Chemours Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Chemours Bundle

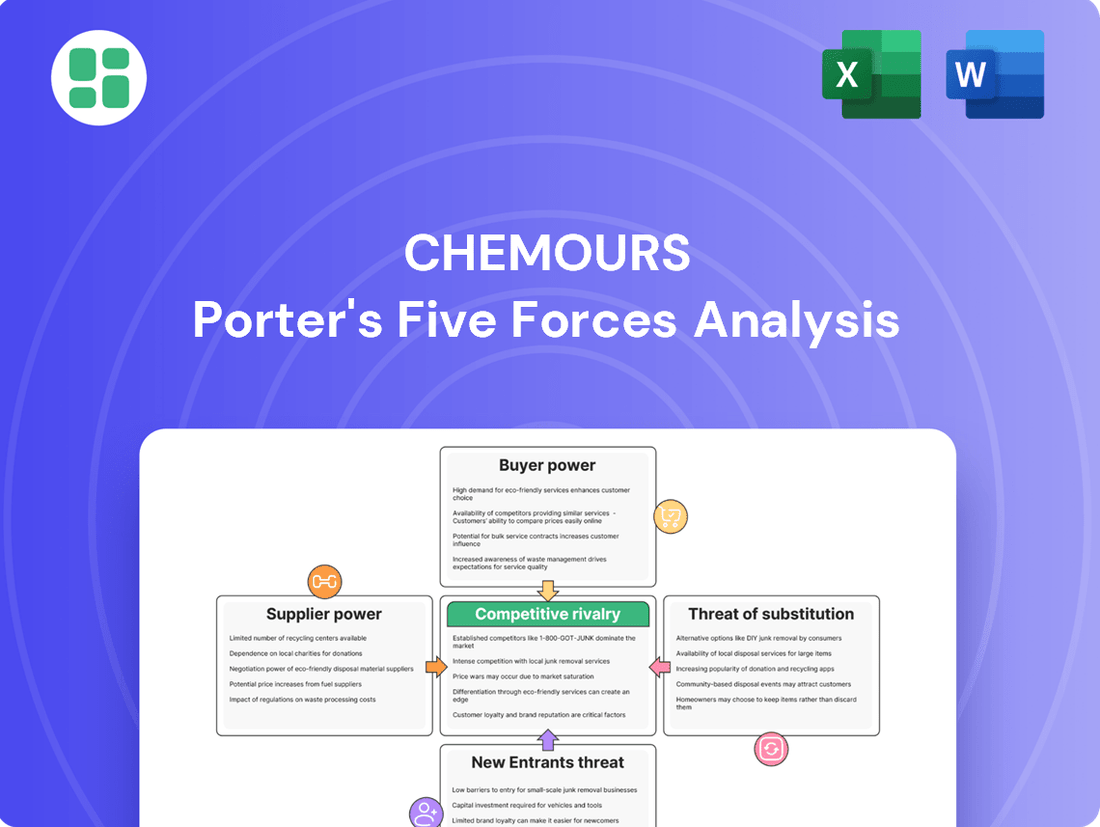

Chemours operates in a landscape shaped by intense rivalry, significant buyer power, and the constant threat of substitutes, particularly in its titanium technologies and fluoroproducts segments. Understanding the nuanced interplay of these forces is critical for navigating its competitive environment.

The complete report reveals the real forces shaping Chemours’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The bargaining power of suppliers to Chemours is significantly shaped by how concentrated the market is for its essential raw materials. For instance, critical inputs like fluorspar, sulfur, and ethylene are crucial for producing performance chemicals. If only a limited number of companies can supply these specialized materials, those suppliers gain considerable leverage.

The uniqueness of certain chemical precursors also plays a vital role. When specific inputs are proprietary or difficult to substitute, suppliers can command higher prices and more favorable terms from Chemours. This can directly impact Chemours' cost structure and profitability.

The costs and complexities Chemours faces when switching chemical suppliers are significant. These include lengthy re-qualification processes, the risk of supply chain disruptions, and the potential need for product reformulation, all of which can empower existing suppliers. For instance, in 2023, Chemours reported that the development and qualification of new chemical inputs can take several months to over a year, depending on the application's complexity.

