Chemours Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Chemours Bundle

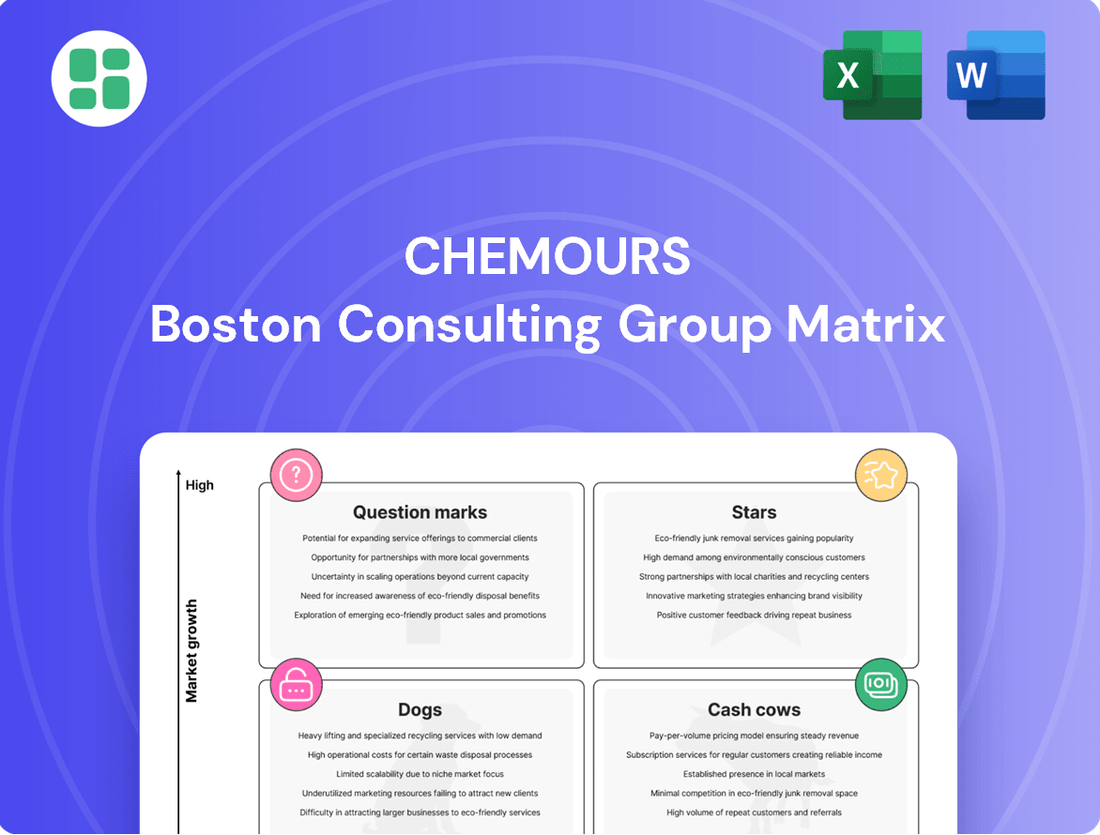

Chemours' strategic positioning is laid bare by its BCG Matrix, highlighting areas of growth and stability within its diverse product portfolio. Understanding whether its offerings are Stars, Cash Cows, Dogs, or Question Marks is crucial for informed decision-making. Purchase the full BCG Matrix to unlock detailed quadrant analysis and actionable strategies that will guide your investment and resource allocation for maximum impact.

Stars

Opteon™ refrigerants are a shining example of a Star in Chemours' portfolio. The demand for these low Global Warming Potential (GWP) products is surging, directly fueled by increasing environmental regulations worldwide.

The U.S. AIM Act, for instance, is a significant driver, pushing the market towards more sustainable refrigerant solutions. Chemours' Opteon™ line is well-positioned to meet this growing need, showing impressive sales growth.

Chemours is strategically expanding its capacity for Opteon™ to capitalize on this expanding market. This proactive approach ensures they can meet the escalating demand and maintain their strong position in the low-GWP refrigerant sector.

Nafion™ membranes, a key offering from Chemours' Advanced Performance Materials segment, are crucial for the burgeoning hydrogen economy. Their application in fuel cells and electrolyzers positions them as a strong contender in the BCG matrix.

