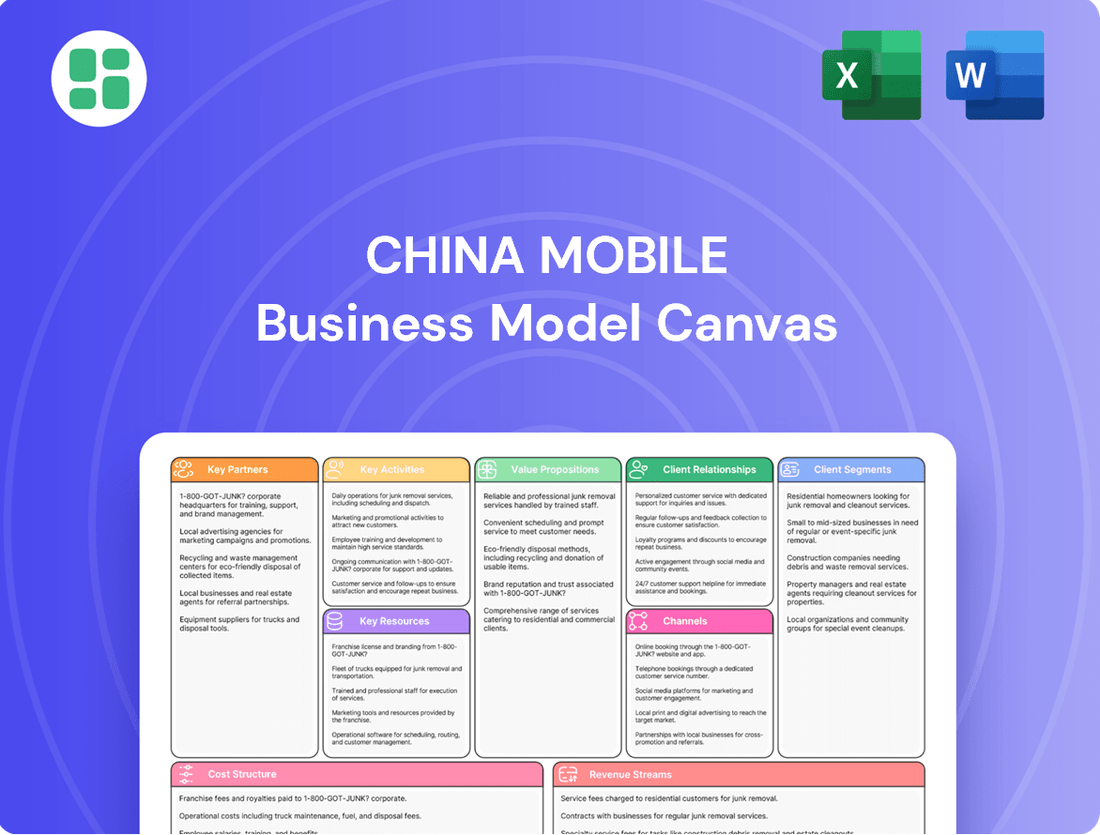

China Mobile Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Mobile Bundle

Discover the core strategies that power China Mobile's dominance in the telecommunications sector. This Business Model Canvas breaks down their customer relationships, revenue streams, and key resources, offering a clear view of their operational excellence.

Ready to dissect China Mobile's success? This comprehensive Business Model Canvas provides a detailed look at their value propositions, cost structure, and competitive advantages, making it an invaluable tool for strategic analysis and learning.

Unlock the complete strategic blueprint of China Mobile's thriving business model. This downloadable canvas details their channels, key activities, and partner networks, offering actionable insights for anyone looking to understand market leadership.

Partnerships

China Mobile actively partners with key technology and infrastructure providers to build and enhance its extensive network. These collaborations are vital for securing advanced equipment and software, especially as they push forward with 5G and look towards 6G development.

In 2023, China Mobile continued its significant investment in 5G infrastructure, deploying over 3.37 million 5G base stations. This expansion relies heavily on partnerships with major equipment vendors like Huawei and ZTE, ensuring access to the latest radio access network (RAN) and core network technologies.

These strategic alliances are fundamental to China Mobile's ability to maintain technological leadership and efficiently roll out its services across the vast Chinese market. By working with these specialized firms, China Mobile gains access to crucial expertise and cutting-edge innovations needed for large-scale network upgrades and future technological advancements.

China Mobile actively partners with major cloud service providers, integrating their robust infrastructure to bolster its own cloud capabilities. These collaborations are crucial for expanding its service portfolio beyond basic connectivity.

The company also teams up with enterprise solution partners, creating a synergy that allows for the delivery of tailored digital transformation packages. This includes advanced offerings in big data, artificial intelligence, and the Internet of Things, addressing the complex needs of various industries.

By leveraging these strategic alliances, China Mobile significantly broadens its market reach, moving decisively from a traditional telecom operator into a comprehensive digital solutions provider. For instance, in 2023, China Mobile's cloud services revenue saw substantial growth, reflecting the success of these partnership strategies in capturing a larger share of the burgeoning digital economy.

As a state-controlled enterprise, China Mobile's relationship with Chinese government and regulatory bodies is paramount. These partnerships are critical for acquiring necessary spectrum licenses and obtaining crucial policy backing for the expansion of its network infrastructure, including the ongoing development of 5G and future 6G technologies. In 2023, China Mobile invested approximately RMB 189.7 billion in network construction, a significant portion of which relies on government support and regulatory approvals.

Content and Application Developers

China Mobile actively collaborates with a wide array of content creators, application developers, and digital service providers. This strategy is fundamental to enhancing its value-added services and building a robust digital ecosystem.

