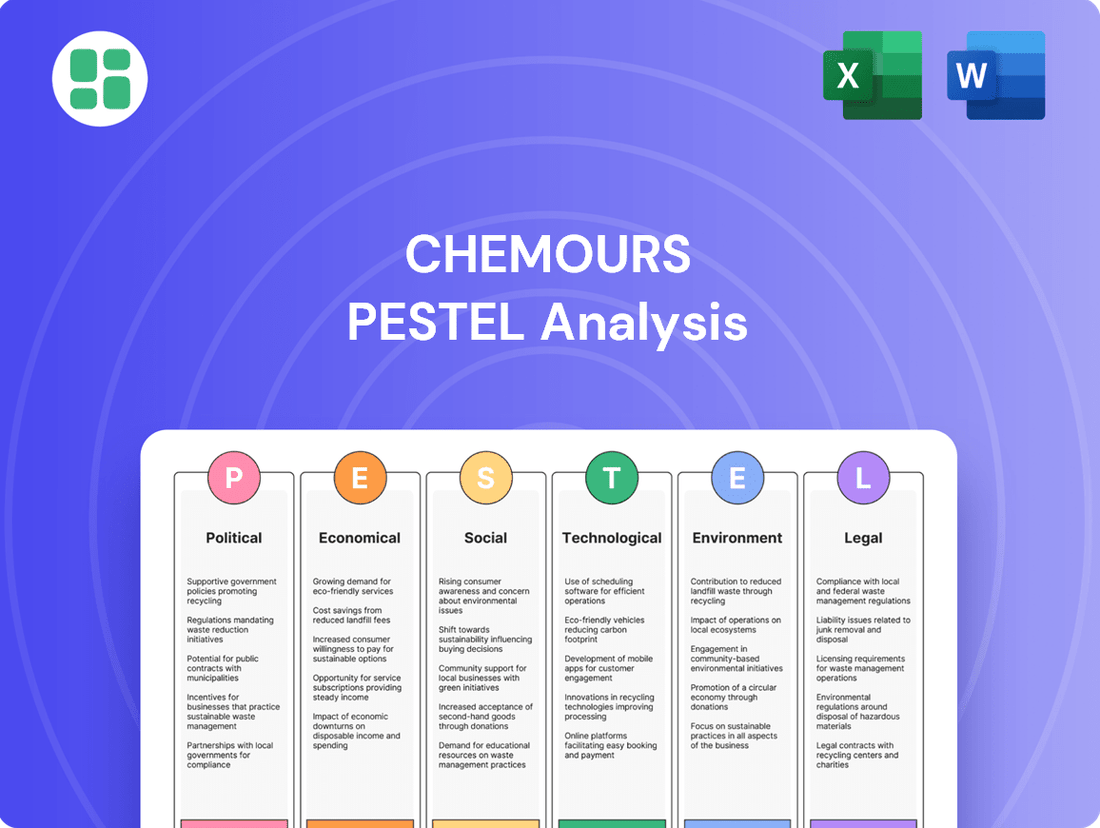

Chemours PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Chemours Bundle

Navigate the complex external forces shaping Chemours's future with our comprehensive PESTEL Analysis. Understand how political, economic, social, technological, environmental, and legal factors present both challenges and opportunities for the company. Gain actionable intelligence to refine your strategy and secure a competitive edge. Download the full version now for deep-dive insights.

Political factors

Chemours navigates a complex web of global chemical industry regulations, which translates into substantial compliance expenditures. These rules govern everything from how chemicals are made and what goes into them, to how waste is handled, directly affecting operational costs and the ability to sell products in different markets.

In 2023 alone, the company reported $43.2 million in costs associated with adhering to 68 international chemical safety regulations. This includes specific outlays for compliance with frameworks like Europe's REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) and China's Chemical Control Law, demonstrating the significant financial burden of international regulatory adherence.

Ongoing litigation surrounding Per- and Polyfluoroalkyl Substances (PFAS) poses a significant political and legal hurdle for companies like Chemours. These 'forever chemicals' have drawn intense scrutiny from government bodies worldwide.

