Chesnara SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Chesnara Bundle

Chesnara's current market position reveals a compelling blend of established strengths and emerging opportunities, but also highlights areas of potential vulnerability. Understanding these dynamics is crucial for navigating its competitive landscape effectively.

Want the full story behind Chesnara's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Chesnara's strength lies in its highly specialized niche: acquiring and managing closed books of life and savings policies. This focus demands particular expertise in efficient administration and investment management, setting them apart from more diversified insurers.

Their deep capabilities in this specific area allow for concentrated resource allocation and the development of unique skills, creating a distinct competitive advantage. This strategic focus is underscored by a proven track record, including 14 successful acquisitions across three territories since 2004.

Chesnara exhibits exceptional cash generation capabilities, a key strength. In 2024, the company reported commercial cash generation of £60 million, marking a significant 14% increase year-over-year. This robust financial performance directly supports its commitment to shareholder returns.

This consistent cash flow fuels Chesnara's impressive dividend growth history. The company proudly holds a 20-year streak of uninterrupted full-year dividend growth, a remarkable achievement unmatched by any other listed UK or European insurer.

Chesnara's solvency and capital position are exceptionally strong. At the close of 2024, their Solvency Coverage Ratio stood at an impressive 203%, comfortably exceeding their target operating range of 140%-160%. This robust capital buffer grants Chesnara considerable financial maneuverability.

This substantial financial strength allows Chesnara to confidently explore and execute value-enhancing strategic initiatives. Specifically, it positions them well to pursue further mergers and acquisitions (M&A) and other strategic investment opportunities that align with their growth objectives.

Diversified Geographic Presence

Chesnara's diversified geographic presence, spanning the UK, Netherlands, and Sweden, is a significant strength. This multi-market footprint helps to buffer the company against localized economic downturns or regulatory changes, fostering greater stability. For instance, as of the first half of 2024, Chesnara reported that its UK operations contributed a substantial portion of its new business, while its European markets provided complementary revenue streams.

This spread across different economic landscapes reduces dependency on any single region. It allows Chesnara to leverage varying market conditions and growth opportunities. The company's strategic expansion into the Netherlands and Sweden in recent years has demonstrably broadened its customer base and revenue generation capabilities, as evidenced by the consistent growth in its European segments throughout 2023 and into early 2024.

- Geographic Diversification: Operations in the UK, Netherlands, and Sweden.

- Risk Mitigation: Reduced reliance on single economic or regulatory environments.

- Market Stability: A more resilient business model due to multi-market operations.

- Revenue Enhancement: Access to diverse customer bases and growth opportunities across Europe.

Proven M&A Capability and Integration Success

Chesnara demonstrates a robust history of successful mergers and acquisitions, consistently proving its capability to identify and integrate new businesses. This strength is underscored by recent transactions, including the significant Canada Life portfolio transfer finalized in the first quarter of 2025.

Furthermore, the proposed acquisition of HSBC Life UK, announced in July 2025, highlights Chesnara's ongoing strategic expansion and commitment to growth through M&A. These deals are not merely about acquisition but also about effective integration.

Chesnara excels at integrating acquired entities onto its strategic platforms, exemplified by the seamless transition onto the new SS&C platform in the UK. This integration capability is crucial for unlocking operational efficiencies and driving value creation post-acquisition.

The company's proven M&A track record and successful integration strategies are key differentiators, enabling it to expand its market presence and enhance its competitive position.

Chesnara's core strength is its specialized focus on acquiring and managing closed life and savings books, a niche demanding high administrative and investment expertise. This allows for concentrated resource allocation and the cultivation of unique skills, creating a distinct competitive advantage, evidenced by 14 successful acquisitions since 2004 across three territories.

The company demonstrates exceptional cash generation, reporting £60 million in commercial cash generation in 2024, a 14% year-over-year increase. This robust financial performance directly supports its commitment to shareholder returns and a remarkable 20-year streak of uninterrupted full-year dividend growth, a unique achievement among UK and European insurers.

Chesnara maintains a strong solvency and capital position, with a Solvency Coverage Ratio of 203% at the close of 2024, well above its 140%-160% target range. This financial strength provides significant maneuverability for strategic initiatives, including further mergers and acquisitions.

