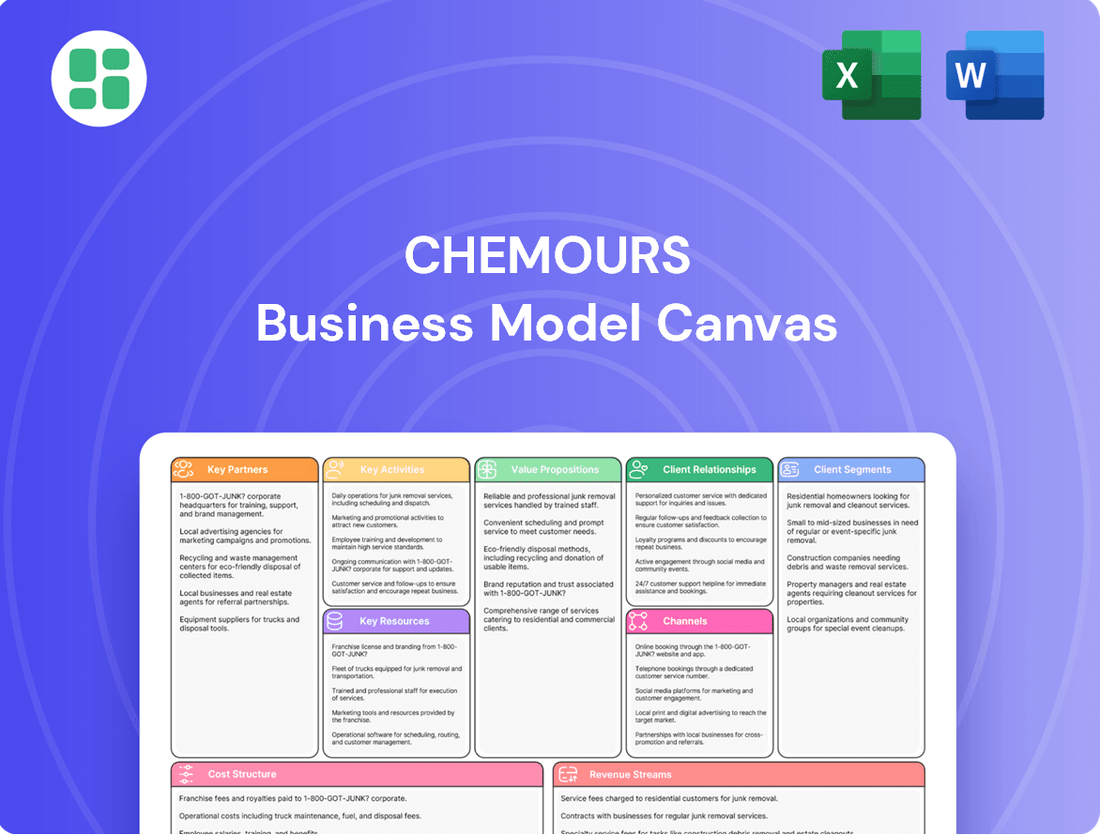

Chemours Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Chemours Bundle

Explore the core components of Chemours's strategic framework with our Business Model Canvas. This detailed analysis breaks down their customer relationships, revenue streams, and key resources, offering a clear view of their operational success. Ideal for anyone seeking to understand how Chemours effectively competes and innovates in the chemical industry.

Partnerships

Chemours actively pursues strategic alliances to co-develop and manufacture novel products, enhancing its market position. A prime example is its collaboration with Navin Fluorine International Limited for the production of Opteon™ two-phase immersion cooling fluid. This partnership is vital for meeting the escalating needs of advanced data centers and AI hardware, utilizing specialized expertise to expedite market entry.

These alliances are instrumental in broadening Chemours' product offerings into rapidly expanding sectors. By sharing development risks, the company accelerates the commercialization of its groundbreaking solutions, ensuring it remains at the forefront of technological innovation.

Chemours relies on strategic supplier and manufacturing collaborations to maintain its operational backbone. For instance, their partnerships in chlor-alkali production are crucial for securing essential raw materials, underpinning their diverse product lines.

These collaborations are not just about material sourcing; they are geared towards optimizing production processes. By working closely with key suppliers, Chemours aims to enhance manufacturing excellence across its segments, ensuring efficiency and reliability.

The company also leverages co-located facilities or agreements with third-party manufacturers. This strategic approach helps to secure critical inputs and further boosts operational efficiency, as seen in their integrated manufacturing networks.

Chemours actively engages in research and development collaborations with leading universities and other chemical industry innovators. These partnerships are crucial for tackling intricate challenges and accelerating the development of cutting-edge solutions, especially in the realm of low global warming potential refrigerants and advanced sustainable materials. For instance, in 2024, Chemours continued its focus on Opteon™ refrigerants, which offer significant environmental benefits compared to older hydrofluorocarbons.

Industry Associations and Advocacy Groups

Chemours actively engages with industry associations and advocacy groups, such as the American Chemistry Council (ACC) and the European Chemical Industry Council (CEFIC), to influence regulatory frameworks. This participation is vital for navigating evolving environmental standards, including those concerning per- and polyfluoroalkyl substances (PFAS) and emissions controls like the U.S. AIM Act. By collaborating with these organizations, Chemours aims to champion science-driven policies that support its product development and operational sustainability.

These partnerships are instrumental in shaping the regulatory environment for the chemical industry. For instance, in 2024, Chemours continued its involvement in discussions surrounding PFAS regulations, which are increasingly impacting product formulations and manufacturing processes globally. The company's advocacy efforts focus on promoting risk-based approaches to chemical management, ensuring that regulations are both protective of human health and the environment, and economically viable.

- Industry Association Engagement: Chemours is a member of key industry bodies that provide platforms for collaborative problem-solving and policy advocacy.

- Regulatory Influence: Participation allows Chemours to contribute to the development of science-based regulations, particularly concerning environmental stewardship.

- Advocacy for Responsible Chemistry: These partnerships enable the company to promote best practices and foster a favorable operating environment for its innovative chemical solutions.

