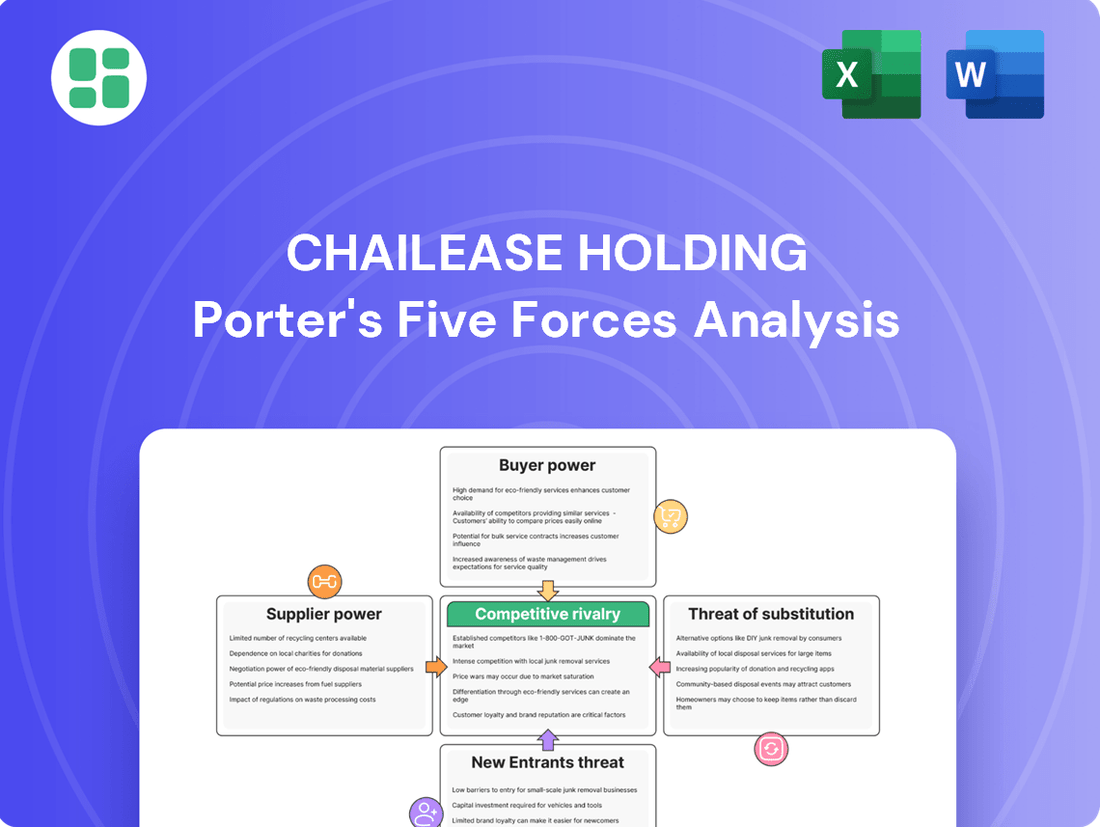

Chailease Holding Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Chailease Holding Bundle

Chailease Holding navigates a competitive landscape shaped by moderate bargaining power of buyers and suppliers, and a significant threat from substitute leasing solutions. The intensity of rivalry among existing players is a key factor influencing profitability.

The complete report reveals the real forces shaping Chailease Holding’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Chailease Holding's ability to secure funding is crucial, as financial services firms depend on capital from banks, bond markets, and other institutions. The bargaining power of these suppliers hinges on factors like current interest rates, market liquidity, and Chailease's credit standing. For instance, if interest rates were to climb significantly in 2024, it would directly increase Chailease's cost of capital, potentially squeezing margins and limiting its lending activities.

Technology and software providers hold significant sway for Chailease, especially as the financial sector leans heavily into digital operations. The efficiency of Chailease's services, data management, and customer interactions hinges directly on the quality of its IT infrastructure and software.

The bargaining power of these tech suppliers escalates when their offerings are unique, hard to copy, or provide a distinct edge in the market. This can translate into increased costs for Chailease or create situations where switching providers becomes challenging and expensive, a common issue in specialized software markets.