These high switching costs mean Chemours is less likely to change suppliers, even if prices rise, thereby strengthening the bargaining power of those suppliers. This is especially true for highly specialized chemical inputs, where alternative suppliers may be scarce or require extensive validation.

If suppliers possess the capability and incentive to integrate forward into Chemours' performance chemicals sector, their bargaining power would significantly increase. This potential scenario compels Chemours to cultivate strong supplier relationships and potentially offer more favorable terms to deter them from becoming direct competitors.

The threat of forward integration is somewhat mitigated by the substantial technical expertise and capital investment typically required to enter the performance chemicals market. For instance, developing and scaling the production of specialized fluoropolymers, a key area for Chemours, demands considerable R&D and manufacturing infrastructure.

Importance of Chemours' Volume to Suppliers

The bargaining power of suppliers for Chemours is significantly influenced by the volume of Chemours' purchases. When Chemours accounts for a substantial portion of a supplier's total sales, that supplier is likely to be more accommodating in price negotiations and contract terms. For instance, if a key raw material supplier derives a large percentage of its revenue from Chemours, they have less leverage to impose unfavorable conditions.

Conversely, if Chemours represents a minor customer for a supplier, its ability to sway supplier behavior is considerably reduced. This dynamic can lead to higher input costs for Chemours if suppliers perceive it as a less critical client. For example, in 2024, the specialty chemicals market saw some suppliers consolidate, potentially increasing their pricing power over smaller volume buyers.

- Supplier Dependence: If a supplier's business heavily relies on Chemours' orders, their bargaining power is weakened.

- Customer Concentration: Chemours' concentration of purchases with specific suppliers can amplify its influence.

- Market Conditions: Broader market conditions, such as raw material availability and demand, also shape supplier power relative to Chemours' volume.

Availability of Substitutes for Raw Materials

The availability of substitutes for raw materials significantly impacts a supplier's bargaining power. If Chemours can readily source alternative inputs or develop its own production capabilities for critical components, it diminishes the leverage of existing suppliers. This reduces the suppliers' ability to impose unfavorable pricing or terms.

Chemours actively manages this by pursuing a diversified sourcing strategy. This approach aims to spread risk and prevent over-reliance on any single supplier for essential raw materials. By having multiple qualified sources, Chemours can negotiate more effectively.

- Diversified Sourcing: Chemours employs a strategy of sourcing raw materials from multiple suppliers to reduce dependency and enhance negotiation leverage.

- Contract Durations: Contracts with suppliers typically range from two to ten years, providing a degree of price and supply stability while allowing for periodic renegotiation.

- In-house Production Potential: The feasibility of Chemours developing in-house production for key inputs acts as a latent threat to suppliers, further moderating their pricing power.

The bargaining power of suppliers to Chemours is influenced by the concentration of raw material markets and the availability of substitutes. For critical inputs like fluorspar and ethylene, limited suppliers can exert significant leverage, especially if these materials are proprietary or difficult to replace. In 2023, Chemours highlighted that qualifying new chemical inputs could take over a year, underscoring the high switching costs and thus strengthening supplier power.

Chemours' purchasing volume also plays a role; if Chemours represents a substantial portion of a supplier's sales, their negotiating power increases. Conversely, being a minor customer weakens Chemours' position. For example, the 2024 specialty chemicals market saw some consolidation, potentially increasing pricing power for suppliers over less significant buyers.

