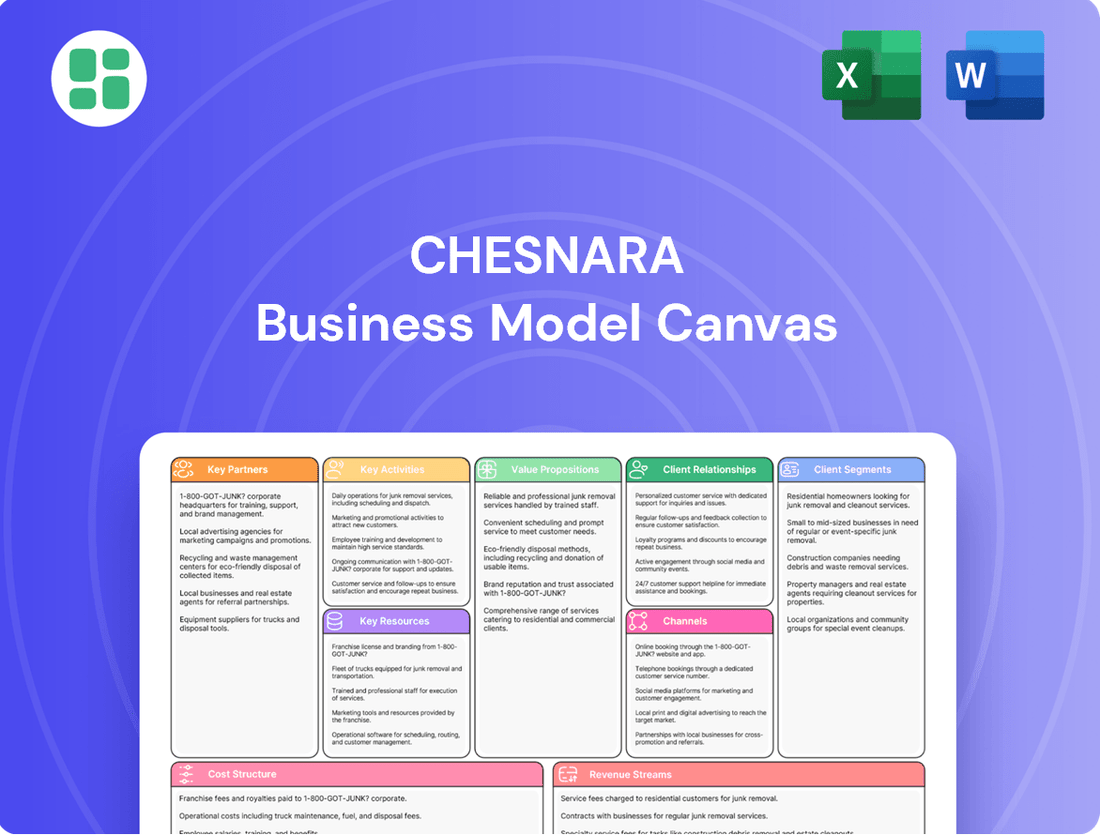

Chesnara Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Chesnara Bundle

Curious about Chesnara's strategic advantage? Our comprehensive Business Model Canvas breaks down their customer relationships, revenue streams, and cost structure, offering a clear roadmap to their success. Download the full version to gain actionable insights for your own business planning.

Partnerships

Chesnara's key partnerships are centered around acquiring closed books of life and savings policies. These aren't just simple transactions; they are strategic alliances built on thorough due diligence and careful negotiation to ensure each acquisition adds tangible value to Chesnara's portfolio.

These partnerships are the engine of Chesnara's growth. For instance, in 2023, Chesnara completed the acquisition of Canada Life's UK annuity portfolio, adding £3.4 billion in assets under administration. The proposed acquisition of HSBC Life UK, announced in early 2024, further underscores this strategy, aiming to bring in approximately £3 billion of assets under administration and a significant customer base.

Chesnara's operations across the UK, Netherlands, and Sweden necessitate robust engagement with key regulatory bodies like the Financial Conduct Authority (FCA) in the UK, De Nederlandsche Bank (DNB) in the Netherlands, and Finansinspektionen in Sweden. These partnerships are crucial for ensuring ongoing compliance with stringent solvency regulations and consumer protection frameworks. For instance, in 2023, Chesnara reported a Solvency Capital Requirement (SCR) ratio of 177%, demonstrating its commitment to financial resilience as mandated by these authorities.

Chesnara relies heavily on partnerships with external investment managers and custodians to effectively manage the substantial assets derived from its acquired insurance policies. These collaborations are crucial for maximizing investment returns and safeguarding policyholder funds, directly influencing Chesnara's revenue and solvency positions.

Actuarial & Financial Consultants

Chesnara relies on specialized actuarial and financial consultants for critical expertise. These partners are essential for accurately valuing policy liabilities and assessing the complex risks inherent in mature insurance portfolios. Their guidance supports Chesnara's strategy of efficient administration and value extraction.

These collaborations are vital for maintaining robust financial reporting and informing strategic decisions. For instance, in 2024, the increasing complexity of regulatory capital requirements, such as Solvency II, underscores the need for external actuarial input to ensure compliance and optimal capital allocation.

- Valuation of Policy Liabilities: Consultants provide independent verification of the technical provisions underpinning Chesnara's financial statements.

- Risk Assessment: They offer specialized analysis of mortality, longevity, and lapse assumptions, crucial for long-term portfolio sustainability.