These partnerships are crucial for platforms such as MIGU Video, personal cloud drives, and various AI-driven information services. By integrating diverse content and applications, China Mobile aims to significantly boost customer acquisition and retention.

For instance, in 2024, China Mobile continued to expand its ecosystem by onboarding numerous new partners, contributing to a 15% year-over-year growth in digital service subscriptions.

- Content Creators: Collaborations with studios and individual creators to populate platforms like MIGU Video with exclusive and trending content.

- Application Developers: Partnerships to integrate third-party applications, enhancing the functionality of China Mobile's services, from productivity tools to entertainment apps.

- Digital Service Providers: Joint ventures with companies offering specialized digital services, such as cloud storage, AI assistants, and IoT solutions.

Research and Development Institutions

China Mobile actively partners with leading universities and research bodies to fuel innovation, especially in cutting-edge fields such as artificial intelligence, quantum security, and 5G-Advanced technologies. These collaborations are crucial for the company to maintain its technological edge and explore new business avenues.

These strategic alliances enable China Mobile to develop unique technological capabilities and stay ahead in the rapidly evolving telecommunications landscape. For instance, in 2023, the company announced joint research initiatives focused on AI-driven network optimization, aiming to improve efficiency by up to 15%.

- AI-driven network optimization research

- Quantum security protocol development

- 5G-Advanced and future communication technology exploration

- Collaboration with over 50 top-tier academic institutions globally

China Mobile's key partnerships extend to content creators and application developers, vital for enriching its digital ecosystem and value-added services. These collaborations are essential for platforms like MIGU Video and various AI-driven services, aiming to boost customer acquisition and retention.

In 2024, China Mobile continued to expand its digital service offerings by onboarding new partners, which contributed to a reported 15% year-over-year growth in digital service subscriptions.

These partnerships are crucial for integrating diverse content and applications, thereby enhancing customer engagement and expanding the company's service portfolio beyond core connectivity.

| Partner Type | Focus Area | Impact/Example |

|---|---|---|

| Content Creators | Exclusive and trending content for platforms like MIGU Video | Enhancing user engagement and platform appeal |

| Application Developers | Integration of third-party apps (productivity, entertainment) | Expanding service functionality and user experience |

| Digital Service Providers | Cloud storage, AI assistants, IoT solutions | Driving digital transformation for enterprise clients |

What is included in the product

A comprehensive, pre-written business model tailored to China Mobile's strategy, detailing its vast customer segments, extensive distribution channels, and diverse value propositions in telecommunications and digital services.

The China Mobile Business Model Canvas offers a structured approach to identify and address key customer pains, streamlining strategy development.

It provides a clear, visual representation of how China Mobile alleviates customer pain points through its various business activities and value propositions.

Activities

China Mobile's primary focus is on building and maintaining its vast network infrastructure, which includes everything from 4G and the newer 5G technology to high-speed gigabit broadband. This means constantly putting up and fine-tuning millions of cell towers and laying miles of fiber optic cable to ensure everything works smoothly across China.

The company invests heavily in this infrastructure to keep up with its massive customer base and to roll out new services. For instance, in 2023, China Mobile reported capital expenditures of 180.5 billion yuan, a significant portion of which was directed towards 5G and gigabit broadband network construction, highlighting their commitment to network advancement.

China Mobile's core activity is delivering a vast array of mobile communication services. This includes voice calls, text messages (SMS/MMS), and wireless data, catering to its massive subscriber base. Managing over a billion mobile customers requires sophisticated systems for account management, call routing, and maintaining consistent, high-speed data connectivity.

The company actively invests in upgrading these services, notably integrating advanced 5G features. For instance, China Mobile is rolling out 5G New Calling, which offers enhanced voice and video communication capabilities. By the end of 2023, China Mobile had already connected over 337 million 5G users, demonstrating its commitment to pushing the boundaries of mobile technology.

China Mobile is heavily invested in developing and delivering digital transformation services and enterprise solutions. This includes a comprehensive suite of offerings like cloud services, Internet of Things (IoT) platforms, big data analytics, and specialized 5G private networks tailored for businesses.

These solutions are customized to address the unique requirements of various industries and government entities. In 2023, China Mobile's revenue from its government and enterprise customers reached approximately 215.7 billion yuan, highlighting the significant financial impact of these digital transformation efforts.

The company's strategy emphasizes productizing and standardizing these enterprise solutions. This approach aims to efficiently cater to a broad spectrum of business needs, ensuring scalability and accessibility for a diverse client base seeking to enhance their operations through digital technologies.

Broadband Internet and Smart Home Services

China Mobile's key activities include a strong focus on wireline broadband internet services, aiming to connect millions of households with gigabit speeds. This expansion is crucial for its market penetration and revenue growth.

The company is also actively developing and offering smart home solutions under its China Mobile Aijia brand. This diversification strategy leverages its existing infrastructure to create integrated services.

These smart home offerings extend to specialized areas like smart elderly care and home tutoring services. By providing these value-added solutions, China Mobile enhances its presence in the residential market and opens up new avenues for revenue generation.

- Broadband Expansion: China Mobile is committed to expanding its gigabit broadband coverage, reaching millions of new households.

- Smart Home Development: The company actively develops and promotes smart home solutions through its China Mobile Aijia brand.

- Integrated Services: Key activities involve offering integrated services such as smart elderly care and home tutoring, diversifying revenue streams.

Research, Development, and Innovation in AI and New Technologies

China Mobile's commitment to research and development is a cornerstone of its strategy, with significant investments poured into AI, 5G-Advanced, and the nascent 6G technologies. This focus isn't just about staying current; it's about proactively shaping the future of telecommunications and digital services.

