Chesnara PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Chesnara Bundle

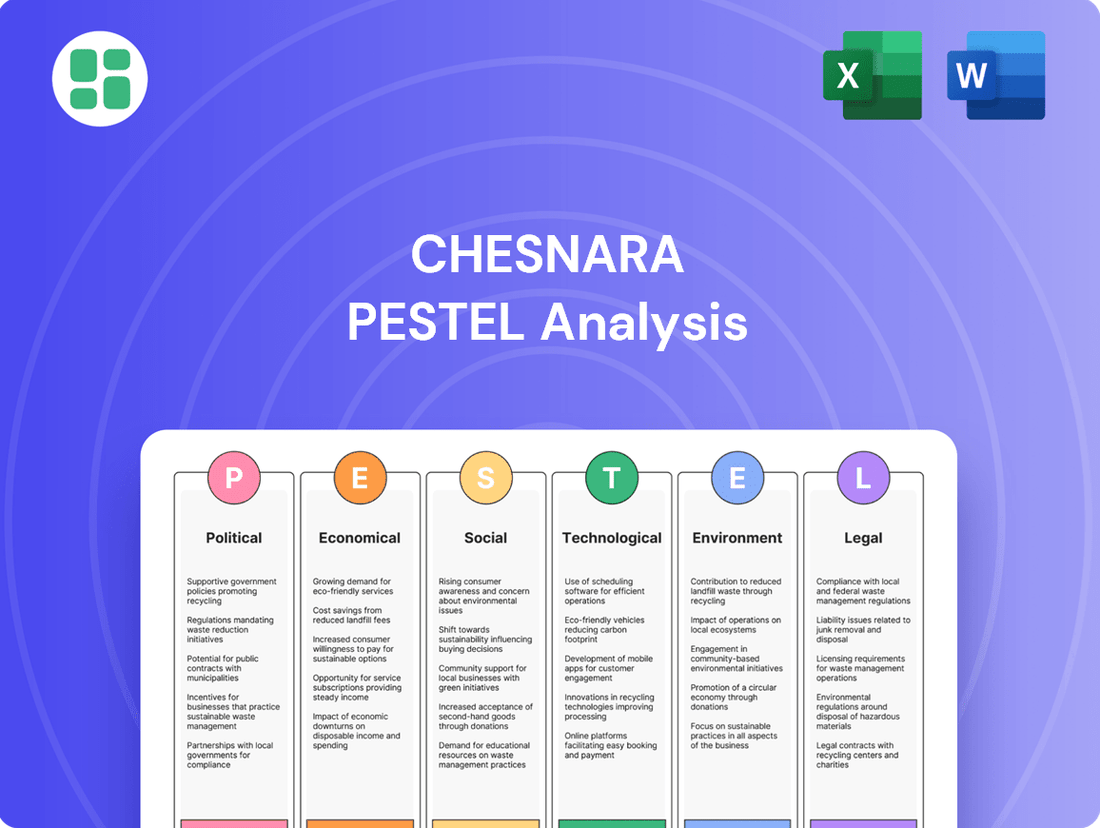

Unlock the critical external factors shaping Chesnara's trajectory with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental forces at play, empowering you to anticipate challenges and capitalize on opportunities. Download the full version now for actionable intelligence to refine your strategy and gain a competitive edge.

Political factors

Chesnara's presence in the UK, Netherlands, and Sweden exposes it to a dynamic regulatory environment where political stability and potential divergence significantly impact operations. For instance, the UK's Financial Services and Markets Act 2023 continues to shape the regulatory landscape post-Brexit, while the Netherlands and Sweden maintain their own distinct prudential and conduct of business rules under their respective financial authorities.

Political shifts can alter the priorities of these oversight bodies, potentially increasing compliance burdens or creating new operational frameworks for companies like Chesnara, which consolidates life and pensions businesses. Navigating these varying national regulatory requirements demands constant vigilance and adaptability to ensure consistent adherence and manage associated costs efficiently.

Government policies on pensions and savings are crucial for Chesnara’s operating environment. For instance, the UK's auto-enrollment pension scheme, introduced in 2012, has significantly boosted private pension savings, with participation rates exceeding 90% by 2023. This trend, while not directly impacting Chesnara's closed books, signals a growing individual savings culture that could influence future market dynamics and potential acquisition targets.

Changes to state pension ages, such as the planned increase to 68 for those born after April 1977, also play a role. This adjustment, expected to be fully implemented by 2046, could subtly alter policyholder behavior regarding private pension contributions and withdrawal strategies, even within closed books, by influencing their overall retirement planning horizon.