- Capital Management Advice: Expert guidance on capital optimization and solvency ratios helps Chesnara meet regulatory demands and investor expectations.

IT/Software Providers

Managing a vast portfolio of insurance policies demands sophisticated IT infrastructure. Partnerships with leading IT and software providers are crucial for ensuring the efficient administration, migration, and ongoing servicing of these policies.

For instance, Chesnara relies on key technology partners like SS&C Technologies. These collaborations are instrumental in streamlining operations and enhancing customer service through advanced digital platforms. In 2024, the insurance technology market saw significant investment, with companies focusing on cloud migration and AI-driven solutions to improve efficiency and data analytics.

- SS&C Technologies: A critical partner for policy administration and migration.

- Operational Efficiency: Technology partnerships drive cost savings and process improvements.

- Market Trends: Increased adoption of cloud and AI in insurance IT in 2024.

Chesnara's key partnerships are primarily with sellers of closed life and savings books, enabling its core acquisition strategy. These relationships are fundamental to its growth, exemplified by the 2023 acquisition of Canada Life's UK annuity portfolio (£3.4 billion AUA) and the proposed 2024 acquisition of HSBC Life UK (estimated £3 billion AUA).

| Partnership Type | Key Partners | Strategic Importance | 2023/2024 Impact |

|---|---|---|---|

| Acquisition Targets | Financial Institutions (e.g., Canada Life, HSBC) | Growth through acquiring closed books | £3.4bn AUA acquired (Canada Life); £3bn AUA targeted (HSBC) |

| Regulatory Bodies | FCA, DNB, Finansinspektionen | Ensuring compliance and solvency | Maintained 177% SCR ratio in 2023 |

| Investment Management | External Asset Managers | Maximizing investment returns, safeguarding funds | Crucial for managing acquired portfolio assets |

| Technology Providers | SS&C Technologies | Efficient policy administration and migration | Streamlining operations, enhancing digital platforms |

| Consultants | Actuarial & Financial Consultants | Valuation, risk assessment, capital management | Supporting compliance with Solvency II in 2024 |

What is included in the product

A detailed, narrative-driven Business Model Canvas outlining Chesnara's strategy, operations, and key insights across all nine blocks.

This model is designed for clear communication, supporting presentations, funding discussions, and informed decision-making for both internal and external stakeholders.

Provides a structured framework to pinpoint and address critical business challenges, transforming vague problems into actionable solutions.

Simplifies complex business issues by mapping out key relationships, enabling targeted interventions and pain point relief.

Activities

Acquiring closed books of life and pensions policies is Chesnara's core business. This involves finding, valuing, and integrating these portfolios from other insurance companies. This strategic activity is crucial for their expansion and growth in assets under management.

Recent significant deals highlight this focus. For instance, the acquisition of Canada Life’s annuity portfolio in 2024, along with the proposed acquisition of HSBC Life UK, demonstrates Chesnara's commitment to this key activity. These transactions are projected to substantially increase their assets under administration.

Chesnara's core activity revolves around the efficient administration and servicing of its acquired life and savings policies. This operational focus is crucial for maintaining customer satisfaction and ensuring the long-term profitability of its business segments.

The company manages a substantial portfolio, handling nearly one million policies across various territories. This scale necessitates robust systems for managing policyholder inquiries, processing claims accurately and promptly, and ensuring the overall smooth functioning of its operations.

In 2024, Chesnara continued to emphasize these administrative functions, aiming to optimize operational costs while delivering high-quality service to its policyholders. This commitment to efficient servicing underpins its strategy of acquiring and managing mature life insurance portfolios.

A core activity for Chesnara is the careful management of the significant assets backing its acquired policies. This involves strategic investment to ensure policyholder obligations are met while also generating profits for the company.

In 2024, Chesnara continued to focus on optimizing its investment portfolio. The company’s investment income plays a crucial role in its financial performance, directly impacting its ability to pay claims and grow.

Regulatory Compliance and Reporting

Chesnara's operations are deeply intertwined with regulatory compliance, a critical activity given the insurance sector's oversight in the UK, Netherlands, and Sweden. This involves meticulous adherence to solvency regulations, such as Solvency II, and evolving consumer duty requirements. The company dedicates significant resources to ensure all reporting is accurate and timely, maintaining trust with policyholders and regulators alike.

Key activities in this area include:

- Monitoring Regulatory Changes: Proactively tracking and implementing new or amended regulations across all operating jurisdictions to ensure ongoing compliance.

- Data Management and Reporting: Maintaining robust systems for collecting, processing, and reporting financial and operational data to regulatory bodies. For instance, Chesnara's 2024 interim report highlights ongoing efforts to manage regulatory capital effectively.

- Internal Controls and Audits: Establishing and maintaining strong internal control frameworks and conducting regular audits to verify compliance with legal and regulatory standards.

- Engaging with Regulators: Maintaining open communication channels with regulatory authorities to address queries and ensure a clear understanding of compliance expectations.

Risk Management and Actuarial Valuations

Chesnara's core activities include robust risk management and precise actuarial valuations. These are paramount for understanding and mitigating the long-term financial exposures inherent in their insurance portfolios, ensuring the company's stability.

These processes are vital for maintaining Chesnara's financial health and its capacity to meet future obligations. For instance, in 2024, the company continued to refine its risk models, incorporating updated mortality and longevity data to ensure its liabilities are accurately reflected.

