Cheniere Energy Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cheniere Energy Bundle

Cheniere Energy's marketing prowess is built on a foundation of strategic Product, Price, Place, and Promotion. This analysis delves into how they position their LNG offerings and navigate global markets.

Discover the intricate details of Cheniere's pricing strategies, their extensive distribution networks, and the promotional tactics that solidify their market leadership.

Unlock a comprehensive, ready-to-use Marketing Mix Analysis for Cheniere Energy, perfect for students, professionals, and anyone seeking to understand their competitive edge.

Product

Cheniere Energy's primary product is liquefied natural gas (LNG), created by cooling natural gas to -260°F (-162°C), drastically reducing its volume for easier global shipping. This transformation is key to their business, enabling the efficient movement of U.S. natural gas resources to international customers. Their value proposition centers on being a dependable supplier of this essential energy source, bridging the gap between North American supply and worldwide demand.

Cheniere Energy's LNG Terminal Services provide crucial liquefaction, storage, and loading capabilities at its Sabine Pass and Corpus Christi facilities. These services are vital for natural gas producers, enabling them to efficiently export their product to global markets. For example, in the first quarter of 2024, Cheniere's Sabine Pass facility exported approximately 3.8 million tonnes of LNG, highlighting the scale of these operations.

Long-term, take-or-pay contracts are central to Cheniere's product strategy, ensuring stable revenue. These agreements, often spanning 20 years or more, provide significant revenue predictability for Cheniere and supply reliability for its global customer base, insulating them from price swings in the spot market.

Cheniere reported that as of the first quarter of 2024, approximately 90% of its expected LNG volumes were contracted through 2030, with a significant portion extending well beyond that. This high contract coverage underscores the strength and stability of its product offering in the competitive LNG market.

Operational Reliability and Flexibility

Cheniere Energy highlights the operational reliability and delivery flexibility of its Liquefied Natural Gas (LNG) product, ensuring it meets varied customer needs. Their advanced terminals and prime U.S. Gulf Coast positioning enable prompt and consistent global shipments. This focus on dependable supply is crucial for energy consumers needing uninterrupted fuel for national security and industrial processes.

Cheniere's Sabine Pass terminal, for example, consistently operates at high utilization rates, demonstrating its reliability. In 2023, Cheniere exported approximately 46.8 million tonnes of LNG, showcasing significant delivery capacity and flexibility to diverse markets, including Europe and Asia. This consistent performance underpins their value proposition for energy buyers.

- Operational Reliability: High utilization rates at U.S. export facilities, such as Sabine Pass, underscore consistent performance.

- Delivery Flexibility: Ability to serve diverse global markets, including Europe and Asia, with timely shipments.

- Strategic Location: U.S. Gulf Coast positioning facilitates efficient access to global shipping lanes.

- Customer Focus: Meeting varied customer requirements through dependable and adaptable supply solutions.

Lower-Carbon Energy Solution

Cheniere is actively marketing its liquefied natural gas (LNG) as a lower-carbon energy alternative, particularly when contrasted with coal and oil. This positioning is crucial for supporting global energy transition objectives and appealing to environmentally conscious markets. By highlighting LNG's relative emissions advantages, Cheniere aims to capture demand from regions seeking to decarbonize their energy mix.

The company is demonstrably committed to reducing its own operational and supply chain emissions. Initiatives include investments in carbon capture technologies and efforts to minimize methane leakage throughout its liquefaction and transportation processes. These actions bolster the credibility of its lower-carbon energy claims.

This strategic focus on sustainability directly addresses increasing Environmental, Social, and Governance (ESG) investor and customer demands. For instance, Cheniere's Sabine Pass facility has been recognized for its efforts in emissions reduction, making its product more attractive to buyers prioritizing ESG performance. The company's 2023 sustainability report highlighted a reduction in Scope 1 and 2 emissions intensity.

Key aspects of Cheniere's lower-carbon energy solution include:

- Relative Emissions Advantage: LNG combustion produces significantly less carbon dioxide and fewer other pollutants compared to coal and oil.

- Operational Emission Reductions: Cheniere is investing in technologies and practices to lower greenhouse gas emissions from its LNG production facilities.

- Supply Chain Transparency: The company is working to improve visibility and reduce emissions across its entire LNG value chain.

