Chailease Holding SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Chailease Holding Bundle

Chailease Holding demonstrates robust financial strength and a strong market presence, but faces potential headwinds from evolving regulatory landscapes and increasing competition. Understanding these dynamics is crucial for navigating the leasing industry effectively.

Want the full story behind Chailease Holding's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Chailease Holding boasts an impressively diverse product portfolio, spanning equipment leasing, vehicle and aircraft leasing, real estate financing, factoring, direct financing, and insurance brokerage. This breadth of offerings is a significant strength, as it mitigates risk by not being overly dependent on any single financial service. For instance, in the first quarter of 2024, their leasing segment contributed a substantial portion of revenue, but factoring and direct financing also showed robust growth, demonstrating the balanced performance across their various services.

Chailease Holding's strategic strength lies in its dedicated focus on small and medium-sized enterprises (SMEs). This segment is often overlooked by larger financial institutions, creating a significant market opportunity for Chailease.

By specializing in SMEs, Chailease has cultivated deep expertise and fostered robust relationships within this vital economic sector. This niche approach has allowed the company to build a substantial market presence and cater effectively to the unique financial requirements of growing businesses.

In 2023, Chailease reported a significant portion of its leasing and factoring business was directed towards SMEs, highlighting its commitment to this segment. This focus has historically contributed to a stable revenue stream, demonstrating the resilience of its business model.

Chailease Holding boasts a significant international presence, operating in key markets across Taiwan, mainland China, and several ASEAN nations including Thailand, Vietnam, and Malaysia. This extensive network, which also extends to the USA, offers substantial geographic diversification, mitigating risks tied to any single country's economic performance.

This broad operational scope allows Chailease to tap into growth opportunities within diverse emerging markets. The company has solidified its position as a market leader in these regions, leveraging its established infrastructure and brand recognition to maintain a strong competitive edge.

Robust Risk Management Framework

Chailease Holding's robust risk management framework is a significant strength. The company's dedication to prudent risk management is underscored by its established Risk Management Committee and a keen focus on thorough asset quality assessments. This proactive stance is crucial for navigating the complexities of its diverse overseas portfolios, directly contributing to a resilient operating performance and maintaining strong capitalization.

The company's commitment to risk mitigation is reflected in its operational stability, even amidst varying economic conditions. For instance, as of the first quarter of 2024, Chailease reported a non-performing loan ratio of 1.24%, demonstrating effective control over credit risk. This focus on asset quality underpins its ability to sustain strong capital adequacy ratios, which stood at 17.5% for Tier 1 capital as of the same period, well above regulatory requirements.

- Established Risk Management Committee: Provides oversight and strategic direction for risk mitigation.

- Focus on Asset Quality: Proactive assessment and management of credit risk in its loan and lease portfolios.

- Resilient Operating Performance: Demonstrated ability to maintain profitability and stability through effective risk controls.

- Strong Capitalization: Maintaining healthy capital adequacy ratios, providing a buffer against potential financial shocks.

Consistent Operating Performance and Strong Capitalization

Chailease Holding consistently delivers solid operating performance, even when the market is a bit bumpy. This stability is a major strength, showing they can manage their business well through different economic conditions. Their capitalization is also robust when you consider the risks they take on, which is a good sign for their financial health.

This consistent performance and strong financial footing mean Chailease Holding is well-placed to fund its own growth and stay financially secure. They’ve shown they can make steady profits and keep those earnings, which is crucial for reinvesting in the business and weathering any storms. For example, as of the first quarter of 2024, Chailease reported a net profit attributable to shareholders of NT$4.6 billion, up 10.6% year-on-year, highlighting this consistent profitability.

- Consistent Profitability: Chailease Holding has a track record of generating stable profits, demonstrating resilience in its core operations.

- Strong Capitalization: The company maintains a healthy capital structure, providing a solid foundation for its business activities and future expansion.

- Retained Earnings for Growth: The ability to retain earnings allows for self-funded growth initiatives and enhances overall financial stability.

