China Glass Holdings Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Glass Holdings Bundle

China Glass Holdings operates in a dynamic market where supplier power, buyer bargaining, and the threat of new entrants significantly shape its competitive landscape. Understanding these forces is crucial for navigating the glass industry's complexities and identifying strategic opportunities.

The complete report reveals the real forces shaping China Glass Holdings’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The primary raw materials for glass production, including silica sand, soda ash, and limestone, have few readily available substitutes. This scarcity grants suppliers a degree of leverage over manufacturers like China Glass Holdings. In 2023, the global market for soda ash, a key ingredient, saw prices fluctuate, with some regions experiencing increases due to supply chain disruptions, directly impacting glass production costs.

Energy costs, especially for natural gas and electricity, represent a substantial portion of the expenses in glass production. Fluctuations in these energy prices can significantly enhance the bargaining power of energy suppliers, directly impacting China Glass Holdings' operational costs.

In 2024, global energy markets experienced notable volatility. For instance, natural gas prices in key regions saw a 15% increase in the first half of the year due to geopolitical tensions and supply chain disruptions, directly affecting manufacturing inputs for companies like China Glass Holdings.

This sensitivity to energy market dynamics means that China Glass Holdings must implement robust supply chain management strategies to mitigate the impact of price swings, ensuring consistent and cost-effective access to essential energy resources.

Suppliers of highly specialized glass manufacturing machinery and technology often hold significant bargaining power. This is due to the unique nature of their offerings and the high switching costs associated with changing vendors. For China Glass Holdings, upgrading or expanding production lines can create a dependency on a limited number of key equipment providers, strengthening their negotiating position.

Supplier concentration in specific regions

Supplier concentration in specific regions significantly impacts China Glass Holdings. If crucial raw material or energy sources are geographically limited or controlled by a small number of entities, these suppliers gain considerable leverage. This can translate into less favorable pricing and stricter delivery terms for China Glass Holdings, potentially disrupting production and increasing costs.

- Geographic Concentration: The concentration of silica sand, a primary raw material for glass production, in specific regions of China, such as Hebei and Shandong provinces, can give suppliers in these areas increased bargaining power.

- Limited Supplier Pool: For specialized coatings or advanced manufacturing equipment essential for high-performance glass, a limited number of global or domestic suppliers can dictate terms.

- Impact on Costs: In 2024, fluctuations in energy prices, often tied to regional supply dynamics, directly influenced the operating costs for glass manufacturers like China Glass Holdings.

- Negotiating Leverage: When suppliers are few and geographically consolidated, they can more easily coordinate pricing strategies, reducing China Glass Holdings ability to negotiate competitive rates.

Potential for forward integration

The potential for suppliers to integrate forward into glass manufacturing presents a significant, albeit often understated, threat to China Glass Holdings. If a key supplier were to establish its own glass production facilities, it could directly compete with its current customers, thereby dramatically enhancing its bargaining power. This strategic move would allow the supplier to capture more of the value chain, potentially dictating terms and pricing to companies like China Glass Holdings.

While the capital intensity of glass manufacturing typically makes this a low probability for most suppliers, the prospect remains a critical consideration. For instance, in 2024, the global float glass market, a key segment for China Glass Holdings, saw significant investment in new production lines by established players, signaling a potential shift. This forward integration threat means that China Glass Holdings must maintain strong, mutually beneficial relationships with its suppliers to mitigate this risk.

- Forward Integration Threat: Suppliers may enter glass manufacturing, increasing their leverage.

- Market Dynamics: Increased investment in new glass production lines in 2024 highlights this potential shift.

- Strategic Importance: China Glass Holdings must manage supplier relationships to counter this threat.

The bargaining power of suppliers for China Glass Holdings is influenced by the availability and cost of essential raw materials like silica sand, soda ash, and limestone. With few substitutes available, suppliers of these materials hold considerable leverage. In 2024, global soda ash prices saw a slight uptick in certain markets due to ongoing logistical challenges, impacting production costs for glass manufacturers.