Chemours is significantly increasing Nafion™ production capacity, signaling confidence in its growth trajectory. This investment is directly tied to the escalating demand for clean energy technologies.

The market for hydrogen-based solutions is expanding rapidly, with projections indicating substantial growth in the coming years. This robust market expansion makes Nafion™ a high-potential product for Chemours. For instance, the global hydrogen fuel cell market was valued at approximately $2.5 billion in 2023 and is expected to reach over $14 billion by 2030, growing at a CAGR of around 27%.

Chemours' Advanced Performance Materials segment is heavily invested in the semiconductor fabrication market, recognizing it as a significant growth engine. The demand for advanced materials in chip manufacturing is soaring, driven by the relentless pace of technological innovation and the increasing complexity of semiconductor designs. This strategic focus positions Chemours to capitalize on a high-growth industry, suggesting strong potential for this business unit to become a market leader.

Advanced Performance Materials for Electric Vehicle (EV) Batteries

Chemours' advanced performance materials for electric vehicle (EV) batteries are a significant growth driver, fitting the profile of a Star in the BCG Matrix. The EV market is experiencing explosive growth, with global EV sales projected to reach over 25 million units in 2024, a substantial increase from previous years. Chemours is strategically positioned to benefit from this trend by supplying critical components for next-generation batteries.

- Market Growth: The global EV market is anticipated to grow at a compound annual growth rate (CAGR) of over 20% through 2030, driven by increasing environmental consciousness and government incentives.

- Chemours' Role: Chemours provides advanced materials like high-purity solvents and electrolyte additives essential for enhancing battery performance, safety, and longevity.

- Strategic Focus: The company's investment in R&D for battery materials underscores its commitment to capturing a significant share of this rapidly expanding market.

Opteon™ 2P50 for Data Center Immersion Cooling

Opteon™ 2P50 is a prime example of a Star in the Chemours BCG Matrix, demonstrating high growth and a significant market share in the emerging data center immersion cooling sector. This innovative fluid is specifically designed for two-phase immersion cooling, a technology crucial for managing the intense heat generated by modern data centers. Chemours' strategic manufacturing agreements underscore its commitment to capturing a substantial portion of this rapidly expanding market.

The demand for efficient cooling solutions is soaring as data infrastructure continues its exponential growth. For context, the global data center market was valued at approximately $200 billion in 2023 and is projected to reach over $400 billion by 2028, with immersion cooling expected to be a key driver of this expansion. Opteon™ 2P50 directly addresses this need, offering superior thermal performance compared to traditional air cooling methods.

- High Growth Potential: The data center immersion cooling market is experiencing rapid expansion, driven by increasing server densities and energy efficiency demands.

- Technological Innovation: Opteon™ 2P50 offers advanced two-phase immersion cooling capabilities, a cutting-edge solution for thermal management.

- Strategic Market Entry: Chemours' manufacturing agreements position it to become a leading supplier in this nascent but high-potential market segment.

- Market Share Capture: The company is poised to gain significant market share due to the unique advantages and growing adoption of its Opteon™ 2P50 fluid.

Chemours' Opteon™ refrigerants are a prime example of a Star, with demand driven by global environmental regulations like the U.S. AIM Act. The company is increasing production capacity to meet this surging need for low Global Warming Potential (GWP) solutions. Nafion™ membranes are also Stars, critical for the growing hydrogen economy and experiencing significant capacity expansion due to clean energy demand. The global hydrogen fuel cell market was valued at approximately $2.5 billion in 2023 and is projected to exceed $14 billion by 2030.

