China Mobile PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Mobile Bundle

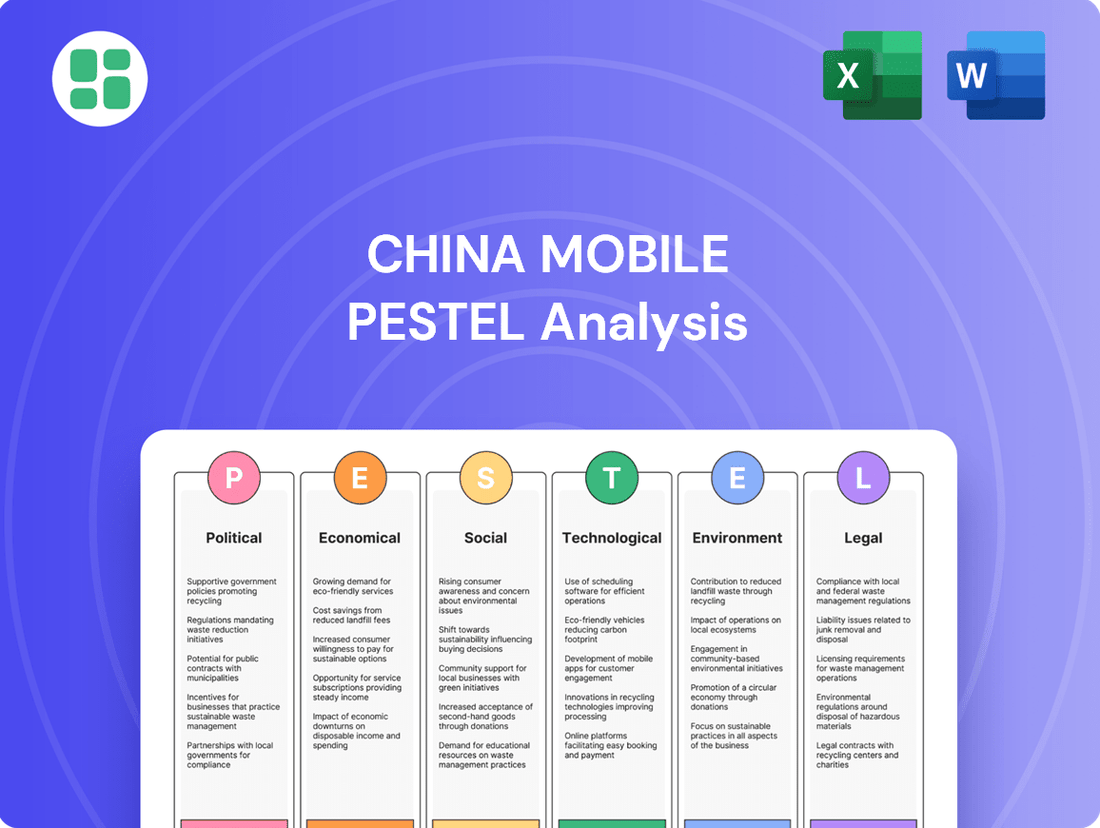

Navigate the complex landscape of China's telecommunications sector with our comprehensive PESTLE analysis of China Mobile. Understand the critical political, economic, social, technological, legal, and environmental factors that are shaping its operations and future growth. Equip yourself with actionable intelligence to make informed strategic decisions and stay ahead of the curve. Download the full PESTLE analysis now to unlock a deeper understanding of China Mobile's external environment and gain a significant competitive advantage.

Political factors

As a state-owned enterprise, China Mobile's strategic path is closely tied to the Chinese government's national objectives, particularly in digital transformation. This means its operations are guided by initiatives like the 'Digital China' strategy, which prioritizes technological advancement and widespread digital integration across the economy.

The government's push for developing new quality productive forces and enhancing digital intelligence directly impacts China Mobile's investment priorities. For instance, the aggressive rollout of 5G infrastructure, a key component of these national strategies, has seen significant capital allocation from the company. By the end of 2023, China Mobile had deployed over 3.37 million 5G base stations, underscoring this government-driven focus.