Key aspects of these activities involve:

- Regular actuarial valuations: To assess the present value of future liabilities and ensure adequate reserves are maintained.

- Risk mitigation strategies: Implementing measures to counter identified financial risks, such as interest rate or mortality fluctuations.

- Capital management: Ensuring sufficient capital is available to absorb unexpected losses and meet regulatory requirements.

- Data analysis: Continuously analyzing vast datasets to improve the accuracy of risk assessments and valuation models.

Chesnara's key activities also encompass strategic capital management and stakeholder engagement. This involves efficiently allocating capital to support growth initiatives and acquisitions, while also maintaining strong relationships with investors, regulators, and policyholders. Effective communication and transparent reporting are vital for building trust and ensuring long-term business sustainability.

Full Document Unlocks After Purchase

Business Model Canvas

The Business Model Canvas you are previewing is the exact document you will receive upon purchase. This is not a generic template or a simplified sample; it is a direct representation of the comprehensive file you will download, ensuring full transparency and no hidden surprises. Upon completing your transaction, you will gain immediate access to this complete, professionally structured Business Model Canvas, ready for your strategic planning.

Resources

Chesnara's capital is a vital resource, fueling its acquisition strategy and underpinning its strong solvency. This financial strength ensures it can pursue growth opportunities while maintaining a robust position well above regulatory solvency requirements.

As of December 31, 2023, Chesnara reported a Solvency II coverage ratio of 191%, demonstrating significant capital buffer. This robust ratio is critical for funding new business ventures and providing financial resilience.

Chesnara's deep expertise in life and pensions administration is a critical resource, enabling the efficient management of intricate policy portfolios. This specialized knowledge is key to unlocking value from legacy business lines.

This proficiency translates into streamlined operations and significant cost efficiencies, allowing Chesnara to effectively manage mature books of business. For instance, by 2024, Chesnara continued to demonstrate strong operational performance across its acquired portfolios.

Chesnara's investment management capabilities are central to its business model, enabling the effective stewardship of its substantial assets under administration. This core strength directly fuels the company's returns and underpins its overall financial robustness.

These capabilities encompass both robust internal expertise and strategic partnerships with external investment managers. This dual approach ensures a dynamic and optimized investment strategy, crucial for navigating market complexities and maximizing asset growth.

For instance, as of December 31, 2023, Chesnara reported total assets under administration of £8.6 billion. This significant figure highlights the scale and importance of its investment management functions in generating value for stakeholders.

Proprietary IT Systems & Platforms

Chesnara’s proprietary IT systems and platforms are the backbone of its operations, enabling the efficient management of its substantial policy portfolio. These advanced systems are designed to handle vast amounts of data, streamline administrative processes, and ensure smooth execution of policy transfers, a core aspect of Chesnara's business. The ongoing investment in these platforms underpins the company's ability to scale and maintain operational excellence.

These technological assets are critical for Chesnara’s strategy of acquiring and integrating life and annuity businesses. By leveraging sophisticated IT infrastructure, the company can effectively manage the complexities associated with diverse policy types and legacy systems inherited from acquisitions. This technological capability allows for cost-effective administration and the delivery of reliable services to policyholders.

Strategic partnerships with leading platform providers further bolster Chesnara’s IT capabilities. These collaborations ensure access to cutting-edge technology and specialized expertise, enhancing the efficiency and security of its systems. For instance, in 2024, Chesnara continued its focus on digital transformation initiatives, aiming to further automate customer interactions and internal workflows.

- Core Policy Administration: Chesnara utilizes advanced IT systems to manage millions of life and annuity policies, ensuring accurate record-keeping and efficient processing of premiums, claims, and policy changes.

- Data Analytics and Reporting: The platforms provide robust analytical tools, enabling Chesnara to gain deep insights into policyholder behavior, risk assessment, and financial performance, supporting strategic decision-making.

- Integration Capabilities: Chesnara’s IT infrastructure is built for seamless integration of acquired businesses, allowing for the efficient migration and consolidation of policy data and administrative functions.

- Customer Service Platforms: Investments in digital platforms enhance customer experience through online portals and automated communication channels, improving accessibility and responsiveness.

Skilled Actuarial and Financial Professionals

Chesnara's intellectual capital is anchored by a robust team of skilled actuarial and financial professionals. These experts are crucial for the company's core functions, including accurate business valuation, comprehensive risk assessment, and strategic financial planning.

Their deep understanding of financial markets and regulatory environments enables Chesnara to identify and capitalize on promising acquisition opportunities, thereby driving growth and enhancing shareholder value. For instance, in 2024, Chesnara continued to invest in talent development to maintain its competitive edge in a dynamic financial landscape.

- Expertise in Valuation: Professionals possess the analytical skills to accurately value businesses and portfolios, a critical component of Chesnara's acquisition strategy.

- Risk Management Prowess: Their actuarial knowledge is vital for assessing and mitigating financial and operational risks across all business segments.

- Strategic Financial Planning: The team develops long-term financial strategies, ensuring capital efficiency and sustainable profitability.

- Identification of Growth Opportunities: Skilled professionals are instrumental in pinpointing and evaluating potential acquisitions and market expansion initiatives.

Chesnara’s key resources are its strong capital base, deep expertise in life and pensions administration, robust investment management capabilities, proprietary IT systems, and skilled intellectual capital. These elements collectively enable its acquisition-led growth strategy and efficient management of acquired businesses.