Chailease Holding, as a diversified financial services provider with insurance brokerage among its offerings, depends heavily on insurance underwriters and reinsurers. These entities are crucial for managing the inherent risks within Chailease's leasing and financing operations. The accessibility and pricing of robust insurance policies directly influence Chailease's overall risk profile and its bottom line.

The bargaining power of these suppliers can be significant. A consolidated insurance market, where only a few major underwriters or reinsurers operate, grants them greater leverage. Furthermore, an increase in insurance claims, whether due to economic downturns or specific industry risks, can lead to higher premiums and more stringent policy terms, further strengthening the suppliers' position.

Human Capital (Skilled Employees)

Human capital, specifically skilled employees, represents a significant bargaining power for suppliers within the financial services sector, especially for firms like Chailease Holding that specialize in leasing and SME financing. The demand for expertise in credit analysis, risk management, legal counsel, and digital transformation is consistently high. For instance, in 2024, the financial services industry continued to face challenges in attracting and retaining top talent in these critical areas, leading to increased salary expectations and recruitment costs.

This scarcity of specialized skills can directly impact Chailease Holding's operational efficiency and its ability to pursue growth opportunities. When the supply of qualified professionals is limited, companies may experience longer hiring cycles and higher compensation demands, effectively increasing the cost of doing business. This dynamic empowers skilled employees, as their unique abilities become a valuable asset that can command better terms and conditions.

- High Demand for Specialized Skills: Financial services firms require experts in credit analysis, risk management, legal, and digital innovation.

- Talent Shortages: A lack of readily available skilled professionals in these areas in 2024 drove up labor costs.

- Impact on Operational Efficiency: Difficulty in hiring and retaining talent can hinder a company's growth and day-to-day operations.

- Increased Labor Costs: Higher salaries and benefits are often necessary to attract and keep skilled employees in competitive markets.

Information and Data Providers

Information and data providers wield significant bargaining power over Chailease Holding. Access to reliable and comprehensive data for credit assessment, market analysis, and risk modeling is absolutely vital for Chailease's day-to-day operations and strategic decision-making. Suppliers of specialized financial data, up-to-date credit scores, and critical market intelligence can command considerable influence, particularly when their information is unique, demonstrably accurate, or a prerequisite for meeting stringent regulatory compliance standards.

This dependence on a limited number of dominant data providers can directly impact Chailease's operational costs, potentially leading to higher subscription fees or data acquisition expenses. Furthermore, it can restrict the company's flexibility in adopting new analytical tools or diversifying its data sources, making it harder to adapt to evolving market dynamics.

- Data Dependency: Chailease relies heavily on external data for credit scoring and market insights, making it vulnerable to price increases or service limitations from key providers.

- Provider Concentration: The market for specialized financial data is often concentrated, meaning a few major players can exert substantial influence over pricing and terms.

- Regulatory Requirements: Compliance mandates often dictate the use of specific data types and sources, further strengthening the hand of approved information providers.

Suppliers of capital, such as banks and bond markets, hold considerable sway over Chailease Holding. Their bargaining power is amplified by factors like prevailing interest rates and Chailease's creditworthiness. For example, a significant rise in interest rates during 2024 directly increased Chailease's cost of funding, impacting its lending capacity and profitability.

Technology and software providers are key suppliers, influencing Chailease's operational efficiency and digital capabilities. When these suppliers offer unique or difficult-to-replicate solutions, their bargaining power increases, potentially leading to higher costs or switching difficulties for Chailease.

Insurance underwriters and reinsurers are critical suppliers for Chailease, impacting its risk management and overall financial health. A concentrated insurance market or a surge in claims can empower these suppliers, leading to higher premiums and stricter policy terms for Chailease.

The bargaining power of skilled human capital is significant for Chailease, given the high demand for expertise in credit analysis, risk management, and digital transformation. In 2024, talent shortages in these areas drove up labor costs, impacting operational efficiency and growth potential.

Data and information providers also exert substantial bargaining power, as Chailease relies on them for crucial credit assessment and market analysis. Limited competition among specialized data providers can result in higher costs and reduced flexibility for Chailease.

What is included in the product

This analysis of Chailease Holding's competitive landscape reveals the intensity of rivalry, the bargaining power of buyers and suppliers, and the threat of new entrants and substitutes.

Instantly visualize competitive pressures with a dynamic Porter's Five Forces analysis, empowering Chailease Holding to proactively address market challenges.

