Chailease Holding PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Chailease Holding Bundle

Navigate the complex external landscape impacting Chailease Holding with our comprehensive PESTLE analysis. Understand how political stability, economic fluctuations, and technological advancements are shaping its operational environment. This expert-crafted report offers actionable intelligence to fortify your strategic decisions. Unlock the full potential of your market understanding—download the complete PESTLE analysis now.

Political factors

Chailease Holding, operating across diverse Asian markets, is deeply intertwined with the financial policies and political stability of these regions. Taiwan's government, via the Financial Supervisory Commission (FSC), is actively pushing for reforms to boost the asset management sector's global standing. These efforts aim to keep domestic capital within Taiwan and draw in foreign investment, potentially easing regulatory burdens for companies like Chailease.

Government initiatives aimed at bolstering Small and Medium-sized Enterprises (SMEs) are a key political consideration for Chailease, as these businesses form the core of its clientele. While pandemic-related government support offered a lifeline, traditional bank lending to SMEs has seen a slowdown in certain markets, resulting in more stringent credit availability. This tightening could present openings for alternative financiers like Chailease, but also suggests a heightened level of due diligence on SME creditworthiness from all lenders.

Geopolitical tensions and evolving international trade relations, particularly between major economies like the US and China, can indirectly influence Chailease Holding's global operations. While a financial leasing company's direct exposure might differ from manufacturers, heightened economic uncertainty stemming from global political risks can temper business confidence. This uncertainty can lead small and medium-sized enterprises (SMEs) to postpone capital expenditure plans, subsequently impacting the demand for leasing services. For instance, the ongoing trade disputes and tariffs implemented in recent years have created a more volatile global economic landscape, potentially slowing investment decisions across various sectors that rely on leasing.

Anti-Corruption and Governance Initiatives

The increasing focus on anti-corruption and strong corporate governance, particularly within financial sectors in Taiwan and other operating regions, directly impacts Chailease Holding's operational integrity. These efforts foster a more stable financial environment and mitigate potential risks.

Chailease has publicly committed to transparency and anti-corruption, actively working to boost employee understanding and adhere to legal frameworks. This proactive stance is crucial for maintaining trust and ensuring sustainable business practices.

- Regulatory Scrutiny: Increased governmental oversight on financial institutions' ethical practices, as observed in recent years, necessitates stringent internal controls.

- Compliance Costs: Implementing robust anti-corruption programs involves ongoing investment in training and auditing, which can affect operational expenses.

- Reputational Capital: A strong track record in governance enhances Chailease's standing with investors, partners, and customers, reducing the likelihood of reputational damage.

Regulatory Focus on Financial Crime and Data Protection

Regulators, such as Taiwan's Financial Supervisory Commission (FSC), are sharpening their focus on financial crime prevention and the safeguarding of personal data. This heightened scrutiny directly impacts financial services firms like Chailease Holding. For instance, in 2023, the FSC conducted numerous on-site examinations emphasizing anti-fraud protocols and data privacy compliance, reflecting a global trend.

Consequently, Chailease must continually bolster its internal controls, fortify information security measures, and enhance its compliance frameworks. This proactive approach is crucial for mitigating risks associated with financial crime and ensuring the protection of sensitive consumer information. The company's commitment to robust data governance and anti-money laundering (AML) procedures is paramount in this evolving regulatory landscape.

These evolving regulatory demands necessitate sustained investment in compliance infrastructure and advanced technology solutions. Chailease's expenditure on cybersecurity and data analytics tools, for example, has seen a steady increase year-on-year to meet these stringent requirements.

- Increased Regulatory Scrutiny: Taiwan's FSC is intensifying its examination of financial institutions, with a particular emphasis on anti-fraud measures and personal data protection.

- Compliance Imperatives: Financial firms like Chailease are required to strengthen internal controls, information security, and compliance frameworks to combat financial crime and safeguard consumer data.

- Investment in Technology: The evolving regulatory environment demands ongoing investment in compliance infrastructure, including advanced cybersecurity and data protection technologies.

- Data Protection Fines: In 2024, several financial institutions globally faced significant penalties for data breaches, underscoring the financial implications of non-compliance with data protection regulations.

Government support for SMEs remains a critical political factor influencing Chailease Holding's customer base. While policies aimed at boosting small businesses are generally favorable, shifts in lending priorities or economic conditions can impact the demand for leasing services. For example, in 2024, several Asian governments continued to implement fiscal stimulus packages targeted at SMEs, which could indirectly benefit Chailease by improving their clients' financial health and capacity for capital investment.