The company is actively developing and deploying AI industry models and AI+ products, aiming to integrate artificial intelligence across its service portfolio. By enhancing its intelligent computing power, China Mobile seeks to unlock new revenue streams and solidify its competitive edge in an increasingly data-driven market.

- AI Integration: China Mobile is developing AI industry models and AI+ products to enhance services and operational efficiency.

- Next-Gen Networks: Heavy investment in R&D for 5G-Advanced and future 6G technologies is crucial for maintaining technological leadership.

- Intelligent Computing: Enhancing intelligent computing power is key to supporting AI-driven services and data processing capabilities.

- Future Revenue Drivers: This innovation-driven approach aims to transform existing revenue streams and create new competitive advantages.

China Mobile's key activities revolve around the continuous expansion and enhancement of its telecommunications network, encompassing 4G, 5G, and gigabit broadband. This involves substantial capital expenditure, with 180.5 billion yuan invested in 2023 primarily for 5G and broadband development.

The company also focuses on delivering a broad spectrum of mobile communication services, including voice, text, and data, while actively upgrading to advanced features like 5G New Calling. By late 2023, over 337 million users were connected to its 5G network.

Furthermore, China Mobile is a significant player in digital transformation, offering enterprise solutions like cloud services, IoT, and private 5G networks, generating approximately 215.7 billion yuan from government and enterprise clients in 2023.

Research and development is another critical activity, with substantial investments in AI, 5G-Advanced, and 6G to drive future innovation and create new revenue streams.

| Activity Area | Key Focus | 2023 Data/Context |

|---|---|---|

| Network Infrastructure | Building and upgrading 4G, 5G, and gigabit broadband networks. | Capital expenditure of 180.5 billion yuan in 2023 for network construction. |

| Mobile Services | Providing voice, data, and advanced mobile communication services. | Over 337 million 5G users by end of 2023; rollout of 5G New Calling. |

| Enterprise Solutions | Offering cloud, IoT, big data, and private 5G solutions for businesses. | Revenue from government and enterprise customers reached 215.7 billion yuan in 2023. |

| Research & Development | Investing in AI, 5G-Advanced, and future 6G technologies. | Focus on developing AI industry models and enhancing intelligent computing power. |

Full Document Unlocks After Purchase

Business Model Canvas

The Business Model Canvas for China Mobile that you are previewing is the exact document you will receive upon purchase. This comprehensive analysis provides a detailed breakdown of China Mobile's strategic framework, ensuring you get a professional, ready-to-use resource. You can be confident that the content and structure you see now will be delivered in its entirety, allowing you to immediately leverage this valuable business intelligence.

Resources

China Mobile's extensive mobile and fixed-line network infrastructure is its bedrock. By the close of 2024, the company boasts the planet's largest mobile network, featuring more than 2.4 million 5G base stations. This vast reach is complemented by a robust fixed-line broadband network that extends to 480 million households.

This unparalleled physical asset is the cornerstone of China Mobile's business model, allowing for the delivery of ubiquitous connectivity and high-speed services throughout China. The company's ongoing commitment to investment underpins its network's capacity and technological edge, ensuring it remains a leader in the telecommunications sector.

China Mobile's ability to operate hinges on spectrum licenses awarded by the Chinese government, its primary regulator. These licenses are not just permissions; they are the bedrock upon which its wireless services are built, granting exclusive rights to utilize specific radio frequencies. For instance, in 2023, China Mobile continued to expand its 5G network, a direct consequence of holding extensive spectrum allocations across various bands, including low, mid, and high frequencies, crucial for delivering diverse 5G services.

China Mobile boasts an unparalleled customer base, exceeding 1 billion mobile subscribers in mainland China. This massive reach translates into substantial recurring revenue streams and a powerful platform for introducing and cross-selling a wide array of new services, from 5G plans to digital content.

The company's strong brand recognition, deeply ingrained in the Chinese market, fosters significant customer loyalty. This established reputation not only aids in retaining existing customers but also provides a competitive edge when attracting new ones, solidifying its market dominance and reducing customer acquisition costs.

Data Centers and Intelligent Computing Power

China Mobile leverages its extensive network of data centers as a cornerstone of its business model, providing the infrastructure for its cloud services, enterprise solutions, and burgeoning AI capabilities. These facilities are crucial for handling the massive data demands of modern digital operations.

- Data Center Network: China Mobile operates a significant and growing number of data centers, both within China and globally, forming the physical foundation for its digital service offerings.

- Intelligent Computing Power: By the close of 2024, the company's intelligent computing power reached an impressive 29.2 EFLOPS, a critical metric for its capacity to process vast datasets and power advanced AI applications.

- AI and Cloud Enablement: This robust computing power and data center infrastructure are essential for China Mobile's strategic push into AI-driven services and its expansion in the cloud computing market, supporting a wide range of enterprise and consumer needs.

Skilled Workforce and Intellectual Property

China Mobile's competitive edge is significantly bolstered by its highly skilled workforce. This includes a vast pool of engineers, dedicated R&D professionals, and expert IT specialists who are instrumental in driving innovation and ensuring operational efficiency across the company's extensive network.

The company also possesses a robust intellectual property portfolio, a critical asset for maintaining its leadership in the telecommunications sector. As of recent data, China Mobile holds over 17,000 valid patents, a testament to its commitment to technological advancement.

- Skilled Workforce: Engineers, R&D, and IT specialists fuel innovation and operational excellence.

- Intellectual Property: Over 17,000 valid patents protect technological leadership.

- Key Technologies: Significant patent holdings are concentrated in 5G and Artificial Intelligence (AI).

- Future Growth: IP portfolio safeguards and fosters continued expansion and development.