Brexit continues to be a political factor for the UK's financial services sector, even for companies like Chesnara that focus on closed books. While Chesnara's Dutch and Swedish operations offer some insulation, potential regulatory divergence or changes in market access following Brexit could indirectly impact its UK assets or future strategic decisions.

Taxation Policy Changes

Changes in corporate tax rates in countries where Chesnara operates, such as potential shifts in the UK's corporation tax from 19% to 25% as implemented in April 2023, can directly affect Chesnara's net profits. Similarly, alterations to insurance premium taxes or tax relief on pension contributions, like the freezing of the tax-free personal allowance for pensions at £1,073,100 until 2028, can influence the demand for life and pensions products. These political decisions on taxation are critical for Chesnara's financial planning, impacting investment strategies and the overall financial health of the consolidator.

Key considerations for Chesnara regarding taxation policy changes include:

- Corporate Tax Rate Impact: Fluctuations in corporate tax rates across operating regions directly influence Chesnara's retained earnings. For instance, a 6% increase in the UK's corporation tax rate from 19% to 25% would reduce the profit available for reinvestment or distribution.

- Insurance Premium Tax (IPT) Adjustments: Any changes to IPT, which varies by country, can affect the pricing and competitiveness of Chesnara's insurance products, potentially altering customer uptake.

- Pension Tax Relief Policies: Government decisions on the tax relief available for pension contributions, such as the lifetime allowance freeze, influence the attractiveness of pension products for individuals and thus impact Chesnara's life and pensions segment.

- Investment Strategy Influence: Taxation policies can also impact the after-tax returns on Chesnara's investment portfolio, necessitating adjustments to asset allocation and investment strategies to maintain optimal financial health.

Political Stability and Geopolitical Risks

The political landscape in the UK, Netherlands, and Sweden, where Chesnara operates, is generally stable. However, any significant shifts or unexpected events could impact investor sentiment and the broader economic outlook, potentially affecting asset valuations. For instance, the UK's political climate has seen shifts in recent years, with general elections scheduled for 2024, which could introduce policy changes impacting financial services.

Broader geopolitical risks, such as ongoing international conflicts or trade disputes, can also create market volatility. While Chesnara's closed book business model offers some insulation from short-term market swings, prolonged geopolitical instability could still influence investment returns and the operational environment. For example, global supply chain disruptions stemming from geopolitical tensions can indirectly affect investment portfolios.

Key considerations include:

- UK Political Stability: Upcoming general elections in 2024 create a period of potential policy uncertainty for the financial sector.

- Netherlands & Sweden Stability: Both nations generally exhibit strong political stability, providing a reliable operating environment.

- Geopolitical Impact: Global events can influence international investment markets, potentially affecting the value of Chesnara's assets.

Political factors significantly shape Chesnara's operating environment across the UK, Netherlands, and Sweden. Government policies on pensions, savings, and taxation directly influence the financial services sector. For example, the UK's auto-enrollment pension scheme, with over 90% participation by 2023, highlights a growing savings culture, while changes to state pension ages, like the planned increase to 68, subtly impact retirement planning horizons.

Taxation policies, such as the UK's corporation tax increase to 25% in April 2023 and the freeze of the pension lifetime allowance until 2028, directly affect Chesnara's profitability and product attractiveness. Political stability in these regions is generally high, though upcoming UK elections in 2024 introduce a degree of policy uncertainty. Geopolitical events can also introduce market volatility, impacting investment portfolios.

| Country | Key Political Factor | Impact on Chesnara | Relevant Data/Policy |

|---|---|---|---|

| UK | Pension Policy | Influences savings culture and retirement planning. | Auto-enrollment participation >90% (2023); State pension age to 68 by 2046. |

| UK | Taxation | Affects corporate profits and product competitiveness. | Corporation tax increased to 25% (April 2023); Pension lifetime allowance frozen at £1,073,100 until 2028. |

| UK | Political Stability | Potential policy shifts impacting financial services. | General election scheduled for 2024. |

| Netherlands & Sweden | Regulatory Environment | Distinct national rules require ongoing compliance. | Adherence to national financial authority regulations. |

| Global | Geopolitics | Market volatility and indirect impact on investments. | Global supply chain disruptions and international conflicts. |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Chesnara, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors for actionable strategic discussions.

Economic factors

Chesnara, as a life and pensions consolidator, faces a dynamic interest rate environment. For instance, the Bank of England base rate, which influences lending and investment returns, stood at 5.25% as of early 2024, a significant increase from the near-zero levels seen for many years prior. This shift impacts Chesnara's profitability by affecting the valuation of its long-term liabilities and the income generated from its investment portfolios.