The Ministry of Industry and Information Technology (MIIT) is a key player, shaping China Mobile's trajectory through its regulatory authority. MIIT sets the pace for network evolution, pushing for aggressive 5G and the upcoming 5G-Advanced rollout, alongside fostering research into next-generation 6G technology. This strategic guidance ensures China Mobile's infrastructure development is intrinsically linked to the nation's broader communication objectives.

China Mobile, while a domestic powerhouse, faces significant geopolitical headwinds. US sanctions, for instance, have historically limited access to advanced chipsets, impacting network upgrades. In 2023, China's reliance on domestic semiconductor production for 5G infrastructure became even more pronounced, with significant state investment aimed at reducing foreign dependency.

State-backed Digital Transformation Initiatives

China Mobile is a key player in executing the Chinese government's ambitious digital transformation agendas. The company provides essential infrastructure and cutting-edge solutions for smart city projects, rural development, and the digital upgrading of businesses. This strategic alignment directly supports the government's aim to embed digital technologies across the entire economic and social fabric.

The company's involvement in state-backed digital initiatives is substantial. For instance, in 2024, China Mobile committed to investing billions in 5G network expansion and data center construction, crucial for these transformation efforts. These investments are designed to bolster capabilities in areas like artificial intelligence, big data, and the Internet of Things (IoT), directly contributing to national digital strategies.

- Infrastructure Backbone: China Mobile's extensive 5G and fiber optic networks serve as the foundational layer for numerous government-led digital initiatives, including smart city deployments and the digitalization of public services.

- Enterprise Digitalization Support: The company offers tailored digital solutions to enterprises, facilitating their transition to cloud computing, big data analytics, and AI-driven operations, thereby boosting productivity and competitiveness.

- Rural Revitalization through Connectivity: By expanding high-speed internet access to rural areas, China Mobile supports government programs aimed at bridging the digital divide and fostering economic development in underserved regions.

- Smart City Development: China Mobile actively participates in building smart city ecosystems, providing connectivity and platforms for intelligent transportation, public safety, and environmental monitoring systems.

Support for Inclusive Digital Development

The Chinese government is strongly committed to inclusive digital development, aiming to reduce the digital divide, particularly in rural and less developed regions. This political push is evident in national strategies focusing on equitable access to technology and information across the country.

China Mobile plays a crucial role in actualizing these political objectives. By the end of 2023, the company had expanded its gigabit broadband network to cover over 500 million households, significantly boosting connectivity in previously underserved areas. Furthermore, its 5G network expansion reached 3.37 million administrative villages by early 2024, directly supporting the government's goal of widespread digital inclusion and fostering regional economic coordination.

- Gigabit Broadband Coverage: Expanded to over 500 million households by the end of 2023.

- 5G Network Reach: Extended to 3.37 million administrative villages as of early 2024.

- Government Alignment: Directly supports national policies for bridging the digital divide and promoting regional growth.

China Mobile's operations are deeply intertwined with government policy, particularly concerning national digital transformation and technological self-sufficiency. The company's significant investments in 5G infrastructure, exceeding 3.37 million base stations by the end of 2023, directly align with state-driven initiatives to bolster digital intelligence and new quality productive forces.

Regulatory bodies like the Ministry of Industry and Information Technology (MIIT) actively shape China Mobile's development, pushing for advancements in 5G-Advanced and future 6G research. This strategic direction ensures the company's infrastructure growth supports broader national communication objectives, even amidst geopolitical challenges like US sanctions impacting access to advanced chipsets, driving a greater reliance on domestic semiconductor production.

The government's commitment to inclusive digital development is a key political driver, aiming to bridge the digital divide. China Mobile's expansion of gigabit broadband to over 500 million households by end-2023 and its 5G network reaching 3.37 million administrative villages by early 2024 are direct responses to these policies, fostering digital inclusion and regional economic coordination.

| Government Initiative | China Mobile's Role/Investment | Key Metric (End 2023/Early 2024) |

| Digital China Strategy | 5G Infrastructure Rollout | 3.37 million 5G base stations deployed |

| Bridging Digital Divide | Rural Connectivity Expansion | 5G network reached 3.37 million administrative villages |

| Technological Self-Sufficiency | Domestic Semiconductor Reliance | Increased state investment in domestic chip production |

| Smart City Development | Providing Connectivity & Platforms | Gigabit broadband coverage to over 500 million households |

What is included in the product

This PESTLE analysis examines the external macro-environmental factors impacting China Mobile across Political, Economic, Social, Technological, Environmental, and Legal dimensions, providing actionable insights for strategic decision-making.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors impacting China Mobile.

