China Mobile Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Mobile Bundle

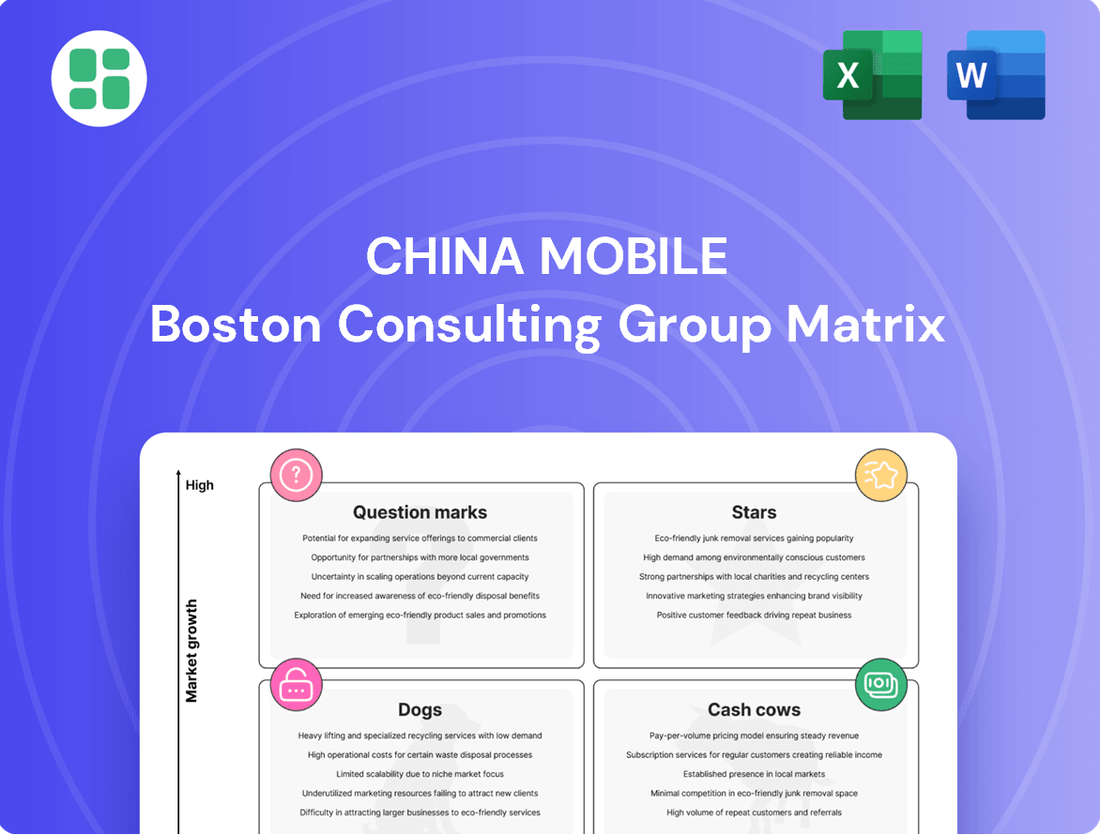

China Mobile's BCG Matrix offers a critical look at its product portfolio, revealing which segments are driving growth and which require careful management. Understand the strategic implications of its Stars, Cash Cows, Dogs, and Question Marks.

This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions for China Mobile.

Purchase the full BCG Matrix to receive a detailed Word report + a high-level Excel summary. It’s everything you need to evaluate, present, and strategize with confidence regarding China Mobile's market position.

Stars

China Mobile is a powerhouse in 5G, boasting 552 million 5G network customers by the close of 2024. This represents a substantial jump of 88 million new users in that year alone. The company's aggressive expansion strategy targets 2.8 million 5G base stations by the end of 2025, underscoring its commitment to leading the market.

This expansive 5G infrastructure is a key driver for China Mobile's mobile service revenue. As more customers migrate to higher average revenue per user (ARPU) 5G services, the company anticipates continued revenue growth. This strategic focus on 5G deployment and service adoption positions them strongly in a dynamic telecommunications landscape.

China Mobile's Digital Transformation Services for Enterprises are a significant growth engine. In 2024, revenue in this segment reached RMB 278.8 billion, marking a robust 9.9% increase year-over-year. This growth underscores the increasing demand for digital solutions within the enterprise sector.