Customer Co-development Initiatives

Chemours actively engages in customer co-development, directly partnering with clients to refine specific applications and tackle unique industry challenges. This ensures their chemical solutions precisely align with market demands.

These close collaborations cultivate strong customer loyalty and generate crucial feedback for ongoing product innovation and customization. For instance, in 2024, Chemours highlighted successful joint development projects in the semiconductor industry, leading to enhanced performance materials.

- Customer-Centric Innovation: Chemours works hand-in-hand with customers to develop new product applications and solve specific technical problems, ensuring their offerings meet precise industry needs.

- Deep Relationship Building: These collaborative efforts foster significant customer loyalty and provide invaluable insights that drive product innovation and customization strategies.

- Tailored Solutions for Growth: By partnering closely with clients, Chemours delivers customized solutions that address their most pressing challenges, thereby promoting mutual business growth and market penetration.

Chemours collaborates with key suppliers for essential raw materials, such as those in chlor-alkali production, ensuring a stable supply chain for its diverse product portfolio. These relationships are critical for maintaining efficient and reliable manufacturing operations across all its segments.

Strategic alliances are formed to co-develop and manufacture novel products, like the Opteon™ two-phase immersion cooling fluid with Navin Fluorine International Limited, targeting high-growth markets such as advanced data centers. These partnerships accelerate market entry and share development risks.

Chemours actively partners with research institutions and industry innovators to tackle complex challenges and speed up the development of new solutions, particularly in areas like low global warming potential refrigerants. For example, ongoing R&D in 2024 focused on advancing Opteon™ refrigerant technology.

Engaging with industry associations such as the American Chemistry Council (ACC) allows Chemours to influence regulatory frameworks and promote science-driven policies. This is crucial for navigating evolving environmental standards, including those related to PFAS and emissions controls, as seen in their 2024 participation in discussions around PFAS regulations.

What is included in the product

This Chemours Business Model Canvas outlines their strategy for producing and selling performance chemicals, focusing on key customer segments like automotive and electronics, and leveraging their integrated production facilities as a core competitive advantage.

Provides a clear, visual representation of Chemours' value proposition, addressing the pain point of understanding complex operations by simplifying them into nine key building blocks.

Helps identify and resolve strategic pain points by offering a structured framework to analyze customer relationships, revenue streams, and cost structures.

Activities

Chemours dedicates substantial resources to research and development, a cornerstone of its strategy to innovate and improve its product offerings. This investment is crucial for developing next-generation materials and refining existing chemical processes. For instance, in 2023, the company reported $273 million in R&D expenses, underscoring its commitment to technological advancement.

A significant focus of Chemours' R&D is on creating sustainable solutions, such as the Opteon™ line of refrigerants with low global warming potential (GWP). These efforts aim to meet increasingly stringent environmental regulations and growing customer demand for eco-friendly alternatives. The company's commitment to sustainability is a key driver for its innovation pipeline.

Furthermore, R&D activities are vital for Chemours' strategic transition away from older, less sustainable products and for exploring new market opportunities. By investing in the development of new applications and materials, Chemours positions itself to capitalize on high-growth sectors and maintain a competitive edge in the evolving chemical industry landscape.

Chemours' core manufacturing activities center on producing a wide array of performance chemicals across its three primary business segments: Titanium Technologies, Thermal & Specialized Solutions, and Advanced Performance Materials. This large-scale production is managed across 28 global manufacturing facilities, ensuring a broad reach for its product lines.

The company's operational efficiency in manufacturing is paramount to satisfying worldwide demand for its chemicals. These products are fundamental components in numerous industrial applications, making reliable and consistent production a key driver of its business success.

Chemours manages a complex global supply chain, crucial for sourcing raw materials like fluorspar and titanium dioxide, ensuring efficient manufacturing across its facilities, and delivering finished products such as titanium technologies and advanced performance materials to customers worldwide.

This involves meticulous logistics, advanced inventory management systems to balance availability and carrying costs, and strategic sourcing initiatives to secure critical inputs and mitigate geopolitical or supplier-specific risks, as seen in their efforts to diversify sourcing for key intermediates.

In 2023, Chemours reported net sales of $6.0 billion, with effective supply chain operations contributing to their ability to maintain competitive pricing and ensure product availability, a key factor in the performance of their Titanium Technologies segment which alone generated $3.2 billion in sales.

Sales, Marketing, and Distribution

Chemours' key activities revolve around actively promoting and selling its broad range of chemical products to a global industrial customer base. This requires building robust customer relationships, offering essential technical support, and utilizing both direct sales forces and established distribution channels to reach various markets.

The company's success hinges on effective sales and marketing strategies to stimulate demand and grow its market share across diverse applications. For instance, in 2023, Chemours reported net sales of $6.0 billion, underscoring the significant volume of business generated through these activities.

- Global Reach: Promoting and selling diverse product lines to industrial customers worldwide.

- Customer Engagement: Developing strong customer relationships and providing technical support.

- Distribution Strategy: Leveraging direct sales teams and extensive distribution networks.

- Market Penetration: Driving demand and expanding market share through effective sales and marketing.

Environmental, Health, and Safety (EH&S) Management and Litigation Resolution

Chemours' key activities prominently feature robust Environmental, Health, and Safety (EH&S) management, a crucial aspect given the chemical industry's inherent risks and regulatory scrutiny. This involves diligently adhering to a complex web of global environmental standards and proactively mitigating potential hazards. The company's commitment extends to managing the significant financial and operational implications of legacy litigation, especially concerning per- and polyfluoroalkyl substances (PFAS).

A substantial portion of these activities is dedicated to addressing environmental responsibilities. This includes significant investments in remediation projects aimed at cleaning up contaminated sites and actively engaging in legal proceedings and settlements to resolve environmental claims. For instance, in 2023, Chemours continued to address PFAS-related matters, including ongoing negotiations and legal actions that impact its financial planning and operational strategies.

- Environmental Compliance: Chemours actively manages its environmental footprint, ensuring compliance with evolving regulations across its global operations.

