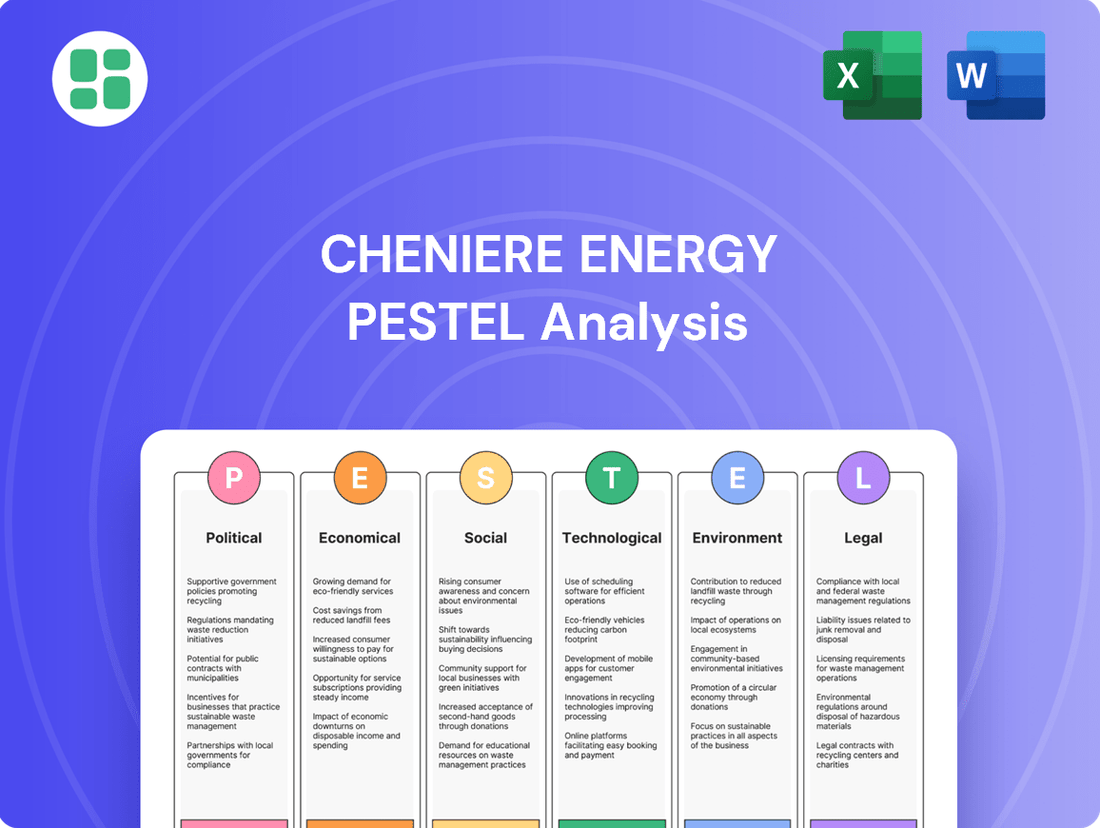

Cheniere Energy PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cheniere Energy Bundle

Cheniere Energy operates within a dynamic global landscape, where political shifts, economic volatility, and technological advancements significantly shape its LNG export business. Understanding these external forces is crucial for strategic planning and risk mitigation.

Our expertly crafted PESTLE analysis delves deep into these critical factors, offering actionable intelligence on how political stability, economic growth, and environmental regulations impact Cheniere's operations and future prospects. Gain the competitive edge you need to navigate this complex market.

Don't get left behind. Download the full Cheniere Energy PESTLE Analysis now to unlock comprehensive insights, identify growth opportunities, and strengthen your strategic decision-making. Your next smart move is just a click away.

Political factors

The US government's evolving policies on Liquefied Natural Gas (LNG) exports are a critical factor for Cheniere Energy. A temporary pause on reviewing new export applications to non-Free Trade Agreement (FTA) countries in early 2024 introduced a period of uncertainty.

However, this pause was overturned in January 2025, leading to the resumption of approvals for such projects. The 2024 LNG Export Study, which demonstrated significant net economic benefits, now serves as a key determinant for future public interest assessments of non-FTA export ventures.

Global geopolitical instability, exemplified by the ongoing Russia-Ukraine conflict and tensions in the Middle East, significantly impacts liquefied natural gas (LNG) demand and pricing by disrupting established energy flows. Cheniere's position as a leading LNG exporter, especially its substantial shipments to Europe, has become vital for bolstering international energy security during periods of heightened global uncertainty.