This segment now accounts for a substantial 31.3% of China Mobile's total telecommunications service revenue. It covers a broad range of offerings, including cloud services, the Internet of Things (IoT), and tailored industry-specific solutions, demonstrating the company's diverse capabilities.

China Mobile is strategically investing in and expanding its presence in this high-growth area. Their commitment to developing 'AI + DICT' capabilities and offering standardized solutions is proving effective in driving strong business expansion and capturing market share within the digital transformation landscape.

China Mobile Cloud is a star in the BCG matrix, showing impressive performance. In 2024, its revenue surged by 20.4% to RMB 100.4 billion, solidifying its standing as a leading cloud services provider. This growth highlights its strong position in the rapidly expanding Chinese cloud market.

The cloud segment is a vital component of China Mobile's Digital Information and Communication Technology (DICT) revenue. It's projected to continue its double-digit year-on-year growth trajectory, underscoring its importance and potential for future expansion.

Mobile IoT Connections and Applications

China Mobile is a dominant force in the burgeoning Internet of Things (IoT) market, holding the top spot globally for cellular IoT connectivity. By the close of 2024, the company boasted an impressive 1.42 billion IoT connections, significantly bolstering China's overall leadership in the sector, which reached 2.7 billion connections.

The company's strategic focus on high-growth IoT applications is a key driver of its success. They are actively expanding mobile IoT into sectors such as intelligent connected vehicles, healthcare, and smart homes, positioning themselves for continued expansion.

This substantial market share in a rapidly expanding industry firmly places China Mobile's IoT segment within the Star category of the BCG Matrix. Their extensive network and commitment to innovation in key application areas underscore their strong competitive advantage and future growth potential.

- Global IoT Leadership: China Mobile's 1.42 billion cellular IoT connections by end-2024 solidify its position as the world's leading provider.

- National IoT Dominance: These connections contribute significantly to China's 2.7 billion total IoT connections, highlighting national leadership.

- Strategic Growth Areas: Active promotion of mobile IoT in intelligent connected vehicles, healthcare, and smart homes fuels future expansion.

- BCG Matrix Classification: The strong market share and high growth potential in IoT firmly place this segment in the Star quadrant.

AI-powered Information Services

China Mobile is heavily investing in AI-powered information services, particularly within its personal market segment. This strategic push is evident in the rapid adoption and revenue generation seen from initiatives like AI+5G New Calling and AI+Cloud handsets. These offerings are designed to leverage artificial intelligence to enhance user experience and create new revenue streams.

The company's commitment to integrating AI across its vast service portfolio and network infrastructure signals a strong belief in the high-growth potential of these AI-driven services. By embedding AI, China Mobile aims to differentiate its offerings and capture a larger share of the evolving digital services market.

- AI+5G New Calling: This service integrates AI capabilities to enhance voice calls, offering features like real-time translation and voice enhancement, contributing to user engagement.

- AI+Cloud Handsets: These devices leverage cloud-based AI processing to deliver advanced functionalities, boosting handset sales and service subscriptions.

- Revenue Growth: China Mobile reported significant revenue growth in its personal market segment, partly fueled by the increasing adoption of these AI-enhanced services. For instance, in 2024, the company saw a notable uptick in average revenue per user (ARPU) for subscribers utilizing these advanced features.

- Strategic Investment: The company continues to allocate substantial resources towards AI research and development, ensuring its services remain at the forefront of technological innovation. This investment is crucial for maintaining a competitive edge in the rapidly advancing AI landscape.

China Mobile's AI-powered information services, particularly within its personal market segment, represent a significant Star in the BCG matrix. The company's investment in AI+5G New Calling and AI+Cloud handsets is driving user engagement and creating new revenue streams. This strategic focus on AI integration across its vast service portfolio signals strong belief in the high-growth potential of these services.

