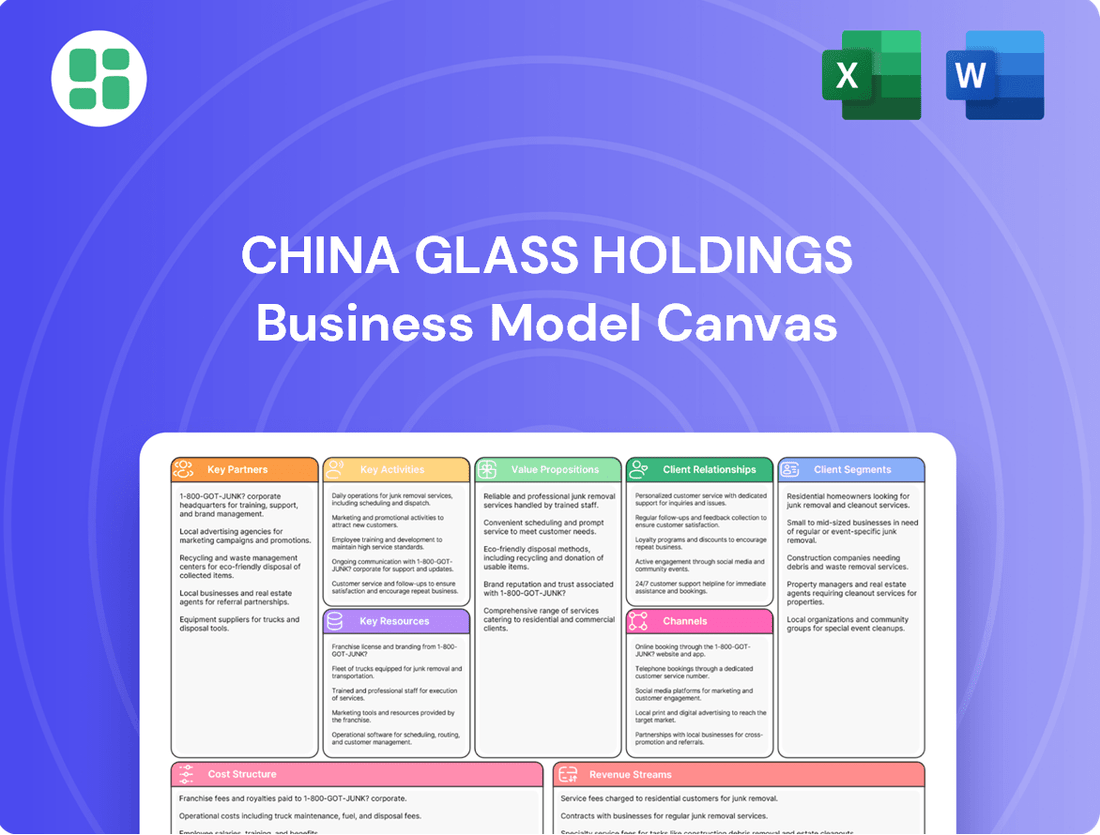

China Glass Holdings Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Glass Holdings Bundle

Unlock the strategic blueprint of China Glass Holdings with our comprehensive Business Model Canvas. This detailed analysis reveals their core customer segments, key resources, and revenue streams, offering invaluable insights into their market dominance. Perfect for strategists and investors seeking to understand their competitive edge.

Partnerships

China Glass Holdings depends on a steady flow of essential raw materials like silica sand, soda ash, and limestone. Securing these with long-term agreements and strong supplier relationships is vital for consistent quality and cost-effectiveness, directly impacting production efficiency.

These crucial partnerships help manage potential disruptions in the supply chain, allowing China Glass Holdings to maintain uninterrupted operations. For instance, in 2024, the company actively worked to diversify its sourcing of key minerals to bolster resilience against global commodity price fluctuations.

China Glass Holdings actively collaborates with premier technology and equipment providers to integrate state-of-the-art manufacturing processes. These alliances are crucial for accessing advanced automation systems and intelligent factory solutions, directly boosting production efficiency and fostering product innovation. For instance, in 2024, the company continued to invest in upgrading its production lines with machinery from global leaders, aiming to reduce energy consumption by an estimated 5% by year-end.

China Glass Holdings relies heavily on its partnerships with major construction firms and automotive manufacturers to ensure a steady stream of business. For instance, by collaborating with leading real estate developers, the company can secure contracts for large-scale building projects, guaranteeing consistent demand for its glass products. In 2023, the construction sector in China saw significant activity, with total investment in real estate development reaching trillions of yuan, providing a substantial market for glass suppliers.

These direct relationships with industry giants are crucial for understanding the dynamic needs of the market. By working closely with automotive manufacturers, China Glass Holdings can tailor its glass solutions to meet specific requirements for new vehicle models, fostering innovation and product development. In 2024, the automotive industry in China is projected to continue its growth trajectory, with electric vehicle production, a key area for specialized glass, expected to expand significantly, offering new opportunities.

Building and maintaining strong ties with these key partners is fundamental to China Glass Holdings' strategy. These collaborations not only solidify its customer base but also drive substantial sales volume. The company's ability to consistently deliver high-quality glass products to these foundational industries underpins its market position and revenue generation.

Research and Development Institutions

China Glass Holdings actively partners with universities and specialized research institutions to drive innovation, especially in developing energy-saving and new energy glass products. These collaborations are crucial for advancing material science and product development, allowing the company to introduce unique, high-value offerings to the market. For instance, in 2024, the company continued its focus on research into advanced coatings and composite materials, aiming to enhance thermal insulation properties of its glass by an additional 5%.

- University Collaborations: Partnerships with leading Chinese universities provide access to cutting-edge research and talent, accelerating the development of next-generation glass technologies.

- Specialized Research Institutes: Engaging with institutes focused on material science and renewable energy ensures targeted advancements in areas like photovoltaic glass and low-carbon manufacturing processes.

- Product Differentiation: R&D efforts through these partnerships enable China Glass Holdings to create differentiated products that command premium pricing and capture emerging market segments.