- ESG Alignment: Cheniere's product offering is increasingly aligned with the growing demand for sustainable energy sources from investors and corporate customers.

Cheniere's product is liquefied natural gas (LNG), a crucial energy commodity that bridges U.S. supply with global demand. Their value proposition is built on being a reliable exporter of this transformed natural gas, which is cooled to -260°F (-162°C) for efficient transport. This allows for the movement of vast quantities of U.S. natural gas to international markets.

The company's product strategy relies heavily on long-term, take-or-pay contracts, ensuring predictable revenue streams. These agreements, often 20 years or more, offer stability for Cheniere and supply security for its customers, shielding them from spot market volatility. As of Q1 2024, approximately 90% of Cheniere's projected LNG volumes through 2030 were already contracted.

Cheniere markets its LNG as a lower-carbon alternative to coal and oil, aligning with global energy transition goals. The company actively invests in reducing its own operational emissions through technologies like carbon capture and methane leak reduction, enhancing the sustainability profile of its product. This focus addresses increasing ESG demands from investors and customers.

| Product Aspect | Description | Key Data/Fact |

|---|---|---|

| Core Offering | Liquefied Natural Gas (LNG) | Transformed natural gas cooled to -260°F (-162°C) for shipping. |

| Revenue Model | Long-term, Take-or-Pay Contracts | ~90% of expected LNG volumes contracted through 2030 (as of Q1 2024). |

| Sustainability Positioning | Lower-Carbon Energy Alternative | Relative emissions advantage over coal and oil; investing in operational emission reductions. |

| Operational Scale | LNG Export Facilities (Sabine Pass, Corpus Christi) | Sabine Pass exported ~3.8 million tonnes in Q1 2024; ~46.8 million tonnes exported in 2023. |

What is included in the product

This analysis offers a comprehensive examination of Cheniere Energy's marketing strategies across Product, Price, Place, and Promotion, providing actionable insights for strategic decision-making.

It delves into Cheniere's unique market positioning and competitive advantages, utilizing real-world data to inform a robust understanding of their marketing mix.

Streamlines understanding of Cheniere's LNG strategy by translating complex market dynamics into actionable 4Ps insights, addressing the pain point of navigating a volatile global energy landscape.

Place

Cheniere's primary 'place' in its marketing mix are its massive LNG export terminals, Sabine Pass and Corpus Christi, situated on the U.S. Gulf Coast. These sites are crucial for channeling American natural gas to international buyers. As of early 2024, Cheniere operates six liquefaction trains across these two locations, with a total nameplate liquefaction capacity of approximately 45 million tonnes per annum (mtpa).

Cheniere's global distribution strategy hinges on efficient utilization of established maritime routes. Their Liquefied Natural Gas (LNG) is shipped from U.S. export facilities to major demand centers, primarily in Asia and Europe, utilizing a dedicated fleet of LNG carriers. This robust logistical framework is critical for accessing international markets.

As of early 2024, the global LNG shipping market is experiencing robust demand, with vessel charter rates reflecting this tightness. Cheniere, as a major exporter, benefits from this established network, with the majority of its LNG exports in 2023 reaching destinations in Europe and Asia, underscoring the importance of these key maritime corridors.

Cheniere's terminals benefit from strategic connections to key U.S. natural gas production basins via an extensive pipeline network. This integration, crucial for their 'Place' in the energy value chain, guarantees a steady supply of feedstock for liquefaction, underpinning their operational reliability.

International Customer Receiving Facilities

Cheniere's 'place' in its marketing mix is defined by its extensive global network of Liquefied Natural Gas (LNG) receiving terminals, which are operated by its diverse customer base. This network includes major utilities, national energy companies, and trading firms across the globe.

These facilities enable Cheniere to connect U.S. natural gas supply with demand centers in key international markets, spanning Asia, Europe, and Latin America. For instance, in 2024, Cheniere's Sabine Pass and Corpus Christi facilities were instrumental in supplying LNG to countries like South Korea and Spain, demonstrating their crucial role in global energy security.

- Global Reach: Cheniere's infrastructure supports the delivery of LNG to over 40 countries, solidifying its position as a major international supplier.

- Customer Diversity: The company serves a broad spectrum of clients, from large national oil companies to independent power producers.

- Strategic Locations: Terminal locations are strategically chosen to optimize access to U.S. production and key international consumption hubs.