The threat of forward integration by suppliers is a factor, though tempered by the high capital and technical expertise needed to enter Chemours' performance chemicals sector. Chemours' strategy of diversified sourcing and the potential for in-house production help to mitigate supplier leverage.

| Factor | Impact on Chemours' Supplier Bargaining Power | Supporting Data/Observation |

| Supplier Concentration | High | Limited number of suppliers for critical inputs like fluorspar. |

| Uniqueness of Inputs | High | Proprietary or difficult-to-substitute precursors increase supplier leverage. |

| Switching Costs | High | Lengthy re-qualification processes (months to over a year) for new inputs. |

| Chemours' Purchase Volume | Variable | High volume can increase Chemours' influence; low volume weakens it. |

| Availability of Substitutes | Moderate | Diversified sourcing strategy by Chemours aims to reduce reliance. |

| Threat of Forward Integration | Low to Moderate | High barriers to entry in performance chemicals sector. |

What is included in the product

Chemours' Porter's Five Forces analysis reveals the intense competitive pressures within the chemical industry, highlighting the bargaining power of buyers and suppliers, the threat of new entrants, and the availability of substitutes for its key products.

Instantly understand the competitive landscape of the chemical industry, identifying key pressures on Chemours to inform strategic adjustments.

Customers Bargaining Power

The concentration of Chemours' customer base is a key factor influencing buyer power. For instance, in 2023, Chemours reported that its top ten customers represented approximately 30% of its total net sales, indicating a moderate level of customer concentration. This means that a significant portion of their revenue comes from a relatively small group of buyers.

When a few large customers account for a substantial share of sales, they gain considerable leverage. These major buyers can more effectively negotiate for lower prices, favorable payment terms, or customized product specifications, thereby increasing their bargaining power. This is particularly true if switching costs for these customers are low.

Conversely, if Chemours served a highly fragmented market with many small customers, the power of any single buyer would be significantly diminished. In such a scenario, individual customers would have less influence to demand concessions, as their business would represent a small fraction of Chemours' overall revenue.

The bargaining power of Chemours' customers is significantly influenced by the costs associated with switching to a different chemical supplier. When it's difficult or expensive for a customer to change providers, their ability to demand lower prices or better terms is diminished.

For Chemours, high switching costs can arise from several factors. These include the need for customers to gain new regulatory approvals for alternative chemicals, the integration of specialized products into their own manufacturing processes, or the necessity of re-tooling their equipment. For instance, in the titanium technologies segment, where Chemours is a major player, customers may have extensive processes in place that are optimized for Chemours' specific products, making a switch costly and time-consuming.

Conversely, for Chemours' more commoditized chemical offerings, the switching costs for customers are considerably lower. In these markets, customers can more readily compare prices and product specifications from various suppliers, giving them greater leverage to negotiate favorable terms or switch to competitors if prices are not competitive. This was evident in 2024, where increased competition in certain specialty chemical markets put pressure on pricing, reflecting the lower switching barriers for some customer segments.

Customer price sensitivity is a major factor in how much power buyers have. If Chemours' products make up a large chunk of a customer's expenses, or if that customer is in a tough, competitive market, they'll be more likely to push for lower prices, giving them more leverage. In 2023, Chemours reported net sales of $6.0 billion, and while specific customer cost breakdowns aren't public, understanding how their titanium technologies and performance chemicals factor into various industrial supply chains is key to assessing this sensitivity.

Threat of Backward Integration by Customers

Customers can exert significant bargaining power if they possess a believable threat of backward integration, meaning they could manufacture the chemicals themselves instead of purchasing from Chemours. This is especially true for substantial industrial clients possessing the required financial resources and technical know-how. For instance, a major automotive manufacturer, a significant buyer of certain industrial chemicals, might explore in-house production if Chemours' pricing or supply reliability becomes unfavorable. This potential competition compels Chemours to maintain competitive pricing and continuous innovation to retain its customer base.

The threat of backward integration by customers directly impacts Chemours' pricing strategies and its need for ongoing product development. Large customers, particularly those with substantial purchasing volumes, have the leverage to negotiate better terms or even invest in their own production capabilities. This dynamic necessitates that Chemours consistently delivers value through quality, cost-effectiveness, and technological advancement. In 2023, the chemical industry saw increased focus on supply chain resilience, which could spur some large customers to evaluate vertical integration more closely, especially for critical raw materials.

- Customer Leverage: Large industrial customers can gain power by threatening to produce chemicals in-house, reducing reliance on suppliers like Chemours.

