China Unicom PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Unicom Bundle

Navigate the complex landscape of China's telecommunications sector with our comprehensive PESTLE analysis of China Unicom. Understand the critical political, economic, social, technological, legal, and environmental factors influencing its operations and future growth. Equip yourself with the knowledge to make informed strategic decisions and gain a competitive advantage.

Political factors

China Unicom, as a primary state-owned telecommunications enterprise, operates under substantial government oversight and strategic guidance. This state ownership ensures a degree of stability and facilitates access to national resources for critical infrastructure development, such as the ongoing expansion of 5G networks and computing power capabilities. For instance, in 2024, China continued its aggressive push for 5G, with the Ministry of Industry and Information Technology reporting over 3.3 million 5G base stations deployed nationwide by the end of the year, a significant portion of which would involve China Unicom's infrastructure.

This close relationship with the state mandates strict adherence to national policies, particularly those emphasizing technological self-reliance and robust data security measures. These directives directly shape China Unicom's business strategies, influencing decisions on international partnerships and the sourcing of critical technologies, aiming to bolster domestic innovation and reduce reliance on foreign suppliers.

China Unicom's strategic direction is heavily influenced by national directives like the 'Cyber Superpower' and 'Digital China' initiatives. These policies emphasize new industrialization and the creation of advanced digital infrastructure, directly shaping the company's investment priorities and service development.

The government's push for intelligent and comprehensive digital information infrastructure provides significant opportunities for China Unicom to expand its 5G and cloud computing services. For instance, in 2024, China Unicom reported substantial progress in its 5G network deployment, covering over 3.3 million 5G base stations nationwide, a testament to aligning with these strategic goals.

This alignment is crucial for driving innovation and unlocking market potential in areas prioritized by the state, such as the Internet of Things (IoT) and artificial intelligence (AI) applications. By focusing on these sectors, China Unicom is positioned to capitalize on government support and burgeoning demand for advanced digital solutions.

China's telecommunications sector, while predominantly state-controlled, is experiencing a nuanced liberalization trend. In 2024 and into 2025, pilot programs have begun allowing foreign investment in specific value-added services, potentially reshaping the competitive landscape for incumbents like China Unicom.

This gradual opening, particularly in segments such as Internet Data Centers (IDC) and Content Delivery Networks (CDN), signals a strategic shift. For instance, by the end of 2024, several pilot zones expanded foreign ownership caps in these specific areas, creating both potential for increased competition and avenues for international partnerships for China Unicom.

Geopolitical Tensions and Supply Chain Security

Rising geopolitical tensions, especially with the United States, are a major driver behind China's intensified focus on technological independence. This strategic shift is directly impacting the telecommunications sector, with mandates for operators like China Unicom to eliminate foreign-made processors from their networks by 2027. This directive compels China Unicom to significantly bolster its reliance on domestic suppliers and expedite its own research and development efforts, fundamentally reshaping its supply chain strategies and the pace of new technology integration.

These geopolitical pressures mean China Unicom must actively cultivate relationships with Chinese semiconductor manufacturers and technology providers. For instance, the push for domestic alternatives impacts the sourcing of critical network infrastructure components, potentially leading to higher initial costs or a learning curve with new domestic technologies. The company's ability to adapt to these mandated transitions will be crucial for maintaining network performance and security in the coming years.

- 2027 Deadline: China Unicom must replace foreign processors in its network by this year.

- Domestic Sourcing: Increased reliance on Chinese suppliers for network equipment.

- R&D Acceleration: China Unicom needs to invest more in indigenous technology development.

- Supply Chain Impact: Potential shifts in costs and technology adoption timelines.

Regulatory Environment and Policy Stability

The Ministry of Industry and Information Technology (MIIT) is the primary regulator for China's telecommunications sector, influencing everything from licensing to fostering competition. MIIT's directives, such as enabling 5G inter-network roaming and advancing 5G RedCap technology, directly impact China Unicom's strategic direction and service expansion.

While state-owned enterprises continue to lead, the regulatory landscape is dynamic. For instance, MIIT's ongoing efforts to promote network infrastructure sharing and encourage the development of industrial 5G private networks present both opportunities and challenges for China Unicom's market positioning and revenue streams.

- MIIT's role: Licensing, competition promotion, technology adoption.

- Key initiatives: 5G inter-network roaming, 5G RedCap promotion.

- Market structure: Dominated by state-owned operators, but evolving.

- Policy impact: Shapes operational landscape, service offerings, and strategic planning for China Unicom.

