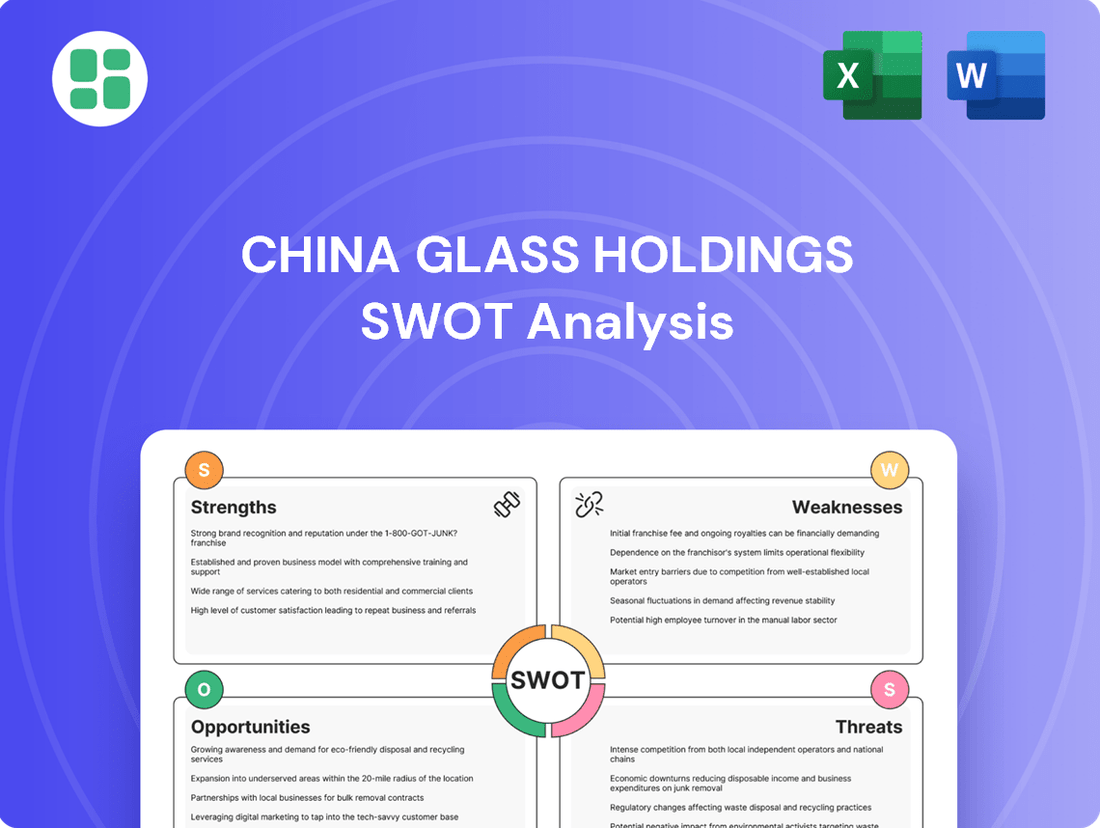

China Glass Holdings SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Glass Holdings Bundle

China Glass Holdings possesses notable strengths in its established market presence and diversified product portfolio, but faces challenges from intense industry competition and fluctuating raw material costs. Understanding these dynamics is crucial for any investor or strategist looking to navigate this sector.

Want to dive deeper into China Glass Holdings' strategic landscape? Our comprehensive SWOT analysis reveals the full picture of their competitive advantages, potential threats, and untapped opportunities.

Unlock actionable insights and gain a competitive edge by purchasing the complete SWOT analysis. This in-depth report provides the detailed context and strategic takeaways you need to make informed decisions and plan for future success.

Strengths

China Glass Holdings Limited boasts a robust and varied product catalog, encompassing essential items like float glass alongside specialized offerings such as architectural and energy-saving glass. This broad product range is a significant advantage, enabling the company to cater to diverse sectors including construction, automotive manufacturing, and interior design, thereby mitigating risks associated with over-dependence on any single market.

The company's strategic focus on high-value-added products is evident in its strong market position in online coated glass, a segment where it commands a substantial share within China. This specialization not only enhances profitability but also positions China Glass Holdings as a key player in advanced glass solutions, a market segment poised for continued growth.

China Glass Holdings stands as a premier float glass manufacturer within China, boasting a solid reputation and well-established production facilities. Its significant market position is underscored by its extensive export network, reaching over 100 countries and regions globally. This broad international footprint, coupled with strategically located production sites, provides considerable competitive and cost benefits.

