Cheniere Energy Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cheniere Energy Bundle

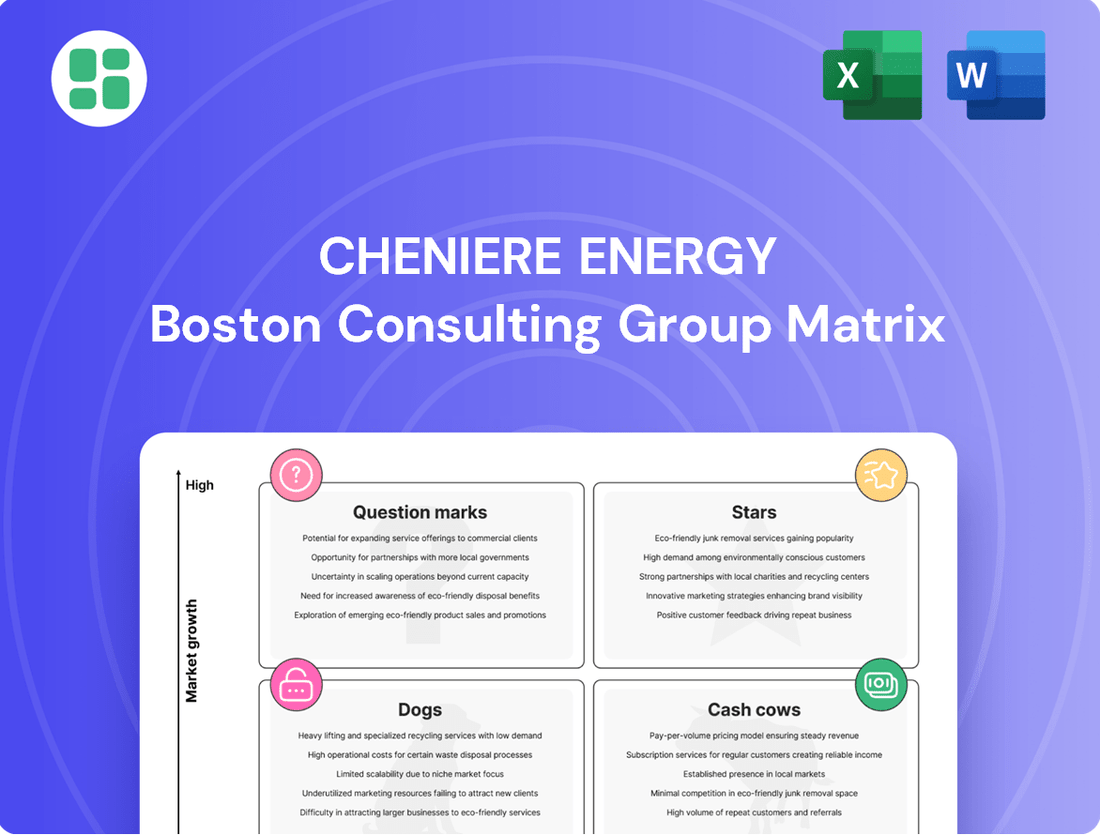

Uncover Cheniere Energy's strategic positioning with our insightful BCG Matrix preview! See which of their ventures are fueling growth and which might need a closer look. Ready to transform this snapshot into actionable strategy?

Dive deeper into Cheniere Energy's BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

The Corpus Christi Stage 3 project, with trains beyond the first one reaching substantial completion in March 2025, signifies a key growth driver for Cheniere Energy. This expansion is poised to add over 10 million tonnes per annum (MTPA) of liquefied natural gas (LNG) capacity, entering a market characterized by robust demand, particularly from Asian buyers.

As these new trains ramp up and achieve full operational status, they are expected to significantly bolster Cheniere's overall production volumes and its competitive standing within the rapidly expanding global LNG export landscape. This strategic expansion directly addresses the increasing international appetite for reliable energy sources.

The United States solidified its position as the world's largest LNG exporter, and Cheniere Energy stands at the forefront of this surge. This dominance in a rapidly expanding global market, fueled by Cheniere's increasing export capacity, firmly places its export platform in the star category.