Energy costs, particularly for natural gas, are a significant expense. The volatility in energy markets in 2024, with natural gas prices experiencing a notable increase in the first half of the year due to geopolitical factors, directly empowered energy suppliers. This necessitates robust supply chain management for China Glass Holdings to secure consistent and cost-effective energy resources.

Suppliers of specialized machinery and advanced technology also wield strong bargaining power due to the unique nature of their products and high switching costs. Furthermore, geographic concentration of key raw materials can consolidate supplier power, potentially leading to less favorable terms for China Glass Holdings. The threat of forward integration by suppliers, though less common, remains a strategic consideration, especially with increased investment in new production lines observed in the global float glass market during 2024.

| Factor | Impact on China Glass Holdings | 2024 Data/Trend |

|---|---|---|

| Raw Material Availability | Limited substitutes grant suppliers leverage. | Fluctuating prices for soda ash in some regions. |

| Energy Costs | High dependency on energy suppliers. | 15% increase in natural gas prices in H1 2024 in key regions. |

| Supplier Concentration | Geographic concentration can increase supplier power. | Regional supply dynamics influence energy price volatility. |

| Specialized Equipment | High switching costs empower specialized suppliers. | Continued reliance on a limited pool of advanced machinery providers. |

What is included in the product

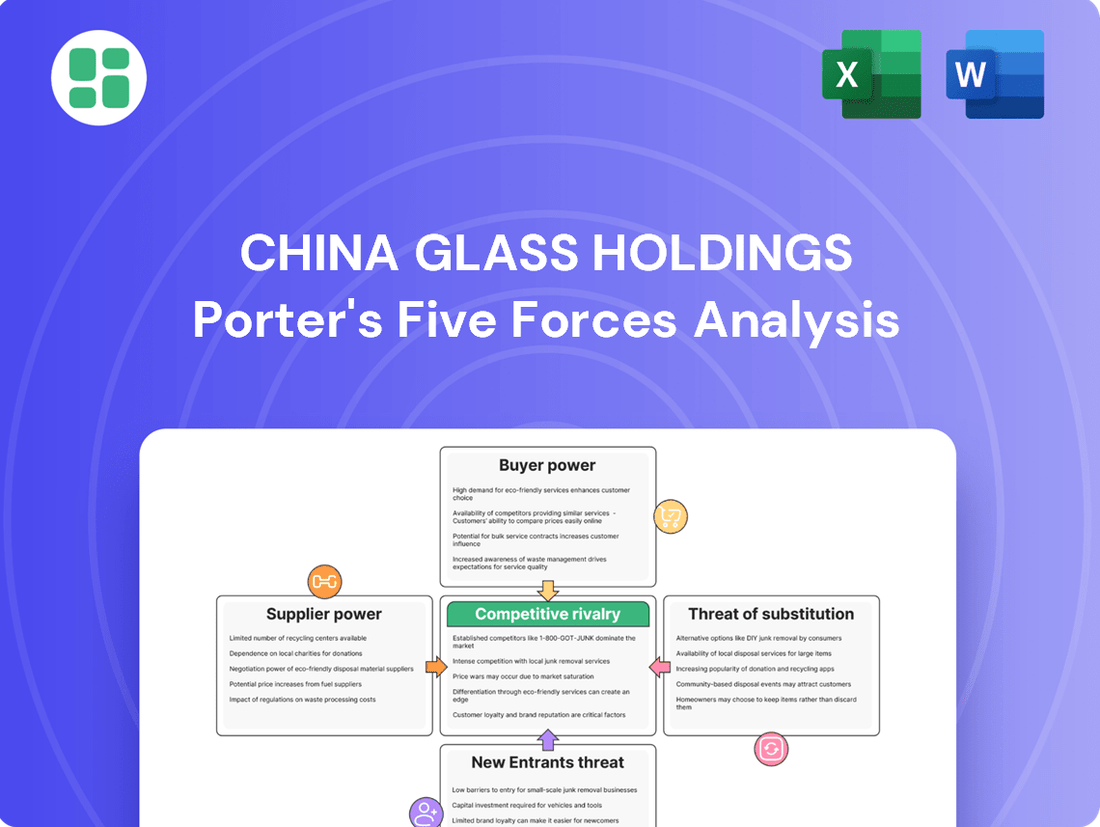

This Porter's Five Forces analysis for China Glass Holdings reveals the intense competitive rivalry within the glass industry, the significant bargaining power of buyers, and the moderate threat of new entrants and substitutes.

