continue to consume valuable resources. This diverts investment away from more promising areas, impacting overall efficiency and profitability for China Unicom.

Commoditized Low-ARPU IoT Connections

Within China Unicom's BCG Matrix, commoditized low-ARPU IoT connections are categorized as Dogs. These are IoT services that, while part of a growing sector, offer very little revenue per user. Think of basic tracking devices or simple sensor networks that have become widely available and lack unique features.

These types of connections often operate on older network technologies, which limits their capabilities and appeal. Furthermore, the market for these basic IoT applications is often saturated, leading to intense price competition and further depressing revenue. In 2023, the average revenue per IoT connection for basic services globally hovered around a few dollars per month, underscoring the low ARPU.

- Low Revenue Generation: These connections contribute minimally to overall revenue due to their low ARPU, often below $5 per connection per month.

- Market Saturation: Many basic IoT applications, like simple asset tracking, are highly commoditized, leading to intense competition.

- Strategic Misalignment: They may not align with China Unicom's strategic focus on higher-value digital intelligence services and advanced IoT solutions.

- Resource Drain: Maintaining these low-margin services can tie up resources that could be better allocated to more promising growth areas.

Underperforming Non-Strategic Enterprise Solutions

Underperforming Non-Strategic Enterprise Solutions in China Unicom's BCG Matrix represent areas that are not contributing significantly to growth or market share. These might be older software systems or niche services that require substantial upkeep but offer minimal return on investment. For instance, a legacy customer relationship management system that is costly to maintain and doesn't integrate with newer cloud-based platforms could fall into this category.

These "dogs" often drain resources that could be better allocated to more promising ventures. In 2024, China Unicom, like many large telecommunications firms, is focusing on streamlining its operations and investing in areas like 5G infrastructure and advanced cloud services. Solutions that do not align with this strategic direction, such as outdated data processing platforms for specific legacy industries, are prime candidates for divestment or phasing out. The challenge lies in identifying these assets and making the difficult decision to let them go to free up capital and personnel for more strategic initiatives.

- Resource Drain: Older, non-scalable enterprise solutions can consume significant IT maintenance budgets, diverting funds from innovation.

- Low ROI: These "dog" services often generate minimal revenue or profit, failing to justify their ongoing operational costs.

- Strategic Misalignment: Solutions that do not support China Unicom's core digital transformation, such as 5G and cloud services, are considered non-strategic.

- Hindrance to Agility: Maintaining legacy systems can slow down the adoption of new technologies and limit the company's ability to respond to market changes.

China Unicom's legacy 2G/3G mobile services are firmly in the Dogs quadrant, facing declining usage as 4G and 5G adoption surges. By the end of 2023, China's 5G connections exceeded 3.37 billion, highlighting the diminishing relevance of older technologies. These services are characterized by a shrinking market, minimal new customer acquisition, and rising maintenance costs that outweigh their revenue generation, making them candidates for divestment.

Traditional fixed-line telephone services also reside in the Dogs quadrant, experiencing a consistent subscriber decline. With a low market share and negligible growth prospects, this segment offers minimal revenue and often represents a net cost due to ongoing maintenance for a shrinking user base.

Commoditized, low-ARPU IoT connections are also classified as Dogs. These services, often operating on older network technologies, face market saturation and intense price competition, leading to very low revenue per user. For instance, in 2023, the average revenue per basic IoT connection globally was only a few dollars per month.

Underperforming non-strategic enterprise solutions, such as legacy IT systems, drain resources with minimal returns. These services, costing significant IT maintenance budgets, often have a low ROI and hinder agility by slowing the adoption of new technologies. In 2024, China Unicom's focus on 5G and cloud services further emphasizes the need to divest or phase out such outdated platforms.

| Service Area | BCG Quadrant | Key Characteristics | Financial Impact | Strategic Implication |

| 2G/3G Mobile Services | Dogs | Declining usage, high maintenance costs, shrinking market | Low revenue, high operational expenditure | Resource drain, candidate for divestment |

| Fixed-Line Telephony | Dogs | Consistent subscriber decline, low market share, minimal growth | Net cost, negligible revenue contribution | Focus on phasing out, resource reallocation |

| Commoditized IoT Connections | Dogs | Low ARPU, market saturation, price competition | Minimal revenue per connection, low margins | Strategic misalignment with advanced IoT |

| Legacy Enterprise Solutions | Dogs | High maintenance costs, low ROI, outdated technology | Resource drain, hinders innovation investment | Hindrance to agility, need for divestment |

Question Marks

China Unicom's Yuanjing Wanwu AI Agent Development Platform represents a strategic move into the burgeoning AI sector, aiming to foster an ecosystem for AI application creation. This platform is positioned as a Stars or Question Marks category within the BCG matrix, given its newness and the high-growth potential of the AI market.