The international LNG market is anticipated to experience robust growth, with North America expected to contribute a substantial share of new supply. This trend further bolsters Cheniere's star status, as its extensive infrastructure is well-positioned to capitalize on this demand. For instance, Cheniere's Sabine Pass and Corpus Christi facilities are key drivers of this export capacity, with ongoing expansions contributing to the US lead in global LNG shipments.

Cheniere's Strategic Capacity Doubling Initiative, targeting 90 MTPA by expanding Sabine Pass and Corpus Christi, clearly positions it as a Star in the BCG matrix. This aggressive expansion reflects a commitment to capturing substantial growth in the global LNG market.

The company's proactive approach to securing new regulatory permits and implementing a phased expansion plan underscores its investment in high-growth potential. This strategy is designed to solidify Cheniere's position as a leader in an increasingly vital energy sector.

New Long-Term Contract Acquisitions for Future Capacity

Cheniere Energy's strategic acquisition of new long-term contracts for future capacity significantly strengthens its position. For instance, the agreement with Indian Oil Corp for future capacity and the recent deal with Galp for the SPL Expansion Project are key indicators. These arrangements secure future revenue streams for capacity that is still under development, demonstrating robust market demand for Cheniere's upcoming LNG supply.

- Secured Capacity: Long-term contracts with entities like Indian Oil Corp and Galp ensure future offtake for Cheniere's expanding LNG infrastructure.

- Revenue Visibility: These agreements provide predictable revenue streams, even for projects not yet fully operational, enhancing financial forecasting.

- Market Validation: The continued signing of such deals underscores the strong global demand for U.S. liquefied natural gas.

Integration of Carbon Reduction Technologies (e.g., LCA studies)

Cheniere's commitment to publishing updated Life Cycle Assessment (LCA) studies for greenhouse gas emissions positions its efforts in carbon reduction technologies as a Star in the BCG Matrix. This focus on sustainability, even if not a direct product, addresses a growing market demand for cleaner energy solutions. For instance, in 2024, the demand for LNG as a transition fuel continued to be strong, driven by energy security concerns and the need to displace coal in power generation. Cheniere’s proactive approach in quantifying and potentially reducing its carbon footprint aligns with this market trend.

Leading in sustainable LNG production offers Cheniere a significant competitive edge. By providing transparent LCA data, the company can attract environmentally conscious buyers and secure long-term contracts in a market increasingly scrutinizing the carbon intensity of energy sources. This strategic advantage is crucial as global regulations and investor sentiment continue to favor lower-emission energy pathways.

- LCAs as a Competitive Differentiator: Publishing updated LCA studies highlights Cheniere's commitment to transparency and environmental stewardship, appealing to a growing segment of the market prioritizing sustainability.

- Market Demand for Cleaner LNG: In 2024, the global demand for LNG as a transitional fuel remained robust, with a noticeable increase in buyer interest for cargoes with lower carbon intensity.

- Strategic Advantage in a Carbon-Conscious Market: By investing in and communicating its carbon reduction efforts, Cheniere can differentiate itself from competitors and capture market share among environmentally aware customers.

Cheniere's substantial LNG export capacity, driven by expansions at Sabine Pass and Corpus Christi, firmly places it in the Star category of the BCG matrix. The company's strategic doubling of capacity to 90 MTPA and its securing of long-term contracts with major buyers like Indian Oil Corp and Galp underscore its leadership in a high-growth global market.

Cheniere's proactive approach to publishing updated Life Cycle Assessment (LCA) studies for greenhouse gas emissions further solidifies its Star status. This commitment to transparency and sustainability aligns with the increasing market demand for cleaner energy solutions, providing a significant competitive edge in 2024's energy landscape.

The company's infrastructure is strategically positioned to capitalize on North America's projected contribution to new global LNG supply, reinforcing its Star classification. This strategic foresight and execution are key to its dominant position.

| Metric | Value | Year | Significance |

|---|---|---|---|

| Total LNG Export Capacity (MTPA) | ~37 MTPA (current) | 2024 | Represents significant existing market share. |

| Target Expansion Capacity (MTPA) | 90 MTPA | Targeted by 2029 | Demonstrates aggressive growth strategy. |

| Corpus Christi Stage 3 Capacity (MTPA) | Over 10 MTPA | Phased completion from March 2025 | Key growth driver for future volumes. |

| Long-term Contracted Volumes | Significant portion of future capacity | Ongoing | Secures future revenue and market demand. |

| LCA Studies Publication | Ongoing | 2024 | Enhances sustainability credentials and market appeal. |

What is included in the product

Cheniere Energy's BCG Matrix provides a strategic overview of its LNG assets, categorizing them as Stars, Cash Cows, Question Marks, or Dogs based on market growth and share.