Instantly visualize the competitive landscape of China Glass Holdings with a clear, one-sheet summary of all five forces, perfect for quick strategic decision-making.

Customers Bargaining Power

Customers in the construction and automotive industries are significant buyers of glass, often placing orders in substantial quantities. This large-volume purchasing power grants them considerable leverage when negotiating prices and contractual terms with suppliers like China Glass Holdings. For instance, in 2024, major construction projects and automotive manufacturers continued to be the primary drivers of demand for flat glass, with large developers and car brands accounting for a significant portion of the market.

In the commoditized float glass market, customers exhibit significant price sensitivity. For instance, in 2024, the average price of standard float glass in China saw fluctuations driven by supply and demand dynamics, making minor price differences a key factor in purchasing decisions. This high degree of price sensitivity means that China Glass Holdings must vigilantly manage its costs and production to remain competitive, as buyers can readily shift to alternative suppliers offering even slightly lower prices.

The sheer number of glass manufacturers operating in China, both domestically and internationally, significantly bolsters customer bargaining power. In 2024, the Chinese glass industry is characterized by a highly fragmented supplier base, with hundreds of companies competing for market share. This abundance of choices means large buyers, such as automotive manufacturers or construction firms, can easily switch suppliers if they find better pricing or terms.

This competitive landscape forces glass producers, including China Glass Holdings, to offer more attractive pricing and superior service to retain their clientele. For instance, a major construction project requiring vast quantities of specialized glass might receive quotes from over a dozen qualified suppliers. The ability to pit these suppliers against each other directly translates into lower costs for the customer, thereby diminishing the profitability margins for individual glass manufacturers.

Customer's ability to backward integrate

China Glass Holdings faces a moderate threat from customers' ability to backward integrate. Large-scale buyers, such as major automotive manufacturers or construction firms, could theoretically establish their own glass production lines.

While the substantial capital investment and technical expertise required make this a rare occurrence, the *potential* for backward integration remains a leverage point for these powerful customers during price negotiations. For instance, a significant automotive OEM might explore partnerships or even direct investment in glass manufacturing if pricing from suppliers like China Glass becomes uncompetitive.

The sheer scale of investment needed for a new glass manufacturing plant, often running into hundreds of millions of dollars, acts as a significant deterrent. This high barrier to entry limits the practical ability of most customers to truly backward integrate, thus capping the bargaining power derived from this specific threat.

- Threat of Backward Integration: Moderate.

- Deterrents: High capital costs and technical expertise required for glass production.

- Customer Profile: Large construction and automotive companies are the primary potential integrators.

- Impact: Primarily a negotiation leverage rather than a frequent reality.

Demand for customized or energy-saving products

The demand for specialized glass, such as energy-saving or highly customized architectural glass, can significantly shift the bargaining power of customers. When products are commoditized, buyers have more leverage. However, China Glass Holdings' strategic emphasis on these niche markets allows them to differentiate their products and potentially secure more favorable pricing. This focus on specialized offerings can mitigate the intense buyer power often seen in the broader glass market.

For instance, the global market for smart glass, a category encompassing energy-saving and customizable solutions, was projected to reach approximately USD 7.5 billion in 2024, with expectations of continued growth. This indicates a strong customer appetite for advanced glass technologies. China Glass Holdings’ participation in this segment means they are catering to a segment where customers are less price-sensitive and more focused on performance and specific features, thereby reducing their overall bargaining power.

- Demand for energy-saving glass: Growing environmental awareness and stricter building codes globally are driving demand for energy-efficient building materials, including specialized glass.