Cheniere Energy's core business, exporting liquefied natural gas (LNG), is deeply intertwined with international trade relations and agreements. Fluctuations in global trade policies, tariffs, or the emergence of trade disputes can directly impact its revenue streams and operational stability. For instance, the ongoing trade tensions between major economies could introduce new complexities for LNG contracts.

To counter this inherent vulnerability, Cheniere has strategically diversified its customer base, supplying LNG to over 40 countries spanning Asia and Europe. This broad geographical reach significantly mitigates the risk associated with policy shifts or disruptions in any single national market. By serving diverse regions, Cheniere enhances its resilience, ensuring that a localized trade issue does not disproportionately affect its overall business performance.

Regulatory and Permitting Environment

The regulatory landscape, particularly concerning permits for Liquefied Natural Gas (LNG) export terminals and rules on methane emissions, is a critical factor for Cheniere's growth and operations. While Cheniere anticipates securing permits for its ongoing expansion, potential shifts in regulations or delays in the permitting process could affect project schedules and expenses.

The U.S. permitting process for new LNG export facilities, such as those Cheniere operates or plans, can be lengthy and complex, often involving multiple federal agencies. For instance, the Federal Energy Regulatory Commission (FERC) oversees pipeline and terminal construction, while the Department of Energy (DOE) grants long-term export authorizations. The Biden administration's focus on climate change has led to increased scrutiny of methane emissions from natural gas production and transportation, which could influence future regulatory requirements for LNG facilities.

- Permitting Timelines: Delays in obtaining federal and state permits for expansion projects, like the Corpus Christi Stage 3 project, can push back in-service dates and increase capital costs.

- Methane Regulations: New or stricter regulations on methane emissions could necessitate additional investments in leak detection and repair technologies, impacting operational expenses.

- Policy Uncertainty: Changes in U.S. energy policy or international trade agreements could create uncertainty around the long-term demand for U.S. LNG exports, indirectly affecting regulatory priorities.

Domestic Political Climate and Elections

The domestic political climate, particularly the upcoming 2024 US presidential election, presents a significant variable for Cheniere Energy. Shifts in administration can directly alter energy policy, influencing everything from environmental regulations to the crucial permitting process for Liquefied Natural Gas (LNG) export terminals. This uncertainty is amplified by recent political actions, such as the temporary pause on new LNG export permits initiated in early 2024, which underscored how domestic political considerations can directly impact industry expansion.

The Biden administration's approach to energy policy, emphasizing climate goals, contrasts with potential future administrations that might prioritize energy independence and fossil fuel production. This divergence could lead to policy changes affecting Cheniere's long-term project development and operational landscape. For instance, a more favorable regulatory environment could accelerate planned expansions, while a stricter approach might introduce delays or increased compliance costs.

- 2024 US Presidential Election: A key event that could reshape energy policy and regulatory frameworks.

- LNG Export Permitting Freeze (2024): Demonstrates the direct impact of political decisions on industry growth.

- Administration Policy Shifts: Potential changes in environmental standards and project approvals based on the winning party's agenda.

The resumption of new LNG export approvals to non-FTA countries in January 2025, following a temporary pause in 2024, signifies a positive shift in U.S. energy export policy. The 2024 LNG Export Study, which highlighted significant net economic benefits, now guides future public interest assessments for these ventures. This policy evolution directly impacts Cheniere's ability to expand its global reach and market access.

Geopolitical events, such as the ongoing conflict in Ukraine and Middle Eastern tensions, continue to influence global LNG demand and pricing, underscoring Cheniere's role in enhancing international energy security. The company's substantial LNG shipments to Europe are particularly critical in this context.

International trade relations and potential disputes remain a key political consideration for Cheniere, as they can directly affect revenue and operational stability. Cheniere's diversification into over 40 countries mitigates risks associated with localized trade policy shifts.

The domestic political landscape, particularly the aftermath of the 2024 US presidential election, will shape future energy policies and regulatory frameworks affecting LNG exports. Potential shifts in administration could lead to changes in environmental standards and project approval processes.

What is included in the product

This PESTLE analysis delves into the Political, Economic, Social, Technological, Environmental, and Legal factors impacting Cheniere Energy, providing a comprehensive overview of its operating landscape.

It offers actionable insights for strategic decision-making, highlighting key external influences and their potential ramifications for the company's future growth and stability.