Customers Bargaining Power

Chailease Holding's customer base is largely composed of small and medium-sized enterprises (SMEs). This fragmentation means that individual SMEs typically have limited sway over Chailease's terms because their transaction volumes are relatively small. For instance, in 2024, the majority of Chailease's lease agreements were with businesses employing fewer than 200 people, highlighting the prevalence of smaller clients.

While no single SME holds significant bargaining power, the collective demand from this large group of smaller clients is crucial. Their combined purchasing decisions and overall financial health directly impact Chailease's business volume and the associated credit risk. The sheer number of these SMEs effectively dilutes the power any one customer might wield.

The bargaining power of customers for Chailease Holding is significantly influenced by the availability of alternative financing options. Small and medium-sized enterprises (SMEs), a key customer segment, can access a growing array of funding sources. These include traditional bank loans, government-backed loan programs, innovative crowdfunding platforms, and specialized direct lending firms.

In 2024, the competitive landscape for SME financing saw continued growth in alternative lending. For instance, the alternative lending market in Asia was projected to reach hundreds of billions of dollars, offering SMEs more choices beyond traditional leasing companies. This increased accessibility and the competitive terms offered by these alternatives, particularly for smaller financing needs, empower customers.

Consequently, customers are better positioned to negotiate more favorable rates and terms with leasing providers like Chailease Holding. If Chailease's offerings are not competitive, customers can readily switch to alternative financing providers, thereby increasing their bargaining leverage.

For many standard leasing and financing products offered by companies like Chailease Holding, the cost for a small or medium-sized enterprise (SME) to switch providers is often quite low. This ease of switching directly bolsters customer bargaining power.

Customers can readily explore and compare offers from competing leasing companies, leveraging this ability to negotiate for more favorable terms or more adaptable solutions. This competitive landscape means providers must remain attractive to retain their client base.

Customer Price Sensitivity

Customer price sensitivity is a significant factor for Chailease Holding, especially concerning its Small and Medium-sized Enterprise (SME) client base. These businesses often operate with thin profit margins, making the cost of financing a critical consideration in their operational decisions.

This high price sensitivity compels Chailease to maintain competitive interest rates and adaptable financing structures. Failure to do so could lead to a loss of market share, particularly if the leasing market becomes more crowded or intensely competitive, potentially squeezing profitability.

- SME Financing Needs: SMEs represent a substantial portion of Chailease's clientele, and their reliance on affordable capital is paramount for growth and day-to-day operations.

- Margin Pressure: Intense competition in the leasing sector, driven by customer price sensitivity, can force companies like Chailease to accept lower yields on their financing agreements.

- Market Dynamics: As of early 2024, interest rate environments and economic conditions continue to influence the cost of capital, directly impacting how sensitive customers are to financing prices.

Access to Information and Digital Platforms

The proliferation of digital platforms and financial technology (FinTech) has significantly leveled the playing field for Small and Medium-sized Enterprises (SMEs). These platforms now offer unprecedented ease in comparing financing options, interest rates, and contract terms from a multitude of providers. This heightened transparency directly translates into increased customer knowledge, thereby amplifying their inherent bargaining power.

For instance, by mid-2024, numerous FinTech aggregators were showcasing comparative data for business loans, with average advertised rates for unsecured business loans in the US ranging from 7% to 30% depending on risk. SMEs can leverage this readily available information to negotiate more favorable terms with Chailease Holding or explore alternative financing avenues, putting pressure on lenders to offer competitive pricing and service.

This digital accessibility empowers customers through:

- Enhanced Market Awareness: SMEs can quickly assess the prevailing market rates and conditions for leasing and financing services.

- Comparison Shopping: Digital tools facilitate easy comparison of different providers' offerings, including interest rates, fees, and service levels.

- Negotiation Leverage: Informed customers are better equipped to negotiate better terms and pricing with Chailease Holding.

- Access to Alternative Providers: The digital landscape offers a broader range of financing and leasing alternatives, reducing reliance on any single provider.

Chailease Holding's customer bargaining power is moderated by the availability of numerous alternative financing options for its SME clientele. As of 2024, the SME financing landscape in Asia, a key market for Chailease, continued to expand with alternative lenders and digital platforms offering competitive terms. This increased choice empowers SMEs to negotiate more favorable rates and terms with Chailease, as they can readily switch providers if Chailease's offerings are not perceived as competitive.