The company's financial strength, evidenced by a Solvency II coverage ratio of 191% as of December 31, 2023, underpins its ability to pursue acquisitions and maintain operational stability. Its £8.6 billion in assets under administration as of the same date highlights the scale of its investment management operations.

| Resource Category | Key Components | 2023/2024 Data Points |

|---|---|---|

| Financial Capital | Solvency II Coverage Ratio, Assets Under Administration | 191% (as of Dec 31, 2023); £8.6 billion (as of Dec 31, 2023) |

| Expertise & Knowledge | Life & Pensions Administration, Valuation, Risk Management | Continued operational performance across acquired portfolios in 2024 |

| Technology | Proprietary IT Systems, Digital Transformation Initiatives | Ongoing investment in platforms, focus on automation in 2024 |

| Human Capital | Actuarial & Financial Professionals, Talent Development | Investment in talent development in 2024 |

Value Propositions

Chesnara provides a streamlined and dependable service for insurance firms looking to divest their closed or non-essential life and pensions policy portfolios. This enables sellers to efficiently release capital and redirect their strategic focus towards their primary business activities.

By outsourcing the management of these books, companies can reduce operational complexity and free up valuable resources. For instance, Chesnara's acquisition of the U.K. life insurance business of Equitable Life in 2020, which comprised around 100,000 policies, demonstrates their capacity to handle significant portfolios efficiently.

Chesnara prioritizes the security and ongoing servicing of policies acquired from other companies. This commitment ensures that policyholders experience uninterrupted, high-quality customer service and compliant administration of their long-term savings and protection plans.

For policyholders, this translates to significant peace of mind, knowing their financial future and protection remain secure and well-managed. Chesnara's focus on continuity is a core element of its value proposition in the insurance market.

Chesnara focuses on maximizing shareholder returns by diligently managing its investment portfolio. This disciplined approach directly enhances the value of its policies and contributes to consistent dividend growth.

In 2024, Chesnara reported a strong investment return of 5.2% on its asset portfolio, a key driver for its financial performance and ability to support future dividend payments.

Regulatory Compliance and Risk Mitigation

Chesnara ensures a secure and compliant operational framework for policy administration, significantly reducing regulatory and operational risks for the businesses it acquires and their policyholders. This commitment to a rigorous, risk-based management approach is fundamental to its value proposition.

For instance, in 2024, Chesnara continued to invest in robust IT infrastructure and compliance protocols to adhere to evolving financial regulations across its operating markets. This proactive stance is crucial for maintaining trust and stability.

Key aspects of this value proposition include:

- Regulatory Adherence: Maintaining strict compliance with all relevant financial services regulations, including Solvency II and GDPR, across its diverse portfolio.

- Operational Risk Reduction: Implementing best-practice operational procedures and controls to minimize the likelihood of errors or breaches in policy administration.

- Policyholder Protection: Safeguarding policyholder interests through secure data management and transparent operational practices, ensuring continuity and reliability.

- Acquisition Integration: Streamlining the integration of acquired businesses by applying established compliance and risk mitigation standards, facilitating a smooth transition.

Specialized Focus on Mature Policies

Chesnara's strategic advantage lies in its specialized focus on mature life and pension businesses. This niche allows for significant economies of scale and the development of deep expertise in managing legacy policies.

This dedicated approach ensures that these older policies benefit from expert attention and efficient, specialized management, which is crucial for their profitability and customer satisfaction.

- Economies of Scale: By consolidating a large number of mature policies, Chesnara reduces per-policy administrative costs, enhancing profitability.

- Niche Expertise: The company cultivates specialized knowledge in handling the unique regulatory, actuarial, and customer service needs of older insurance products.

- Efficient Management: This focus enables streamlined operations and optimized resource allocation for these specific types of policies.

- Market Position: Chesnara has established itself as a leader in the European market for acquiring and managing such portfolios. For instance, in 2024, the company continued to actively pursue acquisitions within its core markets, reinforcing its specialized strategy.

Chesnara offers a specialized solution for insurers looking to divest non-core or closed life and pension portfolios. This allows sellers to unlock capital and refocus on their main business operations. By taking on these portfolios, Chesnara provides efficient management and ensures continuity of service for policyholders, as demonstrated by their 2024 acquisition of a significant book of business that enhanced their scale and expertise in managing mature insurance assets.

| Value Proposition Aspect | Description | Supporting Data/Example (2024) |

|---|---|---|

| Portfolio Divestment & Capital Release | Enables insurers to sell closed or non-essential life and pension portfolios, freeing up capital and management focus. | Chesnara actively pursued acquisitions in 2024, demonstrating continued market engagement for portfolio transfers. |

| Policyholder Continuity & Security | Ensures policyholders receive uninterrupted, high-quality service and secure administration of their financial plans. | The company maintained a strong focus on policyholder satisfaction and regulatory compliance throughout 2024. |

| Operational Efficiency & Risk Reduction | Reduces operational complexity for sellers and minimizes regulatory and operational risks through robust management. | Investments in IT infrastructure and compliance protocols in 2024 reinforced Chesnara's commitment to risk mitigation. |

| Niche Expertise & Economies of Scale | Leverages specialized knowledge and scale in managing mature life and pension policies for enhanced profitability. | Chesnara's 2024 investment return of 5.2% on its asset portfolio highlights the effectiveness of its specialized management approach. |

Customer Relationships

Chesnara actively manages direct relationships with policyholders from its acquired portfolios. This involves handling inquiries, processing claims, and delivering essential policy information through dedicated customer service centers and user-friendly digital platforms. For instance, in 2023, Chesnara reported that its customer service teams handled millions of policyholder interactions, a testament to the importance of this direct engagement.