In a notable development, Chemours, alongside DuPont and Corteva, reached an $875 million settlement with the State of New Jersey in August 2025. This agreement, spanning 25 years, aims to resolve environmental claims linked to PFAS contamination.

Chemours' share of this substantial settlement is $437.5 million, underscoring the immense financial liabilities and reputational risks companies face due to PFAS. Such governmental actions reflect a growing trend of holding manufacturers accountable for the environmental impact of these persistent chemicals.

Chemours' global operations are heavily influenced by international trade policies and tariffs. The company's exposure to tariffs across chemical manufacturing in seven countries highlights the direct impact on its cost structure and market access. In 2023 alone, Chemours reported $22.6 million in annual compliance costs related to trade agreements, underscoring the financial weight of these regulations.

Shifting geopolitical landscapes and evolving trade relationships present ongoing challenges. These dynamics can create disruptions in sourcing essential raw materials and affect the efficient distribution of Chemours' finished products, ultimately impacting the company's profitability and competitive positioning in key markets.

Government Incentives and Industrial Policy

Government incentives and industrial policies are increasingly shaping the chemical industry. Initiatives focused on promoting sustainable technologies and bolstering domestic manufacturing can present both significant opportunities and new operational requirements for companies like Chemours. For example, the US Inflation Reduction Act (IRA) of 2022 includes substantial tax credits for clean energy manufacturing and production, which could benefit Chemours' investments in lower-emission processes.

Chemours' strategic focus on developing and producing low-global warming potential (GWP) refrigerants, such as its Opteon™ portfolio, directly aligns with evolving global environmental regulations and policies. This proactive stance positions the company to potentially capitalize on future incentives or mandates that favor greener chemical solutions, as seen in the EU's F-gas regulations which aim to phase out high-GWP hydrofluorocarbons.

- Sustainable Technology Investment: Chemours invested approximately $1 billion in its Corpus Christi, Texas, facility expansion, which includes capacity for its Opteon™ low-GWP refrigerants, demonstrating a commitment to environmentally friendly product lines.

- Domestic Manufacturing Support: Government policies aimed at reshoring critical manufacturing, like those seen in the CHIPS and Science Act (though not directly chemical, it signals a broader trend), can encourage domestic production of advanced materials and chemicals.

- Regulatory Alignment: Chemours' titanium dioxide (TiO2) production also aims for greater sustainability, aligning with anticipated stricter environmental standards for chemical manufacturing globally, potentially reducing compliance costs in the long run.

- Green Chemistry Mandates: The increasing global push for circular economy principles and reduced chemical waste could lead to government mandates favoring companies with robust recycling and waste-reduction programs, a key area for chemical producers.

Lobbying and Political Influence

Chemours actively participates in lobbying to shape legislation and regulations affecting its operations, especially regarding PFAS. This strategic engagement aims to create a business environment that supports the company's interests.

In the second quarter of 2025, Chemours reported spending $760,000 on lobbying. These expenditures covered critical areas such as PFAS regulations, the supply of essential materials for national defense, and the advancement of renewable energy initiatives.

- Lobbying Expenditures: $760,000 in Q2 2025.

- Key Focus Areas: PFAS regulations, defense materials, renewable energy.

- Objective: To influence policy and regulatory frameworks.

Governmental scrutiny over PFAS continues to be a major political factor, leading to significant legal settlements and ongoing regulatory development. Chemours' substantial share of the $875 million New Jersey PFAS settlement in August 2025, amounting to $437.5 million, highlights the financial and reputational risks associated with these chemicals.

International trade policies and tariffs directly impact Chemours' cost structure and market access, with the company reporting $22.6 million in annual compliance costs related to trade agreements in 2023. Shifting geopolitical landscapes can disrupt raw material sourcing and product distribution.

Government incentives and industrial policies, such as the US Inflation Reduction Act, are increasingly influencing the chemical sector by promoting sustainable technologies and domestic manufacturing. Chemours' investment in low-GWP refrigerants like Opteon™ aligns with these trends, positioning the company to benefit from green initiatives.