Sophisticated Logistics and Infrastructure Hubs

Cheniere's 'Place' is defined by its extensive and integrated network of liquefied natural gas (LNG) facilities and associated infrastructure. This sophisticated system is crucial for its global operations, enabling the efficient movement of natural gas from source to market.

The company's infrastructure includes large-scale liquefaction plants, such as its Sabine Pass and Corpus Christi facilities, which are capable of processing vast quantities of natural gas. These sites are strategically located with direct access to pipeline networks and deep-water ports, facilitating the loading of LNG carriers.

Key aspects of Cheniere's place strategy include:

- Integrated Terminal Operations: Facilities designed for efficient gas reception, liquefaction, storage, and loading.

- Strategic Port Access: Locations on the U.S. Gulf Coast providing direct access to global shipping lanes.

- Pipeline Connectivity: Robust connections to North American natural gas supply basins.

- Vessel Loading Infrastructure: Specialized berths and equipment for the safe and efficient transfer of LNG to ships.

In 2024, Cheniere continued to expand its export capacity, with its Sabine Pass facility operating six liquefaction trains and its Corpus Christi facility operating three trains, with further expansion projects underway. This physical footprint underpins its ability to serve diverse international markets.

Cheniere's 'place' is fundamentally its physical infrastructure for liquefaction and export, primarily its Sabine Pass and Corpus Christi terminals. These U.S. Gulf Coast locations are vital for accessing both North American gas supply and global shipping routes.

By early 2024, Cheniere's Sabine Pass facility boasted six operational liquefaction trains, with Corpus Christi featuring three, collectively offering around 45 million tonnes per annum (mtpa) of export capacity. This physical presence is augmented by strategic pipeline connections to major U.S. gas basins, ensuring a consistent feedstock supply.

The company's global reach, enabled by these terminals, allows it to deliver LNG to over 40 countries, serving a diverse clientele including national energy companies and independent power producers.

| Facility | Operational Trains (Early 2024) | Approximate Nameplate Capacity (mtpa) |