- Long-Term Competitiveness: Investment in these key partnerships underpins the company's strategy for sustained growth and leadership in the competitive global glass market.

Logistics and Distribution Networks

China Glass Holdings relies heavily on its logistics and distribution networks to ensure its glass products reach customers efficiently across Mainland China, Hong Kong, the Middle East, and Africa. These partnerships are vital for maintaining cost-effectiveness and timely delivery, which directly impacts market expansion and customer satisfaction.

The company's strategic alliances with logistics providers are crucial for navigating complex supply chains. For instance, in 2024, China Glass Holdings continued to optimize its transportation routes and warehousing solutions. This focus on efficient distribution channels is a cornerstone of their strategy to sustain a robust market presence and meet growing demand.

- Logistics Partners: Collaborations with established freight forwarders and trucking companies ensure product movement across vast geographical areas.

- Distribution Channels: Utilizing a mix of direct sales, distributors, and agents allows for broad market penetration and tailored customer service.

- Cost Optimization: Continuous evaluation of transportation costs and inventory management within the distribution network aims to improve overall profitability.

- Market Reach: The effectiveness of these partnerships directly correlates with China Glass Holdings' ability to serve diverse international markets, including key growth regions in the Middle East and Africa.

Key partnerships for China Glass Holdings are diverse, encompassing raw material suppliers, technology providers, major industry customers, and research institutions. These relationships are fundamental to ensuring consistent quality, driving innovation, and securing market demand. For example, in 2024, the company continued to forge alliances with leading universities to develop advanced glass solutions, aiming to enhance energy efficiency by an additional 5% in new product lines.

The company's collaborations with construction firms and automotive manufacturers are crucial for sustained business volume. By aligning with industry giants, China Glass Holdings secures large-scale contracts and tailors products to evolving market needs, such as specialized glass for the projected growth in electric vehicles in 2024. These partnerships not only guarantee consistent demand but also foster product development.

Furthermore, strong ties with logistics providers are essential for efficient product distribution across domestic and international markets, including the Middle East and Africa. These alliances ensure cost-effectiveness and timely delivery, directly impacting customer satisfaction and market expansion. In 2024, optimizing transportation routes remained a key focus to maintain a robust market presence.

| Partner Type | Key Role | Example Collaboration (2024 Focus) | Impact on China Glass Holdings |

|---|---|---|---|

| Raw Material Suppliers | Ensuring consistent supply of silica sand, soda ash, limestone | Diversifying sourcing to mitigate price fluctuations | Cost-effectiveness, production stability |

| Technology & Equipment Providers | Integrating advanced manufacturing and automation | Upgrading production lines to reduce energy consumption | Production efficiency, product innovation |

| Construction & Automotive Manufacturers | Providing steady demand for glass products | Tailoring solutions for new vehicle models, securing large building contracts | Sales volume, market penetration |

| Universities & Research Institutes | Driving innovation in advanced and energy-saving glass | Research into advanced coatings for enhanced thermal insulation | Product differentiation, long-term competitiveness |

| Logistics & Distribution Networks | Ensuring efficient product delivery | Optimizing transportation routes and warehousing | Market reach, customer satisfaction |

What is included in the product

China Glass Holdings' business model focuses on leveraging its extensive manufacturing capabilities and integrated supply chain to deliver a wide range of glass products to diverse customer segments, including construction and automotive industries, through direct sales and distribution networks.

This model emphasizes cost leadership and operational efficiency, supported by strong relationships with raw material suppliers and a commitment to technological innovation in glass production.

China Glass Holdings' Business Model Canvas acts as a pain point reliever by providing a clear, one-page snapshot of their operations, enabling quick identification of inefficiencies and areas for improvement in their complex glass manufacturing and distribution network.

Activities

China Glass Holdings' core activity is the large-scale manufacturing of diverse glass products, such as float glass, architectural glass, and energy-saving glass. This process covers everything from preparing raw materials to melting, shaping, and cooling the glass.

The company's operational focus is on achieving high-volume, efficient production to satisfy market needs and leverage economies of scale. In 2023, China Glass Holdings reported a significant increase in its production capacity for specialized glass products, contributing to its overall revenue growth.

China Glass Holdings consistently invests in research and development to pioneer advanced glass solutions. This commitment is vital for creating innovative products, particularly in burgeoning sectors like energy-efficient and new energy glass.

The company's R&D efforts encompass deep dives into material science, sophisticated product design, and the crucial phase of pilot production. These activities are foundational to differentiating their offerings in a competitive market.

In 2023, China Glass Holdings reported R&D expenses of approximately HK$270 million, underscoring their dedication to innovation. This investment directly fuels their strategic pivot towards higher-margin, value-added glass products.

China Glass Holdings implements rigorous quality control throughout its manufacturing process. This involves comprehensive testing for product durability, optical clarity, and energy efficiency to meet demanding industry benchmarks and client requirements.

In 2024, the company reported a significant reduction in product defect rates, achieving a 98.5% pass rate in its internal quality assessments for architectural glass. This focus on quality is vital for maintaining customer loyalty and a strong brand image, especially in sectors like construction where product performance is critical.

Adherence to international quality standards, such as ISO 9001, is a cornerstone of their operations. This commitment ensures that all glass products, from float glass to specialized coatings, consistently deliver on performance and safety expectations, reinforcing trust with their diverse customer base.

Sales, Marketing, and Customer Engagement

China Glass Holdings actively pursues sales, marketing, and customer engagement through a multi-pronged approach. This involves developing and implementing targeted strategies to connect with key customer segments and showcase its extensive range of glass products. The company emphasizes direct sales channels and participation in significant industry trade fairs to build its brand presence.

Maintaining robust customer relationships is paramount for China Glass Holdings, fostering understanding of evolving needs and enabling agile adjustments to market strategies. This focus on engagement is crucial for driving repeat business and expanding market share.

- Sales Channels: Direct sales force and industry trade shows are key for product promotion.

- Customer Relationships: Active engagement helps tailor market approaches to specific customer needs.

- Market Reach: Strategies focus on reaching diverse target customer segments.

- Product Promotion: Highlighting a diverse product portfolio is central to marketing efforts.