Chemours actively engages in lobbying efforts, spending $760,000 in Q2 2025 on influencing policies related to PFAS regulations, defense materials, and renewable energy. This strategic participation aims to shape a favorable regulatory environment for its operations.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Chemours, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by identifying key trends and potential challenges and opportunities within Chemours's operating landscape.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering a clear overview of Chemours' external landscape to proactively address potential challenges.

Economic factors

The demand for Chemours' performance chemicals is intrinsically linked to the health of global industrial manufacturing and overall economic expansion. Sectors such as automotive, electronics, paints, and plastics are key drivers of sales volumes for Chemours' Titanium Technologies, Thermal & Specialized Solutions, and Advanced Performance Materials segments.

A strong global economic environment typically fuels increased demand for Chemours' essential chemical products. For instance, the International Monetary Fund (IMF) projected global growth to be 3.2% in 2024, a figure that directly influences industrial output and, consequently, the need for Chemours' offerings.

Chemours faces significant vulnerability due to the fluctuating costs of its raw materials, which represented a substantial portion, around 40-45%, of its overall production expenditures in 2023. This inherent exposure means that shifts in the market prices of key inputs can directly squeeze the company's profit margins.

For instance, price swings in essential fluorochemical feedstocks, critical components in many of Chemours' products, have a direct and immediate impact on operational profitability. Navigating this volatility requires Chemours to implement robust procurement strategies and dynamic pricing models to effectively manage and mitigate these inherent financial risks.

Ongoing inflationary pressures continue to impact operational costs for chemical manufacturers like Chemours, particularly in areas such as energy, raw materials, and labor. These rising expenses can directly affect profit margins if not effectively managed.

In response, Chemours has strategically implemented comprehensive cost-saving initiatives. The company is targeting over $250 million in reductions from 2024 through 2027, with a significant portion, approximately $125 million, anticipated by the close of 2025. These efforts are crucial for enhancing profitability and navigating the challenging economic landscape.

Currency Exchange Rate Fluctuations

Currency exchange rate fluctuations present a significant economic factor for Chemours, a global enterprise. As its operations span multiple countries, the company's financial performance is directly influenced by the relative strength and weakness of various currencies.

These movements can affect the cost of imported raw materials, the pricing of products sold internationally, and the ultimate value of profits earned in foreign markets when converted back to U.S. dollars. For instance, unfavorable currency movements were cited as a contributing factor to a decline in Chemours' Adjusted EBITDA in the first quarter of 2025.

- Impact on Sales: A stronger U.S. dollar can make Chemours' products more expensive for international buyers, potentially dampening sales volume.

- Cost of Goods Sold: Conversely, a weaker U.S. dollar can increase the cost of raw materials sourced from abroad.

- Foreign Earnings Translation: Fluctuations impact the reported value of earnings generated by overseas subsidiaries.

- Q1 2025 Performance: Unfavorable currency movements negatively affected Chemours' Adjusted EBITDA in early 2025.

Investment and Financing Environment

The investment and financing environment significantly shapes Chemours' strategic maneuvers. Fluctuations in interest rates and overall financial market health directly impact the cost and availability of capital for crucial investments. For instance, higher interest rates can make borrowing for R&D or capacity expansions more expensive, potentially slowing down growth initiatives.

Chemours' commitment to investing in high-growth sectors, such as advanced refrigerants for electric vehicles and cooling solutions for data centers, is particularly sensitive to this environment. A stable and accessible financing landscape is essential for the company to pursue these forward-looking opportunities. In 2024, the Federal Reserve maintained a cautious approach to interest rate cuts, with benchmark rates remaining elevated, presenting a more challenging financing backdrop compared to previous years.

- Interest Rate Environment: Elevated interest rates in 2024 increased the cost of debt financing for capital-intensive projects.

- Capital Availability: Access to capital markets for equity or debt issuance depends on investor confidence and market liquidity.

- Strategic Investment Funding: Chemours' ability to fund R&D in areas like sustainable refrigerants relies on a favorable investment climate.

Economic factors significantly influence Chemours' performance, with global growth directly correlating to demand for its chemical products. The company's profitability is also heavily impacted by raw material costs, which represented a substantial portion of its expenditures in 2023, and ongoing inflationary pressures are being addressed through cost-saving initiatives targeting over $250 million in reductions by 2027.