This analysis helps Cheniere Energy make informed decisions about investing in its LNG export terminals and infrastructure.

A clear Cheniere BCG Matrix visualizes LNG assets, alleviating the pain of understanding portfolio performance and strategic direction.

Cash Cows

The existing operational trains at Cheniere's Sabine Pass Liquefaction terminal are prime examples of Cash Cows within the BCG Matrix. These facilities boast a high market share in the global Liquefied Natural Gas (LNG) market and have demonstrated stable, reliable operations for years, consistently generating substantial cash flow for the company.

These mature assets benefit from long-term, take-or-pay contracts, which secure a significant portion of their export capacity. This contractual structure provides predictable revenue streams, reinforcing Sabine Pass's role as a foundational cash generator for Cheniere Energy. For instance, in the first quarter of 2024, Cheniere reported that Sabine Pass exported approximately 3.6 million tonnes of LNG, underscoring its consistent output and market presence.

The existing trains at Cheniere's Corpus Christi Liquefaction terminal function as robust cash cows, mirroring the success of Sabine Pass. These operational units boast high utilization, consistently benefiting from long-term agreements that guarantee predictable revenue.

This stability translates into significant and reliable distributable cash flow for Cheniere. For instance, in the first quarter of 2024, Cheniere reported that its Corpus Christi terminal, including its existing trains, played a crucial role in its financial performance, contributing to a substantial increase in adjusted EBITDA compared to the previous year.

Cheniere's long-term, take-or-pay LNG sales agreements are undeniably its cash cows. With over 90-95% of its operational volumes secured by these contracts, the company enjoys a remarkably stable and predictable revenue stream. This structure insulates Cheniere from the volatility of spot LNG prices, ensuring consistent cash flow to support its operations and financial obligations.

Existing Pipeline and Infrastructure Network

Cheniere's extensive pipeline and infrastructure network, designed to supply its liquefaction terminals, is a cornerstone of its cash flow generation. This mature infrastructure, largely depreciated, demands minimal additional capital investment while facilitating substantial revenue from LNG exports.

The strategic positioning and robust connectivity of this network ensure seamless gas procurement and delivery, directly contributing to the high profit margins associated with Cheniere's LNG export operations. As of the first quarter of 2024, Cheniere reported adjusted EBITDA of $1.4 billion, a testament to the efficient operation of these core assets.

- Mature Infrastructure: Cheniere's pipeline network and associated infrastructure are largely depreciated, leading to lower ongoing capital expenditure requirements.

- Revenue Generation: This established network is critical for feeding its liquefaction terminals, enabling significant revenue from LNG exports.

- Strategic Connectivity: The network's location and connectivity ensure efficient gas sourcing and delivery, enhancing export margins.

- Financial Contribution: In Q1 2024, Cheniere's operations, heavily reliant on this infrastructure, generated $1.4 billion in adjusted EBITDA.

Stable Revenue from Fixed Liquefaction Fees

Cheniere Energy's (CHX) Sabine Pass and Corpus Christi liquefaction facilities generate incredibly stable revenue thanks to fixed liquefaction fees. These fees, charged per ton of LNG processed, are collected regardless of whether the LNG is actually delivered. This structure shields a significant portion of Cheniere's income from the wild swings often seen in the spot LNG market.

This predictable income stream is a cornerstone of Cheniere's financial health. For instance, in the first quarter of 2024, Cheniere reported adjusted EBITDA of $1.6 billion, a substantial portion of which is attributable to these fee-based contracts. This stability allows the company to confidently invest in expansion projects and manage its debt effectively.

- Stable Revenue Base: Fixed liquefaction fees provide a predictable income stream, insulating Cheniere from LNG price volatility.

- Contracted Volumes: A significant portion of Cheniere's capacity is secured under long-term agreements, ensuring consistent fee collection.