Advanced performance materials for electric vehicle (EV) batteries represent another Star, benefiting from the explosive EV market growth, with global sales expected to surpass 25 million units in 2024. Chemours supplies essential components for these batteries, aiming to capture significant market share in a sector projected to grow at over 20% CAGR through 2030. Opteon™ 2P50, a fluid for data center immersion cooling, is also a Star, addressing the heat management needs of the expanding data center market, valued at around $200 billion in 2023.

| Product | BCG Category | Key Growth Driver | Market Context (2023/2024 Data) | Chemours' Strategy |

| Opteon™ Refrigerants | Star | Environmental Regulations (Low GWP Demand) | Surging demand due to global regulations. | Capacity expansion to meet growing need. |

| Nafion™ Membranes | Star | Hydrogen Economy Growth | Global hydrogen fuel cell market ~$2.5B (2023), projected growth. | Increased production capacity, capitalizing on clean energy demand. |

| EV Battery Materials | Star | Electric Vehicle Market Expansion | Global EV sales >25M units (2024 est.), >20% CAGR projected. | Supplying critical components, R&D investment. |

| Opteon™ 2P50 (Immersion Cooling) | Star | Data Center Growth & Efficiency Needs | Global data center market ~$200B (2023), immersion cooling is a key driver. | Manufacturing agreements to capture market share. |

What is included in the product

The Chemours BCG Matrix provides a strategic overview of its business units, categorizing them as Stars, Cash Cows, Question Marks, and Dogs based on market share and growth.

This analysis helps Chemours identify which segments to invest in, maintain, or divest to optimize its portfolio.

A clear Chemours BCG Matrix visualizes business unit performance, easing the pain of strategic uncertainty.

Cash Cows

The Titanium Technologies segment, driven by its Ti-Pure™ titanium dioxide brand, is a prime example of a Cash Cow for Chemours. This segment benefits from a dominant market share in the mature titanium dioxide industry, a critical component used as a white pigment in paints, plastics, and paper.

Despite the industry's moderate, albeit cyclical, growth prospects, Ti-Pure™ consistently delivers robust revenue and significant cash flow. For instance, in 2023, the Titanium Technologies segment reported net sales of $2.7 billion, underscoring its substantial contribution to Chemours' overall financial performance.

Established fluoropolymer product lines within Chemours' Advanced Performance Materials (APM) segment are classic Cash Cows. These products, like certain grades of PTFE and FEP, cater to mature, stable industrial markets where their proven performance and reliability have secured high market share. For instance, in 2024, Chemours reported that its APM segment, which houses these fluoropolymers, continued to be a significant contributor to its overall revenue, demonstrating consistent profitability.

Chemours' core refrigerant blends, excluding the high-growth Opteon™ line, represent a stable cash cow within their Thermal & Specialized Solutions (TSS) segment. These established products serve a vast, existing market of refrigeration and air conditioning systems, guaranteeing consistent revenue streams.

In 2024, Chemours continued to see significant demand for these foundational refrigerants, which are critical for maintaining existing infrastructure. This segment benefits from a large, mature installed base, providing a predictable and reliable source of cash flow for the company, even as the industry shifts towards newer, more environmentally friendly options.

Specialty Chemicals for Industrial Manufacturing

Chemours' specialty chemicals segment serves a broad spectrum of industrial manufacturing, providing crucial components for established sectors. These chemicals are vital for processes ranging from automotive production to electronics assembly, highlighting their widespread application.

The nature of these specialty chemicals, often requiring proprietary formulations and deep-seated customer partnerships, creates significant barriers to market entry. This exclusivity helps ensure a consistent demand and pricing power for Chemours.

These products are considered Cash Cows within the Chemours portfolio, generating reliable revenue and profit streams. In 2024, Chemours reported that its Titanium Technologies segment, which includes many industrial chemicals, continued to be a strong performer, contributing significantly to overall profitability and supporting investments in other business areas.

- Established Market Presence: Chemours supplies essential specialty chemicals to numerous established industrial manufacturing sectors.

- High Entry Barriers: Specialized formulations and strong customer relationships create significant hurdles for new competitors.

- Stable Revenue Generation: These products are a consistent source of profit, characteristic of a Cash Cow business.

- Support for Growth: Profits from this segment help fund research and development or expansion into emerging markets.

Mature Applications of Advanced Performance Materials

Mature applications within Chemours' Advanced Performance Materials segment, such as established coatings and wire insulation, function as cash cows. These areas leverage Chemours' robust market position and proven product efficacy to deliver steady revenue streams. For instance, in 2024, Chemours reported that its Titanium Technologies segment, which includes many mature product lines, continued to be a significant contributor to overall profitability, demonstrating the reliability of these established markets.