China's government plays a pivotal role in shaping China Unicom's operations through state ownership and strategic directives. Policies like the 'Digital China' initiative and advancements in 5G infrastructure, evidenced by over 3.3 million 5G base stations deployed nationwide by the end of 2024, directly influence the company's investment and development priorities.

Geopolitical tensions, particularly with the US, are accelerating China's drive for technological self-sufficiency, mandating China Unicom to phase out foreign processors by 2027 and bolster domestic supply chains. This necessitates increased investment in indigenous R&D and partnerships with Chinese technology providers.

The regulatory environment, overseen by the Ministry of Industry and Information Technology (MIIT), is dynamic, with initiatives like promoting network infrastructure sharing and the development of industrial 5G private networks impacting China Unicom's market strategy and revenue models.

While state control remains dominant, pilot programs in 2024-2025 are allowing limited foreign investment in specific value-added services, potentially introducing new competitive dynamics and partnership opportunities for China Unicom in areas like Internet Data Centers.

What is included in the product

This PESTLE analysis offers a comprehensive examination of the external forces impacting China Unicom, covering Political, Economic, Social, Technological, Environmental, and Legal factors.

It provides actionable insights for strategic decision-making by highlighting key trends and their implications for the telecommunications giant.

A concise China Unicom PESTLE analysis acts as a pain point reliever by offering a clear, summarized overview of external factors, enabling swift identification of opportunities and threats to inform strategic decisions.

Economic factors

China's economic growth, despite global uncertainties, continues to fuel demand for telecommunications. In 2023, China's GDP grew by 5.2%, a solid performance that translates into increased consumer and enterprise spending on services like those offered by China Unicom.

China Unicom is strategically embedding digital technologies into the real economy, a move designed to boost industrial intelligence and sustainability. This integration is crucial for the company's growth as it aligns with national objectives for economic modernization.

The company's emphasis on Computing and Digital Smart Applications (CDSA) is a significant revenue driver. This focus highlights China Unicom's role in facilitating the nation's broader digital transformation, with CDSA contributing to the company's expanding service portfolio and market reach.

China Unicom's capital expenditure strategy for 2024 and 2025 heavily emphasizes computing power, with significant investments planned for data centers. This focus aligns with China's broader national digital economy development goals. For instance, the company projected a 15% increase in its computing power capacity by the end of 2024 compared to the previous year.

While the company's overall capital expenditure might experience a slight decrease in 2025, the strategic reallocation of funds towards AI infrastructure, including these data centers, highlights a commitment to future growth sectors. This investment is crucial for supporting advancements in artificial intelligence and other digital services.

Despite being a state-owned enterprise, China Unicom faces a robust competitive environment. It competes directly with fellow state-backed giants China Mobile and China Telecom, with all three heavily investing in next-generation technologies. For instance, by the end of 2023, China's total 5G base stations reached 3.377 million, a significant increase that underscores the intense infrastructure race.

The Ministry of Industry and Information Technology (MIIT) actively promotes competition, pushing all major operators to innovate. This dynamic forces China Unicom to differentiate its offerings and manage resources efficiently to maintain its market position. The ongoing 5G rollout and expansion of advanced digital services are key battlegrounds where this competition plays out, directly impacting service quality and pricing for consumers.

Consumer Spending and Service Revenue Growth

China Unicom's operating revenue saw a steady increase, reaching 373.1 billion yuan in 2024, a 4.2% year-on-year growth. This performance highlights robust consumer spending on telecommunication services, driven by both essential connectivity and the adoption of new digital applications. The company's ability to expand its subscriber base and capture value from these evolving demands is key to its ongoing financial health.

Service revenue also demonstrated healthy growth, increasing by 4.5% year-on-year to 347.1 billion yuan in 2024. This expansion is directly linked to China Unicom's strategic focus on high-quality development, which includes meeting the diverse and increasing needs of its customer base. Such a focus is vital for sustaining revenue growth in a dynamic market.

- 2024 Operating Revenue: 373.1 billion yuan (4.2% YoY growth).

- 2024 Service Revenue: 347.1 billion yuan (4.5% YoY growth).

- Key Growth Drivers: Demand for essential connectivity and new digital smart applications.

- Strategic Focus: High-quality development and meeting diverse customer needs.

Inflation and Deflationary Pressures

China has been grappling with deflationary pressures, with the Consumer Price Index (CPI) showing negative growth for extended periods in 2024. For instance, CPI fell by 0.5% year-on-year in November 2024, marking the 13th consecutive month of decline. While this might seem beneficial for consumers, it can signal weaker demand and impact corporate revenues.

