Cheniere Energy Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cheniere Energy Bundle

Cheniere Energy operates in a dynamic market influenced by significant bargaining power from its buyers, particularly large utility companies and industrial consumers. The threat of new entrants, while present, is somewhat mitigated by the substantial capital requirements for LNG infrastructure. Understanding these forces is crucial for strategic planning.

The complete report reveals the real forces shaping Cheniere Energy’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Cheniere Energy's reliance on natural gas as its core feedstock means the bargaining power of its suppliers is a significant factor. The concentration of natural gas producers, especially in key supply basins like the Appalachian Basin, can create leverage for these suppliers. In 2024, the U.S. continued to be a major global producer of natural gas, with production figures consistently high, but regional pipeline constraints and localized demand can still empower certain suppliers.

Cheniere's access to natural gas from diverse U.S. basins, including the Permian, Haynesville, and Marcellus, significantly dilutes supplier bargaining power. The vast and interconnected U.S. pipeline infrastructure, spanning over 300,000 miles, provides Cheniere with considerable flexibility in sourcing its liquefied natural gas (LNG) feedstock. This broad access ensures competitive pricing and reduces reliance on any single gas producer or pipeline operator, contributing to supply stability.

Switching costs for Cheniere Energy with its natural gas suppliers are generally low due to the commoditized nature of natural gas. This means Cheniere can often find alternative suppliers if needed without incurring massive penalties.

However, the significant investment in long-term transportation agreements and dedicated pipeline infrastructure creates a degree of stickiness. Breaking these established logistical chains to switch suppliers can lead to substantial transitional costs or temporary disruptions in supply, impacting operational efficiency.

Uniqueness of Specialized Equipment and Services

Cheniere Energy's reliance on highly specialized equipment for liquefaction and terminal operations, alongside unique engineering and construction services, significantly bolsters supplier bargaining power. For instance, the complex nature of constructing liquefied natural gas (LNG) terminals means few contractors possess the necessary expertise and track record. This limited pool of qualified suppliers, such as Bechtel, which has been involved in major LNG terminal projects, can command higher prices and more favorable contract terms.

The barriers to entry for companies providing these specialized LNG infrastructure components and services are substantial. Developing the technology for liquefaction, building large-scale regasification terminals, and managing the logistics of LNG shipping require immense capital investment and advanced technical know-how. This scarcity of capable suppliers means Cheniere has fewer alternatives, giving these suppliers considerable leverage in negotiations.

In 2024, the global demand for LNG infrastructure continued to drive demand for these specialized services. Companies like Cheniere, expanding their export capacity, face intense competition for these limited resources. This dynamic is reflected in the project costs and timelines for new LNG facilities, where the availability and pricing of specialized construction and equipment suppliers play a critical role.

- Specialized Equipment: Liquefaction units, cryogenic storage tanks, and specialized vessels are critical and have limited suppliers.

- Engineering & Construction: Firms with proven LNG terminal construction experience, like Bechtel, hold significant leverage.

- High Barriers to Entry: The technical complexity and capital requirements for LNG infrastructure suppliers create a concentrated market.

- Impact on Costs: Supplier power directly influences the capital expenditure for Cheniere's expansion projects.

Forward Integration Threat by Suppliers

The threat of suppliers integrating forward into liquefaction and export is a notable, albeit less prevalent, concern for Cheniere Energy. Large natural gas producers could, in theory, establish their own LNG export terminals, directly competing with Cheniere. This would essentially turn suppliers into rivals.

However, this forward integration threat is significantly mitigated by the enormous capital investment and complex regulatory processes required to build and operate LNG export facilities. For instance, the construction of a single liquefaction train can cost billions of dollars, and obtaining the necessary permits and approvals is a lengthy and intricate undertaking. These substantial barriers to entry make it challenging even for large upstream companies to pursue this strategy, thus limiting the immediate competitive pressure on Cheniere.