Geographic diversification across the UK, Netherlands, and Sweden provides resilience against localized economic or regulatory shifts, fostering greater business stability. This multi-market footprint reduces dependency on any single region, allowing Chesnara to capitalize on diverse market conditions and growth opportunities.

| Metric | 2023 | 2024 | YoY Change |

|---|---|---|---|

| Commercial Cash Generation (£m) | 52.6 | 60.0 | +14.1% |

| Solvency Coverage Ratio (%) | 195% | 203% | +4.1% |

| Dividend Growth Streak (Years) | 19 | 20 | +1 |

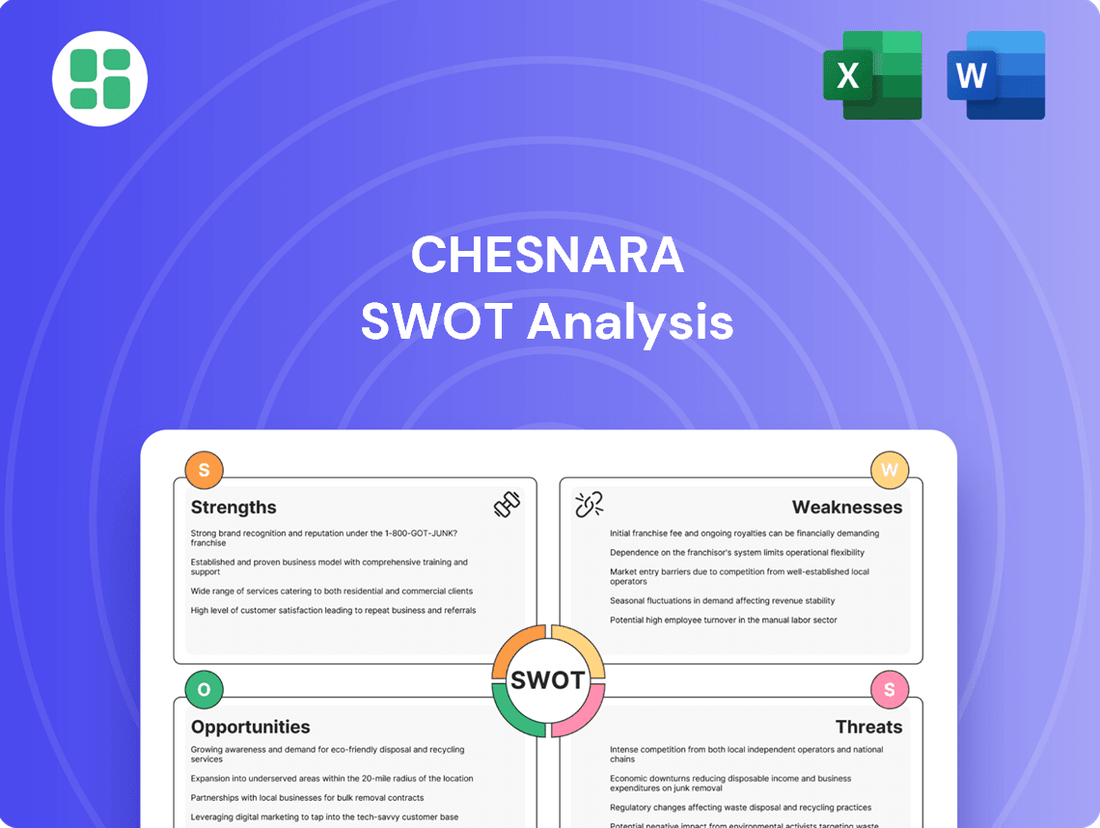

What is included in the product

Delivers a comprehensive assessment of Chesnara's internal strengths and weaknesses alongside external opportunities and threats.

Simplifies complex SWOT analysis into an actionable, easy-to-understand format, reducing the pain of data overload.

Weaknesses

Chesnara's strategy heavily leans on acquiring closed books of business, which, while a proven value driver, creates a significant dependency. This reliance means that if the supply of attractive acquisition targets shrinks or if competition for them escalates, Chesnara's growth trajectory could be significantly hampered. For instance, in 2023, acquisitions contributed a substantial portion of its new business, highlighting this dependence.

