China Glass Holdings Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Glass Holdings Bundle

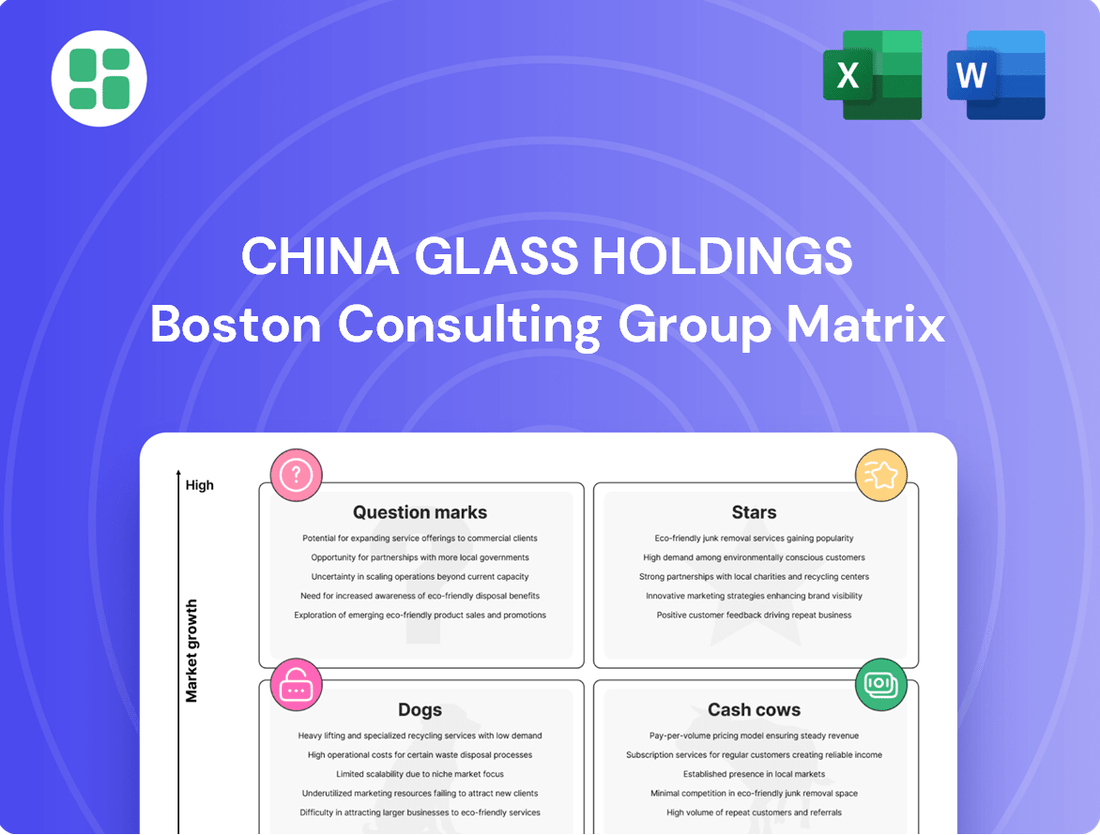

China Glass Holdings' BCG Matrix offers a crucial snapshot of its product portfolio's market share and growth potential. Understand which segments are driving revenue and which might be underperforming.

Unlock the full strategic potential by purchasing the complete BCG Matrix. Gain detailed quadrant analysis and actionable insights to optimize your investment and product development strategies.

Stars

Ultra-clear rolled photovoltaic glass represents a potential star in China Glass Holdings' BCG Matrix. The company is making a substantial investment in a new Egyptian facility, slated to commence operations by the end of 2025 with a daily output of 800 tons of this specialized glass.

This strategic move targets the booming solar energy market, a sector experiencing robust growth driven by global commitments to renewable energy. The high demand for photovoltaic glass positions this product line for significant expansion and market leadership, aligning with the characteristics of a star in the BCG framework.

High-Performance Energy-Saving Glass, like Low-E coated glass, is a key player in China Glass Holdings' portfolio. The demand for such products is surging, fueled by government initiatives pushing for eco-friendly buildings and sustainable construction practices.