Geopolitical stability and trade relations are also significant. Tensions between major economic blocs can create uncertainty, leading businesses to delay capital expenditures, thereby reducing leasing demand. Conversely, stable international relations can foster cross-border investment and economic growth, potentially increasing opportunities for Chailease. The ongoing efforts to de-escalate certain trade disputes in 2024 suggest a potential for improved global economic sentiment, which could positively impact Chailease's markets.

Regulatory reforms, particularly in financial services, directly shape Chailease's operating environment. Taiwan's Financial Supervisory Commission (FSC) has been actively promoting financial sector innovation and consumer protection. In 2024, the FSC continued to emphasize stringent compliance and data security for financial institutions, requiring companies like Chailease to invest in robust internal controls and cybersecurity measures. This focus aims to ensure market integrity and build investor confidence.

What is included in the product

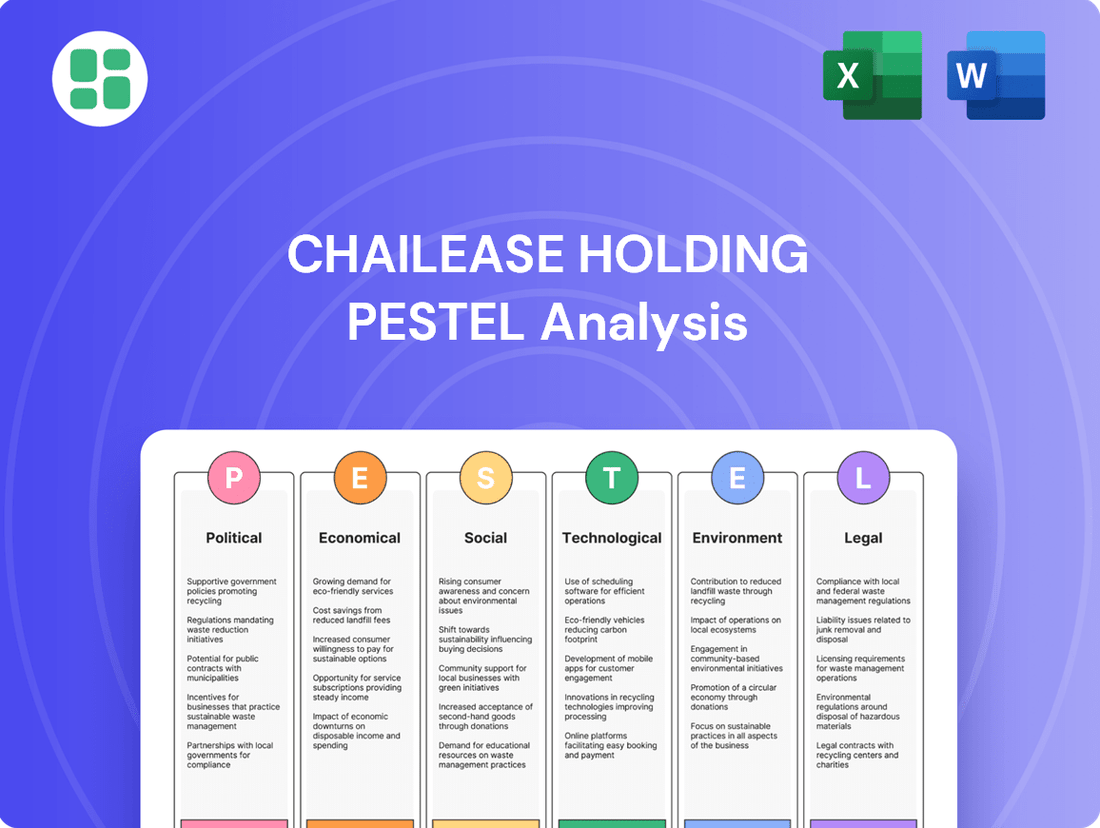

This PESTLE analysis examines the external macro-environmental factors influencing Chailease Holding across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides actionable insights into market dynamics and regulatory landscapes to inform strategic decision-making and identify opportunities.

A concise Chailease Holding PESTLE analysis that distills complex external factors into actionable insights, easing the burden of comprehensive market research for strategic decision-making.

Economic factors

Rising interest rates, a notable trend in many global economies throughout 2024 and into early 2025, are significantly impacting credit conditions. For instance, central banks in key Southeast Asian markets have maintained or increased benchmark rates to combat inflation, making it more expensive for businesses, especially Small and Medium-sized Enterprises (SMEs), to secure loans.

This tightening of credit means that borrowing costs for companies utilizing Chailease's services are likely to increase. Access to substantial financing may also become more restricted, potentially leading SMEs to delay or scale back their capital expenditure plans, directly affecting the demand for leasing and financing solutions.