Helps support discussions on external risk and market positioning during planning sessions by clearly outlining the political, economic, social, technological, legal, and environmental influences on China Mobile.

Economic factors

China's economic expansion is a key driver for China Mobile. As the nation's GDP grows, so does the disposable income of consumers and the investment capacity of businesses, directly boosting demand for telecommunication and digital services. For instance, China Mobile's operating revenue saw a healthy 3.1% rise in 2024, with its core telecommunications services revenue climbing 3%, reflecting this positive correlation.

China Mobile's economic performance is significantly bolstered by the accelerating growth in its digital transformation services. In 2024, this segment experienced a robust 9.9% year-on-year increase, demonstrating its increasing importance within the company's overall revenue structure.

These digital services, encompassing cloud computing and enterprise solutions, now account for a substantial 31.3% of China Mobile's total telecommunications service revenue. This strategic pivot towards higher-value, intelligent digital offerings is vital for the company's long-term sustainability and market competitiveness.

The expansion of these digital services is a key strategy for China Mobile to diversify its income sources, moving away from a primary dependence on traditional voice and data services. This diversification is essential for navigating the evolving telecommunications landscape and capturing new market opportunities.

China Mobile faces a dynamic market, even with its state backing. Competitors like China Telecom and China Unicom are significant players, pushing the need for constant upgrades. This rivalry is a key driver for the company's substantial capital expenditures.

In 2023, China Mobile reported a 2.7% year-on-year increase in operating revenue, reaching ¥925.7 billion, demonstrating its ability to grow despite intense competition. This growth is fueled by the ongoing rollout and adoption of advanced technologies, including 5G, which requires continuous investment to maintain a competitive edge and attract its massive customer base.

Substantial Capital Expenditure and Infrastructure Investment

China Mobile's commitment to substantial capital expenditure is a cornerstone of its strategy, fueling its extensive network expansion and technological advancements. The company's significant investments are crucial for maintaining its competitive edge in the rapidly evolving telecommunications landscape.

In 2024, China Mobile allocated a considerable 164 billion yuan towards capital expenditure. Looking ahead to 2025, the company has ambitious plans to deploy an additional 340,000 5G base stations. This aggressive rollout is projected to bring its total 5G base station count to approximately 2.8 million by the end of 2025.

- Network Expansion: Continued investment in 5G base stations is key to broadening network coverage and enhancing service quality across China.

- Technological Advancement: These capital expenditures also support the integration of new technologies like artificial intelligence (AI) and the Internet of Things (IoT), enabling new services and revenue streams.

- Future Readiness: The sustained infrastructure investment positions China Mobile to capitalize on future growth opportunities driven by digital transformation and increasing data demands.

Subscriber Growth and ARPU Trends

China Mobile's subscriber growth remains robust, exceeding 1 billion mobile customers by the close of 2024. This massive user base is increasingly adopting advanced technologies, with 5G network users alone reaching 552 million in the same period, showcasing significant network expansion and customer uptake.

While the average revenue per user (ARPU) saw a minor dip in 2024, the sheer volume of new 5G connections and the expanding portfolio of digital services are key drivers for revenue resilience. This trend indicates a strategic shift towards higher-value services, mitigating the impact of ARPU fluctuations.

- Subscriber Base: Surpassed 1 billion mobile customers by end of 2024.

- 5G Penetration: 5G network users reached 552 million by end of 2024.

- ARPU Trend: Experienced a slight decline in 2024.

- Revenue Drivers: Growth in 5G and digital services are stabilizing revenue.

China's economic landscape directly fuels China Mobile's growth. As the nation's GDP expands, so does consumer spending power and business investment, increasing demand for telecom and digital services. China Mobile's operating revenue grew by 3.1% in 2024, with telecommunications services revenue up 3%, highlighting this connection.