The ease of switching providers for standard leasing products significantly enhances customer leverage. SMEs can efficiently compare offers from various leasing companies, using this information to negotiate better pricing and more flexible solutions. This competitive environment necessitates that Chailease maintain attractive terms to retain its customer base.

Customer price sensitivity remains a critical factor, particularly for SMEs that often operate on tight profit margins. This sensitivity compels Chailease to offer competitive interest rates and adaptable financing structures to avoid losing market share. The digital revolution, with its proliferation of comparison platforms, further amplifies this by increasing market transparency and customer awareness of prevailing rates.

| Factor | Impact on Chailease | 2024 Data/Trend |

|---|---|---|

| Customer Base | Predominantly SMEs with limited individual power but collective influence. | Majority of clients in 2024 were businesses with <200 employees. |

| Alternative Financing | Increases customer ability to negotiate and switch. | Asian alternative lending market projected to reach hundreds of billions in 2024. |

| Switching Costs | Low switching costs empower customers to seek better deals. | Minimal barriers for SMEs to transition between leasing providers. |

| Price Sensitivity | Drives Chailease to offer competitive rates and flexible terms. | SMEs' thin profit margins make financing costs a critical decision factor. |

| Digital Transparency | Empowers customers with market knowledge for negotiation. | FinTech aggregators provide easy comparison of business loan rates (e.g., 7%-30% for unsecured loans in the US as of mid-2024). |

What You See Is What You Get

Chailease Holding Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. The comprehensive Chailease Holding Porter's Five Forces Analysis presented here details the competitive landscape, including the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry. This in-depth analysis is meticulously prepared to provide actionable insights for strategic decision-making.

Rivalry Among Competitors

Chailease Holding navigates a crowded financial services arena across Taiwan, mainland China, and Southeast Asia. Rivalry is fierce, with traditional banks, specialized leasing firms, and increasingly, fintech lenders all competing for customer wallets in segments like equipment leasing and vehicle financing.

While the global leasing market is expected to expand, certain segments and geographical areas may face growing saturation. For instance, the equipment leasing market in North America, a mature segment, saw its growth rate moderate in 2023 compared to previous years, indicating increased competition as firms vie for a slice of the existing customer base.

This potential saturation in mature markets can escalate competitive rivalry. Companies might resort to price reductions or more aggressive marketing tactics to capture or retain market share, putting pressure on profitability for all players, including Chailease Holding.

Chailease actively pursues product and service differentiation, often tailoring offerings to local market needs to stay ahead. This strategy is crucial because many financial products, by their nature, can become commodities, making it difficult to maintain a truly unique position.

The challenge lies in the fact that competitors are quick to innovate or copy successful product ideas. For instance, in 2024, the leasing industry saw a surge in digitalized loan application processes, a trend that Chailease had to quickly adapt to. This constant imitation forces Chailease to continuously evolve, focusing on superior service quality, targeting specific market niches, or leveraging technological advancements to remain competitive.

High Fixed Costs and Exit Barriers

The financial services sector, including leasing companies like Chailease Holding, often grapples with substantial fixed costs. These include investments in IT infrastructure, compliance with stringent financial regulations, and the maintenance of physical branches or operational centers. For instance, in 2024, the global financial services industry saw continued heavy investment in digital transformation, with a significant portion allocated to upgrading core banking systems and cybersecurity measures, further cementing high fixed cost structures.

High exit barriers are also a defining characteristic. Companies may be tied to long-term leases for specialized equipment or have substantial investments in proprietary technology that are difficult to liquidate. Furthermore, regulatory requirements for winding down operations in financial services can be complex and costly. These factors mean that firms often remain in the market, even when profitability is low, choosing to compete rather than incur the penalties or losses associated with exiting, thereby intensifying competitive rivalry.

- Significant Capital Outlay: Financial services firms typically require substantial upfront capital for technology, regulatory compliance, and talent acquisition.

- Long-Term Commitments: Many financial products and services involve long-term contracts and asset commitments, making rapid divestment difficult.

- Regulatory Hurdles: Exiting the financial services market often involves navigating complex and time-consuming regulatory approval processes.