The company's commitment to AI is yielding tangible results, with notable upticks in average revenue per user (ARPU) for subscribers utilizing these advanced features in 2024. This segment is poised for continued expansion as China Mobile allocates substantial resources towards AI research and development, ensuring its services remain at the forefront of technological innovation.

| Service Segment | 2024 Revenue (RMB Billion) | Year-over-Year Growth (%) | BCG Category |

| 5G Services | N/A (Integrated into Mobile Services Revenue) | Significant Growth Driven by 552M 5G Customers | Star |

| Digital Transformation Services | 278.8 | 9.9% | Cash Cow/Question Mark (High Revenue, Moderate Growth) |

| China Mobile Cloud | 100.4 | 20.4% | Star |

| IoT | N/A (Integrated into Mobile Services Revenue) | High Growth, Dominant Market Share | Star |

| AI-Powered Information Services | N/A (Contributing to Personal Market ARPU Growth) | High Growth Potential, Strategic Investment | Star |

What is included in the product

This BCG Matrix analysis highlights China Mobile's product portfolio, categorizing units into Stars, Cash Cows, Question Marks, and Dogs.

It provides strategic insights, identifying which areas to invest in, hold, or divest for optimal growth and profitability.

A clear China Mobile BCG Matrix visualizes strategic options, relieving the pain of indecision regarding resource allocation.

Cash Cows

China Mobile's traditional 4G mobile voice and data services are a classic Cash Cow. With over 1 billion mobile customers, the company commands a dominant position in this mature market.

While voice revenue is seeing a decline, the substantial growth in mobile data revenue ensures a consistent and significant cash flow for China Mobile.

These established services require minimal new investment, allowing them to reliably generate substantial profits. For instance, in 2023, China Mobile reported that its mobile services revenue reached 567.9 billion RMB, with data services being a key driver of this figure.

China Mobile's fixed broadband internet services are a prime example of a cash cow within its business portfolio. By the close of 2024, the company commanded an impressive 278 million household broadband customers, solidifying its position as a market leader.

This segment consistently delivers substantial and stable revenue streams. The company's commitment to ongoing network enhancements, such as the 'Gigabit + FTTR' initiative, is crucial for retaining its vast customer base and supporting average revenue per user (ARPU).

The sheer scale of China Mobile's existing infrastructure, coupled with its enormous subscriber numbers, firmly places fixed broadband services in the cash cow category, representing a reliable and significant contributor to the company's overall financial health.

Basic enterprise connectivity and IT solutions form a bedrock for China Mobile, holding a significant market share. Despite not being the fastest-growing area, this segment consistently delivers stable, recurring revenue from a vast corporate client base, which reached 32.59 million enterprises in 2024.

These essential services benefit from established customer relationships, minimizing the need for extensive marketing spend. The steady demand ensures a reliable income stream, making this a core, albeit mature, component of China Mobile's portfolio.

Legacy Value-Added Services (VAS)

Legacy Value-Added Services (VAS) within China Mobile's portfolio, while not experiencing rapid expansion, remain significant cash cows. These services, often involving fundamental offerings like enhanced SMS packages or caller identification features, benefit from an enormous and established subscriber base. Their widespread, habitual use ensures a steady stream of revenue, even with minimal growth projections.

The operational costs associated with these legacy VAS are remarkably low. This efficiency, coupled with their consistent demand, allows them to generate substantial positive cash flow for China Mobile. For instance, in 2023, China Mobile reported a net profit of approximately RMB 133.5 billion, with a significant portion of this stemming from its diverse service offerings, including these mature VAS.

- Consistent Revenue Generation: Despite market shifts, legacy VAS maintain a stable income source due to their deep penetration within China Mobile's vast subscriber network.

- Low Operational Costs: These mature services require minimal investment in infrastructure and development, leading to high-profit margins.

- Contribution to Overall Cash Flow: Their dependable revenue streams bolster China Mobile's financial stability, funding investments in newer, high-growth areas.

- Massive Subscriber Base: The sheer scale of China Mobile's user base ensures that even low-growth services can generate significant aggregate cash.

Network Infrastructure and Wholesale Services

China Mobile's network infrastructure and wholesale services are a clear cash cow. As the world's largest mobile network operator, its vast 5G and fiber broadband networks are a significant asset, generating consistent and high-margin revenue. This segment benefits from the substantial upfront investment already made in building out this extensive infrastructure.

The company's ability to offer wholesale services to other operators or cater to large enterprise needs underscores the maturity and profitability of this segment. For instance, in 2023, China Mobile reported a significant portion of its revenue derived from its infrastructure and wholesale offerings, highlighting its stability and cash-generating power.