Chailease Holding's diversified product and service offerings, encompassing equipment leasing, vehicle and aircraft leasing, real estate financing, factoring, direct financing, and insurance brokerage, represent a significant strength. This broad portfolio mitigates reliance on any single financial service, fostering a more stable revenue stream. For example, in Q1 2024, while leasing remained a major contributor, factoring and direct financing also demonstrated robust growth, showcasing the balanced performance across its various business segments.

The company's strategic focus on small and medium-sized enterprises (SMEs) is a key differentiator. By catering to this often underserved market, Chailease has developed specialized expertise and strong client relationships, positioning itself as a vital financial partner for growing businesses. This niche approach has historically translated into a stable and resilient revenue base, as evidenced by the significant portion of their 2023 leasing and factoring business directed towards SMEs.

Chailease Holding's extensive international footprint across Taiwan, mainland China, and several ASEAN nations, along with its presence in the USA, provides substantial geographic diversification. This broad operational scope allows the company to capitalize on growth opportunities in various emerging markets, leveraging its established infrastructure and brand recognition to maintain a competitive edge and reduce exposure to country-specific economic downturns.

A robust risk management framework, overseen by a dedicated Risk Management Committee and emphasizing thorough asset quality assessments, is a core strength. This proactive approach ensures operational stability and strong capitalization, even amidst fluctuating economic conditions. As of Q1 2024, Chailease maintained a non-performing loan ratio of 1.24% and a Tier 1 capital ratio of 17.5%, demonstrating effective credit risk control and a solid financial buffer.

| Metric | Q1 2024 (NT$ Billions) | Year-on-Year Growth |

|---|---|---|

| Net Profit Attributable to Shareholders | 4.6 | +10.6% |

| Tier 1 Capital Ratio | 17.5% | N/A |

| Non-Performing Loan Ratio | 1.24% | N/A |

What is included in the product

Delivers a strategic overview of Chailease Holding’s internal and external business factors, highlighting its competitive advantages and potential market challenges.

Offers a clear, actionable framework to address Chailease's competitive challenges and capitalize on market opportunities.

Weaknesses

Chailease Holding's reliance on financing for small and medium-sized enterprises (SMEs) makes it particularly vulnerable to economic downturns. In Taiwan, for instance, a significant slowdown could lead to a rise in loan defaults among its SME clients, directly affecting the company's asset quality and profitability. Similarly, China's economic performance heavily influences Chailease's operations there, with a weakening Chinese economy potentially increasing non-performing loans.

Chailease Holding, like many financial services firms, faces significant risks from fluctuating interest rates. Changes in these rates directly impact the company's cost of borrowing, which can squeeze its net interest margins if higher funding costs can't be passed on to customers. For instance, if the central bank raises benchmark rates, Chailease's expenses for acquiring capital will likely increase.

While Chailease Holding's focus on Small and Medium Enterprises (SMEs) is a strategic advantage, it also creates a concentration risk. If a substantial part of its lending portfolio is exposed to a single industry or if numerous SMEs encounter synchronized economic difficulties, the company could face an elevated rate of credit defaults.

For instance, during economic downturns, SMEs are often more vulnerable than larger corporations. A significant portion of Chailease's loan book being concentrated in sectors heavily impacted by supply chain disruptions or changing consumer spending patterns in 2024 could amplify potential losses.

Regulatory and Geopolitical Risks in Overseas Operations

Operating in numerous countries means Chailease Holding must navigate a complex web of differing regulations and potential geopolitical shifts. This can create significant compliance hurdles.

For instance, changes in China's financial regulations or increased political instability in key ASEAN markets could directly impact Chailease's operational efficiency and introduce unforeseen risks. As of late 2024, China's regulatory landscape for financial leasing continues to evolve, with a focus on risk control and consumer protection, potentially affecting capital requirements and business practices.

- Diverse Regulatory Environments: Exposure to varying legal frameworks across different jurisdictions.

- Geopolitical Instability: Vulnerability to political tensions and policy changes in major operating regions like China and Southeast Asia.

- Compliance Challenges: Increased cost and complexity in adhering to diverse and evolving local laws.

