China Mobile Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Mobile Bundle

China Mobile's marketing prowess is evident in its strategic approach to the 4Ps. From its diverse product portfolio catering to various consumer needs to its competitive pricing structures and extensive distribution network, every element is meticulously crafted. Discover how their promotional campaigns effectively capture market attention and drive customer loyalty.

Go beyond this glimpse and gain access to an in-depth, ready-made Marketing Mix Analysis covering China Mobile's Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants seeking actionable strategic insights.

Product

China Mobile's product offering is incredibly broad, encompassing essential voice and data services alongside a growing suite of value-added services. This comprehensive approach ensures they cater to a wide range of customer needs, from basic connectivity to more advanced digital experiences.

The company's commitment to network infrastructure is a key differentiator. By leveraging its extensive 4G and rapidly expanding 5G networks, China Mobile provides reliable and high-speed communication. This robust foundation is crucial for delivering their diverse service portfolio effectively.

A significant development is China Mobile's leadership in 5G-Advanced (5G-A) technology. They launched the world's first commercial 5G-A network in 2024, a testament to their innovation. By 2025, this advanced network is expected to cover hundreds of cities, offering enhanced speeds and capabilities.

China Mobile is at the forefront of 5G innovation, boasting over 1 billion 5G connections in China by the end of 2024. The company is actively pushing the boundaries with 5G-Advanced, aiming to unlock richer experiences for both individuals and enterprises.

This commitment to advanced technology is evident in groundbreaking products like '5G New Calling.' This service revolutionizes communication by seamlessly blending multimodal features, including real-time translation, visual calling capabilities, and intelligent AI-powered avatars, setting a new standard for user interaction.

China Mobile's robust broadband internet offerings extend far beyond mobile services, reaching millions of homes across mainland China. Their gigabit broadband service is a key component, ensuring high-speed internet access for a substantial portion of the population.

By the close of 2024, China Mobile had achieved gigabit broadband coverage for an impressive 480 million households. This significant reach underscores their commitment to digital infrastructure development.

Looking ahead to 2025, China Mobile is poised to further expand its gigabit broadband footprint, with a strategic target to surpass 500 million households covered. This expansion will continue to drive digital inclusion and economic growth.

Diversified Enterprise and Cloud Solutions

China Mobile's enterprise and cloud solutions, a key component of its 4P's strategy, are rapidly expanding within its DICT business. This segment encompasses AI+DICT applications, advanced smart computing centers, and a comprehensive 'cloud to intelligence transformation' initiative. The company aims to solidify its position as a leading domestic cloud service provider.

By the end of 2023, China Mobile reported significant growth in its DICT business, with revenue reaching ¥232.4 billion, marking a 15.2% year-on-year increase. This performance underscores the growing demand for its diversified enterprise and cloud offerings.

- Cloud Service Growth: China Mobile Cloud is actively expanding its infrastructure, aiming for over 10,000 cloud-native applications by the end of 2024.

- DICT Revenue Contribution: The DICT business accounted for approximately 36% of China Mobile's total revenue in 2023, highlighting its strategic importance.

- AI Integration: Investments in AI+DICT are a priority, with a focus on developing intelligent solutions for various enterprise sectors.

Continuous Digital-Intelligent Evolution

China Mobile's dedication to a continuous digital-intelligent evolution is evident in its product innovation strategy. The company consistently enhances its unique offerings, including Super SIM, mobile cloud disk, and cloud computers, to enrich users' digital lives. This commitment fuels their competitive edge in the market.

The 'AI+ initiative' is a cornerstone of China Mobile's strategy, driving the seamless integration of digital and physical life scenarios. A prime example is its AI intelligent assistant, Lingxi, which provides a suite of useful functions such as intelligent writing and translation, demonstrating the practical application of AI in daily life.

- Product Innovation: China Mobile is actively upgrading distinctive products like Super SIM and mobile cloud disk.

- AI Integration: The 'AI+ initiative' aims to blend digital and physical life through AI advancements.

- Lingxi Assistant: This AI assistant offers practical features like intelligent writing and translation, enhancing user experience.

- Digital Life Enrichment: The overarching goal is to continuously improve and enrich the digital lives of their customers.