The company's digital transformation services are a significant growth engine, increasing by 9.9% year-on-year in 2024. These services, including cloud and enterprise solutions, now represent 31.3% of total telecommunications service revenue, underscoring their importance for future competitiveness.

China Mobile's financial performance is closely tied to its substantial capital expenditures. In 2024, the company invested 164 billion yuan, with plans for 340,000 new 5G base stations in 2025, aiming for a total of 2.8 million by year-end. This investment supports network expansion and technological advancement, crucial for maintaining market leadership.

| Metric | 2023 | 2024 (Actual/Estimate) | 2025 (Projection) |

|---|---|---|---|

| Operating Revenue | ¥925.7 billion (+2.7% YoY) | (Further growth expected) | (Continued growth expected) |

| Digital Transformation Services Revenue Growth | (Not specified) | 9.9% YoY | (Continued strong growth anticipated) |

| Capital Expenditure | (Not specified) | 164 billion yuan | (Significant investment expected) |

| 5G Base Stations | (Not specified) | (Ongoing expansion) | 2.8 million (target) |

What You See Is What You Get

China Mobile PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of China Mobile delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions. You'll gain valuable insights into market dynamics and potential challenges.

Sociological factors

China's rapid embrace of 5G is a significant sociological shift, with over 1 billion 5G connections recorded by the close of 2024. This widespread adoption, projected to reach 61% by the end of 2025, indicates a societal readiness and desire for advanced digital services.

This surge in 5G usage directly fuels increased demand for data-intensive applications and services, fundamentally altering how Chinese consumers interact with technology and consume information.

Consumer expectations in China are rapidly evolving, with a growing demand for advanced digital services like AI-powered applications and mobile cloud storage. This shift is driven by increased digital literacy and a desire for integrated, value-added experiences. For instance, by the end of 2023, China's digital economy had reached an estimated 52.97 trillion yuan, highlighting the pervasive influence of digital trends on consumer behavior.

China Mobile is strategically adapting to these changing consumer preferences by investing in and expanding its AI-driven information services. The company is also focusing on building robust smart home ecosystems, aiming to provide a more comprehensive and connected digital lifestyle for its users. This proactive approach ensures they remain competitive in a market where sophisticated, integrated digital solutions are increasingly becoming the norm.

China's ongoing urbanization drives significant demand for advanced mobile and broadband services, with urban populations increasingly relying on digital connectivity for daily life and economic activity. This trend directly benefits China Mobile by expanding its customer base in densely populated areas.

Concurrently, China Mobile is actively expanding its 5G network and digital services into rural and remote regions, aiming to connect an estimated 600 million people in villages by the end of 2024. This strategic push is crucial for bridging the digital divide, ensuring equitable access to information and economic opportunities across the nation.

Digital Literacy and Inclusion Initiatives

The increasing reliance on digital services highlights the critical need for digital literacy throughout China's population. China Mobile's efforts to broaden access to cutting-edge telecommunication services are instrumental in fostering digital inclusion. This focus ensures that more people can effectively engage with and benefit from emerging digital technologies.

By the end of 2023, China Mobile had achieved a subscriber base of over 1.19 billion mobile users, with 5G connections surpassing 700 million. Their ongoing investments in rural broadband expansion and digital skills training programs directly address the digital divide, aiming to empower a larger segment of society to participate in the digital economy.

- Digital Literacy Focus: China Mobile's commitment to improving digital literacy supports the effective adoption of its services.

- Digital Inclusion Efforts: Initiatives like affordable data plans and accessible 5G networks aim to bring more citizens online.

- Societal Impact: Enhanced digital literacy and inclusion empower individuals and communities to leverage technological advancements for economic and social progress.

Corporate Social Responsibility and Public Trust

As a major state-owned enterprise, China Mobile carries substantial societal obligations. This involves actively fighting telecom fraud, a persistent issue in China, and ensuring robust communication infrastructure during natural disasters and other emergencies. In 2023, China Mobile reported investing heavily in network security to combat fraud, aiming to protect its 990 million mobile subscribers.

Furthermore, China Mobile is committed to fostering inclusive digital development, bridging the digital divide across the nation. This commitment is crucial for building and sustaining public trust and a favorable corporate reputation. For instance, the company's rural broadband expansion initiatives in 2024 aimed to connect millions of underserved households.