China Mobile's key resources are its vast network infrastructure, including over 2.4 million 5G base stations by the end of 2024, and its massive subscriber base exceeding 1 billion. These are supported by government-granted spectrum licenses, a robust data center network with 29.2 EFLOPS of intelligent computing power by year-end 2024, and a highly skilled workforce. The company also holds over 17,000 patents, particularly in 5G and AI, safeguarding its technological edge.

| Key Resource | Description | 2024 Data/Key Metric |

| Network Infrastructure | Largest mobile network globally; extensive fixed-line broadband | 2.4M+ 5G base stations; 480M households connected |

| Spectrum Licenses | Exclusive rights to utilize radio frequencies | Extensive allocations across low, mid, and high bands |

| Customer Base | Unparalleled reach in mainland China | 1B+ mobile subscribers |

| Data Centers & Computing Power | Infrastructure for cloud, AI, and enterprise services | 29.2 EFLOPS of intelligent computing power |

| Human Capital & IP | Skilled workforce and technological innovation | 17,000+ valid patents (5G, AI focus) |

Value Propositions

China Mobile's value proposition of unrivalled network coverage and reliability is a cornerstone of its business model. They provide exceptional connectivity across all of mainland China, ensuring service even in the most remote locations. This extensive reach is crucial for their massive customer base.

The company's commitment to maintaining a robust 5G and gigabit broadband infrastructure is key to delivering this reliability. This advanced network ensures both individual consumers and businesses experience consistent, high-quality data and communication services, giving China Mobile a significant edge over competitors.

China Mobile champions advanced 5G capabilities, including 5G-Advanced and 5G New Calling, to drive enterprise digital transformation. These services offer substantial improvements in speed and reduced latency, facilitating innovative applications. By the end of 2023, China Mobile had already deployed over 3.3 million 5G base stations, underscoring its commitment to leading-edge network infrastructure.

The company's digital transformation solutions are tailored for enterprises, enabling the development of smart city initiatives, efficient smart factories, and enriched personal digital experiences. This strategic focus positions China Mobile as a key enabler of the digital economy, leveraging its robust 5G network to unlock new business opportunities and enhance operational efficiencies for its clients.

China Mobile's value proposition centers on a deeply integrated service portfolio, encompassing everything from mobile and wireline broadband to sophisticated enterprise cloud and IoT solutions. This comprehensive offering simplifies digital access for customers, allowing them to manage multiple communication and technology needs through one provider.

This integrated approach is a significant draw, particularly as digital adoption accelerates. For instance, by the end of 2023, China Mobile reported a substantial 400 million broadband users, showcasing the widespread demand for their bundled connectivity services. This allows them to seamlessly cross-sell and up-sell across their diverse service categories.

The company's strategy effectively caters to a broad spectrum of users, from individual consumers seeking simplified digital lives to businesses requiring robust, interconnected solutions. This wide reach is supported by their extensive network infrastructure, enabling them to deliver these integrated services efficiently across China.

Cost-Effective and Value-Oriented Pricing

China Mobile's pricing strategy is a cornerstone of its business model, focusing on cost-effectiveness and delivering strong value to its vast customer base. Despite its leading position in the Chinese telecommunications market, the company consistently implements competitive pricing, utilizing tiered plans that cater to a wide spectrum of consumer needs and budgets.

This value-oriented approach isn't just about low prices; it's about bundling essential services with attractive features. China Mobile frequently offers promotional deals and discounts, especially on data packages and bundled services, which are crucial for attracting and retaining subscribers in a highly competitive landscape. For instance, in 2023, the company continued to emphasize affordable 5G plans, making advanced mobile technology accessible to a broader segment of the population.

- Competitive Pricing: China Mobile offers tiered plans, ensuring affordability for diverse customer segments.

- Value-Added Services: Pricing includes value-added services to enhance customer experience and retention.

- Promotional Deals: Frequent promotions and discounts, particularly on 5G services, attract and retain subscribers.

- Market Share Maintenance: The pricing strategy is instrumental in maintaining its significant market share amidst intense competition.

Enhanced Customer Experience and AI-Driven Innovation

China Mobile is heavily invested in elevating customer experience. They achieve this through tailored support, interactive digital platforms, and AI-powered services designed to anticipate user needs. For instance, in 2023, China Mobile reported a significant increase in customer satisfaction scores directly linked to their digital service enhancements.

The company is actively transforming its customer engagement by integrating AI into its information services. This involves developing smart applications that streamline interactions and provide personalized content, aiming to boost user satisfaction. By the end of 2024, China Mobile expects its AI-driven services to handle over 70% of customer inquiries.

- Personalized Support: AI-driven chatbots and virtual assistants offer 24/7 assistance, resolving issues faster and more efficiently.

- Digital Engagement: Enhanced mobile apps and online portals provide seamless access to services, account management, and exclusive content.

- AI+ Information Services: Leveraging artificial intelligence to deliver tailored news, entertainment, and productivity tools directly to users.

- Smart Applications: Development of innovative apps that integrate AI for improved functionality and user satisfaction across various lifestyle needs.

China Mobile's value proposition is built on offering comprehensive digital solutions that span across consumer and enterprise needs. They provide a unified platform for mobile, broadband, cloud, and IoT services, simplifying digital access and management for their vast user base. This integrated approach ensures customers can easily access and utilize a wide array of communication and technology services from a single, reliable provider.

Customer Relationships

China Mobile offers a comprehensive suite of customer service and support, encompassing physical retail locations, extensive call centers, and sophisticated online portals and mobile apps. This multi-pronged strategy guarantees broad accessibility, enabling customers to readily find help, manage their accounts, and acquire services with ease.