- Stable Revenue Streams: The foundational nature of network infrastructure provides predictable income.

- High Profit Margins: Once built, the cost of servicing additional wholesale clients is relatively low.

- Leveraging Existing Assets: China Mobile capitalizes on its massive network investment for new revenue opportunities.

- Market Leadership: Its scale as the largest operator enhances its bargaining power in wholesale agreements.

China Mobile's 5G network infrastructure, while a growth area, also functions as a cash cow due to its extensive build-out and high utilization. The company's substantial investment in 5G, reaching 338,000 5G base stations by the end of 2024, underpins its ability to generate consistent revenue from this advanced technology.

These established 5G networks are now mature enough to provide reliable income streams, often through wholesale agreements or by supporting a vast number of connected devices. The operational costs for these networks are largely sunk, allowing for high profit margins on ongoing usage and services.

The sheer scale of China Mobile's 5G deployment means it can efficiently serve a massive customer base, solidifying its position as a cash cow. In 2023, China Mobile reported a 7.7% year-on-year increase in its telecommunications services revenue, with 5G playing a significant role.

| Service Category | Description | Key Characteristic | 2023 Revenue (RMB Billion) | Customer Base (End 2024) |

|---|---|---|---|---|

| 4G Mobile Services | Voice and data for existing subscribers | Mature, high penetration, stable cash flow | 567.9 (Total Mobile Services) | Over 1 Billion |

| Fixed Broadband | Internet access for households | Dominant market share, recurring revenue | N/A (Segmented within overall revenue) | 278 Million Households |

| Enterprise Connectivity & IT | Basic services for businesses | Stable, recurring revenue from corporate clients | N/A (Segmented within overall revenue) | 32.59 Million Enterprises |

| Legacy Value-Added Services (VAS) | SMS, caller ID, etc. | Low cost, habitual use, large subscriber base | N/A (Contributes to overall profit) | Vast subscriber base |

| Network Infrastructure & Wholesale | 5G and fiber networks for internal and external use | High utilization, high margins, leveraging sunk costs | N/A (Contributes to overall revenue) | 338,000 5G Base Stations |

What You’re Viewing Is Included

China Mobile BCG Matrix

The China Mobile BCG Matrix preview you are currently viewing is the identical, fully formatted document you will receive immediately after purchase. This means no watermarks, no placeholder text, and no hidden surprises – just the complete, professionally designed analysis ready for your strategic planning. You can be confident that the insights and structure presented here are precisely what you will download, enabling you to directly apply this valuable market intelligence to your business decisions without any further editing or preparation.

Dogs

China Mobile's legacy 2G and 3G services are firmly in the Dogs quadrant of the BCG Matrix. With 5G adoption surging and 4G still holding strong, these older networks face a shrinking market and declining subscriber base.

These services likely contribute very little to revenue while still requiring operational expenses for maintenance. China Mobile is actively working to phase out these technologies, signaling a move towards divestiture or complete discontinuation.

China Mobile's outdated fixed-line telephony services are a classic example of a 'Dog' in the BCG matrix. While the company historically had a significant presence, this segment is experiencing a long-term decline. Consumers are increasingly opting for mobile communication and internet-based alternatives, leading to a shrinking customer base and reduced revenue for traditional landlines.

This segment is characterized by low growth and a diminishing market share, especially when compared to China Mobile's dominant mobile and broadband offerings. These services often operate at break-even or function as cash traps, requiring ongoing maintenance without significant return on investment. Consequently, capital expenditure in this area is minimal, with the strategic focus being on efficiently managing the managed decline of these legacy services.

Certain very basic, low-Average Revenue Per User (ARPU) prepaid mobile plans in highly saturated segments may fall into the Dogs category of China Mobile's BCG Matrix. These plans often experience high churn rates and contribute little to overall profitability, tying up resources without significant returns. For instance, in 2024, China Mobile continued its efforts to reduce its base of these low-ARPU subscribers, aiming to improve overall network efficiency and customer value.

