Chesnara Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Chesnara Bundle

Chesnara's competitive landscape is shaped by powerful forces, from the bargaining power of its customers to the ever-present threat of new entrants. Understanding these dynamics is crucial for any strategic decision.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Chesnara’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Chesnara's reliance on specialized IT and administration software, such as SS&C for its UK operations, grants these providers considerable bargaining power. The intricate nature of managing closed books of life and savings policies necessitates highly tailored solutions, making it difficult and costly for Chesnara to switch vendors. This dependence, coupled with the critical role these systems play in operational efficiency, amplifies supplier leverage.

Actuarial and professional consulting services hold significant sway in the life and pensions industry due to their specialized nature. These consultants are indispensable for accurate valuations, thorough risk assessments, and ensuring adherence to complex regulatory frameworks, making their input critical for companies like Chesnara.

Leading firms such as Milliman, Aon Hewitt, and Willis Towers Watson possess deep, niche expertise that is not easily replicated. The essential role these services play in compliance and strategic decision-making, coupled with the high barrier to entry for such specialized knowledge, empowers these consultants with considerable bargaining power over their clients.

Chesnara's reliance on asset managers and custodians for its £14 billion in assets under administration as of December 2024 means these service providers can hold significant bargaining power. Their influence stems from their expertise, track record, and the sheer volume of assets they manage, potentially impacting Chesnara's operational costs and investment performance.

Regulatory Compliance and Legal Expertise

Chesnara's operations span the UK, Netherlands, and Sweden, necessitating a profound understanding of intricate and ever-changing financial regulations. Specialized legal and compliance expertise is crucial, particularly for navigating acquisitions and policy transfers, making these service providers indispensable. Their specialized knowledge represents a critical, non-substitutable input, thus affording them significant bargaining power.

The complexity of cross-border financial regulations means Chesnara relies heavily on external legal and compliance consultants. For instance, the Solvency II directive, implemented across the EU, demands significant compliance efforts. In 2024, the cost of regulatory compliance for financial services firms in the UK alone was estimated to be in the billions, highlighting the substantial investment required and the leverage held by those who can provide this essential service.

- Regulatory Complexity: Chesnara must adhere to diverse financial regulations in the UK, Netherlands, and Sweden.

- Need for Specialized Expertise: Navigating these regulations, especially during M&A activity, requires highly specialized legal and compliance consultants.

- Non-Substitutability: The unique knowledge of these consultants makes their services difficult to replace, strengthening their bargaining position.

- Cost of Non-Compliance: The significant financial penalties and reputational damage associated with regulatory breaches underscore the value of expert guidance.

Data Security and Cybersecurity Vendors

The bargaining power of data security and cybersecurity vendors for Chesnara is significant due to the critical need to protect sensitive policyholder information. The increasing sophistication of cyber threats means Chesnara must rely on specialized vendors for advanced protection and ongoing monitoring.

In 2024, the global cybersecurity market was valued at approximately $270 billion, with projections indicating continued growth. This robust market size underscores the essential nature of these services and the dependence of companies like Chesnara on these specialized providers.

The need for continuous updates, threat intelligence, and specialized expertise grants these vendors considerable leverage. Chesnara’s investment in these solutions is not merely a cost but a fundamental requirement for operational integrity and regulatory compliance.

- Critical Data Protection: Chesnara handles sensitive policyholder data, making robust cybersecurity essential.

- Specialized Expertise: Cybersecurity vendors offer unique, high-demand skills and technologies.

- Evolving Threat Landscape: The constant emergence of new threats necessitates ongoing investment and reliance on expert vendors.