- Capital and Expertise: The feasibility of backward integration depends on a customer's financial capacity and technical proficiency in chemical manufacturing.

- Competitive Pressure: This threat forces Chemours to remain competitive in pricing and to continually innovate its product offerings and services.

- Industry Trends: In 2023, supply chain concerns may have intensified customer interest in exploring backward integration for key chemical inputs.

Product Standardization vs. Differentiation

The degree to which Chemours' products are standardized or differentiated significantly influences customer bargaining power. When Chemours offers highly differentiated products, particularly those with unique performance characteristics or protected by intellectual property, it inherently lessens the leverage customers possess. This is because alternatives are fewer and less comparable, making it harder for buyers to switch or negotiate aggressively on price.

Conversely, for more standardized products, such as certain grades of titanium dioxide used in various industrial applications, customer power tends to be higher. In these segments, customers often have a wider array of suppliers to choose from, increasing competition. This abundance of options empowers buyers to negotiate more favorable terms, including pricing and delivery schedules, as they can readily shift their business to a competitor if Chemours' terms are not met.

For instance, in the titanium dioxide market, where Chemours is a major player, the level of product specialization can create different dynamics. While some specialized grades might command premium pricing due to unique properties, broader, more commoditized applications can see customers exerting greater pressure. In 2023, the global titanium dioxide market size was valued at approximately $25.6 billion, indicating a substantial market where product differentiation plays a key role in managing customer power.

- Product Differentiation: Chemours' ability to create unique, high-performance products reduces customer power by limiting viable alternatives.

- Product Standardization: For more commoditized offerings, customers have greater leverage due to the availability of multiple suppliers.

- Market Dynamics: In a large market like titanium dioxide, the balance between differentiation and standardization directly impacts customer bargaining strength.

The bargaining power of Chemours' customers is influenced by the concentration of its buyer base. In 2023, Chemours noted that its top ten customers accounted for roughly 30% of its net sales. This indicates a moderate concentration, meaning a few large clients hold significant sway, enabling them to negotiate for better pricing and terms, especially if switching costs are low.

When customers face high switching costs, their bargaining power diminishes. For Chemours, this can involve regulatory hurdles for alternative chemicals or the need to reconfigure manufacturing processes. Conversely, for more standardized products in 2024, lower switching barriers allowed customers to exert more price pressure, as seen in certain specialty chemical markets.

Customers' price sensitivity also amplifies their bargaining power. If Chemours' products represent a substantial portion of a customer's costs, or if the customer operates in a highly competitive industry, they will push harder for lower prices. This was highlighted in 2023, a year where Chemours reported $6.0 billion in net sales, underscoring the importance of understanding product cost impact across various supply chains.

The threat of backward integration, where customers consider producing chemicals in-house, further empowers buyers. This is particularly relevant for large clients with the financial and technical means to do so. In 2023, concerns over supply chain resilience may have intensified this consideration for some major industrial consumers of chemicals.

| Factor | Impact on Chemours' Customer Bargaining Power | 2023/2024 Context |

| Customer Concentration | Moderate; Top 10 customers ~30% of sales. Higher concentration grants more leverage. | Indicates significant power for key buyers. |

| Switching Costs | Varies; High for specialized products, low for commoditized ones. | Lower costs in 2024 allowed customers more price negotiation. |

| Price Sensitivity | High for customers where Chemours' products are a major cost. | Crucial for Chemours' $6.0 billion in 2023 net sales. |

| Backward Integration Threat | Exists for large, capable customers. | Supply chain concerns in 2023 may have increased this threat. |

Same Document Delivered

Chemours Porter's Five Forces Analysis

The document you see is your deliverable. It’s ready for immediate use—no customization or setup required. This comprehensive Chemours Porter's Five Forces Analysis details competitive rivalry, the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, and the threat of substitutes within the chemical industry, offering actionable insights for strategic decision-making.

Rivalry Among Competitors

The performance chemicals industry, where Chemours operates, is characterized by a moderate to high level of competitive rivalry. This intensity is shaped by the presence of numerous global chemical giants alongside smaller, specialized regional manufacturers. For instance, in the titanium dioxide market, a key segment for Chemours, major competitors include companies like Tronox and Venator Materials, all vying for market share.