- Customization in architectural glass: Architects and developers increasingly seek unique aesthetic and functional properties, leading to demand for customized glass solutions.

- China Glass Holdings' market position: The company's investment in R&D for advanced glass products positions it to capitalize on these trends, potentially reducing customer price sensitivity.

- Market data: The global smart glass market is expected to grow significantly, indicating a strong customer willingness to pay for value-added glass products.

Customers in construction and automotive sectors are major buyers, wielding significant power due to large order volumes. In 2024, these industries remained key demand drivers for flat glass, with major players representing a substantial market share. This scale allows them to negotiate favorable prices and terms with suppliers like China Glass Holdings.

The commoditized nature of float glass makes customers highly price-sensitive. In 2024, price fluctuations in the Chinese float glass market meant that even minor price differences influenced purchasing decisions. This sensitivity compels China Glass Holdings to maintain cost efficiency and competitive pricing, as buyers can easily switch to cheaper alternatives.

A fragmented supplier landscape in China, with numerous domestic and international manufacturers, further amplifies customer bargaining power. In 2024, the abundance of choices for large buyers like automotive firms meant they could readily switch suppliers for better deals, forcing producers to offer competitive pricing and service.

The threat of backward integration by large customers, such as automotive OEMs, is moderate. While the substantial capital investment and technical expertise required for glass production act as deterrents, the potential for integration provides leverage in price negotiations. However, the high barrier to entry, estimated at hundreds of millions of dollars for a new plant, limits the practical ability of most customers to pursue this.

| Factor | Description | 2024 Relevance |

|---|---|---|

| Volume Purchasing | Large orders from construction and automotive sectors. | Key driver of customer negotiation power. |

| Price Sensitivity | Customers prioritize lower prices in commoditized markets. | Minor price differences influence purchasing decisions. |

| Supplier Fragmentation | Numerous glass manufacturers in China. | Increases buyer choice and supplier competition. |

| Backward Integration Potential | Customers establishing their own glass production. | Moderate threat, primarily as negotiation leverage due to high costs. |

Preview the Actual Deliverable

China Glass Holdings Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It details China Glass Holdings' competitive landscape through Porter's Five Forces, analyzing the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitute products within the glass manufacturing industry.

Rivalry Among Competitors

China Glass Holdings operates within a fiercely competitive landscape. The sheer volume of domestic and international players in the Chinese glass market means constant pressure on pricing and product differentiation. In 2024, the market's fragmentation necessitates continuous innovation and cost-efficiency efforts to maintain a competitive edge.

Periods of overcapacity in the Chinese glass industry often trigger intense price competition as manufacturers scramble to sell excess stock. This can significantly squeeze profit margins for all players, including China Glass Holdings. For instance, during certain periods in 2023, the average selling price for float glass in China saw declines of up to 15% year-on-year due to these oversupply pressures.

China Glass Holdings encounters significant hurdles in differentiating its core float glass offerings, leading to intense price-based competition. This makes it difficult for the company to stand out in a market where many players offer similar basic products.

Success in the float glass sector often hinges on achieving economies of scale, optimizing distribution networks, and delivering superior customer service rather than unique product features. For instance, in 2024, the average price for standard float glass in China saw fluctuations, underscoring the sensitivity to cost efficiencies and market supply dynamics.

High fixed costs and exit barriers

China Glass Holdings, like many in the industry, faces intense competition partly due to high fixed costs. The significant investment required for glass manufacturing facilities, including furnaces and specialized machinery, creates a substantial barrier to entry and exit. For instance, the capital expenditure for a modern float glass production line can easily run into tens of millions of dollars. This capital intensity means companies are compelled to operate at high capacity utilization to spread these costs, leading to aggressive pricing strategies when demand falters.

These high fixed costs also contribute to considerable exit barriers. Once a company has invested heavily in plant and equipment, it's difficult and costly to divest or repurpose these assets. Consequently, firms are often incentivized to continue production, even at low margins, to cover ongoing operational expenses and avoid significant write-downs. This dynamic intensifies rivalry, as capacity tends to remain in the market, putting constant pressure on profitability for all players, including China Glass Holdings.