A prolonged period of low interest rates, characteristic of the decade leading up to recent hikes, presented challenges for Chesnara in generating sufficient returns to meet the guaranteed benefits on older policies. Conversely, the current rising rate environment, while potentially boosting investment income, also increases the cost of capital for Chesnara, requiring careful management of its balance sheet.

Inflation rates significantly influence Chesnara's financial landscape. For instance, the UK's Consumer Price Index (CPI) remained elevated, reaching 4.0% in January 2024, a figure that, while down from its 2023 peaks, still represents a substantial increase impacting purchasing power and operational expenses.

Central banks' monetary policy, a direct response to inflation, dictates interest rates. The Bank of England's base rate, held at 5.25% as of early 2024, affects borrowing costs and investment returns, making liability management crucial for companies like Chesnara, especially concerning their long-term insurance obligations.

Managing liabilities in such an environment demands robust investment strategies. Chesnara must navigate potential erosion of fixed-income asset values due to inflation and implement hedging techniques to mitigate risks associated with fluctuating market conditions and interest rate changes.

Global equity markets have shown resilience, with the MSCI World Index up approximately 10% year-to-date as of mid-2024, though volatility remains a concern. Bond yields have fluctuated, with benchmark 10-year government bond yields in major economies like the US and Germany hovering around 4-4.5%, impacting Chesnara's fixed income portfolio returns.

Real estate markets present a mixed picture; while some sectors show stable or modest growth, others face headwinds from higher interest rates and evolving demand patterns, potentially affecting the valuation of Chesnara's property holdings.

The performance of these diverse asset classes directly influences Chesnara's ability to meet its policyholder obligations, underscoring the importance of its asset-liability management strategies to navigate market fluctuations and maintain solvency.

Currency Exchange Rate Fluctuations

Chesnara's operations across the UK (GBP), Netherlands (EUR), and Sweden (SEK) expose it to currency exchange rate fluctuations. Significant shifts in these rates can directly affect the consolidated financial results, impacting reported earnings and the valuation of assets and liabilities denominated in different currencies.

For instance, a strengthening GBP against the EUR or SEK would make Chesnara's European earnings appear lower when translated back into its primary reporting currency. Conversely, a weaker GBP would boost the reported value of its European holdings. This volatility necessitates careful financial management.

As of mid-2024, the GBP/EUR exchange rate has seen volatility, with the pound experiencing periods of both strength and weakness against the Euro. Similarly, the GBP/SEK rate has also shown fluctuations, influenced by broader economic trends in the UK and Sweden. These movements directly translate into potential gains or losses for Chesnara's consolidated financial statements.

- Impact on Earnings: Fluctuations can cause reported profits to rise or fall simply due to currency translation, not operational performance.

- Asset Valuation: The book value of assets held in EUR and SEK is directly affected by the prevailing exchange rates.

- Hedging Strategies: Chesnara likely employs hedging instruments, such as forward contracts or currency options, to lock in exchange rates and mitigate foreign exchange risk.

- Economic Sensitivity: Exchange rates are sensitive to interest rate differentials, inflation, and geopolitical events, all of which Chesnara must monitor.

Economic Growth and Consumer Spending

While Chesnara's core business of managing closed books of business isn't directly driven by new policy sales, a robust economy generally fosters stability in financial markets. This economic health can indirectly benefit Chesnara by bolstering the financial stability of other entities within the financial services sector, potentially creating future acquisition avenues or influencing the overall regulatory landscape. For instance, the UK's GDP grew by an estimated 0.5% in the first quarter of 2024, indicating a degree of economic resilience that supports a stable operating environment.

Consumer spending, a key indicator of economic vitality, also plays an indirect role. While Chesnara doesn't rely on immediate consumer purchasing decisions for its existing books, sustained consumer confidence and spending power contribute to the overall financial health of the market. This can translate into a more stable environment for financial institutions, which may in turn affect Chesnara's long-term strategic opportunities. In the UK, retail sales volumes saw a modest increase of 0.5% in April 2024 compared to the previous month, suggesting a gradual improvement in consumer activity.

- Economic Growth: A growing economy generally leads to more stable financial markets, which is beneficial for companies managing legacy assets.

- Consumer Confidence: Higher consumer confidence supports overall market stability, indirectly benefiting Chesnara by ensuring the financial health of its partners and potential acquisition targets.

- Financial Market Stability: The UK's estimated 0.5% GDP growth in Q1 2024 and a 0.5% rise in retail sales in April 2024 point to an improving economic backdrop.

- Indirect Impact: Chesnara's business is shielded from direct consumer spending fluctuations but benefits from the broader economic stability that supports financial institutions.