A concise Cheniere Energy PESTLE analysis that cuts through complexity, empowering faster, more informed strategic decisions by highlighting key external factors impacting the LNG market.

Economic factors

Global natural gas demand hit record levels in 2024 and is expected to keep climbing through 2025. This surge is largely fueled by industrial expansion and the need for power generation, especially in key markets like Asia and Europe.

Cheniere is well-positioned to capitalize on this strong demand. Its extensive portfolio of long-term Liquefied Natural Gas (LNG) supply contracts ensures consistent revenue, even when faced with the natural volatility of short-term LNG prices.

The United States boasts substantial natural gas reserves, a critical economic advantage for Cheniere Energy. This abundance, coupled with significant investments in pipeline networks and liquefaction facilities like Cheniere's Sabine Pass and Corpus Christi terminals, directly fuels the company's growth and export capabilities.

Cheniere's strategic expansion, particularly the Corpus Christi Stage 3 project, is a prime example of this. This project alone is set to add approximately 10 million tonnes per annum (mtpa) of export capacity, significantly enhancing Cheniere's revenue potential and future cash flow generation in the 2024-2025 period and beyond.

Currency fluctuations significantly impact Cheniere Energy's international competitiveness as a major exporter of U.S. liquefied natural gas (LNG). A stronger U.S. dollar, for instance, can make American LNG more expensive for foreign buyers, potentially dampening demand. Conversely, a weaker dollar can boost competitiveness by making U.S. exports more attractive in global markets.

Cheniere's extensive portfolio of long-term contracts, predominantly denominated in U.S. dollars, provides a crucial hedge against currency volatility. These contracts offer a degree of revenue stability, insulating the company from significant adverse movements in exchange rates for a substantial portion of its sales. This contractual structure is vital for managing financial risk in the inherently volatile global energy market.

For 2024 and into 2025, the U.S. dollar has shown resilience, influenced by factors like interest rate differentials and global economic uncertainty. This strength presents a persistent challenge to the cost-competitiveness of U.S. LNG exports. For example, if the euro weakens against the dollar, European buyers face higher costs for U.S. LNG, potentially shifting demand towards other suppliers or energy sources.

Capital Investment and Project Financing

Cheniere Energy's ambitious expansion plans, including the Corpus Christi Stage 3 project and potential new liquefaction trains, necessitate significant capital outlays. For instance, the Corpus Christi Stage 3 project alone is estimated to cost around $8 billion, highlighting the scale of investment required.

The company's financial performance and growth are intrinsically linked to its capacity to secure the necessary project financing and effectively manage construction expenses. Successful execution of these capital-intensive projects is paramount for maintaining its competitive edge and ensuring long-term financial stability.

- Corpus Christi Stage 3 Estimated Cost: Approximately $8 billion.

- Financing Dependence: Growth hinges on securing debt and equity for new projects.

- Cost Management: Efficiently managing construction and operational costs is critical for profitability.

Market Volatility and Competition

While Cheniere's long-term contracts offer a degree of stability, the broader liquefied natural gas (LNG) market is inherently volatile. This volatility stems from fluctuating global supply and demand, influenced by factors like weather patterns, economic growth, and geopolitical events. For instance, the International Energy Agency (IEA) reported in early 2024 that global LNG demand was projected to grow by 2.5% in 2024, but this growth is subject to the pace of economic recovery in key importing regions.

Increased global competition is also a significant factor impacting Cheniere. New LNG export facilities are coming online in various countries, particularly in North America and the Middle East. This expansion could lead to oversupply in certain periods, potentially pressuring spot market prices and affecting contract renegotiations. By mid-2024, several new liquefaction trains were nearing completion, adding substantial capacity to the global market.

These competitive pressures and market dynamics can influence Cheniere's ability to secure new long-term agreements and potentially impact the pricing of its uncontracted volumes. The company must navigate these shifts to maintain its market position and profitability.

- Market Volatility: Global LNG demand is forecast to increase, but susceptible to economic slowdowns and geopolitical disruptions impacting supply chains.

- Increased Competition: New export projects globally are adding significant capacity, potentially leading to oversupply and price pressures.

- Pricing Influence: Competition and market sentiment can affect Cheniere's pricing power on uncontracted volumes and influence future contract negotiations.

Global economic growth in 2024 and projected for 2025 continues to be a primary driver for natural gas demand, particularly in Asia and Europe. This sustained demand underpins Cheniere's revenue streams, especially given its substantial portfolio of long-term LNG contracts.