- High Capital Investment: Glass manufacturing requires substantial upfront investment in specialized equipment and infrastructure, making it a capital-intensive industry.

- Operational Necessity: Companies must maintain high production levels to amortize these fixed costs, leading to a constant drive for sales volume.

- Exit Barriers: The difficulty and cost associated with exiting the market mean that excess capacity persists, intensifying price competition.

- Profitability Squeeze: The combination of high fixed costs and sustained competitive pressure can significantly impact profit margins for companies like China Glass Holdings.

Acquisitions and consolidation trends

Recent trends show a significant uptick in acquisitions and consolidation within China's glass manufacturing sector. This is creating larger, more dominant players. For instance, by the end of 2023, the top five glass manufacturers in China controlled an estimated 60% of the market share, a notable increase from previous years.

This structural shift means China Glass Holdings is likely to face intensified rivalry. As market power becomes more concentrated among fewer, larger entities, competition for market share, resources, and customer contracts will naturally escalate. These consolidated giants often possess greater economies of scale and enhanced bargaining power.

- Increased Market Share Concentration: Leading glass manufacturers are actively pursuing mergers and acquisitions to expand their operational footprint and product portfolios.

- Emergence of Dominant Competitors: Consolidation is fostering the rise of a few, very large glass producers with substantial market influence.

- Heightened Competitive Pressure: China Glass Holdings must navigate a landscape where rivals have greater resources and potentially more aggressive market strategies due to their consolidated strength.

The competitive rivalry within China's glass industry is intense, driven by a fragmented market and high fixed costs inherent in production. China Glass Holdings must contend with numerous domestic and international players, many of whom are also striving for scale and efficiency. Periods of oversupply, common in 2023 and anticipated in 2024, often lead to aggressive price wars, squeezing profit margins across the board.

Consolidation is a growing trend, with the top five glass manufacturers in China estimated to hold 60% of the market share by the end of 2023. This concentration means China Glass Holdings is increasingly facing larger, more formidable competitors with greater resources and market influence, intensifying the need for strategic differentiation and cost management.

| Metric | 2023 (Est.) | 2024 (Outlook) | Impact on China Glass Holdings |

|---|---|---|---|

| Top 5 Market Share | 60% | Projected to increase | Heightened pressure from larger rivals |

| Average Float Glass Price Volatility | Up to 15% YoY decline in certain periods | Continued sensitivity to supply/demand | Risk of margin erosion |

| Capital Expenditure for New Line | Tens of millions USD | Consistent requirement | High fixed cost burden |

SSubstitutes Threaten

For architectural applications, substitutes like advanced plastics, metals, and composite panels can replace glass, impacting demand. In 2023, the global market for advanced plastics in construction saw significant growth, with some segments experiencing over 8% year-over-year increases, driven by demand for lightweight and durable solutions.

These alternatives offer varied properties such as enhanced insulation or greater impact resistance, presenting a competitive challenge. For instance, certain composite panels can provide superior thermal performance compared to standard glass, potentially reducing energy costs for buildings.

The availability and cost-effectiveness of these substitutes are key factors. While glass remains a primary choice for transparency and aesthetics, rising material costs for certain glass types can make alternatives more appealing to developers seeking to manage project budgets.

The threat of substitutes for China Glass Holdings is evolving with advancements in material science. Research and development are exploring new translucent or transparent materials that could potentially outperform traditional glass in terms of properties or cost-effectiveness. While these alternatives are not yet a significant market force, they represent a potential long-term challenge to glass manufacturers.

For certain decorative and protective uses, materials like acrylics and other polymers present a viable alternative to glass, particularly when impact resistance or reduced weight are key considerations. For example, the global acrylic sheet market was valued at approximately USD 10.5 billion in 2023 and is projected to grow, indicating increasing adoption in applications traditionally held by glass.