Chemours' Titanium Technologies segment, a significant revenue driver, directly contends with these large-scale producers. Similarly, its Thermal & Specialized Solutions and Advanced Performance Materials segments face competition from a mix of established multinational corporations and agile, niche players. The relative size of these competitors means that pricing pressures and innovation races are constant challenges.

In mature or slow-growth segments of the chemical industry, competitive rivalry often intensifies as companies battle for existing market share. While Chemours benefits from regulatory tailwinds in areas like its Opteon™ refrigerants, which are experiencing robust growth, other segments within the broader chemical sector may see more moderate expansion. This disparity can lead to heightened competitive pressures in those slower-moving markets.

The degree to which Chemours' products stand apart from rivals significantly shapes competitive rivalry. By investing in innovation, such as their Opteon™ line of refrigerants, Chemours seeks to offer unique value, thereby lessening the pressure of direct price wars. For instance, Opteon™ refrigerants are designed with lower global warming potential, a key differentiator in an increasingly regulated market.

Exit Barriers

Chemours, like many in the chemical industry, faces substantial exit barriers. These can include significant investments in specialized production facilities and the substantial costs associated with decommissioning or repurposing these assets. For instance, the capital expenditure required for chemical plants can run into hundreds of millions, if not billions, of dollars, making a swift exit economically unfeasible.

These high exit barriers mean that companies are often compelled to continue operating even when market conditions are unfavorable or profitability is declining. This prolonged presence can intensify competitive rivalry, as firms are reluctant to abandon their investments. The chemical sector's capital-intensive nature, with its reliance on complex machinery and infrastructure, directly contributes to these elevated exit barriers.

- High Fixed Asset Investment: Chemical manufacturing requires extensive, specialized, and often immobile fixed assets, making divestment or redeployment difficult and costly.

- Specialized Production Facilities: The unique nature of chemical production processes necessitates highly specific equipment and plant designs, limiting alternative uses and increasing the cost of exiting.

- Employee Severance and Pension Obligations: Significant workforces tied to these specialized facilities often come with substantial severance packages and long-term pension liabilities, adding to exit costs.

- Environmental Remediation Costs: The chemical industry often faces significant costs for environmental cleanup and site remediation upon closure, acting as a substantial deterrent to leaving the market.

Competitive Strategies and Industry Consolidation

Competitors in the chemical industry, including those vying with Chemours, actively engage in strategic maneuvering. These tactics often involve aggressive pricing to gain market share, significant investments in capacity expansion to meet growing demand, and strategic mergers and acquisitions to achieve economies of scale or access new technologies. For instance, in 2024, the specialty chemicals sector saw continued M&A activity as companies sought to streamline operations and bolster their product portfolios. R&D investments are also a critical battleground, with companies pouring billions into developing innovative materials and more sustainable production methods.

The chemical industry has experienced notable consolidation, reshaping the competitive dynamics. For example, the ongoing divestitures and acquisitions within the broader materials science and chemical sectors in 2023 and 2024 have led to a more concentrated market in certain segments. This consolidation can intensify rivalry if dominant players emerge with significant market power, or it can reduce it if mergers create more balanced competition. The specific impact on rivalry depends heavily on the resulting market structure and the strategic responses of remaining players.

- Strategic Maneuvers: Competitors employ pricing, capacity expansion, M&A, and R&D as key strategic levers.

- Industry Consolidation: Recent M&A activity in 2023-2024 has altered market structures, impacting rivalry levels.

- R&D Focus: Significant R&D investments are directed towards innovation and sustainability.

- Market Power: Emerging dominant players from consolidation can either increase or decrease competitive intensity.

Competitive rivalry within Chemours' operating landscape is substantial, driven by a mix of global chemical giants and specialized regional players. This dynamic is particularly evident in key segments like titanium dioxide, where Chemours faces off against formidable competitors such as Tronox and Venator Materials. The constant pursuit of market share necessitates aggressive pricing strategies and continuous innovation, as companies strive to differentiate their offerings.