- Litigation Resolution: A core activity involves resolving legacy litigation, particularly concerning PFAS, through legal settlements and ongoing legal defense strategies.

- Remediation Investments: The company allocates significant resources to environmental remediation efforts at various sites, demonstrating a commitment to addressing past impacts.

- Operational License: Proactive EH&S management and successful litigation resolution are vital for maintaining Chemours' license to operate and ensuring long-term financial stability.

Chemours' key activities are centered on innovation through significant research and development, particularly in creating sustainable chemical solutions like low-GWP refrigerants. Their manufacturing operations are extensive, spanning 28 global facilities to produce a wide range of performance chemicals, ensuring reliable supply for diverse industrial needs. The company also manages a complex global supply chain, crucial for sourcing raw materials and delivering finished products efficiently, as evidenced by their $6.0 billion in net sales in 2023.

Furthermore, Chemours actively engages in sales and marketing to drive demand and expand market share, supported by strong customer relationships and technical assistance. A critical ongoing activity involves robust Environmental, Health, and Safety (EH&S) management, including substantial investments in remediation and resolution of legacy litigation, particularly related to PFAS, which is vital for maintaining their operational license and financial stability.

| Key Activity | Description | 2023 Data/Impact |

| Research & Development | Innovating and improving chemical products and processes. | $273 million in R&D expenses. Focus on low-GWP refrigerants (Opteon™). |

| Manufacturing | Large-scale production of performance chemicals across global facilities. | Operates 28 global manufacturing sites. Essential for meeting worldwide demand. |

| Supply Chain Management | Sourcing raw materials, managing logistics, and ensuring product delivery. | Supports $6.0 billion in net sales. Critical for competitive pricing and availability. |

| Sales & Marketing | Promoting products, building customer relationships, and driving market share. | Underpins $6.0 billion in net sales. Includes direct sales and distribution channels. |

| EH&S & Litigation Management | Ensuring compliance, mitigating risks, and resolving environmental claims. | Addresses PFAS-related matters and remediation investments. Vital for operational license. |

Delivered as Displayed

Business Model Canvas

The Chemours Business Model Canvas preview you are viewing is an exact representation of the final document you will receive upon purchase. This means the structure, content, and formatting are identical to what you'll download, ensuring no surprises. You'll gain full access to this comprehensive business model, ready for immediate use and customization.

Resources

Chemours leverages a strong intellectual property portfolio, including patents and proprietary technologies, to maintain its competitive edge. Globally recognized brands like Opteon™, Ti-Pure™, Nafion™, Teflon™, Viton™, and Krytox™ are central to its value proposition, signifying deep market trust built over decades of innovation and reliable performance in specialized chemical solutions.

Chemours operates a robust global network of 28 manufacturing sites, a crucial element of its business model. These facilities are strategically positioned to efficiently serve its diverse customer base across various markets. In 2023, the company continued to invest in these operations, recognizing their importance for large-scale, complex chemical production.

Chemours' business model hinges on its highly skilled workforce, comprising chemists, engineers, and technical specialists. These professionals are the engine behind innovation, ensuring operational efficiency and providing crucial customer support. Their collective scientific expertise is fundamental to developing cutting-edge materials and offering in-depth application knowledge.

In 2024, Chemours continued to emphasize talent development and retention as a strategic imperative. This focus is vital for maintaining its competitive edge in technological leadership. The company's commitment to nurturing its human capital directly translates into its ability to create advanced chemical solutions and support its global customer base effectively.

Financial Capital

Chemours' access to financial capital, encompassing cash on hand, credit lines, and shareholder equity, is fundamental. This capital fuels everything from daily operations and crucial capital investments to research and development, and importantly, managing its substantial liabilities.

A robust financial standing enables Chemours to pursue growth opportunities, service its debt obligations effectively, and maintain resilience through economic downturns. Investors closely scrutinize the company's financial health and liquidity to gauge its stability and future potential.

For instance, as of the first quarter of 2024, Chemours reported cash and cash equivalents of approximately $1.5 billion. The company also maintained access to committed revolving credit facilities, providing further financial flexibility.

- Cash Reserves: Approximately $1.5 billion in cash and cash equivalents as of Q1 2024.

- Credit Facilities: Access to committed revolving credit facilities, offering additional liquidity.

- Equity: Significant equity base supporting its operations and investment capacity.

- Financial Health: Crucial for funding R&D, capital expenditures, and managing liabilities.

Raw Materials and Supply Chain Access

Chemours' operations heavily rely on consistent access to key raw materials like titanium ore, fluorospar, and various chemical intermediates. These are the building blocks for their diverse product portfolio, impacting everything from coatings to refrigerants.

To ensure this vital supply chain remains robust, Chemours cultivates strategic relationships with its suppliers. Diversifying sourcing is a critical strategy, aiming to mitigate risks and maintain cost-effectiveness. For instance, in 2023, the company continued to emphasize long-term agreements with key titanium dioxide feedstock providers.

- Titanium Ore: Essential for titanium dioxide production, a core Chemours product.

- Fluorospar: A critical input for fluorochemicals, including refrigerants and polymers.

- Chemical Intermediates: A broad category of chemicals used in various synthesis processes across their business segments.

Effective management of these raw material inputs is not just about availability; it's paramount for uninterrupted manufacturing and timely product delivery to customers worldwide. Disruptions in this area can significantly impact production schedules and revenue streams.

Chemours' key resources include its extensive patent portfolio and globally recognized brands like Opteon™ and Teflon™, which are foundational to its market position. The company's 28 global manufacturing sites are critical for efficient production and distribution, supported by a highly skilled workforce of chemists and engineers driving innovation and operational excellence.