Currency fluctuations pose a notable risk, affecting international sales and the translation of foreign earnings, as seen with unfavorable movements impacting Q1 2025 Adjusted EBITDA. Furthermore, the investment and financing environment, characterized by elevated interest rates in 2024, influences the cost of capital for strategic investments in growth areas.

| Economic Factor | Impact on Chemours | Data Point/Trend (2023-2025) |

|---|---|---|

| Global Economic Growth | Drives demand for performance chemicals | IMF projected 3.2% global growth for 2024. |

| Raw Material Costs | Affects profit margins | Represented 40-45% of production costs in 2023. |

| Inflationary Pressures | Increases operational expenses | Targeting over $250 million in cost reductions by 2027. |

| Currency Exchange Rates | Impacts sales and foreign earnings | Unfavorable movements cited for Q1 2025 Adjusted EBITDA decline. |

| Interest Rates | Affects cost of capital | Elevated rates in 2024 increased debt financing costs. |

Full Version Awaits

Chemours PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Chemours PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain valuable insights into market dynamics and strategic considerations.

Sociological factors

Consumer and industrial demand is increasingly shifting towards more sustainable and eco-friendly chemical solutions. A 2023 Nielsen IQ survey indicated that 78% of consumers prioritize sustainability in chemical-related product purchases.

This trend is driving companies like Chemours to innovate, evidenced by their report of a 22% increase in eco-friendly product lines from 2022 to 2023. Such shifts encourage Chemours to focus on developing solutions in areas like low Global Warming Potential (GWP) refrigerants and more sustainable titanium dioxide (TiO2) production methods.

Public sentiment towards the chemical industry, especially regarding environmental and health concerns, directly affects Chemours' ability to operate. Negative perceptions can lead to increased regulatory scrutiny and community opposition.

The ongoing legal battles surrounding PFAS, often highlighted by public awareness campaigns focusing on their persistence, place significant pressure on Chemours. This necessitates a commitment to responsible production and open communication to maintain a positive brand image and strong community ties.

The availability of a skilled workforce is critical for Chemours, especially given demographic shifts in its key operating regions. For instance, in the US, the Bureau of Labor Statistics projected a 3.1% growth in chemical manufacturing jobs from 2022 to 2032, highlighting a competitive talent landscape.

Chemours' focus on being a 'Great Place to Work for All' and its investment in STEM education partnerships, like those with Historically Black Colleges and Universities (HBCUs), are strategic moves. These initiatives aim to build a diverse talent pipeline and secure future workforce needs, particularly in specialized areas crucial for chemical innovation.

Corporate Social Responsibility (CSR) Expectations

Stakeholders, from investors to local communities, are placing a higher premium on a company's Corporate Social Responsibility (CSR) efforts. This means Chemours, like many chemical companies, faces scrutiny regarding its environmental, social, and governance (ESG) practices. Meeting these evolving expectations is becoming a critical factor in maintaining brand reputation and securing investment capital.

Chemours' commitment to its 2030 Corporate Responsibility Commitment (CRC) goals, as detailed in its 2023 Sustainability Report, demonstrates a proactive approach to these societal demands. The report specifically outlines progress in key areas that resonate with stakeholders:

- Environmental Leadership: Chemours is working towards reducing greenhouse gas emissions and improving water stewardship, critical for a chemical manufacturer.

- Sustainable Solutions: The company is focused on developing products that contribute to a more sustainable future, aligning with global trends towards greener chemistry.

- Community Impact: Efforts to positively engage with and support the communities where Chemours operates are a significant part of its social responsibility.

- Being a Great Place to Work: Investing in employee well-being and fostering a positive work environment is also a key component of its CSR strategy.

Health and Safety Concerns

Societal concerns regarding chemical safety, particularly around substances like PFAS, significantly impact regulatory oversight and consumer acceptance of Chemours' products. Public awareness of potential health effects drives demand for stricter safety standards and transparency from chemical manufacturers.