For Chailease Holding, this economic climate translates to a higher cost of funding for its own operations. Consequently, the company might see a dampening effect on the overall demand for its leasing and financing products as businesses become more conservative with their investment decisions due to increased borrowing expenses and reduced credit availability.

Overall GDP growth across Asia, particularly in key markets like Taiwan, China, and Southeast Asia, directly influences the demand for Chailease's leasing and financing services. For instance, Taiwan's GDP growth was projected to be around 3.0% in 2024, indicating a stable economic environment, while China's growth was estimated at 4.5% for the same period, presenting significant opportunities.

The health of the SME sector is critical as these businesses are major clients for Chailease. Many SMEs in the region are navigating a challenging financing landscape in 2024, with tighter credit conditions potentially impacting their ability to invest and expand. This could translate to slower uptake of leasing solutions, affecting Chailease's revenue streams.

Chailease's financial performance is intrinsically linked to the resilience and expansionary capacity of SMEs. As of early 2024, reports indicated that many SMEs were still recovering from supply chain disruptions and inflationary pressures, which could delay their capital expenditure plans and, consequently, their demand for equipment leasing and financing from Chailease.

Persistent inflation remains a key economic challenge, with global inflation rates fluctuating. For instance, in early 2024, many developed economies experienced inflation rates still above central bank targets, though showing signs of moderation from 2023 peaks. This trend directly impacts Chailease by raising the cost of capital and operational expenses, potentially squeezing profit margins if lease agreements do not sufficiently adjust for rising prices.

The erosion of real value in future lease payments is a critical concern. If inflation outpaces the built-in escalation clauses in contracts, the purchasing power of future income diminishes. For example, if inflation averages 3% annually, a lease payment of $1000 in five years will have less real value than it does today. This necessitates careful contract structuring and dynamic pricing strategies to mitigate such risks.

Broader economic uncertainty driven by inflation influences investment and spending. Businesses may delay capital expenditure decisions, including leasing new equipment, due to concerns about future costs and demand. Similarly, consumer spending can be curtailed as households grapple with higher prices for essential goods, impacting the demand for leased assets across various sectors served by Chailease.

Currency Fluctuations

Currency fluctuations present a significant economic factor for Chailease Holding, a multinational entity. Changes in exchange rates directly impact the translation of revenues and profits generated in its various geographical segments. For example, in 2023, Chailease Holding experienced profit declines in key markets like Mainland China and ASEAN countries. These downturns were attributed to a mix of market-specific economic challenges and, importantly, the impact of unfavorable exchange rates, which can erode the value of earnings when converted back to the company's reporting currency.

The company's exposure to these currency shifts is a constant consideration in its financial planning and risk management. Fluctuations can create volatility in reported earnings, making it harder to predict consistent financial performance across its international operations. This economic reality necessitates strategies to mitigate currency risk, ensuring that the company's overall profitability remains robust despite external currency movements.

- Impact on Reported Earnings: Currency fluctuations can significantly alter the reported financial results of multinational corporations like Chailease Holding, affecting revenues and profits from overseas operations.

- 2023 Performance Context: Declines in profits for Chailease Holding in Mainland China and ASEAN countries during 2023 were partly exacerbated by unfavorable exchange rate movements, highlighting the real-world impact.

- Mitigation Strategies: Companies operating globally often employ hedging strategies or natural hedging techniques to offset the negative effects of currency volatility on their financial statements.

Competition in the Financial Services Sector

The financial services sector in Taiwan is incredibly crowded, with a vast number of institutions vying for market share. This intense competition, particularly for banks, has led to a noticeable squeeze on net interest margins, making it harder to generate profits from lending alone. For Chailease, which focuses on leasing, this means the entire industry is constantly pressured to innovate and offer unique products and services.

To thrive in this environment, financial companies, including Chailease, must prioritize cost management and operational efficiency. This focus is crucial for maintaining profitability amidst the fierce rivalry. The drive for differentiation means that simply offering standard financial products is no longer enough; companies need to find ways to stand out.

- Saturated Market: Taiwan's financial services industry is characterized by a high density of players.

- Margin Pressure: Intense competition has resulted in reduced net interest margins for many financial institutions.

- Differentiation Imperative: Leasing companies like Chailease must offer distinct products and services to attract and retain customers.

- Operational Efficiency: Cost control and streamlined operations are critical for profitability in a competitive landscape.

Rising interest rates globally through 2024 and into early 2025 have increased borrowing costs for businesses, potentially reducing demand for Chailease's financing solutions. Persistent inflation also erodes the real value of future lease payments, necessitating careful contract structuring and dynamic pricing strategies to mitigate this risk.