|---|---|---|

| Sabine Pass | 6 | 30 |

| Corpus Christi | 3 | 15 |

| Total | 9 | 45 |

What You Preview Is What You Download

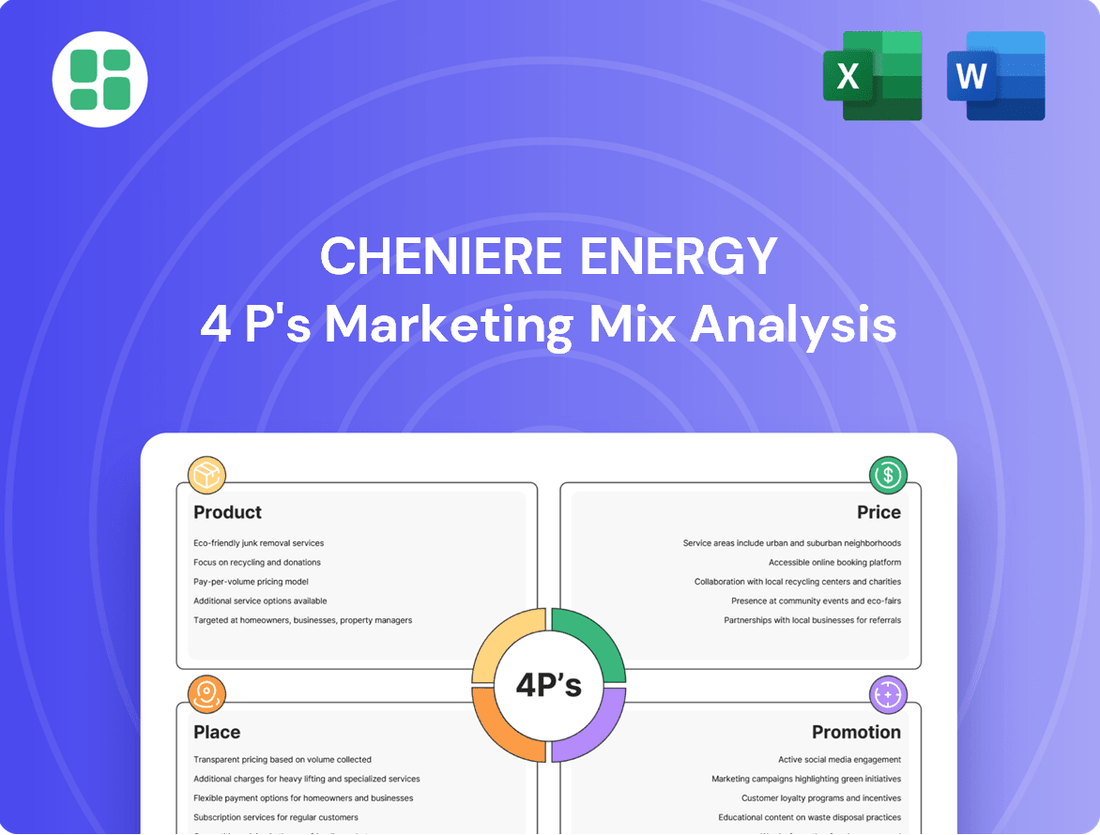

Cheniere Energy 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Cheniere Energy 4P's Marketing Mix Analysis covers product, price, place, and promotion strategies in detail. You'll gain immediate access to this ready-to-use report, empowering your strategic planning.

Promotion

Cheniere Energy's promotion in the B2B space centers on forging direct relationships with key players like major energy companies, utilities, and national governments. This approach emphasizes building trust through consistent operational performance and offering adaptable contractual terms to meet diverse client needs.

The company actively engages in direct negotiations and showcases its reliability to secure long-term agreements. This strategy is crucial given the extended sales cycles inherent in the energy sector, where multi-decade contracts are common, necessitating a deep understanding of client operations and market dynamics.

Cheniere Energy actively engages in global energy forums, a critical promotional element. In 2023, the company participated in over 20 major industry events, including the LNG Americas Summit and the World Gas Conference. This presence allows direct engagement with key stakeholders, fostering relationships essential for securing long-term LNG offtake agreements.

These forums are instrumental in showcasing Cheniere's operational excellence and its role in enhancing global energy security. By presenting their integrated infrastructure and liquefaction capabilities, they reinforce their position as a leading LNG exporter. Such high-profile participation helps shape industry dialogue and policy, influencing market perceptions.

Cheniere Energy prioritizes robust investor relations and transparent financial communications as a core promotional element. This involves consistent engagement through quarterly earnings calls, detailed investor presentations, and comprehensive annual reports to keep the financial community informed about their operational and financial performance, strategic direction, and market insights.

In 2024, Cheniere continued its proactive communication strategy, with earnings calls consistently highlighting progress on its Corpus Christi Stage 3 expansion project, which is on track for substantial completion in 2025. The company’s investor relations team actively disseminates timely press releases, ensuring stakeholders have access to critical updates, thereby building trust and attracting capital for ongoing development.

Corporate Social Responsibility (CSR) & ESG Storytelling

Cheniere Energy actively promotes its Corporate Social Responsibility (CSR) and Environmental, Social, and Governance (ESG) commitments. This strategy is crucial for attracting investors and customers who prioritize sustainability, thereby bolstering Cheniere's brand image and long-term resilience. By showcasing their dedication to environmental protection and community involvement, they align with prevailing global sustainability objectives.

The company's ESG storytelling is exemplified through its comprehensive reporting and tangible initiatives. For instance, in their 2023 ESG Report, Cheniere detailed progress on its emissions reduction targets and community investment programs. These efforts are not just about compliance; they are a core part of their promotional strategy, demonstrating a commitment that resonates with a growing segment of the market.

- Emissions Reduction: Cheniere is investing in technologies and operational improvements to lower its greenhouse gas emissions intensity, aligning with industry best practices and investor expectations for 2024 and beyond.

- Community Engagement: The company actively supports local communities where it operates through various programs, fostering positive relationships and demonstrating social responsibility, a key aspect of its 2024 outreach.

- Governance: Strong corporate governance practices are highlighted to ensure transparency and accountability, building trust with stakeholders and reinforcing their commitment to ethical operations through 2025.

- ESG Reporting: Comprehensive ESG reports, like the one released in 2023, provide data-driven insights into their performance, serving as a vital promotional tool for attracting ESG-focused capital.