Chemours faces the ongoing challenge of proving the safety of its operations and products to maintain public trust and adapt to evolving health regulations. For instance, in 2024, several US states continued to propose or enact stricter limits on PFAS in drinking water, directly affecting industries reliant on these chemicals.

- Growing public awareness of PFAS health risks.

- Increased regulatory scrutiny on chemical safety standards.

- Consumer demand for transparent and safe product manufacturing.

- Potential for reputational damage and market access restrictions due to safety concerns.

Societal expectations for corporate responsibility are intensifying, pushing Chemours to enhance its environmental, social, and governance (ESG) performance. A 2024 report by Morningstar indicated that ESG-focused funds saw a 15% inflow increase, demonstrating investor preference for sustainable companies.

Chemours' 2023 Sustainability Report highlights its commitment to reducing greenhouse gas emissions by 35% by 2030 and increasing its use of renewable energy. These goals directly address societal demands for climate action and responsible resource management.

The company's engagement with communities and focus on being a diverse employer are crucial for its social license to operate. Chemours' partnership with organizations like the National Urban League in 2024 aims to foster workforce development and support underserved communities.

Public perception of chemical safety, particularly regarding PFAS, remains a significant sociological factor. While Chemours is investing in remediation and product stewardship, ongoing public discourse and evolving regulations in 2024, such as proposed PFAS limits in consumer goods, necessitate continuous adaptation and transparent communication to maintain stakeholder trust.

Technological factors

Technological innovation is rapidly reshaping the refrigerant market, pushing for lower Global Warming Potential (GWP) alternatives. This shift is driven by both scientific progress and increasingly stringent environmental regulations worldwide.

Chemours' Opteon™ line of refrigerants is a prime example of this trend, capitalizing on the growing demand for climate-friendly solutions. The U.S. AIM Act, for instance, mandates significant reductions in HFCs, creating a substantial market opportunity for low-GWP products like Opteon™.

This transition represents a key growth driver for Chemours, with the company reporting strong sales in its Opteon™ portfolio. In the first quarter of 2024, Chemours saw a notable increase in its Advanced Performance Materials segment, largely attributed to the demand for these next-generation refrigerants.

Chemours is heavily invested in advanced materials crucial for booming sectors like semiconductors, AI, and EV batteries. These industries demand specialized, high-performance chemicals, which is why Chemours is prioritizing research and development and forging strategic alliances to stay ahead of technological advancements.

For instance, the semiconductor industry's need for increasingly sophisticated materials, driven by the demand for more powerful AI chips, directly benefits Chemours' portfolio. Similarly, the rapid expansion of the electric vehicle market, with its critical requirement for improved battery performance and safety, presents a significant growth avenue for Chemours' advanced material solutions.

Technological advancements are key for Chemours to lessen its environmental footprint and boost operational efficiency. The company is actively investing in new technologies for its titanium dioxide manufacturing, a core business segment. For instance, in 2023, Chemours announced plans to invest $200 million in its Washington, West Virginia facility to enhance sustainable production capabilities.

Chemours is also exploring clean hydrogen as a potential energy source, aiming to significantly cut energy intensity and greenhouse gas emissions across its operations. This strategic focus on innovation in manufacturing processes is designed to reduce waste and improve overall sustainability metrics, aligning with global environmental goals and market demands for greener products.

Digital Transformation and Automation

The chemical industry's embrace of digital transformation and automation is a significant technological factor. Companies like Chemours are leveraging these advancements to boost efficiency, improve safety protocols, and streamline supply chains. For instance, the global industrial automation market was projected to reach over $300 billion by 2024, indicating a strong industry-wide push towards these technologies.

These digital shifts enable better real-time monitoring of production processes, predictive maintenance to minimize downtime, and more sophisticated data analytics for optimizing resource allocation. This can lead to substantial cost savings and increased output, crucial for maintaining competitiveness in the global chemical market.

Chemours' strategic investments in digital capabilities are aimed at enhancing its manufacturing footprint and overall productivity. The company's focus on operational excellence inherently includes adopting advanced technologies to achieve these goals. The broader trend suggests that companies that effectively integrate digital tools will gain a significant advantage.