China Glass Holdings must actively monitor these specific niche markets where alternative materials are gaining traction. The growing demand for lightweight, shatter-resistant materials in sectors like automotive and construction, where acrylics are increasingly used, could pose a threat if not addressed through product innovation or strategic partnerships.

Cost-effectiveness of alternatives

The cost-effectiveness of alternatives directly impacts China Glass Holdings. If the expense of producing or installing glass products rises substantially, substitute materials like plastics, composites, or even advanced metals could become more appealing to the construction and automotive sectors. Maintaining price competitiveness is therefore essential for China Glass to hold onto its market share.

For instance, in 2024, the global average price of construction materials saw an upward trend, with some key components experiencing increases of 5-10% year-over-year. This volatility makes the price of glass a critical factor when compared to alternatives.

- Price Sensitivity: Industries heavily reliant on glass, such as building and automotive, are sensitive to price fluctuations.

- Material Innovation: Advances in alternative materials may offer comparable performance at a lower or more stable price point.

- Economic Downturns: During economic slowdowns, cost savings become paramount, potentially driving demand towards cheaper substitutes.

Regulatory shifts favoring alternative materials

The threat of substitutes for China Glass Holdings is amplified by potential regulatory shifts favoring alternative building materials. For instance, new environmental regulations or updated building codes could mandate or incentivize the use of materials with a lower carbon footprint or enhanced safety profiles, potentially impacting glass demand.

These regulatory changes might specifically target materials that offer superior energy efficiency or recyclability compared to traditional glass products. For example, by mid-2024, several regions were exploring stricter energy performance standards for new constructions, which could indirectly boost demand for advanced insulation materials that might compete with glass in certain applications.

China Glass Holdings needs to proactively monitor and adapt to these evolving regulatory landscapes. A key consideration is how new standards might impact the cost-competitiveness of glass versus alternatives like advanced composites or specially treated wood products. The company's ability to innovate and offer glass solutions that meet or exceed these new environmental and safety benchmarks will be crucial for mitigating this threat.

- Regulatory Pressure: Evolving building codes and environmental standards could favor materials with better energy efficiency or lower embodied carbon.

- Material Competition: Alternatives like advanced composites or engineered wood might gain traction if regulations favor their performance characteristics.

- Innovation Imperative: China Glass Holdings must invest in R&D to ensure its products meet or exceed new regulatory requirements to remain competitive.

The threat of substitutes for China Glass Holdings is significant, especially in construction and automotive sectors where alternatives like advanced plastics, composites, and metals offer compelling advantages. For instance, the global market for advanced plastics in construction experienced growth exceeding 8% in certain segments during 2023, driven by demand for lighter, more durable materials.

These substitutes, such as composite panels, provide enhanced insulation and impact resistance, potentially reducing energy costs for buildings. The acrylic sheet market alone was valued at approximately USD 10.5 billion in 2023, reflecting increasing adoption in applications traditionally dominated by glass, particularly where shatter resistance is crucial.

Price sensitivity is a major factor; with global construction material prices seeing a 5-10% year-over-year increase in 2024, the cost-effectiveness of glass versus alternatives becomes a key consideration for developers. Furthermore, evolving regulatory landscapes, with potential mandates for materials offering better energy efficiency or lower carbon footprints, could favor substitutes, necessitating continuous innovation from China Glass Holdings.

| Substitute Material | Key Advantages | 2023 Market Context |

|---|---|---|

| Advanced Plastics | Lightweight, durability, insulation | Significant growth in construction segments |

| Composite Panels | Superior thermal performance, impact resistance | Increasing adoption for energy efficiency |

| Acrylic Sheets | Shatter resistance, reduced weight | USD 10.5 billion market value in 2023 |

Entrants Threaten

Establishing a modern glass manufacturing facility, like those operated by China Glass Holdings, demands a substantial capital investment. This includes acquiring land, purchasing highly specialized and expensive machinery, and building the necessary infrastructure. For instance, a new float glass production line can cost upwards of $100 million, making it difficult for smaller players to enter the market.