GDP growth across Asia, projected at around 3.0% for Taiwan and 4.5% for China in 2024, indicates varying opportunities for Chailease. However, the SME sector, a key client base, faces tighter credit conditions, potentially delaying capital expenditure and impacting Chailease's revenue.

Currency fluctuations, as seen in Chailease's 2023 profit declines in Mainland China and ASEAN countries due to unfavorable exchange rates, continue to be a significant factor affecting reported earnings and requiring robust risk mitigation strategies.

Preview the Actual Deliverable

Chailease Holding PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Chailease Holding delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting its operations and strategic direction. Understand the external forces shaping the leasing industry and Chailease's market position.

Sociological factors

Small and medium-sized enterprises (SMEs) are showing a growing preference for financing solutions that are both adaptable and digitally integrated. This trend is driven by a perception of increasing caution from traditional banking institutions. For instance, a 2024 survey indicated that over 60% of SMEs prioritize speed and ease of access when seeking capital, often looking beyond conventional bank loans.

This evolving landscape presents a clear directive for companies like Chailease. Adapting to these changing SME financing preferences means not only offering more flexible loan terms but also enhancing digital platforms for a smoother, faster application and approval process. By doing so, Chailease can effectively tap into this growing demand for agile financial services.

The financial literacy and digital adoption rates among Small and Medium-sized Enterprises (SMEs) are critical indicators of their capacity to utilize sophisticated financial tools and digital platforms. Globally, and especially in Asian markets, SMEs are increasingly adopting digital-only banking and mobile payment solutions. For instance, a 2024 report indicated that over 60% of SMEs in Southeast Asia now use mobile banking for their daily transactions, highlighting the imperative for companies like Chailease to offer user-friendly and easily accessible digital financial services to remain competitive.

Attracting and retaining top talent, particularly in burgeoning fields like FinTech, data analytics, and ESG compliance, is paramount for Chailease. In 2024, the global demand for FinTech professionals saw a significant surge, with some reports indicating a 30% year-over-year increase in job postings for these roles. This competitive landscape necessitates strategic investment in employee development and fostering an appealing workplace culture.

Chailease must prioritize robust talent management strategies to support its ambitious digital transformation and sustainability objectives. This includes offering continuous learning opportunities and creating an environment that values innovation and employee well-being. For instance, companies that invest more in employee training often report higher retention rates, with some studies showing a 10-15% improvement in employee loyalty.

Societal Expectations for Responsible Business

Societies increasingly expect businesses to act responsibly, looking beyond just profits. This means companies are being scrutinized for their environmental impact, labor practices, and community engagement. Chailease Holding recognizes this shift, embedding social responsibility into its core strategy. For example, in 2023, the company reported significant contributions to public welfare initiatives, aiming to bolster its brand image and foster trust among its diverse stakeholders.

Chailease's commitment to social responsibility is demonstrated through active participation in public welfare programs and support for social welfare organizations. This approach not only addresses societal expectations but also serves to strengthen its corporate reputation and build stronger relationships with customers, employees, and the broader community. Such initiatives are crucial for long-term sustainability and stakeholder buy-in.

Key aspects of societal expectations influencing Chailease:

- Growing demand for corporate social responsibility (CSR) initiatives.

- Emphasis on ethical business practices and transparency.

- Importance of community engagement and public welfare contributions.

- Impact of social responsibility on brand reputation and stakeholder trust.

Demographic Shifts and Regional Growth

Demographic shifts in Taiwan, including an aging population and a growing middle class, directly impact leasing demand. For instance, the increasing number of small and medium-sized enterprises (SMEs) in technology and advanced manufacturing sectors in 2024-2025 fuels demand for equipment leasing. Chailease Holding's strategic focus on these growing segments, alongside its expansion into Southeast Asian markets with similar demographic trends, positions it to capitalize on these evolving needs.

Regional development, particularly the rise of economic hubs in Vietnam and Indonesia, presents significant growth opportunities. As these regions experience industrial expansion and urbanization, the need for financing infrastructure, manufacturing equipment, and commercial vehicles increases. Chailease's localized approach, tailoring financial products to specific regional demands, is a key strategy to navigate these demographic and economic divergences.

- Taiwan's aging population necessitates flexible financing solutions for healthcare and elder care businesses.

- Growth of SMEs in tech sectors drives demand for specialized IT and machinery leasing.

- Southeast Asian urbanization creates opportunities in construction and transportation equipment financing.

- Chailease's localization strategy aims to meet diverse regional demographic and economic needs.