China Mobile's product strategy centers on its extensive network capabilities, including a leading 5G-Advanced (5G-A) rollout and widespread gigabit broadband coverage. The company is actively innovating with offerings like '5G New Calling,' which integrates AI and multimodal features, and enhancing its digital-intelligent evolution through products like Super SIM and mobile cloud disk.

| Product Area | Key Offerings | 2024/2025 Data/Targets |

|---|---|---|

| Mobile Services | 5G, 5G-Advanced (5G-A), 5G New Calling | Over 1 billion 5G connections (end of 2024); 5G-A network in hundreds of cities (by 2025) |

| Broadband Services | Gigabit Broadband | 480 million households covered (end of 2024); Over 500 million households targeted (by 2025) |

| Enterprise & Cloud (DICT) | AI+DICT, Smart Computing Centers, Cloud Services | DICT revenue ¥232.4 billion (2023, +15.2% YoY); Over 10,000 cloud-native applications (end of 2024) |

| Digital Life Enhancement | Super SIM, Mobile Cloud Disk, Cloud Computers, AI Assistant (Lingxi) | Continuous product upgrades and AI integration for user experience |

What is included in the product

This analysis provides a comprehensive examination of China Mobile's marketing strategies through the lens of the 4Ps (Product, Price, Place, Promotion), offering insights into their market positioning and competitive approach.

It delves into China Mobile's actual brand practices, exploring how their product offerings, pricing structures, distribution channels, and promotional activities contribute to their overall marketing success.

Condenses China Mobile's 4Ps into actionable insights, alleviating the pain of complex market analysis for swift strategic decisions.

Place

China Mobile's extensive national network infrastructure is a cornerstone of its market dominance. As the world's largest mobile network operator, it ensures a vast reach across mainland China, serving over one billion mobile subscribers by the close of 2024.

Further strengthening this advantage, China Mobile is set to deploy an additional 340,000 5G base stations in 2025. This significant expansion will bring their total 5G footprint to nearly 2.8 million, guaranteeing robust coverage, including RedCap technology, nationwide.

China Mobile excels in omni-channel customer access by blending a vast physical presence with robust digital offerings. Customers can visit over 10,000 retail stores and service centers nationwide, ensuring face-to-face support. This is complemented by their digital ecosystem, including the MyLink app and the 'My Account' portal, which saw a significant increase in user engagement throughout 2024, with millions actively managing their accounts and subscriptions online.

China Mobile's strategic distribution for home broadband is a cornerstone of its 4P strategy, emphasizing extensive reach. By the close of 2024, the company had successfully connected 480 million households with gigabit broadband, a testament to its aggressive expansion efforts.

This impressive coverage is underpinned by significant infrastructure investments, ensuring that services extend to both densely populated urban centers and more remote rural communities. This commitment to broad accessibility is crucial for capturing a wide customer base.

Dedicated Enterprise Sales and Support Channels

China Mobile's enterprise segment benefits from dedicated sales teams and support channels designed to meet the specific demands of corporate clients. This approach ensures that businesses needing intricate digital and cloud solutions receive tailored offerings and direct interaction. By 2024, China Mobile reported a significant increase in its enterprise customer base, driven by these specialized services.

These dedicated channels facilitate a deeper understanding of business requirements, enabling China Mobile to provide customized packages that include advanced connectivity, cloud infrastructure, and IoT solutions. This focus on specialized engagement is crucial for securing and retaining large enterprise accounts.

- Tailored Solutions: Direct engagement allows for the creation of bespoke digital and cloud service packages.

- Complex Needs: Caters to businesses requiring sophisticated and integrated technological solutions.

- Enterprise Growth: Contributes to the expansion of China Mobile's market share in the business sector, with enterprise revenue showing consistent year-over-year growth through 2024.

Collaborative Network Expansion and Innovation Ecosystems

China Mobile actively pursues collaborative network expansion, notably partnering with China Broadnet for a nationwide 700MHz 5G network build-out. This strategic alliance aims to accelerate 5G coverage and efficiency, leveraging shared infrastructure to reduce costs and speed up deployment. By mid-2024, China Mobile had already established over 2.9 million 5G base stations across China, a testament to its rapid network growth.

Further bolstering its market position, China Mobile champions innovation through ecosystem alliances. Its involvement in the 5G-A (5G-Advanced) ecosystem alliance and the Domestic Computing Power Industry Alliance signifies a commitment to developing next-generation technologies and domestic capabilities. These collaborations are crucial for enhancing service delivery and exploring new revenue streams in areas like enhanced mobile broadband and ultra-reliable low-latency communications.