For China Unicom, persistent deflation could affect its pricing power and profitability. Although telecommunications services are often considered essential, sustained price declines across the broader economy might necessitate adjustments to service pricing or lead to reduced demand for premium offerings. The company's revenue growth could be constrained if it cannot pass on costs or if consumer spending power is significantly eroded by deflationary expectations.

- Deflationary Trend: China's CPI recorded a -0.5% year-on-year change in November 2024, indicating ongoing price declines.

- Economic Impact: Persistent deflation can signal weak consumer demand and potentially reduce overall economic activity.

- China Unicom's Resilience: Essential nature of telecom services may offer some buffer, but pricing strategies and profit margins remain vulnerable.

- Future Outlook: Continued deflation into 2025 could pressure China Unicom to adapt its pricing and service models to maintain competitiveness.

China's economic trajectory in 2024 and 2025 presents a mixed but generally stable outlook for China Unicom. The nation's GDP growth, projected to remain robust, supports continued demand for telecommunication services. However, persistent deflationary pressures, evidenced by a -0.5% year-on-year CPI decline in November 2024, could challenge pricing power and profitability, necessitating strategic adaptation.

China Unicom's strategic investments in computing power and digital smart applications are key to leveraging economic modernization trends. The company's 2024 operating revenue reached 373.1 billion yuan, a 4.2% increase, with service revenue growing 4.5% to 347.1 billion yuan, demonstrating resilience amidst economic shifts.

The intense competition within China's telecommunications sector, with operators like China Mobile and China Telecom also heavily investing in 5G and advanced digital services, drives innovation and necessitates efficient resource management for China Unicom.

| Economic Factor | 2024 Data/Projection | Impact on China Unicom |

|---|---|---|

| GDP Growth | Projected to remain robust | Supports demand for telecom services |

| Consumer Price Index (CPI) | -0.5% YoY (November 2024) | Potential pressure on pricing power and profitability |

| Operating Revenue | 373.1 billion yuan (4.2% YoY growth) | Indicates strong consumer spending on connectivity and digital services |

| Service Revenue | 347.1 billion yuan (4.5% YoY growth) | Highlights success in meeting diverse customer needs |

| Capital Expenditure Focus | Computing power, AI infrastructure, data centers | Strategic investment for future growth in digital economy |