Suppliers of specialized IT and actuarial services hold significant sway over Chesnara. This is due to the niche expertise required for managing closed life and savings books, making vendor switching costly and complex. For example, SS&C's software is vital for UK operations, and firms like Milliman and Aon Hewitt provide indispensable actuarial consulting.

| Supplier Type | Reason for Bargaining Power | Impact on Chesnara |

|---|---|---|

| IT & Software Providers (e.g., SS&C) | High switching costs, specialized nature of software for closed books | Potential for increased costs, operational dependence |

| Actuarial & Consulting Firms (e.g., Milliman, Aon Hewitt) | Niche expertise, critical for valuations, risk assessment, and regulatory compliance | Essential for strategic decisions and compliance, limiting negotiation flexibility |

| Asset Managers & Custodians | Managing significant assets under administration (£14 billion as of Dec 2024) | Influence on operational costs and investment performance |

| Legal & Compliance Consultants | Navigating complex, cross-border regulations (e.g., Solvency II) | High dependence due to penalties for non-compliance; UK compliance costs in billions in 2024 |

| Data Security & Cybersecurity Vendors | Protecting sensitive policyholder data, evolving threat landscape | Essential for operational integrity and regulatory compliance; global market ~$270 billion in 2024 |

What is included in the product

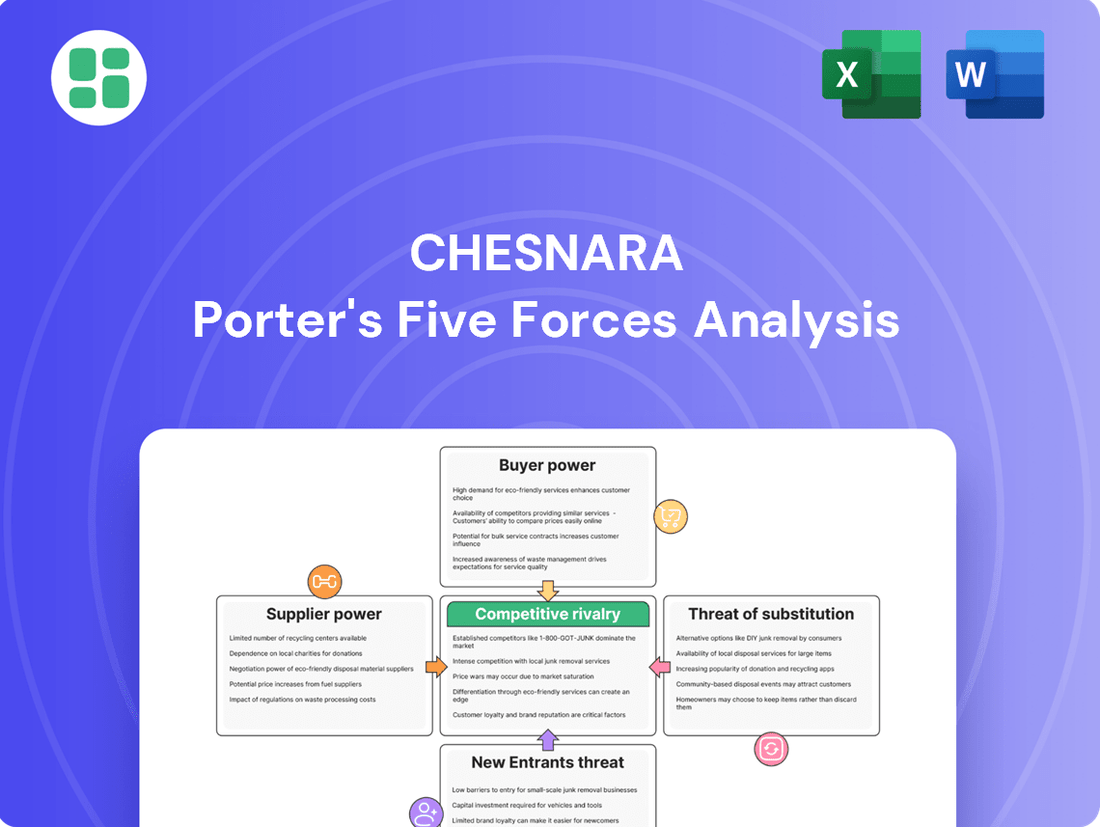

This analysis dissects the competitive landscape for Chesnara by examining the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the impact of substitute products.

Instantly identify and address competitive threats with a visual breakdown of each Porter's Five Forces element.