Chesnara's ongoing acquisition strategy, while a core growth driver, introduces significant integration risks. Successfully merging acquired portfolios, such as the Canada Life and HSBC Life UK transfers, demands meticulous operational planning to prevent disruptions and achieve anticipated cost synergies.

As a life and pensions consolidator, Chesnara's financial health is closely linked to the ups and downs of the market. Fluctuations in interest rates and investment returns directly affect the value of the assets they manage and the profitability of their core business. For instance, a significant drop in equity markets, as seen in periods of economic uncertainty, can reduce the value of Chesnara's investment portfolio, impacting their solvency and earnings potential.

Regulatory Complexity Across Jurisdictions

Chesnara's operations across the UK, Netherlands, and Sweden mean it must contend with a patchwork of distinct and frequently updated regulations. For instance, adhering to the UK's Consumer Duty alongside the EU's Solvency II framework presents a significant challenge. This multi-jurisdictional regulatory landscape necessitates substantial investment in compliance infrastructure and expertise, potentially impacting operational efficiency and increasing costs.

The evolving nature of these regulations, such as the ongoing implementation and interpretation of Solvency II, adds another layer of complexity. Chesnara must remain agile, dedicating resources to monitor and adapt to changes in capital requirements, consumer protection standards, and reporting obligations across its operating territories. This constant adaptation can strain resources and divert focus from core business growth initiatives.

Key regulatory frameworks impacting Chesnara include:

- Solvency II: A comprehensive EU directive governing capital requirements for insurance and reinsurance companies, with national variations.

- UK Consumer Duty: A recent regulation in the UK focusing on enhanced consumer protection and fair treatment.

- National Insurance Regulations: Specific rules in the Netherlands and Sweden regarding solvency, product oversight, and market conduct.

Potential for Dilution from Equity Raises

Large acquisitions, like the proposed HSBC Life UK deal, often require equity raises to finance them. For instance, Chesnara conducted a £140 million Rights Issue in July 2025 to support such growth initiatives. While crucial for expansion, these equity raises can dilute the ownership stake of existing shareholders, potentially impacting earnings per share in the immediate future.

- Dilution Risk: Equity raises, such as the £140 million Rights Issue in July 2025, can dilute existing shareholders' stakes.

- Impact on EPS: This dilution may lead to a short-term decrease in earnings per share.

- Growth Financing: Such raises are often necessary to fund significant growth opportunities, like the HSBC Life UK acquisition.

Chesnara's reliance on acquiring closed books of business makes it vulnerable to market shifts and increased competition for these assets. This dependence was evident in 2023, where acquisitions formed a significant portion of its new business generation. Furthermore, the integration of these acquired portfolios, such as the Canada Life and HSBC Life UK transfers, presents considerable operational challenges and risks that could impact synergy realization.

Full Version Awaits

Chesnara SWOT Analysis

You’re previewing the actual analysis document. Buy now to access the full, detailed report.

This preview reflects the real document you'll receive—professional, structured, and ready to use.

The content below is pulled directly from the final SWOT analysis. Unlock the full report when you purchase.

Opportunities

The life and pensions sector still presents significant opportunities for consolidation. Larger insurance companies are increasingly looking to simplify their operations or exit less central business areas, which could lead to more closed books becoming available. Chesnara's established track record in mergers and acquisitions positions it advantageously to seize these potential deals.

A favorable interest rate environment, particularly higher or stable rates, presents a significant opportunity for Chesnara. This can boost investment returns on its substantial asset base and improve the profitability of its insurance and annuity portfolios. For instance, if Chesnara holds a large proportion of fixed-income assets, higher prevailing rates translate directly into increased income generation and enhanced economic value for the company.

Chesnara can capitalize on technological advancements to streamline operations and boost efficiency. For instance, their partnership with SS&C in the UK, a leading provider of financial services technology, offers a prime opportunity to leverage cutting-edge platforms for administrative tasks. This can significantly reduce manual effort and associated costs.