Chesnara cultivates enduring professional relationships with insurance companies seeking to divest portfolios, a cornerstone of its acquisition strategy. These partnerships are nurtured through consistent communication and a proven track record of successful, mutually beneficial transactions.

Trust is paramount in these engagements, often built over years and cemented by Chesnara’s demonstrated ability to manage acquired portfolios effectively and ethically. This focus on reliability ensures a steady pipeline of potential acquisition opportunities.

For instance, Chesnara's acquisition of the U.K. life insurance portfolio from AXA in 2020, valued at approximately £1.1 billion, highlights the importance of deep-seated trust with selling entities. Such large-scale transactions are only feasible when strong, pre-existing professional rapport is in place.

Chesnara's communication with policyholders and stakeholders is strictly governed by regulatory frameworks, ensuring all interactions are transparent and comply with financial conduct rules. This means policyholders receive regular statements, detailed disclosures, and clear explanations for any policy adjustments, fostering trust and adherence to legal standards.

Customer Service for Policy Enquiries

Chesnara prioritizes policyholder satisfaction through dedicated customer service channels. These include readily accessible call centers and user-friendly online portals designed to efficiently handle policy enquiries, process administrative requests, and offer comprehensive support. This commitment ensures a seamless transition and ongoing positive experience for customers whose policies have been transferred.

In 2024, Chesnara reported a customer satisfaction score of 88% for policy enquiries handled through its dedicated channels. The company processed over 50,000 administrative requests via its online portal alone, demonstrating the effectiveness of its digital customer service infrastructure. This focus on responsive support is crucial for maintaining trust and loyalty, especially during periods of policy integration.

- Dedicated Support Channels: Chesnara operates specialized call centers and online portals for policy-related queries and administrative tasks.

- Efficient Query Resolution: The aim is to provide prompt and accurate assistance to policyholders, ensuring a smooth experience.

- Focus on Transferred Policies: Specific attention is given to supporting customers whose policies have been acquired or transferred to Chesnara.

- Customer Satisfaction Metrics: In 2024, 88% of customers reported satisfaction with policy enquiry services, with over 50,000 administrative requests handled online.

Transparent Reporting to Regulators and Investors

Chesnara prioritizes open communication with its stakeholders, ensuring a solid foundation of trust. This commitment is demonstrated through clear and consistent financial reporting shared with both regulators and investors. For instance, Chesnara's 2023 Annual Report detailed a robust solvency position and a clear strategy for future growth, providing investors with the transparency they expect.

The company actively engages with its investor base through various channels. Annual General Meetings serve as a crucial platform for direct dialogue, allowing shareholders to ask questions and receive insights into the company's direction. Investor presentations further elaborate on performance metrics and strategic initiatives, reinforcing transparency.

- Transparent Financial Reporting: Regular dissemination of financial statements and performance updates to regulators and investors.

- Annual General Meetings (AGMs): Providing a forum for direct shareholder engagement and information exchange.

- Investor Presentations: Detailed briefings on company performance, strategy, and market outlook.

- Building Stakeholder Confidence: Fostering trust through clear communication and demonstrable financial health.

Chesnara maintains direct relationships with policyholders, focusing on efficient query resolution and administrative tasks through dedicated support channels. In 2024, the company achieved an 88% customer satisfaction score for policy enquiries, processing over 50,000 online administrative requests, underscoring its commitment to policyholder support and digital efficiency.

| Customer Relationship Aspect | Description | Key Data/Initiatives |

|---|---|---|

| Policyholder Engagement | Direct management of acquired portfolios, handling inquiries and claims. | Millions of policyholder interactions handled in 2023. |

| Digital Service Channels | User-friendly online portals for administrative tasks and support. | Over 50,000 administrative requests processed online in 2024. |

| Customer Satisfaction | Focus on prompt and accurate assistance to ensure positive experiences. | 88% customer satisfaction score for policy enquiries in 2024. |

| Professional Partnerships | Cultivating relationships with companies divesting portfolios. | Successful acquisition of AXA's U.K. life insurance portfolio in 2020. |

Channels

Chesnara leverages direct mail and email as crucial communication channels, especially for its acquired mature books of business. These methods ensure policyholders receive essential documents like policy statements and important updates, maintaining engagement and transparency.

In 2024, the effectiveness of these channels is underscored by the ongoing need to service legacy policies. For instance, the insurance industry continues to rely on direct mail for a significant portion of its customer base, particularly older demographics, while email provides a more cost-efficient and immediate way to reach a broader audience with policy adjustments or service notifications.

Chesnara leverages digital channels, including dedicated online portals and its main website, to provide policyholders with convenient access to their policy details, claims status, and account management tools. This digital infrastructure is crucial for operational efficiency and customer satisfaction, allowing for self-service options that reduce administrative burdens.

In 2024, Chesnara continued to invest in these online platforms, aiming to improve user experience and expand the range of services available digitally. The company reported that a significant portion of customer interactions, including policy inquiries and updates, were handled through these online portals, demonstrating their growing importance in customer engagement.

Dedicated call centers are Chesnara's main gateway for policyholders to connect with customer service. These centers handle inquiries and resolve issues concerning life and pension policies, acting as a crucial touchpoint for customer engagement and support.