- High Capital Expenditure: Building an LNG export terminal involves billions of dollars in upfront investment, a significant deterrent for potential entrants.

- Regulatory Hurdles: Navigating environmental reviews, permitting, and international trade regulations presents a complex and time-consuming challenge.

- Technical Expertise: Operating liquefaction facilities requires specialized engineering and operational knowledge, which may not be readily available to all natural gas producers.

- Economies of Scale: Existing players like Cheniere benefit from established infrastructure and operational efficiencies that are difficult for new entrants to replicate quickly.

Cheniere's bargaining power with its natural gas suppliers is moderated by the vast U.S. supply network, which spans over 300,000 miles of pipeline, offering significant sourcing flexibility. While regional pipeline constraints can empower some suppliers, Cheniere's access to diverse basins like the Marcellus and Permian generally keeps supplier leverage in check.

The bargaining power of suppliers for specialized LNG infrastructure and services is considerably higher due to substantial barriers to entry, including immense capital requirements and technical expertise. For example, firms like Bechtel, with proven LNG terminal construction experience, hold significant leverage, impacting project costs for companies like Cheniere in 2024.

The threat of upstream suppliers integrating forward into LNG exports is limited by the billions of dollars in capital expenditure and complex regulatory hurdles involved in building and operating export facilities, making it a less prevalent concern for Cheniere.

| Factor | Impact on Cheniere | 2024 Context |

|---|---|---|

| Supplier Concentration (Natural Gas) | Moderate | U.S. production remains high, but regional constraints can shift power. |

| Supplier Specialization (LNG Infrastructure) | High | Limited qualified suppliers for complex LNG terminal construction and equipment. |

| Switching Costs (Natural Gas) | Low (commoditized) | Generally easy to find alternative gas suppliers. |

| Switching Costs (Infrastructure) | High (logistics) | Significant costs or disruptions if established pipeline/transportation agreements are altered. |

| Forward Integration Threat | Low | Enormous capital and regulatory barriers deter upstream companies from building their own export facilities. |