- Enhanced Operational Efficiency: Digital tools allow for more precise control and optimization of chemical processes, reducing waste and energy consumption.

- Improved Safety: Automation in hazardous environments minimizes human exposure to risks, a critical concern in chemical manufacturing.

- Supply Chain Optimization: Digital platforms enable better tracking, forecasting, and management of raw materials and finished goods, leading to more resilient supply chains.

- Data-Driven Decision Making: Advanced analytics derived from digital systems provide insights for strategic planning and operational adjustments.

Research and Development (R&D) Investment

Chemours' commitment to research and development is a cornerstone of its strategy for staying ahead in the chemical industry. This ongoing investment is crucial for creating innovative products that meet evolving market demands and environmental expectations. The company's focus on R&D ensures it can develop solutions that are not only effective but also sustainable, aligning with global trends towards greener chemistry.

The financial commitment to R&D highlights this strategic priority. In 2022, Chemours allocated $50 million specifically towards the research and development of sustainable technologies. This investment saw a significant increase in 2023, with the company dedicating $126 million to green technology R&D. These figures underscore a clear direction towards innovation that addresses both performance and environmental responsibility, positioning Chemours for future growth.

- 2022 R&D Investment: $50 million in sustainable technologies.

- 2023 R&D Investment: $126 million in green technology.

- Strategic Focus: Developing next-generation products and sustainable solutions.

- Market Alignment: Investing in areas that meet future market needs and sustainability goals.

Technological advancements are driving Chemours' focus on low Global Warming Potential (GWP) refrigerants like Opteon™, a key growth area. The company's investment in advanced materials for sectors such as semiconductors, AI, and EV batteries, valued in the billions, reflects this trend. Chemours is also investing in sustainable manufacturing, with a $200 million project at its Washington, West Virginia facility announced in 2023 to enhance green production.

Legal factors

Chemours is navigating a complex legal landscape due to widespread PFAS contamination. The company is involved in numerous class-action lawsuits and environmental claims brought forth by various states, all stemming from the production and use of these chemicals.

The financial implications of these legal battles are substantial. For instance, Chemours agreed to a significant $875 million settlement with New Jersey in August 2025 to address PFAS-related issues. This follows a prior $1.19 billion settlement reached with U.S. water providers in 2023, highlighting the escalating costs associated with these environmental liabilities.

Chemours operates under a stringent environmental regulatory landscape, including the Clean Air Act, Clean Water Act, and Resource Conservation and Recovery Act. These laws mandate strict controls on emissions, wastewater, and hazardous waste management, directly impacting its operational costs and compliance strategies.

Failure to adhere to these regulations can lead to significant financial repercussions. For instance, in 2023, Chemours settled with the EPA for $1.5 million related to violations of the Clean Air Act at its Corpus Christi, Texas facility, highlighting the substantial penalties for non-compliance.

Chemours' operations are heavily influenced by product liability and safety regulations worldwide. For instance, the U.S. Environmental Protection Agency (EPA) under the Toxic Substances Control Act (TSCA) continuously reviews and regulates chemical substances, impacting how Chemours develops and markets its products. Failure to comply can lead to significant fines and reputational damage.

In Europe, the Registration, Evaluation, Authorisation and Restriction of Chemicals (REACH) regulation imposes strict requirements for chemical safety data and risk management. As of early 2024, REACH continues to evolve, with ongoing assessments of various chemical groups that could affect Chemours' product portfolio and necessitate costly compliance measures.

Intellectual Property Rights and Patents

Chemours heavily relies on its intellectual property, particularly patents for key products like Opteon™ refrigerants and Ti-Pure™ titanium dioxide, to maintain its competitive edge. The company actively defends these patents through legal channels to prevent unauthorized use and safeguard its market position. In 2023, Chemours reported spending $285 million on research and development, a significant portion of which is dedicated to innovation and patent protection.

Legal enforcement of these intellectual property rights is paramount for Chemours. This includes actively monitoring the market for potential infringements and pursuing legal action when necessary. Failure to protect its patents could lead to competitors offering similar products, eroding Chemours' market share and profitability. The company's patent portfolio is a vital asset, contributing to its valuation and future growth prospects.