Strategic Partnerships and Industry Thought Leadership

Cheniere actively cultivates strategic partnerships across the energy sector, from upstream producers to midstream pipeline operators and downstream shipping firms. These alliances are crucial for optimizing their integrated LNG value chain, ensuring reliable supply and expanding market access. For instance, Cheniere's 2024 agreements with various producers solidify their feedstock procurement, bolstering operational stability.

Thought leadership is another cornerstone of Cheniere's promotional strategy. By having executives actively participate in industry conferences and publish analyses, they influence the narrative around LNG's role in the global energy transition. This engagement positions Cheniere as a forward-thinking leader, particularly as the company navigates evolving regulatory landscapes and technological advancements in 2025.

- Strategic Alliances: Partnerships with producers and pipeline operators enhance supply chain resilience.

- Market Reach: Collaborations with shipping companies expand global LNG distribution capabilities.

- Industry Influence: Executive thought leadership shapes discourse on LNG's energy transition role.

- Brand Positioning: Thought leadership reinforces Cheniere's status as a premier LNG provider.

Cheniere's promotional efforts in the B2B arena are multifaceted, focusing on direct engagement, industry presence, and transparent communication. The company leverages global energy forums and robust investor relations to build trust and secure long-term contracts, vital for its substantial infrastructure projects like the Corpus Christi Stage 3 expansion, expected to see significant progress in 2025.

Its commitment to ESG principles and strategic partnerships further solidifies its market position. By actively reporting on emissions reduction and community engagement, as seen in its 2023 ESG Report, Cheniere appeals to sustainability-conscious investors and customers, reinforcing its image as a responsible energy leader through 2024 and into 2025.

| Promotional Activity | Key Engagement Channels | 2023/2024 Focus | Impact |

|---|---|---|---|

| Direct Relationship Building | Negotiations, Contractual Adaptability | Securing multi-decade LNG offtake agreements | Establishes long-term revenue streams |

| Industry Forum Participation | LNG Americas Summit, World Gas Conference | Showcasing operational excellence, energy security role | Enhances brand visibility and stakeholder relationships |

| Investor Relations | Earnings Calls, Annual Reports, Press Releases | Communicating progress on Corpus Christi Stage 3 (on track for 2025 completion) | Attracts capital, builds investor confidence |

| ESG & CSR Communication | ESG Reports, Community Investment Programs | Highlighting emissions reduction targets, community support | Appeals to ESG-focused investors, strengthens brand image |

Price

Cheniere's pricing strategy heavily relies on long-term, often 20-year, take-or-pay contracts for liquefaction and sales. These agreements are crucial for securing predictable revenue, with a fixed fee designed to recoup substantial capital expenditures and a variable component tied to natural gas benchmarks like Henry Hub, ensuring customers have long-term price visibility.

Cheniere Energy's Henry Hub-linked pricing model is a cornerstone of its marketing strategy, providing a transparent and market-driven approach for a significant portion of its liquefied natural gas (LNG) exports. This mechanism allows international customers to tap into the cost-competitiveness of U.S. natural gas. For instance, in early 2024, Henry Hub spot prices often hovered around $2.00-$3.00 per million British thermal units (MMBtu), offering a distinct advantage compared to many other global benchmarks.

This pricing structure directly connects the cost of Cheniere's LNG to the U.S. domestic natural gas market, making it highly appealing to global buyers. The liquidity and depth of the U.S. gas market, reflected in Henry Hub pricing, ensure a reliable and accessible supply. This transparency fosters trust and predictability for international partners seeking cost-effective energy solutions, a critical factor in securing long-term offtake agreements.

Beyond its robust long-term agreements, Cheniere actively participates in the spot market for its uncontracted liquefied natural gas (LNG) volumes. This strategy allows for opportunistic sales, maximizing revenue when market conditions are favorable.

Spot market transactions are directly influenced by current global LNG prices, which are highly sensitive to immediate supply and demand shifts. For instance, in early 2024, spot LNG prices in Asia saw significant volatility, with some benchmarks exceeding $10 per million British thermal units (MMbtu) due to weather events and geopolitical factors, presenting opportunities for Cheniere.

This flexibility enables Cheniere to adapt to market dynamics, potentially achieving higher profit margins during periods of constrained supply or increased demand, thereby enhancing its overall financial performance.