- Operational Disruptions: Potential for business interruptions due to political events or sudden regulatory shifts.

Competitive Pressures from Traditional Banks and Fintechs

Chailease Holding operates in a highly competitive landscape, facing significant pressure from both traditional commercial banks and agile fintech companies. These competitors offer a range of alternative financing solutions, often with faster approval times and potentially lower costs, directly challenging Chailease's market position.

This intensified competition impacts pricing strategies and client acquisition efforts. For instance, as of early 2024, the global fintech market for alternative lending was projected to reach over $3 trillion by 2027, highlighting the scale of this disruptive force. Chailease must continuously innovate and differentiate its offerings to maintain its edge.

- Intense Competition: Established banks and fintechs provide alternative financing, increasing market rivalry.

- Pricing Pressure: Competitors' offerings can force Chailease to adjust its pricing models.

- Client Acquisition Challenges: Gaining new clients becomes more difficult with numerous alternative providers.

- Market Share Erosion Risk: Failure to innovate could lead to a loss of market share to more dynamic players.

Chailease Holding's concentration on small and medium-sized enterprises (SMEs) exposes it to heightened credit risk, especially during economic slowdowns. A significant portion of its portfolio being tied to sectors vulnerable to economic shifts in 2024, like manufacturing or retail, could lead to increased defaults. For example, if a major economic downturn hits Taiwan or China, a substantial rise in non-performing loans from its SME clients is a tangible threat to asset quality.

Preview the Actual Deliverable

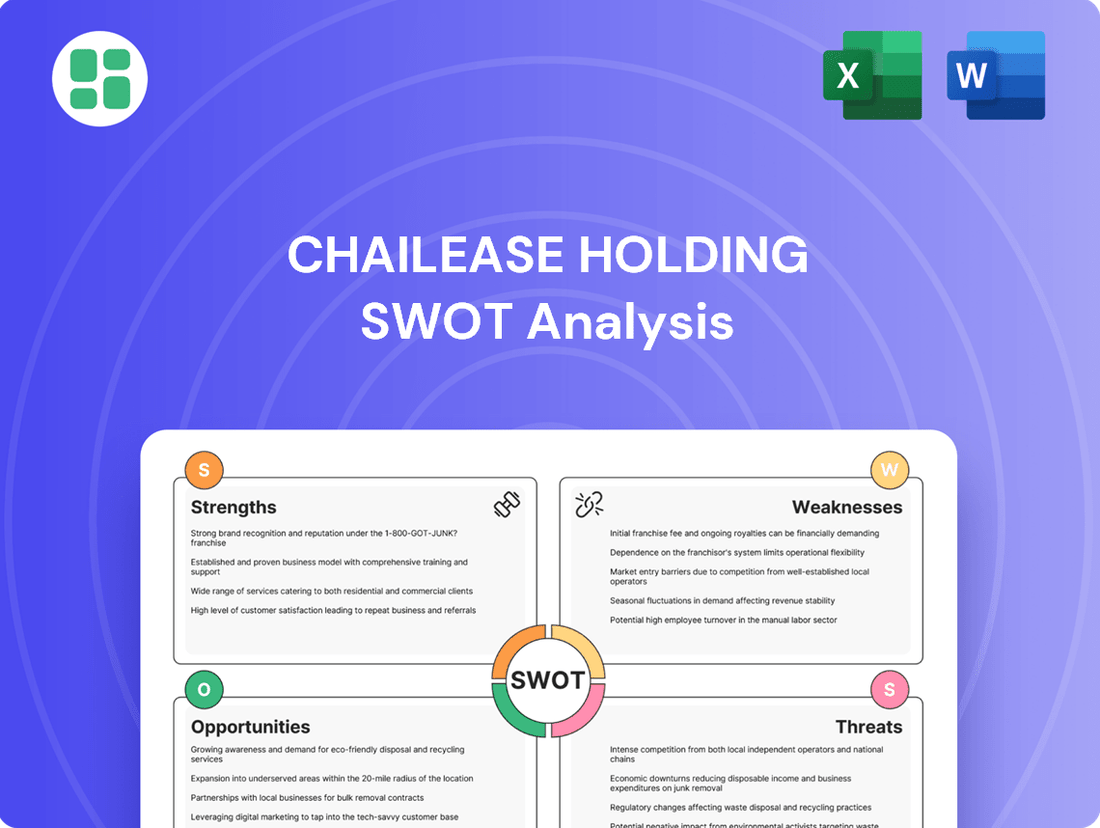

Chailease Holding SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. It provides a clear overview of Chailease Holding's Strengths, Weaknesses, Opportunities, and Threats. The full, detailed analysis is unlocked immediately upon purchase.