Financial capital, including approximately $1.5 billion in cash and cash equivalents as of Q1 2024, alongside credit facilities, underpins Chemours' ability to fund R&D, capital expenditures, and manage liabilities. Reliable access to raw materials such as titanium ore and fluorospar, secured through strategic supplier relationships, is also a vital resource for uninterrupted manufacturing.

| Resource Category | Key Components | Significance | 2024 Data/Context |

|---|---|---|---|

| Intellectual Property & Brands | Patents, Proprietary Technologies, Opteon™, Ti-Pure™, Teflon™ | Competitive advantage, market trust, premium pricing | Continued investment in innovation to maintain leadership. |

| Manufacturing Infrastructure | 28 Global Manufacturing Sites | Efficient production, global reach, supply chain reliability | Ongoing strategic investments to optimize operations. |

| Human Capital | Skilled Chemists, Engineers, Technical Specialists | Innovation, operational efficiency, customer support | Emphasis on talent development and retention for technological leadership. |

| Financial Resources | Cash Reserves, Credit Facilities, Equity | Funding R&D, CapEx, liability management, stability | ~$1.5 billion cash (Q1 2024); access to revolving credit facilities. |

| Raw Material Access | Titanium Ore, Fluorospar, Chemical Intermediates | Uninterrupted production, cost-effectiveness, product quality | Focus on long-term agreements with feedstock providers. |

Value Propositions

Chemours offers market-leading chemical products that provide exceptional performance and critical functions for diverse sectors. These advanced solutions are designed to boost the efficiency, longevity, and safety of the final goods our customers produce, contributing to their competitive edge.

Our deep understanding of materials science allows us to develop specialized chemical formulations that tackle demanding industrial problems. For instance, in 2024, Chemours' titanium technologies segment continued to be a significant revenue driver, with the company reporting over $6 billion in net sales for this segment alone, highlighting the market’s demand for high-performance materials.

Chemours champions sustainability by offering solutions like its Opteon™ refrigerants, which boast significantly lower global warming potential compared to older alternatives. This directly addresses the urgent global need to mitigate climate change impacts.

The company actively works to shrink its environmental footprint, investing in technologies aimed at cutting emissions and cleaning up historical sites. For instance, in 2023, Chemours reported progress in its voluntary remediation efforts at various legacy locations.

This dedication to environmental responsibility is not just ethical; it's a strategic advantage. The increasing market demand for eco-friendly products positions Chemours favorably, appealing to customers and investors prioritizing sustainability.

Chemours offers deep application expertise and robust technical support, enabling customers to maximize product performance and pioneer novel uses. This specialized knowledge, cultivated through close collaboration, translates into customized solutions that address specific industry challenges.

In 2024, Chemours continued to invest heavily in its technical service teams, with a significant portion of its R&D budget allocated to application development support. This focus resulted in the successful launch of several new product formulations, directly addressing customer-driven needs in the semiconductor and advanced electronics sectors.

This value-added approach fosters strong, enduring customer partnerships and acts as a catalyst for innovation across a broad spectrum of end markets, reinforcing Chemours' position as a solutions provider rather than just a material supplier.

Innovation and Advanced Materials

Chemours drives progress through chemistry, developing innovative solutions that are vital for industries like automotive, electronics, and data centers. Their dedication to research and development ensures they stay ahead in chemical technology.

The Advanced Performance Materials segment is a key area where Chemours delivers high-tech solutions for demanding, high-value applications. This focus on advanced materials is crucial for enabling next-generation technologies.

- Innovation in Action: Chemours' R&D investments are geared towards creating chemistry-based innovations that address evolving industry needs.

- Critical Industry Enablement: Their materials are foundational for advancements in sectors such as automotive (e.g., lightweighting, battery technology), electronics (e.g., semiconductors, displays), and data centers (e.g., cooling solutions).

- Advanced Performance Materials: This segment specifically targets high-value applications where superior material properties are essential, driving performance and efficiency.

Reliable Supply and Global Reach

Chemours leverages its extensive global manufacturing footprint and a robust distribution network to guarantee a dependable supply of its critical chemical products to customers across the globe. This expansive infrastructure is a cornerstone of their value proposition, ensuring continuity for clients.

With operations and sales reaching approximately 110 countries, Chemours demonstrates a significant global reach, enabling it to cater effectively to a wide array of diverse markets and customer needs. This broad presence is key to their international strategy.

- Global Manufacturing Footprint: Chemours operates numerous manufacturing sites strategically located worldwide, enhancing supply chain resilience.

- Extensive Distribution Network: A well-established network ensures efficient and timely delivery of products to customers in over 100 countries.

- Market Penetration: Serving approximately 110 countries signifies a deep understanding and ability to meet the varied demands of international markets.

- Customer Confidence: This global capability instills confidence and provides consistency for a diverse international clientele, reinforcing their reliability.

Chemours delivers essential, high-performance chemical solutions that are critical for numerous industries, enhancing product efficiency and durability. Their commitment to innovation is evident in their sustained investment in research and development, particularly in advanced materials that enable next-generation technologies.

The company's Titanium Technologies segment, a significant revenue contributor, generated over $6 billion in net sales in 2024, underscoring the strong market demand for their high-quality titanium dioxide. Furthermore, Chemours' Opteon™ refrigerants, with their low global warming potential, directly address the growing need for sustainable solutions in climate change mitigation efforts.

Chemours provides deep application expertise and technical support, fostering strong customer partnerships and driving innovation. This collaborative approach ensures customers can optimize product performance and develop novel applications, solidifying Chemours' role as a solutions provider.

| Value Proposition | Description | Supporting Data/Fact |

|---|---|---|

| Market-Leading Chemical Products | Exceptional performance and critical functions for diverse sectors. | Titanium Technologies segment net sales exceeded $6 billion in 2024. |

| Sustainability Solutions | Eco-friendly products like Opteon™ refrigerants with low global warming potential. | Addressing urgent global need to mitigate climate change impacts. |

| Deep Application Expertise | Specialized knowledge and technical support for customers. | Investment in technical service teams and R&D for application development in 2024. |

| Global Reach and Reliability | Extensive manufacturing footprint and distribution network. | Operations and sales in approximately 110 countries. |

Customer Relationships

Chemours cultivates direct relationships with its industrial clientele via specialized sales and technical support teams. These experts offer in-depth product knowledge and application assistance, ensuring customers maximize performance. This direct interaction builds enduring partnerships grounded in reliability and specialized know-how.