What is included in the product

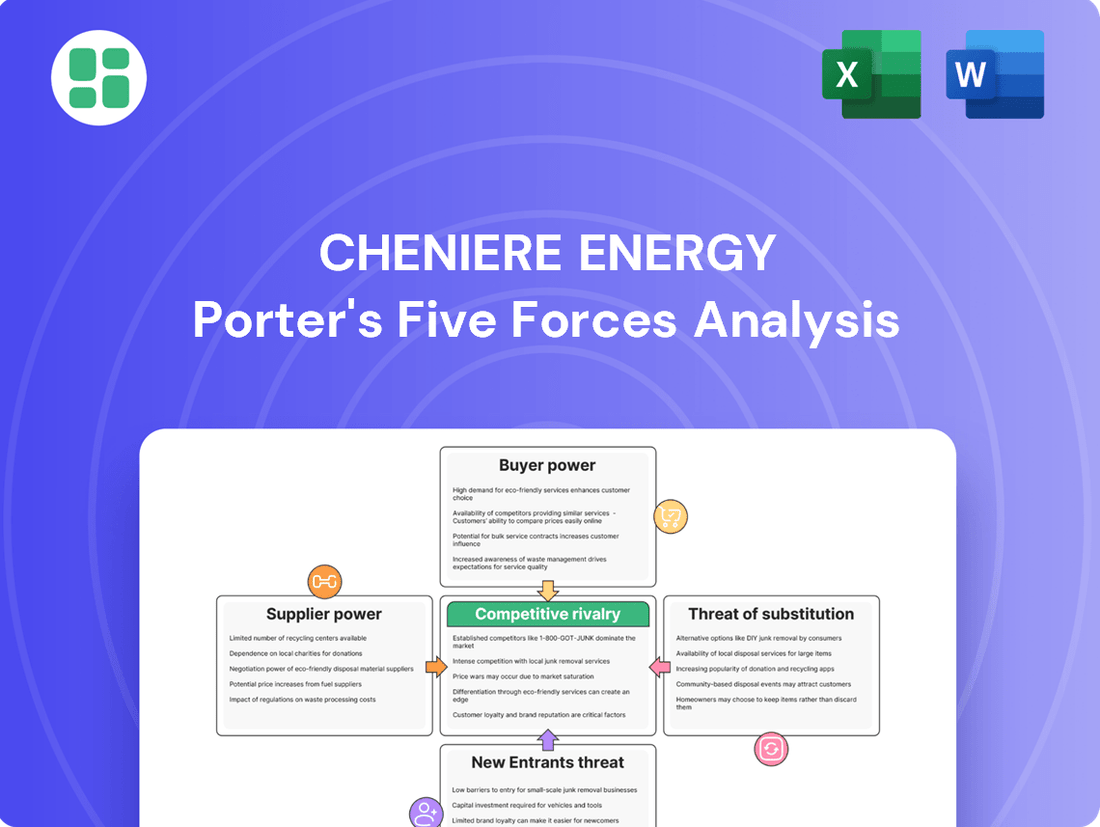

This Porter's Five Forces analysis for Cheniere Energy examines the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the LNG market.

Instantly assess competitive threats and opportunities in the LNG market with a dynamic Cheniere Energy Porter's Five Forces model.

Customers Bargaining Power

Cheniere's customer base is primarily composed of substantial entities like global utilities, major energy corporations, and international trading houses, with a significant concentration in the Asian and European markets. These large buyers, while driving substantial demand, possess the leverage to influence pricing, particularly when the market experiences an oversupply of Liquefied Natural Gas (LNG).

Despite this concentration, the escalating worldwide demand for LNG, fueled by the pursuit of energy security and decarbonization initiatives, generally bolsters Cheniere's negotiating power. For instance, in 2023, global LNG demand reached record levels, underscoring the robust market for Cheniere's products.

Cheniere's reliance on long-term, take-or-pay contracts significantly shields it from customer bargaining power. Around 95% of its LNG output is committed under these agreements, meaning customers pay for the contracted volume regardless of whether they actually receive it.

This contractual structure provides Cheniere with a predictable and stable revenue stream, insulating it from the typical pressures customers might exert on pricing or delivery volumes. The commitment from buyers under these terms effectively locks in demand and cash flow, diminishing their ability to negotiate more favorable terms once the contract is in place.

The bargaining power of Cheniere's customers is influenced by the availability of alternative Liquefied Natural Gas (LNG) suppliers. Major players like QatarEnergy, Woodside Energy, and numerous other U.S. and global producers offer diverse supply options.

The global LNG market is projected to see a significant influx of new capacity between 2025 and 2028. This expansion could further bolster customer bargaining power by increasing supply choices and fostering more competitive pricing dynamics.

Customer Switching Costs

Customer switching costs for LNG suppliers like Cheniere Energy are substantial. These include the significant investments required for regasification terminals, which are specialized and costly infrastructure. For instance, building a new LNG import terminal can cost billions of dollars, making it a major barrier for buyers wanting to switch suppliers.

Furthermore, existing contractual obligations with Cheniere often lock customers into long-term agreements. These contracts, frequently spanning 10-20 years, can carry substantial penalties for early termination, effectively increasing the cost of switching. The complexity of establishing new supply chain logistics, including transportation and distribution networks, also adds to these switching costs.

The long-term nature of LNG deals is a key factor. For example, many of Cheniere's contracts, such as those with European buyers, extend well into the 2030s and beyond. Renegotiating or breaking these agreements to switch suppliers can lead to significant financial repercussions, reinforcing customer loyalty and reducing their bargaining power.

These high switching costs translate into a lower bargaining power for customers. They are less likely to demand lower prices or more favorable terms when the cost and complexity of changing suppliers are so high.

- High Capital Investment: Regasification terminals represent a significant upfront cost for customers, often running into hundreds of millions or even billions of dollars.