These efforts directly impact public perception and regulatory relationships.

- Combating Telecom Fraud: China Mobile's proactive measures against fraud are essential for consumer confidence.

- Emergency Communication: Ensuring network reliability during crises is a core social responsibility, highlighted during flood relief efforts in 2024.

- Digital Inclusion: Expanding access to digital services promotes equitable development and strengthens community ties.

- Public Trust: Demonstrating commitment to these social responsibilities is paramount for maintaining a positive public image and stakeholder support.

China's societal shift towards digital engagement is accelerating, evidenced by over 1 billion 5G connections by year-end 2024, with projections indicating 61% adoption by the end of 2025. This trend fuels demand for data-intensive services and elevates consumer expectations for advanced digital solutions, such as AI and mobile cloud, with China's digital economy reaching an estimated 52.97 trillion yuan in 2023.

| Sociological Factor | Description | Impact on China Mobile | Data/Statistics (2023-2025) |

|---|---|---|---|

| Digital Adoption & Expectations | Rapid uptake of advanced technologies like 5G and demand for integrated digital services. | Drives demand for China Mobile's 5G network and value-added services. | 1 billion+ 5G connections (end 2024), 61% projected 5G adoption (end 2025), 52.97 trillion yuan digital economy (2023). |

| Urbanization & Digital Divide | Increasing urban populations and efforts to connect rural areas. | Expands customer base in cities and necessitates rural network expansion. | Rural expansion targeting 600 million people (end 2024). |

| Digital Literacy & Inclusion | Growing need for digital skills and equitable access to technology. | Requires investment in training and accessible service offerings. | 1.19 billion mobile users, 700 million+ 5G users (end 2023). |

| Social Responsibility | Combating fraud and ensuring network reliability during emergencies. | Enhances brand reputation and customer trust. | Heavy investment in network security (2023). |

Technological factors

China Mobile is aggressively expanding its 5G infrastructure, having already deployed more than 2.4 million 5G base stations by the end of 2024. This rapid build-out is projected to reach close to 2.8 million base stations by the end of 2025, underscoring their commitment to leading in advanced mobile network technologies.

The company's strategic rollout of 5G-Advanced networks across over 300 cities is a crucial technological factor. This advanced network capability is essential for powering innovative applications and ensuring China Mobile maintains its competitive edge in the evolving telecommunications landscape.

China Mobile is significantly boosting its AI and cloud capabilities, demonstrating this with its self-built intelligent computing power reaching 29.2 EFLOPS in 2024. This substantial investment underpins their 'AI+ Global Strategy,' which aims to embed AI across all operations.

The company is actively integrating AI into crucial areas like customer service, network management, and sales. This strategic move is designed to not only improve operational efficiency but also to foster the development of novel intelligent solutions, positioning China Mobile at the forefront of technological advancement in the telecommunications sector.

China Mobile is aggressively pushing into the enterprise sector, using its advanced 5G, AI, and cloud services to create tailored solutions for various industries and smart city projects. This strategic focus is evident in its robust revenue growth, with the enterprise market contributing 209.1 billion yuan in 2024 alone. This figure highlights a significant expansion in its business-to-business operations and the successful integration of diverse Internet of Things (IoT) applications.

Research and Development in Future Technologies

China Mobile is heavily invested in pioneering future communication standards, moving beyond 5G-Advanced to actively research and develop 6G technology. This strategic focus on next-generation networks is crucial for maintaining its competitive edge in the rapidly evolving global telecommunications landscape.

Their commitment to innovation is underscored by significant R&D expenditure. For instance, China Mobile's investment in research and development reached approximately RMB 20.1 billion in 2023, a substantial portion of which is directed towards future technologies like 6G.

- 6G Research: China Mobile is a key player in the global 6G research community, collaborating with international partners and contributing to standardization efforts.

- Spectrum Allocation: Early discussions and planning for 6G spectrum allocation are underway, with China Mobile actively participating to secure future bandwidth.

- Emerging Applications: R&D efforts are also focused on identifying and developing applications that will leverage the capabilities of 6G, such as holographic communication and advanced AI integration.