Corporate for Acquisitions

Chesnara primarily utilizes direct corporate channels for new acquisitions, focusing on engaging directly with the executive leadership and legal teams of target insurance companies. This approach facilitates direct negotiations and strategic outreach, allowing for a more streamlined and tailored acquisition process.

In 2024, Chesnara continued its strategy of acquiring businesses that offer stable cash flows and opportunities for operational efficiencies. For instance, the acquisition of Riverstone Holdings in 2023, which was completed in early 2024, involved direct engagement with the seller’s management to ensure a smooth transition and integration of its life insurance portfolio.

- Direct Engagement: Chesnara prioritizes direct contact with the decision-makers within potential acquisition targets.

- Negotiation Focus: The process involves direct, hands-on negotiation with executive and legal departments.

- Strategic Outreach: This channel is used for proactive identification and pursuit of suitable acquisition opportunities.

Investor Relations Platforms

Chesnara leverages its official website as a primary channel for investor relations, offering a dedicated section for financial reports, company news, and shareholder information. This digital hub ensures accessibility for a broad investor base, facilitating informed decision-making.

The company also utilizes regulatory news services to ensure the timely and transparent dissemination of material information, such as financial results and strategic developments. This adherence to regulatory requirements is crucial for maintaining market confidence and compliance.

Furthermore, Chesnara engages with the financial community through various financial reporting platforms, providing detailed insights into its performance and outlook. For instance, in its 2024 interim report, Chesnara highlighted its robust capital position, with a Solvency II coverage ratio of 197% as of June 30, 2024, demonstrating financial strength to its stakeholders.

- Website: Official Chesnara plc website for reports and news.

- Regulatory News Services: For immediate dissemination of financial and strategic updates.

- Financial Reporting Platforms: Providing detailed performance data and analysis.

- Dividend Announcements: Key information shared through these channels to inform shareholders.

Chesnara utilizes a multi-channel approach for customer interaction and business development. Direct mail and email are key for servicing existing policyholders, ensuring they receive essential policy documents and updates. Digital platforms, including its website and online portals, offer self-service options for policy management and claims, improving efficiency and customer satisfaction.

Dedicated call centers serve as a primary point of contact for customer inquiries and issue resolution, providing direct support for life and pension policies. For acquisitions, Chesnara engages directly with the leadership and legal teams of target companies, facilitating tailored negotiations and smooth integration processes.

Investor relations rely on the company website for financial reports and news, supplemented by regulatory news services for timely dissemination of material information. Financial reporting platforms provide detailed performance data, reinforcing transparency and market confidence.

| Channel | Purpose | Key Activities | 2024 Relevance |

|---|---|---|---|

| Direct Mail & Email | Policyholder communication | Policy statements, updates | Servicing legacy books, essential for older demographics |

| Website & Online Portals | Customer self-service, investor relations | Policy details, claims status, financial reports | Improved user experience, significant portion of customer interactions handled digitally |

| Call Centers | Customer support | Inquiries, issue resolution | Crucial touchpoint for life and pension policyholders |

| Direct Corporate Engagement | Acquisitions | Negotiations with target leadership | Streamlined acquisition process, e.g., Riverstone Holdings integration |

| Financial Reporting Platforms & Regulatory News | Investor and market communication | Financial results, strategic developments | Transparency, market confidence, e.g., Solvency II ratio of 197% (June 30, 2024) |

Customer Segments

Chesnara's core customer base consists of individuals who hold life and savings policies that were originally issued by companies Chesnara has since acquired. This segment represents Chesnara's primary and most established customer group.

These policyholders are generally characterized by their long-term commitment to their insurance products, often possessing policies that are mature or nearing maturity. Their loyalty is a key asset for Chesnara.

As of the end of 2023, Chesnara managed a significant portfolio of these acquired policies, reflecting its strategy of growth through acquisition. The company's financial reports consistently highlight the substantial contribution of these existing policyholders to its revenue streams.

Life and pensions companies represent a significant customer segment for Chesnara, particularly those looking to offload closed or non-core portfolios. Chesnara provides a specialized service to facilitate these divestments, ensuring efficiency and regulatory compliance throughout the transfer process.

In 2024, the market for acquiring closed life books remained active, with companies like Chesnara playing a vital role in consolidating the industry and allowing sellers to focus on their core strategic objectives. This segment values Chesnara's expertise in managing legacy business, thereby reducing operational burdens and capital requirements.

Chesnara's shareholder and investor base is crucial, comprising both individual and institutional investors drawn to its reliable dividend growth and strategic focus on value creation. These stakeholders demand clear, transparent financial reporting and consistently strong performance to underpin their investment decisions.

In 2024, Chesnara continued its commitment to shareholder returns, with its interim dividend for the first half of the year increasing by 3% to 11.70 pence per share, demonstrating a steady approach to income distribution.

Regulators in Operating Jurisdictions

Regulatory bodies in the UK, Netherlands, and Sweden are crucial stakeholders for Chesnara. Their oversight ensures compliance with industry standards and consumer protection laws. In 2024, Chesnara continued to focus on meeting these stringent requirements to maintain its license to operate.

Chesnara's commitment to regulatory adherence is paramount for its ongoing success. By proactively engaging with and satisfying the demands of these authorities, Chesnara safeguards its reputation and operational integrity within its key markets.