- Contractual Lock-ins: Long-term LNG supply agreements, typically 10-20 years, impose penalties for early termination, making it financially prohibitive to switch.

- Supply Chain Disruption: Establishing new logistics for transportation, storage, and distribution creates operational complexities and costs for customers seeking alternative suppliers.

- Limited Supplier Options: In certain regions, the number of available LNG suppliers and regasification facilities can be limited, further constraining customer choice and bargaining power.

Price Sensitivity of End-Users

While Cheniere's primary customers are sophisticated energy companies, the ultimate demand for Liquefied Natural Gas (LNG) is shaped by the price sensitivity of the end-users. These end-users, such as power plants and industrial facilities, constantly evaluate the cost-effectiveness of LNG against alternative energy sources. For instance, in early 2024, global LNG spot prices experienced volatility, with some regions seeing prices dip below $2 per million British thermal units (MMBtu), making LNG highly competitive. Conversely, during periods of higher pricing, the attractiveness of LNG can diminish, potentially influencing customers' decisions on new long-term contracts or their flexibility within existing agreements.

The price sensitivity of these ultimate consumers directly impacts Cheniere's customer base. If end-users find LNG too expensive compared to natural gas pipelines or other fuels, the demand for Cheniere's exported LNG could weaken. This indirect pressure means that Cheniere must remain competitive in its pricing, even though its direct contracts are with large corporations. For example, a significant drop in industrial production in a key importing region could reduce overall energy demand, indirectly affecting Cheniere's ability to secure favorable contract terms.

- End-User Price Sensitivity: The willingness of power generators and industrial users to purchase LNG is heavily influenced by its price relative to other fuels.

- Global LNG Spot Price Impact: Fluctuations in global LNG spot prices, which can vary significantly month-to-month, directly affect the attractiveness of LNG for end-users.

- Contract Negotiation Leverage: Price-sensitive end-users may exert pressure on Cheniere's direct customers, potentially limiting their willingness to commit to new long-term contracts or demanding more flexible terms in existing ones.

- Indirect Demand Influence: The ultimate demand for Cheniere's LNG is indirectly shaped by the cost considerations of the final consumers of energy, impacting the overall market dynamics.

Cheniere's customers, primarily large global energy firms, possess considerable bargaining power due to the availability of alternative LNG suppliers and the potential for increased global capacity. However, this power is significantly mitigated by the high switching costs associated with LNG infrastructure and long-term contractual commitments.

The extensive use of take-or-pay contracts, covering approximately 95% of Cheniere's LNG output, effectively locks in revenue and reduces customer leverage by ensuring payment regardless of actual offtake. This contractual insulation is a critical factor in limiting customer bargaining power.

While end-user price sensitivity can indirectly influence negotiations, the substantial capital investment required for regasification terminals and the financial penalties for early contract termination create significant barriers for customers looking to switch suppliers, thereby diminishing their overall bargaining strength.

Preview Before You Purchase

Cheniere Energy Porter's Five Forces Analysis

This preview shows the exact Cheniere Energy Porter's Five Forces Analysis you'll receive immediately after purchase, detailing the competitive landscape of the LNG export market. You'll gain insights into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry. This comprehensive document is ready for your immediate use, offering a thorough understanding of the strategic forces shaping Cheniere's operations.

Rivalry Among Competitors

The global liquefied natural gas (LNG) market features a mix of formidable competitors, including major state-owned enterprises and integrated energy giants. Cheniere Energy, while the leading U.S. LNG exporter and the second largest globally, operates in a highly competitive landscape. Key rivals such as QatarEnergy, Woodside Energy, Shell, and ExxonMobil possess significant scale and market influence.

The global liquefied natural gas (LNG) market is on a strong upward trajectory, with demand expected to continue its climb. This surge is particularly evident in Asia and Europe, fueled by a dual focus on energy security and the ongoing shift from coal to cleaner energy sources. This robust growth paints a promising picture for companies like Cheniere Energy, signaling ample opportunities for expansion and increased market penetration.