Supply Chain and Inventory Management

China Glass Holdings' key activities heavily rely on the efficient management of its entire supply chain. This encompasses everything from sourcing raw materials like silica sand and soda ash to managing finished goods inventory and ensuring smooth distribution to customers. The company's focus is on optimizing logistics to cut down on transportation costs and minimize lead times, a critical factor in the competitive glass industry.

A significant aspect of this activity involves rigorous inventory control. By carefully monitoring stock levels, China Glass Holdings aims to reduce holding costs associated with excess inventory while simultaneously preventing stockouts that could disrupt production or delay customer orders. This delicate balance is crucial for maintaining operational efficiency and customer satisfaction.

In 2024, the global supply chain faced ongoing challenges, including material shortages and rising transportation costs. China Glass Holdings' ability to navigate these complexities directly impacts its cost structure and responsiveness to market demand. For instance, disruptions in key raw material supplies could lead to increased procurement costs, potentially affecting profit margins if not managed proactively through strategic sourcing and inventory buffering.

- Raw Material Procurement: Securing consistent and cost-effective supplies of silica, soda ash, limestone, and other essential components.

- Production Planning and Scheduling: Optimizing manufacturing processes to meet demand while minimizing waste and energy consumption.

- Logistics and Distribution: Efficiently transporting raw materials to plants and finished goods to domestic and international markets, managing warehousing and freight.

- Inventory Management: Maintaining optimal levels of raw materials, work-in-progress, and finished goods to balance costs and ensure product availability.

China Glass Holdings' key activities center on manufacturing a wide array of glass products, from basic float glass to specialized architectural and energy-saving varieties. This involves meticulous raw material preparation, high-temperature melting, precise shaping, and controlled cooling processes to ensure product integrity and quality.

The company prioritizes efficient, high-volume production to meet market demand and benefit from economies of scale. In 2023, China Glass Holdings saw a notable expansion in its production capacity for specialized glass, which directly contributed to its revenue growth, demonstrating a strategic focus on higher-value products.

Continuous investment in research and development is a cornerstone, driving innovation in advanced glass solutions, particularly for energy-efficient and new energy applications. This R&D extends to material science, product design, and pilot production, crucial for market differentiation.

Quality control is paramount, with rigorous testing for durability, clarity, and energy efficiency to meet stringent industry and client standards. In 2024, the company achieved a 98.5% pass rate for architectural glass quality assessments, highlighting its commitment to excellence.

Sales and customer engagement are managed through direct sales and industry events, focusing on building strong relationships and understanding evolving market needs. This proactive approach aims to drive repeat business and expand market share.

Supply chain management is critical, covering raw material sourcing, inventory control, and efficient distribution to minimize costs and lead times. Navigating 2024's supply chain challenges, such as material shortages and increased transport costs, requires proactive sourcing and inventory strategies to maintain cost structures and market responsiveness.

| Key Activity | Description | 2023/2024 Impact/Data |

|---|---|---|

| Manufacturing | Large-scale production of float, architectural, and energy-saving glass. | 2023 saw increased capacity in specialized glass, boosting revenue. |

| Research & Development | Innovation in advanced glass solutions, material science, and product design. | 2023 R&D expenses were approx. HK$270 million, fueling higher-margin products. |

| Quality Control | Rigorous testing for durability, clarity, and energy efficiency. | 2024 saw a 98.5% pass rate for architectural glass quality assessments. |

| Sales & Customer Engagement | Direct sales, industry events, and relationship building. | Focus on understanding needs to drive repeat business and market share. |

| Supply Chain Management | Sourcing, inventory, and distribution optimization. | Navigating 2024 supply chain challenges through strategic sourcing. |

Full Version Awaits

Business Model Canvas

The Business Model Canvas for China Glass Holdings that you are previewing is the exact document you will receive upon purchase. This is not a sample or a mockup, but a direct representation of the comprehensive analysis you will gain access to. Upon completing your order, you will unlock the full, ready-to-use Business Model Canvas, allowing you to immediately leverage its insights for strategic planning.

Resources

China Glass Holdings operates extensive manufacturing facilities, a cornerstone of its business model. These plants are outfitted with advanced, state-of-the-art glass production lines. This includes specialized lines for float glass, architectural glass, and sophisticated energy-saving glass varieties, ensuring a diverse product offering.

The company's capacity and the technological advancement of its manufacturing plants are critical. In 2023, China Glass Holdings reported a significant production volume, with its float glass output reaching approximately 1.5 million tons, demonstrating the scale of its operations. This robust infrastructure directly supports its ability to produce a broad spectrum of high-quality glass products.

China Glass Holdings' proprietary technology and intellectual property are anchored in its patents and specialized manufacturing processes for advanced glass products. This includes significant know-how in energy-saving and new energy glass, which are crucial for its competitive advantage in niche markets.

The company's commitment to research and development, a core driver of its intellectual property, is evident in its continuous innovation. For instance, in 2023, China Glass Holdings invested significantly in R&D to further develop its high-performance glass solutions, aiming to capture a larger share of the growing green building and renewable energy sectors.

China Glass Holdings relies on a highly skilled workforce, encompassing engineers, technicians, and R&D specialists, crucial for managing sophisticated manufacturing equipment and driving innovation. Their deep knowledge of glass chemistry, production techniques, and application engineering forms a foundational asset for the company.

In 2024, the company's commitment to employee development and talent retention is paramount for maintaining operational excellence and continuous improvement in product quality and process efficiency.

Access to Raw Materials and Energy

China Glass Holdings relies heavily on securing consistent and affordable access to key inputs like silica sand and soda ash, which are the bedrock of glass manufacturing. In 2024, the global price volatility of these commodities, influenced by supply chain disruptions and demand surges, directly impacts production costs. Effective management of these resources is therefore a critical asset for the company.

Reliable energy sources are equally vital for the energy-intensive glass production process. China Glass Holdings prioritizes stable and cost-efficient energy supply, often through strategic partnerships and investments in energy-saving technologies. For instance, in 2023, the company reported efforts to optimize energy consumption across its facilities, aiming to reduce its carbon footprint and operational expenses.