Economic factors significantly shape Chesnara's operational environment and financial performance. Interest rate movements, for example, directly impact Chesnara's investment income and the valuation of its liabilities. Inflation affects purchasing power and operational costs, while currency exchange rates influence its consolidated financial results due to its international presence.

The Bank of England base rate was 5.25% in early 2024, a notable increase from previous years. UK CPI inflation stood at 4.0% in January 2024, still elevated despite a decrease from its 2023 peaks. Global equity markets, like the MSCI World Index, showed gains of around 10% year-to-date by mid-2024, though bond yields in major economies hovered around 4-4.5%.

| Economic Factor | Metric | Value (as of early/mid-2024) | Impact on Chesnara |

| Interest Rates | Bank of England Base Rate | 5.25% | Affects investment returns and liability valuations. |

| Inflation | UK CPI | 4.0% (Jan 2024) | Influences operational costs and purchasing power. |

| Global Equities | MSCI World Index (YTD) | ~+10% | Contributes to investment portfolio performance. |

| Bond Yields | 10-year Govt Bonds (US/Germany) | ~4-4.5% | Impacts fixed income portfolio returns. |

| GDP Growth | UK GDP (Q1 2024 est.) | ~0.5% | Supports overall market stability. |

Same Document Delivered

Chesnara PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Chesnara PESTLE analysis breaks down the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Explore key insights and strategic considerations presented in this detailed report.

Sociological factors

Chesnara faces significant demographic shifts, particularly in its key markets of the UK, Netherlands, and Sweden. These nations are experiencing a marked aging of their populations, a trend expected to continue through 2025 and beyond. For instance, the UK’s Office for National Statistics projected that the proportion of people aged 65 and over in the UK could reach 25% by 2040, a significant increase from current levels.

This aging trend is directly linked to increasing life expectancy. As individuals live longer, Chesnara's obligations for pension payouts and life insurance claims naturally extend in duration. This requires careful actuarial modeling and financial provisioning to ensure the company can meet its long-term commitments. In 2023, life expectancy at birth in the UK was around 79 years for men and 83 years for women, figures that have seen a steady upward trend over decades.

The financial implications are substantial. Longer lifespans mean that pension funds need to be sustainable for a greater number of years, and life insurance policies may be held for longer periods. Accurately forecasting these longevity trends is critical for Chesnara’s reserving strategy and overall financial health, impacting capital requirements and investment planning.

Public trust in financial institutions, including life and pensions providers like Chesnara, is a cornerstone of industry stability and reputation. Even with closed books, maintaining this trust through transparent administration and dependable service is crucial for policyholder satisfaction and mitigating reputational damage. For instance, a 2024 survey by Edelman found that trust in financial services globally averaged 62%, a figure that can be significantly impacted by even isolated incidents of mismanagement.

Societal expectations regarding retirement are shifting significantly. Many individuals are choosing to work longer, with the average retirement age in the UK gradually increasing, pushing towards 66 and beyond in the coming years. This evolving landscape means policyholders might access their pension funds later, impacting how Chesnara manages its closed books and customer engagement strategies.

The rise of phased retirement and a greater desire for flexible access to pension savings are also key trends. This flexibility can alter the timing and nature of withdrawals, requiring Chesnara to adapt its administrative systems and communication to accommodate these changing policyholder needs and ensure efficient management of its legacy portfolios.

Financial Literacy and Awareness

The general level of financial literacy among the population significantly impacts how individuals understand and manage their life and pension policies. In the UK, for instance, a 2024 report indicated that only 38% of adults feel confident managing their finances, a figure that directly influences policyholder engagement and expectations. This means companies like Chesnara must prioritize clear communication and efficient policy administration to cater to a diverse understanding of financial concepts.

A more financially aware populace tends to have higher expectations for transparency and service. This pressure encourages insurers to adopt more robust customer relationship management systems and clearer policy documentation. For example, the Financial Conduct Authority (FCA) in the UK has been pushing for greater transparency in financial products, a trend likely to intensify as consumer understanding grows.

- Financial Literacy Gap: Data from 2024 suggests a significant portion of the UK population lacks confidence in managing their finances, impacting policy understanding.

- Demand for Transparency: Increased financial awareness drives higher expectations for clear communication and efficient policy administration from companies like Chesnara.

- Industry Education: Proactive educational initiatives by the financial services industry can build trust and improve customer engagement with complex products.

- Regulatory Influence: Regulatory bodies are increasingly focused on enhancing financial literacy and consumer protection, influencing how companies operate.

Societal Expectations for Responsible Business

There's a growing expectation for businesses, including financial services, to act ethically and with social responsibility. This means Chesnara, as a consolidator of older insurance policies, faces pressure to manage these assets responsibly, ensuring fair treatment and good governance for policyholders. This extends to how they handle customer issues and personal data.