However, this attractive growth environment also acts as a magnet for new players and increased capacity additions. As more companies enter the market or existing ones expand their operations, the competition for securing market share intensifies. This dynamic means that while the pie is getting bigger, the fight for each slice will become more vigorous, directly impacting competitive rivalry within the industry.

Indeed, the global LNG trade demonstrated this expansion, growing by 2.4% in 2024. This statistic underscores the market's vitality and the increasing global reliance on LNG. For Cheniere, this growth presents both the chance to capitalize on rising demand and the challenge of navigating an increasingly crowded and competitive landscape.

While Liquefied Natural Gas (LNG) is fundamentally a commoditized product with limited inherent differentiation, competition in this sector often pivots to factors beyond the molecule itself. Cheniere Energy, a key player, distinguishes itself through its emphasis on reliable supply chains and extensive, robust liquefaction and regasification infrastructure. This focus on operational excellence and infrastructure reliability becomes a crucial differentiator in a market where consistent delivery is paramount for customers.

High Fixed Costs and Exit Barriers

The LNG liquefaction and export sector is characterized by extremely high fixed costs. Building an LNG terminal, for instance, can cost billions of dollars, with Cheniere's Sabine Pass facility representing a significant investment. These substantial upfront capital expenditures mean that once a facility is operational, companies are compelled to keep it running to amortize those costs, even if market conditions are unfavorable.

These immense investments in specialized infrastructure, such as liquefaction plants and regasification terminals, create formidable exit barriers. The assets are highly specific to the LNG industry and have limited alternative uses, making it difficult and costly for companies to divest or repurpose them. This situation forces players to remain in the market, contributing to sustained competitive rivalry.

- High Capital Intensity: The construction of LNG export terminals requires billions in upfront investment, such as Cheniere's Corpus Christi expansion projects.

- Specialized Assets: LNG infrastructure is highly specialized, leading to significant costs and difficulties in repurposing or selling assets if a company decides to exit the market.

- Operational Imperative: High fixed costs incentivize companies to operate continuously to recover investments, intensifying competition even during periods of lower demand or pricing.

Geopolitical Factors and Trade Policies

Geopolitical events and evolving trade policies are a significant force shaping Cheniere's competitive environment. For instance, Europe's concerted effort to reduce its reliance on Russian natural gas, a trend that accelerated in 2022 and continued through 2023 and 2024, has created substantial demand for Liquefied Natural Gas (LNG) from alternative suppliers like Cheniere.

The U.S. Department of Energy's ongoing review of LNG export authorizations also directly impacts market access and competitive positioning. In early 2024, the DOE announced a pause on certain new LNG export approvals, citing the need to consider climate impacts and economic factors more thoroughly. This decision could potentially slow the pace of new project development and impact the global supply of U.S. LNG, directly affecting Cheniere's future growth and competitive standing.

- Europe's Diversification: Increased LNG imports by European nations, driven by energy security concerns, have boosted demand for U.S. LNG exports, benefiting Cheniere.

- U.S. Export Policy: The DOE's review of LNG export authorizations, including the pause announced in early 2024, introduces uncertainty and can alter supply-demand balances, influencing Cheniere's market access.

- Global Supply Dynamics: Geopolitical shifts can rapidly change the availability and pricing of LNG globally, creating both opportunities and challenges for Cheniere as a major exporter.

The competitive rivalry within the global LNG market is intense, with Cheniere Energy facing established players like QatarEnergy and emerging exporters. While the market grew by 2.4% in 2024, this expansion attracts new capacity and intensifies the fight for market share.