Robust Cybersecurity and Data Security Capabilities

China Mobile places a significant emphasis on robust cybersecurity and data security, recognizing the critical importance of protecting its vast digital infrastructure and customer information. This focus is driven by the increasing reliance on digital services across its operations and customer interactions.

The company is actively investing in and enhancing its cybersecurity capabilities platform, implementing advanced technologies and stringent protocols to safeguard its network and data. This commitment ensures secure operations and robust data protection for its millions of users, aligning with China's evolving national data security regulations.

- Enhanced Threat Detection: China Mobile has bolstered its systems for identifying and responding to cyber threats in real-time.

- Data Encryption Standards: The company employs advanced encryption methods to protect sensitive customer data both in transit and at rest.

- Regulatory Compliance: Continuous efforts are made to ensure full adherence to China's comprehensive cybersecurity and data protection laws, such as the Cybersecurity Law and the Data Security Law.

- Investment in Security Infrastructure: Significant capital is allocated to upgrading and maintaining state-of-the-art security infrastructure to counter emerging cyber risks.

China Mobile's technological advancement is highlighted by its extensive 5G network, aiming for nearly 2.8 million base stations by the end of 2025, with 5G-Advanced deployed in over 300 cities. Their substantial investment in AI and cloud computing, reaching 29.2 EFLOPS of intelligent computing power in 2024, fuels their 'AI+ Global Strategy.' The company is also actively researching 6G technology, dedicating significant R&D funds, approximately RMB 20.1 billion in 2023, to future communication standards and emerging applications like holographic communication.

| Technology Area | 2024 Data/Projection | 2025 Projection | Impact |

|---|---|---|---|

| 5G Base Stations | Over 2.4 million | Nearly 2.8 million | Expands network coverage and capacity, enabling advanced services. |

| 5G-Advanced Deployment | Over 300 cities | Continued expansion | Supports innovative applications and enhances user experience. |

| Intelligent Computing Power | 29.2 EFLOPS | Further growth expected | Drives AI capabilities and operational efficiency. |

| R&D Expenditure (2023) | ~ RMB 20.1 billion | N/A | Fuels innovation in 6G and other future technologies. |

Legal factors

China Mobile's operations are significantly shaped by the Personal Information Protection Law (PIPL). This law, enacted to safeguard user data, mandates explicit consent for any collection, processing, or sharing of personal information. For China Mobile, this means stringent requirements for obtaining user permissions before utilizing data for services or marketing.

Furthermore, PIPL imposes strict rules on cross-border data transfers, requiring security assessments and adherence to specific protocols. Failure to comply with these regulations can result in substantial fines, potentially impacting China Mobile's financial performance and operational continuity. As of recent reports, data privacy violations in China can incur penalties up to 5% of the previous year's annual turnover, underscoring the critical need for robust compliance measures.

Effective January 1, 2025, the Network Data Security Management Regulations in China mandate stringent data classification and protection measures. China Mobile must ensure its data handling and transfer practices align with these new legal requirements, which encompass both personal and important data categories. Failure to comply could result in significant penalties, impacting operational continuity and customer trust.

China Mobile, as a dominant force in the telecommunications industry, navigates a strict anti-monopoly and fair competition landscape. These regulations are in place to prevent any single entity from unfairly leveraging its market position, ensuring a more level playing field for competitors.

While its state-owned enterprise (SOE) status offers inherent advantages, China Mobile is bound by laws that prohibit monopolistic practices. For instance, the Anti-Monopoly Law of the People's Republic of China, enacted in 2008 and amended in 2022, mandates that companies with significant market power must not engage in activities that restrict competition, such as price fixing or exclusive dealing.

The regulatory environment actively promotes a healthy competitive ecosystem. In 2023, China continued to emphasize fair competition, with regulatory bodies like the State Administration for Market Regulation (SAMR) issuing guidelines and conducting investigations to uphold these principles across various sectors, including telecommunications.

Telecommunications Licensing and Operational Compliance

China Mobile's operations are governed by telecommunications licenses granted by the Ministry of Industry and Information Technology (MIIT). These licenses are crucial, defining the company's service offerings, network expansion targets, and adherence to operational benchmarks. In 2024, the MIIT continued to emphasize network security and data privacy within its licensing framework, impacting how China Mobile deploys new technologies like 5G-Advanced and its ongoing 5G network buildout, which by Q3 2024 had covered over 3.3 million 5G base stations nationwide.