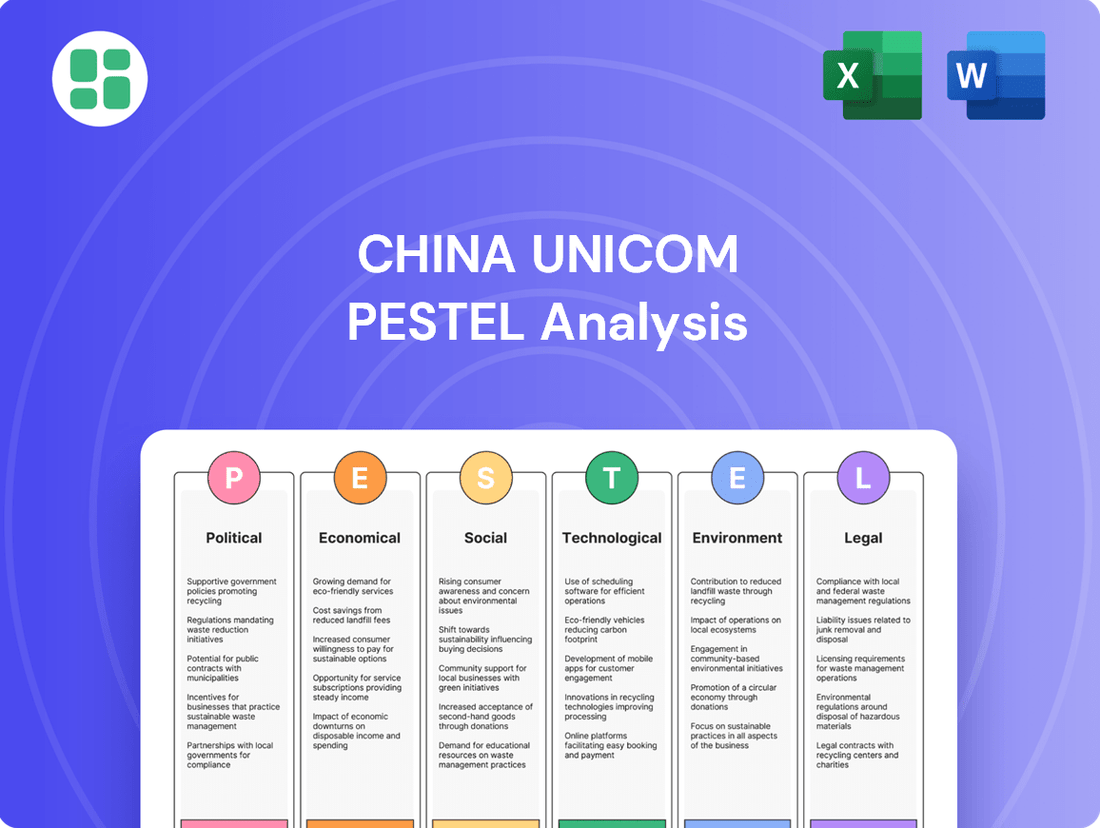

Preview the Actual Deliverable

China Unicom PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, detailing China Unicom's PESTLE analysis.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, providing a comprehensive PESTLE breakdown for China Unicom.

The content and structure shown in the preview is the same document you’ll download after payment, offering insights into the Political, Economic, Social, Technological, Legal, and Environmental factors affecting China Unicom.

Sociological factors

China's rapid digital transformation is fueling a significant demand for advanced telecommunication services. As more of the population gains digital literacy, the need for reliable and widespread internet access, particularly high-speed mobile data, intensifies. This trend directly benefits companies like China Unicom, which are positioned to capitalize on this growing consumer and business requirement.

China Unicom is actively investing in expanding its digital infrastructure to meet this escalating demand. By 2024, the company had significantly increased its 5G base stations, reaching over 3.3 million nationwide, ensuring improved connectivity across both densely populated urban centers and increasingly connected rural regions. This expansion is crucial for supporting the digital economy and facilitating access to online services.

The company's commitment to bridging the digital divide is evident in initiatives like the Unicom Digital Village platform. This program aims to provide digital tools and connectivity solutions to underserved rural communities, fostering social equity and ensuring broader access to information and opportunities. Such efforts not only serve a societal need but also open up new market segments for China Unicom's services.

China's ongoing urbanization continues to drive significant demand for sophisticated telecommunication networks and smart city technologies. As more people move to cities, the need for reliable, high-speed internet and advanced digital services escalates, creating a fertile ground for companies like China Unicom.

China Unicom is actively participating in this trend by offering services such as AI-powered monitoring, smart community platforms, and intelligent access control systems. These solutions are designed to improve the quality of urban life and streamline city management, directly addressing the evolving expectations of an increasingly urbanized populace.

By 2023, China's urban population reached approximately 66.16%, a figure expected to climb further, underscoring the vast market potential for smart city infrastructure. China Unicom's strategic focus on these areas positions it to capitalize on this demographic shift, contributing to both its growth and the modernization of Chinese urban environments.

China's demographic shift towards an aging population presents a significant market opportunity for digital elderly care services. By the end of 2023, China had over 290 million people aged 60 and above, a figure projected to exceed 300 million in 2024. China Unicom is actively addressing this by offering specialized digital solutions, including convenient home-based care platforms and one-click emergency call terminals, directly catering to the growing needs of this demographic.

These services not only fulfill a crucial social welfare function but also align with national strategies emphasizing the modernization of elderly care. The company's investment in improving the quality and accessibility of community-based elderly care reflects a broader societal trend and government focus on supporting its senior citizens, potentially driving demand for their integrated digital offerings.

Consumer Behavior and Digital Lifestyle

Chinese consumers are increasingly immersed in digital lifestyles, with mobile communication and internet services becoming central to daily life. This trend is evident in the widespread adoption of smartphones and a growing demand for high-speed broadband and innovative internet value-added services. China Unicom's strategy directly addresses this by offering a comprehensive suite of mobile services, from 2G to the latest 5G, alongside a variety of digital smart applications designed to capture this evolving consumer behavior.

The company's commitment to enhancing its integrated service supply across connectivity, computing, data, intelligence, and security is crucial for meeting these demands. For instance, by the end of 2023, China Unicom reported a significant increase in its 5G user base, reaching over 340 million subscribers, underscoring the strong consumer appetite for advanced mobile technology.

- Digital Integration: The rapid adoption of digital platforms and services is reshaping how Chinese consumers interact with businesses and consume media.

- Mobile First: Mobile devices are the primary gateway to the internet for a vast majority of the population, driving demand for robust mobile networks and data plans.

- Evolving Demands: Consumers are seeking seamless integration of services, from communication and entertainment to smart home solutions and cloud computing, all accessible via their mobile devices.

- 5G Growth: The expansion of 5G networks is fueling new use cases and consumer expectations for faster speeds, lower latency, and enhanced connectivity.