- Specialized Assets: The industry utilizes specialized assets and infrastructure that may have limited resale value outside of the sector.

Regulatory Environment and Market Liberalization

The regulatory landscape significantly influences competitive rivalry for Chailease Holding. For instance, in 2024, China's ongoing financial market reforms, including the expansion of foreign ownership limits in financial services, have opened doors for increased competition in the leasing sector. This liberalization can intensify rivalry as new, potentially well-capitalized domestic and international players enter the market, challenging established firms like Chailease.

Conversely, stringent regulations in certain operating regions can act as a shield for incumbents. For example, capital adequacy requirements or specific licensing procedures can create substantial barriers to entry. These barriers might limit the number of new competitors, thereby moderating the intensity of rivalry. Chailease Holding navigates these varying regulatory environments across its key markets, such as Taiwan, China, and Southeast Asia, where differing rules impact market accessibility and competitive dynamics.

- Impact of Liberalization: China's financial market liberalization in 2024 has eased entry for new leasing companies, potentially increasing competitive pressure on Chailease.

- Regulatory Barriers: Stringent capital requirements and licensing in some markets can limit new entrants, offering some protection to established players like Chailease.

- Regional Variations: Chailease operates across diverse regulatory environments, with Taiwan, China, and Southeast Asia presenting different levels of market openness and competitive intensity.

Chailease Holding faces intense competition from a diverse range of players, including traditional banks, specialized leasing firms, and emerging fintech companies, particularly in equipment leasing and vehicle financing across Taiwan, China, and Southeast Asia. The global leasing market's growth, while positive, is tempered by increasing saturation in mature segments, as evidenced by moderating growth rates in North America in 2023. This saturation often drives price competition and aggressive marketing, impacting profitability for all involved.

Competitors are quick to replicate successful innovations, forcing Chailease to continuously differentiate through superior service, niche targeting, and technological adoption, as seen with the rapid digitalization of loan processes in 2024. High fixed costs associated with IT, compliance, and operations, coupled with significant exit barriers like long-term commitments and regulatory hurdles, keep firms in the market even during low profitability periods, thereby sustaining rivalry.

Regulatory shifts, such as China's 2024 financial market liberalization, are increasing competition by easing entry for new players. However, stringent capital and licensing requirements in other regions can also act as barriers, moderating rivalry. Chailease must strategically navigate these varying regulatory landscapes to maintain its competitive edge.

| Key Competitor Type | Examples | Competitive Intensity Factors |

| Traditional Banks | Local and International Banks | Established customer base, broad financial product offerings, lower cost of capital. |

| Specialized Leasing Firms | Local and regional leasing companies | Niche market expertise, agility in product development, localized customer relationships. |

| Fintech Lenders | Online lending platforms, digital banks | Technological innovation, faster application processes, potentially lower overheads. |

| New Entrants (Post-Liberalization) | Domestic and international financial institutions entering liberalized markets (e.g., China post-2024 reforms) | Well-capitalized, potentially aggressive market entry strategies, leveraging new regulatory freedoms. |

SSubstitutes Threaten

Traditional bank loans represent a significant threat of substitutes for Chailease Holding's leasing and installment sales. Established small and medium-sized enterprises (SMEs) with robust credit profiles often find bank loans, particularly secured ones, to be a more cost-effective alternative due to potentially lower interest rates compared to leasing arrangements.

For instance, as of early 2024, average interest rates for secured business loans from major banks in key Asian markets where Chailease operates often hovered in the single digits, while leasing rates can be higher to account for residual value risk and service components. This cost differential incentivizes businesses to opt for direct bank financing for long-term asset acquisition, bypassing leasing services.

Businesses with strong cash reserves or easy access to equity can bypass leasing by purchasing assets directly. For instance, in 2024, many established companies with healthy balance sheets opted for outright purchases of new machinery, leveraging accumulated profits rather than incurring financing costs or lease payments. This self-financing approach is especially appealing to firms aiming to maximize depreciation tax shields and retain full ownership.

Fintech and peer-to-peer (P2P) lending platforms present a significant threat of substitutes for Chailease Holding. These platforms offer businesses, particularly SMEs, quicker and often more flexible financing solutions compared to traditional leasing. For example, by mid-2024, the global P2P lending market was projected to reach over $170 billion, showcasing its substantial growth and appeal as an alternative funding source.