- Financial Predictability: This fee structure underpins Cheniere's ability to forecast earnings and fund capital expenditures.

- Competitive Advantage: The fee-based model offers a distinct advantage over competitors reliant on spot market pricing.

Cheniere's operational liquefaction trains at both Sabine Pass and Corpus Christi are definitive cash cows. These facilities represent high market share in the LNG sector, consistently delivering stable operations and substantial cash flow. Their mature status, bolstered by long-term, take-or-pay contracts, ensures predictable revenue, making them foundational for Cheniere's financial strength.

The company's extensive, largely depreciated pipeline infrastructure also functions as a cash cow. This network facilitates efficient gas procurement and delivery to its terminals, minimizing capital expenditure while maximizing revenue from LNG exports. This infrastructure is critical for Cheniere's high profit margins.

Cheniere's fee-based contracts, securing liquefaction fees regardless of LNG delivery, are key cash cows. This structure shields a significant portion of income from spot market volatility, providing a stable foundation for earnings. In Q1 2024, Cheniere reported adjusted EBITDA of $1.6 billion, with these contracts a major contributor.

| Asset/Contract Type | BCG Classification | Market Share | Revenue Stability | Q1 2024 Contribution (Illustrative) |

| Sabine Pass Liquefaction (Existing Trains) | Cash Cow | High | Very High (Take-or-Pay) | Significant EBITDA Contribution |

| Corpus Christi Liquefaction (Existing Trains) | Cash Cow | High | Very High (Take-or-Pay) | Significant EBITDA Contribution |

| LNG Sales Agreements (Fee-Based) | Cash Cow | N/A (Contractual) | Very High (Fixed Fees) | Underpins $1.6B Q1 2024 Adjusted EBITDA |

| Pipeline & Infrastructure Network | Cash Cow | N/A (Internal) | High (Operational Efficiency) | Enables High Export Margins |

Preview = Final Product

Cheniere Energy BCG Matrix

The Cheniere Energy BCG Matrix preview you are currently viewing is the precise, unwatermarked document you will receive immediately after purchase. This comprehensive analysis, designed for strategic clarity, contains no demo content and is ready for professional use as is. You can confidently expect the exact same formatted BCG Matrix report, meticulously crafted with market-backed insights, to be delivered directly to you upon completing your transaction.

Dogs

Within Cheniere Energy's portfolio, certain ancillary operations might be considered underutilized or less efficient. These are typically smaller, peripheral services or legacy assets that don't significantly contribute to the company's primary LNG export revenue stream. They operate in segments with limited growth potential and may not command a substantial market share.

These less efficient operations could represent support services or minor infrastructure that consumes resources without generating commensurate returns. While Cheniere's core LNG business is robust, these ancillary functions, if underperforming, would fall into the "question mark" or potentially "dog" category of a BCG matrix, requiring careful evaluation for resource allocation or divestment.

While Cheniere Energy primarily operates with long-term contracts, its exposure to the short-term spot market can be a challenge during price downturns. In 2024, global LNG spot prices experienced volatility, with some periods seeing significant dips due to oversupply and milder weather. This uncontracted portion of Cheniere's volumes, while offering flexibility, can become a 'Dog' in the BCG matrix when these spot prices fall below operational costs or significantly reduce expected margins.

Outdated or less competitive operational practices can manifest as internal inefficiencies that drain resources. For Cheniere Energy, even with generally modern infrastructure, any lag in efficiency compared to industry benchmarks could increase operating costs. For instance, if older equipment requires more frequent maintenance or consumes more energy, it directly impacts profitability without contributing to market expansion.

Divested Non-Core Assets or Businesses

Cheniere Energy has historically focused on its core liquefied natural gas (LNG) export business. While specific recent divestitures of non-core assets aren't prominently detailed, any past ventures into less profitable or low-growth areas that were subsequently shed would have been classified as Dogs in the BCG Matrix. This strategic shedding allows the company to concentrate resources on its high-performing LNG operations.

- Strategic Focus: Cheniere's primary strategy revolves around its LNG export terminals, making ventures outside this core area potential candidates for divestment if they become underperformers.

- Resource Allocation: Divesting non-core assets frees up capital and management attention to reinvest in the company's LNG infrastructure and growth projects.