Societal expectations are increasingly driving corporate behavior towards greater social responsibility. Consumers and stakeholders are demanding ethical practices, transparency, and active community engagement from businesses like Chailease. For example, a 2024 survey revealed that 70% of consumers consider a company's social impact when making purchasing decisions, highlighting the importance of CSR for brand loyalty and reputation.

Chailease Holding's proactive approach to social welfare initiatives, including significant contributions to public welfare programs in 2023, directly addresses these evolving societal demands. This commitment not only enhances its corporate image but also fosters deeper trust among customers, employees, and the wider community, which is crucial for sustained growth and stakeholder buy-in.

The company's focus on ethical operations and community involvement is a strategic imperative, reflecting a broader societal shift where corporate citizenship is as valued as financial performance. This focus is essential for building a resilient and respected brand in the current business environment.

Chailease's commitment to social responsibility is demonstrated through active participation in public welfare programs and support for social welfare organizations. This approach not only addresses societal expectations but also serves to strengthen its corporate reputation and build stronger relationships with customers, employees, and the broader community. Such initiatives are crucial for long-term sustainability and stakeholder buy-in.

Technological factors

The leasing sector is rapidly embracing digital solutions, driven by customer demand for streamlined asset management and quick lease approvals. This shift is compelling companies like Chailease to overhaul their operations.

Chailease is investing heavily in digital platforms and data analytics to enhance service and asset quality, aiming for end-to-end digital processes. For example, in 2023, their digital transformation initiatives contributed to a 15% increase in processing efficiency for new lease applications.

Artificial intelligence and machine learning are fundamentally reshaping the leasing industry. These technologies are empowering companies like Chailease to make more accurate predictions, streamline operations, and identify target clients with greater precision. For instance, AI can analyze vast datasets to predict equipment depreciation or customer default risk, leading to better pricing and portfolio management.

Chailease is actively investing in AI-driven tools to bolster its competitive edge and fortify risk management. This includes leveraging AI for advanced data analytics to understand market trends and customer behavior, improving credit assessment processes for more accurate risk evaluation, and automating the application processing to expedite service delivery. The company's commitment to these advancements is crucial in navigating the evolving financial landscape.

The increasing reliance on digital platforms for financial services, including those offered by Chailease, amplifies cybersecurity and data security risks. Protecting sensitive customer information and financial transaction integrity from sophisticated cyber threats is no longer optional; it's fundamental to maintaining customer trust and operational continuity.

As of early 2024, the global cost of cybercrime was projected to reach $10.5 trillion annually by 2025, highlighting the significant financial exposure. Financial institutions like Chailease face mounting pressure to invest heavily in robust security measures to prevent data breaches, which can lead to substantial financial losses and reputational damage.

Regulatory bodies worldwide are intensifying their scrutiny of information security practices. For instance, in 2024, many jurisdictions continued to strengthen data protection laws, such as GDPR and similar frameworks, imposing stricter compliance requirements and heavier penalties for non-compliance, making cybersecurity a critical operational and strategic imperative for Chailease.

Integration of FinTech and Digital Lending Platforms

The financial technology (FinTech) sector, particularly in digital lending, is fundamentally altering how small and medium-sized enterprises (SMEs) access capital. Platforms offering peer-to-peer lending, private credit, and crowdfunding are becoming increasingly prevalent, providing alternative avenues for financing that often bypass traditional banking channels.

For Chailease Holding, staying ahead necessitates a proactive approach to integrating these FinTech innovations. This could involve strategic partnerships with emerging FinTech companies or developing proprietary digital solutions. By embracing these technologies, Chailease can enhance its ability to offer SMEs more flexible, efficient, and rapid financing options, thereby solidifying its competitive position in the evolving market.

Consider the growth trajectory: the global FinTech market was valued at over $2.4 trillion in 2023 and is projected to reach $10 trillion by 2030, with digital lending being a significant contributor. In 2024, FinTech adoption by SMEs is expected to continue its upward trend, with many actively seeking digital solutions for their funding needs.

- FinTech's Impact on SME Financing: Digital lending platforms and alternative financing solutions are democratizing access to capital for SMEs.

- Chailease's Strategic Imperative: Continuous integration and leveraging of FinTech are crucial for competitiveness and offering agile financing.

- Market Growth: The FinTech sector, including digital lending, is experiencing rapid expansion, indicating a strong demand for these services.

- Customer Demand: SMEs are increasingly turning to digital channels for faster and more flexible financing solutions.

Automation and Operational Efficiency

Automation, particularly Robotic Process Automation (RPA), is revolutionizing back-office operations in the leasing industry. For Chailease, this means drastically cutting down onboarding times and streamlining repetitive tasks throughout the leasing lifecycle. Companies adopting these technologies are seeing significant improvements in how quickly they can serve clients.