This segment is experiencing robust growth, with China Glass Holdings reporting a significant 50% increase in sales for energy-saving and new energy glass during 2024. This impressive figure highlights both strong market acceptance and the company's dominant presence in this rapidly expanding sector.

Photothermal Ultra-clear Glass and Solar Reflector Glass, manufactured by Gansu Daming, a subsidiary of China Glass Holdings, experienced a notable uplift in sales during 2024. This growth is directly linked to the expanding solar photothermal power generation sector, which offers substantial market potential.

These specialized glass products benefit from existing technical barriers, which have helped maintain a strong market position throughout 2024. The demand for these high-performance materials is expected to continue as the renewable energy industry matures.

Coated Glass Products (Float-Process Online Coated Glass)

Coated Glass Products, specifically float-process online coated glass, represent a significant growth area for China Glass Holdings within the BCG framework. The company has successfully leveraged its proprietary intellectual property to transition production towards these higher-margin items. This strategic shift resulted in a notable 30% surge in coated glass sales during 2024, underscoring a robust market position in a segment experiencing amplified demand. This growth is largely fueled by the increasing global emphasis on energy-efficient building solutions and advanced material applications.

The strong performance in coated glass products points to a favorable market dynamic. Key drivers include:

- Growing demand for energy efficiency: Building codes and consumer preferences are increasingly prioritizing insulated and low-emissivity glass, directly benefiting coated glass sales.

- Technological advantage: China Glass Holdings' proprietary technology allows for superior product quality and performance compared to competitors.

- Market penetration: The 30% sales increase in 2024 suggests successful market capture and expansion within this specialized segment.

- Higher profit margins: The strategic move to higher-margin products directly contributes to improved overall profitability for the company.

Specialized Automotive Glass

Specialized Automotive Glass, within China Glass Holdings' BCG Matrix, likely falls into the Stars category due to the booming electric vehicle (EV) market and increasing demand for advanced features. The global automotive glass market was valued at approximately $20 billion in 2023 and is projected to grow significantly, driven by EV adoption and technological advancements like Advanced Driver-Assistance Systems (ADAS) and Heads-Up Displays (HUD).

If China Glass Holdings holds a substantial market share in these high-value segments, such as panoramic sunroofs, privacy glass, or glass for autonomous driving systems, it would position this business unit as a Star. The growth rate in specialized automotive glass is outpacing the general automotive market. For instance, the demand for ADAS-compatible windshields is expected to see a compound annual growth rate (CAGR) of over 10% in the coming years.

- High Growth Potential: The automotive sector, particularly EVs, is a rapidly expanding market.

- Technological Advancement: Increased demand for sophisticated glass solutions for ADAS and HUD systems.

- Market Share: A strong position in specialized segments like panoramic roofs or complex-shaped glass would solidify its Star status.

- Industry Trends: The global automotive glass market is projected to reach over $25 billion by 2028, with specialized glass being a key driver.

Ultra-clear rolled photovoltaic glass, high-performance energy-saving glass, photothermal ultra-clear glass, solar reflector glass, and specialized automotive glass all represent strong contenders for Stars within China Glass Holdings' BCG Matrix.

The company's significant investment in a new Egyptian facility for ultra-clear photovoltaic glass, alongside a 50% sales increase in energy-saving glass during 2024, underscores rapid market adoption.

Furthermore, a 30% surge in coated glass sales in 2024, driven by proprietary technology and demand for energy efficiency, solidifies its Star potential.

The automotive glass segment, fueled by EV growth and ADAS technology, also shows promising high-growth trajectories.

| Product Category | BCG Status | Key Growth Drivers | 2024 Performance Highlight | Future Outlook |

| Ultra-clear PV Glass | Star | Global solar energy demand | New Egyptian facility commencing late 2025 | Continued expansion in renewable energy sector |

| High-Performance Energy-Saving Glass | Star | Eco-friendly building initiatives | 50% sales increase in 2024 | Sustained demand for sustainable construction |

| Photothermal & Solar Reflector Glass | Star | Growth in solar thermal power | Notable sales uplift in 2024 | Leveraging technical barriers for market position |

| Coated Glass Products | Star | Energy efficiency, advanced materials | 30% sales surge in 2024 | Higher margins from proprietary technology |

| Specialized Automotive Glass | Star | EV market growth, ADAS features | Projected market value over $25B by 2028 | Outpacing general automotive market growth |

What is included in the product

This BCG Matrix analysis provides clear descriptions and strategic insights for China Glass Holdings' Stars, Cash Cows, Question Marks, and Dogs.