Customers Bargaining Power

For Chesnara, managing closed books means dealing with policyholders whose contracts are already set. This generally gives individual policyholders very little direct power to negotiate terms or prices. Their influence is mainly channeled through regulatory bodies, which ensure fair practices and good outcomes for customers.

Chesnara's strategy for these closed books centers on efficient administration and providing excellent customer service. For example, in 2024, Chesnara reported managing a significant number of closed book policies, emphasizing their commitment to operational excellence in this segment.

For Chesnara, the primary customers with significant bargaining power are the entities selling closed books of business, such as other insurers or pension schemes. These sellers have the leverage to negotiate deal terms, pricing, and transfer conditions because they can select from various consolidators in the market.

The competitive landscape for acquiring these portfolios is evident in Chesnara's recent activities. For instance, the acquisition of HSBC Life UK for £260 million and a portfolio from Canada Life demonstrates the substantial financial commitments and competitive bidding involved in securing these business books.

Regulatory bodies, such as the Financial Conduct Authority (FCA) in the UK and the European Insurance and Occupational Pensions Authority (EIOPA), wield significant influence, acting as powerful advocates for policyholders. These organizations enforce stringent consumer protection, solvency, and fair value regulations, directly impacting Chesnara's operations and strategic decisions.

The oversight provided by these supervisory bodies translates into substantial bargaining power, as they can impose compliance requirements and penalties, effectively channeling customer interests. For instance, in 2024, the FCA continued its focus on ensuring fair treatment of vulnerable customers, a key area where regulatory intervention directly benefits policyholders by ensuring equitable practices.

Pension Scheme Trustees

Pension scheme trustees wield significant bargaining power in the bulk annuity market. As fiduciaries, their primary responsibility is to secure the best outcomes for scheme members, which translates into demanding competitive pricing, robust security of benefits, and high service standards from potential consolidators. This dynamic is amplified by the increasing number of schemes seeking buy-outs, creating a more competitive landscape for annuity providers.

The bargaining power of these trustees is further underscored by the growing volume of pension liabilities being transferred. For instance, the UK bulk annuity market saw record activity in 2023, with insurers agreeing to take on approximately £50 billion in liabilities, a substantial increase from previous years. This trend suggests a strong seller's market for pension schemes, allowing trustees to negotiate more favorable terms.

Key factors influencing trustee bargaining power include:

- Scheme Size and Maturity: Larger, more mature schemes typically have greater leverage due to the significant value of the transaction.

- Competitive Provider Landscape: The presence of multiple well-capitalized insurers willing to underwrite buy-outs intensifies competition and empowers trustees.

- Regulatory Environment: Evolving regulations and solvency requirements for insurers can influence their capacity and pricing, indirectly affecting trustee negotiation strength.

Market Reputation and Service Quality

While individual policyholders at Chesnara lack direct negotiation power, their collective sentiment and the company's reputation for service quality significantly influence the bargaining power of customers. Chesnara's commitment to good customer outcomes is a strategic imperative, as a strong market reputation deters potential regulatory intervention and enhances its appeal to acquisition targets. A decline in service quality, evidenced by a rise in customer complaints, could lead to reputational damage, impacting Chesnara's growth through acquisitions.

- Reputation as a Shield: A strong market reputation, built on consistent service quality, acts as a buffer against customer power.

- Collective Influence: Individual policyholders may not negotiate, but their aggregated satisfaction or dissatisfaction can sway market perception.

- Acquisition Leverage: Sellers of insurance portfolios prioritize buyers with a proven track record of excellent customer service, impacting Chesnara's M&A strategy.

- Regulatory Scrutiny: Poor customer outcomes and negative publicity can attract unwanted attention from regulatory bodies, increasing operational risk.

For Chesnara, the bargaining power of customers is nuanced. While individual policyholders in closed books have limited direct power, their collective satisfaction, amplified by regulatory oversight, shapes Chesnara's operational focus. The primary customer power lies with sellers of closed books and pension scheme trustees, who leverage market competition and fiduciary duties to negotiate favorable terms.