Opportunities

Chailease Holding's strategy actively targets diverse niche markets, presenting a clear opportunity for expansion. This includes venturing into underserved or high-growth geographic regions, with a particular focus on the ASEAN bloc.

The company can also capitalize on emerging asset classes, such as green energy equipment financing. This specialization could tap into growing demand for sustainable solutions and provide a competitive edge.

For instance, Chailease's presence in Vietnam, a key ASEAN market, has shown robust growth. In 2023, their Vietnam operations contributed significantly to their overall revenue, highlighting the potential of expanding within similar high-potential markets.

Chailease Holding can significantly boost its operations by adopting advanced digital technologies like AI and data analytics. This integration is projected to improve efficiency in credit assessments and enhance the overall customer experience. For instance, in 2023, companies that heavily invested in AI saw an average of a 7% increase in profitability, demonstrating the tangible benefits of such digital advancements.

The company can attract a wider range of clients, particularly tech-savvy small and medium-sized enterprises (SMEs), by implementing digital lease origination and online platforms. These digital solutions streamline processes, making it easier for businesses to access financing. By 2025, it's estimated that over 60% of SME financing applications will be processed digitally, highlighting a critical market shift that Chailease can capitalize on.

The global financial leasing market is experiencing robust growth, with projections indicating a significant expansion driven by the increasing need for flexible, asset-backed financing. Small and medium-sized enterprises (SMEs) are particularly seeking these solutions to manage capital efficiently and reduce upfront investment burdens. This trend presents a substantial opportunity for Chailease to innovate and offer customized leasing structures that cater to diverse business needs.

Strategic Partnerships and Acquisitions

Strategic partnerships and acquisitions offer Chailease Holding significant avenues for growth. Collaborating with technology providers can enhance digital offerings, while teaming up with local financial institutions can streamline operations and improve access to capital. For instance, in 2024, fintech partnerships became crucial for expanding digital lending platforms across Southeast Asia, a key market for Chailease.

Acquiring smaller, specialized players can rapidly expand Chailease's service portfolio and market reach. This strategy is particularly effective in navigating diverse regulatory environments and gaining invaluable local market intelligence. By integrating new capabilities, Chailease can offer a more comprehensive suite of financial solutions, boosting its competitive edge.

- Accelerated Market Penetration: Partnerships can open doors to new customer segments and geographic regions, as seen with Chailease's expansion into Vietnam's growing SME market in late 2024.

- Enhanced Service Offerings: Collaborations with specialized fintech firms in 2024 allowed for the integration of advanced data analytics and AI-driven credit scoring, improving lending efficiency.

- Regulatory Navigation: Local partnerships provide crucial expertise in understanding and complying with varying financial regulations across different Asian markets, mitigating compliance risks.

- Acquisition of Niche Capabilities: Acquiring smaller companies with unique technologies or established customer bases in 2025 can provide immediate competitive advantages and diversify revenue streams.

Leveraging ESG and Green Financing Initiatives

Chailease is well-positioned to capitalize on the growing demand for ESG and green financing. The company's existing involvement in solar power plant financing and its commitment to assisting clients in achieving net-zero emissions demonstrates a foundational understanding of this market. By broadening its scope to include ESG-compliant financing and green asset leasing, Chailease can tap into a significant global sustainability trend.

This strategic shift can unlock new revenue streams and attract a growing segment of environmentally conscious clients and investors. For instance, the global green bond market reached an estimated $1.5 trillion in issuance in 2023, signaling strong investor appetite for sustainable investments. Furthermore, by offering specialized green asset leasing, Chailease can differentiate itself in a competitive landscape.