It highlights which units to invest in, hold, or divest, offering tailored analysis for the company's product portfolio.

The China Glass Holdings BCG Matrix offers a clear, one-page overview, alleviating the pain of complex strategic analysis by placing each business unit in a quadrant.

Cash Cows

Standard Clear Float Glass (Domestic Construction) in China Glass Holdings' portfolio fits the Cash Cow quadrant. China's dominance in float glass production, exceeding fifty percent global market share, underscores the maturity and stability of this sector.

The Chinese float glass market is projected to see a Compound Annual Growth Rate of 6.3% between 2025 and 2031, indicating continued, albeit moderate, expansion.

Despite domestic real estate market headwinds impacting pricing, China Glass Holdings' strategic expansion of sales channels in Kazakhstan led to a remarkable 42% surge in clear glass sales, demonstrating robust cash generation from this established product line.

Standard Architectural Glass, a cornerstone of China Glass Holdings' portfolio, operates within the global architectural flat glass market, which reached USD 128 billion in 2023. This segment, encompassing basic and tempered glass for general construction, is expected to see a 4.8% compound annual growth rate from 2024 to 2032.

China's significant presence in the Asia Pacific region solidifies this segment's importance. Given China Glass Holdings' established production capabilities, standard architectural glass functions as a reliable cash cow, generating consistent revenue streams from a mature and stable market.

China Glass Holdings' painted glass products are a clear Cash Cow. The company strategically shifted its product offerings, increasing the proportion of painted glass to meet local tastes. This move significantly boosted sales of its distinct 'CNG' branded painted glass by an impressive 79% in 2024.

This strong performance highlights a dominant and stable position within a specific segment of the architectural decoration market. The established branding for 'CNG' painted glass ensures consistent revenue generation with minimal need for further promotional investment, a hallmark of a mature and profitable product line.

Glass for Household Appliances

The household appliance glass segment for China Glass Holdings represents a classic cash cow. Despite a slower construction market, demand for glass used in refrigerators, ovens, and other appliances has seen consistent growth. This stability, coupled with steady pricing and healthy profit margins, positions this division as a reliable contributor to the company's overall financial strength.

As a major player in the diversified glass manufacturing industry, China Glass Holdings likely commands a substantial market share within this mature, low-growth sector. This allows the company to generate predictable revenue streams and cash flow, which can then be reinvested in more promising or high-growth areas of the business.

- Consistent Demand: The ongoing need for replacement parts and new appliance production ensures a steady market for household appliance glass.

- Stable Pricing: Unlike more volatile markets, appliance glass prices have remained relatively stable, supporting predictable revenue.

- Healthy Margins: The segment typically offers good profit margins, contributing significantly to cash generation.

- Market Share: China Glass Holdings' established position in this sector solidifies its role as a reliable cash generator.

Basic Insulated Glass Units (IGUs)

Basic Insulated Glass Units (IGUs) represent a significant Cash Cow for China Glass Holdings. This segment of the architectural flat glass market was valued at USD 34.9 billion in 2023. IGUs are favored for their excellent thermal insulation, driving a projected 5.2% compound annual growth rate.

China Glass Holdings benefits from its established production capabilities for energy-saving glass, which directly includes IGUs. This mature product line, holding a strong market share, allows the company to generate consistent revenue and cash flow.

- Market Value: USD 34.9 billion in 2023 for the architectural flat glass market.

- Growth Rate: Expected 5.2% CAGR for insulated glass.

- Key Driver: Superior thermal insulation properties of IGUs.

- Company Position: Established production lines for energy-saving glass, including IGUs.