By embracing new technologies, Chesnara can achieve substantial operational cost reductions. The company's focus on digital transformation, evidenced by investments in automation and data analytics, is expected to yield tangible benefits. For example, a 10% reduction in administrative expenses through technology adoption could translate to millions in savings annually, directly impacting profitability.

Expansion into Adjacent or New Mature Markets

Chesnara has a significant opportunity to expand into other mature life and pensions markets across Europe, leveraging its established expertise. This strategic move could diversify revenue streams, enhance its overall scale, and potentially uncover new acquisition targets, building on its successful track record. For instance, markets like Germany or the Netherlands, with their substantial aging populations and developed financial sectors, present attractive avenues for growth.

This expansion would not only broaden Chesnara's geographical footprint but also allow it to tap into different customer segments and regulatory environments. The company's recent performance, with Chesnara plc reporting a 9% increase in adjusted operating profit to £127 million for the first half of 2024, demonstrates its financial capability to undertake such strategic initiatives.

- Diversification of Revenue: Entering new mature European markets reduces reliance on existing territories.

- Increased Scale: Expanding market presence enhances operational efficiency and bargaining power.

- Acquisition Opportunities: New markets often present attractive targets for consolidation and growth.

- Leveraging Expertise: Applying proven life and pensions business models to new, receptive markets.

Enhanced Shareholder Value from Large Acquisitions

Chesnara's strategic acquisitions, such as the notable HSBC Life UK deal completed in 2024, are poised to substantially boost its assets under administration and expand its policyholder base. This growth is a key driver for potential inclusion in major stock market indices, including the FTSE 250.

- Increased Scale: The HSBC Life UK acquisition alone added approximately £4.2 billion in assets under administration, significantly enhancing Chesnara's market presence.

- Market Visibility: Inclusion in indices like the FTSE 250 would elevate Chesnara's profile, attracting greater investor attention and potentially improving trading liquidity.

- Shareholder Value: The combination of enhanced scale, market visibility, and operational synergies from such large-scale acquisitions is designed to directly translate into increased shareholder value.

Chesnara is well-positioned to benefit from ongoing consolidation within the life and pensions sector, as larger firms divest non-core assets. A favorable interest rate environment, particularly if rates remain stable or increase, offers a significant boost to investment returns on its asset base. Furthermore, the company can leverage technological advancements, such as its partnership with SS&C, to drive operational efficiencies and cost reductions.

Chesnara's strategic expansion into other mature European markets presents a compelling growth avenue, diversifying revenue and increasing scale. Acquisitions, like the completed HSBC Life UK deal in 2024 which added £4.2 billion in assets, are key to this strategy, enhancing market visibility and potential inclusion in indices like the FTSE 250.

| Opportunity Area | Key Benefit | Supporting Data/Example |

|---|---|---|

| Market Consolidation | Acquisition of closed books and simplifying businesses | HSBC Life UK deal (2024) |

| Favorable Interest Rates | Increased investment returns and portfolio profitability | Company's substantial asset base |

| Technological Advancements | Operational efficiency and cost reduction | SS&C partnership in the UK |

| European Market Expansion | Revenue diversification and increased scale | Potential in Germany, Netherlands |

Threats

The market for acquiring closed life and pensions books is becoming increasingly crowded. Chesnara faces stiff competition not only from other specialist consolidators but also from larger, established insurers looking to expand their portfolios. This heightened competition directly impacts acquisition prices, potentially inflating them and making it harder for Chesnara to secure deals at valuations that support its value creation targets. For instance, reports from industry analysts in late 2024 and early 2025 indicate a noticeable uptick in bidding activity for attractive portfolios, with some deals seeing premiums rise by as much as 5-10% compared to previous years.

Adverse regulatory changes present a significant threat to Chesnara. For instance, the ongoing evolution of Solvency II in the UK and EU, coupled with new consumer protection mandates like the UK's Consumer Duty, could necessitate substantial investments in compliance infrastructure and processes. These shifts might also introduce operational complexities and potentially impact capital requirements, as seen with increased scrutiny on financial services firms' risk management frameworks.