- Expanding ESG-compliant financing: Chailease can develop tailored financial products for renewable energy projects, energy efficiency upgrades, and sustainable infrastructure.

- Green asset leasing: Offering leases for electric vehicles, energy-efficient machinery, and other environmentally friendly assets can attract a new client base.

- Attracting ESG-focused investors: Demonstrating a strong ESG commitment can improve Chailease's attractiveness to institutional investors prioritizing sustainability, potentially lowering its cost of capital.

- Supporting client sustainability goals: By facilitating green financing, Chailease can become a key partner for businesses aiming to reduce their carbon footprint and meet regulatory requirements.

Chailease Holding can leverage the increasing global demand for green financing and ESG-compliant solutions. The company's existing focus on renewable energy projects, like solar power plants, provides a solid foundation to expand into financing energy efficiency upgrades and sustainable infrastructure. This aligns with a significant market trend, as the global green bond market saw substantial issuance in 2023, exceeding $1.5 trillion, indicating strong investor interest.

By offering specialized green asset leasing for items such as electric vehicles and energy-efficient machinery, Chailease can attract environmentally conscious clients and differentiate itself. This strategic move not only opens new revenue streams but also enhances the company's appeal to institutional investors prioritizing sustainability, potentially improving its cost of capital.

Furthermore, strategic partnerships, particularly with fintech firms, are crucial for enhancing digital capabilities and market penetration. For example, collaborations in 2024 were vital for expanding digital lending platforms across Southeast Asia. Acquisitions of smaller, specialized companies in 2025 can also rapidly broaden Chailease's service portfolio and market reach, offering immediate competitive advantages.

| Opportunity Area | Key Action | Market Trend/Data Point |

|---|---|---|

| Green Financing & ESG | Expand financing for renewable energy, energy efficiency, and sustainable infrastructure. | Global green bond market issuance exceeded $1.5 trillion in 2023. |

| Green Asset Leasing | Offer leases for EVs, energy-efficient machinery. | Growing client and investor demand for sustainable assets. |

| Digital Transformation | Integrate AI and data analytics for credit assessment and customer experience. | AI investment projected to increase profitability by 7% for adopting companies (2023 data). |

| Strategic Partnerships & Acquisitions | Collaborate with fintechs; acquire specialized players. | Fintech partnerships crucial for digital lending expansion in Southeast Asia (2024). |

Threats

A significant economic slowdown, particularly in key markets like China and Southeast Asia, poses a substantial threat to Chailease. A prolonged downturn could lead to a sharp increase in default rates among its small and medium-sized enterprise (SME) clients, directly impacting the company's asset quality and profitability.

For instance, if global GDP growth falters significantly in 2024-2025, as some forecasts suggest, the demand for leasing services could contract. This would translate into higher non-performing loans for Chailease, potentially straining its financial performance.

Sustained increases in benchmark interest rates, such as the US Federal Reserve's policy rate which saw multiple hikes through 2023 and into early 2024, directly translate to higher funding costs for Chailease. This upward pressure on borrowing expenses can compress its net interest margin, a key profitability metric.

If Chailease finds it challenging to pass these elevated funding costs onto its clients through higher lending rates, its overall profitability is likely to be negatively impacted. For example, in a rising rate environment, if loan pricing adjustments lag behind increases in the cost of capital, margins will shrink.

Chailease Holding, as a multinational financial services firm, faces significant threats from intensifying regulatory scrutiny. The company operates across numerous jurisdictions, each with its own evolving financial regulations, particularly concerning lending practices and capital adequacy. For instance, in 2024, several Asian markets saw proposed increases in capital reserve requirements for financial institutions, which could directly impact Chailease's operational flexibility and increase compliance burdens.

Disruptive Technologies and Business Models

The financial sector is rapidly evolving, with fintech innovations like peer-to-peer lending and blockchain-based financing presenting significant challenges to established players like Chailease Holding. These new models can offer faster, cheaper, or more accessible financing options, directly competing with traditional leasing and financing services. For instance, the global P2P lending market was projected to reach over $300 billion by 2025, indicating a substantial shift in capital access.