China Glass Holdings' standard clear float glass, a key component in domestic construction, functions as a cash cow. Despite a projected 6.3% CAGR for the Chinese float glass market between 2025-2031, the sector is mature. The company's strategic sales channel expansion in Kazakhstan, leading to a 42% rise in clear glass sales in 2024, demonstrates its ability to extract consistent cash from this established product.

The company's painted glass, under the 'CNG' brand, is another strong cash cow. A strategic shift to increase painted glass proportion to meet local tastes resulted in a remarkable 79% sales increase in 2024. This highlights a stable market position and consistent revenue generation with minimal additional investment, characteristic of a mature product.

Household appliance glass is a classic cash cow for China Glass Holdings. This segment, while experiencing slower construction market growth, shows consistent demand and steady pricing, offering healthy profit margins. China Glass Holdings' established market share ensures predictable revenue streams from this low-growth, stable sector.

Basic Insulated Glass Units (IGUs) are a significant cash cow, valued at USD 34.9 billion in 2023 for the architectural flat glass market. With a projected 5.2% CAGR, driven by thermal insulation benefits, China Glass Holdings leverages its established energy-saving glass production lines. This mature product line, with strong market share, consistently generates revenue and cash flow.

| Product Segment | BCG Quadrant | Key Data Points | 2024 Performance Indicator |

|---|---|---|---|

| Standard Clear Float Glass | Cash Cow | China's float glass market projected 6.3% CAGR (2025-2031). Mature, stable sector. | 42% surge in clear glass sales (Kazakhstan expansion). |

| Painted Glass (CNG Brand) | Cash Cow | Strategic product mix shift to meet local tastes. | 79% sales increase for 'CNG' branded painted glass. |

| Household Appliance Glass | Cash Cow | Consistent demand, steady pricing, healthy margins. | Steady growth and predictable revenue generation. |

| Basic Insulated Glass Units (IGUs) | Cash Cow | Architectural flat glass market valued at USD 34.9 billion (2023). Projected 5.2% CAGR. | Consistent revenue and cash flow from established production. |

What You’re Viewing Is Included

China Glass Holdings BCG Matrix

The China Glass Holdings BCG Matrix preview you are viewing is the exact, fully formatted document you will receive upon purchase. This comprehensive analysis, designed for strategic clarity, contains no watermarks or demo content, ensuring you get a professional and ready-to-use report. What you see here is precisely the file that will be delivered to you, enabling immediate application in your business planning and decision-making processes. This is the actual BCG Matrix report, unlocked for your use after purchase, ready for editing, printing, or presenting to stakeholders.

Dogs

In 2024, China Glass Holdings had three float glass production lines undergoing cold repair, technical modification, or relocation. This situation highlights older, less efficient assets within their portfolio. The overall float glass market faced declining domestic average selling prices (ASPs) due to the ongoing weakness in China's real estate sector.

These unoperated or underperforming lines represent tied-up capital and are generating low returns in a difficult market segment. Consequently, they are prime candidates for divestiture or substantial investment in modernization to improve efficiency and market competitiveness.

The Chinese real estate sector's ongoing challenges in 2024 directly impacted architectural glass demand, causing a noticeable drop in float glass prices. This oversupply situation in commodity clear glass segments, characterized by intense competition and a lack of product differentiation, means these areas are likely yielding very low profits and consuming valuable company resources.

Within China Glass Holdings' portfolio, certain niche decoration glass products, characterized by low market demand and minimal growth prospects, fall into the 'dog' category. These specialized or older decorative items, despite potentially being part of a once-profitable segment, now struggle to generate significant revenue. For instance, if a particular hand-painted glass technique, once popular, now sees very limited orders, it would fit this description.

These 'dog' products often operate at break-even or even incur losses, effectively tying up valuable production capacity that could be allocated to more profitable lines, such as their cash cow painted glass. In 2024, the overall decorative glass market in China showed moderate growth, but these specific niche products likely experienced a decline, perhaps seeing a year-over-year decrease in sales volume of over 10%, according to industry analysts.