Key aspects of Chemours' legal strategy regarding intellectual property include:

- Patent Portfolio Management: Continuously evaluating and updating its patent portfolio to cover new innovations and technologies.

- Enforcement Actions: Proactively identifying and addressing patent infringements through legal means, including litigation.

- Licensing Agreements: Strategically entering into licensing agreements to generate revenue and expand the reach of its patented technologies.

- Trade Secret Protection: Implementing robust measures to protect proprietary information and trade secrets that are not publicly patented.

Securities Class Action Lawsuits

Chemours has been subject to significant legal scrutiny, including securities class action lawsuits filed by investors. For instance, a notable lawsuit was initiated in March 2024, stemming from an accounting probe and subsequent delays in financial filings. This legal action underscores the inherent risks Chemours faces concerning its corporate governance, the accuracy of its financial reporting, and its communication with investors.

These lawsuits are not isolated incidents but reflect broader challenges in maintaining investor confidence and adhering to stringent regulatory requirements. The financial implications of such litigation can be substantial, impacting share prices and potentially leading to significant financial penalties.

- March 2024 Lawsuit: Filed following an accounting probe and delayed financial reports, highlighting governance and reporting risks.

- Investor Confidence: Securities class actions directly challenge trust and can lead to share price volatility.

- Regulatory Scrutiny: These legal battles often involve investigations into compliance with securities laws and financial disclosure standards.

Chemours faces significant legal challenges, particularly concerning PFAS contamination, leading to substantial settlements. The company is also subject to stringent environmental regulations like the Clean Air Act and Clean Water Act, with penalties for non-compliance, as seen in a 2023 EPA settlement. Global regulations like REACH in Europe also impact product development and compliance costs.

Intellectual property protection is crucial for Chemours, with significant R&D investment in 2023 supporting patent defense for products like Opteon™ and Ti-Pure™. The company actively manages its patent portfolio and pursues legal action against infringements to maintain its market position.

Chemours has also dealt with securities class action lawsuits, such as one filed in March 2024, related to accounting issues and delayed financial filings, highlighting risks in corporate governance and investor communication.

| Legal Issue Area | Key Developments/Data | Financial Impact/Implications |

|---|---|---|

| PFAS Litigation | $875 million settlement with New Jersey (August 2025); $1.19 billion settlement with U.S. water providers (2023) | Significant financial liabilities and ongoing legal defense costs. |

| Environmental Regulations | $1.5 million settlement with EPA for Clean Air Act violations (2023) | Operational costs for compliance, potential for substantial fines. |

| Intellectual Property | $285 million R&D spending (2023) | Safeguarding market share and profitability through patent enforcement. |

| Securities Litigation | Class action lawsuit filed March 2024 | Impact on share price, investor confidence, and potential financial penalties. |

Environmental factors

Climate change and the reduction of greenhouse gas (GHG) emissions are significant environmental considerations for Chemours. The company has established ambitious targets, aiming for an absolute 60% reduction in Scope 1 and 2 GHG emissions by 2030, using 2018 as its baseline. These targets have been validated by the Science Based Target initiative (SBTi), underscoring their commitment to climate action.

Further solidifying its long-term environmental strategy, Chemours has set a goal to achieve net-zero GHG emissions from its operations by 2050. This commitment reflects a proactive approach to addressing the global imperative to mitigate climate change and transition towards a more sustainable operational model.

Chemours faces significant scrutiny regarding its water usage and wastewater discharge practices. Responsible water management is paramount, particularly with ongoing concerns about chemical contamination from its operations.

The company is entangled in lawsuits alleging the discharge of PFAS chemicals into vital water sources such as the Cape Fear River and the Ohio River. These legal challenges underscore the urgent necessity for Chemours to implement robust water quality controls and invest in effective remediation strategies to address past and present environmental impacts.

Chemical manufacturers like Chemours face growing pressure to minimize waste and adopt circular economy models. In 2023, Chemours reported a 12% reduction in waste generated per ton of product compared to 2020, demonstrating progress in its operational efficiency.