Embracing automation allows Chailease to boost its operational efficiency and lower costs. This technological shift directly translates to faster service delivery, a critical factor in meeting modern customer expectations. For instance, in 2024, many financial services firms reported a 20-30% reduction in processing times for routine tasks after implementing RPA solutions.

The benefits extend to enhanced accuracy and a reduced error rate in data handling. This not only improves customer satisfaction but also minimizes compliance risks.

- Reduced Back-Office Processing Times: RPA can automate data entry, document verification, and customer onboarding, potentially cutting processing times by up to 40% in some financial institutions as of early 2025.

- Cost Savings: Automation reduces the need for manual labor in repetitive tasks, leading to significant operational cost reductions, estimated to be between 15-25% for back-office functions.

- Improved Customer Experience: Faster turnaround times and fewer errors contribute to a smoother and more satisfactory customer journey.

Technological advancements, particularly in digitalization and automation, are fundamentally reshaping the leasing industry. Chailease Holding is actively investing in digital platforms and AI to improve efficiency and risk management, aiming for end-to-end digital processes. For example, their digital transformation efforts in 2023 led to a 15% increase in processing efficiency for new lease applications.

The rise of FinTech, especially in digital lending, is democratizing access to capital for SMEs, creating new competitive landscapes. The global FinTech market was valued at over $2.4 trillion in 2023, with digital lending a significant driver, and adoption by SMEs is projected to grow substantially in 2024.

Automation, such as Robotic Process Automation (RPA), is crucial for streamlining back-office operations, reducing processing times, and enhancing accuracy. Financial institutions reported an average 20-30% reduction in processing times for routine tasks after implementing RPA in 2024.

However, increased reliance on digital platforms heightens cybersecurity risks, with global cybercrime costs projected to reach $10.5 trillion annually by 2025. This necessitates significant investment in robust security measures to protect sensitive data and maintain customer trust, especially as regulatory scrutiny intensifies.

Legal factors

Chailease operates within a stringent financial regulatory environment, especially in Taiwan, where the Financial Supervisory Commission (FSC) is actively enhancing oversight. For 2025, the FSC's focus on areas like anti-fraud initiatives, real estate lending risk, consumer protection, and corporate governance directly shapes Chailease's compliance obligations.

Data privacy and protection laws are increasingly critical for financial services firms like Chailease, especially with the ongoing digitalization of operations. Regulators worldwide are focusing on how companies handle sensitive customer information. For instance, the European Union's General Data Protection Regulation (GDPR) sets a high bar, and many countries are adopting similar frameworks, impacting how Chailease must manage data across different jurisdictions.

Financial institutions, including Chailease, operate under stringent global Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) regulations. These rules are designed to prevent illicit financial activities and require robust compliance frameworks.

Taiwan's Financial Supervisory Commission (FSC) has been actively harmonizing local banking regulations with international AML standards. This proactive approach necessitates continuous vigilance and the implementation of strong compliance mechanisms by companies like Chailease to effectively combat financial crime.

Contract and Leasing-Specific Laws

Chailease's primary operations in leasing and installment sales are heavily influenced by contract and leasing-specific laws. These legal frameworks, which differ significantly by country, dictate how agreements are structured, enforced, and managed. For instance, in Taiwan, the Civil Code and the Leasehold Act provide the foundational legal basis for leasing transactions, covering aspects like contract formation, tenant rights, and landlord obligations.

Navigating these regulations is paramount for Chailease to ensure the validity of its leasing and installment sale contracts. Adherence to these laws is critical for managing asset ownership, especially when dealing with leased equipment or financed purchases. The company must also be well-versed in laws governing default, repossession, and bankruptcy proceedings to protect its interests and recover assets effectively. In 2023, Chailease reported a significant portion of its revenue derived from these core leasing activities, underscoring the direct impact of these legal factors on its financial performance.

- Contract Enforceability: Legal requirements for contract clarity and mutual agreement are essential for Chailease to enforce terms and conditions across its diverse client base.

- Asset Ownership and Recovery: Laws governing title transfer, collateral rights, and repossession procedures directly impact Chailease's ability to manage and recover leased assets.

- Jurisdictional Variations: Chailease must comply with a complex web of international and local leasing regulations, as seen in its operations across Asia, where legal systems can vary substantially.

- Default and Bankruptcy Laws: Understanding and applying laws related to customer defaults and bankruptcies is crucial for risk mitigation and asset protection, a key concern for financial institutions like Chailease.