Cheniere differentiates itself through reliable infrastructure and operational excellence, crucial in a commoditized market. However, the massive capital investment required for LNG terminals, like Cheniere's Sabine Pass, creates high exit barriers, ensuring sustained competition as companies must operate facilities to recoup costs.

| Competitor | Approximate 2024 LNG Export Capacity (MTPA) | Key Markets |

|---|---|---|

| Cheniere Energy | ~52 | Europe, Asia |

| QatarEnergy | ~100+ | Asia, Europe |

| Woodside Energy | ~30+ | Asia |

| Shell | ~40+ | Global |

| ExxonMobil | ~20+ | Global |

SSubstitutes Threaten

For regions with robust pipeline networks, such as much of Europe and North America, natural gas delivered via pipeline directly competes with Liquefied Natural Gas (LNG). This established infrastructure offers a readily available alternative, potentially dampening demand for LNG in these connected markets. In 2023, Europe's pipeline imports of natural gas remained significant, though the reliance shifted due to geopolitical events.

However, the threat of pipeline natural gas as a substitute for LNG is evolving. Geopolitical considerations and a strong push for energy security and supply diversification have significantly boosted the strategic importance and demand for LNG globally. This trend is likely to continue as nations seek to mitigate risks associated with single-source pipeline supplies.

The increasing viability and adoption of renewable energy sources like solar and wind present a significant long-term threat to natural gas demand in power generation. As renewables become more cost-competitive, they directly substitute for natural gas in electricity production, a key market for Cheniere. For example, by the end of 2023, global renewable energy capacity additions reached a record high, with solar PV alone accounting for over two-thirds of the growth, according to the International Energy Agency (IEA).

Furthermore, global decarbonization policies and substantial investments in renewable infrastructure, particularly in major LNG importing regions such as Europe and Asia, could dampen future demand for liquefied natural gas. The European Union, for instance, aims to significantly increase its renewable energy share, with targets for 2030 impacting long-term energy planning and potentially reducing reliance on imported fuels like LNG.

Coal and oil represent significant substitutes for natural gas, particularly in power generation and industrial applications. While natural gas burns cleaner than coal, the price volatility of Liquefied Natural Gas (LNG) can sometimes make coal a more cost-effective option for certain regions and industries. For instance, during periods of high LNG prices in 2024, some power plants that could switch fuels may have found coal to be more economically viable, impacting demand for natural gas.

Nuclear Power

Nuclear power presents a significant threat of substitution for natural gas, especially in electricity generation. As a low-carbon baseload power source, it directly competes with gas-fired power plants. For instance, Japan, a major LNG importer, is actively working to restart more nuclear reactors, aiming to bring 20-22 reactors back online by 2024, which could significantly curb its demand for imported natural gas.

South Korea is also expanding its nuclear capacity, with plans to build new reactors and extend the lifespan of existing ones, further reducing its reliance on LNG. This strategic shift by major energy consumers can directly impact the long-term demand for liquefied natural gas, a key market for Cheniere Energy.

- Nuclear power offers a stable, low-carbon electricity source, directly competing with natural gas power generation.

- Countries like Japan are reactivating nuclear plants to reduce their dependence on imported fuels, including LNG.

- South Korea's commitment to nuclear energy expansion also signals a potential decrease in future LNG import requirements.

Emerging Energy Technologies (e.g., Green Hydrogen)

Emerging energy technologies, like green hydrogen and advanced battery storage, pose a potential long-term threat. As these solutions mature and become more economically viable, they could offer competitive alternatives to natural gas, especially in sectors that are challenging to decarbonize. This maturation could lead to a reduction in future demand for Liquefied Natural Gas (LNG).

For instance, by 2030, the International Energy Agency (IEA) projects that global green hydrogen production capacity could reach 35 million tonnes, a significant increase from current levels. This growth, coupled with advancements in battery technology, could directly impact the demand for natural gas in industrial processes and power generation, areas where Cheniere Energy is a major player.

- Green Hydrogen's Growing Potential: The IEA forecasts a substantial rise in green hydrogen production, potentially displacing natural gas in heavy industry.

- Battery Storage Advancements: Improved battery technology offers another pathway to reduce reliance on natural gas for grid balancing and peak power.

- Cost Competitiveness is Key: The ultimate threat level depends on how quickly these substitute technologies achieve cost parity with natural gas.