For instance, in the UK, the Financial Conduct Authority (FCA) has been increasingly focused on consumer protection and fair treatment of customers. In 2023, the FCA reported receiving over 2.7 million consumer complaints, highlighting the public's sensitivity to how financial firms handle their interactions and data. Chesnara's commitment to these principles directly influences its reputation and regulatory standing.

Key societal expectations impacting Chesnara include:

- Ethical Asset Management: Ensuring that mature policies are managed in a way that benefits policyholders and avoids predatory practices.

- Corporate Social Responsibility (CSR): Demonstrating a commitment to broader societal well-being beyond just profit, potentially through community engagement or environmental initiatives.

- Customer Data Privacy: Adhering to strict data protection regulations like GDPR, with robust measures to safeguard policyholder information.

- Transparency and Fairness: Providing clear communication and fair outcomes in all customer dealings, especially when managing legacy products.

Societal attitudes towards retirement are evolving, with individuals increasingly opting to extend their working lives. This trend, observed across Chesnara's key markets, means policyholders may access pension funds later, influencing how the company manages its closed books and engages with customers. The rise of phased retirement and a desire for flexible pension access further necessitate adaptive administrative systems and communication strategies for Chesnara.

Technological factors

Chesnara's administrative efficiency hinges on digitizing and automating its vast portfolio of closed life and pension policies. This technological shift is not just about modernization; it's a direct driver of cost reduction and enhanced operational capacity.

By adopting advanced platforms for policy administration, claims handling, and customer engagement, Chesnara can unlock substantial operational savings. For instance, industry-wide, companies leveraging AI-powered claims processing have seen reductions in processing times by up to 40% and error rates by 25% in 2024.

Continued investment in these digital tools is paramount for Chesnara to maintain its competitive edge and ensure scalability in managing its legacy business. This commitment to technological advancement is a core component of its long-term strategic planning.

Chesnara's reliance on technology makes it a target for cyber threats, posing a significant risk to its sensitive policyholder data. A data breach could severely damage its reputation and lead to substantial financial penalties. For instance, in 2023, the global average cost of a data breach reached $4.45 million, according to IBM's Cost of a Data Breach Report.

Maintaining robust cybersecurity is crucial for Chesnara to protect personal and financial information, thereby safeguarding policyholder trust. Compliance with data protection laws, such as the General Data Protection Regulation (GDPR), is non-negotiable, with fines potentially reaching 4% of global annual turnover or €20 million, whichever is higher.

To mitigate these risks, Chesnara must prioritize regular security audits and continuous system enhancements. Investing in advanced threat detection and response capabilities, along with ongoing employee training, will be key to staying ahead of evolving cyberattack methods.

Leveraging big data analytics and artificial intelligence allows Chesnara to gain deeper insights into its policyholder base, actuarial trends, and investment portfolio performance. For instance, by analyzing vast datasets, Chesnara could potentially improve its customer segmentation for targeted product development, a strategy that saw the insurance industry's global spending on AI reach an estimated $2.6 billion in 2023.

Advanced analytics can optimize risk assessment, enhance asset-liability matching, and identify opportunities for operational efficiencies within its closed books. In 2024, the adoption of AI in insurance is projected to streamline underwriting processes, with some firms reporting a 10-15% reduction in processing times.

This technological advancement directly supports more informed strategic decisions for Chesnara, enabling proactive adjustments to investment strategies based on predictive modeling. The global market for data analytics in financial services was valued at over $20 billion in 2024, underscoring the significant competitive advantage derived from data-driven insights.

Legacy System Integration and Modernization

Chesnara's acquisition strategy frequently involves integrating diverse legacy IT systems from closed books, presenting a significant technological hurdle. The company's success hinges on its capacity to modernize and unify these disparate platforms. For instance, in 2024, Chesnara continued its focus on streamlining IT infrastructure, aiming to reduce the operational overhead associated with managing multiple legacy systems inherited from past acquisitions.

The modernization of these systems is not merely a cost-saving measure but a strategic imperative. By achieving efficient integration, Chesnara can enhance data accuracy, which is crucial for regulatory compliance and informed decision-making. This also paves the way for a more cohesive administrative framework, ultimately boosting operational efficiency and unlocking long-term shareholder value.

- System Consolidation: Chesnara is actively working to consolidate its IT landscape, moving away from fragmented legacy systems towards more integrated solutions.

- Data Quality Improvement: Modernization efforts directly target enhancing data integrity across all acquired books, supporting better analytics and risk management.