Corporate Governance and Disclosure Requirements

Corporate governance and disclosure requirements are becoming increasingly stringent, especially concerning environmental, social, and governance (ESG) factors. Taiwan's full adoption of IFRS S1 and S2 by 2025 signifies a major shift towards mandatory sustainability reporting. This means companies like Chailease must enhance transparency and provide detailed ESG-related information in their financial and sustainability reports.

Compliance with these evolving international standards is crucial for maintaining investor confidence and accessing capital markets. Chailease's reporting practices will need to adapt to ensure accuracy and completeness, directly impacting how investors perceive its long-term viability and commitment to sustainable business operations. This includes clear communication on climate-related risks and opportunities, as well as broader sustainability matters.

- IFRS S1 and S2 Adoption: Taiwan's full implementation by 2025 mandates comprehensive sustainability disclosures.

- Enhanced Transparency: Companies must report on ESG performance, influencing investor relations.

- Reporting Practices: Financial and sustainability reports need alignment with international standards for credibility.

- Investor Perception: Adherence to new governance and disclosure rules impacts capital access and valuation.

Chailease must navigate evolving data privacy regulations, with a global trend towards stricter consumer data protection laws impacting how sensitive customer information is handled across its operations. Adherence to frameworks like GDPR, or similar national legislation, is crucial for maintaining trust and avoiding penalties. The company’s commitment to robust data security measures is therefore a key legal consideration.

Anti-money laundering (AML) and counter-terrorist financing (CTF) regulations remain a critical legal area for Chailease. Taiwan's Financial Supervisory Commission (FSC) continues to align local rules with international standards, requiring ongoing vigilance in implementing effective compliance mechanisms to prevent illicit financial activities and ensure regulatory adherence across all business dealings.

The legal landscape for leasing and installment sales contracts is complex and varies by jurisdiction, directly affecting Chailease's core business. Understanding and complying with national laws regarding contract formation, asset ownership, repossession, and bankruptcy procedures is essential for safeguarding its assets and ensuring the enforceability of its agreements. In 2023, leasing and installment sales constituted a significant portion of Chailease's revenue, highlighting the direct impact of these legal frameworks.

Corporate governance and ESG disclosure requirements are tightening, with Taiwan's adoption of IFRS S1 and S2 by 2025 mandating comprehensive sustainability reporting. Chailease must enhance transparency and accurately report on ESG factors to maintain investor confidence and access capital markets, directly influencing its valuation and long-term strategic positioning.

| Legal Factor | Key Considerations for Chailease | Impact on Operations | Regulatory Focus (2024-2025) |

|---|---|---|---|

| Data Privacy | Compliance with GDPR-like regulations, secure handling of customer data | Customer trust, operational costs, potential fines | Enhanced data protection, cross-border data transfer rules |

| AML/CTF | Robust compliance frameworks, transaction monitoring | Reputational risk, regulatory penalties | Harmonization with international standards, combating financial crime |

| Contract Law | Enforceability of leasing agreements, asset recovery laws | Revenue generation, asset management efficiency | Clarity in contract terms, default and bankruptcy procedures |

| Corporate Governance & ESG | Adherence to IFRS S1/S2, transparent ESG reporting | Investor relations, capital access, market perception | Mandatory sustainability disclosures, climate risk reporting |

Environmental factors

The financial world is increasingly focused on Environmental, Social, and Governance (ESG) factors. This means companies, including Chailease Holding, are facing more pressure to make sustainability a core part of their strategy and the products they offer.

Chailease Holding has embraced ESG principles, embedding them into its main business operations. They are actively working on sustainable development, which includes creating financial products and services specifically labeled as ESG-friendly.

For instance, by the end of 2023, global sustainable finance assets were projected to reach over $50 trillion, demonstrating a significant market shift. Chailease Holding’s commitment to ESG-labelled products aligns with this trend, positioning them to capture a growing segment of environmentally conscious investors and clients.

The global imperative to achieve net-zero carbon emissions by 2050, mirrored in Taiwan's Climate Change Adaptation Act, significantly influences financial institutions like Chailease. This regulatory environment necessitates a proactive approach to sustainability.

Chailease's commitment to the Science Based Targets initiative (SBTi) in 2024 demonstrates a strategic move to define a concrete carbon reduction roadmap. Furthermore, the implementation of frameworks such as the Task Force on Climate-related Financial Disclosures (TCFD) is crucial for integrating climate-related risks and opportunities into their core business strategies and decision-making processes.

The financial sector's commitment to sustainability is accelerating, with a notable surge in credit availability for green projects and substantial capital flowing into renewable energy. For instance, global green bond issuance reached an estimated $600 billion in 2024, a significant increase from previous years, highlighting this growing trend.