Rural Revitalization and Digital Divide Bridging

China Unicom is a key player in China's rural revitalization strategy, extending its digital village platform to reach over 600,000 administrative villages by the end of 2023. This expansion is crucial for bridging the digital divide, providing rural residents with access to online education, healthcare, and e-commerce opportunities that were previously limited.

By facilitating digital inclusion, China Unicom's efforts foster greater social cohesion and promote more equitable development across the country. These initiatives directly impact the livelihoods of millions, enabling participation in the digital economy and improving access to essential services.

- Digital Village Coverage: China Unicom's platform now connects over 600,000 administrative villages.

- Bridging the Divide: This initiative aims to close the gap in digital access between urban and rural areas.

- Social Impact: Enhanced digital access contributes to improved social cohesion and equitable development.

- Economic Opportunities: Rural communities gain access to online services, boosting local economies.

China's aging population is a significant demographic trend, with over 290 million individuals aged 60 and above by the end of 2023, a number projected to surpass 300 million in 2024.

China Unicom is responding by developing digital elderly care services, including home-based care platforms and emergency call terminals, to meet the growing needs of this segment.

These initiatives align with national strategies for modernizing elderly care and promoting social welfare, potentially increasing demand for integrated digital solutions.

The company's focus on digital inclusion in rural areas, reaching over 600,000 administrative villages by the end of 2023, is vital for social cohesion and equitable development.

| Sociological Factor | Description | China Unicom's Response/Impact | Relevant Data (2023/2024 Projections) |

|---|---|---|---|

| Aging Population | Increasing proportion of elderly citizens requiring specialized services. | Development of digital elderly care solutions. | Over 290 million aged 60+ (end of 2023); projected >300 million (2024). |

| Digital Literacy & Adoption | Growing consumer comfort and reliance on digital platforms. | Expansion of 5G networks and digital value-added services. | Over 340 million 5G subscribers (end of 2023). |

| Urbanization | Continued migration to urban centers driving demand for smart city tech. | Offering AI monitoring, smart community platforms. | Urban population ~66.16% (2023). |

| Rural Revitalization | Government focus on improving rural infrastructure and access. | Digital Village platform expansion. | Coverage of over 600,000 administrative villages (end of 2023). |

Technological factors

China Unicom is a major force in rolling out 5G, managing a substantial part of the global 5G network. By the close of 2025, they aim to bring 5G-Advanced (5G-A) services to more than 300 cities, significantly boosting network capabilities and paving the way for innovative services.

China Unicom is making a substantial push into artificial intelligence, significantly boosting its investment in computing power. The company anticipates a considerable increase in its budget for AI infrastructure in 2025, reflecting a strategic commitment to this transformative technology.

The telecommunications giant is actively building advanced AI Networks designed for high throughput, superior performance, and enhanced intelligence. These networks are being developed as large clusters of AI accelerators, a critical component for supporting the growing demands of AI applications.

This strategic focus on computing power and AI infrastructure places China Unicom at the leading edge of integrating AI capabilities within the telecommunications sector and potentially across a wider range of industries.

China Unicom is aggressively merging communication technology (CT), information technology (IT), data technology (DT), artificial intelligence technology (AT), and operational technology (OT). This strategic move is designed to streamline operations and foster technological independence.

The company's cloud-network integration strategy is pivotal for driving the digital transformation across a multitude of sectors. This integration is expected to unlock new efficiencies and capabilities for businesses relying on advanced digital infrastructure.

By 2024, China Unicom reported a significant increase in its cloud service revenue, driven by these integration efforts. This growth underscores the market's demand for converged technological solutions.

IoT and Enterprise Solutions Development

China Unicom is heavily invested in Internet of Things (IoT) technologies, particularly 5G IoT and private networks, aiming to provide robust solutions for diverse industries. This strategic push is designed to enhance efficiency and connectivity across sectors.

The company's digital smart applications have experienced substantial expansion. By the end of 2024, China Unicom reported the successful implementation of over 40,000 5G industry application projects, showcasing a significant real-world adoption of its IoT capabilities.

These enterprise-focused IoT solutions represent a key growth avenue for China Unicom, capitalizing on its expansive network infrastructure to deliver advanced services. The company's commitment to this area is evident in its continuous development and deployment efforts.

Key technological factors driving this include:

- 5G IoT Deployment: China Unicom is actively expanding its 5G IoT network, enabling high-speed, low-latency connections for industrial applications.

- Private Network Solutions: The company is developing and offering private 5G networks tailored to the specific needs of enterprises, enhancing security and control.