The U.S. economy's strength, including its robust natural gas production and infrastructure, provides Cheniere with a significant competitive advantage. This advantage is further amplified by ongoing investments in liquefaction capacity, such as the Corpus Christi Stage 3 expansion, which is expected to add approximately 10 million tonnes per annum of export capacity by 2025.

Currency exchange rates, particularly the U.S. dollar's strength in 2024, present a challenge to the cost-competitiveness of U.S. LNG exports. However, Cheniere's predominantly U.S. dollar-denominated long-term contracts offer a crucial hedge against these currency fluctuations, providing revenue stability.

Cheniere's significant capital expenditure plans for expansion projects, like the estimated $8 billion Corpus Christi Stage 3, highlight the company's reliance on financial markets for growth. Securing financing and managing construction costs are critical for its continued development and market position through 2025.

| Economic Factor | Impact on Cheniere | Data/Projection (2024-2025) |

|---|---|---|

| Global Natural Gas Demand | Drives revenue and contract security | Record levels in 2024, projected continued growth through 2025. |

| U.S. Natural Gas Production | Provides feedstock advantage and export capacity | Abundant reserves and expanding infrastructure. |

| U.S. Dollar Strength | Affects export competitiveness | Resilient dollar in 2024 poses cost challenges for buyers. |

| Interest Rates & Financing Costs | Impacts capital expenditure for expansion | Higher rates could increase borrowing costs for projects like Corpus Christi Stage 3. |

What You See Is What You Get

Cheniere Energy PESTLE Analysis

The preview shown here is the exact Cheniere Energy PESTLE Analysis you’ll receive after purchase—fully formatted and ready to use. This comprehensive document details the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Cheniere's operations. You can confidently assess these critical business influences with the complete, unaltered analysis.

Sociological factors

Cheniere Energy places significant emphasis on its community relations, particularly around its Sabine Pass and Corpus Christi terminals. The company actively works to address potential social impacts such as job creation, flaring, lighting, and traffic, recognizing these as crucial elements for maintaining its social license to operate. This engagement is fundamental for both current operational stability and future growth initiatives.

Cheniere Energy's operations are a significant job creator, directly employing thousands and indirectly supporting many more through its supply chain. In 2023, the company reported approximately 1,100 direct employees, a figure that swells considerably when considering construction, logistics, and service providers. This employment influx stimulates local economies, boosting spending and tax revenues in communities like Corpus Christi, Texas, and Hackberry, Louisiana.

The company actively focuses on developing a local workforce and engaging regional suppliers, aiming to maximize the economic benefit within its operating areas. This commitment not only fosters goodwill but also ensures operational efficiency by tapping into local expertise and resources. For instance, their supplier diversity programs aim to increase participation from businesses within a certain radius of their facilities.

Public and stakeholder sentiment regarding fossil fuels and the global energy transition significantly shapes the perception of Liquefied Natural Gas (LNG). Growing environmental awareness and calls for decarbonization create a complex landscape for energy companies.

Cheniere is actively working to position LNG as a vital bridge fuel, facilitating a move towards a lower-carbon future. The company highlights LNG's potential to improve air quality compared to other fossil fuels and support the displacement of higher-emitting energy sources, such as coal.

Data from the International Energy Agency (IEA) in its 2024 reports indicates that while renewable energy sources are expanding rapidly, natural gas still plays a crucial role in providing grid stability and meeting energy demand during the transition. This underscores the ongoing debate and varied perspectives on LNG's long-term viability.

Health and Safety Standards

Cheniere Energy places a strong emphasis on maintaining rigorous health and safety standards for its employees and the communities where it operates. This commitment is fundamental to its reputation and ability to meet stringent regulatory requirements.

The company's operational safety performance is a critical metric, with Cheniere consistently achieving a top-decile safety record within the energy sector. For instance, in 2023, Cheniere reported a Total Recordable Incident Rate (TRIR) of 0.37, significantly below the industry average.

- Workforce Safety: Cheniere's focus on preventing workplace injuries and illnesses is paramount, contributing to operational continuity and employee well-being.

- Community Impact: Ensuring safety extends beyond its facilities to protect the health of surrounding communities.

- Regulatory Compliance: Adherence to health and safety regulations is non-negotiable for maintaining operating licenses and avoiding penalties.

- Industry Benchmarking: A top-decile safety record, as demonstrated by its TRIR, highlights Cheniere's dedication to best practices.