Compliance with these MIIT regulations is non-negotiable for China Mobile's sustained business activities and future growth. Failure to meet these stringent requirements, such as those related to spectrum usage or service quality, could result in significant penalties or even the revocation of operating licenses. The company's commitment to these legal mandates underpins its ability to maintain market leadership and pursue strategic initiatives, including its significant investments in artificial intelligence and cloud computing infrastructure throughout 2024.

Key legal factors influencing China Mobile include:

- Licensing Authority: The MIIT is the primary regulator responsible for issuing and overseeing telecommunications licenses.

- Scope of Operations: Licenses specify authorized services, geographic coverage, and network buildout obligations.

- Operational Standards: Compliance with regulations on network quality, security, and data protection is mandatory.

- Regulatory Evolution: Adapting to evolving MIIT policies, particularly concerning emerging technologies and competition, is critical for continued compliance and market positioning.

Navigating International Legal and Sanction Regimes

China Mobile must navigate a complex web of international legal and sanction regimes, a significant challenge given global geopolitical tensions. Restrictions imposed by countries like the United States on Chinese technology firms can directly affect China Mobile's ability to source critical components and collaborate with international partners. For instance, the ongoing scrutiny of Huawei, a major equipment supplier, highlights the potential disruptions to supply chains and technological development for Chinese telecom giants.

These external legal pressures necessitate robust compliance strategies and proactive risk management. The company's international expansion plans, particularly in regions with strong ties to Western economies, could be hampered by these sanctions. China Mobile's 2023 annual report indicated a continued focus on international markets, but the evolving regulatory landscape demands careful consideration of legal implications in all overseas ventures.

- Regulatory Scrutiny: China Mobile faces increased scrutiny from international regulatory bodies concerning data privacy and national security, impacting its operations in foreign markets.

- Sanction Risks: Potential sanctions on Chinese technology companies could restrict access to essential hardware and software, affecting network upgrades and service delivery.

- Trade Disputes: Ongoing trade disputes between major economic powers create an uncertain environment for international business, potentially impacting China Mobile's global partnerships and investments.

- Compliance Costs: Adhering to diverse and often conflicting international legal frameworks and sanctions requires significant investment in legal expertise and compliance infrastructure.

China Mobile's adherence to the Personal Information Protection Law (PIPL) and upcoming Network Data Security Management Regulations (effective Jan 1, 2025) dictates stringent data handling and consent requirements, with potential fines up to 5% of annual turnover for non-compliance. The company also operates under China's Anti-Monopoly Law, which, as amended in 2022, prohibits market dominance abuse, a key focus for regulators like SAMR in 2023 to ensure fair competition.

Environmental factors

China Mobile is making significant strides to align with China's ambitious environmental targets, specifically aiming for carbon peaking by 2030 and carbon neutrality by 2060. This commitment is crucial given the Information and Communication Technology (ICT) sector's substantial energy consumption.

The company is actively pursuing strategies to lower its carbon footprint, underscoring its role in contributing to these national climate objectives. For instance, by the end of 2023, China Mobile had already achieved over 1.4 million base stations powered by renewable energy, a tangible step towards reducing its reliance on fossil fuels.

China Mobile is actively pursuing ambitious energy efficiency targets, aiming to slash its Scope 1 and Scope 2 Greenhouse Gas emission intensity by 20% by 2025, using 2020 as a baseline. This commitment extends to reducing overall energy consumption per unit of telecom business by a similar 20% within the same timeframe.

Achieving these goals necessitates substantial energy savings initiatives across China Mobile's vast 5G infrastructure and numerous data centers. For instance, in 2023, the company reported a 12% reduction in energy consumption per unit of telecom business compared to the 2020 baseline, demonstrating tangible progress towards its 2025 objectives.

China Mobile is significantly investing in environmental sustainability through its 'Green Action Plan' and 'C2 Three Energy' initiatives. These programs are geared towards developing environmentally friendly wireless technologies, intelligent computing centers, optical networks, and buildings, aiming to reduce their carbon footprint.