These segments benefit from minimal need for substantial capital expenditure for expansion, allowing for consistent cash generation. Chemours' long-standing relationships and brand recognition in these sectors, like those in automotive coatings or durable plastics, ensure a stable demand. This stability allows Chemours to allocate resources effectively, often reinvesting profits into higher-growth areas of the business.

- Stable Demand: Mature applications in coatings and insulation benefit from consistent, predictable market needs.

- Low Investment: These segments require limited new capital for growth, maximizing cash flow generation.

- Market Leadership: Chemours' established presence and product quality in these areas ensure continued customer loyalty.

- Profitability Driver: These cash cows provide essential funds for investment in emerging technologies and market expansion.

Chemours' established fluoropolymer product lines, particularly those serving mature industrial markets, function as reliable cash cows. These products, like certain grades of PTFE and FEP, benefit from high market share due to proven performance and customer loyalty. In 2024, Chemours highlighted the continued profitability of its Advanced Performance Materials segment, which houses these fluoropolymers, demonstrating their consistent contribution to the company's financial stability.

These segments require minimal new capital investment for expansion, allowing for robust cash flow generation. Chemours' strong brand recognition and long-standing customer relationships in sectors such as automotive and electronics ensure stable demand for these essential materials. This consistent profitability allows Chemours to strategically allocate capital towards growth initiatives in other business areas.

| Product Segment | BCG Category | 2023 Net Sales (USD Billions) | Key Characteristics |

| Titanium Technologies (Ti-Pure™) | Cash Cow | 2.7 | Dominant market share, mature industry, consistent cash flow. |

| Established Fluoropolymers (APM) | Cash Cow | (Included in APM segment) | High market share, stable demand, low investment needs. |

| Core Refrigerants (TSS) | Cash Cow | (Included in TSS segment) | Large installed base, predictable revenue, mature market. |

What You See Is What You Get

Chemours BCG Matrix

The Chemours BCG Matrix preview you are viewing is the exact, fully formatted document you will receive upon purchase. This comprehensive analysis, designed for strategic decision-making, will be delivered to you without any watermarks or demo content, ensuring immediate usability for your business planning needs.

Dogs

The decision to exit the Surface Protection Solutions (SPS) Capstone™ business unequivocally places it in the Dogs quadrant of the BCG Matrix. This segment experienced declining sales, with Chemours reporting a 10% decrease in net sales for the Titanium Technologies segment, which includes SPS, in the first quarter of 2024 compared to the same period in 2023. The company also incurred restructuring charges and asset write-offs related to this divestiture.

This area represents a low-growth, low-market share segment that Chemours has deemed non-strategic. The divestiture of Capstone™ is expected to free up resources for investment in more promising business areas. Chemours' strategic focus in 2024 remains on its Titanium Technologies and Advanced Performance Materials segments, which are seen as having higher growth potential and market leadership.

Legacy Freon™ refrigerants represent a declining product category for Chemours. Regulatory phase-downs targeting high Global Warming Potential (GWP) chemicals are shrinking the market, leading to persistent price drops and lower sales volumes. While still generating some revenue, their future outlook is dim, making them a less attractive investment for the company's resources.

Chemours has identified underperforming or idled assets within its Advanced Performance Materials (APM) segment. These assets, described as having no future intended use, suggest a strategic move to divest or cease operations for units that are not contributing effectively to the company's growth or profitability. This aligns with the characteristics of 'Dogs' in the BCG matrix, representing low market share and low growth potential.

In 2024, Chemours reported significant asset-related charges and write-offs, specifically mentioning those within the APM segment. These charges are indicative of the company's efforts to streamline its operations by exiting or decommissioning assets that are no longer strategically viable or economically beneficial. Such actions are typical for businesses managing a portfolio of diverse product lines and manufacturing capabilities.

Specific Commoditized Titanium Dioxide Product Lines

Within Chemours' Titanium Technologies segment, which generally performs as a Cash Cow, specific, highly commoditized titanium dioxide (TiO2) product lines can be viewed as potential Dogs. This is particularly true for those offerings situated in markets experiencing significant oversupply or a noticeable dip in demand.