Physical Retail Locations for Basic Transactions

Physical retail locations for basic transactions, such as SIM card top-ups and simple plan changes, represent a segment of China Mobile's operations that is experiencing a shift in relevance due to increasing digitalization. While these stores historically served as crucial touchpoints, their primary function for basic services is being superseded by online platforms and mobile applications. This trend is evident across the telecommunications industry, where customers increasingly prefer self-service options for routine tasks.

In 2024, China Mobile continued to invest in its digital channels, which offer convenience and efficiency for basic transactions. For instance, the company's official app and website provide seamless options for recharging accounts and managing subscriptions, drawing customers away from physical stores for these specific needs. This evolution means that stores solely focused on these basic functions may be viewed as less strategic unless they can adapt to offer more value-added services or enhanced customer experiences.

- Declining Foot Traffic for Basic Services: Many customers now opt for digital channels for SIM top-ups and basic plan modifications, reducing the necessity of physical visits for these transactions.

- Adaptation for Higher-Value Services: Stores that do not evolve to handle complex sales, personalized consultations, or device demonstrations may struggle to justify their operational costs.

- Efficiency Concerns: Locations primarily facilitating low-complexity, low-revenue transactions can be considered inefficient compared to those driving new service adoption or device sales.

- Growth Potential Limitations: The inherent nature of basic transactions limits the growth potential of physical locations that are not equipped for more sophisticated customer engagement or sales.

Non-Strategic, Low-Performing Investments/Ventures

Non-strategic, low-performing investments or ventures within China Mobile's portfolio would represent minor, non-core initiatives that have struggled to gain market traction or achieve profitability. These are often small segments with a low market share operating in slow or stagnant markets, consuming resources without a clear path to future growth or contribution. In 2023, China Mobile continued to focus on its core telecommunications services, with investments in emerging areas like 5G and cloud computing showing stronger performance. Ventures that fall into the non-strategic, low-performing category could be candidates for divestment or significant restructuring to reallocate capital more effectively.

- Underperforming Ventures: These are ventures that have not met their financial or strategic objectives, potentially showing negative returns or minimal growth.

- Resource Drain: They consume management attention and financial resources without contributing significantly to overall profitability or market position.

- Divestment Consideration: Such ventures are prime candidates for sale or closure to free up capital and focus on core, high-growth areas.

- Market Stagnation: Often found in mature or declining market segments, these ventures struggle to differentiate or compete effectively.

China Mobile's legacy 2G and 3G networks, along with outdated fixed-line telephony, are prime examples of 'Dogs' in the BCG Matrix. These segments face shrinking markets and declining subscriber bases, contributing little revenue while still incurring maintenance costs. The company is actively phasing out these technologies, indicating a strategic move towards divestment or discontinuation to reallocate resources to more promising areas.

Furthermore, certain low-ARPU prepaid mobile plans and physical retail locations focused solely on basic transactions also fall into the 'Dog' category. These segments experience high churn, low profitability, and are increasingly being superseded by digital channels. China Mobile's 2024 strategy involved reducing these low-value subscribers and investing in digital platforms, highlighting the diminishing relevance of these legacy operations.

| Segment | BCG Quadrant | Market Share | Market Growth | Strategic Outlook |

|---|---|---|---|---|

| 2G/3G Networks | Dog | Very Low | Declining | Phasing out, divestment |

| Fixed-Line Telephony | Dog | Low | Declining | Managed decline, minimal investment |

| Low-ARPU Prepaid Plans | Dog | Low | Stagnant to Declining | Reduction of subscriber base |

| Basic Transaction Retail Stores | Dog | Declining Relevance | Declining | Adaptation or closure, focus on digital |

Question Marks

China Mobile is heavily investing in advanced AI and data-driven solutions, exemplified by their 'Jiutian Zhongqing' foundation model and AI+ initiatives spanning diverse sectors. These are crucial for future growth.

While the overall AI application market is booming, China Mobile's specific market share in these highly specialized, advanced AI segments is still emerging, especially when compared to established AI-focused companies. This means they are building their presence.

These forward-looking AI projects require significant capital expenditure. However, they hold substantial potential to evolve into future Stars within the BCG matrix if they achieve widespread adoption and establish market leadership in their respective niches.

China Mobile's international expansion is a key growth driver, with its international business revenue reaching RMB 22.8 billion in 2024, marking a 10.2% increase. This growth is supported by strategic investments in new submarine cable systems, enhancing global connectivity.