While the platform is designed to empower partners, its current market penetration and revenue generation are likely minimal, characteristic of a Question Mark. Significant investment will be crucial to drive adoption, refine capabilities, and establish a competitive edge against established players in the AI development space.

China Unicom's investment in AI-driven digital lifestyle and smart home products, such as 5G New Calling and the 'Smart Home Tone' robot, positions it in a rapidly expanding market. The smart home sector in China saw significant growth, with revenue projected to reach $70 billion in 2024, indicating strong potential.

These new offerings are categorized as question marks due to their novelty and the need to quickly acquire a substantial paying user base. For instance, the adoption rate of smart home devices is crucial; by the end of 2023, over 200 million households in China had at least one smart home device, a figure Unicom aims to leverage.

China Unicom's investment in Integrated Communication and Sensing (ICS) technologies, along with integrated sky and earth networks, positions them within the Stars quadrant of the BCG matrix. These advanced capabilities, crucial for 5G-Advanced, represent high-growth potential due to their innovative nature and emerging applications.

While these technologies are in the early stages of commercialization, their development signifies a strategic focus on future market leadership. China Unicom's commitment to substantial R&D in these areas underscores their belief in the long-term revenue generation and market share expansion these ventures can achieve, even with current low market penetration.

Specialized Niche Enterprise Digital Solutions (Early Stage)

Within China Unicom's Computing and Digital Smart Applications (CDSA) segment, early-stage, specialized niche enterprise digital solutions represent potential question marks. These offerings, targeting emerging areas like advanced smart city infrastructure or bespoke solutions for niche vertical industries, are positioned for high growth but currently exhibit low market share and may require significant investment to scale. For instance, a new AI-driven predictive maintenance platform for specialized industrial equipment, while promising, might still be in its early adoption phase.

These specialized solutions are characterized by their focus on high-potential, yet unproven, market segments. While the overall digital transformation market in China is expanding rapidly, with the digital economy projected to contribute significantly to GDP, these niche offerings are still carving out their space. By July 2025, China Unicom's investment in these areas will be crucial for their transition from question marks to stars.

- Targeting High-Growth Sub-Segments: Solutions for specific smart city applications, like intelligent traffic management or environmental monitoring systems, are entering markets with substantial projected growth rates.

- Limited Market Penetration: Despite the potential, these specialized solutions often face challenges in achieving widespread adoption due to their novelty and the need for extensive customization for diverse enterprise needs.

- Investment Requirement: Significant ongoing research and development, coupled with marketing and sales efforts, are necessary to build brand recognition and secure a solid customer base in these nascent markets.

- Future Potential: Successful development and market entry could position these niche solutions as future cash cows as their respective markets mature and demand increases.

eSIM Solutions for IoT and Automotive

China Unicom is making significant strides in the eSIM space, especially for the burgeoning Internet of Things (IoT) and automotive sectors. They are actively forging strategic partnerships to accelerate eSIM adoption in these areas.

While the IoT and automotive markets represent a high-growth trajectory for eSIM technology, China Unicom’s current market share in providing these solutions within these specific verticals is still in its formative stages. This necessitates ongoing investment to secure a more substantial position and capitalize on the anticipated expansion.

- Market Potential: The global IoT connections are projected to reach 29.3 billion by 2030, with automotive applications forming a substantial portion of this growth.

- Strategic Focus: China Unicom's engagement in eSIM for IoT and automotive aligns with industry trends, positioning them to benefit from increased device connectivity.

- Investment Needs: Capturing significant market share will require continued investment in infrastructure, partnerships, and tailored eSIM solutions for these specialized sectors.

- Competitive Landscape: The eSIM market is competitive, with established players and emerging technologies requiring China Unicom to differentiate its offerings effectively.

China Unicom's AI agent development platform and smart home initiatives are prime examples of Question Marks in their BCG matrix. These ventures operate in high-growth markets, such as AI and smart homes, which are projected to see significant expansion. However, their current market penetration and revenue generation are still in early stages, demanding substantial investment to gain traction and compete effectively.

The company's focus on niche enterprise digital solutions within its CDSA segment also falls into the Question Mark category. While these offerings target expanding digital transformation markets, their specialized nature means they are still establishing market share and require considerable R&D and marketing to scale successfully. Similarly, their eSIM solutions for IoT and automotive are in a high-potential but nascent phase, needing continued investment to secure a stronger foothold.

| Business Unit | BCG Category | Market Growth | Market Share | Investment Needs |

|---|---|---|---|---|

| AI Agent Development Platform | Question Mark | High | Low | High |

| Smart Home Products (e.g., 5G New Calling) | Question Mark | High | Low | High |

| Niche Enterprise Digital Solutions | Question Mark | High | Low | High |

| eSIM for IoT & Automotive | Question Mark | High | Low | High |

BCG Matrix Data Sources

Our China Unicom BCG Matrix is built on comprehensive data, integrating financial reports, market share analysis, and industry growth forecasts.