These particular sub-segments within the TiO2 market might face ongoing challenges with pricing pressure and exhibit very limited potential for growth. Consequently, they could generate minimal returns on the capital invested in them. For instance, in 2024, certain regions saw TiO2 prices fluctuate due to these supply-demand imbalances.

- Commoditized TiO2 Product Lines: Areas with standardized TiO2 grades facing intense competition.

- Market Oversupply: Regions where TiO2 production outstrips consumer needs.

- Subdued Demand: Sectors or geographies where TiO2 consumption is weakening.

- Limited Growth & Pricing Pressure: These factors combine to reduce profitability for these specific product lines.

Non-Strategic or Obsolete Chemical Formulations

Chemours' portfolio may include chemical formulations that are no longer competitive. These products, often rendered obsolete by new technologies or shifts in industry demand, typically possess a low market share and little prospect for future growth. Their continued presence can tie up valuable company capital without generating significant returns.

These non-strategic or obsolete chemical formulations are characterized by:

- Declining Market Relevance: Products that no longer meet current industry needs or customer specifications.

- Low Growth Potential: Minimal to no anticipated expansion in sales or market penetration.

- Capital Immobilization: Resources are allocated to products that offer little to no future economic benefit.

- Technological Obsolescence: Formulations superseded by more advanced or efficient alternatives.

Chemours' divestiture of the Surface Protection Solutions (SPS) Capstone™ business firmly places it in the Dogs category due to declining sales and a strategic shift away from non-core assets. This move, alongside the management of legacy Freon™ refrigerants facing regulatory phase-downs, highlights Chemours' efforts to streamline its portfolio. The company is actively addressing underperforming assets within its Advanced Performance Materials segment, indicated by significant asset-related charges reported in 2024, to reallocate resources to higher-growth areas.

Certain commoditized titanium dioxide (TiO2) product lines within the Titanium Technologies segment, particularly those in markets with oversupply and subdued demand, can also be classified as Dogs. These specific sub-segments face pricing pressures and exhibit limited growth potential, generating minimal returns on invested capital. For example, in 2024, regional TiO2 markets experienced price volatility due to these supply-demand imbalances.

Chemours' portfolio may also encompass chemical formulations that have become obsolete due to technological advancements or shifts in industry demand. These products, characterized by declining market relevance and low growth potential, tie up capital without offering significant future economic benefit. The company's 2024 financial reports noted restructuring charges and asset write-offs, signaling a proactive approach to divesting or decommissioning such non-strategic assets.

| Business Unit/Product Line | BCG Category | Rationale | 2024 Data/Observation |

| SPS Capstone™ | Dogs | Divested, declining sales, non-strategic | 10% decrease in Titanium Technologies net sales (Q1 2024 vs Q1 2023) |

| Legacy Freon™ Refrigerants | Dogs | Regulatory phase-downs, declining market | Persistent price drops and lower sales volumes |

| Underperforming APM Assets | Dogs | No future intended use, underperforming | Significant asset-related charges and write-offs in APM segment |

| Commoditized TiO2 Lines | Dogs | Market oversupply, subdued demand, pricing pressure | Regional TiO2 price fluctuations due to supply-demand imbalances |

| Obsolete Chemical Formulations | Dogs | Declining market relevance, technological obsolescence | Capital immobilization without significant returns |

Question Marks

Chemours is actively investing in emerging digital and advanced electronics materials, looking beyond traditional semiconductors into areas like specialized displays and next-generation computing. These markets represent significant growth potential, with the global advanced electronics market projected to reach over $2 trillion by 2030. Chemours is likely in the early stages of establishing its presence here, requiring substantial capital to develop competitive advantages and capture market share.

Chemours is actively investing in sustainable and circular economy solutions. For instance, their advanced recycling technologies aim to process complex plastic waste, turning it into valuable chemical feedstocks. This aligns with the growing global demand for environmentally friendly alternatives and resource efficiency.

These emerging areas represent significant growth potential, fueled by increasing consumer and regulatory pressure for sustainability. However, Chemours' current market penetration in these nascent fields is relatively small, necessitating considerable investment in research and development to scale up innovative solutions and capture market share.