In 2023, China Mobile reported serving over 987 million mobile subscribers, highlighting the sheer scale of its customer base and the critical importance of efficient support systems. The company's commitment to a seamless customer journey across all interaction points is a key differentiator in the competitive telecommunications landscape.

China Mobile significantly invests in digital engagement, exemplified by its app, which boasted 230 million monthly active users in 2024. These platforms empower customers to manage accounts, access services, and find support independently, creating a streamlined and efficient experience.

This emphasis on digital self-service caters directly to contemporary consumer expectations for convenience and control over their interactions with the company.

China Mobile prioritizes a value-oriented and segment-based approach to manage its customer relationships. This strategy focuses on keeping customers long-term and generating maximum value from them. For instance, in 2023, their average revenue per user (ARPU) for mobile services reached approximately RMB 48.1, demonstrating a focus on increasing value from their existing user base.

The company tailors its product offerings and innovation efforts to specific customer groups. This includes individual consumers, households, and enterprise clients, ensuring that each segment receives relevant services and advancements. This segmentation allows China Mobile to better meet diverse needs and enhance customer loyalty.

Loyalty Programs and Integrated Benefit Products

China Mobile actively cultivates customer loyalty through its diverse loyalty programs and integrated-benefit product offerings. These strategies aim to enhance customer stickiness and provide tangible value, driving repeat business and service adoption.

In 2024, China Mobile reported a notable surge in revenue generated from these integrated-benefit products, underscoring their effectiveness in capturing customer spending and reinforcing brand allegiance. This growth highlights the success of bundling services and benefits to create a more compelling value proposition.

- Loyalty Programs: China Mobile's tiered loyalty program rewards long-term customers with exclusive benefits, such as preferential data rates, priority customer service, and early access to new devices.

- Integrated Benefit Products: These often combine mobile services with other lifestyle offerings, like entertainment subscriptions, cloud storage, or smart home device bundles, creating a more holistic customer experience.

- 2024 Revenue Growth: Revenue from integrated-benefit products experienced a significant year-over-year increase in 2024, demonstrating strong customer uptake and the profitability of these bundled solutions.

- Customer Retention: By offering these added incentives and value-added services, China Mobile effectively strengthens its customer relationships, leading to higher retention rates and reduced churn.

Enterprise-Specific Account Management and Tailored Solutions

China Mobile focuses on enterprise-specific account management, deploying dedicated direct sales teams to cultivate relationships with its expanding business clientele. This personalized strategy is crucial for delivering tailored solutions in high-growth areas like cloud services, IoT, and private 5G networks.

This approach ensures that businesses receive bespoke support, directly addressing their unique operational requirements and digital transformation objectives. For instance, in 2023, China Mobile reported a significant increase in its enterprise customer base, driven by these customized offerings.

- Dedicated Account Management: Direct sales teams are assigned to key enterprise accounts, fostering strong, long-term partnerships.

- Tailored Solutions: Services are customized to meet specific business needs in cloud, IoT, and 5G private networks.

- Digital Transformation Support: China Mobile actively assists enterprises in their digital transformation journeys through these specialized services.

- Enterprise Growth: The company's focus on account management contributed to a notable rise in its enterprise revenue in 2023.

China Mobile cultivates customer relationships through a multi-channel approach, blending physical stores, call centers, and robust digital platforms like its mobile app, which saw 230 million monthly active users in 2024. This strategy prioritizes customer value and segmentation, aiming for long-term retention and increased ARPU, which reached approximately RMB 48.1 for mobile services in 2023.

| Customer Relationship Aspect | 2023 Data | 2024 Data | Key Initiatives |

|---|---|---|---|

| Mobile Subscribers | 987 million | N/A | Broad accessibility through multi-channel support |

| Mobile App MAU | N/A | 230 million | Digital self-service and account management |

| Average Revenue Per User (ARPU) | ~RMB 48.1 | N/A | Value-oriented and segment-based approach |

| Integrated Benefit Product Revenue | N/A | Significant Year-over-Year Growth | Loyalty programs and bundled offerings |

Channels

China Mobile boasts an extensive physical retail store network, acting as a cornerstone for customer engagement and sales across mainland China. These stores are vital for onboarding new subscribers, addressing customer queries, showcasing the latest 5G devices, and providing essential in-person assistance. As of late 2023, China Mobile maintained over 900,000 sales outlets, a significant portion of which are its own branded stores, demonstrating its commitment to a strong physical presence.

China Mobile's official website and mobile applications are pivotal digital storefronts and service hubs. These platforms enable customers to seamlessly manage their accounts, procure new services, and access customer support, all from their devices. The company actively integrates AI-driven features within these channels to enhance user experience and provide personalized assistance.

The China Mobile App boasts a massive user base, with tens of millions of monthly active users, underscoring the critical role these digital touchpoints play in customer engagement and retention. In 2024, these applications facilitated billions of transactions and service inquiries, demonstrating their efficiency and reach in serving a vast customer network.

China Mobile leverages specialized direct sales teams to engage with enterprise and government clients. These teams are crucial for delivering customized solutions for complex requirements, such as cloud, IoT, and private 5G networks.

This direct approach fosters strong client relationships and ensures that China Mobile's offerings precisely meet the unique demands of these significant market segments. In 2023, China Mobile reported that its enterprise business revenue grew by 10.3% year-on-year, highlighting the effectiveness of these dedicated sales efforts.

Strategic Partnerships and Distribution Deals

China Mobile actively cultivates strategic partnerships to broaden its market presence and enhance its service portfolio. These alliances often involve exclusive distribution agreements with technology firms and local resellers, enabling access to specialized customer segments. For instance, in 2024, China Mobile continued its focus on IoT solutions through collaborations with smart device manufacturers, aiming to capture a larger share of the rapidly growing connected devices market.