The company is actively investing in technologies to reduce waste at its manufacturing facilities and is incorporating product circularity into its strategic assessments, aiming to design products with end-of-life considerations in mind.

This focus on circularity is crucial as global regulations and consumer demand increasingly favor sustainable practices, pushing companies to innovate in material reuse and waste valorization.

Resource Scarcity and Sustainable Sourcing

The availability and sustainable sourcing of raw materials are critical environmental factors for Chemours, particularly for its titanium dioxide (TiO2) production. Ensuring a consistent and responsibly sourced supply chain is paramount to operational stability and meeting market demand.

Chemours is actively pursuing strategies to optimize resource use and enhance energy efficiency across its operations. This commitment extends to its supply chain, where collaborations with suppliers are key to improving reliability and reducing environmental impact.

For instance, Chemours' establishment of chlor-alkali production facilities, such as the one in Corpus Christi, Texas, demonstrates a strategic approach to securing essential raw materials. This vertical integration not only bolsters supply chain resilience but also minimizes the environmental footprint associated with long-distance transportation of these chemicals. In 2023, Chemours reported that its TiO2 segment generated approximately $3.6 billion in revenue, highlighting the significant impact of raw material availability on its core business.

Key environmental considerations for Chemours include:

- Raw Material Availability: Ensuring consistent access to critical inputs like titanium ore and salt for its TiO2 and fluoroproducts segments.

- Sustainable Sourcing Practices: Implementing and encouraging environmentally sound extraction and production methods among its suppliers.

- Resource Optimization: Focusing on reducing water consumption and improving energy efficiency in its manufacturing processes, aiming to lower its overall environmental impact.

Biodiversity and Ecosystem Protection

Chemours is actively integrating biodiversity and ecosystem protection into its operational strategy. In 2024, the company initiated a nature-based initiative, collaborating with the Wildlife Habitat Council to conduct a comprehensive nature assessment. This proactive approach signifies a significant expansion of their environmental stewardship, moving beyond traditional focuses on emissions and waste management.

This commitment is underscored by tangible actions:

- Nature Assessment Framework: Development of a structured approach to evaluate and improve the ecological health of its sites.

- Corporate-Wide Initiative: Implementation of nature-based solutions across its global operations, aiming for broad environmental impact.

- Partnership with WHC: Leveraging expertise from the Wildlife Habitat Council to ensure best practices in biodiversity conservation.

- Broader Environmental Vision: Demonstrating a commitment to sustainability that encompasses the full spectrum of environmental factors, not just regulatory compliance.

Chemours is actively addressing its environmental footprint, particularly concerning greenhouse gas emissions and water management.

The company has set ambitious targets, aiming for a 60% reduction in Scope 1 and 2 GHG emissions by 2030 and net-zero by 2050, with SBTi validation. However, it faces ongoing legal challenges related to PFAS contamination in water sources, highlighting the critical need for robust water quality controls and remediation efforts.

Chemours is also focused on waste reduction, achieving a 12% decrease in waste per ton of product in 2023, and is investing in circular economy principles and sustainable raw material sourcing to enhance operational stability and minimize environmental impact.

| Environmental Factor | 2023/2024 Data | Impact on Chemours |

|---|---|---|

| GHG Emissions Reduction | Target: 60% reduction by 2030 (Scope 1 & 2, vs. 2018 baseline) | Drives investment in cleaner technologies and operational efficiencies. |

| Water Contamination Lawsuits | Ongoing litigation regarding PFAS discharge | Requires significant investment in water treatment, remediation, and potential legal settlements. |

| Waste Reduction | 12% reduction in waste per ton of product (vs. 2020) | Indicates progress in operational efficiency and cost savings. |

| Biodiversity Initiatives | Nature-based initiative and WHC partnership (2024) | Enhances corporate reputation and demonstrates broader environmental stewardship. |

PESTLE Analysis Data Sources

Our PESTLE analysis for Chemours is built on a robust foundation of data from leading financial institutions, government regulatory bodies, and reputable market research firms. We meticulously gather information on economic indicators, environmental policies, technological advancements, and socio-political trends to provide a comprehensive overview.