Glass Products Highly Dependent on Stagnant Construction Sub-sectors

Glass products heavily reliant on the residential construction sector are likely positioned as dogs within China Glass Holdings' BCG Matrix. This is due to a significant downturn in this segment, directly affecting demand for their offerings. For instance, the area of completed residential buildings saw a substantial decrease of 21.7% in the first half of 2024, a stark indicator of the challenges faced.

When China Glass Holdings holds a low competitive advantage in supplying glass for these particularly struggling construction sub-sectors, those product lines fall squarely into the dog category. These are products that generate low market share in a slow-growing or declining market. Their contribution to the company’s overall growth and profitability is minimal, and they may even represent a drain on resources.

- Residential Construction Downturn: A 21.7% decrease in completed residential buildings during H1 2024 highlights a major challenge for glass suppliers.

- Low Market Share in Stagnant Sectors: Products serving these impacted areas with weak competitive positioning are classified as dogs.

- Resource Drain Potential: These dog products may require investment without yielding significant returns, potentially impacting overall company efficiency.

Products with Declining Export Potential Due to Trade Frictions

Certain glass products from China may experience declining export potential due to ongoing trade frictions. While exports can help manage domestic supply, these international disputes can disrupt the flow of goods. Products heavily dependent on markets now imposing significant trade barriers or seeing reduced demand are categorized as dogs in the BCG Matrix. This indicates low market growth and a potential contraction in market share.

For example, if a particular type of specialized glass, crucial for a specific industry in a country imposing new tariffs, sees its export volume shrink significantly, it would fall into this category. In 2024, global trade tensions have continued to impact various sectors, and the glass industry is not immune. Data from the first half of 2024 indicated a slowdown in export growth for certain glass categories to specific Western markets, directly attributable to retaliatory tariffs and protectionist policies.

- Impact of Tariffs: Products facing substantial import tariffs in key markets are likely to see reduced demand, pushing them into the dog category.

- Market Diversification Challenges: If a product's export success is tied to a limited number of markets that are now experiencing trade disputes, its growth prospects dim.

- Shifting Global Demand: Changes in international consumer preferences or industrial needs, exacerbated by trade barriers, can relegate previously strong export items to dog status.

- Example Scenario: A type of architectural glass, heavily exported to a nation that has recently imposed a 25% tariff on such imports, would exemplify a product with declining export potential.

Products within China Glass Holdings' portfolio that are characterized by low market share in slow-growing or declining markets are considered dogs. These segments, often tied to the struggling residential construction sector, saw a substantial 21.7% decrease in completed residential buildings in the first half of 2024, directly impacting demand for related glass products.

Certain niche decorative glass products, experiencing minimal growth and low market demand, also fall into this category. For example, a specific hand-painted glass technique with very limited orders would fit this description, potentially seeing a year-over-year sales volume decrease of over 10% in 2024.

Furthermore, glass items facing declining export potential due to ongoing trade frictions and tariffs are likely dogs. Data from the first half of 2024 indicated a slowdown in export growth for certain glass categories to Western markets, directly attributable to protectionist policies.

These 'dog' products may operate at break-even or incur losses, tying up valuable production capacity and potentially draining company resources without significant returns.

Question Marks

Ultra-thin foldable glass represents a significant emerging market within display technology, with innovations like 30-micron flexible folding glass showcased at events like China Glass 2025. This positions China Glass Holdings, if involved in this segment, in a high-growth area.

However, as an emerging technology, the market share for such products is likely to be low initially. This scenario suggests that China Glass Holdings' foldable glass initiatives would fall into the question mark category of the BCG matrix.

Significant investment would be necessary to develop production capabilities and capture market share in this rapidly evolving sector. For instance, the global foldable display market was projected to reach $15.5 billion by 2025, indicating substantial future potential but also the need for early-stage investment.

Smart glass technologies, such as electrochromic and smart-dimming glass, represent a burgeoning segment within the specialized glass market. Innovations in this area, including advancements showcased at events like China Glass 2025, highlight its appeal to high-tech sectors. This market's growth is fueled by rapid technological progress and a rising demand for intelligent building solutions, indicating significant future potential.