In 2024, regulatory bodies continued to emphasize consumer protection, indirectly empowering policyholders. For instance, the FCA's ongoing focus on fair treatment of vulnerable customers means Chesnara must maintain high service standards to avoid penalties and maintain its reputation, which is crucial for acquiring new portfolios.

The significant volume of bulk annuity transactions, with the UK market seeing approximately £50 billion in liabilities transferred in 2023, highlights the strong negotiating position of pension scheme trustees. This competitive environment allows them to secure better pricing and terms for their members.

| Customer Type | Bargaining Power Influence | Chesnara Strategy Implication |

|---|---|---|

| Individual Policyholders (Closed Books) | Low direct power; High collective/regulatory influence | Focus on operational efficiency and customer service to maintain reputation and avoid regulatory scrutiny. |

| Sellers of Closed Books | High leverage due to market competition | Competitive pricing and attractive deal terms are crucial for acquisition success. |

| Pension Scheme Trustees | High leverage due to fiduciary duty and market volume | Demonstrate strong financial security, competitive pricing, and high service standards. |

Preview the Actual Deliverable

Chesnara Porter's Five Forces Analysis

This preview showcases the complete Chesnara Porter's Five Forces Analysis, providing a detailed examination of competitive forces within the industry. The document you see here is the exact, professionally formatted report you will receive immediately after purchase, ensuring full transparency and immediate usability. You're looking at the actual document; once you complete your purchase, you’ll get instant access to this exact file, ready for your strategic planning needs.

Rivalry Among Competitors

The life and pensions market, especially for closed books, is dominated by a few large, well-funded companies. Chesnara competes with major players like Phoenix Group and Rothesay, particularly within the UK market, as well as in the Netherlands and Sweden.

This sector is characterized by ongoing consolidation, meaning companies are actively acquiring others. For instance, in 2023, the UK life and pensions sector saw significant M&A activity, with deals valued in the billions, highlighting the intense competition for acquiring these closed books of business.

Competitive rivalry in the insurance sector, particularly concerning closed books of business, significantly impacts acquisition opportunities and pricing for companies like Chesnara. The pursuit of these attractive portfolios often leads to intense bidding wars.

Chesnara's growth strategy is deeply rooted in value-adding acquisitions, evidenced by its fourteen completed deals, including recent significant transactions with Canada Life and HSBC Life UK. This aggressive acquisition approach means Chesnara is actively participating in a competitive market.

The heightened competition for desirable closed books can inflate acquisition prices, thereby squeezing profit margins. For instance, Chesnara's acquisition of HSBC Life UK for £260 million in 2023 demonstrates the substantial capital deployment required in this environment, directly reflecting the pricing pressures driven by rivalry.

While the broader life insurance market might face challenges, the niche of closed book consolidation is seeing consistent activity. This is largely because established insurers are keen to divest older, less profitable liabilities to concentrate on their newer ventures. This dynamic fuels a steady stream of acquisition targets, naturally intensifying competition among the firms specializing in this consolidation.

The European market, in particular, is witnessing a significant trend of consolidation within occupational pension funds. This ongoing restructuring creates a competitive landscape as various consolidators vie for these pension portfolios. For instance, the UK’s pension risk transfer market, a key area for consolidation, saw significant deal volumes in 2023, with estimates suggesting over £40 billion in liabilities transferred, indicating robust, albeit competitive, market conditions.

Product Differentiation and Service Quality

In the closed book life insurance market, differentiation isn't about launching new products, as these policies are already established. Instead, Chesnara and its competitors focus on excelling in efficient administration, robust investment management, and providing outstanding customer service for these legacy policies. This means streamlining operations and ensuring policyholders receive prompt and accurate support.

Chesnara specifically highlights efficient policy administration and achieving positive customer outcomes as core to its strategy. This focus on operational excellence allows them to manage acquired books of business effectively. For instance, in 2024, Chesnara reported a Solvency II coverage ratio of 187%, demonstrating strong capital management which underpins its ability to deliver on service promises.