- Operational Efficiency Gains: Successful integration of IT systems is projected to yield operational cost reductions, estimated to be in the range of 5-10% for newly integrated portfolios.

- Digital Transformation: The ongoing technological upgrades are part of Chesnara's broader digital transformation, aiming to create a more agile and responsive business model.

Automation and AI in Customer Service

Automation and AI are significantly reshaping customer service operations, particularly for companies managing closed book policies. Technologies like chatbots and Robotic Process Automation (RPA) are being deployed to handle a substantial volume of routine inquiries and administrative tasks. This not only speeds up responses but also allows human agents to focus on more intricate policyholder needs, ultimately boosting efficiency and satisfaction.

The impact of these advancements is quantifiable. For instance, studies in 2024 indicate that AI-powered customer service solutions can reduce operational costs by up to 30% while simultaneously improving first-contact resolution rates by as much as 25%. This efficiency gain is critical for businesses like Chesnara, which manage a large portfolio of legacy policies where streamlined processing is key.

- Chatbots handle up to 80% of routine customer queries, freeing up human agents.

- RPA can automate data entry and policy updates, reducing errors by over 50%.

- AI-driven analytics in 2025 are improving personalized customer interactions based on historical data.

- Companies investing in AI for customer service saw an average increase of 15% in customer retention in late 2024.

Technological advancements are central to Chesnara's strategy for managing its extensive portfolio of closed life and pension policies. By embracing digital transformation, the company aims to enhance administrative efficiency, reduce costs, and improve customer engagement.

The adoption of AI and automation is key to streamlining operations. For example, AI-powered claims processing can reduce processing times by up to 40%, as observed in the industry in 2024. Furthermore, investments in advanced analytics, with the financial services sector's data analytics market valued at over $20 billion in 2024, enable deeper insights into policyholder behavior and market trends.

Chesnara must also address the significant cybersecurity risks associated with its digital infrastructure. The global average cost of a data breach reached $4.45 million in 2023, highlighting the financial and reputational damage a breach could inflict. Robust security measures, including regular audits and employee training, are therefore critical.

Integrating disparate legacy IT systems from acquired businesses remains a challenge, but successful consolidation efforts in 2024 are projected to yield operational cost reductions of 5-10% for newly integrated portfolios, improving data accuracy and decision-making.

| Technology Area | Impact on Chesnara | Supporting Data/Trends (2023-2025) |

| Digitization & Automation | Cost reduction, operational efficiency, improved claims handling | AI claims processing: up to 40% faster, 25% fewer errors (2024 industry data) |

| Big Data & AI Analytics | Enhanced customer insights, risk assessment, investment optimization | Financial services data analytics market: >$20 billion (2024); AI in insurance spending: $2.6 billion (2023) |

| Cybersecurity | Risk mitigation, data protection, reputation management | Average data breach cost: $4.45 million (2023); GDPR fines up to 4% of global turnover |

| System Integration | Operational efficiency, data integrity, cost savings | Projected 5-10% cost reduction for integrated portfolios; focus on IT consolidation (2024) |

| Customer Service Tech (AI/RPA) | Faster query resolution, cost reduction, improved customer retention | AI customer service: up to 30% cost reduction, 25% higher first-contact resolution; 15% customer retention increase (late 2024) |

Legal factors

Chesnara navigates a complex web of financial services regulations across its key operating markets: the UK, the Netherlands, and Sweden. In the UK, this means strict adherence to frameworks set by the Financial Conduct Authority (FCA) and the Prudential Regulation Authority (PRA). Similarly, in the Netherlands, the De Nederlandsche Bank (DNB) and the Authority for the Financial Markets (AFM) are key regulatory bodies. Sweden's financial landscape is overseen by Finansinspektionen.

Compliance with solvency requirements, such as Solvency II, is critical for Chesnara's stability and operational license. The company must also maintain rigorous standards for conduct and capital adequacy. For instance, as of Q1 2024, the UK’s Solvency II ratio for the insurance sector averaged around 180%, highlighting the substantial capital buffers required.

Any shifts in these national regulatory environments can trigger significant operational and capital adjustments for Chesnara. For example, a tightening of capital requirements in the Netherlands could necessitate the reallocation of assets or the raising of additional capital, directly impacting the company's financial strategy and performance.

The General Data Protection Regulation (GDPR) and similar national laws mandate rigorous standards for Chesnara's handling of policyholder data. This includes strict rules on collection, storage, processing, and protection, with non-compliance potentially resulting in significant financial penalties and reputational harm. For instance, in 2023, fines under GDPR continued to be substantial, with some companies facing multi-million Euro penalties for data breaches or improper data handling.