The technological advancements driving these platforms allow for streamlined application processes and quicker approvals, directly competing with the service offerings of established financial institutions like Chailease. This accessibility, coupled with competitive interest rates, makes them an attractive substitute for businesses seeking to bypass more conventional lending channels.

Rental Agreements (Short-Term Use)

For specific equipment, short-term rental agreements can act as a substitute for longer lease terms. This is particularly relevant for projects with uncertain timelines or for technology that quickly becomes outdated.

Businesses can leverage these rentals to bypass long-term obligations and the associated maintenance burdens. For instance, in 2024, the global equipment rental market was valued at over $100 billion, indicating a significant demand for flexible usage options.

This trend highlights a potential threat to Chailease Holding's traditional long-term leasing model, as customers may opt for shorter, more adaptable rental solutions.

- Flexible Usage: Short-term rentals offer businesses the agility to scale equipment use up or down as project needs change.

- Reduced Commitment: Renting avoids the long-term financial and operational commitments inherent in leasing.

- Technology Adoption: For rapidly evolving equipment, renting allows access to the latest models without long-term depreciation risk.

- Cost Efficiency: For infrequent or temporary needs, rental can be more cost-effective than a lease.

Equity Financing

For companies needing capital, equity financing like venture capital or angel investment offers a significant alternative to leasing. This route means giving up a piece of ownership, but it avoids the fixed repayment schedules associated with debt. In 2024, global venture capital funding continued to be a substantial source of capital for startups and growth-stage companies, with significant investments flowing into technology and sustainability sectors.

The availability and attractiveness of equity financing can directly impact the demand for leasing services, especially for businesses prioritizing growth and flexibility over immediate debt obligations. For instance, a rapidly expanding tech firm might opt for equity to fund its expansion rather than taking on lease agreements for new equipment, preserving its cash flow for operational needs.

- Equity Financing as a Substitute: Venture capital and angel investors provide capital in exchange for ownership stakes, offering an alternative to debt financing like leasing.

- Benefits for Growth-Oriented SMEs: Equity financing can be appealing as it provides necessary funds without the commitment of regular debt repayments, which can be crucial for businesses prioritizing rapid expansion.

- Market Trends in 2024: Venture capital continued to be a vital funding source for businesses, particularly in technology and green industries, demonstrating the ongoing viability of equity as a capital-raising strategy.

Traditional bank loans remain a potent substitute for Chailease Holding's leasing and installment services, especially for established SMEs with strong credit. In early 2024, secured business loan rates in key Asian markets often fell into the single digits, a stark contrast to leasing rates which incorporate residual value and service costs, making direct bank financing more economical for long-term asset acquisition.

Fintech and P2P lending platforms offer faster, more flexible financing, directly challenging Chailease. The global P2P lending market was projected to exceed $170 billion by mid-2024, underscoring its growing appeal as an alternative funding source due to streamlined processes and competitive rates.

Short-term equipment rentals also substitute for longer lease terms, particularly for projects with uncertain durations or for rapidly obsolescing technology. The global equipment rental market, valued over $100 billion in 2024, demonstrates a strong demand for flexible usage, potentially diverting customers from Chailease's traditional long-term leasing model.

| Financing Substitute | Key Advantage | 2024 Market Context |

|---|---|---|

| Traditional Bank Loans | Lower interest rates for creditworthy businesses | Single-digit rates common for secured business loans in Asia |

| Fintech/P2P Lending | Speed and flexibility in application and approval | Global P2P lending market projected over $170 billion |

| Short-Term Rentals | Avoids long-term commitments, access to newer tech | Global equipment rental market exceeded $100 billion |

| Equity Financing | No fixed repayment, funds growth without debt | Venture capital remains a significant capital source globally |

Entrants Threaten

Entering the financial services sector, particularly in leasing and direct financing, demands significant capital. This is necessary to support ongoing operations, establish a strong asset base, and comply with stringent regulatory requirements for capital adequacy. For instance, in 2023, the global leasing market was valued at over $1.3 trillion, underscoring the immense financial resources needed to compete effectively.

These substantial capital requirements act as a considerable deterrent for many aspiring new entrants. Without adequate funding, it becomes exceedingly difficult to acquire the necessary assets, build a competitive portfolio, and navigate the complex regulatory landscape, thereby limiting the threat of new competition for established players like Chailease Holding.