Competitors in this space, often referred to as consolidators, vie for dominance by showcasing their capability to integrate and manage these acquired portfolios with maximum efficiency and minimal cost. Success hinges on economies of scale and sophisticated back-office systems. The ability to effectively manage legacy assets and liabilities while maintaining high service standards is paramount.

- Efficient Administration: Chesnara's commitment to streamlined processes in managing closed books.

- Investment Management: The crucial role of strong performance in legacy asset portfolios.

- Customer Service: Delivering superior support for existing policyholders is a key differentiator.

- Consolidator Competition: Focus on cost-efficiency and integration capabilities for acquired business.

Regulatory Environment and Capital Requirements

The insurance industry is heavily regulated, with frameworks like Solvency II significantly shaping competition. Companies that can effectively manage capital requirements and maintain strong solvency positions gain a distinct advantage.

Chesnara's robust solvency coverage ratio, reported at 203% as of the end of 2023, exemplifies this. This strong financial footing provides considerable flexibility, particularly for strategic mergers and acquisitions, allowing Chesnara to pursue attractive opportunities more readily than less capitalized competitors.

- Regulatory Compliance: Adherence to strict regulations like Solvency II is paramount, favoring well-capitalized firms.

- Capital Strength: Chesnara's 203% solvency ratio (end of 2023) demonstrates superior capital adequacy.

- M&A Advantage: Strong solvency enables Chesnara to pursue strategic acquisitions, enhancing its market position.

The competitive rivalry in the closed book life and pensions market is intense, driven by a few large, well-funded players like Phoenix Group and Rothesay, alongside Chesnara. This consolidation-focused sector sees companies actively acquiring portfolios, with significant M&A activity in the UK in 2023, involving billions in deals.

The competition for attractive closed books often leads to bidding wars, driving up acquisition prices and potentially squeezing profit margins, as seen with Chesnara's £260 million acquisition of HSBC Life UK in 2023. Success in this arena hinges on efficient administration, strong investment management, and superior customer service for legacy policies.

Chesnara's strategy of value-adding acquisitions, including fourteen completed deals, places it directly in this competitive environment. The ability to manage acquired portfolios efficiently and cost-effectively, supported by strong capital positions like Chesnara's 203% solvency ratio at the end of 2023, is crucial for outperforming rivals.

| Competitor/Metric | Chesnara (2023/2024 Data) | Key Competitors (General Market) |

|---|---|---|

| Market Position | Active consolidator in UK, Netherlands, Sweden | Dominant players like Phoenix Group, Rothesay |

| Acquisition Strategy | Growth through value-adding acquisitions (14 completed) | Focus on acquiring closed books and divesting liabilities |

| Capital Strength (Solvency Ratio) | 203% (end 2023) | Generally strong, but Chesnara's ratio provides an advantage |

| Key Differentiators | Efficient administration, investment management, customer service | Economies of scale, integration capabilities, cost-efficiency |

| M&A Activity Example | HSBC Life UK acquisition (£260m in 2023) | Significant M&A in UK sector (billions in 2023) |

SSubstitutes Threaten

Policyholders might opt to surrender their policies for cash or move them to different providers, especially if Chesnara's closed books offer less flexibility or competitive returns. This gradual outflow of assets impacts the total funds Chesnara manages, even though the company focuses on extracting maximum value from its existing portfolio. For instance, in 2024, the life insurance industry saw continued policy surrenders, particularly for older, less competitive products, as policyholders sought higher yields elsewhere.

While a full pension buy-out with a consolidator is a primary option for de-risking defined-benefit pension schemes, companies also consider alternatives like partial buy-ins or retaining liability management in-house. These strategies allow for a more tailored approach to pension risk, potentially offering cost efficiencies or greater control over asset allocation. The pension risk transfer market saw significant activity in 2023, with over £20 billion in transactions completed in the UK alone, indicating a robust landscape of available solutions.

Consumers increasingly opt for direct investment alternatives, such as low-cost index funds and exchange-traded funds (ETFs), which offer greater control and potentially higher returns compared to traditional life and pension products. In 2024, the global ETF market alone was valued at over $11 trillion, demonstrating a significant shift towards these accessible investment vehicles.