Consumer protection laws, like the UK's Financial Conduct Authority (FCA) Consumer Duty, are increasingly shaping financial services. This means Chesnara must prioritize fair treatment, transparency, and accessibility in all its dealings, especially with closed book policies. The FCA reported in early 2024 that firms are investing significantly to meet these new consumer-centric requirements.

Anti-Money Laundering (AML) and Sanctions Compliance

Chesnara, as a financial services provider, must strictly adhere to Anti-Money Laundering (AML) and counter-terrorist financing (CTF) laws. This includes thorough customer due diligence, reporting suspicious transactions, and complying with global sanctions lists. Failure to do so can result in significant fines and reputational damage.

In 2024, global AML enforcement actions continued to rise, with regulators imposing substantial penalties on financial institutions. For instance, the Financial Action Task Force (FATF) continues to update its recommendations, impacting how companies like Chesnara manage compliance. These regulations are designed to prevent illicit funds from entering the financial system.

- Regulatory Scrutiny: Chesnara faces ongoing scrutiny from regulatory bodies like the Financial Conduct Authority (FCA) in the UK, which enforces AML/CTF regulations.

- Due Diligence Requirements: Implementing robust Know Your Customer (KYC) and Customer Due Diligence (CDD) processes is paramount to identify and verify policyholders.

- Sanctions Compliance: Chesnara must ensure its operations and customer base do not violate international sanctions imposed by entities such as the United Nations and OFAC.

- Reporting Obligations: The company is legally bound to report any suspected money laundering or terrorist financing activities to the relevant authorities promptly.

Contract Law and Policy Terms

Chesnara's core operations are built upon the legal interpretation and enforcement of life and pension policy contracts. The company must meticulously understand the specific terms and conditions of all acquired policies to ensure administrative actions remain compliant, directly impacting its financial stability and customer trust. For instance, in 2023, the UK's Financial Conduct Authority (FCA) continued its focus on ensuring fair treatment of vulnerable customers, a key aspect of policy contract adherence.

Legal disputes or challenges concerning policy terms can lead to substantial financial penalties and damage Chesnara's reputation. This necessitates robust legal counsel and proactive risk management to navigate complex contractual obligations. The increasing volume of regulatory scrutiny, such as the ongoing implementation of Solvency II requirements for insurance companies, underscores the critical need for legal precision in policy management.

- Contractual Adherence: Chesnara's revenue and profitability are directly tied to the accurate administration and upholding of existing policy terms.

- Regulatory Compliance: Adherence to contract law is paramount, especially with evolving regulations like those impacting consumer protection in financial services.

- Litigation Risk: Unresolved disputes over policy interpretation can result in costly legal battles, impacting financial performance.

- Reputational Impact: Fair and transparent handling of policy contracts is vital for maintaining customer confidence and brand integrity.

Chesnara operates under stringent financial services regulations across the UK, Netherlands, and Sweden, overseen by bodies like the FCA, PRA, DNB, AFM, and Finansinspektionen. Compliance with solvency frameworks, such as Solvency II, is crucial, with UK insurers averaging around 180% solvency ratios in Q1 2024, demanding significant capital buffers.

Data protection laws like GDPR impose strict rules on handling policyholder information, with significant penalties for non-compliance, as evidenced by substantial GDPR fines levied in 2023. Consumer protection mandates, such as the FCA's Consumer Duty, require fair treatment and transparency, prompting significant investment from firms in early 2024.

The company must also adhere to Anti-Money Laundering (AML) and counter-terrorist financing (CTF) laws, including robust due diligence and reporting, with global AML enforcement actions continuing to rise in 2024. Legal interpretation and enforcement of policy contracts are fundamental, with the FCA focusing on fair treatment of vulnerable customers in 2023, impacting Chesnara's administrative compliance and financial stability.

Navigating these legal and regulatory landscapes requires meticulous attention to contract law and proactive risk management to avoid costly litigation and protect Chesnara's reputation.

Environmental factors

Chesnara faces growing demands from regulators, investors, and the public to incorporate Environmental, Social, and Governance (ESG) principles into its investment decisions. This trend is significant even for Chesnara's focus on closed books, as its asset management activities must now align with ESG criteria, potentially reshaping how assets are allocated.

The need for robust ESG reporting is paramount, with stakeholders and regulatory bodies expecting transparency on how these factors are integrated. For instance, by the end of 2024, major financial institutions are expected to provide more detailed disclosures on climate-related financial risks, a trend that will likely cascade to companies like Chesnara.