- Historical Context: While no recent specific examples are cited, the principle remains that divesting underperforming or non-strategic units aligns with optimizing the business portfolio.

Minimal Share in Niche, Stagnant Energy Sub-markets

Cheniere Energy's involvement in niche energy sub-markets with minimal growth and its own insignificant market share within them would likely be categorized as Dogs in the BCG Matrix. These are areas where the company has little strategic advantage and limited potential for future returns. For instance, if Cheniere held a small stake in a legacy oil pipeline that is seeing declining volumes and no significant investment for expansion, it would fit this description.

Such minimal participations, often remnants of past diversification efforts or acquired assets, do not contribute meaningfully to Cheniere's primary focus on expanding its liquefied natural gas (LNG) export capabilities. The energy landscape is rapidly shifting towards cleaner fuels, making investments in declining fossil fuel sub-markets increasingly unattractive. In 2024, the global energy market continued to emphasize decarbonization and the transition to renewables, further marginalizing such niche, low-growth segments.

- Low Growth Potential: These sub-markets are characterized by stagnant or declining demand, limiting any upside for Cheniere.

- Insignificant Market Share: Cheniere's presence in these areas is too small to exert influence or achieve economies of scale.

- Resource Diversion: Maintaining even minimal involvement diverts management attention and capital from core, high-growth LNG projects.

- Strategic Misalignment: These activities do not align with Cheniere's strategic objective of becoming a leading global LNG exporter.

Cheniere Energy's "Dogs" represent ventures with low growth and low market share, often ancillary services or legacy assets. These segments consume resources without generating significant returns, diverting focus from the core LNG business. For example, a small, non-strategic stake in a declining fossil fuel pipeline would fit this category, especially in 2024's decarbonization-focused energy market.

These underperforming units, if they exist, offer little strategic advantage and minimal potential for future gains. Their continued existence can drain capital and management attention that would be better allocated to Cheniere's robust LNG export operations.

Divesting such "Dog" assets allows Cheniere to streamline its portfolio, concentrating resources on its high-performing LNG infrastructure and growth initiatives, aligning with its strategic objective of global LNG leadership.

While specific 2024 data on Cheniere's "Dog" assets isn't publicly itemized, the principle of divesting non-core, underperforming units remains a key strategy for optimizing resource allocation and enhancing overall business performance.

Question Marks

The Sabine Pass Liquefaction Expansion Project (SPL Expansion), encompassing proposed Trains 8 and beyond, represents a significant Question Mark for Cheniere Energy. This venture targets a high-growth market with the potential to add up to 20 million tonnes per annum (MTPA) of liquefied natural gas (LNG) capacity.

However, the project is currently in its nascent stages, awaiting crucial regulatory approvals and a definitive final investment decision (FID). This developmental phase necessitates considerable capital outlay before any returns are guaranteed, highlighting its Question Mark status within the BCG framework.

The Corpus Christi Liquefaction Midscale Trains 8 & 9 project, with final investment decision (FID) approved in June 2025, fits the Question Mark category within Cheniere Energy's BCG Matrix. These new trains are set to add over 3 million tonnes per annum (MTPA) of liquefaction capacity, significantly expanding operations.

Despite the substantial capacity addition, these midscale trains are still in the early stages of construction and commissioning as of mid-2025. They necessitate considerable continued investment before becoming fully operational and generating consistent revenue.

Their future market position and contribution to Cheniere's overall portfolio are uncertain, hinging on successful project execution and prevailing market dynamics for liquefied natural gas (LNG).

Cheniere Energy's exploration into new energy transition technologies, like advanced carbon capture or hydrogen infrastructure, would likely place them in the Question Mark quadrant of the BCG Matrix. These ventures represent high-growth potential markets but currently have minimal market share for Cheniere, demanding significant, often risky, investment to establish viability and future profitability.

Uncontracted Future Capacity Beyond Current Projects

Cheniere's uncontracted future capacity, representing potential LNG production beyond its existing and under-construction projects, falls into the Question Mark category of the BCG Matrix. This signifies opportunities for growth but also carries inherent risks due to the lack of secured long-term customer agreements.

The company is actively exploring expansion opportunities, including the potential for additional liquefaction trains at its Sabine Pass and Corpus Christi facilities. For instance, Cheniere has been evaluating the feasibility of a third Corpus Christi expansion project, which, if pursued without secured contracts, would be considered uncontracted future capacity.