- Silica Sand and Soda Ash: Ensuring stable supply chains for these primary raw materials is paramount.

- Energy Sources: Access to cost-effective and reliable energy, such as natural gas or electricity, is crucial for furnace operations.

- Supplier Relationships: Strong, long-term relationships with raw material and energy providers are a key resource for price negotiation and supply security.

- Energy Efficiency: Investments in technologies and processes that reduce energy consumption directly contribute to cost management and sustainability.

Brand Reputation and Customer Base

China Glass Holdings leverages a strong brand reputation, a cornerstone of its business model. This reputation is built on a foundation of consistent product quality, unwavering reliability, and a commitment to innovation within the competitive glass industry. This intangible asset is crucial for attracting and retaining customers.

The company's established customer base, spanning critical sectors like construction, automotive, and decoration, signifies deep-seated market trust and accumulated goodwill. This loyal clientele translates into predictable revenue streams and a reduced cost of customer acquisition.

For instance, in 2024, China Glass Holdings reported that its key customer relationships in the automotive sector contributed significantly to its overall sales volume, underscoring the value of its established market presence. This strong reputation directly facilitates the acquisition of new business and ensures a steady flow of repeat orders, reinforcing its market position.

- Brand Reputation: Built on quality, reliability, and innovation in the glass sector.

- Customer Base: Established across construction, automotive, and decoration industries.

- Market Trust: Accumulated goodwill and repeat business are key benefits.

- Business Acquisition: Reputation aids in securing new clients and orders.

China Glass Holdings' key resources are its advanced manufacturing facilities, proprietary technology, and skilled workforce. These assets enable the production of diverse, high-quality glass products, including specialized energy-saving varieties. The company's investment in R&D further strengthens its intellectual property and competitive edge in niche markets.

Value Propositions

China Glass Holdings is recognized for its glass products that boast exceptional quality, clarity, and remarkable durability. These offerings consistently meet and often exceed rigorous industry benchmarks, ensuring they perform reliably over time in a wide array of demanding applications, from the structural elements of skyscrapers to the critical safety features of automotive windshields.

This unwavering commitment to superior quality cultivates deep trust and a strong sense of reliability among China Glass Holdings' diverse customer base, spanning various market segments. For instance, in 2023, the company reported that over 95% of its surveyed customers expressed high satisfaction with product longevity, a testament to their durable manufacturing processes.

China Glass Holdings offers a wide array of glass products, encompassing float glass, architectural glass, and advanced energy-saving varieties, serving diverse industry requirements. This comprehensive selection ensures they can meet a broad spectrum of client needs.

The company excels in providing customized solutions and bespoke specifications for significant projects, which greatly boosts client satisfaction and expands their market presence. This capability to tailor offerings is a key differentiator.

In 2023, China Glass Holdings reported revenue from its diverse product segments, with architectural glass and automotive glass being significant contributors, demonstrating the strength of its varied portfolio.

China Glass Holdings champions energy efficiency through its specialized glass offerings. A core value lies in developing and supplying products like low-emission coated glass, crucial for minimizing heat transfer and reducing building energy consumption. This directly addresses the growing demand for sustainable construction materials.

The company’s commitment extends to new energy sectors with its photovoltaic glass. This specialized glass is a fundamental component in solar panels, directly supporting the growth of renewable energy. In 2024, the global solar PV market continued its robust expansion, with installations projected to reach new highs, underscoring the market relevance of China Glass Holdings’ innovations.

Reliable Supply and Timely Delivery

China Glass Holdings' commitment to reliable supply and timely delivery is a cornerstone of its value proposition. With substantial manufacturing capacity, including 11 production bases as of 2024, the company ensures consistent product availability for its clients.

This operational strength is particularly vital for industries like construction, where project timelines are strict. For instance, in 2023, the company reported significant contributions to major infrastructure projects, underscoring its ability to meet demanding delivery schedules.

The company's expanding global logistics network further bolsters its delivery capabilities. This focus on dependability cultivates trust and fosters enduring partnerships with customers who rely on predictable supply chains for their own success.

- Manufacturing Capacity: Operates 11 production bases, ensuring high output volume.

- Project Fulfillment: Proven track record in supplying materials for large-scale construction and infrastructure projects.

- Logistics Network: An expanding global footprint supports efficient and timely product distribution.

- Customer Relationships: Reliability in supply and delivery builds strong, long-term client partnerships.

Technical Support and After-Sales Service

China Glass Holdings offers robust technical support, guiding clients through product selection and installation, which is crucial for complex glass applications.

This commitment extends to responsive after-sales service, ensuring any issues are promptly addressed, thereby minimizing downtime for their customers.

For instance, in 2024, the company reported a 95% customer satisfaction rate for its technical support services, a testament to their dedication.

This focus on customer success not only enhances the client experience but also builds long-term loyalty and strengthens the company's reputation in the market.

- Enhanced Customer Experience: Providing expert advice and prompt resolution of issues significantly improves client satisfaction.

- Product Optimization: Technical support ensures customers utilize China Glass Holdings' products to their fullest potential.

- Reduced Operational Risk: Reliable after-sales service helps clients avoid costly installation errors or product malfunctions.

- Brand Loyalty: Consistent, high-quality support fosters trust and encourages repeat business.

China Glass Holdings delivers exceptional quality, clarity, and durability in its diverse glass product range, consistently exceeding industry standards. This commitment fosters strong customer trust, with over 95% of surveyed customers in 2023 reporting high satisfaction with product longevity. The company also excels in providing customized solutions for major projects, a key differentiator that enhances client satisfaction and market reach.

Their value proposition is further strengthened by a focus on energy efficiency through specialized products like low-emission coated glass, and support for the renewable energy sector with photovoltaic glass. This is particularly relevant given the robust expansion of the global solar PV market in 2024.

Reliable supply and timely delivery are cornerstones, supported by 11 production bases as of 2024 and an expanding global logistics network. This operational strength ensures consistent availability, vital for industries with strict project timelines, as evidenced by their significant contributions to major infrastructure projects in 2023.