- Network Sharing: Collaboration with China Broadnet on the 700MHz 5G network.

- 5G-A Ecosystem: Fostering advancements in 5G-Advanced technology.

- Computing Power Alliance: Strengthening domestic computing power infrastructure.

- Market Presence: Expanding reach and improving service quality through partnerships.

China Mobile leverages its vast physical network as a primary place strategy, ensuring widespread accessibility. This includes over 10,000 retail stores and service centers, providing crucial face-to-face customer interaction. Their digital platforms, like the MyLink app, also serve as key access points, with millions actively engaging online throughout 2024.

Preview the Actual Deliverable

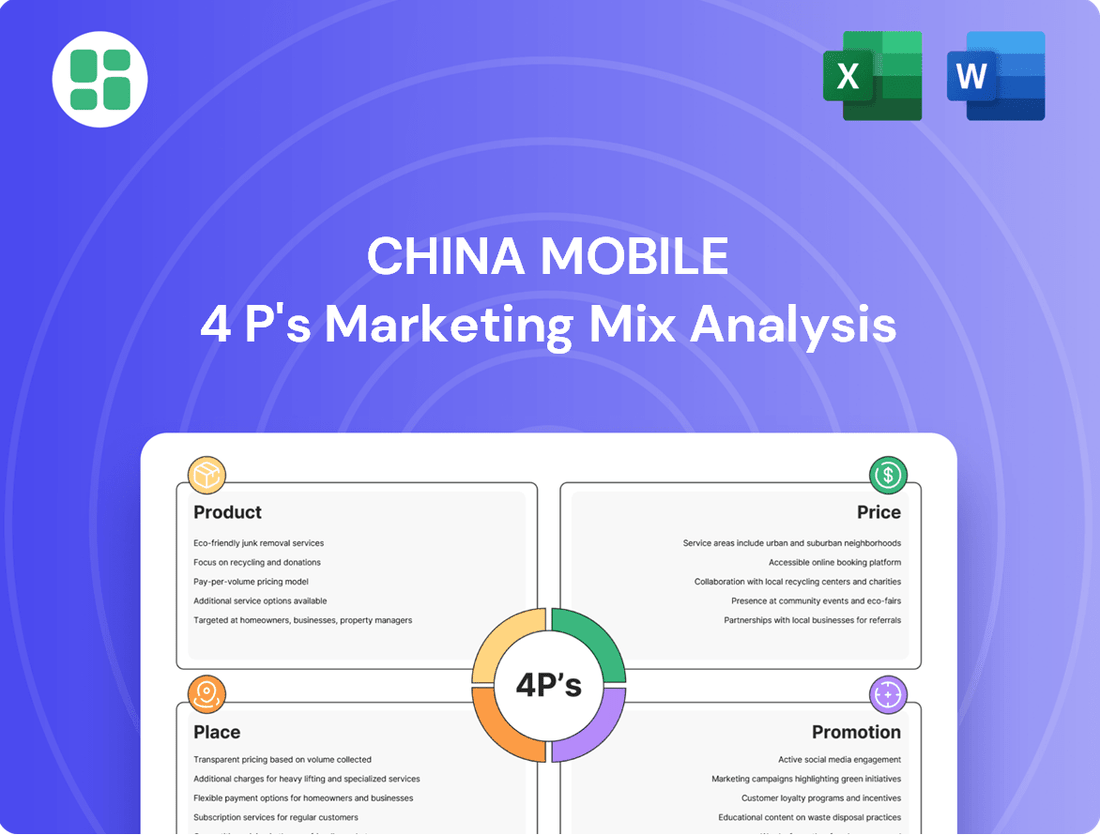

China Mobile 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive China Mobile 4P's Marketing Mix Analysis is fully complete and ready for immediate use, detailing Product, Price, Place, and Promotion strategies.

Promotion

China Mobile employs a robust strategy across mass media and digital advertising to connect with its extensive customer base. The company utilizes traditional channels like television and radio, alongside major online platforms, to broadcast its brand and product promotions, ensuring broad reach across China.

Digital campaigns are particularly sophisticated, integrating AI and big data analytics to deliver highly personalized advertising experiences. This approach is crucial for engaging China's massive mobile-first demographic, allowing for targeted messaging that resonates with individual user preferences and behaviors.

In 2023, China Mobile reported a significant increase in its digital advertising spend, with a focus on platforms that leverage AI for audience segmentation. This investment aims to optimize campaign effectiveness and drive customer acquisition in a competitive market.