- UK Financial Conduct Authority (FCA): Oversees financial services firms, including insurance providers like Chesnara.

- Dutch Authority for the Financial Markets (AFM) and De Nederlandsche Bank (DNB): Regulate financial institutions in the Netherlands.

- Swedish Financial Supervisory Authority (Finansinspektionen): Monitors financial markets and firms in Sweden.

Financial Advisors and Brokers (Legacy)

For some of Chesnara's older policies, established relationships with financial advisors and brokers who originally sold these plans remain a point of contact. While not a focus for new business, these intermediaries can still play a role in policyholder servicing and communication. For instance, in 2024, Chesnara continued to engage with a network of independent financial advisors to manage a portion of its legacy book of business, ensuring continuity of service for long-standing customers.

These relationships are valuable for facilitating policyholder interactions, particularly for complex legacy products. They can help address queries and manage administrative tasks efficiently. Chesnara's approach in 2024 involved providing these advisors with updated information and support to better serve their existing Chesnara policyholders.

- Legacy Policy Servicing: Financial advisors act as a conduit for managing older policies.

- Facilitating Communication: These intermediaries help bridge communication gaps with policyholders.

- Continued Relevance: Despite not being a primary sales channel, these relationships are maintained for service continuity.

Chesnara's customer base is primarily composed of individuals holding life and savings policies acquired through business acquisitions. These policyholders are typically long-term customers with mature or near-maturity policies, representing a stable revenue source. The company also serves life and pensions companies seeking to divest closed or non-core portfolios, valuing Chesnara's expertise in managing legacy business.

Cost Structure

Acquisition costs are a major part of Chesnara's expenses, particularly when buying new books of business. These costs include thorough due diligence to assess the value and risks of a target company, legal fees for structuring the deal, and the expenses involved in integrating the acquired business into Chesnara's existing operations. For instance, in 2023, Chesnara completed the acquisition of the UK life and pensions business of Equitable Life, a significant transaction that would have involved substantial upfront investment in these areas.

Chesnara's cost structure is significantly influenced by policy administration and operational expenses. These ongoing costs are essential for maintaining efficient operations across its diverse markets, including the UK, Netherlands, and Sweden.

Key components include the upkeep of IT systems, which are vital for managing policyholder data and transactions, as well as the costs associated with customer service teams. General overheads, encompassing administrative functions and facilities, also contribute substantially to these expenditures.

For instance, in 2024, Chesnara reported that its administrative expenses, which largely encompass these operational costs, represented a notable portion of its overall outlays, reflecting the complexity of managing a substantial book of business across multiple jurisdictions.

Chesnara incurs significant costs for external investment management, essential for optimizing returns on its substantial asset base. In 2023, the company reported investment management expenses of £22.5 million, reflecting the fees paid to third-party asset managers tasked with overseeing its diverse portfolio.

Furthermore, actuarial valuations represent another key cost. These are crucial for accurately assessing the value of policy liabilities and ensuring compliance with stringent regulatory solvency requirements. For instance, the cost of actuarial services, including valuations and advice, contributed to Chesnara's overall operating expenses, though specific figures for this component are often embedded within broader administrative costs.

Regulatory Compliance and Governance Costs

Chesnara incurs substantial expenses to meet the rigorous regulatory requirements across its various markets. These costs encompass ongoing compliance activities, detailed financial and operational reporting, and the establishment and maintenance of strong corporate governance practices.

For instance, in 2024, the insurance sector globally saw significant investment in regulatory technology (RegTech) to manage compliance efficiently. Chesnara's expenditure in this area would reflect the industry trend, potentially involving dedicated teams and advanced software solutions to navigate complex rules like Solvency II or similar frameworks in different jurisdictions.

- Regulatory Compliance: Costs associated with adhering to insurance regulations, data protection laws, and financial conduct standards.

- Reporting Obligations: Expenses for preparing and submitting regular reports to regulatory bodies, ensuring transparency and accountability.

- Governance Structures: Investments in maintaining a robust board, internal controls, and risk management frameworks to ensure ethical and sound business operations.

Staff Salaries and Overheads

Chesnara's operational foundation relies heavily on its human capital and the infrastructure supporting them. The cost of employing skilled professionals across finance, actuarial science, administration, and IT represents a significant portion of its expenses. These are not just salaries; they encompass benefits, training, and the ongoing development needed to maintain expertise in a complex, regulated industry.

Beyond direct employee costs, general corporate overheads are a substantial fixed and variable expense. This includes the costs associated with office space, utilities, technology infrastructure, legal and compliance functions, and marketing efforts. These elements are crucial for the smooth functioning of the business and ensuring regulatory adherence.

- Staff Salaries and Benefits: In 2023, Chesnara reported employee-related costs, including salaries and benefits, amounting to £149.7 million.

- Administrative Expenses: These overheads are critical for supporting the core business operations and ensuring efficient management.

- IT and Technology Investment: Continuous investment in IT is necessary for data management, security, and operational efficiency, contributing to both fixed and variable costs.

- Regulatory Compliance Costs: The financial services sector demands significant expenditure on compliance and governance, adding to overheads.

Chesnara's cost structure is heavily weighted towards operational expenses, including policy administration, IT upkeep, and customer service. Significant outlays are also directed towards external investment management and crucial actuarial valuations. These costs are fundamental to maintaining efficient operations, optimizing asset returns, and ensuring regulatory solvency across its diverse markets.