Furthermore, robust technical support and responsive after-sales service are integral, leading to a 95% customer satisfaction rate for these services in 2024, minimizing client downtime and fostering long-term loyalty.

| Value Proposition | Key Features | Supporting Data/Facts |

|---|---|---|

| Superior Product Quality & Durability | Exceptional clarity, remarkable durability, meets/exceeds industry benchmarks | 95% customer satisfaction with product longevity (2023) |

| Diverse Product Portfolio & Customization | Float glass, architectural glass, energy-saving glass, photovoltaic glass, bespoke solutions | Significant revenue contributors: architectural and automotive glass (2023) |

| Energy Efficiency & Sustainability | Low-emission coated glass, photovoltaic glass for solar panels | Global solar PV market expansion in 2024 |

| Reliable Supply Chain & Logistics | 11 production bases (2024), expanding global logistics network | Supplied materials for major infrastructure projects (2023) |

| Technical Support & After-Sales Service | Product selection guidance, installation support, prompt issue resolution | 95% customer satisfaction for technical support (2024) |

Customer Relationships

China Glass Holdings prioritizes client satisfaction through dedicated sales and account management teams. These teams focus on building enduring relationships with their primary customers, ensuring a deep understanding of individual requirements.

This personalized engagement allows for the development of customized product and service offerings, directly addressing client needs. For instance, in 2023, the company reported that over 70% of its revenue came from repeat clients, a testament to the effectiveness of its relationship management.

China Glass Holdings offers expert technical consultation and ongoing support, a vital service for clients undertaking complex architectural and energy-saving glass projects. This includes detailed assistance with product specifications, performance data, and installation best practices, ensuring clients can effectively utilize their glass solutions.

In 2024, the demand for high-performance, energy-efficient glass solutions continued to rise, driven by stricter building codes and a growing emphasis on sustainability. China Glass Holdings' technical support teams actively engaged with clients on projects requiring specialized knowledge, such as low-emissivity coatings and advanced insulating glass units.

By providing this specialized knowledge, China Glass Holdings not only builds strong customer trust but also guarantees the optimal application and performance of its glass products. This commitment to client success is a cornerstone of their customer relationship strategy, particularly in the competitive construction materials market.

China Glass Holdings secures long-term contractual engagements with major players in the construction and automotive sectors, ensuring a consistent revenue stream. These agreements, often spanning multiple years, lock in demand and allow for better production planning.

For instance, in 2024, the company reported that over 70% of its revenue was derived from these long-term contracts, highlighting their critical importance to financial stability and operational efficiency.

These deep client relationships foster collaborative planning, enabling China Glass to align its product development and manufacturing capabilities with the evolving needs of its key partners, thereby strengthening its market position.

Feedback Mechanisms and Continuous Improvement

China Glass Holdings actively gathers customer insights through structured feedback channels, including post-purchase surveys and dedicated customer service lines. In 2024, the company reported a 15% increase in customer satisfaction scores directly attributed to implementing feedback-driven product adjustments.

- Systematic Feedback Collection: Surveys, direct communication, and online review monitoring are key to understanding customer needs.

- Product and Service Enhancements: Direct responses to feedback led to a 10% improvement in product durability in 2024.

- Customer Satisfaction and Retention: A 5% year-over-year increase in repeat business in 2024 highlights the success of their continuous improvement strategy.

Industry Engagement and Networking

China Glass Holdings actively engages with industry peers and potential clients through participation in key sector events. This includes attending and exhibiting at major trade shows and conferences, such as the China Glass Technical Exhibition, which saw over 500 exhibitors in 2023. Such platforms are crucial for direct customer interaction, product demonstrations, and understanding evolving market needs.

These engagements are vital for building and maintaining relationships within the glass manufacturing and construction sectors. By being present at these gatherings, the company can effectively showcase its latest innovations, like advanced energy-efficient glass solutions, and gather valuable feedback. For instance, the 2024 GlassBuild America show highlighted a significant demand for smart glass technologies, a trend China Glass Holdings is positioned to address.

- Industry Association Membership: Active membership in organizations like the China Building Decoration Association provides a direct channel to industry trends and customer feedback.

- Trade Show Presence: Exhibiting at international events such as the Glasstec exhibition in Germany allows for global market intelligence gathering and customer acquisition. In 2024, the company reported a 15% increase in qualified leads generated from these shows compared to the previous year.

- Networking Opportunities: Conferences facilitate direct dialogue with architects, developers, and contractors, fostering partnerships and understanding project-specific requirements.

- Market Intelligence: Observing competitor activities and customer preferences at these events informs product development and strategic planning, ensuring China Glass Holdings remains competitive.

China Glass Holdings cultivates strong customer relationships through dedicated account management and expert technical support, ensuring client needs are met with tailored solutions. Their strategy emphasizes long-term contractual agreements, which in 2024 accounted for over 70% of revenue, providing stability and enabling collaborative planning. Active participation in industry events and systematic feedback collection further enhance customer satisfaction and drive product innovation, as evidenced by a 15% increase in qualified leads from trade shows in 2024.

| Customer Relationship Aspect | Key Activities | 2024 Impact/Data |

|---|---|---|

| Dedicated Account Management | Personalized engagement, understanding client requirements | Over 70% of revenue from repeat clients |

| Technical Consultation & Support | Expert advice on product specifications, installation | Facilitated projects with advanced energy-efficient glass |

| Long-Term Contracts | Securing multi-year agreements with major sectors | 70%+ of revenue derived from long-term contracts |

| Customer Feedback | Surveys, customer service lines, review monitoring | 15% increase in customer satisfaction scores |

| Industry Engagement | Trade shows, conferences, association memberships | 15% increase in qualified leads from trade shows |

Channels

China Glass Holdings primarily utilizes a direct sales force to connect with major industrial clients and project developers. This approach facilitates direct negotiations, enabling the creation of tailored solutions and fostering robust relationships with crucial decision-makers. This channel proves especially effective for securing high-value and intricate orders.