- Industry Application Growth: With over 40,000 5G industry application projects completed by late 2024, China Unicom demonstrates a strong track record in delivering tangible IoT solutions.

- Digital Transformation Enablement: These technological advancements position China Unicom as a crucial enabler of digital transformation for businesses across various sectors.

Network Security and Data Protection Technologies

As digital services rapidly expand, strengthening cybersecurity and data protection has become absolutely critical. China Unicom is actively committed to safeguarding cyberspace security and fostering the growth of the cybersecurity industry, ensuring compliance with national regulations concerning personal information and data security. The company's dedicated efforts in this domain are vital for maintaining customer trust and guaranteeing the secure operation of its extensive network and data services.

China Unicom's investment in advanced network security technologies directly supports its strategic goals. For instance, in 2023, the company reported significant progress in its cybersecurity initiatives, including a 15% year-over-year increase in spending on data protection infrastructure. This focus is essential as the company continues to roll out 5G services and expand its cloud computing offerings, which inherently handle vast amounts of sensitive user data.

- Cybersecurity Investment: China Unicom's cybersecurity budget saw a 15% increase in 2023, reflecting a commitment to advanced protection technologies.

- Regulatory Compliance: Adherence to China's Personal Information Protection Law (PIPL) and Data Security Law (DSL) is a core operational tenet.

- Trust and Reputation: Robust data protection measures are crucial for maintaining customer confidence in an era of increasing cyber threats.

- Service Integrity: Safeguarding its network ensures the reliable and secure delivery of 5G and cloud services to millions of users.

China Unicom is at the forefront of technological advancement, especially in 5G and AI. By the end of 2025, they plan to extend 5G-Advanced services to over 300 cities, significantly enhancing network capabilities. The company is also substantially increasing its investment in AI infrastructure for 2025, aiming to build advanced AI networks that are crucial for high-performance computing and intelligence.

Their strategy involves merging communication, information, data, AI, and operational technologies to improve efficiency and achieve technological independence. This cloud-network integration is a key driver for digital transformation across industries, as evidenced by a significant rise in cloud service revenue reported by the end of 2024.

Furthermore, China Unicom is heavily invested in IoT, particularly 5G IoT and private networks, having completed over 40,000 5G industry application projects by late 2024. This demonstrates a strong market adoption of their IoT solutions, positioning them as a vital enabler of digital transformation.

Cybersecurity is a critical focus, with a 15% year-over-year increase in data protection infrastructure spending reported in 2023. This commitment ensures compliance with data security regulations and maintains customer trust as they expand their 5G and cloud offerings.

| Technology Area | 2024/2025 Focus | Key Data/Milestones |

|---|---|---|

| 5G Rollout | Expansion of 5G-Advanced | Target: 300+ cities by end of 2025 |

| Artificial Intelligence | Increased Computing Power Investment | Significant budget increase anticipated for 2025 |

| IoT Deployment | 5G IoT & Private Networks | 40,000+ 5G industry application projects by late 2024 |

| Cybersecurity | Data Protection & Compliance | 15% YoY increase in data protection infrastructure spending (2023) |

Legal factors

China Unicom navigates a regulatory landscape primarily shaped by the Ministry of Industry and Information Technology (MIIT). This framework, while not a single consolidated telecom law, comprises numerous specific regulations governing licensing, operational standards, and service provisions. For instance, MIIT's directives on 5G spectrum allocation and network deployment directly impact China Unicom's capital expenditure and rollout strategies.

Adherence to these dynamic regulations is crucial for China Unicom's sustained operations and continued market participation. In 2023, the MIIT continued its focus on network security and data privacy, issuing updated guidelines that required significant compliance efforts from all major telecom operators, including China Unicom, to ensure user data protection.

China Unicom must navigate a robust legal landscape for data privacy and security, significantly shaped by recent legislation. The Personal Information Protection Law (PIPL), effective November 1, 2021, and the Data Security Law (DSL), effective September 1, 2021, establish stringent requirements for handling personal information and critical data. These laws mandate strict adherence to data collection, storage, processing, and cross-border transfer protocols, directly impacting China Unicom's operations as a major telecommunications provider and data processor.

Adherence to PIPL and DSL means China Unicom faces increased compliance costs and potential penalties for violations, which can include fines up to 5% of the previous year's annual turnover or RMB 50 million, and suspension of business operations. For instance, in 2023, several companies faced scrutiny and penalties for non-compliance with data protection regulations, highlighting the enforcement rigor. This necessitates substantial investment in data governance frameworks, secure infrastructure, and employee training to safeguard user privacy and national data security interests.