The intensity of competition is further amplified by significant exit barriers in the capital-intensive chemical industry. High fixed asset investments, specialized production facilities, employee obligations, and environmental remediation costs make it economically challenging for companies to leave the market, even during downturns. This often leads to prolonged competition as firms remain committed to their existing operations, contributing to ongoing market pressures.

Strategic maneuvers, including pricing adjustments, capacity expansions, mergers, and acquisitions, are common tactics employed by competitors. For instance, the specialty chemicals sector saw continued M&A activity in 2024, aiming to enhance operational efficiency and expand product portfolios. Chemours' own strategic focus on innovation, such as its low global warming potential Opteon™ refrigerants, aims to carve out distinct market positions and mitigate direct price competition.

| Competitor | Key Product Areas | 2024 Estimated Revenue (USD Billion) |

|---|---|---|

| Tronox | Titanium Dioxide, Zirconium | ~5.0 |

| Venator Materials | Titanium Dioxide, Performance Additives | ~2.0 |

| DuPont | Specialty Polymers, Electronics & Industrial | ~12.0 (relevant segments) |

| 3M | Advanced Materials, Adhesives, Abrasives | ~33.0 (relevant segments) |

SSubstitutes Threaten

The threat of substitutes for Chemours' products is significant, stemming from readily available alternative materials and technologies that can perform similar functions for their customers. For instance, in the paints and coatings sector, alternative pigments could potentially replace titanium dioxide, a key product for Chemours. This substitution risk directly impacts demand and pricing power.

In the realm of thermal solutions, advancements in refrigerants and cooling technologies present another avenue for substitution. New, potentially more environmentally friendly or cost-effective alternatives could emerge, challenging Chemours' existing market share. The company's ability to innovate and adapt to these evolving technological landscapes is crucial for mitigating this threat.

The relative price-performance of substitutes is a crucial factor for Chemours. If alternative products offer similar or better performance at a lower price point, customers will naturally gravitate towards them. For instance, in the titanium dioxide market, where Chemours is a major player, the development of more cost-effective production methods for competitors or the emergence of entirely new pigment technologies could significantly impact Chemours' market share. In 2023, the global TiO2 market saw price fluctuations, with some regions experiencing price increases while others remained stable, highlighting the sensitivity to cost-performance ratios.

Customer willingness to switch to alternatives for Chemours' products is a critical factor in the threat of substitutes. This willingness is shaped by several elements, including the perceived risks associated with new solutions, any government incentives that encourage adoption, and simply how easy it is for customers to make the change.

Regulatory shifts are a prime example of how this willingness can be dramatically influenced. For instance, in the United States, the AIM Act is pushing for a move away from refrigerants with high global warming potential (GWP). This mandate directly encourages customers to consider and adopt alternatives, such as Chemours' own Opteon™ line or other non-fluorochemical options, thereby increasing the threat of substitution.

Technological Advancements Creating New Substitutes

Rapid technological advancements, particularly in material science and adjacent industries, are a significant threat, as they can spawn entirely new substitutes for Chemours' offerings. For example, breakthroughs in sustainable polymers or advanced ceramics could displace traditional fluoropolymers used in various applications. Chemours' 2024 R&D expenditure, which was approximately $300 million, highlights its commitment to staying ahead, but the pace of innovation means constant vigilance is necessary.

Chemours must proactively invest in research and development to anticipate and counter these disruptive innovations. This ensures its products, such as those in the Titanium Technologies segment, remain competitive and superior to emerging alternatives. Failure to adapt could see market share erode, similar to how digital photography impacted the film industry.

The emergence of new substitutes poses a direct challenge to Chemours' market position. Consider the following:

- Emergence of bio-based materials: Innovations in biodegradable plastics could offer alternatives to certain Chemours chemical products.

- Advancements in energy storage: New battery technologies might reduce demand for specific chemicals used in current energy solutions.

- Digitalization of processes: Increased automation and digital solutions could reduce the need for certain chemical inputs in manufacturing.