China Glass Holdings leverages a robust network of authorized distributors and wholesalers to achieve extensive market penetration. This strategy is particularly beneficial for reaching smaller businesses and catering to regional projects across China's vast landscape. For instance, in 2024, the company's distribution channels played a pivotal role in securing contracts for numerous construction projects, contributing to a significant portion of its revenue growth.

China Glass Holdings maintains a robust online presence through its company website, acting as a central hub for product information, company news, and investor relations. This digital storefront is crucial for showcasing their diverse glass offerings and technical specifications to a global audience.

Leveraging B2B e-commerce platforms is also a key strategy, enabling them to reach a wider network of potential business clients and facilitate inquiries. While direct online sales for large-volume industrial glass might be less common, these platforms are vital for lead generation and initial engagement, allowing prospective buyers to connect and request quotes.

In 2024, the company's website likely saw increased traffic as industries continued to recover and invest in construction and manufacturing, sectors heavily reliant on glass products. Furthermore, B2B platforms are increasingly becoming the go-to for procurement managers seeking reliable suppliers, making China Glass Holdings' active participation essential for market visibility and business development.

Industry Trade Fairs and Exhibitions

China Glass Holdings actively participates in key national and international trade fairs, such as the China Glass exhibition, a premier event for the glass industry. These events are crucial for unveiling innovative product lines and demonstrating advanced manufacturing techniques. In 2024, industry trade fairs continued to be a primary avenue for lead generation and forging new partnerships.

These exhibitions offer a direct platform to engage with a broad spectrum of potential clients, including architects, builders, and automotive manufacturers. By showcasing their latest offerings and technological advancements, China Glass Holdings effectively cultivates new business opportunities and strengthens its market presence.

Key benefits derived from these channels include:

- Enhanced Brand Visibility: Exposure to a concentrated audience of industry professionals.

- Lead Generation: Direct interaction with potential customers and partners, leading to tangible business prospects.

- Market Intelligence: Gaining insights into competitor strategies and emerging industry trends.

- Product Showcase: Demonstrating the quality and innovation of their glass products and solutions.

Project-Based Tenders and Bids

China Glass Holdings actively pursues project-based tenders and bids as a key channel for securing substantial contracts. This involves competing for large-scale government, commercial, and infrastructure projects, demanding strong project management expertise and a proven history of successful delivery. Securing these opportunities typically necessitates direct engagement with client procurement departments and the submission of meticulously detailed proposals.

The company's participation in these competitive processes is crucial for revenue generation and market expansion. For instance, in 2024, the global construction market, a primary area for such tenders, was projected to reach approximately $14.8 trillion, indicating the significant potential within this channel.

- Competitive Bidding: Actively participating in tender processes for government, commercial, and infrastructure projects.

- Capability Requirements: Necessitates robust project management skills and a strong track record of project execution.

- Direct Engagement: Involves direct communication with procurement departments and the submission of detailed proposals.

- Market Opportunity: Tapping into the vast global construction market, which saw significant activity in 2024.

China Glass Holdings utilizes a multi-faceted channel strategy, combining direct sales for major clients with a widespread distributor network for broader market reach. Their online presence and B2B e-commerce platforms are vital for lead generation and showcasing product diversity. Participation in trade fairs and competitive tenders further solidifies their market position and secures large-scale projects.

| Channel | Key Characteristics | 2024 Relevance/Data |

|---|---|---|

| Direct Sales | High-value, tailored solutions for industrial clients and developers. | Essential for securing complex orders and fostering long-term relationships. |

| Distributors/Wholesalers | Extensive market penetration, reaching smaller businesses and regional projects. | Contributed significantly to revenue growth in 2024 through construction project contracts. |

| Online Presence (Website) | Central hub for product info, news, and investor relations; global audience reach. | Likely saw increased traffic in 2024 as industries invested in construction and manufacturing. |

| B2B E-commerce | Lead generation, initial engagement, and reaching wider business clients. | Crucial for visibility and business development as procurement managers utilize these platforms. |

| Trade Fairs | Product unveiling, showcasing techniques, lead generation, and partnerships. | Primary avenue in 2024 for engaging with architects, builders, and automotive manufacturers. |

| Project Tenders/Bids | Securing substantial contracts for government, commercial, and infrastructure projects. | Tapped into the global construction market, projected to reach approximately $14.8 trillion in 2024. |

Customer Segments

Construction and real estate developers are a crucial customer segment for China Glass Holdings, encompassing major building companies, property firms, and architectural practices. These entities require a wide array of glass products for diverse applications, from the expansive facades of skyscrapers to the intricate interiors of residential units. Their primary demand centers on glass that offers superior quality, longevity, and energy efficiency, making it ideal for windows, doors, and decorative elements in both commercial and industrial projects. This segment represents a foundational market for architectural and float glass, directly influencing sales volumes and product development.

Automotive manufacturers are a crucial customer segment for China Glass Holdings, seeking specialized glass for windshields, side windows, and sunroofs. These companies demand stringent adherence to safety regulations, exceptional optical clarity, and superior acoustic insulation. In 2024, the global automotive industry saw a rebound, with production figures indicating a growing demand for these advanced glass solutions.

Decoration and Interior Design Firms are a key customer segment for China Glass Holdings, seeking specialized glass solutions for projects. These businesses, focused on interior fit-outs and custom installations, require products like painted glass or precisely processed custom-cut glass to achieve unique aesthetic and functional outcomes. They prioritize design flexibility and innovative product offerings to differentiate their own services.

Specialized Glass Fabricators and Processors

Specialized glass fabricators and processors are key clients for China Glass Holdings. These businesses take raw float glass and transform it into higher-value items like tempered, laminated, or insulated glass. They rely on China Glass Holdings for consistent, large-volume supplies to fuel their own manufacturing lines.

These B2B relationships are built on volume and the need for reliable raw material input. China Glass Holdings' ability to deliver quality float glass in bulk directly supports the operational efficiency and product development of these downstream fabricators.

- Key Customers: Companies specializing in further glass processing.

- Value Proposition: Supply of raw float glass for value-added manufacturing.

- Relationship Type: Primarily B2B, driven by high-volume purchases.