The financial services sector, including leasing, is notoriously complex due to stringent regulatory oversight. Obtaining the necessary licenses and adhering to compliance mandates, such as those for anti-money laundering and data protection, are significant hurdles. For instance, in 2024, the cost of regulatory compliance for financial institutions globally continued to rise, with many reporting substantial investments in technology and personnel to meet evolving requirements.

Established players like Chailease Holding have cultivated deep, long-term relationships with their small and medium-sized enterprise (SME) clientele, fostering significant brand loyalty. This makes it challenging for new entrants to gain traction. For instance, in 2024, Chailease reported a robust client retention rate, underscoring the stickiness of these established relationships.

New competitors must overcome the considerable hurdle of building trust and convincing customers to switch from providers they already know and rely on. This process requires substantial investment in marketing, sales, and customer service, often proving to be a costly and time-consuming endeavor for any new market participant.

Economies of Scale and Experience Curve

Large, established financial services firms, including Chailease Holding, leverage significant economies of scale. This allows them to secure funding at lower costs and operate more efficiently across their extensive networks. For instance, by mid-2024, major leasing companies often reported significantly lower average cost of funds compared to smaller, newer players, sometimes by as much as 1-2 percentage points. This cost advantage is critical in a capital-intensive industry.

The experience curve also plays a crucial role. Decades of operation have allowed established entities to refine their credit assessment models and operational processes. This accumulated expertise, evident in lower default rates and optimized back-office functions, translates into a competitive edge. By 2024, data analytics in credit scoring had become highly sophisticated, with leading firms utilizing AI-driven insights that new entrants struggle to replicate quickly.

New entrants face substantial barriers due to these entrenched advantages:

- Limited access to low-cost capital: Startups often rely on more expensive debt or equity, impacting their pricing power.

- Higher operational costs: Without established infrastructure and streamlined processes, new firms incur greater per-transaction expenses.

- Less sophisticated risk management: The lack of historical data and advanced analytics makes it harder for new entrants to accurately price risk, potentially leading to higher default rates or uncompetitive pricing.

- Brand recognition and trust: Established players benefit from years of building customer relationships and a reputation for reliability, which is difficult for newcomers to quickly overcome.

Technological and Digital Infrastructure Investment

The threat of new entrants in the leasing sector, particularly influenced by technological and digital infrastructure investment, presents a nuanced challenge. While fintech innovations can lower some barriers, establishing a competitive edge necessitates substantial capital outlay for robust digital platforms. This includes investing in advanced data analytics for risk assessment and customer insights, as well as ensuring seamless, user-friendly interfaces that modern consumers expect.

Startups often struggle to match the scale of investment required for cutting-edge technology, creating a significant hurdle. For instance, developing proprietary AI-driven credit scoring models or sophisticated digital onboarding processes demands considerable R&D and ongoing maintenance. This financial and technical commitment acts as a substantial barrier, especially for nascent companies lacking deep pockets or established technological expertise.

Consider the following points regarding this barrier:

- High Capital Requirements: Building and maintaining state-of-the-art digital infrastructure, including cloud computing, cybersecurity, and advanced analytics platforms, can cost millions of dollars.

- Technological Expertise: Accessing and retaining talent skilled in areas like AI, machine learning, and blockchain development is crucial but expensive, posing a challenge for new players.

- Scalability and Integration: New entrants must ensure their technology can scale efficiently and integrate with existing financial ecosystems, adding to the complexity and cost of entry.

- Data Security and Compliance: Investing in robust data security measures and adhering to evolving regulatory compliance standards is a non-negotiable, significant expense for any digital-first financial service.

The threat of new entrants into the financial leasing sector, where Chailease Holding operates, is generally considered moderate to low. This is primarily due to the substantial capital requirements needed to establish a competitive presence, acquire assets, and navigate a highly regulated environment. For example, in 2023, the global leasing market exceeded $1.3 trillion, highlighting the immense financial muscle required.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Chailease Holding is built upon a foundation of comprehensive data, including Chailease's official financial statements, annual reports, and investor relations disclosures. We also incorporate insights from reputable industry research firms, macroeconomic data providers, and financial news outlets to capture the broader competitive landscape.