Recent policy shifts have seen foreign investment caps eased in specific value-added telecom services within pilot zones, potentially reshaping competition for China Unicom. For instance, by the end of 2023, China had opened up its market further, allowing foreign ownership in areas like internet data centers and cloud computing services, which could attract new players.

Despite these openings, China Unicom, as a significant state-owned enterprise, continues to navigate a regulatory environment that emphasizes national control over core telecommunications infrastructure. This dual approach means while certain segments might see increased foreign participation, the fundamental control of basic networks remains a key consideration.

Anti-Monopoly and Fair Competition Rules

China's Ministry of Industry and Information Technology (MIIT) has actively implemented anti-monopoly and fair competition rules, targeting improper practices by internet companies and unfair competition among mobile applications. These regulations, particularly those introduced in 2021 and further refined in 2023, underscore a commitment to a more level playing field. For instance, directives issued in late 2023 specifically addressed issues like app store exclusivity and preferential treatment for certain services, impacting the digital ecosystem where China Unicom operates.

Despite being a state-owned enterprise, China Unicom is not exempt from these fair competition principles. The company must navigate an environment that increasingly scrutinizes market dominance and anti-competitive behaviors, even within the telecommunications sector. This ensures that all players, regardless of ownership structure, contribute to a dynamic and competitive market.

The overarching goal of these legal frameworks is to cultivate a robust and healthy market environment. By preventing monopolistic tendencies and promoting fair play, China aims to spur innovation and benefit consumers through greater choice and potentially lower prices. This regulatory push is a significant factor for China Unicom's strategic planning.

- MIIT's 2023 directives focused on app store practices, impacting digital service distribution.

- State-owned status does not exempt China Unicom from fair competition mandates.

- Regulations aim to prevent monopolistic behavior and foster market innovation.

International Regulations and Geopolitical Compliance

China Unicom's global ambitions, particularly its role in the Digital Silk Road, mean it must meticulously adhere to a patchwork of international telecommunications regulations. This complex web includes differing data privacy laws, spectrum allocation rules, and cybersecurity standards across various operating regions. Navigating these varied legal landscapes is crucial for maintaining its international network infrastructure and service delivery.

Geopolitical tensions and the potential for foreign sanctions or export controls pose significant risks to China Unicom's global operations. For instance, in 2023, the US continued to maintain restrictions on certain Chinese technology firms, impacting supply chains and market access for companies with significant global reach. China Unicom must therefore implement robust compliance frameworks and diversify its sourcing strategies to mitigate these risks and ensure the continuity of its international connectivity projects.

China Unicom operates under the stringent oversight of the Ministry of Industry and Information Technology (MIIT), which dictates licensing, operational standards, and service provisions. The company's compliance with data privacy laws like PIPL and DSL is paramount, with potential fines reaching up to 5% of annual turnover for violations, as seen with other firms facing scrutiny in 2023. Furthermore, MIIT's 2023 directives targeting anti-competitive practices in the digital space, such as app store exclusivity, necessitate careful navigation to ensure fair competition, even for state-owned enterprises.

Environmental factors

China Unicom is actively integrating its operations with China's ambitious national targets for carbon peaking, set for 2030, and carbon neutrality by 2060. This strategic alignment underscores the company's commitment to fostering sustainable, green development within the telecommunications sector.

The company has enhanced its 'Carbon Search Green Action Plan (2024-2025)', introducing updated initiatives focused on energy conservation and carbon emission reduction. These plans are designed to permeate all aspects of China Unicom's business, from its extensive network infrastructure to its daily operational practices, aiming for tangible environmental improvements.

China Unicom faces substantial environmental pressure from the energy demands of its vast network infrastructure, particularly with the ongoing 5G rollout and the escalating need for computing power. In 2023, the company reported a significant increase in electricity consumption, driven by these network expansions.

To address this, China Unicom is actively pursuing a strategy of reducing equipment energy consumption and implementing green, low-carbon operational practices. This initiative is central to their coordinated transformation towards both digitalization and environmental sustainability.

The company is optimizing network operations to enhance resource utilization and energy efficiency. For instance, by the end of 2024, they aim to achieve a 15% reduction in energy consumption per unit of traffic compared to 2022 levels, a target that reflects their commitment to greener network operations.

China Unicom, as a major telecommunications provider, inevitably generates electronic waste from its extensive network infrastructure and the consumer devices it distributes. Navigating China's evolving environmental regulations concerning e-waste is paramount. For instance, China's commitment to a circular economy, as highlighted in its 14th Five-Year Plan (2021-2025), emphasizes resource efficiency and waste reduction, directly impacting companies like China Unicom.