Chemours actively partners with its customers to tackle complex issues, often developing bespoke solutions tailored to individual operational requirements. This co-creation process ensures that Chemours' products fit seamlessly into customer workflows, fostering a deeper integration and mutual understanding.

This collaborative approach isn't just about solving immediate problems; it's a cornerstone of innovation. By working hand-in-hand, Chemours and its clients can identify unmet needs and engineer novel products. For instance, in 2024, Chemours reported that over 70% of its new product development pipeline was directly influenced by customer feedback and joint development projects.

Such deep engagement significantly bolsters customer loyalty. When clients see Chemours as a true partner invested in their success, rather than just a supplier, it creates a strong bond. This commitment to shared success is a key differentiator, particularly in competitive markets where tailored solutions are highly valued.

Chemours actively supports customers in adapting to evolving regulatory landscapes, such as the U.S. AIM Act's mandate for transitioning to lower Global Warming Potential (GWP) refrigerants. This involves providing compliant product alternatives and offering crucial technical assistance to ensure seamless operational shifts.

By proactively guiding clients through these complex regulatory transitions, Chemours helps them meet stringent requirements and maintain uninterrupted business continuity, fostering strong, reliable customer relationships.

Long-Term Strategic Partnerships

Chemours cultivates long-term strategic partnerships with its key accounts, moving beyond simple transactions. These alliances involve continuous collaboration, joint strategic planning, and a shared outlook on future growth and product development.

These deep relationships are crucial for Chemours' sustained success and mutual advancement.

- Key Account Focus: Chemours prioritizes building enduring relationships with its most significant customers, fostering collaboration that extends beyond immediate sales needs.

- Joint Innovation: These partnerships often involve shared research and development efforts, aligning Chemours' product pipeline with customer-specific future requirements.

- Sustained Revenue: By embedding themselves within customer value chains, Chemours secures more predictable and stable revenue streams, reinforcing long-term business viability.

- Market Insight: Direct, ongoing dialogue with strategic partners provides Chemours with invaluable market intelligence, informing strategic decisions and product innovation.

Customer Feedback and Continuous Improvement

Chemours places a strong emphasis on gathering customer feedback, which is then woven into the fabric of their product development and service enhancements. This deliberate approach to listening ensures their offerings stay aligned with evolving market needs.

- Customer Feedback Integration: Chemours actively solicits input through various channels, directly influencing product innovation and service delivery.

- Market Adaptability: This continuous feedback loop empowers Chemours to swiftly adapt to shifts in market demands, making their solutions more relevant and effective.

- Client Responsiveness: By prioritizing customer insights, Chemours maintains a high level of responsiveness, ensuring they remain a valuable partner to their clients.

- 2024 Focus: In 2024, Chemours continued to invest in digital platforms for real-time customer feedback, aiming to reduce product development cycles by an estimated 15% for key product lines based on early pilot programs.

Chemours fosters deep customer relationships through dedicated technical support and collaborative problem-solving, often co-creating bespoke solutions. This partnership approach drives innovation, with over 70% of its 2024 new product pipeline influenced by customer feedback and joint projects.

By proactively assisting clients with regulatory transitions, such as the U.S. AIM Act for refrigerants, Chemours ensures seamless operational shifts and reinforces its role as a reliable partner.

Chemours prioritizes key account management, engaging in strategic planning and shared growth outlooks, which secures predictable revenue and provides vital market intelligence.

The company actively integrates customer feedback, utilizing digital platforms in 2024 to expedite product development cycles by an estimated 15% for key lines.

| Relationship Type | Key Activities | Customer Benefit | 2024 Data Point |

| Direct Sales & Technical Support | Product knowledge, application assistance | Maximized performance, reliability | N/A (Ongoing) |

| Co-creation & Bespoke Solutions | Joint development, tailored products | Seamless integration, problem-solving | >70% of new product pipeline influenced by customer input |

| Strategic Partnerships | Joint planning, long-term collaboration | Predictable revenue, market insight | N/A (Ongoing) |

| Regulatory Guidance | Compliance support, product alternatives | Uninterrupted operations, regulatory adherence | Focus on GWP refrigerant transition |

Channels

Chemours employs a direct sales force to cultivate relationships with major industrial clients and significant accounts worldwide. This approach facilitates direct negotiations and the development of customized solutions, ensuring a deep comprehension of client requirements.

This direct engagement is vital for navigating intricate sales processes and fostering robust, long-term customer partnerships. In 2024, Chemours reported that its direct sales channel was instrumental in securing key contracts within the automotive and electronics sectors, contributing significantly to revenue growth.

Chemours utilizes an extensive global distribution network to ensure its products reach a broad customer base, particularly those needing widespread accessibility. This network is crucial for markets like automotive and electronics where consistent supply is paramount.

Distributors are key partners, enabling Chemours to serve smaller customers effectively and offer localized logistical support. For instance, their titanium dioxide products, a significant revenue driver, rely on these networks for efficient delivery to paint and plastics manufacturers worldwide.

In 2024, Chemours continued to optimize this network, aiming for enhanced efficiency and reduced lead times. The company's commitment to supply chain resilience means investing in robust distribution channels to mitigate disruptions and ensure product availability across its diverse geographic markets.

Chemours leverages its corporate website and dedicated investor relations portal to foster an informative online presence. These platforms serve as crucial hubs for detailed product information, essential technical data, and readily accessible financial reports, ensuring stakeholders are well-informed.

While direct sales of its industrial chemicals don't primarily occur online, Chemours' digital channels are vital for managing customer inquiries, offering extensive technical resources, and facilitating clear investor communication. This digital strategy significantly enhances accessibility and transparency across its stakeholder base.

In 2023, Chemours reported a significant portion of its investor communications were handled digitally, reflecting a broader trend in corporate engagement. The company's website traffic saw a consistent increase, particularly around earnings release periods, underscoring the importance of these digital touchpoints for transparency and information dissemination.