China Glass Holdings stands out as a technological leader, being one of only three companies worldwide with proprietary online Low-E glass and online TCO glass technology, holding full independent intellectual property rights within China. This advanced capability firmly establishes them at the forefront of the energy-saving and new energy glass sectors, perfectly syncing with the increasing global demand for sustainable construction materials.

Comprehensive Industry Chain and R&D Capabilities

China Glass Holdings boasts a comprehensive industry chain, integrating research and development, manufacturing, processing, and sales. This end-to-end control fuels innovation and efficiency. In 2024, the company operated 8 production bases and 17 glass production lines, supported by a dedicated R&D center, underscoring its robust operational infrastructure.

This integrated model facilitates continuous advancements in product design and manufacturing processes. China Glass Holdings’ extensive network allows for streamlined operations and a quicker response to market demands.

- Integrated Operations: Covers R&D, manufacturing, processing, and sales.

- Extensive Infrastructure: Operates 8 production bases and 17 production lines.

- Innovation Focus: Employs a dedicated R&D center for product development.

Strategic Shareholder Support

China Glass Holdings benefits immensely from the strategic backing of its primary shareholder, Triumph Science Technology Group Co., Ltd. This robust support, stemming from its parent company, China National Building Materials Group Co., Ltd., a major state-owned enterprise, injects crucial financial stability into the company. Such a strong financial lifeline is particularly advantageous in the capital-heavy glass manufacturing sector, helping to offset potential financial vulnerabilities and providing a competitive edge.

This significant shareholder support translates into tangible advantages for China Glass Holdings. For instance, in 2023, Triumph Science Technology Group's continued investment played a vital role in the company's operational continuity and expansion plans, especially during periods of market volatility. This backing not only bolsters the company's financial resilience but also enhances its capacity to undertake large-scale projects and research and development initiatives, which are critical for long-term growth and innovation in the industry.

The financial strength derived from its largest shareholder allows China Glass Holdings to:

- Access favorable financing terms, reducing the cost of capital for investments.

- Maintain operational stability, even during challenging economic cycles.

- Fund strategic acquisitions or joint ventures that enhance market position.

- Invest in advanced manufacturing technologies to improve efficiency and product quality.

China Glass Holdings possesses a diverse product portfolio, catering to construction, automotive, and interior design sectors, which reduces reliance on any single market. Its leadership in online coated glass, a high-value segment, ensures strong profitability and positions it for future growth. The company's technological prowess, including proprietary online Low-E and TCO glass technology, sets it apart in the energy-saving glass market.

| Strength | Description | Supporting Data/Context |

|---|---|---|

| Product Diversification | Broad range of glass products including float, architectural, and energy-saving glass. | Caters to construction, automotive, and interior design. |

| Market Leadership in Niche Segments | Strong market share in online coated glass within China. | High-value-added product focus enhances profitability. |

| Technological Innovation | Proprietary online Low-E and TCO glass technology. | One of three global companies with this capability, holding full IP rights in China. |

| Integrated Value Chain | Covers R&D, manufacturing, processing, and sales. | Operated 8 production bases and 17 lines in 2024. |

| Strategic Shareholder Support | Backed by Triumph Science Technology Group, a subsidiary of CNBM. | Provides financial stability and facilitates investment in advanced technologies. |

What is included in the product

Delivers a strategic overview of China Glass Holdings’s internal and external business factors, highlighting its market position and potential growth avenues.

Offers a clear, actionable framework to identify and address China Glass Holdings' key strategic challenges and opportunities.

Weaknesses

China Glass Holdings faced a challenging financial year in 2024, reporting a significant net loss of CNY 876.58 million. This marks a substantial increase in losses compared to the prior year, despite a rise in revenue. The widening deficit points to considerable cost pressures or margin erosion impacting the company's bottom line.

The substantial financial loss in 2024, even with revenue growth, highlights potential operational inefficiencies or intense market competition that are hindering profitability. These results can negatively affect investor confidence and the company's ability to fund future growth initiatives.

China Glass Holdings faces a significant challenge with its high financial leverage and tight liquidity. This means the company carries a considerable amount of debt relative to its equity, and its ability to meet short-term obligations is constrained.

While strong backing from its largest shareholder offers a crucial safety net, this reliance on external support, particularly from this shareholder, underscores a potential vulnerability. Changes in interest rates or a tightening of credit markets could therefore pose a risk.

The company's financial statements reveal a substantial portion of its loans and payables are owed to its largest shareholder, further emphasizing this dependency. For instance, as of December 31, 2023, the company reported total borrowings of HK$2.5 billion, with a significant portion linked to related parties.