Adherence to these national directives, which promote responsible disposal and recycling, is crucial for China Unicom's operational and reputational standing. While specific public disclosures on their e-waste management practices are limited, it's reasonable to infer that sustainability initiatives would involve robust recycling programs and the exploration of circular economy principles to minimize environmental impact.

Climate Change Risk and Opportunity Management

China Unicom actively incorporates climate change into its risk management framework, enhancing its ability to analyze, assess, and manage climate-related risks and opportunities. This strategic integration allows the company to better adapt to evolving environmental conditions and uncover avenues for sustainable expansion.

The company is exploring opportunities to leverage its digital solutions for environmental protection initiatives. For instance, China Unicom's smart city solutions can contribute to energy efficiency and reduced emissions in urban areas.

- Climate Risk Integration: China Unicom's 2023 ESG report details its commitment to integrating climate change considerations into its enterprise-wide risk management, aligning with global best practices.

- Digital Solutions for Sustainability: The company is developing and deploying IoT and big data platforms that can aid in environmental monitoring and resource management for clients.

- Green Network Development: By the end of 2024, China Unicom aims to further reduce the carbon footprint of its network infrastructure through energy-efficient technologies and renewable energy sourcing.

Sustainable Infrastructure and Green Digital Transformation

China Unicom is actively integrating digital intelligence with environmental protection, exemplified by its digital platforms supporting river and lake governance. This initiative aligns with the national push for ecological preservation. For instance, in 2023, the company supported smart environmental monitoring projects that enhanced data collection accuracy for water quality by an estimated 20% compared to traditional methods.

The company's commitment to building new infrastructure incorporates green development principles, contributing to China's 'Beautiful China' initiative. This involves adopting eco-friendly industrial practices across its operations. China Unicom's investments in 5G network expansion, for example, prioritize energy-efficient base station designs, aiming to reduce energy consumption per gigabyte of data by 15% by the end of 2025.

- Digital Platforms for Environmental Governance: China Unicom's smart solutions are being deployed to monitor and manage natural resources, improving efficiency in areas like water management.

- Green Infrastructure Development: The company is prioritizing energy-efficient technologies in its network build-out, supporting national environmental goals.

- Eco-friendly Industrial Practices: Operational strategies are being revised to minimize environmental impact, reflecting a commitment to sustainable business.

- Smart Environmental Monitoring: Investments in advanced monitoring systems enhance data accuracy and responsiveness for environmental protection efforts.

China Unicom's environmental strategy is deeply intertwined with China's national climate goals, aiming for carbon peaking by 2030 and carbon neutrality by 2060. The company is actively enhancing its 'Carbon Search Green Action Plan' for 2024-2025, focusing on energy conservation and emission reductions across its vast network infrastructure.

The significant energy demands of its 5G rollout and data centers present a key environmental challenge, with electricity consumption rising in 2023. China Unicom is addressing this by optimizing network operations and adopting green practices, targeting a 15% reduction in energy consumption per unit of traffic by the end of 2024 compared to 2022 levels.

Electronic waste management is another critical area, influenced by China's circular economy initiatives under the 14th Five-Year Plan. The company is also leveraging its digital solutions, such as smart city platforms, to support environmental protection and resource management, as seen in its smart environmental monitoring projects in 2023.

| Environmental Focus | 2023/2024 Initiatives | Targets/Goals | Impact/Data Point |

|---|---|---|---|

| Carbon Reduction | Enhancing 'Carbon Search Green Action Plan' | Carbon peaking by 2030, Carbon neutrality by 2060 | Reported increase in electricity consumption in 2023 due to network expansion |

| Energy Efficiency | Optimizing network operations, green practices | 15% reduction in energy consumption per unit of traffic by end of 2024 (vs. 2022) | Prioritizing energy-efficient base station designs for 5G expansion |

| E-Waste Management | Adherence to circular economy principles | Responsible disposal and recycling | Influenced by China's 14th Five-Year Plan (2021-2025) |

| Digital Solutions for Environment | Developing smart city and environmental monitoring platforms | Supporting river/lake governance, enhancing environmental data accuracy | Smart environmental monitoring projects improved water quality data accuracy by ~20% in 2023 |

PESTLE Analysis Data Sources

Our China Unicom PESTLE Analysis is built on a comprehensive foundation of data from official Chinese government sources, leading international financial institutions, and reputable industry research firms. This ensures a robust understanding of the political, economic, social, technological, legal, and environmental factors impacting the company.