The threat of substitutes for Cheniere Energy's Liquefied Natural Gas (LNG) is multifaceted, encompassing traditional energy sources and emerging technologies. Pipeline natural gas remains a direct substitute in regions with well-developed infrastructure, though geopolitical shifts are increasing LNG's strategic appeal. Renewables like solar and wind are increasingly cost-competitive, directly displacing natural gas in power generation, with global renewable capacity additions hitting record highs in 2023. Coal and oil also serve as substitutes, particularly when LNG prices spike, making them economically viable alternatives in certain contexts. Nuclear power, a low-carbon baseload source, directly competes with gas-fired plants, with countries like Japan actively restarting reactors to reduce LNG reliance.

Emerging technologies such as green hydrogen and advanced battery storage represent a growing long-term threat. As these solutions mature and become more cost-effective, they are poised to offer competitive alternatives to natural gas, especially in hard-to-decarbonize sectors. The International Energy Agency (IEA) projects a significant increase in global green hydrogen production capacity by 2030, which, alongside battery technology advancements, could curb future demand for LNG in industrial processes and power generation.

| Substitute Energy Source | Key Impact on LNG Demand | Relevant 2023/2024 Data/Projections |

|---|---|---|

| Pipeline Natural Gas | Direct competition in connected markets, but geopolitical factors are increasing LNG's strategic value. | Europe's pipeline imports remained significant in 2023, with evolving supply dynamics. |

| Renewable Energy (Solar, Wind) | Increasing cost-competitiveness directly displaces natural gas in power generation. | Global renewable capacity additions reached a record high in 2023, with solar PV leading growth (IEA). |

| Coal & Oil | Economic substitutes when LNG prices are high, particularly in power generation. | Periods of high LNG prices in 2024 may have made coal more economically viable for some dual-fuel plants. |

| Nuclear Power | Low-carbon baseload alternative, directly competing with gas-fired power plants. | Japan aimed to restart 20-22 nuclear reactors by 2024 to reduce imported fuel reliance. |

| Green Hydrogen | Potential long-term displacement in industrial processes and power generation. | IEA projects global green hydrogen production capacity could reach 35 million tonnes by 2030. |

Entrants Threaten

The development of LNG liquefaction and export terminals demands enormous capital outlays, frequently reaching tens of billions of dollars. This substantial financial barrier significantly deters new entrants from entering the market. For example, Cheniere's Sabine Pass and Corpus Christi facilities represented multi-billion dollar investments, illustrating the scale of capital required.

New entrants into the liquefied natural gas (LNG) export market, like Cheniere Energy operates in, face a formidable hurdle in the extensive regulatory approvals and permitting processes. These aren't quick checkboxes; they involve years of meticulous environmental impact studies, safety reviews, and securing rights-of-way. For instance, obtaining a Free Trade Agreement (FTA) authorization from the U.S. Department of Energy, a critical step for LNG exports, can be a protracted affair, as seen with projects navigating this pathway.

The sheer complexity and duration of these governmental and community consultations create significant barriers. Potential competitors must contend with evolving environmental regulations and the need for broad public consensus, which can introduce substantial delays and cost overruns. This lengthy and uncertain timeline effectively deters many smaller or less capitalized players from even attempting to enter the market, thereby protecting established companies like Cheniere.

New entrants face significant hurdles in securing reliable, long-term access to sufficient natural gas feedstock. This is a major barrier, as the supply chain for natural gas is complex and requires substantial investment to establish.

Furthermore, connecting to existing pipeline infrastructure is crucial for efficient transportation and delivery. Cheniere has already built these essential connections and cultivated strong relationships within the industry, making it difficult for newcomers to match their established network.

In 2024, the ongoing development of new LNG export terminals highlights the capital-intensive nature of this sector, requiring billions of dollars in upfront investment for infrastructure and feedstock agreements.