China Glass Holdings' reliance on the construction sector is a notable weakness. A substantial part of its demand, especially for clear and architectural glass, is directly linked to real estate development and building projects.

The Chinese construction industry, particularly the residential segment, has encountered significant headwinds. Projections indicate a continued downturn in new housing starts and completions through 2025-2026, which will inevitably curb demand for glass products.

Vulnerability to Raw Material and Energy Cost Volatility

China Glass Holdings faces significant challenges due to the inherent volatility in the costs of essential raw materials and energy. The glass manufacturing process relies heavily on inputs such as silica sand, soda ash, and limestone, alongside substantial energy consumption, typically natural gas. Fluctuations in these prices directly impact the company's cost structure and, consequently, its profit margins.

Recent market data highlights this vulnerability. For instance, global commodity prices for key industrial materials saw an average increase of 8-12% in late 2024, with natural gas prices experiencing even sharper spikes, particularly in key manufacturing regions, by as much as 15-20% in certain periods. These upward pressures can significantly squeeze China Glass Holdings' production economics, potentially reducing profitability if not effectively managed or passed on to customers.

- Raw Material Price Sensitivity: The glass industry's reliance on silica sand, soda ash, and limestone makes it susceptible to supply chain disruptions and price hikes.

- Energy Cost Exposure: High natural gas consumption in glass production means soaring energy prices directly inflate operating expenses.

- Impact on Profitability: Increased input and energy costs can erode profit margins if they cannot be offset by price increases or efficiency gains.

- Market Trend Data: Reports from early 2025 indicated a continued upward trend in industrial commodity prices, exacerbating these cost pressures for manufacturers like China Glass Holdings.

Intense Competition in the Glass Market

The flat glass market in China is a crowded arena, featuring numerous domestic and international companies vying for market share. While China Glass Holdings is a significant entity, it faces intense competition. The top few companies control a substantial portion of the market, but their collective share isn't so dominant that it eliminates fierce rivalry, which can put pressure on pricing and growth opportunities.

This competitive landscape means China Glass Holdings must constantly innovate and manage costs effectively. For instance, as of early 2024, the domestic flat glass production capacity in China exceeded 1.2 billion square meters annually, with numerous players contributing to this high supply. This oversupply can exacerbate price competition.

- Market Saturation: The sheer volume of producers limits individual company pricing power.

- Technological Advancements: Competitors are also investing in new technologies, requiring continuous R&D investment from China Glass Holdings.

- Price Wars: Periods of intense competition can lead to price reductions, impacting profit margins.

China Glass Holdings' significant financial losses in 2024, totaling CNY 876.58 million despite revenue growth, highlight operational inefficiencies or margin pressures. This financial strain, coupled with high leverage and tight liquidity, limits its ability to fund future expansion and manage short-term obligations effectively.

The company's substantial reliance on the construction sector, particularly residential real estate, exposes it to the downturn in new housing starts projected through 2025-2026. This dependency is a key vulnerability, as reduced construction activity directly translates to lower demand for its glass products.

Intense competition within China's flat glass market, characterized by overcapacity exceeding 1.2 billion square meters annually as of early 2024, exerts downward pressure on pricing. This environment necessitates continuous innovation and cost management to maintain profitability against numerous domestic and international rivals.

Full Version Awaits

China Glass Holdings SWOT Analysis

This is the actual China Glass Holdings SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of the company's internal strengths and weaknesses, alongside external opportunities and threats.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, detailing key strategic considerations for China Glass Holdings.

This is a real excerpt from the complete China Glass Holdings SWOT analysis. Once purchased, you’ll receive the full, editable version, ready for your strategic planning needs.

Opportunities

The surge in demand for energy-efficient and new energy glass presents a significant opportunity. Emerging sectors like solar power and the global push for sustainable construction are fueling a need for advanced glass solutions, such as low-emissivity (Low-E) and transparent conductive oxide (TCO) glass, alongside photovoltaic glass. China Glass Holdings is well-positioned to capitalize on this trend, given its established capabilities in these specialized glass types.

China Glass Holdings is strategically expanding its global footprint, leveraging its established export network that already reaches over 100 countries. This international push is a significant opportunity to diversify revenue streams and tap into new growth markets.

The company's investment in a new glass manufacturing facility in Egypt exemplifies this strategy. This move is designed to capitalize on increasing demand in North Africa and surrounding areas, while simultaneously positioning China Glass Holdings to reduce import dependencies for these regions.

China's ongoing commitment to infrastructure development, with significant government spending projected through 2029, offers a robust market for construction glass. This includes ambitious projects like high-speed rail networks and large-scale water conservancy initiatives, which directly translate into demand for glass products.