A key objective is to boost the utilization of clean energy sources across its operations. For instance, by the end of 2023, China Mobile had already achieved a substantial increase in renewable energy usage, with clean energy accounting for approximately 30% of its total energy consumption for network operations.

Furthermore, the company is integrating energy conservation standards into its procurement decisions. This means that new equipment and infrastructure purchases are evaluated not just on performance and cost, but also on their energy efficiency and environmental impact, ensuring a more sustainable supply chain.

E-waste Management and Circular Economy Practices

China Mobile, as a major telecommunications operator, faces increasing pressure to manage the substantial electronic waste (e-waste) generated by its extensive network infrastructure and consumer devices. The company's sustainability initiatives likely encompass efforts to recycle and repurpose old equipment. For instance, China’s national e-waste recycling volume reached approximately 2.4 million tons in 2023, highlighting the scale of this environmental challenge and the opportunities for responsible management.

Embracing circular economy principles is becoming crucial for companies like China Mobile. This involves designing products for longevity, repairability, and recyclability, and establishing robust take-back programs for old devices. By integrating these practices, China Mobile can not only mitigate environmental impact but also potentially create new revenue streams and reduce reliance on virgin materials. The global market for electronics recycling is projected to grow significantly, indicating a strong trend towards these sustainable models.

- E-waste Volume: China's e-waste recycling volume exceeded 2.4 million tons in 2023, underscoring the environmental imperative for companies like China Mobile.

- Circular Economy Growth: The global electronics recycling market is expanding, signaling a shift towards sustainable practices and resource efficiency that China Mobile can leverage.

- Resource Recovery: Implementing circular economy models allows for the recovery of valuable materials from e-waste, reducing the need for new resource extraction.

- Extended Producer Responsibility: Telecommunication providers are increasingly held accountable for the end-of-life management of their products, driving investment in e-waste solutions.

Digital Empowerment for Societal Carbon Reduction

China Mobile actively utilizes its digital and intelligent technologies to assist other industries and society in lowering carbon emissions. By offering innovative digital solutions, the company enables various sectors to improve their sustainability and operational efficiency. This directly supports China's national objectives for ecological protection and green development.

For instance, China Mobile’s smart grid solutions are designed to optimize energy distribution and reduce waste. In 2023, the company reported that its smart city initiatives, which include energy management systems, contributed to an estimated reduction of 5 million tons of carbon dioxide equivalent across participating municipalities. This demonstrates a tangible impact on societal carbon reduction through technological deployment.

- Smart Grid Optimization: China Mobile's smart grid technologies enhance energy efficiency, leading to reduced consumption and associated emissions.

- Smart City Initiatives: Deployment of IoT and data analytics in urban environments supports better resource management, including energy and transportation, thereby lowering the carbon footprint.

- Digital Transformation for Industry: The company provides digital tools and platforms that allow businesses to monitor and reduce their environmental impact, fostering greener operational practices.

- Contribution to National Goals: These efforts align with China's commitment to peak carbon emissions before 2030 and achieve carbon neutrality by 2060, leveraging digital power for ecological progress.

China Mobile is actively aligning with China's ambitious environmental goals, aiming for carbon peaking by 2030 and carbon neutrality by 2060. The company is implementing strategies to reduce its carbon footprint, such as powering over 1.4 million base stations with renewable energy by the end of 2023, and aims to cut its emission intensity by 20% by 2025.

The company's 'Green Action Plan' and 'C2 Three Energy' initiatives focus on developing eco-friendly technologies and boosting clean energy usage, which reached approximately 30% of total energy consumption for network operations by the end of 2023. Furthermore, China Mobile is integrating energy efficiency into its procurement processes and addressing e-waste, with China's recycling volume reaching 2.4 million tons in 2023.

China Mobile also leverages its digital and intelligent technologies to help other sectors reduce emissions, with its smart city initiatives contributing to an estimated 5 million tons of CO2 equivalent reduction in 2023.

PESTLE Analysis Data Sources

Our China Mobile PESTLE Analysis is built on a robust foundation of official government reports from China, reputable financial institutions like the IMF and World Bank, and leading market research firms. This ensures comprehensive coverage of political, economic, and social factors impacting the telecommunications sector.