Industry Trade Shows and Conferences

Chemours actively participates in key industry trade shows and conferences, such as the International Air-Conditioning, Heating, Refrigerating Exposition (AHR Expo) and the Specialty & Custom Chemicals America (SCA). These events are crucial for demonstrating their latest innovations in areas like low global warming potential refrigerants and advanced performance materials. For instance, at AHR Expo 2024, Chemours highlighted its Opteon™ portfolio, emphasizing its role in sustainable cooling solutions.

These gatherings offer direct engagement with a diverse customer base, from HVAC manufacturers to chemical distributors, allowing for immediate feedback and relationship building. They also serve as valuable platforms for gathering competitive intelligence and understanding emerging market trends. Chemours leverages these opportunities to solidify its position as a technology leader in the chemical sector.

- Product Showcase: Demonstrating new offerings like advanced fluoropolymers and refrigerants.

- Customer Engagement: Direct interaction with potential and existing clients to foster relationships and gather feedback.

- Market Intelligence: Observing competitor activities and identifying emerging industry trends.

- Brand Reinforcement: Highlighting technological leadership and commitment to innovation.

Technical Seminars and Webinars

Chemours leverages technical seminars and webinars as a key channel to disseminate crucial information about its product portfolio, innovative applications, and evolving regulatory landscapes. These sessions are designed to cultivate a more informed customer base and industry stakeholders, fostering a deeper understanding of Chemours' offerings and their practical implementation.

These educational platforms are instrumental in facilitating knowledge transfer, thereby strengthening relationships and encouraging greater collaboration. For instance, in 2024, Chemours hosted over 50 webinars covering topics from sustainable chemistry solutions to advanced material science, reaching an estimated 15,000 participants globally.

- Knowledge Dissemination: Educating on product features, benefits, and safe handling practices.

- Market Engagement: Building relationships and gathering feedback from customers and partners.

- Thought Leadership: Showcasing expertise and innovation to establish credibility.

- Regulatory Updates: Informing stakeholders about compliance and industry standards.

Chemours utilizes a multi-faceted channel strategy, blending direct sales with a robust distribution network to reach diverse customer segments. Industry events and digital platforms further support engagement and information dissemination.

These channels are critical for showcasing innovation, building relationships, and ensuring product accessibility across global markets. In 2024, Chemours' direct sales and distribution efforts were key drivers of growth, particularly in sectors like automotive and electronics.

The company's commitment to digital engagement and technical education through webinars and seminars in 2024 enhanced customer understanding and solidified its market position.

| Channel | Description | Key Activities | 2024 Impact/Focus |

|---|---|---|---|

| Direct Sales Force | Cultivates relationships with major industrial clients. | Direct negotiations, customized solutions. | Secured key contracts in automotive and electronics. |

| Global Distribution Network | Ensures widespread product accessibility. | Serves smaller customers, offers localized support. | Optimized for efficiency and reduced lead times. |

| Corporate Website & Investor Relations | Online hub for product information and financial reports. | Managing inquiries, providing technical resources. | Increased traffic, enhanced transparency. |

| Industry Trade Shows & Conferences | Showcases innovations and engages with customers. | Product demonstrations, market intelligence gathering. | Highlighted Opteon™ portfolio at AHR Expo 2024. |

| Technical Seminars & Webinars | Disseminates product information and fosters knowledge transfer. | Educating on applications, regulatory updates. | Hosted over 50 webinars in 2024. |

Customer Segments

Chemours is a key supplier to the automotive industry, providing performance chemicals vital for vehicle components like air conditioning refrigerants and materials for lightweighting and durability. These offerings directly support improvements in vehicle performance, safety, and fuel efficiency.

In 2024, the automotive sector represented a substantial market for Chemours, particularly within its Thermal & Specialized Solutions and Advanced Performance Materials segments. For instance, demand for refrigerants like Opteon™ YF, a low global warming potential (GWP) solution, saw continued growth driven by evolving environmental regulations and consumer preference for more sustainable vehicles.

Paints and coatings manufacturers are a core customer segment for Chemours, relying heavily on its titanium dioxide (TiO2) pigments. These pigments are essential for achieving opacity, brightness, and durability in a vast array of paint and coating formulations. This foundational customer base drives significant volume for Chemours' Titanium Technologies segment.

Chemours is a key supplier of refrigerants, including its well-known Opteon™ and Freon™ brands, to the HVAC sector, serving residential, commercial, and automotive applications. This market is experiencing a major shift towards refrigerants with lower global warming potential (GWP), which is boosting demand for Chemours' advanced Opteon™ product line.

The U.S. AIM Act, for instance, is a significant regulatory driver, mandating phasedowns of high-GWP hydrofluorocarbons (HFCs) and directly influencing customer choices and driving adoption of Chemours' lower-GWP solutions. This regulatory environment is creating substantial opportunities for Chemours as the industry adapts to more sustainable cooling technologies.

Electronics and Semiconductor Industries

Chemours is a key supplier to the electronics and semiconductor industries, offering advanced performance materials vital for manufacturing. These specialized fluids and polymers are indispensable for creating high-performance chips and sophisticated electronic components.

This sector's rapid technological advancements necessitate materials with exceptional purity and innovative capabilities. For instance, Chemours' Ti-Pure™ titanium dioxide is used in photoresists for semiconductor lithography, a critical step in chip production.

- Advanced Materials: Chemours supplies critical chemicals and polymers for chip fabrication and advanced electronics.

- High Purity Demands: The semiconductor industry requires ultra-high purity materials for reliable and efficient chip manufacturing.

- Technological Evolution: This segment constantly seeks cutting-edge solutions to meet the demands of smaller, faster, and more powerful electronic devices.

- Market Relevance: The global semiconductor market was valued at approximately $600 billion in 2023, highlighting the significant demand for enabling materials.

General Industrial and Manufacturing

The general industrial and manufacturing sector forms a crucial customer base for Chemours, spanning a wide range of applications like plastics production, mining operations, and various general industrial processes. These diverse clients depend on Chemours' broad portfolio of chemical solutions to drive their manufacturing activities.