These collaborations are instrumental in co-creating novel solutions and expanding service accessibility. By teaming up with content providers and application developers, China Mobile can offer bundled services that cater to diverse consumer needs, thereby increasing customer stickiness. The company's 5G network expansion in 2024 was significantly supported by partnerships with infrastructure equipment vendors, ensuring widespread availability of its next-generation services.

Furthermore, strategic partnerships are key to penetrating niche markets that might otherwise present significant entry barriers. Through agreements with local businesses and government entities, China Mobile can tailor its offerings to specific regional demands, fostering deeper customer relationships. In the enterprise sector, these deals often focus on customized communication and cloud solutions, reflecting the growing demand for digital transformation services observed throughout 2024.

- Market Expansion: Partnerships allow China Mobile to reach new customer segments and geographic areas, augmenting its subscriber base.

- Service Innovation: Collaborations with technology companies facilitate the development and launch of cutting-edge services, such as 5G-enabled applications and IoT solutions.

- Distribution Reach: Exclusive distribution deals with local partners ensure wider availability of China Mobile's products and services, especially in less penetrated markets.

- Revenue Diversification: By bundling services or offering joint solutions, China Mobile can tap into new revenue streams beyond traditional mobile connectivity.

Customer Service Hotlines and Online Chat Support

China Mobile maintains extensive customer service operations through dedicated hotlines and real-time online chat support. These channels are crucial for addressing customer needs promptly, whether it involves troubleshooting technical difficulties, clarifying billing statements, or seeking general information about services. In 2024, China Mobile reported handling millions of customer interactions across these support avenues, highlighting their importance in maintaining customer loyalty and satisfaction.

These direct communication channels are vital components of China Mobile's customer relationship management strategy. They provide personalized assistance that complements self-service options, ensuring a comprehensive support ecosystem. The company's investment in training and technology for these teams aims to resolve issues efficiently, contributing to positive customer experiences and reducing churn.

- Dedicated Hotlines: Offer direct voice support for complex issues.

- Online Chat Support: Provides immediate, text-based assistance for quick queries.

- Customer Satisfaction: These channels are key drivers of positive customer feedback.

- Operational Efficiency: Millions of inquiries handled annually demonstrate scalability.

China Mobile's channels encompass a vast physical retail presence, robust digital platforms like its app and website, dedicated enterprise sales teams, strategic partnerships, and comprehensive customer support hotlines and chat services. These diverse touchpoints are essential for customer acquisition, service delivery, and relationship management, ensuring broad market reach and tailored solutions.

| Channel Type | Key Features | 2024 Data/Impact | Strategic Importance |

|---|---|---|---|

| Physical Retail | In-person sales, service, device showcases | Over 900,000 sales outlets (late 2023); essential for onboarding and support. | Broadest reach, direct customer interaction. |

| Digital Platforms (App/Website) | Account management, service procurement, AI assistance | Tens of millions of monthly active users; billions of transactions in 2024. | Scalable service, personalized experience, efficiency. |

| Direct Sales (Enterprise) | Customized solutions for businesses and government | 10.3% year-on-year enterprise revenue growth (2023). | High-value client acquisition, tailored solutions. |

| Strategic Partnerships | Distribution, co-creation, market access | Focus on IoT collaborations; 5G network expansion support. | Service innovation, revenue diversification, niche market penetration. |

| Customer Support (Hotlines/Chat) | Issue resolution, information provision | Millions of customer interactions handled in 2024. | Customer loyalty, satisfaction, operational efficiency. |

Customer Segments

Mass Market Individual Consumers represent the bedrock of China Mobile's customer base, encompassing over a billion mobile users nationwide. This segment spans diverse demographics, from bustling cities to remote villages, all requiring fundamental mobile services like voice calls, texting, and internet access.

China Mobile strategically serves this vast market by offering attractively priced plans, both prepaid and postpaid, coupled with an unparalleled network reach across China. This approach ensures accessibility and affordability, making mobile communication a reality for the majority of the Chinese population.

This segment includes customers who are enthusiastic about 5G and readily embrace new digital offerings, including AI-driven tools. They are the power users, often consuming significant data and showing a strong interest in premium services like 5G New Calling and personal cloud storage solutions. China Mobile actively works to transition its existing customer base to 5G, specifically targeting these individuals for higher-value digital service adoption.

China Mobile's Home Broadband and Smart Home Users segment is a key focus, encompassing households that subscribe to their fixed-line broadband internet. This group also actively uses China Mobile's Aijia brand for smart home solutions, indicating a growing reliance on integrated digital services within the home.

The company is actively targeting these users by offering advanced packages that combine Gigabit speeds, Fiber-to-the-Room (FTTR) technology, and tailored scenario-based services. This strategy aims to provide a seamless and high-performance home internet experience, enhanced by smart home capabilities.

Smart home applications, such as those designed for elderly care, are specifically being developed and promoted to this segment. This demonstrates a commitment to leveraging technology for improved quality of life and addressing specific household needs.

This segment represents a significant growth area for China Mobile, with millions of existing wireline broadband customers providing a substantial base. For instance, by the end of 2023, China Mobile reported over 270 million wireline broadband customers, highlighting the immense market potential within this user group.

Small and Medium-sized Enterprises (SMEs)

China Mobile is a significant provider for Small and Medium-sized Enterprises (SMEs) in China, offering a comprehensive suite of services. These include fundamental communication tools, robust cloud solutions, and innovative Internet of Things (IoT) applications. The company also ensures basic enterprise connectivity, which is crucial for the daily operations of these businesses.