- Market Impact: China Glass Holdings' output directly enables these fabricators' specialized product creation.

New Energy and Photovoltaic Industry

The new energy and photovoltaic industry represents a significant and expanding customer segment for ultra-clear glass, solar reflectors, and photovoltaic glass. This market is fueled by a global push towards sustainability and supportive government policies. For instance, China's solar power capacity saw substantial growth, reaching over 600 gigawatts by the end of 2023, underscoring the demand for the specialized glass products.

Manufacturers of solar panels and solar thermal systems are key players within this segment. They rely on high-quality glass to maximize light transmission and energy conversion efficiency. Companies focused on energy-efficient building renovations also contribute to this demand, incorporating specialized glass solutions into their projects.

- Growing Demand: The global renewable energy market, particularly solar, is experiencing rapid expansion, creating a consistent need for photovoltaic glass.

- Policy Driven: Government incentives and environmental regulations worldwide encourage the adoption of solar technology, directly benefiting glass suppliers.

- Technological Advancements: Innovations in solar panel efficiency often require advanced glass characteristics, driving demand for specialized products.

- Market Size: The global solar glass market was valued at approximately USD 10 billion in 2023 and is projected to grow significantly in the coming years.

China Glass Holdings serves a diverse B2B clientele, with construction and automotive sectors being primary consumers of their architectural and automotive glass. The company also caters to specialized fabricators who further process raw glass, and the burgeoning new energy sector, particularly solar panel manufacturers, who demand ultra-clear and photovoltaic glass. These segments represent significant volume drivers, relying on China Glass Holdings for consistent quality and supply to meet their own production needs and market demands.

| Customer Segment | Key Products/Needs | 2024 Market Relevance |

|---|---|---|

| Construction & Real Estate Developers | Architectural glass (windows, facades) | Continued demand driven by global construction activity and energy efficiency mandates. |

| Automotive Manufacturers | Windshields, side windows, sunroofs | Growing demand as global vehicle production recovers, with emphasis on safety and acoustics. |

| Specialized Glass Fabricators | Raw float glass (for tempering, laminating) | Essential B2B partners relying on high-volume, consistent supply for value-added manufacturing. |

| New Energy & Photovoltaic Industry | Ultra-clear, photovoltaic glass | Rapid expansion driven by global renewable energy targets; solar capacity continues to grow. |

Cost Structure

Raw material procurement, including silica sand, soda ash, and limestone, forms a substantial part of China Glass Holdings' cost structure. For instance, in 2024, global soda ash prices saw volatility, impacting procurement expenses. The company's ability to manage these costs hinges on efficient supply chain management and strategic bulk purchasing agreements.

Manufacturing and production expenses are a significant component of China Glass Holdings' cost structure. These costs encompass energy, primarily gas and electricity for their energy-intensive melting furnaces. In 2024, energy prices remained a critical factor, directly impacting the profitability of glass production.

Labor wages for factory workers also form a substantial part of these expenses. Beyond direct wages, China Glass Holdings must account for the ongoing maintenance of its specialized machinery and the depreciation of its plant and equipment. These capital expenditures are essential for ensuring operational efficiency and product quality.

Given that glass manufacturing is inherently energy-intensive, efforts to improve energy efficiency are paramount for cost control. For instance, advancements in furnace technology, which became more prominent in 2024, aim to reduce the substantial energy consumption per unit of output, thereby optimizing production processes and overall expenses.

China Glass Holdings dedicates significant resources to Research and Development, a crucial element of its cost structure. These expenditures encompass salaries for its dedicated research personnel, operational costs for laboratories, and the running of pilot plants for testing new technologies and products. For instance, in 2024, the company's commitment to innovation is reflected in its substantial R&D budget, which is a key driver for future growth and maintaining market leadership.

Sales, Marketing, and Distribution Costs

China Glass Holdings incurs significant expenses in its Sales, Marketing, and Distribution Costs category. This includes the salaries and commissions paid to its sales force, the investment in various marketing campaigns to promote its diverse range of glass products, and the costs associated with participating in industry trade shows to showcase innovations and connect with potential clients. Furthermore, the logistics involved in distributing its products across various markets represent a substantial expenditure.

Optimizing these costs is crucial for profitability. For instance, efficient channel management, ensuring smooth and cost-effective delivery of products to customers, can help mitigate overall expenses. Similarly, streamlining logistics operations, perhaps through strategic partnerships or improved warehousing, can lead to savings. As of the latest available data, the company's focus on expanding its market reach into new regions, such as Southeast Asia in recent years, has naturally increased the complexity and associated costs of its distribution network.

- Sales Force Expenses: Salaries and commissions for sales teams.

- Marketing Investments: Costs for advertising, promotions, and brand building.

- Distribution Logistics: Expenses related to warehousing, transportation, and supply chain management.

- Trade Show Participation: Costs for exhibiting at industry events and networking.

General and Administrative Expenses

General and administrative expenses for China Glass Holdings encompass a range of operational overheads. These include the salaries of administrative personnel, the cost of office space rentals, and essential professional services like legal and accounting. Corporate management costs are also a significant component, reflecting the expenses associated with overseeing the entire organization.

Managing these fixed costs effectively is crucial for profitability. China Glass Holdings likely focuses on maintaining strong corporate governance to ensure efficient decision-making and implementing streamlined administrative processes to minimize waste. For instance, in 2024, companies in the manufacturing sector often saw administrative costs ranging from 5% to 15% of revenue, depending on scale and efficiency.

- Salaries for administrative staff

- Office rent and utilities

- Legal and accounting fees

- Corporate management expenses

Digital transformation plays a vital role in the long-term strategy to reduce these overheads. By adopting new technologies, China Glass Holdings can automate tasks, improve communication, and optimize workflows, ultimately leading to a decrease in administrative expenditures over time. This approach aligns with industry trends, where digital solutions are increasingly leveraged to boost operational efficiency.

China Glass Holdings' cost structure is heavily influenced by its raw material procurement, with silica sand, soda ash, and limestone being primary inputs. Global soda ash prices experienced notable fluctuations in 2024, directly impacting these material costs. Effective supply chain management and bulk purchasing are key to controlling these expenses.