While these new markets present significant opportunities, China Mobile often enters with a smaller market share than established local competitors. This necessitates substantial upfront investment to build infrastructure and gain traction.

China Mobile is making significant strides in emerging digital content and financial technology (FinTech) services. In 2024, this new market sector saw revenue climb by 8.7% to RMB 53.6 billion. The FinTech segment, particularly its payment services, experienced explosive growth, expanding by a remarkable 52% during the same year.

Metaverse and Web3 Related Initiatives

China Mobile is actively investigating the Metaverse and Web3, recognizing their potential as significant future growth drivers for the telecommunications industry. These emerging sectors represent high-potential markets, though they currently hold minimal market share and necessitate substantial, speculative investment with outcomes that are far from guaranteed.

The success of these initiatives is intrinsically linked to achieving broad consumer acceptance and the continued evolution of the underlying technologies. For instance, the global Metaverse market was projected to reach $678.8 billion by 2030, indicating the scale of opportunity, yet adoption remains nascent.

- High Growth Potential: Metaverse and Web3 are seen as transformative technologies with the potential to redefine digital interaction and commerce.

- Low Current Market Share: Despite the hype, actual adoption and revenue generation from these sectors are still in their early stages for major players like China Mobile.

- Significant Investment Required: Developing robust infrastructure, content, and user experiences for these new digital realms demands considerable capital outlay with uncertain return timelines.

- Dependence on Adoption and Maturation: Widespread user uptake and the technological maturity of blockchain, VR/AR, and decentralized systems are critical for realizing the full potential of these ventures.

5G-Advanced (5G-A) and 6G Research & Development

China Mobile is a significant player in the advancement of mobile communication technologies, actively driving the development of 5G-Advanced (5G-A). By June 2024, the company had already deployed 5G-A networks in more than 280 cities, demonstrating a commitment to early adoption and infrastructure build-out.

This focus on 5G-A is a strategic move to solidify its position in an evolving technological landscape. Simultaneously, China Mobile is investing heavily in research and development for 6G, the next generation of wireless technology. While the long-term potential for 6G is substantial, its widespread commercialization and market dominance remain uncertain and are expected to be some years away.

These ambitious R&D efforts, particularly in 6G, represent a considerable capital expenditure for China Mobile. However, this investment is deemed essential for maintaining a competitive edge and securing future leadership in the telecommunications sector.

- 5G-Advanced Deployment: Over 280 cities had 5G-A networks by June 2024.

- 6G Research: China Mobile is actively engaged in 6G R&D.

- Strategic Importance: Crucial for future market leadership and competitive advantage.

- Capital Investment: Significant expenditure required for these advanced technologies.

China Mobile's ventures into emerging technologies like Metaverse and Web3 are characterized by high growth potential but currently low market share. These initiatives demand significant investment, with success hinging on broad consumer adoption and technological maturation.

The company's investment in advanced AI and data-driven solutions, such as the 'Jiutian Zhongqing' model, positions them for future growth in specialized segments. While the overall AI market is expanding, China Mobile's share in these advanced niches is still developing, requiring substantial capital for potential future market leadership.

China Mobile's international expansion, with revenue reaching RMB 22.8 billion in 2024 (a 10.2% increase), is a key driver. However, entering new markets often means starting with a smaller share than local competitors, necessitating upfront investment to build infrastructure and gain traction.

The company is also making strides in digital content and FinTech, with revenue climbing to RMB 53.6 billion in 2024, an 8.7% increase. FinTech, particularly payment services, saw remarkable 52% growth in the same year.

| Initiative | Growth Potential | Current Market Share | Investment Level | Key Dependencies |

| Metaverse & Web3 | High | Low | High | Consumer adoption, Tech maturity |

| Advanced AI & Data Solutions | High | Emerging | High | Market adoption, Niche leadership |

| International Expansion | High | Moderate (vs. local) | Moderate | Infrastructure build-out, Market penetration |

| Digital Content & FinTech | High | Growing | Moderate | Service adoption, Regulatory environment |

BCG Matrix Data Sources

Our China Mobile BCG Matrix is built on a foundation of official financial disclosures, comprehensive market research reports, and internal performance metrics to provide a clear strategic overview.