When Chemours introduces niche, high-performance products into new geographic markets where it currently has limited presence, these ventures can be considered Question Marks in the BCG Matrix. The market itself might be growing, but Chemours needs to invest heavily in market entry, distribution, and brand building. For instance, expanding their advanced performance materials into emerging Asian markets requires significant upfront capital. Without substantial investment and successful market penetration, these new ventures risk becoming Dogs.

Early-Stage Research and Development Projects

Early-stage research and development projects within Chemours, particularly those exploring novel chemistries or applications in nascent, high-growth sectors, are categorized as Question Marks. These ventures demand substantial initial capital without a certain payoff, yet they possess the capability to evolve into future Stars if they successfully penetrate and gain market share.

For instance, Chemours' investments in advanced materials for next-generation battery technologies or sustainable polymer solutions, where market acceptance is still developing, exemplify these Question Mark projects. These areas often require significant R&D expenditure, with projections suggesting potential market sizes in the tens of billions of dollars by the early 2030s for some of these emerging applications.

- High Investment, Uncertain Returns: Projects like developing novel fluoropolymers for advanced semiconductor manufacturing involve substantial upfront R&D costs, often running into millions of dollars per project, with no assurance of market success.

- Potential for Future Stars: If successful, these early-stage innovations could capture significant market share in rapidly expanding industries, mirroring the trajectory of past successful ventures that transitioned from uncertain beginnings to market leadership.

- Strategic Importance: Chemours' commitment to these R&D efforts, as evidenced by its ongoing allocation of R&D budget towards exploring new chemical frontiers, underscores their strategic importance in building a future pipeline of profitable products.

Specialized Fluoropolymers for New Energy Storage Technologies

Chemours is exploring specialized fluoropolymers for emerging energy storage, such as solid-state and advanced flow batteries. These niche markets represent significant future growth potential, but Chemours currently holds a minor market share, requiring considerable strategic investment to capture opportunities.

The demand for advanced battery components is projected to surge. For instance, the global solid-state battery market is anticipated to reach over $10 billion by 2030, indicating a substantial addressable market for specialized materials. Chemours’ entry into these segments would likely position them as a challenger, necessitating aggressive research and development and market penetration strategies.

- High-Growth Potential: Emerging energy storage technologies offer substantial long-term revenue streams.

- Low Market Share: Chemours faces established players and needs to invest heavily to gain traction.

- Strategic Investment: Significant R&D and market development are crucial for success in these specialized fields.

- Competitive Landscape: Understanding and outmaneuvering competitors in these nascent markets is key.

Chemours' ventures into new, high-growth markets with uncertain outcomes are classified as Question Marks. These initiatives require substantial investment to build market share, with the potential to become future Stars or, if unsuccessful, devolve into Dogs.

For example, Chemours' development of specialized materials for next-generation semiconductor fabrication, a sector projected for significant expansion, represents a classic Question Mark. The company is investing heavily in R&D for these advanced polymers, aiming to capture a piece of a market that could reach hundreds of billions of dollars globally by the late 2020s.

These projects demand significant capital outlay for research, development, and market entry, often without immediate returns. Chemours' strategic allocation of resources to these areas highlights their belief in their future potential, despite the inherent risks and the need for aggressive market penetration strategies.

Chemours' exploration of novel materials for advanced electronics, such as those used in flexible displays and high-performance computing, exemplifies its Question Mark portfolio. These are nascent markets with substantial growth projections, but Chemours currently holds a limited position, necessitating significant investment in innovation and market development.

| Category | Description | Investment Needs | Market Potential | Chemours' Position |

| Question Marks | New ventures in high-growth, uncertain markets. | High | High | Low Market Share |

| Example: Advanced Electronics Materials | Specialized polymers for next-gen displays and computing. | Significant R&D and market entry costs. | Global market projected to exceed $2 trillion by 2030. | Developing presence, requires substantial investment. |

| Example: Next-Gen Battery Materials | Fluoropolymers for solid-state and advanced flow batteries. | Heavy R&D and strategic partnerships needed. | Solid-state battery market potentially over $10 billion by 2030. | Challenger position, needs aggressive penetration. |

BCG Matrix Data Sources

Our Chemours BCG Matrix leverages comprehensive data, including internal financial reports, market share analysis, and industry growth projections, to accurately position each business segment.