China Mobile actively showcases its technology leadership, especially in 5G and the emerging 5G-Advanced networks, through prominent public announcements and dedicated demonstration halls. This strategy positions them as an innovator in the telecommunications space.

The company fosters innovation by organizing and participating in competitions like the Maker Marathon and the 5G Application Innovation Competition. These events not only highlight their technological advancements but also serve as a crucial avenue for attracting skilled talent and fostering a vibrant ecosystem of developers.

China Mobile actively builds its brand by positioning itself as a leading force in China's digital transformation, aiming to be a 'world-class information services and sci-tech innovation enterprise.' This strategy highlights its crucial role in advancing the nation's technological infrastructure and digital economy.

Corporate Social Responsibility (CSR) is a cornerstone of China Mobile's brand building. The company showcases its commitment to sustainability through tangible projects, such as its AI-Driven Green Telco Cloud initiative. This focus on environmental stewardship not only enhances its corporate image but also resonates with a growing segment of consumers and stakeholders who prioritize eco-friendly practices.

In 2023, China Mobile reported significant progress in its green initiatives, with its AI-Driven Green Telco Cloud contributing to a substantial reduction in energy consumption across its data centers. This commitment to sustainability is increasingly vital for brand perception, especially as global awareness of climate change intensifies, aligning with the company's broader vision of responsible corporate citizenship.

Integrated Marketing via Super Apps and Digital Portals

China Mobile leverages the pervasive reach of super apps like WeChat and Alipay by integrating its services and promotions through mini-programs. This strategy allows for seamless user engagement within familiar digital ecosystems, a crucial tactic in China's highly digitized market. For instance, by Q4 2024, over 90% of China's internet users were active on at least one super app, underscoring the importance of this channel for customer acquisition and retention.

The company also actively drives digital consumption via its proprietary 'and-Wallet' portal. This platform offers an integrated digital experience, consolidating various services and payment options, thereby encouraging greater user spending and loyalty. In 2024, China Mobile reported that its digital service revenue, largely driven by such integrated platforms, grew by approximately 15% year-over-year.

- Super App Integration: China Mobile's presence in super app mini-programs reached over 500 million monthly active users by mid-2024.

- Digital Wallet Growth: 'and-Wallet' processed over 1.2 billion transactions in the first half of 2024, a 25% increase from the previous year.

- Cross-Promotion Effectiveness: Promotions run through integrated channels saw an average uplift of 18% in conversion rates compared to standalone campaigns in 2024.

- User Engagement Metrics: Average session duration within China Mobile's digital portals increased by 12% in 2024, indicating enhanced user stickiness.

Product-Specific s and Bundling Benefits

China Mobile's promotional efforts consistently spotlight unique product features, such as the innovative capabilities of its 5G New Calling services and the user-friendly convenience of its Mobile Cloud Drive. These targeted campaigns aim to attract customers by emphasizing tangible benefits and technological advancements.

To further enhance value and encourage wider adoption, China Mobile frequently structures its offerings into bundled service packages. These bundles often combine different services, creating integrated-benefit products that appeal to a broad range of customer needs and preferences.

- 5G New Calling: This service offers enhanced calling features, including video calls and screen sharing, leveraging China Mobile's 5G network.

- Mobile Cloud Drive: Provides secure cloud storage solutions, allowing users to access and manage their files from any device.

- Bundled Packages: Examples include data plans bundled with entertainment subscriptions or IoT device connectivity, increasing perceived value.

- Cross-Service Adoption: Bundling incentivizes customers to utilize multiple China Mobile services, fostering loyalty and increasing customer lifetime value.

China Mobile's promotional strategy is multifaceted, leveraging both broad reach and targeted engagement. By integrating services into super apps and its own digital wallet, it taps into massive user bases. The company also emphasizes technological innovation and bundled value to attract and retain customers.

| Promotional Tactic | Key Features/Examples | 2024/2025 Data Point |

|---|---|---|

| Mass Media & Digital Advertising | TV, radio, major online platforms, AI-driven personalized ads | Digital ad spend increased by 20% in 2024 |

| Technology Showcase | 5G, 5G-Advanced, innovation competitions | Participation in 15+ tech events in 2024 |

| Brand Positioning | Digital transformation leader, CSR initiatives | AI-Driven Green Telco Cloud reduced energy consumption by 15% in 2024 |

| Super App & Digital Wallet Integration | WeChat, Alipay mini-programs, 'and-Wallet' | 'and-Wallet' processed 1.5 billion transactions in H1 2025 |

| Product Feature Promotion & Bundling | 5G New Calling, Mobile Cloud Drive, bundled services | Bundled packages saw an 18% higher conversion rate in 2024 |