- Potential for Growth: Uncontracted capacity offers Cheniere the flexibility to capitalize on future market demand and potentially secure higher prices if market conditions are favorable.

- Contracting Risk: Without long-term off-take agreements, this capacity faces the risk of becoming a Dog if market demand softens or if competitors secure contracts first, requiring significant marketing and potentially lower pricing to fill.

- Strategic Importance: Developing this capacity is crucial for Cheniere to maintain its leading position in the global LNG market and to meet anticipated future demand, which is projected to grow significantly.

- Investment Uncertainty: The substantial capital investment required for these expansions necessitates a clear path to revenue generation through contracting, making the uncontracted nature a key consideration for financial viability.

Ventures into New Geographic Markets or Customer Segments

Ventures into entirely new geographic markets for LNG export or new customer segments would place Cheniere Energy in the 'Question Marks' category of the BCG Matrix. These represent high-potential growth areas but come with significant risks and require substantial investment to establish a foothold.

For instance, expanding into emerging Asian markets beyond current key customers or targeting industrial users directly, rather than solely utilities, would demand new infrastructure, marketing efforts, and regulatory navigation. Cheniere's substantial capital expenditures, such as the approximately $7 billion invested in its Corpus Christi Stage 3 expansion, illustrate the scale of investment required for growth, underscoring the capital intensity of such new market ventures.

- High Investment, Uncertain Returns: Entering new territories or customer bases necessitates significant upfront capital for market development, infrastructure, and sales, with the immediate return on investment being uncertain.

- Potential for High Growth: These new ventures offer the possibility of tapping into untapped demand and diversifying Cheniere's revenue streams, aligning with the high-growth characteristic of Question Marks.

- Strategic Importance: Successfully penetrating these new segments could significantly bolster Cheniere's long-term market position and competitive advantage in the global LNG landscape.

- Risk Mitigation Required: Careful market analysis and phased investment strategies would be crucial to manage the inherent risks associated with these ambitious expansion plans.

Cheniere's uncontracted future capacity, representing potential LNG production beyond its existing and under-construction projects, falls into the Question Mark category. This signifies opportunities for growth but also carries inherent risks due to the lack of secured long-term customer agreements.

The company is actively exploring expansion opportunities, including the potential for additional liquefaction trains at its Sabine Pass and Corpus Christi facilities. For instance, Cheniere has been evaluating the feasibility of a third Corpus Christi expansion project, which, if pursued without secured contracts, would be considered uncontracted future capacity.

Without long-term off-take agreements, this capacity faces the risk of becoming a Dog if market demand softens or if competitors secure contracts first, requiring significant marketing and potentially lower pricing to fill.

Developing this capacity is crucial for Cheniere to maintain its leading position in the global LNG market and to meet anticipated future demand, which is projected to grow significantly.

| Project/Venture | BCG Category | Key Characteristics | Potential Impact |

|---|---|---|---|

| Sabine Pass Liquefaction Expansion (SPL Expansion) | Question Mark | High growth potential (up to 20 MTPA), awaiting regulatory approval and FID. Requires significant capital before guaranteed returns. | Could substantially increase Cheniere's LNG export capacity if successful. |

| Corpus Christi Liquefaction Midscale Trains 8 & 9 | Question Mark | FID approved June 2025, adding over 3 MTPA. Early construction/commissioning stages, requiring continued investment. Future market position uncertain. | Expands CCL capacity but dependent on project execution and market dynamics. |

| New Energy Transition Technologies (e.g., Carbon Capture, Hydrogen) | Question Mark | High growth potential, minimal current market share for Cheniere. Demands significant, potentially risky investment. | Positions Cheniere for future energy markets but carries early-stage adoption risks. |

| Uncontracted Future Capacity | Question Mark | Flexibility to capitalize on future demand, but risk of low utilization without secured contracts. | Offers growth potential but requires strategic contracting to mitigate risk. |

| New Geographic Markets/Customer Segments | Question Mark | High potential growth, requires substantial investment in infrastructure and market development. | Diversifies revenue streams and strengthens global market position if successful. |

BCG Matrix Data Sources

Our Cheniere Energy BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.