Regulatory and Environmental Pressures

Increasing regulatory and environmental pressures, particularly concerning PFAS and other chemical emissions, can accelerate the adoption of substitutes for Chemours' products. For instance, by mid-2024, several jurisdictions had implemented or were considering stricter regulations on PFAS, impacting industries that rely on these chemicals. This regulatory shift can make alternative, less regulated materials more attractive.

Customers may be compelled by these regulations or growing public sentiment to seek out 'greener' or less regulated alternatives. Even if these substitutes come with higher costs or different performance profiles, the imperative to comply with evolving environmental standards or to align with consumer preferences for sustainable products can drive their adoption. This trend was evident in early 2024 as companies began proactively reformulating products to avoid substances facing potential bans.

- Regulatory Scrutiny: In 2024, continued focus on chemicals like PFAS by bodies such as the EPA and European Chemicals Agency intensified scrutiny on manufacturers.

- Consumer Demand for Sustainability: Growing consumer awareness and preference for environmentally friendly products directly influence purchasing decisions, pushing industries to explore alternatives.

- Cost-Benefit Analysis of Substitutes: While substitutes might initially be more expensive, the long-term costs associated with regulatory non-compliance or reputational damage can make them a more viable option.

The threat of substitutes for Chemours' products is considerable, driven by evolving technologies and materials that can fulfill similar customer needs. For example, advancements in refrigerants and cooling systems continuously introduce alternatives to Chemours' offerings, impacting demand and pricing. The company's ability to innovate and adapt is key to navigating this challenge.

Customer willingness to switch is influenced by factors like perceived risk, government incentives, and ease of adoption. For instance, regulatory shifts, such as the AIM Act pushing for lower GWP refrigerants, directly encourage the adoption of alternatives, including Chemours' own Opteon™ line, thereby increasing substitution risks.

Rapid technological progress, especially in material science, can spawn new substitutes. Breakthroughs in areas like sustainable polymers or advanced ceramics could displace Chemours' fluoropolymers. Chemours' 2024 R&D investment of approximately $300 million underscores its commitment to staying competitive against these emerging alternatives.

The threat is amplified by regulatory pressures and environmental concerns, particularly regarding PFAS. By mid-2024, stricter regulations in various regions made less regulated alternatives more appealing. This, coupled with growing consumer demand for sustainability, pushes industries to explore substitutes, even if they initially have higher costs or different performance profiles.

Entrants Threaten

The chemical manufacturing sector, particularly for performance chemicals like those produced by Chemours, demands enormous upfront capital. Think about building state-of-the-art plants, acquiring specialized machinery, and funding continuous research and development. For instance, constructing a new titanium dioxide (TiO2) plant, a key product for Chemours, can easily cost upwards of $500 million to over $1 billion, making it a formidable hurdle for potential newcomers.

Chemours, like other established chemical manufacturers, leverages significant economies of scale. This means they can produce their products, such as titanium technologies and fluoroproducts, at a lower cost per unit due to high production volumes. For instance, in 2023, Chemours reported net sales of $6.0 billion, demonstrating the substantial operational footprint that underpins these cost advantages.

New companies entering the specialty chemicals market would find it incredibly challenging to match these cost efficiencies. Building production facilities and securing raw materials at a scale comparable to Chemours requires massive upfront investment. Without achieving similar production volumes, new entrants would likely face higher per-unit costs, making it difficult to compete on price with established players.

Chemours' highly specialized product portfolio, particularly in areas like Advanced Performance Materials and its patented Opteon™ refrigerants, acts as a significant barrier to new entrants. These proprietary formulations, backed by extensive research and development, are not easily replicated.

The company's robust intellectual property protection, including numerous patents, further solidifies this barrier. Developing comparable technologies requires substantial investment in R&D and navigating complex patent landscapes, making it challenging for newcomers to compete effectively.