Existing players like China Glass Holdings enjoy significant cost advantages due to their established economies of scale in manufacturing, raw material sourcing, and logistics. This allows them to achieve lower per-unit production costs, making it difficult for newcomers to compete on price from the outset.

For instance, in 2023, China Glass Holdings reported a production capacity of approximately 10 million tons of float glass. A new entrant would need substantial upfront investment to even approach such volumes, let alone achieve comparable operational efficiencies and cost savings in procurement and distribution networks.

Established distribution channels and customer relationships pose a significant barrier for new entrants in China Glass Holdings' market. Incumbent firms have cultivated robust networks, making it challenging for newcomers to secure access to critical sales and supply chain infrastructure. For instance, by the end of 2024, major players in the Chinese flat glass sector reported an average of over 90% of their sales volume flowing through established, long-term contracts with major construction and automotive manufacturers, underscoring the difficulty new entrants face in replicating these deep-seated ties.

Proprietary technology and expertise

The threat of new entrants in the specialized glass market, particularly for products like energy-saving glass, is significantly mitigated by the proprietary technology and deep expertise required. Companies like China Glass Holdings often rely on intricate manufacturing processes and specialized technical know-how that are not easily replicated.

New players would face substantial hurdles, including the need for heavy investment in research and development or the costly acquisition of existing technology. This barrier makes it challenging for newcomers to compete effectively, especially considering the lead times and capital expenditure involved in developing and scaling such advanced production capabilities.

For instance, the development of advanced low-emissivity coatings for energy-saving glass involves complex chemical compositions and precise application techniques.

- Proprietary Processes: Energy-saving glass manufacturing often utilizes patented or closely guarded production methods.

- High R&D Costs: New entrants must invest millions in research to develop comparable or superior technology.

- Technical Expertise Gap: A significant pool of specialized engineers and technicians is needed, which is not readily available.

- Capital Intensity: Setting up advanced glass production facilities can cost hundreds of millions of dollars.

Government policies and regulations

Government policies and regulations can significantly impact the threat of new entrants in China's glass manufacturing sector. For instance, stringent environmental regulations, particularly concerning emissions and energy efficiency, can raise the capital expenditure required for new facilities, making it harder for smaller players to compete. In 2024, China continued to emphasize green development, with policies aimed at reducing industrial pollution potentially adding substantial compliance costs for new glass manufacturers.

These regulatory hurdles can act as a barrier, favoring established companies that already possess the necessary permits and infrastructure to meet evolving standards.

- Environmental compliance costs: New entrants face significant upfront investment to meet China's increasingly strict environmental protection laws for industrial production.

- Permitting and licensing: Obtaining necessary operational permits and licenses can be a lengthy and complex process, deterring potential new competitors.

- Energy efficiency mandates: Government pushes for energy conservation in manufacturing, including the glass industry, require advanced technologies that new entrants may struggle to afford initially.

- Safety standards: Adherence to rigorous safety regulations in manufacturing plants adds another layer of complexity and cost for newcomers.

The threat of new entrants in China Glass Holdings' market is generally low due to high capital requirements for advanced manufacturing, such as float glass lines costing over $100 million. Established players benefit from economies of scale, with China Glass Holdings operating at approximately 10 million tons of float glass capacity in 2023, creating significant cost advantages. Furthermore, deep-rooted distribution networks and customer relationships, with over 90% of sales in 2024 secured by long-term contracts, present a formidable barrier for newcomers.

| Barrier | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | Setting up a modern glass plant can cost upwards of $100 million. | Very High |

| Economies of Scale | China Glass Holdings' 2023 capacity of 10 million tons allows for lower per-unit costs. | High |

| Distribution & Relationships | Over 90% of 2024 sales are via established contracts. | High |

| Technology & Expertise | Proprietary processes for specialized glass require significant R&D and skilled labor. | High |

| Government Regulations | Strict environmental and safety standards (e.g., 2024 green development policies) increase compliance costs. | Medium |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for China Glass Holdings is built upon a foundation of robust data, including the company's annual reports, industry-specific market research from firms like IBISWorld, and relevant government publications detailing the Chinese manufacturing sector.