Chailease Holding actively participates in this shift, utilizing its market position to encourage customers and suppliers towards sustainability. The company's direct involvement in financing green energy projects, such as solar and wind farms, demonstrates its alignment with the global push for environmentally conscious investment strategies.

Carbon Pricing and Emission Regulations

Taiwan's introduction of carbon fee collection and domestic carbon credit trading, effective in 2024, signifies a concrete move towards carbon pricing. This regulatory shift means companies such as Chailease, and their clientele, will likely encounter carbon fees or gain advantages from emission reduction incentives. Consequently, robust monitoring and reporting of carbon emissions, encompassing Scope 1, 2, and 3, will become a necessity for businesses, with mandatory reporting commencing in 2025.

The implementation of these environmental regulations presents both challenges and opportunities for Chailease. For instance, companies that proactively reduce their carbon footprint could see financial benefits through carbon credits, while those with higher emissions will face increased operational costs due to carbon fees. This evolving landscape necessitates a strategic approach to sustainability, integrating emission management into core business operations and client engagement models. The Taiwanese government aims to drive industrial decarbonization through these measures, with initial targets focusing on energy-intensive sectors.

- Carbon Pricing Implementation: Taiwan began implementing carbon fee collection and domestic carbon credit trading in 2024.

- Reporting Mandates: Companies, including Chailease, will be required to monitor and report Scope 1, 2, and 3 emissions starting in 2025.

- Financial Implications: Businesses may face carbon fees or receive incentives for emission reduction efforts.

- Sustainability Focus: The regulations encourage companies to invest in decarbonization strategies and sustainable practices.

Environmental Risk Management

Chailease Holding must actively manage environmental risks inherent in its financed assets, which often include real estate and vehicles. This involves a thorough assessment of the environmental footprint of its investment and financing operations, a critical step in responsible corporate stewardship.

A key focus for Chailease is identifying and quantifying greenhouse gas emissions directly linked to its loan and leasing portfolio. For instance, in 2024, the company is enhancing its data collection methods to better track Scope 3 emissions, which often arise from the use of financed assets by its clients.

Furthermore, Chailease is committed to supporting clients in their transition to lower-carbon operations and promoting energy conservation. This includes offering financing solutions for renewable energy projects and energy-efficient equipment, aligning with global efforts to combat climate change.

- Portfolio Emission Tracking: Chailease is implementing advanced analytics in 2024 to provide more granular data on the carbon intensity of its financed assets, aiming for a 10% improvement in data accuracy by year-end.

- Low-Carbon Financing Initiatives: The company is expanding its green financing products, with a target to increase the proportion of green asset financing by 15% in 2025 compared to 2023 levels.

- Client Engagement for Sustainability: Chailease is developing tailored advisory services to help clients reduce their environmental impact, focusing on sectors like transportation and manufacturing where emissions reduction opportunities are significant.

Taiwan's 2024 carbon pricing and credit trading initiatives, alongside mandatory emissions reporting from 2025, directly impact Chailease and its clients. This regulatory push encourages decarbonization, potentially leading to cost increases for high emitters and financial benefits for those reducing their carbon footprint.

Chailease is actively managing environmental risks within its financed assets, such as real estate and vehicles, by enhancing data collection for Scope 3 emissions in 2024. The company is also expanding its green financing, aiming for a 15% increase in green asset financing by 2025.

The company's commitment to SBTi in 2024 and TCFD implementation underscores a strategic integration of climate risks and opportunities. This proactive stance aligns with the global trend of sustainable finance, evidenced by projected over $50 trillion in global sustainable finance assets by the end of 2023 and an estimated $600 billion in global green bond issuance in 2024.

| Environmental Factor | Impact on Chailease | Key Data/Initiatives |

| Carbon Pricing & Trading | Potential cost increases or incentives based on emissions. | Taiwanese carbon fee collection and credit trading began in 2024. |

| Emissions Reporting | Necessity for robust Scope 1, 2, and 3 monitoring. | Mandatory reporting commences in 2025. |

| Green Finance Growth | Opportunity to finance sustainable projects. | Global sustainable finance assets projected over $50 trillion (end of 2023). Global green bond issuance estimated at $600 billion (2024). |

| Net-Zero Targets | Drives investment in low-carbon solutions. | Chailease committed to SBTi in 2024; TCFD implementation. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Chailease Holding is built on a robust foundation of data from official government publications, reputable financial news outlets, and leading market research firms. This ensures that our insights into political, economic, social, technological, legal, and environmental factors are both comprehensive and current.