The persistent trend of urbanization across China further bolsters this opportunity. As cities expand and modernize, there's a continuous need for new buildings, renovations, and commercial spaces, all of which require substantial quantities of glass, benefiting companies like China Glass Holdings.

Technological Advancements and Smart Manufacturing

The glass industry's embrace of technological innovation, particularly smart manufacturing and digitalization, presents a significant opportunity. China Glass Holdings is well-positioned to capitalize on this trend, building upon its existing smart factory projects and robust R&D. For instance, the company's investment in advanced automation and digital platforms aims to streamline operations and boost output.

Leveraging advancements such as Building Information Modeling (BIM) integration and increased automation can directly translate into enhanced production efficiency and improved product quality. This focus on smart manufacturing is crucial for cost-effectiveness in a competitive global market. By adopting these technologies, China Glass Holdings can expect to see tangible benefits in its operational performance.

- Industry Transformation: The global glass sector is increasingly adopting smart manufacturing, with a significant push towards digitalization and automation.

- China Glass Holdings' Position: The company's ongoing smart factory initiatives and R&D investments are key enablers to harness these technological advancements.

- Efficiency Gains: Integration of BIM and automation technologies is projected to significantly improve production efficiency and reduce operational costs.

- Quality Enhancement: Smart manufacturing processes are expected to lead to higher and more consistent product quality, meeting evolving market demands.

Product Diversification into Specialized Glass

The growing demand for specialized glass, including smart glass and advanced glass-coated materials for the electronics and automotive industries, presents a significant opportunity. China Glass Holdings can leverage its existing R&D capabilities and broad product range to enter these high-margin niche markets.

Expanding into these specialized segments allows China Glass Holdings to tap into sectors with higher growth potential and less price sensitivity compared to traditional glass products. For instance, the global smart glass market was projected to reach $8.5 billion by 2025, indicating substantial room for growth.

- Targeting high-tech sectors: Focus on automotive, aerospace, and consumer electronics where advanced glass solutions are increasingly critical.

- Investing in R&D for smart glass: Develop innovative functionalities like variable tinting, self-cleaning, and energy efficiency.

- Developing glass-coated materials: Create specialized coatings for enhanced durability, conductivity, or aesthetic appeal in premium applications.

- Strategic partnerships: Collaborate with technology firms or end-product manufacturers to accelerate market penetration.

The global shift towards sustainability and energy efficiency is a major tailwind, driving demand for specialized glass like low-emissivity (Low-E) and photovoltaic glass. China Glass Holdings' established expertise in these areas positions it to benefit from this trend. Furthermore, the company's strategic global expansion, exemplified by its new facility in Egypt, aims to capture growth in new markets and diversify revenue.

China's ongoing infrastructure development, with substantial government investment planned through 2029, will continue to fuel demand for construction glass. Urbanization trends also contribute by necessitating new buildings and renovations. The company's commitment to smart manufacturing and digitalization, including advanced automation and BIM integration, promises enhanced operational efficiency and product quality, crucial for competitiveness.

The increasing demand for specialized glass in high-tech sectors like electronics and automotive presents a significant opportunity for higher-margin products. For instance, the global smart glass market was projected to reach $8.5 billion by 2025, highlighting substantial growth potential in these niche areas.

| Opportunity Area | Projected Growth/Impact | China Glass Holdings' Relevance |

|---|---|---|

| Energy-Efficient & New Energy Glass | Growing demand due to sustainability initiatives. | Leveraging existing capabilities in Low-E and photovoltaic glass. |

| Global Market Expansion | Diversification of revenue streams and tapping new growth markets. | Established export network reaching over 100 countries; new facility in Egypt. |

| Infrastructure Development (China) | Robust market for construction glass driven by government spending. | Benefiting from large-scale projects like high-speed rail. |

| Smart Manufacturing & Digitalization | Enhanced production efficiency and product quality. | Ongoing smart factory projects and R&D investments. |

| Specialized Glass (Electronics, Automotive) | High-margin niche markets with strong growth potential. | Potential to enter markets like smart glass, with a projected global market of $8.5 billion by 2025. |

Threats

A significant threat to China Glass Holdings stems from the ongoing downturn in China's real estate and construction sectors. Persistent weak demand, evidenced by declining new housing starts and completions, directly dampens the need for glass products.

This sector's sluggishness, exacerbated by rising debt levels among property developers, is projected to constrain overall construction output through 2024 and into 2025. For instance, in 2023, property investment in China fell by 9.6%, a trend that continued to impact construction activity into early 2024.