Infrastructure Capacity Reservation Fees

Beyond the fluctuating price of LNG itself, Cheniere's pricing structure incorporates a significant component: a fee for reserving and utilizing its premium liquefaction and export infrastructure. This ensures customers secure dedicated access to the terminal's services, irrespective of their actual LNG offtake volumes.

This capacity reservation fee is fundamental to Cheniere's business model, enabling the recovery of its substantial capital investments in sophisticated facilities and underpinning the long-term financial health of its operations.

For instance, Cheniere's Sabine Pass facility has a nameplate liquefaction capacity of approximately 22 million tonnes per annum (mtpa). The revenue generated from these reservation fees is vital for maintaining and expanding such large-scale, capital-intensive projects.

- Dedicated Access: Customers pay for guaranteed access to Cheniere's liquefaction and export capacity.

- Capital Recovery: Fees are essential for recouping the significant upfront investment in terminals.

- Financial Stability: Reservation fees provide a predictable revenue stream, crucial for ongoing operations and future development.

- Infrastructure Utilization: This model allows Cheniere to cover fixed costs even if contracted volumes fluctuate.

Global Market and Competitive Dynamics

Cheniere's pricing strategy is deeply intertwined with the global LNG market's competitive landscape. Regional demand fluctuations, geopolitical shifts, new supply projects coming online, and competitor pricing all directly impact Cheniere's ability to secure favorable contract terms and spot market prices. For instance, in early 2024, the market saw increased price volatility due to ongoing geopolitical tensions in Eastern Europe, which influenced shipping costs and supply availability, forcing Cheniere to adapt its pricing to remain competitive.

Maintaining a competitive edge is paramount for Cheniere to win new contracts and retain its market share. The company faces competition from established players and emerging exporters, all vying for a piece of the growing global demand. As of mid-2024, the global LNG market is projected to see continued growth, with demand in Asia, particularly China and India, remaining a key driver, creating both opportunities and intense competition for Cheniere.

- Global LNG Demand Growth: Projections indicate a steady increase in global LNG demand through 2025, driven by energy transition policies and industrial growth in emerging economies.

- Competitive Supply Landscape: New liquefaction projects in North America and other regions are expected to add significant supply to the market by 2025, intensifying competition.

- Price Sensitivity: Contract prices are highly sensitive to regional supply-demand balances and the cost of alternative fuels, requiring Cheniere to offer flexible and competitive pricing structures.

- Spot Market Volatility: The spot LNG market remains subject to rapid price swings influenced by weather events, unexpected outages, and geopolitical developments, impacting Cheniere's short-term revenue.

Cheniere's pricing is fundamentally structured around long-term, take-or-pay contracts, typically spanning 20 years. This provides revenue predictability by covering capital costs and offering a variable component linked to U.S. natural gas benchmarks like Henry Hub, ensuring customer price clarity.

The Henry Hub pricing model, common in early 2024 with prices around $2.00-$3.00 per MMBtu, makes U.S. LNG cost-competitive globally. This transparency builds trust with international buyers seeking stable energy sources.

Beyond contracted volumes, Cheniere leverages the spot market for uncontracted LNG, capitalizing on favorable price swings. For instance, in early 2024, Asian spot LNG prices could exceed $10 per MMBtu due to market volatility, offering profit opportunities.

A critical part of Cheniere's pricing is the infrastructure reservation fee, ensuring customers secure dedicated liquefaction and export capacity. This fee, vital for recouping substantial investments in facilities like Sabine Pass (22 mtpa capacity), provides stable revenue.

| Pricing Element | Description | Example (Early 2024) |

|---|---|---|

| Long-Term Contracts | 20-year take-or-pay agreements | Fixed fee + Henry Hub linked variable component |

| Henry Hub Pricing | Indexation to U.S. natural gas benchmark | Spot prices ~$2.00-$3.00/MMBtu |

| Spot Market Sales | Opportunistic sales of uncontracted volumes | Asian spot prices >$10/MMBtu possible |

| Capacity Reservation Fee | Fee for guaranteed access to liquefaction/export infrastructure | Essential for capital recovery on facilities like Sabine Pass |

4P's Marketing Mix Analysis Data Sources

Our Cheniere Energy 4P's Marketing Mix Analysis is grounded in a comprehensive review of official company disclosures, including SEC filings, investor presentations, and annual reports. We also incorporate insights from industry analysis, market research, and news releases to capture their strategic positioning and operational activities.