Climate change presents significant physical and transition risks to Chesnara's investment portfolio. Extreme weather events, such as floods or heatwaves, can directly impact the value of real estate holdings, while evolving regulations and market shifts related to decarbonization can negatively affect investments in carbon-intensive sectors. For instance, as of early 2025, the insurance industry is increasingly factoring climate resilience into property valuations, with some studies indicating a potential 10-20% devaluation for assets in high-risk flood zones.

Effectively assessing and proactively mitigating these climate-related financial risks is becoming paramount for Chesnara's long-term investment strategy. This involves a thorough understanding of how physical impacts and the transition to a low-carbon economy will influence asset performance and overall portfolio valuation. By 2024, major financial institutions reported a growing emphasis on climate risk disclosure, with a significant portion of assets under management being assessed for climate vulnerability.

Chesnara faces growing pressure for detailed sustainability reporting, driven by stricter environmental regulations and investor demands. This includes disclosing climate-related risks and carbon emissions, potentially aligning with TCFD recommendations.

Reputational Risk from Environmental Practices

Public and investor perception of a company's environmental responsibility significantly impacts its reputation and attractiveness. For Chesnara, while its direct operational footprint is minimal due to its office-based consolidation model, its investment decisions and broader commitment to environmental stewardship are crucial. Negative perceptions stemming from investments in unsustainable practices could indeed harm investor relations and overall market standing.

The increasing focus on Environmental, Social, and Governance (ESG) factors means that even companies with limited direct environmental impact must demonstrate a commitment to sustainability. For instance, a significant portion of institutional investors, including pension funds and asset managers, are increasingly integrating ESG criteria into their investment analysis. In 2024, surveys indicated that over 70% of institutional investors consider ESG performance when making investment decisions, and this trend is expected to continue growing through 2025.

- Investor Scrutiny: Investors are increasingly scrutinizing companies' ESG performance, with a growing emphasis on environmental factors.

- Reputational Impact: Negative publicity or perceived inaction on environmental issues can damage Chesnara's brand and stakeholder trust.

- Investment Alignment: Chesnara's investment portfolio must align with evolving sustainability expectations to maintain its attractiveness to a broad investor base.

Operational Environmental Footprint

While Chesnara's primary focus is financial services, its day-to-day operations do have an environmental impact. This includes the energy used in its offices, how waste is managed, and the carbon emissions from business travel. For instance, in 2023, many companies, including those in the financial sector, reported increased efforts in reducing their Scope 1 and Scope 2 emissions, with targets often set for 2030.

Chesnara's commitment to sustainability can be seen in initiatives aimed at lowering this operational footprint. These might involve upgrading office buildings for better energy efficiency or encouraging employees to adopt more eco-friendly commuting habits. Such actions not only bolster the company's corporate social responsibility profile but also align with the growing global emphasis on environmental stewardship.

- Energy Efficiency: Investments in energy-saving technologies for office spaces.

- Waste Reduction: Implementing comprehensive recycling programs and reducing paper consumption.

- Sustainable Travel: Encouraging virtual meetings and opting for lower-emission travel options.

- Employee Engagement: Promoting environmental awareness and sustainable practices among staff.

Environmental factors are increasingly shaping Chesnara's strategic landscape, driven by regulatory shifts and investor demands for ESG integration. Climate change poses tangible risks to its investment portfolio, impacting asset valuations, particularly in real estate. For example, by early 2025, insurers are factoring climate resilience into property valuations, potentially devaluing assets in high-risk zones by 10-20%.

Chesnara must navigate growing expectations for sustainability reporting, including disclosures on climate risks and carbon emissions, aligning with frameworks like TCFD. Investor scrutiny on ESG performance is intensifying, with over 70% of institutional investors in 2024 considering ESG factors in their decisions. This scrutiny extends to Chesnara's investment choices, where alignment with sustainability principles is crucial for market attractiveness.

| Factor | Impact on Chesnara | Data/Trend (2024-2025) |

| Climate Change Risks | Physical and transition risks to investment portfolio, affecting asset valuations. | 10-20% potential devaluation of assets in high-risk flood zones by early 2025 (insurance industry estimates). |

| ESG Integration | Demand for ESG principles in investment decisions and reporting. | Over 70% of institutional investors considered ESG in 2024; trend expected to grow. |

| Regulatory Pressure | Increased need for transparency on climate-related financial risks. | Major financial institutions expected to enhance climate risk disclosures by end of 2024. |

| Operational Footprint | Energy use, waste management, and travel emissions from offices. | Many financial sector companies reported efforts to reduce Scope 1 & 2 emissions in 2023. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Chesnara is built upon a robust foundation of data, drawing from official government publications for political and legal insights, reputable economic databases for market trends, and leading industry reports for technological advancements and social shifts. We also incorporate environmental agency data to ensure a comprehensive understanding of ecological factors.