Customers within this segment often procure products from Chemours' Titanium Technologies, Thermal & Specialized Solutions, and Advanced Performance Materials segments. This broad engagement highlights the foundational and specialty chemical needs met by Chemours across numerous industrial value chains.

- Diverse Applications: This segment utilizes Chemours' chemicals in everything from creating durable plastics to enabling efficient mineral extraction and supporting a multitude of general manufacturing processes.

- Cross-Segment Demand: Customers in general industrial and manufacturing often source products across Chemours' main business segments, demonstrating the company's integrated value proposition.

- Market Reach: The broad nature of this segment signifies a diversified demand base, providing Chemours with resilience and consistent revenue streams from essential industrial inputs.

- Economic Impact: In 2024, industrial manufacturing remains a significant contributor to global GDP, underscoring the importance of reliable chemical suppliers like Chemours to maintain production levels and drive economic activity.

Chemours serves diverse customer segments, including automotive and paints & coatings, providing essential performance chemicals and pigments. The electronics and semiconductor industries rely on Chemours for high-purity materials critical for advanced chip manufacturing. Furthermore, the general industrial and manufacturing sector utilizes Chemours' broad chemical portfolio across various production processes.

| Customer Segment | Key Products/Applications | 2024 Market Relevance/Drivers |

| Automotive | Refrigerants (Opteon™ YF), lightweighting materials | Growing demand for low GWP refrigerants, fuel efficiency regulations. |

| Paints & Coatings | Titanium Dioxide (TiO2) pigments (Ti-Pure™) | Essential for opacity, brightness, and durability in coatings. |

| HVAC | Refrigerants (Opteon™, Freon™) | Shift to low GWP refrigerants driven by regulations like the AIM Act. |

| Electronics & Semiconductor | Advanced polymers, specialty fluids, photoresist materials | High purity demands, technological evolution in chip manufacturing. Global semiconductor market valued ~ $600 billion in 2023. |

| General Industrial & Manufacturing | Chemicals for plastics, mining, various industrial processes | Broad applications across diverse value chains, supporting economic activity. |

Cost Structure

Chemours' cost of goods sold (COGS) is heavily influenced by the direct expenses tied to chemical production. This includes the cost of essential raw materials, the labor directly involved in manufacturing, and the overhead costs associated with running their factories.

For instance, in 2024, Chemours reported significant COGS, reflecting the substantial investment in raw materials like titanium dioxide feedstock and fluorochemical precursors. Fluctuations in global commodity prices for these inputs, along with the company's ongoing efforts to optimize manufacturing processes and improve operational efficiency, directly impact the bottom line of their COGS.

Effectively managing these direct production costs is paramount for Chemours to ensure profitability across its diverse business segments, from Titanium Technologies to Thermal & Specialized Solutions.

Selling, General, and Administrative (SG&A) expenses for Chemours encompass costs vital for its operations beyond manufacturing, including sales, marketing, distribution, and corporate overhead. These expenses are crucial for reaching customers and managing the company's overall structure.

In 2023, Chemours reported SG&A expenses of approximately $1.1 billion. The company's 'Pathway to Thrive' initiative, launched in 2022, specifically targets optimizing these overhead costs, aiming for significant savings to improve profitability and operational efficiency.

Chemours dedicates significant resources to Research and Development, a core component of its cost structure. In 2023, the company reported R&D expenses of $333 million, underscoring its commitment to innovation and the development of new products and technologies.

This substantial investment is vital for Chemours to maintain its competitive edge in the chemical industry, particularly in areas like advanced materials and sustainable solutions. The company's R&D efforts are directly linked to its long-term strategy for growth and market differentiation.

Litigation and Environmental Remediation Costs

Chemours faces substantial litigation and environmental remediation costs, primarily stemming from legacy PFAS liabilities. These expenses directly impact the company's financial performance and cash flow. For instance, in 2023, Chemours recorded significant charges related to environmental liabilities and legal settlements, impacting its earnings.

- PFAS Litigation: Ongoing legal challenges related to per- and polyfluoroalkyl substances necessitate significant legal defense and potential settlement outlays.

- Environmental Remediation: Costs associated with cleaning up contaminated sites and addressing environmental impacts are a major financial commitment.

- Financial Impact: These liabilities can lead to substantial charges, affecting profitability and requiring careful financial planning and cash management.

Capital Expenditures (CapEx)

Chemours' cost structure heavily features capital expenditures (CapEx) as it consistently invests in its manufacturing infrastructure, equipment, and capacity enhancements. These substantial investments are crucial for maintaining high operational efficiency, integrating advanced technologies, and driving growth, such as the expansion of its Opteon™ product line. For instance, in 2023, Chemours reported capital expenditures of $750 million, reflecting its commitment to these strategic upgrades and future revenue streams.

These CapEx decisions are directly linked to Chemours' overarching strategic goals and its projections for future revenue. The company prioritizes investments that will not only sustain current operations but also enable it to capitalize on emerging market opportunities and meet increasing customer demand. This forward-looking approach ensures that its manufacturing capabilities remain competitive and scalable.

- Manufacturing Facility Upgrades: Ongoing investments to modernize and maintain production plants.

- Technology Integration: Capital allocated for adopting new and improved manufacturing technologies.

- Capacity Expansion: Funding for increasing production volumes, particularly for high-demand products like Opteon™.

- Strategic Growth Initiatives: Investments supporting the development and scaling of new product lines and market penetration.

Chemours' cost structure is dominated by significant investments in raw materials and manufacturing, alongside substantial R&D and SG&A expenses. The company also faces considerable financial outlays due to litigation and environmental liabilities, particularly concerning PFAS. Strategic capital expenditures are crucial for maintaining and expanding its production capabilities.

| Cost Category | 2023 Actuals (Approx.) | Key Drivers |

|---|---|---|

| Cost of Goods Sold (COGS) | Significant portion of revenue | Raw material costs (e.g., titanium dioxide feedstock, fluorochemical precursors), direct labor, factory overhead |

| Selling, General, and Administrative (SG&A) | $1.1 billion | Sales, marketing, distribution, corporate overhead; targeted for optimization via 'Pathway to Thrive' |

| Research & Development (R&D) | $333 million | Innovation, new product development (e.g., advanced materials, sustainable solutions) |

| Litigation & Environmental Liabilities | Substantial charges recorded | PFAS litigation, environmental remediation, legal settlements |

| Capital Expenditures (CapEx) | $750 million | Manufacturing infrastructure, technology integration, capacity expansion (e.g., Opteon™) |

Revenue Streams

Revenue within the Titanium Technologies segment is primarily derived from the sale of titanium dioxide (TiO2) pigments, famously marketed under the Ti-Pure™ brand. These pigments are essential components in a wide array of everyday products, including paints, coatings, plastics, and paper, making this segment a cornerstone of Chemours' financial performance.