Failure to embrace and integrate these disruptive technologies could result in a considerable loss of market share for Chailease. Companies that can quickly adapt and offer similar or superior digital solutions will likely attract a larger customer base. The speed of technological adoption is critical; by 2024, it's estimated that over 70% of businesses will be using AI in some capacity, highlighting the imperative for digital transformation.

- Fintech Disruption: New platforms offer alternative financing, potentially undercutting traditional leasing.

- Market Share Erosion: Slow adaptation to digital models risks losing customers to more agile competitors.

- Blockchain Potential: Blockchain technology could streamline and secure financing processes, posing a threat if not adopted.

- P2P Lending Growth: The expanding peer-to-peer lending market signifies a growing preference for alternative financing channels.

Credit Risk and Asset Quality Deterioration

Chailease Holding faces a significant threat from the inherent credit risk in its lending to small and medium-sized enterprises (SMEs). This risk is amplified by the potential for economic volatility, which could directly lead to a decline in the quality of its loan portfolio. For instance, during periods of economic slowdown, SMEs often experience revenue shortfalls, increasing their likelihood of default.

A deterioration in asset quality would likely force Chailease to increase its provisions for bad debts. This would directly impact the company's profitability, as higher provisioning directly reduces net income. For example, a 1% increase in non-performing loans could necessitate a substantial rise in loan loss reserves, depending on the specific portfolio mix and historical default rates.

- Credit Risk: Lending to SMEs inherently carries higher default probabilities compared to larger corporations.

- Economic Volatility: Fluctuations in GDP growth, interest rates, and inflation can disproportionately affect SME repayment capacity.

- Asset Quality Deterioration: A rise in non-performing loans (NPLs) would signal a weakening of the company's asset base.

- Provisioning Impact: Increased loan loss provisions directly reduce profitability and can impact capital adequacy ratios.

Intensifying competition from both traditional financial institutions and emerging fintech players presents a significant threat to Chailease Holding. As the financial landscape evolves, companies offering more agile, digitally-native solutions can capture market share. For instance, by early 2024, several challenger banks in Asia had expanded their SME lending offerings, directly competing with Chailease's core business.

The potential for regulatory changes across its operating regions poses a constant risk. Stricter capital requirements or new compliance mandates could increase operational costs and limit business expansion. For example, proposed changes to lending regulations in Taiwan during 2024 could necessitate adjustments to Chailease's risk management frameworks.

Economic downturns, particularly in key Asian markets, can lead to increased default rates among its SME clients. If economic growth falters, as some forecasts for 2024-2025 suggest, Chailease could see a rise in non-performing loans. This would strain its asset quality and profitability, as higher provisions for bad debts would be required.

Chailease Holding's reliance on wholesale funding means that rising interest rates directly impact its cost of capital. With benchmark rates remaining elevated through early 2024, the company faces compressed net interest margins if it cannot fully pass these costs onto its clients.

| Threat Category | Specific Risk | Potential Impact | Example Data/Trend (2024-2025) |

| Competition | Fintech Disruption & New Entrants | Loss of market share, pressure on pricing | Global P2P lending market projected to exceed $300 billion by 2025. |

| Regulatory Environment | Evolving Regulations & Compliance Costs | Increased operational expenses, restricted flexibility | Proposed increases in capital reserve requirements in several Asian markets in 2024. |

| Economic Conditions | SME Default Risk & Economic Slowdown | Deterioration of asset quality, reduced profitability | Potential for faltering global GDP growth in 2024-2025 impacting SME repayment capacity. |

| Interest Rate Sensitivity | Rising Funding Costs | Compressed net interest margins, reduced profitability | Multiple interest rate hikes by major central banks through 2023 and into early 2024. |

SWOT Analysis Data Sources

This SWOT analysis is built upon a foundation of reliable data, including Chailease's official financial statements, comprehensive market research reports, and expert industry analyses to provide a well-rounded and accurate assessment.