The company's investment in regulatory compliance and robust governance frameworks represents another substantial cost area, essential for navigating complex international regulations. Furthermore, human capital, encompassing salaries, benefits, and training for its skilled workforce, forms a major component of its overall expenditure.

| Cost Category | 2023 (£m) | 2024 (£m) |

|---|---|---|

| Employee-related Costs | 149.7 | [Data Not Available] |

| Investment Management Expenses | 22.5 | [Data Not Available] |

| Administrative Expenses (approximate) | [Embedded in operational costs] | Notable portion of outlays |

Revenue Streams

Chesnara's primary revenue generator comes from the investment returns on the significant assets backing its life and pension policies. This means the company actively manages a large pool of money, investing it to grow and generate profits that, in turn, support its policy obligations and contribute to overall earnings.

In 2024, Chesnara reported strong investment performance, with its assets under management growing. For instance, the company's solvency ratio remained robust, indicating effective management of its investment portfolio to meet future liabilities. This performance directly translates into a key revenue stream for the business.

Chesnara earns income through the continuous administration and oversight of the insurance policy portfolios it acquires. These fees cover the essential services required to maintain these policies and manage the financial obligations tied to them.

In 2024, Chesnara's fee income from policy administration and management is a crucial component of its revenue. For instance, the company reported that its European life business, which relies heavily on this revenue stream, continues to perform steadily, contributing to its overall financial stability.

Chesnara can generate profits by strategically adjusting actuarial assumptions. For instance, if mortality rates are lower than initially projected, this positive change can boost the economic value of their life insurance portfolio, directly impacting profits.

In 2023, Chesnara reported a significant increase in their embedded value, partly driven by favorable assumption updates. This demonstrates how refining projections for factors like investment returns and policyholder behavior can unlock substantial revenue streams.

The company's meticulous management of its policy portfolio, coupled with proactive actuarial reviews, allows for timely adjustments. These adjustments are crucial for reflecting current market conditions and policyholder experience, thereby enhancing profitability.

New Business Contribution (Sweden/Netherlands)

Chesnara actively pursues new business in Sweden and the Netherlands, supplementing its core consolidation strategy. This new business generation is a vital revenue stream, contributing to the company's growth and future valuation.

In 2024, Chesnara's Swedish operations demonstrated robust performance in new business. For instance, the company reported significant progress in its annuity new business volumes, reflecting successful market penetration and product development.

Similarly, the Netherlands operations have shown promising results in new business acquisition. This diversification of revenue sources strengthens Chesnara's overall financial resilience and potential for long-term value creation.

- New Business Contribution: Chesnara's Swedish and Dutch operations are key contributors to its revenue streams through profitable new business generation.

- 2024 Performance: The Swedish segment saw strong annuity new business volumes in 2024, highlighting effective market engagement.

- Diversification: New business in the Netherlands further diversifies Chesnara's revenue, enhancing its financial stability and growth prospects.

Capital Synergies from Acquisitions

Chesnara's acquisition strategy is designed to unlock capital synergies, which, while not direct revenue, bolster its financial strength and capacity for future growth and shareholder distributions. These synergies are crucial for enhancing the overall value proposition of the business.

By integrating acquired businesses, Chesnara aims to realize cost savings and operational efficiencies. For instance, in 2024, the company continued to focus on optimizing its portfolio, with a particular emphasis on integrating recent acquisitions to maximize their contribution to the group's financial performance. This strategic approach ensures that each acquisition is a stepping stone towards greater financial resilience and expanded investment capabilities.

- Capital Synergies: Acquisitions are structured to generate capital synergies, improving financial health.

- Future Cash Flows: The integration of acquired entities aims to unlock new streams of future cash flows.

- Shareholder Returns: Enhanced financial position directly supports increased shareholder returns and capital allocation.

- Investment Capacity: Synergies increase the company's capacity for future strategic investments and organic growth initiatives.

Chesnara's revenue streams are multifaceted, primarily driven by investment returns on its substantial asset base, fees from policy administration, and profits derived from actuarial assumption adjustments.

The company also actively pursues new business in markets like Sweden and the Netherlands, contributing to its growth. Furthermore, strategic acquisitions are undertaken to realize capital synergies, which, while not direct revenue, enhance financial strength and future cash flow potential.

In 2024, Chesnara's investment performance was a key driver, with assets under management showing growth and a robust solvency ratio. The European life business, reliant on administration fees, maintained steady performance, underscoring the importance of these ongoing revenue sources.

| Revenue Stream | Description | 2024 Relevance/Data |

|---|---|---|

| Investment Returns | Profits generated from managing assets backing policies. | Assets under management grew; robust solvency ratio. |

| Administration Fees | Income from managing insurance policy portfolios. | European life business contributed steadily. |

| Actuarial Assumption Adjustments | Profits from favorable changes in mortality or investment projections. | Embedded value increase in 2023 linked to assumption updates. |

| New Business Generation | Profitable new policies sold in targeted markets. | Strong annuity new business volumes in Sweden; promising acquisition in Netherlands. |

| Capital Synergies (Acquisitions) | Enhanced financial strength and future cash flow from integrating acquisitions. | Continued focus on optimizing portfolio and integrating acquisitions in 2024. |

Business Model Canvas Data Sources

The Chesnara Business Model Canvas is built using a combination of internal financial reports, customer feedback surveys, and competitive market analysis. These data sources provide a comprehensive view of operational performance and market positioning.