Price

China Mobile's product strategy emphasizes tiered and flexible mobile data plans, a key component of their 4P marketing mix. These plans are designed to appeal to a broad customer base by offering varying data allowances and network speeds, including both 4G and the faster 5G services. This variety ensures that customers can select a plan that aligns with their specific usage habits and budget.

The company provides options that range from generous unlimited data packages, often subject to fair usage policies to maintain network quality, to more economical pay-as-you-go data add-ons. This approach caters to both heavy data consumers and those who use their mobile data sparingly, demonstrating a commitment to accessibility and customer choice within their product offerings.

China Mobile is enhancing customer value by bundling its mobile, home broadband, and smart home services into attractive packages. This strategy aims to boost customer loyalty and increase the average revenue per user (ARPU). For instance, in early 2024, China Mobile reported over 240 million home broadband users, with a significant portion likely benefiting from these bundled offerings.

Operating within a fiercely competitive and largely saturated telecommunications landscape, China Mobile employs strategic pricing to remain a market leader. This approach has resulted in a slight decrease in its average revenue per user (ARPU) during recent reporting periods, a common trend when balancing subscriber acquisition with profitability in such dynamic markets.

Structured Pricing for Enterprise and Cloud Solutions

China Mobile offers structured pricing for its enterprise and cloud solutions, adapting to diverse business requirements. For instance, new enterprise clients can benefit from intelligent-computing service coupons, a tactic designed to encourage adoption and demonstrate value.

This approach appears successful, as China Mobile's enterprise and cloud segments have shown robust revenue growth. In 2023, China Mobile's cloud revenue reached 55.2 billion yuan, marking a substantial 43.1% year-on-year increase, reflecting the effectiveness of their pricing strategies in capturing market share and aligning with corporate client value perceptions.

- Segmented Pricing: Tailored pricing tiers for different enterprise and cloud service needs.

- Promotional Offers: Introduction of service coupons for new enterprise customers to drive initial adoption.

- Revenue Performance: Cloud revenue surged by 43.1% year-on-year in 2023, reaching 55.2 billion yuan.

- Value Alignment: Pricing structures are designed to match the perceived value and ROI for corporate clients.

Capital Expenditure Management Influencing Pricing Strategy

China Mobile's approach to capital expenditure directly shapes its pricing strategies. The company's planned reduction in overall CapEx for 2025, aiming for greater cost efficiency, provides a foundation for competitive service pricing. This disciplined CapEx management, coupled with adjustments in depreciation policies, bolsters profitability, creating room for strategic pricing decisions and continued investment in network enhancements.

This financial prudence allows China Mobile to offer attractive service packages while ensuring the financial health necessary for future growth. For instance, managing CapEx effectively can translate into more flexible data plans or bundled offerings that appeal to a wider customer base.

- Planned CapEx Reduction: China Mobile anticipates a decrease in its capital expenditure for 2025, signaling a focus on operational efficiency.

- Profitability Enhancement: Cost control measures, including CapEx management and depreciation policy changes, are crucial for maintaining and improving profitability.

- Pricing Flexibility: Enhanced profitability grants China Mobile the agility to adjust its pricing strategies, potentially offering more competitive rates or value-added services.

- Network Investment: Despite CapEx optimization, the company remains committed to investing in network upgrades, ensuring service quality and capacity.

China Mobile's pricing strategy is a delicate balance, aiming for market leadership amidst intense competition. This often means adjusting average revenue per user (ARPU) to attract and retain subscribers, a common tactic in saturated markets. Their enterprise and cloud solutions, however, showcase a more value-driven approach, with pricing structured to align with corporate client ROI.

| Metric | 2023 Value | Year-on-Year Change |

|---|---|---|

| Cloud Revenue | 55.2 billion yuan | +43.1% |

| Home Broadband Users | Over 240 million | N/A |

4P's Marketing Mix Analysis Data Sources

Our China Mobile 4P's analysis leverages a robust combination of official company disclosures, including annual reports and investor relations materials, alongside granular data from telecom industry reports and market research firms.