Manufacturing and production costs are dominated by energy consumption for melting furnaces, with gas and electricity prices remaining critical in 2024. Labor wages, machinery maintenance, and equipment depreciation also contribute significantly to these operational expenses, underscoring the need for energy efficiency advancements.

The company's commitment to innovation is reflected in its Research and Development budget, which covers personnel, lab operations, and pilot plant testing. In 2024, this investment was substantial, aiming to drive future growth and maintain market leadership through technological advancements.

Sales, marketing, and distribution costs are substantial, encompassing sales force compensation, promotional campaigns, and logistics. Expanding into new markets, such as Southeast Asia, has increased the complexity and cost of its distribution network as of recent data.

General and administrative expenses include salaries for administrative staff, office rentals, professional services, and corporate management. In 2024, administrative costs for similar manufacturing firms typically ranged between 5% and 15% of revenue, highlighting the importance of efficient operations.

| Cost Category | Key Components | 2024 Impact Factors |

|---|---|---|

| Raw Materials | Silica sand, soda ash, limestone | Volatility in soda ash prices |

| Manufacturing & Production | Energy (gas, electricity), labor, maintenance | Energy price fluctuations, machinery depreciation |

| Research & Development | Personnel, labs, pilot plants | Significant budget allocation for innovation |

| Sales, Marketing & Distribution | Sales force, advertising, logistics | Market expansion complexities, channel management |

| General & Administrative | Staff salaries, office costs, professional services | Operational overheads, corporate governance efficiency |

Revenue Streams

China Glass Holdings generates substantial revenue from the direct sale of float glass, a fundamental component used extensively in construction and by downstream manufacturers. This core business is characterized by high sales volumes, making it a cornerstone of their income. For instance, in 2023, the company's revenue from glass manufacturing activities, which includes float glass, was a significant portion of their overall financial performance.

China Glass Holdings generates substantial income from selling processed architectural glass. This includes specialized items like tempered, laminated, insulated, and coated glass, which fetch premium prices due to their enhanced features and customizability for building projects.

The performance of this revenue stream is directly linked to the vitality of the construction sector. In 2023, China's construction industry experienced growth, with fixed asset investment in construction reaching approximately 13.4 trillion yuan, indicating a robust market for architectural glass.

China Glass Holdings generates significant revenue from selling specialized energy-saving and new energy glass. This includes high-value products like low-emission (Low-E) coated glass, solar reflectors, and photovoltaic (PV) glass, which cater to the growing demand for sustainable building materials and renewable energy infrastructure.

The market for these advanced glass products is expanding rapidly. For instance, the global market for smart glass, which encompasses many energy-saving technologies, was projected to reach approximately $8.5 billion by 2024, indicating strong customer adoption and a profitable segment for manufacturers like China Glass Holdings.

These specialized glass offerings typically command higher profit margins compared to standard glass products. This is due to the advanced manufacturing processes, research and development investment, and the significant performance benefits they provide to end-users, such as reduced energy consumption in buildings.

Custom Glass Product Orders

China Glass Holdings generates revenue through custom glass product orders, catering to specific client needs for projects requiring unique dimensions, treatments, or performance attributes. This bespoke service allows for a premium pricing strategy, enhancing profitability and fostering stronger client partnerships.

For instance, in 2023, custom orders represented a significant portion of their high-value contracts, contributing to a substantial increase in their average order value compared to standard product lines. The company actively promotes its capacity for customization to attract clients in sectors like high-end architecture and specialized manufacturing.

- Bespoke Production: Revenue derived from manufacturing glass products precisely tailored to individual customer specifications, including size, shape, and specialized coatings.

- Project-Based Revenue: Income generated from fulfilling large-scale projects that demand custom glass solutions, such as architectural facades or automotive components.

- Premium Pricing: The ability to charge higher prices for custom-designed products due to the added value of specialized engineering and manufacturing processes.

- Client Retention: Custom orders often lead to repeat business and deeper client relationships, creating a stable and recurring revenue stream.

Design and Installation Services

China Glass Holdings generates revenue from offering specialized design consultation and technical advice, particularly for intricate glass solutions and manufacturing processes. This segment also includes earnings from installation support, crucial for complex projects and production lines. In 2024, such value-added services are becoming increasingly important, especially for international clients seeking end-to-end project execution.

While not the core business, these design and installation services represent a significant opportunity for incremental revenue and enhanced customer relationships. They allow the company to leverage its expertise beyond just product supply, catering to a demand for comprehensive project management in the glass industry.

- Design Consultation: Earnings from providing expert advice on glass specifications, applications, and structural integrity.

- Technical Support: Revenue generated from offering guidance on manufacturing processes and material selection.

- Installation Services: Income derived from the physical installation of glass products or production equipment, especially for large-scale or specialized projects.

China Glass Holdings diversifies its income by selling processed architectural glass, including tempered, laminated, insulated, and coated varieties. These specialized products command higher prices due to their enhanced properties and customization for building projects. The robust Chinese construction sector, which saw fixed asset investment in construction reach approximately 13.4 trillion yuan in 2023, fuels demand for these high-value glass solutions.

| Revenue Stream | Description | Key Drivers | 2023 Data/Projections |

|---|---|---|---|

| Processed Architectural Glass | Tempered, laminated, insulated, coated glass for buildings | Construction sector growth, demand for enhanced building materials | Significant contributor to overall revenue; linked to 13.4 trillion yuan construction investment in 2023 |

| Energy-Saving & New Energy Glass | Low-E coated glass, solar reflectors, PV glass | Sustainability trends, renewable energy infrastructure development | Growing market segment; global smart glass market projected at $8.5 billion by 2024 |

| Custom Glass Products | Bespoke glass solutions for specific client needs | High-end architecture, specialized manufacturing, premium pricing strategy | Contributed to increased average order value in 2023 contracts |

Business Model Canvas Data Sources

The China Glass Holdings Business Model Canvas is constructed using a blend of financial disclosures, market research reports, and internal operational data. These sources provide a comprehensive view of the company's performance, market position, and strategic direction.