Environmental Justice Considerations

Cheniere Energy's social performance framework actively addresses environmental justice concerns, particularly for communities historically facing disproportionate environmental burdens. This commitment is crucial as the company expands its liquefied natural gas (LNG) infrastructure, recognizing the potential impacts on vulnerable populations.

The company's approach involves proactive engagement with these communities to understand and mitigate potential adverse effects. For instance, in 2023, Cheniere reported investing millions in community benefit programs and local initiatives near its Sabine Pass and Corpus Christi facilities, aiming to foster equitable outcomes and address community needs.

- Community Engagement: Cheniere emphasizes dialogue with stakeholders in areas surrounding its operations to identify and address environmental justice issues.

- Impact Mitigation: The company implements strategies to reduce the environmental footprint of its projects, especially in or near disadvantaged communities.

- Social Investment: In 2023, Cheniere's community investment programs focused on areas like education, environmental stewardship, and economic development, totaling over $15 million across its operational regions.

Cheniere's community engagement is vital for its social license to operate, focusing on job creation and addressing local concerns like flaring and traffic. The company directly employed around 1,100 individuals in 2023, with a significant multiplier effect on local economies through its supply chain and construction activities.

Public perception of LNG is influenced by the ongoing energy transition and environmental awareness, with Cheniere positioning LNG as a bridge fuel. While renewables are growing, the International Energy Agency (IEA) noted in 2024 that natural gas remains critical for grid stability during this transition, highlighting varied perspectives on LNG's long-term role.

Cheniere prioritizes rigorous health and safety standards, achieving a top-decile safety record with a 2023 Total Recordable Incident Rate (TRIR) of 0.37, well below the industry average. This commitment extends to community well-being and regulatory compliance, reinforcing its operational integrity.

Addressing environmental justice is a key focus, with millions invested in community benefit programs in 2023, exceeding $15 million across its operational regions. These investments target education, environmental stewardship, and economic development, aiming for equitable outcomes in areas near its facilities.

| Sociological Factor | Cheniere's Approach | Key Data/Impact (2023/2024) |

|---|---|---|

| Community Relations & Social License | Proactive engagement on job creation, local impacts (flaring, traffic). | Approx. 1,100 direct employees; significant indirect job creation. |

| Public Perception & Energy Transition | Positioning LNG as a bridge fuel; addressing environmental concerns. | IEA 2024: Natural gas critical for grid stability during transition. |

| Health & Safety Standards | Rigorous internal standards; focus on employee and community well-being. | TRIR of 0.37 (top-decile performance). |

| Environmental Justice & Social Investment | Mitigating impacts on vulnerable populations; community benefit programs. | Over $15 million invested in community programs. |

Technological factors

Continuous advancements in liquefaction technology, like Cheniere's implementation of the Optimized Cascade® process, are significantly boosting LNG production efficiency. This innovation directly translates to a lower emissions intensity per ton of LNG, enhancing Cheniere's environmental profile and operational competitiveness in the global market.

The advancement and deployment of Carbon Capture, Utilization, and Storage (CCUS) technologies are becoming increasingly vital for minimizing the carbon intensity associated with Liquefied Natural Gas (LNG) production. Cheniere Energy is actively investigating and investing in CCUS initiatives to capture carbon dioxide emissions directly from its operational sites.

This strategic focus on CCUS is designed to help Cheniere achieve its net-zero emission objectives and satisfy a growing market preference for LNG with a reduced environmental impact. For instance, in 2024, Cheniere announced plans to explore CCUS at its Sabine Pass facility, a significant step towards decarbonizing its operations.

Cheniere is actively implementing cutting-edge technologies and data analytics to precisely measure, track, report, and verify methane emissions throughout its operations. This focus on technological advancement is key to understanding and managing its environmental footprint.

The company has established a voluntary goal to reduce its methane emissions intensity, a move that demonstrates its commitment to enhancing environmental performance and adhering to leading industry standards. This proactive approach positions Cheniere to meet evolving regulatory expectations and investor demands for sustainability.

Operational Efficiency and Automation

Cheniere Energy actively integrates technological advancements to boost operational efficiency and cut costs across its LNG infrastructure. The company is a prime example of how embracing automation and digital solutions can significantly optimize complex processes. For instance, in 2023, Cheniere reported that its Sabine Pass terminal achieved a record utilization rate, partly attributed to enhanced operational controls driven by technology.

Automation and digital tools are central to optimizing LNG terminal operations and pipeline management for Cheniere. These technologies enable real-time monitoring, predictive maintenance, and streamlined logistics, all contributing to improved reliability and reduced downtime. The company's investment in digital transformation initiatives aims to create more resilient and cost-effective supply chains.