This trend presents a threat to Chesnara by potentially reducing the future supply of closed books. As more individuals channel their savings into direct investments, fewer new traditional life and pension policies are written, which are the primary source of Chesnara's acquired business portfolios.

Government-backed Pension Schemes and Social Security

Government-backed pension schemes and social security programs present a significant threat of substitution for Chesnara's private pension products. In the UK, for instance, the State Pension provides a baseline income for retirees, potentially diminishing the perceived need for supplementary private pensions. Similarly, the Netherlands boasts a robust social security system, and Sweden's national pension system further reinforces this substitute effect.

The expansion and continued support of these state provisions directly reduce individuals' reliance on the private sector for retirement income. This can lead to lower demand for Chesnara's life and pensions offerings, impacting both new business and the long-term viability of existing, potentially closed, books of business. For example, as of 2024, the UK State Pension age continues to rise, encouraging longer working lives but also solidifying the state's role as a primary retirement income provider.

- UK State Pension: Provides a foundational retirement income, reducing reliance on private pensions.

- Dutch Social Security: A comprehensive system that offers a safety net, lessening the need for private retirement savings.

- Swedish National Pension System: Offers significant state-backed retirement benefits, acting as a strong substitute for private pension plans.

Technological Disruption in Financial Planning

Emerging FinTech solutions, offering highly personalized and low-cost financial planning and investment management, pose a significant threat of substitution. These digital platforms can bypass traditional, often complex, life and pension products. For instance, robo-advisors saw substantial growth, with assets under management for robo-advisory services reaching an estimated $2.7 trillion globally by the end of 2023, a figure projected to climb further.

While the impact on Chesnara's existing closed books might be less immediate, the broader market is undeniably being reshaped. This technological shift influences future policy creation and the potential for new, more agile closed books to emerge. The accessibility and user-friendliness of these digital alternatives can attract younger demographics and those seeking simpler financial solutions, potentially diverting future business away from incumbent providers.

- FinTech's Growing Market Share: Robo-advisors and digital wealth management platforms are rapidly gaining traction, potentially capturing a significant portion of the financial planning market.

- Personalization and Cost Efficiency: These substitutes often provide tailored advice and investment strategies at a fraction of the cost of traditional financial advisory services.

- Impact on New Business: The appeal of user-friendly, low-cost digital solutions could reduce the attractiveness of traditional life and pension products for new customers.

- Regulatory Influence: The rise of FinTech may also prompt regulatory changes that further level the playing field or introduce new competitive dynamics.

The threat of substitutes for Chesnara arises from alternative ways customers can achieve similar financial outcomes, such as managing retirement or savings. These substitutes can siphon away funds that might otherwise be invested in traditional life and pension products. For instance, the continued growth of direct investment vehicles like ETFs, which surpassed $11 trillion in market value globally in 2024, highlights a significant shift in consumer preference towards more accessible and potentially higher-yielding options.

Entrants Threaten

Entering the life and pensions consolidation market, especially for acquiring closed books of business, requires a significant amount of capital. This high financial barrier makes it challenging for new companies to enter the industry.

Chesnara's own financial activities highlight this requirement. In 2023, the company completed a £260 million acquisition of HSBC Life UK. Furthermore, Chesnara conducted a £140 million rights issue, demonstrating the substantial financial resources needed to operate and grow within this sector.

The life and pensions sector in the UK, Netherlands, and Sweden operates under a stringent regulatory framework. This includes complex rules around solvency, consumer protection, and data privacy, creating significant hurdles for potential new entrants.

Compliance costs are substantial, often requiring significant upfront investment in systems and expertise. For example, Solvency II regulations, which dictate capital requirements for insurers, demand robust risk management frameworks and extensive reporting, adding to the financial burden of new players.

The approval processes for new entrants are typically lengthy and demanding. Regulators scrutinize business plans, financial projections, and operational capabilities, ensuring that only well-prepared and financially sound entities can enter the market, thereby limiting the threat of new competition.