In 2023, the Titanium Technologies segment generated approximately $4.4 billion in net sales, representing a substantial portion of Chemours' total revenue. While this market can experience fluctuations due to cyclical demand and pricing dynamics, it consistently provides a stable revenue foundation for the company.

The Thermal & Specialized Solutions (TSS) segment at Chemours brings in revenue primarily through the sale of refrigerants, featuring well-known brands like Opteon™ and Freon™. This segment also includes other specialized chemical products designed for thermal management applications.

A significant driver of growth for TSS is the increasing demand for Opteon™ refrigerants, which have a low Global Warming Potential (GWP). This demand is directly linked to global regulatory shifts pushing for more environmentally friendly cooling solutions.

Chemours reported that for the full year 2023, the TSS segment generated approximately $2.5 billion in net sales. Sales within this segment are notably affected by seasonal patterns, particularly in the air conditioning market, and the broader dynamics of the global refrigeration industry.

The Advanced Performance Materials (APM) segment generates revenue through the sale of specialized fluoropolymers and advanced materials. These high-value products are crucial for demanding applications in sectors like electronics, automotive, and general industrial markets.

Key products within APM include well-known brands such as Nafion™, Teflon™, Viton™, and Krytox™. These materials are recognized for their unique properties, enabling performance in challenging environments.

While some areas within APM may experience market cyclicality, the segment generally benefits from robust pricing power in its high-value application niches. Continued innovation also plays a significant role in maintaining its competitive edge.

For instance, in the first quarter of 2024, Chemours reported APM net sales of $641 million, showcasing the segment's substantial contribution to the company's overall financial performance.

Licensing and Technology Fees

Chemours, with its significant investment in research and development, likely generates revenue through licensing its patented technologies and providing technical expertise. This stream capitalizes on their proprietary processes and extensive R&D efforts.

While not always a headline figure, these licensing and technology fees can represent a high-margin component of Chemours' overall financial performance, contributing to profitability without the direct costs associated with manufacturing and distribution.

- Intellectual Property Monetization: Chemours' portfolio of patents and proprietary chemical processes offers opportunities for revenue generation through licensing agreements with other companies.

- Technical Know-How: Beyond patents, Chemours can earn fees by sharing its specialized knowledge and technical support related to its chemical innovations.

- High-Margin Contribution: Licensing and technology fees typically have lower associated costs compared to product sales, leading to potentially higher profit margins.

Sales of Other Chemical Solutions

Chemours' revenue streams extend beyond its core segments with sales from its Other segment, which encompasses performance chemicals and intermediates like sodium cyanide. While this segment represents a smaller portion of overall revenue, it diversifies income and leverages the company's established chemical manufacturing capabilities for various industrial uses.

In 2023, the Other segment contributed $315 million to Chemours' total net sales of $6.9 billion, showcasing its role as a supplementary revenue generator. This segment's offerings are crucial for industries requiring specialized chemical inputs, underscoring Chemours' broad application expertise.

- Sodium Cyanide Sales: A key component of the Other segment, providing essential chemicals for industries such as mining and electroplating.

- Performance Chemicals: This category includes a range of specialized chemicals tailored for specific industrial applications, contributing to revenue diversity.

- Intermediates: Products used as building blocks in the production of other chemicals, further broadening Chemours' market reach.

- Industrial Applications: These sales cater to a wide array of industrial sectors, demonstrating the versatility of Chemours' chemical solutions beyond its primary markets.

Chemours' revenue is built upon distinct segments, each contributing unique value. The Titanium Technologies segment, its largest, relies on titanium dioxide (TiO2) pigment sales, with Ti-Pure™ being a flagship brand. This segment generated approximately $4.4 billion in net sales in 2023, underscoring its foundational role.

The Thermal & Specialized Solutions (TSS) segment, driven by refrigerants like Opteon™ and Freon™, reported $2.5 billion in net sales for 2023. This segment's growth is bolstered by increasing demand for low Global Warming Potential (GWP) refrigerants, aligning with environmental regulations.

Advanced Performance Materials (APM) generates revenue from high-value fluoropolymers and materials such as Nafion™, Teflon™, and Viton™, crucial for sectors like electronics and automotive. In Q1 2024, APM net sales reached $641 million, demonstrating its significant contribution.

Additionally, Chemours monetizes its intellectual property through licensing and technical expertise, offering a high-margin revenue stream. The Other segment, including sodium cyanide, added $315 million in 2023, diversifying income and leveraging manufacturing capabilities.

| Segment | Key Products | 2023 Net Sales (Approx.) | Key Drivers |

| Titanium Technologies | TiO2 Pigments (Ti-Pure™) | $4.4 billion | Paint, coatings, plastics, paper demand |

| Thermal & Specialized Solutions | Refrigerants (Opteon™, Freon™) | $2.5 billion | Low-GWP refrigerant demand, HVAC market |

| Advanced Performance Materials | Fluoropolymers (Nafion™, Teflon™) | $641 million (Q1 2024) | Electronics, automotive, industrial applications |

| Other | Sodium Cyanide, Performance Chemicals | $315 million | Mining, electroplating, industrial inputs |

Business Model Canvas Data Sources

The Chemours Business Model Canvas is built upon a foundation of comprehensive market research, internal financial statements, and strategic planning documents. These diverse data sources ensure each component of the canvas accurately reflects the company's current operations and future direction.