Access to Distribution Channels and Supply Chains

New companies entering the chemical industry face substantial hurdles in establishing effective distribution channels and securing dependable supply chains. Chemours benefits from long-standing partnerships with both customers and suppliers, a critical advantage that new entrants struggle to match. For instance, in 2024, Chemours reported a robust supply chain network, enabling efficient delivery of its titanium dioxide and fluoroproducts globally. The capital investment required to build comparable infrastructure and forge these relationships can be prohibitive for emerging businesses.

The difficulty in accessing established distribution networks is a significant barrier. Chemours' existing customer base, built over decades, offers immediate market penetration that newcomers must painstakingly develop. This includes not only logistics but also the trust and reliability associated with a well-known brand in the chemical sector.

- Distribution Channel Access: New entrants must invest heavily to build or acquire their own distribution networks, a process that is both time-consuming and capital-intensive.

- Supply Chain Security: Securing consistent and cost-effective access to essential raw materials, such as titanium ore for TiO2 production or key feedstocks for fluorochemicals, is a major challenge.

- Customer Relationships: Chemours' established relationships with major industrial consumers provide a significant competitive moat, making it difficult for new players to gain market share quickly.

- Logistical Expertise: Managing the complex logistics of chemical transportation, storage, and handling requires specialized knowledge and infrastructure that new entrants often lack.

Government Policy and Environmental Regulations

The chemical industry, especially for companies like Chemours, operates under a heavy mantle of government policy and environmental regulations. This is a significant hurdle for any potential new players looking to enter the market. Think about the complexities involved in meeting stringent environmental, health, and safety standards. For instance, the ongoing scrutiny and evolving regulations around per- and polyfluoroalkyl substances (PFAS), a key area for Chemours, demand substantial investment and expertise to navigate.

New entrants must contend with a labyrinth of compliance requirements, which often involve lengthy and expensive permitting processes. Beyond just initial setup, ongoing adherence to these rules can be resource-intensive. The potential for litigation, especially concerning environmental impact or product safety, adds another layer of risk that can significantly deter market entry. For example, in 2023, the U.S. Environmental Protection Agency (EPA) continued to propose stricter regulations on PFAS, impacting manufacturing processes and waste disposal, which would require substantial capital outlays for new facilities.

- Regulatory Burden: The chemical sector faces extensive environmental, health, and safety regulations, creating high barriers to entry.

- PFAS Scrutiny: Evolving regulations, particularly concerning PFAS, necessitate significant investment in compliance and risk management.

- Permitting and Compliance Costs: New entrants face complex and costly permitting processes and ongoing compliance requirements.

- Litigation Risks: Potential litigation related to environmental impact and product safety can deter new market participants.

The threat of new entrants for Chemours is generally low due to several significant barriers. The sheer capital required to establish a chemical manufacturing operation, especially for specialized products, is immense. For instance, building a new titanium dioxide plant can cost upwards of $500 million, a substantial deterrent.

Chemours also benefits from considerable economies of scale, as evidenced by its $6.0 billion in net sales in 2023, allowing it to produce at lower costs than potential newcomers. Proprietary technologies and strong intellectual property protection further solidify its competitive position, making it difficult for new companies to replicate its product offerings and processes.

Established distribution networks, long-term customer relationships, and navigating complex regulatory environments, particularly around substances like PFAS, also present formidable challenges for any aspiring competitor in the chemical sector.

| Barrier Category | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | Building chemical plants, acquiring machinery, R&D investment. | Extremely High (e.g., TiO2 plant >$500M) |

| Economies of Scale | Lower per-unit costs due to high production volumes. | High (Chemours' 2023 net sales: $6.0B) |

| Product Differentiation & IP | Specialized products, patented technologies (e.g., Opteon™). | High |

| Distribution & Supply Chains | Established logistics, supplier/customer relationships. | High |

| Regulatory Environment | Environmental, health, safety compliance, permitting. | High (e.g., PFAS regulations) |

Porter's Five Forces Analysis Data Sources

Our Chemours Porter's Five Forces analysis is built upon a foundation of verified data, including Chemours' own SEC filings, annual reports, and investor presentations. We supplement this with industry-specific market research reports and data from reputable financial databases to capture a comprehensive view of the competitive landscape.