The need for specialized expertise and infrastructure presents a substantial barrier to new entrants in the closed book management market. Effectively managing these portfolios demands deep actuarial knowledge, intricate legal understanding, and sophisticated IT systems capable of integrating with legacy infrastructure. Chesnara itself emphasizes the critical role of efficient policy administration, a capability that new players would struggle to replicate quickly.

Access to Acquisition Opportunities and Relationships

The threat of new entrants in the insurance consolidator market, particularly for acquiring closed books, is significantly constrained by the necessity of established relationships with major insurers seeking to divest. Existing players have cultivated these vital networks over many years, creating a substantial barrier.

Newcomers would face immense difficulty in accessing attractive deal flow, as sellers naturally gravitate towards proven and reliable buyers with a track record of successful acquisitions. This reliance on pre-existing trust and proven performance makes it challenging for new entities to break into the market.

For instance, in 2024, the market for acquiring closed books of business remained dominated by a few large, established consolidators who benefit from long-standing partnerships. These relationships are crucial for identifying and securing lucrative divestment opportunities, a hurdle that new entrants must overcome.

- Relationship Dependency: Acquiring closed books hinges on deep-seated relationships with large insurers, a significant barrier for new entrants.

- Deal Flow Access: Sellers prefer established, trustworthy consolidators, limiting new players' access to attractive acquisition opportunities.

- Years of Network Building: Existing consolidators have invested years in building these crucial networks, creating a competitive advantage.

- Trust as a Key Factor: The insurance industry's emphasis on trust means new entrants must prove their reliability before securing deals.

Brand Reputation and Trust

In the financial services sector, particularly for companies like Chesnara that manage long-term liabilities, brand reputation and trust are absolutely critical. Policyholders and those selling businesses to Chesnara need to be confident their assets and obligations are being handled with the utmost security and skill. Established firms with a history of reliable performance, such as Chesnara's consistent dividend growth, inherently possess this trust.

For new companies attempting to enter this market, replicating the level of trust and credibility that established players enjoy is a formidable challenge. This deep-seated trust acts as a significant barrier, making it difficult for newcomers to attract customers and business partners away from proven entities.

- Trust is a key differentiator in financial services.

- Chesnara's track record of consistent dividend growth builds customer confidence.

- New entrants face significant hurdles in establishing a comparable reputation.

The threat of new entrants into the life and pensions consolidation market is low, primarily due to substantial capital requirements and rigorous regulatory hurdles. New players must navigate complex compliance, including Solvency II, which demands significant upfront investment in risk management and reporting systems, making entry costly and time-consuming.

Established relationships with sellers are paramount for accessing deal flow, a network that new entrants lack. In 2024, the market for closed books acquisition remained concentrated among established consolidators who leverage long-standing partnerships, a critical advantage for securing lucrative divestment opportunities that newcomers struggle to access.

Brand reputation and trust are also significant barriers. Chesnara's consistent dividend growth, for instance, reinforces its credibility with policyholders and business partners. New entrants face a considerable challenge in replicating this established trust, which is essential for attracting both customers and deal flow in the financial services sector.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | Acquiring closed books demands substantial financial resources. | High barrier to entry, limiting the number of potential new players. |

| Regulatory Compliance | Stringent UK, Netherlands, and Sweden regulations (e.g., Solvency II) require extensive investment in systems and expertise. | Increases upfront costs and time-to-market, favoring established entities. |

| Established Relationships | Access to attractive deal flow depends on long-standing partnerships with insurers. | New entrants struggle to gain access to sellers and secure acquisition opportunities. |

| Brand Reputation & Trust | Credibility and trust are vital in financial services, built over time through reliable performance. | Newcomers must overcome significant hurdles to establish a comparable reputation, hindering customer and partner acquisition. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Chesnara is built upon a foundation of publicly available financial reports, investor presentations, and industry-specific market research. We also incorporate data from regulatory filings and reputable business news outlets to capture a comprehensive view of the competitive landscape.