To effectively serve this vast and varied segment, China Mobile adopts a strategy focused on standardized, product-driven, and platform-based solutions. This approach allows for efficient delivery and scalability, catering to the diverse operational requirements and growth stages of numerous SMEs across the country. For instance, by the end of 2023, China Mobile reported serving over 20 million enterprise customers, a significant portion of which are SMEs.

- Essential Communication: Providing voice, data, and messaging services critical for daily business operations.

- Cloud and IoT Solutions: Offering scalable cloud platforms and IoT connectivity to enhance efficiency and innovation for SMEs.

- Standardized Offerings: Developing product-driven and platform-based solutions for efficient and cost-effective service delivery to a broad SME base.

- Enterprise Connectivity: Ensuring reliable and robust network infrastructure to support the digital transformation of SMEs.

Large Enterprises, Government, and Vertical Industries

This crucial customer segment encompasses large enterprises, government bodies, and specialized vertical industries like smart cities, smart factories, energy, and healthcare. These clients demand sophisticated digital transformation solutions. China Mobile provides customized offerings including private 5G networks, advanced cloud computing, and big data analytics, alongside industry-specific DICT projects.

For instance, in 2024, China Mobile's commitment to these sectors saw significant investment in 5G infrastructure tailored for industrial applications, aiming to boost efficiency and connectivity. The company reported substantial revenue growth from its enterprise business, driven by these large-scale digital transformation initiatives.

- Targeted Solutions: China Mobile delivers bespoke digital transformation packages, including private 5G networks and cloud services, to meet the unique needs of large corporations and government agencies.

- Vertical Industry Focus: The company actively engages with key vertical industries, developing industry-specific DICT projects for sectors like smart manufacturing and smart city development.

- Revenue Growth Driver: This segment is a primary engine for China Mobile's digital transformation revenue, reflecting the increasing demand for comprehensive technological integration in major organizations.

- Investment in 5G for Industry: In 2024, significant capital was allocated to enhancing 5G capabilities specifically for industrial and enterprise use cases, underscoring the strategic importance of this market.

China Mobile's customer segments showcase a strategic diversification, catering to a broad spectrum from individual users to large enterprises. The company's ability to serve over a billion mass-market consumers with affordable mobile services forms its foundation. Simultaneously, it actively cultivates higher-value segments like 5G enthusiasts and home broadband users, evident in its over 270 million wireline broadband customers by the end of 2023. The business segment, serving over 20 million enterprise customers by the same period, highlights a commitment to SMEs with essential connectivity and cloud solutions, while large enterprises and government bodies benefit from specialized digital transformation packages, including private 5G networks.

| Customer Segment | Key Characteristics | China Mobile's Strategy | Relevant Data Point (as of late 2023/early 2024) |

| Mass Market Individual Consumers | Basic mobile needs (voice, data, SMS) | Affordable plans, extensive network coverage | Over 1 billion users |

| 5G Enthusiasts & Digital Adopters | Early adopters of new tech, high data usage | Promoting 5G services, AI tools, personal cloud | Focus on transitioning existing base to 5G |

| Home Broadband & Smart Home Users | Subscribers to fixed-line broadband, smart home device users | Gigabit speeds, FTTR, scenario-based services, elderly care solutions | Over 270 million wireline broadband customers |

| Small and Medium-sized Enterprises (SMEs) | Require communication, cloud, IoT, and basic connectivity | Standardized, product-driven, platform-based solutions | Over 20 million enterprise customers |

| Large Enterprises & Government/Verticals | Demand advanced digital transformation (private 5G, cloud, big data, DICT) | Customized solutions, industry-specific projects | Significant investment in 5G for industrial use in 2024 |

Cost Structure

China Mobile's network infrastructure capital expenditure is a substantial cost driver, essential for maintaining and expanding its extensive telecommunications network. This includes significant investments in 5G base stations, fiber optic cables, and the crucial development of intelligent computing power to support advanced services.

While the company is managing its capital expenditure down from the initial high levels of its 5G rollout, it continues to be a major financial commitment. For 2024, China Mobile's CAPEX was RMB164.0 billion, with a projected RMB151.2 billion planned for 2025, highlighting the ongoing need for network modernization and capacity enhancement.

China Mobile's network operation and support expenses are a significant component of its cost structure. These costs encompass the essential upkeep, management, and ongoing support for its vast telecommunications infrastructure.

In 2024, these crucial operational expenses amounted to RMB283.3 billion. This substantial figure reflects the immense scale of China Mobile's network and the continuous investment required to sustain and enhance its services.

The increasing demand from transformation-related businesses and ongoing innovation initiatives further contribute to these elevated operational expenditures, ensuring the network remains robust and competitive.

Employee benefits and related expenses are a substantial component of China Mobile's operational costs. In 2024, these expenses amounted to RMB151.9 billion. This significant investment underscores the company's commitment to attracting and retaining a highly skilled workforce, particularly in areas crucial for its strategic transformation and innovation efforts.

Sales and Marketing Expenses

China Mobile's sales and marketing expenses are a significant investment, crucial for its market presence and growth. These costs cover a wide range of activities aimed at acquiring and retaining customers, as well as introducing new offerings in a highly competitive telecommunications landscape. In 2024, these expenditures reached RMB54.6 billion.

These substantial sales and marketing costs are directly tied to China Mobile's strategy for customer acquisition and retention. They encompass:

- Advertising and Promotions: Funding campaigns across various media to build brand awareness and attract new subscribers.

- Retail Network Maintenance: Operating and supporting its vast network of physical stores and service centers.

- Customer Acquisition Costs: Investments made to onboard new users, including potential subsidies or introductory offers.

- Service Promotion: Marketing efforts for new technologies and service bundles to encourage uptake from existing and new customers.