While the market for smart glass is experiencing high growth, driven by innovation and the increasing adoption of smart building features, China Glass Holdings' market share in this specific niche would likely be nascent. Entering this segment would necessitate substantial investment in research and development, alongside concerted efforts to build market awareness and secure widespread adoption.

Aerogel energy-saving glass, showcased at China Glass 2025 by the China Building Materials Academy, signifies a significant innovation in the energy-efficient building sector. This product targets a market experiencing robust growth, driven by increasing global demand for sustainable construction solutions. For China Glass Holdings, this represents a prime opportunity to position itself within a high-potential category.

If China Glass Holdings is investing in or developing aerogel glass, it aligns with a strategy for a 'Star' or 'Question Mark' in the BCG matrix. The market for advanced insulation materials is expanding, with global aerogel market size projected to reach over $1.5 billion by 2027, according to various industry analyses. This suggests substantial future growth, but requires significant investment to capture market share.

Advanced Photovoltaic Battery Module Products

China Glass Holdings' advanced photovoltaic battery module products are categorized within their energy-saving and new energy glass segment. While the company has a strong position in photovoltaic glass, which is a Star in the BCG matrix, its expansion into complete modules represents a newer, potentially high-growth, but less established area.

This segment is experiencing rapid expansion driven by the global push for renewable energy sources. For instance, the global solar energy market was valued at approximately USD 231.3 billion in 2023 and is projected to grow significantly. However, China Glass Holdings' market share in the complete module manufacturing, beyond just the glass component, may still be relatively low, positioning these products as Question Marks.

- High Growth Potential: The renewable energy sector's expansion fuels demand for photovoltaic components.

- Value-Added Offering: Moving beyond glass to complete modules signifies a step towards higher value-added products.

- Market Share Uncertainty: The company's established strength in photovoltaic glass doesn't automatically translate to dominance in the broader module market.

- Investment Need: As a Question Mark, these products likely require significant investment to capture market share and transition towards becoming Stars.

Glass for New Infrastructure/Smart City Initiatives

Glass for new infrastructure and smart city initiatives represents a significant growth area for China Glass Holdings, likely fitting into the 'Question Marks' category of the BCG Matrix. The global construction glass market is projected to expand at a compound annual growth rate of 7.8% from 2022 to 2030, driven by a surge in smart city projects and increased construction investment in developing nations.

If China Glass Holdings can innovate by offering specialized glass products designed for these advanced urban environments – think glass with embedded sensors for data collection or enhanced aesthetic features for modern architecture – they can tap into a high-potential market. Currently, their market share in this specific niche might be relatively small, making it a classic 'Question Mark' where substantial investment could yield high returns.

- Market Growth: The construction glass market is expanding at a robust 7.8% CAGR (2022-2030).

- Smart City Demand: Increasing smart city initiatives globally fuel demand for advanced glass solutions.

- Innovation Opportunity: Developing sensor-integrated or aesthetically advanced glass for smart cities presents a key growth avenue.

- Strategic Positioning: This segment is a 'Question Mark' if China Glass Holdings has low market share but faces high market growth.

China Glass Holdings' ventures into ultra-thin foldable glass and advanced photovoltaic battery modules likely fall into the Question Mark category. These segments exhibit high market growth potential, driven by technological advancements and the global shift towards renewables, with the foldable display market projected to reach $15.5 billion by 2025. However, the company's market share in these newer, specialized areas is probably still developing, necessitating significant investment to establish a strong foothold and transition them into Stars.

| Product Area | Market Growth | China Glass Holdings' Market Share | BCG Category | Investment Implication |

|---|---|---|---|---|

| Ultra-thin Foldable Glass | High | Low (Emerging) | Question Mark | Requires significant R&D and production investment |

| Advanced PV Battery Modules | High (Renewable Energy) | Low to Moderate | Question Mark | Needs investment to scale production and gain market traction |

BCG Matrix Data Sources

Our China Glass Holdings BCG Matrix is built on robust data, integrating financial disclosures, market research reports, and industry expert analyses to provide a comprehensive view.