- Digital Twin Technology: Implementing digital twins for its facilities allows for virtual simulations and performance analysis, identifying potential issues before they impact physical operations.

- Advanced Process Control (APC): APC systems are deployed to fine-tune processing parameters, leading to higher yields and reduced energy consumption.

- AI-Powered Analytics: Utilizing artificial intelligence for data analysis helps in forecasting demand, optimizing cargo scheduling, and managing inventory more effectively.

- Robotics and Drones: Employing robots and drones for inspections and maintenance in hazardous or hard-to-reach areas enhances safety and efficiency.

Integration of Renewable Energy Sources

Integrating renewable energy sources like solar and wind to power parts of LNG production and liquefaction facilities could drastically cut Cheniere's operational carbon footprint. This move aligns directly with the global energy transition, a critical factor for energy companies in 2024 and beyond.

Cheniere is already exploring these avenues. For instance, their Corpus Christi facility is investigating the use of renewable power for its operations. This strategy not only addresses environmental concerns but also potentially offers cost savings as renewable energy prices continue to fall.

- Reduced Emissions: Lowering greenhouse gas emissions from LNG processing.

- Cost Efficiency: Potential long-term savings on energy expenditures.

- Regulatory Compliance: Meeting increasingly stringent environmental regulations.

- Enhanced Reputation: Demonstrating commitment to sustainability for investors and stakeholders.

Technological advancements are central to Cheniere's strategy, driving efficiency and sustainability in LNG production. Innovations in liquefaction, like the Optimized Cascade® process, enhance output and reduce emissions intensity. The company is actively investing in Carbon Capture, Utilization, and Storage (CCUS) to meet net-zero goals, with plans for CCUS exploration at Sabine Pass announced in 2024.

Cheniere leverages digital tools and AI for operational optimization, including methane emission tracking and predictive maintenance. For example, the Sabine Pass terminal achieved record utilization in 2023, partly due to enhanced technological controls. The integration of renewable energy sources is also a key focus, with Corpus Christi exploring renewable power for its operations to further cut its carbon footprint.

| Technology Area | Impact on Cheniere | Key Initiatives/Examples |

|---|---|---|

| Liquefaction Efficiency | Increased production output, reduced emissions intensity | Optimized Cascade® process |

| Decarbonization | Minimizing carbon footprint, meeting net-zero targets | CCUS exploration at Sabine Pass (2024 announcement) |

| Operational Optimization | Improved reliability, reduced downtime, cost savings | Digital twins, AI analytics, automation, robotics, drones |

| Renewable Energy Integration | Lower operational carbon footprint, potential cost savings | Renewable power exploration at Corpus Christi facility |

Legal factors

Cheniere Energy operates under a complex web of environmental laws, impacting everything from air emissions to water discharge and waste disposal. These regulations, enforced by agencies like the EPA, necessitate significant compliance efforts and investments.

Securing and retaining permits for its LNG facilities and any future expansions is a crucial legal hurdle. This process typically involves extensive environmental impact assessments, ensuring operations meet strict legal standards and minimize ecological impact.

For instance, the permitting process for new export terminals can take years, involving detailed reviews of potential effects on air quality, marine life, and local communities, reflecting the significant legal and regulatory scrutiny Cheniere faces.

The export of Liquefied Natural Gas (LNG) from the United States is primarily regulated by the Natural Gas Act, which mandates authorization from the Department of Energy (DOE). This regulatory framework is critical for companies like Cheniere Energy, which operate LNG export terminals.

While exports to countries with Free Trade Agreements (FTAs) are typically considered to be in the public interest, this streamlines the approval process. In contrast, applications for non-FTA exports face a more rigorous public interest review. This distinction significantly influences the timeline and certainty of project approvals and expansions.

For instance, in 2023, the U.S. exported approximately 13.9 million metric tons of LNG per month, a substantial increase from previous years, highlighting the growing importance of these authorizations. The DOE's ongoing review processes, especially for non-FTA destinations, can introduce variability into project development schedules and capital expenditure plans for LNG exporters.

Cheniere's substantial global export operations are directly shaped by international trade regulations, including tariffs and sanctions, especially those pertinent to the energy sector. These legal frameworks can significantly alter market dynamics and supply chains for liquefied natural gas (LNG).