Technological Expertise and Operational Complexity

Operating large-scale Liquefied Natural Gas (LNG) liquefaction facilities demands a high degree of specialized technological expertise and intricate operational capabilities. The significant know-how needed to design, construct, and safely manage these complex plants acts as a substantial barrier to entry. This expertise is typically cultivated over many years of hands-on experience and considerable investment in research and development.

For Cheniere Energy, this translates into a formidable entry barrier for potential competitors. The capital expenditure for a single LNG export terminal can easily exceed $10 billion, a figure that only the most established and well-funded entities can consider. For instance, Cheniere's Sabine Pass facility, one of the largest in the world, represents a massive investment in advanced engineering and operational infrastructure.

- Specialized Engineering: Designing and building liquefaction trains requires deep knowledge of cryogenic processes, materials science, and safety protocols.

- Operational Know-How: Safely and efficiently operating these facilities involves managing complex machinery, stringent safety standards, and a highly skilled workforce.

- Regulatory Hurdles: Obtaining permits and approvals for LNG facilities is a lengthy and complex process, often requiring years of engagement with various regulatory bodies.

- Capital Intensity: The immense upfront capital required to construct LNG export terminals is a significant deterrent for new players.

Established Long-Term Contracts and Market Access

Established players like Cheniere Energy have a significant advantage due to long-term, take-or-pay contracts. For instance, Cheniere has secured a substantial portion of its liquefaction capacity through these agreements, often spanning 20 years or more, with major global energy companies. This effectively locks in demand and revenue streams for decades to come.

New entrants face considerable hurdles in securing similar long-term contracts. Competing against incumbents with established market access, a proven operational history, and existing relationships with creditworthy buyers is exceptionally challenging. These entrenched contracts create a formidable barrier, making it difficult for new companies to gain a foothold and guarantee their own future demand.

- Long-Term Contract Lock-in: Cheniere's Sabine Pass and Corpus Christi facilities have a high percentage of their export capacity contracted through long-term agreements, providing revenue visibility.

- Buyer Creditworthiness: Contracts are typically with investment-grade counterparties, reducing counterparty risk for established players.

- Market Access Barrier: New entrants must replicate these strong buyer relationships and secure similar long-term commitments to compete effectively.

The threat of new entrants in the LNG export market, where Cheniere Energy operates, is significantly dampened by the immense capital requirements. Building an LNG export terminal can easily cost over $10 billion, a sum that acts as a substantial deterrent for most potential competitors. For example, Cheniere's own projects represent multi-billion dollar investments, underscoring this financial barrier. In 2024, the ongoing construction of new LNG facilities continues to highlight these massive upfront costs, reinforcing the capital-intensive nature of the industry.

New entrants also face considerable challenges in securing long-term, take-or-pay contracts with creditworthy buyers, a crucial element for revenue stability. Cheniere has already locked in a significant portion of its capacity through such agreements, often spanning two decades or more, making it difficult for newcomers to guarantee their own demand and compete effectively. This established contract base provides a significant advantage, limiting opportunities for new players to gain market access and secure future revenue streams.

| Factor | Impact on New Entrants | Cheniere's Position |

|---|---|---|

| Capital Intensity | Extremely High (>$10 billion per terminal) | Established, multi-terminal operator |

| Regulatory Approvals | Lengthy and complex (years for permits) | Navigated and secured multiple key authorizations |

| Feedstock Access & Infrastructure | Difficult to secure reliable supply and pipeline connections | Established supply chains and pipeline integration |

| Technological Expertise | Requires specialized knowledge in cryogenic processes and safety | Possesses deep operational know-how and experience |

| Long-Term Contracts | Challenging to secure comparable agreements | High percentage of capacity contracted long-term |

Porter's Five Forces Analysis Data Sources

Our Cheniere Energy Porter's Five Forces analysis is built upon a foundation of comprehensive data, including SEC filings, annual reports, investor presentations, and industry-specific market research from firms like S&P Global Platts and Wood Mackenzie.