An economic downturn poses a significant threat by potentially reducing consumer spending, which could impact Chesnara's sales and overall revenue. For instance, if inflation remains elevated as seen in late 2023 and early 2024, discretionary spending often decreases, directly affecting the demand for Chesnara's products and services.

Prolonged low interest rates, should they reverse their current upward trend, could also negatively affect Chesnara. Lower rates might reduce the returns on Chesnara's investment portfolio, impacting its profitability and the financial health of its policyholders. For example, if interest rates were to fall back to the historically low levels seen in the early 2020s, the yield on Chesnara's fixed-income assets would likely decline.

Operational Risks and Cyber Security

Chesnara, managing a substantial volume of policies, is susceptible to operational risks. These include the possibility of data breaches, disruptions to critical systems, or errors in how policies are managed. Such incidents can significantly impact customer trust and operational efficiency.

Cyber security threats pose a significant and escalating risk to companies like Chesnara within the financial services industry. A successful cyber attack could result in severe reputational damage and substantial financial penalties, impacting the company's bottom line and market standing.

- Data Breach Impact: In 2024, the average cost of a data breach reached $4.73 million globally, according to IBM's Cost of a Data Breach Report. For Chesnara, a breach could lead to significant financial and reputational harm.

- System Failures: Downtime in policy administration systems can halt critical operations, affecting customer service and potentially incurring regulatory fines for non-compliance.

- Cybersecurity Investment: The global cybersecurity market is projected to reach over $300 billion by 2025, highlighting the increasing investment needed to counter evolving threats. Chesnara must continually invest to stay ahead.

Reputational Damage

Reputational damage poses a significant threat to Chesnara. Negative customer experiences, such as poor outcomes from policies or difficulties with policy administration, can quickly erode public trust. For instance, in the first half of 2024, Chesnara reported a slight increase in customer complaints related to policy servicing, which, if not addressed proactively, could tarnish its image.

Failure to meet stringent regulatory expectations in the financial services sector can also lead to severe reputational harm. In 2024, the Financial Conduct Authority (FCA) continued to emphasize consumer protection, and any perceived lapse by Chesnara could result in public scrutiny and a loss of confidence. This trust is critical for attracting new clients and for the successful integration of future acquisitions, as a damaged reputation can make potential partners or sellers hesitant.

The impact of reputational damage can be substantial:

- Erosion of Customer Trust: A damaged reputation makes it harder to attract and retain customers in a competitive market.

- Reduced New Business Acquisition: Negative publicity can deter potential clients from engaging with Chesnara's products and services.

- Hindered Future Acquisitions: A poor reputation can make it more challenging and costly to acquire other businesses, as potential targets may be wary of association.

- Increased Regulatory Scrutiny: Reputational issues often attract unwanted attention from financial regulators, leading to potential investigations and penalties.

Intensifying competition within the closed life and pensions book acquisition market is a significant threat, potentially driving up acquisition prices and impacting Chesnara's profitability targets. Furthermore, evolving regulatory landscapes, such as changes to Solvency II and new consumer protection rules, necessitate ongoing investment and could introduce operational complexities. An economic downturn, characterized by reduced consumer spending due to persistent inflation, also poses a risk to revenue streams.

| Threat Category | Specific Threat | Potential Impact | Relevant Data/Trend (2024-2025) |

|---|---|---|---|

| Market Competition | Increased acquisition prices | Reduced profitability on new deals | Bidding premiums up 5-10% in late 2024/early 2025 |

| Regulatory Changes | New consumer protection mandates (e.g., UK Consumer Duty) | Increased compliance costs, operational complexity | Heightened scrutiny on financial services risk management |

| Economic Conditions | Sustained high inflation | Reduced consumer spending, lower demand | Discretionary spending cuts impacting product demand |

| Operational Risks | Cybersecurity threats | Reputational damage, financial penalties | Global data breach cost ~$4.73M (2024); Cybersecurity market >$300B by 2025 |

SWOT Analysis Data Sources

This SWOT analysis is built upon a robust foundation of data, encompassing internal financial reports, comprehensive market research, and expert industry analysis to ensure a thorough and accurate assessment of Chesnara's strategic position.