Geopolitical sanctions, for instance, have demonstrably impacted the energy landscape. The sanctions imposed on Russian LNG, for example, have led to significant realignments in global energy flows, creating both challenges and opportunities for companies like Cheniere as they adapt to these evolving trade environments.

Safety and Operational Compliance

Cheniere Energy operates under a stringent legal framework requiring absolute adherence to safety regulations and operational standards for its liquefied natural gas (LNG) facilities and extensive pipeline network. This legal mandate is critical for maintaining its license to operate and for public trust.

Compliance with federal and state laws is non-negotiable. This includes regulations like the Pipeline Safety Act, the Clean Air Act, and the Occupational Safety and Health Act (OSHA). For instance, in 2023, the U.S. Department of Transportation's Pipeline and Hazardous Materials Safety Administration (PHMSA) continued to enforce rigorous safety standards, with significant oversight on LNG infrastructure.

- Mandatory Safety Standards: Legal requirements dictate comprehensive safety protocols for LNG handling, storage, and transportation.

- Environmental Regulations: Adherence to laws governing emissions, hazardous waste disposal, and spill prevention is legally enforced.

- Occupational Safety: Compliance with OSHA standards ensures worker safety, with penalties for violations.

- Permitting and Licensing: Continuous operation depends on maintaining all necessary federal and state permits, subject to ongoing review and compliance checks.

Tax Laws and Incentives

Changes in tax laws and the availability of tax credits, particularly those related to alternative fuels and carbon capture technologies, can significantly influence Cheniere Energy's financial performance. The company actively seeks to leverage these incentives, though their realization often depends on evolving interpretations and regulatory approvals. For instance, the Inflation Reduction Act of 2022 introduced enhanced tax credits for clean energy projects, which could benefit Cheniere's future developments and existing operations.

These tax considerations are crucial for capital-intensive projects like those undertaken by Cheniere. The company's ability to secure and utilize tax credits directly impacts project economics and overall profitability. As of late 2024, the energy sector continues to monitor legislative developments that could further alter the tax landscape for liquefied natural gas (LNG) and related infrastructure.

- Impact of Tax Credits: Tax credits for carbon capture, utilization, and storage (CCUS) and clean hydrogen production, as expanded by the Inflation Reduction Act, offer potential financial benefits for Cheniere's decarbonization efforts.

- Legislative Monitoring: Cheniere actively tracks changes in U.S. federal and state tax policies that could affect its operations and investment decisions.

- Economic Sensitivity: The company's profitability is sensitive to the interplay between tax liabilities and available tax incentives, influencing the net cost of its projects.

- Regulatory Uncertainty: The finalization and interpretation of tax credit eligibility criteria by agencies like the IRS can introduce uncertainty into financial planning.

Cheniere's operations are heavily influenced by U.S. export regulations, particularly the Department of Energy's authorization process for LNG exports. While exports to Free Trade Agreement countries are generally streamlined, non-FTA exports undergo a more rigorous public interest review, impacting project timelines.

International trade laws, including sanctions and tariffs, directly shape Cheniere's global market access and supply chains. For instance, the impact of sanctions on Russian LNG in 2022 demonstrated how geopolitical events can cause significant shifts in energy flows, creating both challenges and opportunities.

The company must also navigate evolving tax laws and incentives, such as those introduced by the Inflation Reduction Act of 2022, which could offer financial benefits for decarbonization efforts. Monitoring these legislative changes is crucial for strategic financial planning and investment decisions.

| Regulatory Area | Key Legal Frameworks | Impact on Cheniere | 2023/2024 Data Point |

|---|---|---|---|

| Export Authorization | Natural Gas Act, DOE approvals | Streamlined for FTA, rigorous for non-FTA | U.S. LNG exports averaged ~13.9 MT/month in 2023 |

| International Trade | Trade agreements, sanctions, tariffs | Affects market access and supply chains | Sanctions on Russian LNG altered global energy flows |

| Tax Policy | Inflation Reduction Act, federal/state tax laws | Potential benefits from clean energy credits | IRA enhanced credits for CCUS and clean hydrogen |

Environmental factors

Global and national climate change policies, including emissions reduction targets, directly impact the Liquefied Natural Gas (LNG) industry. For instance, the European Union's Fit for 55 package aims for a 55% net greenhouse gas (GHG) emission reduction by 2030 compared to 1990 levels, influencing demand for cleaner energy sources.

Cheniere Energy has a climate strategy focused on measuring and mitigating its greenhouse gas emissions, particularly methane, to enhance its environmental performance. This strategy aligns with the growing pressure for energy companies to contribute to lower-carbon energy solutions, a trend expected to intensify through 2025.