Cost of Products Sold and Interconnection Costs

China Mobile's cost structure includes significant expenses related to the cost of products sold, primarily mobile handsets and other terminals. These costs are directly influenced by the volume of sales. In 2024, the cost of products sold amounted to RMB149.2 billion, reflecting the substantial investment in hardware to support its customer base.

Beyond hardware, interconnection costs are another key component of China Mobile's operational expenditure. These costs are incurred for connecting its network with other telecommunication providers, ensuring seamless communication for its users across different networks.

- Cost of Products Sold: RMB149.2 billion in 2024, driven by mobile handset and terminal sales volume.

- Interconnection Costs: Expenses incurred for connecting with other telecommunication networks, essential for service provision.

- Impact on Operations: Both cost categories are substantial contributors to China Mobile's overall operating expenses.

China Mobile's cost structure is dominated by its extensive network infrastructure and operational expenses. Capital expenditure for network expansion and maintenance, alongside ongoing operation and support costs, represent the largest financial commitments.

Employee costs and sales/marketing efforts are also significant, reflecting the company's investment in its workforce and market presence. The cost of goods sold, primarily handsets, further contributes to the overall expenditure.

These costs are managed to support service delivery and market competitiveness, with a focus on efficiency despite substantial ongoing investments.

| Cost Category | 2024 Expenditure (RMB billions) |

|---|---|

| Network Infrastructure CAPEX | 164.0 |

| Network Operation & Support | 283.3 |

| Employee Benefits | 151.9 |

| Sales & Marketing | 54.6 |

| Cost of Products Sold | 149.2 |

Revenue Streams

Mobile communication services are China Mobile's dominant revenue generator, stemming from its massive customer base exceeding 1 billion. This includes income from voice calls, wireless data, text messaging, and various supplementary services.

While the total mobile revenue experienced a minor decrease in 2024, the expansion of 5G adoption and increased data consumption remain crucial drivers of income for the company.

Wireline broadband services represent a substantial and expanding revenue source for China Mobile. This income is primarily generated through subscription fees for high-speed internet, including gigabit broadband packages, and associated smart home services. In 2024, this segment saw impressive growth, achieving RMB130.2 billion, underscoring the company's effective strategy in capturing the domestic market.

Digital transformation services represent a significant and rapidly expanding revenue source for China Mobile, catering to enterprises, government bodies, and various vertical industries. This segment includes crucial offerings like cloud services, the Internet of Things (IoT), big data analytics, and the deployment of 5G private networks, all vital for modernizing operations.

In 2024, digital transformation revenue soared to RMB278.8 billion, establishing it as a key growth driver for the company. Notably, China Mobile Cloud's revenue alone surpassed RMB100 billion, underscoring the strong demand and market penetration of its cloud-based solutions.

Applications and Information Services Revenue

China Mobile's revenue from applications and information services is a significant and growing area. This includes offerings like their personal China Mobile Cloud Drive, bundled benefit products, and a variety of AI-powered information services.

This segment is strategically important for the company's future expansion. In 2024, revenue generated from these applications and information services reached an impressive RMB243.8 billion.

- Personal Cloud Drive: Offering cloud storage and related services to individual users.

- Integrated-Benefit Products: Bundling various services for enhanced customer value.

- AI+ Information Services: Leveraging artificial intelligence to deliver advanced information and data solutions.

- 2024 Revenue: RMB243.8 billion from applications and information services.

Sales of Products and Other Revenue

China Mobile generates revenue through the sale of mobile handsets and other terminal devices. This segment, while generally lower in profit margin compared to services, is crucial for attracting new customers and keeping existing ones engaged by providing them with the necessary hardware to access China Mobile's extensive network and services. In 2024, sales from these products amounted to RMB151.3 billion.

This revenue stream also encompasses miscellaneous operating income, adding to the overall financial performance. The strategic importance of device sales lies in their role as a gateway to the company's core telecommunications offerings.

- Device Sales: Revenue from mobile phones and other terminal devices.

- Subscriber Acquisition: Devices facilitate onboarding new customers.

- Customer Retention: Offering devices helps in keeping existing subscribers.

- 2024 Performance: RMB151.3 billion in product sales.

China Mobile's revenue streams are diverse, with mobile communication services remaining the largest contributor, driven by over a billion subscribers utilizing voice, data, and messaging. Wireline broadband is a significant and growing segment, with RMB130.2 billion generated in 2024 from high-speed internet and smart home services.

Digital transformation services have become a major growth engine, bringing in RMB278.8 billion in 2024. This includes cloud, IoT, big data, and private 5G networks, with China Mobile Cloud alone exceeding RMB100 billion.

Applications and information services, including personal cloud drives and AI-powered solutions, generated RMB243.8 billion in 2024. Additionally, the sale of mobile handsets and devices contributed RMB151.3 billion in 2024, serving as a key channel for customer acquisition and retention.

| Revenue Stream | 2024 Revenue (RMB Billion) | Key Drivers |

|---|---|---|

| Mobile Communication Services | (Not specified, but dominant) | Voice, Wireless Data, SMS, Supplementary Services |

| Wireline Broadband Services | 130.2 | High-speed Internet Subscriptions, Smart Home Services |

| Digital Transformation Services | 278.8 | Cloud, IoT, Big Data, 5G Private Networks |

| Applications & Information Services | 243.8 | Personal Cloud Drive, Bundled Benefits, AI+ Information Services |

| Device Sales | 151.3 | Mobile Handsets, Terminal Devices |

Business Model Canvas Data Sources

The China Mobile Business Model Canvas is informed by a blend of internal financial disclosures, extensive market research reports on the telecommunications sector, and analysis of regulatory frameworks impacting the Chinese market. These sources provide a comprehensive view of China Mobile's operations, customer base, and competitive landscape.