China Glass Holdings faces a significant threat from volatile raw material and energy prices. Fluctuations in the cost of key inputs like silica sand, soda ash, and limestone directly impact production expenses. For instance, global commodity prices saw considerable upward pressure throughout 2023 and into early 2024 due to ongoing supply chain issues and geopolitical factors, which would have squeezed margins for glass manufacturers.

Soaring energy costs, particularly for natural gas, pose another continuous challenge. The energy-intensive nature of glass production means that spikes in fuel prices, as seen in various global energy markets in recent years, can severely affect profitability. This volatility makes it difficult for companies like China Glass Holdings to accurately forecast production costs and maintain stable profit margins, especially when these increases cannot be fully passed on to customers.

The Chinese glass sector is grappling with significant overcapacity, forcing companies to slash prices to clear inventory. This intense competition, with numerous domestic and international players like Fuyao Glass and Saint-Gobain, puts considerable pressure on China Glass Holdings.

This competitive landscape directly impacts profitability, as price wars can erode margins. For instance, in 2023, the average selling price for certain flat glass products in China saw a decline, directly linked to the oversupply. China Glass Holdings, despite its market position, is not immune to these market dynamics, facing the constant threat of market share erosion if it cannot maintain competitive pricing.

Trade Tensions and Protectionist Policies

Ongoing trade tensions between the United States and China, marked by the imposition of tariffs on Chinese imports, pose a significant threat to China Glass Holdings. These trade frictions can dampen investor sentiment and potentially disrupt the company's access to key international export markets. For instance, the US imposed tariffs on various Chinese goods, impacting bilateral trade volumes and creating an uncertain environment for exporters.

While a strong US dollar could theoretically make Chinese exports more competitive, the overarching trade disputes introduce substantial volatility and risk. This uncertainty directly affects China Glass Holdings' ability to forecast and manage its international sales, as tariff rates and trade policies can change rapidly. The company must navigate these complexities to mitigate potential revenue shortfalls and maintain its global market presence.

- Tariff Impact: Past US tariffs have led to increased costs for imported components and reduced export competitiveness for Chinese manufacturers.

- Market Access: Protectionist policies can lead to market access restrictions, limiting China Glass Holdings' ability to sell its products in certain regions.

- Supply Chain Disruption: Trade tensions can disrupt global supply chains, affecting the availability and cost of raw materials essential for glass production.

Stricter Environmental Regulations and Compliance Costs

China's commitment to environmental protection is intensifying, leading to stricter regulations for industries like glass manufacturing. This means companies, including China Glass Holdings, must invest heavily in advanced emission control technologies and adopt more sustainable production methods. For instance, by the end of 2024, many industrial facilities in key regions were expected to meet enhanced air quality standards, requiring significant upgrades.

These compliance efforts translate directly into increased operational expenses. The cost of retrofitting existing plants or building new ones with greener technology can be substantial, impacting profit margins. For China Glass Holdings, this could mean higher capital expenditures and ongoing maintenance costs associated with environmental compliance, potentially affecting its competitive pricing and overall financial health in the near term.

- Increased Capital Expenditure: Investments in new emission control systems and cleaner production technologies are projected to rise for Chinese glass manufacturers, potentially adding millions to operational budgets.

- Higher Operating Costs: Ongoing expenses for maintaining and upgrading environmental equipment, as well as potentially higher energy costs for cleaner processes, will likely increase.

- Potential for Fines: Non-compliance with new environmental standards could result in significant fines, further impacting financial performance.

Intensifying environmental regulations in China pose a significant threat, necessitating substantial investments in cleaner production technologies and emission controls. These compliance costs directly impact profitability, with potential for increased capital expenditure and higher operating expenses. Failure to meet these evolving standards could also lead to substantial fines.

| Threat Category | Specific Risk | Potential Impact | Data Point/Context |

|---|---|---|---|

| Regulatory Compliance | Stricter Environmental Standards | Increased Capital Expenditure, Higher Operating Costs, Potential Fines | By end of 2024, key Chinese regions mandated enhanced air quality standards, requiring industrial upgrades. |

| Market Dynamics | Intense Competition & Price Wars | Eroded Profit Margins, Market Share Loss | Average selling prices for certain flat glass products in China declined in 2023 due to oversupply. |

| Geopolitical Factors | Trade Tensions & Tariffs | Reduced Export Competitiveness, Market Access Restrictions, Supply Chain Disruptions | US tariffs on Chinese goods have impacted bilateral trade volumes, creating uncertainty for exporters. |

SWOT Analysis Data Sources

This SWOT analysis for China Glass Holdings is built upon a foundation of reliable data, including the company's official financial statements, comprehensive market research reports, and expert analyses from industry professionals.