Methane emissions from natural gas infrastructure, including those operated by Cheniere, represent a critical environmental challenge. These emissions contribute significantly to greenhouse gas effects.

Cheniere is actively addressing this by implementing measurement-informed programs to better understand and control its methane footprint. The company has set a specific target to reduce its Scope 1 methane emissions intensity, underscoring a proactive approach to environmental stewardship.

LNG liquefaction processes, like those operated by Cheniere, are water-intensive. This means careful management of water intake and discharge is crucial. For instance, Cheniere's Sabine Pass facility, a major LNG export terminal, relies on significant water volumes for its operations.

Cheniere actively works to mitigate water-related risks. This includes monitoring water quality and quantity, and implementing strategies to reduce its environmental footprint. The company's sustainability reports often detail its approach to water stewardship, reflecting the growing importance of this resource in energy production.

Land Use and Biodiversity Impacts

Cheniere Energy's operations, particularly the construction and expansion of its Liquefied Natural Gas (LNG) facilities and extensive pipeline networks, inherently demand substantial land use. This extensive footprint can lead to significant impacts on local ecosystems, potentially disrupting habitats and affecting biodiversity. For instance, the Sabine Pass LNG terminal, one of Cheniere's flagship projects, occupies a considerable area, necessitating careful planning to manage its environmental interface.

To address these challenges, Cheniere is committed to rigorous environmental impact assessments (EIAs) and the implementation of comprehensive mitigation strategies. These measures are designed to minimize habitat fragmentation, protect endangered species, and restore disturbed areas post-construction. The company's 2023 sustainability report highlighted ongoing efforts in habitat restoration and conservation programs across its operational sites.

- Land Footprint: Cheniere's LNG terminals and associated infrastructure, including pipelines, cover extensive land areas, impacting local ecosystems.

- Biodiversity Concerns: Habitat disruption and potential impacts on local flora and fauna are key considerations during project development and operation.

- Mitigation Efforts: The company employs environmental impact assessments and mitigation strategies to reduce negative effects on biodiversity.

- Sustainability Reporting: Cheniere's 2023 sustainability report details its ongoing commitment to environmental stewardship and conservation initiatives.

Transition to Cleaner Energy and Bridge Fuel Role

Cheniere views liquefied natural gas (LNG) as a critical component in the global shift towards cleaner energy. While natural gas is still a fossil fuel, the company emphasizes its role as a 'bridge fuel,' offering a less carbon-intensive alternative to coal. This positioning is supported by data showing that replacing coal with natural gas can significantly reduce greenhouse gas emissions, with estimates suggesting up to a 50% reduction in CO2 emissions from power generation.

The company's strategy leverages the growing demand for cleaner energy solutions. As of early 2024, global LNG demand continued to rise, driven by countries seeking to decarbonize their energy sectors and enhance energy security. Cheniere's infrastructure is well-positioned to meet this demand, facilitating the transition away from more polluting fuels.

- Bridge Fuel Narrative: Cheniere markets its LNG as a cleaner alternative to coal, aiding in the global energy transition.

- Emission Reduction Potential: Displacing coal with natural gas can lead to substantial reductions in greenhouse gas emissions.

- Market Demand: Global LNG demand saw continued growth in early 2024, underscoring the need for such transitional fuels.

Global climate policies, like the EU's Fit for 55 aiming for a 55% GHG reduction by 2030, directly influence LNG demand. Cheniere's strategy focuses on measuring and mitigating methane emissions, a key environmental challenge, with a target to reduce its Scope 1 methane emissions intensity.

LNG operations are water-intensive, requiring careful management. Cheniere's Sabine Pass facility, for example, uses significant water volumes, and the company implements strategies to monitor and reduce its water footprint, as detailed in its sustainability reports.

Cheniere's infrastructure development necessitates substantial land use, impacting local ecosystems. The company conducts environmental impact assessments and implements mitigation strategies, including habitat restoration, to minimize these effects, as noted in its 2023 sustainability report.

Cheniere positions LNG as a crucial 'bridge fuel' in the energy transition, offering a cleaner alternative to coal. This is supported by data showing natural gas can reduce CO2 emissions by up to 50% in power generation, aligning with rising global LNG demand observed in early 2024.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Cheniere Energy is built on a robust foundation of data from official government publications, leading financial news outlets, and reputable industry analysis firms. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the liquefied natural gas sector.