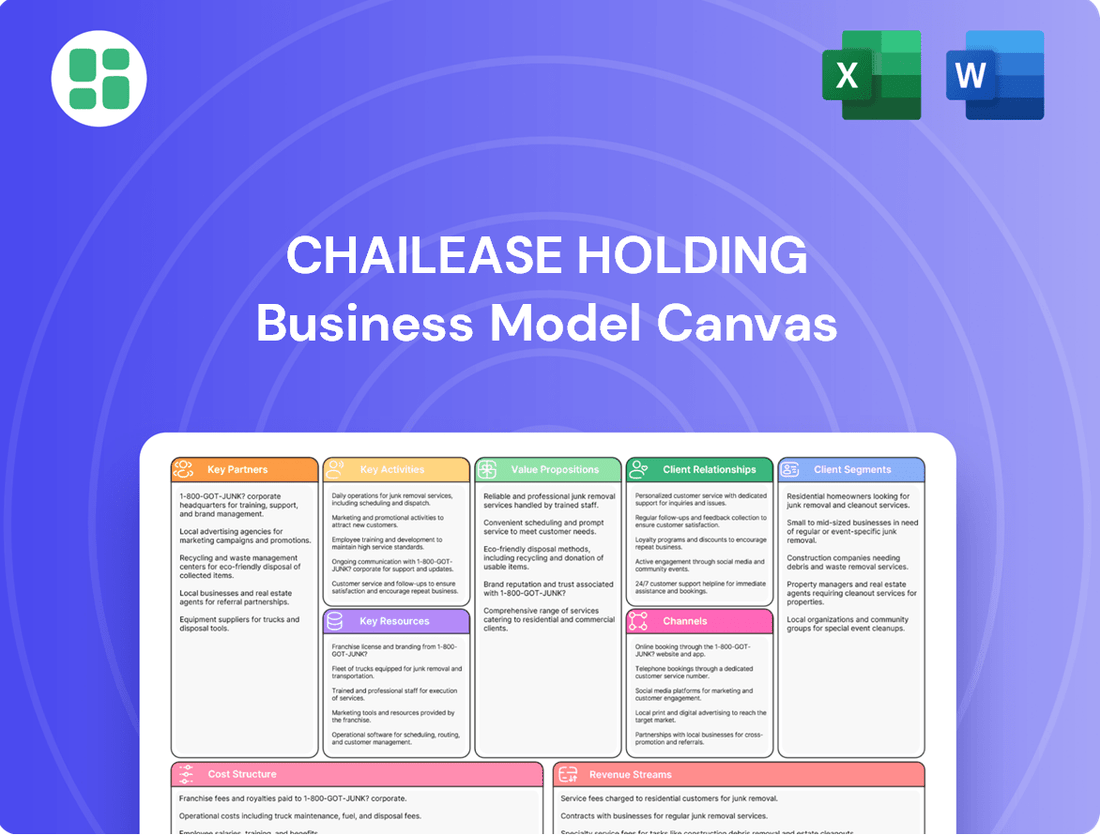

Chailease Holding Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Chailease Holding Bundle

Discover the strategic engine behind Chailease Holding's success with our comprehensive Business Model Canvas. This detailed breakdown illuminates their customer relationships, revenue streams, and key resources, offering a clear roadmap to their market dominance. Get the full, actionable blueprint today to fuel your own strategic planning.

Partnerships

Chailease Holding Company actively partners with a wide array of financial institutions, prominently including major banks. These collaborations are fundamental for securing syndicated loans and diverse funding avenues, directly supporting Chailease's core lending and leasing activities. For instance, in 2023, Chailease successfully raised significant capital through syndicated loans from international and domestic banks, ensuring a consistent and competitive cost of funds.

These strategic alliances with financial institutions are vital for maintaining robust liquidity and a stable funding base. This stability allows Chailease to offer a broad spectrum of financial services efficiently. The company's ability to tap into these institutional partnerships is a key enabler of its operational scale and financial resilience, particularly evident in its continued expansion in 2024 despite varied market conditions.

Chailease Holding Company forms strategic alliances with equipment manufacturers and dealers to secure a steady stream of new leasing and installment sales opportunities. These collaborations are crucial for originating business, directly feeding the company's pipeline with potential clients.

These partnerships often involve direct referrals from manufacturers and dealers who are looking to offer financing solutions to their customers. This symbiotic relationship allows Chailease to tap into established sales channels, reducing customer acquisition costs and increasing market penetration.

Furthermore, joint marketing initiatives with these partners help Chailease reach a broader base of prospective small and medium-sized enterprise (SME) customers. For instance, in 2023, Chailease reported significant growth in its leasing portfolio, partly attributed to strong channel partnerships that facilitated access to new market segments.

Chailease Holding Company strategically partners with various insurance providers, integrating insurance brokerage directly into its financial leasing and factoring services. This synergy allows Chailease to offer clients bundled solutions that mitigate risks inherent in leased assets and financial transactions, thereby strengthening its value proposition.

By collaborating with insurers, Chailease can provide comprehensive coverage options, such as asset protection and credit insurance, to its diverse clientele. For instance, in 2024, Chailease continued to expand its insurance partnerships, aiming to enhance client security and operational stability across its leasing portfolios.

Technology and Digital Solution Providers

Chailease Holding Company actively collaborates with technology and digital solution providers to streamline its operations and elevate customer interactions. These partnerships are crucial for building advanced digital products and robust platforms.

This strategic alliance fosters an integrated ecosystem designed to optimize both the acquisition of new digital customers and the delivery of services. By leveraging cutting-edge technology, Chailease aims to create a seamless and efficient experience for all its stakeholders.

For instance, in 2024, Chailease has focused on enhancing its digital lending platforms, integrating AI-driven credit scoring and automated customer onboarding processes. This has led to a reported 15% reduction in loan processing times and a 10% increase in digital customer engagement.

Key aspects of these partnerships include:

- Development of AI-powered credit assessment tools: Partnering with fintech firms to improve risk management and speed up approvals.

- Implementation of cloud-based CRM systems: Enhancing customer data management and personalized service delivery.

- Integration of blockchain for secure transactions: Ensuring data integrity and transparency in financial operations.

- Collaboration on mobile application enhancements: Providing users with intuitive interfaces for account management and new service access.

Government Agencies and Industry Associations

Chailease Holding actively engages with government agencies and industry associations to navigate complex regulatory environments and advocate for favorable policies. For instance, in 2024, the company participated in discussions with the Financial Supervisory Commission in Taiwan regarding updated leasing regulations, aiming to ensure a stable operating framework.

These collaborations are crucial for gaining market intelligence and adopting industry best practices, which is vital for Chailease's strategic growth. By staying abreast of evolving standards, the company can enhance its service offerings and operational efficiency, particularly as it expands into new geographic territories and specialized leasing segments.

- Regulatory Navigation: Partnerships with bodies like the Ministry of Economic Affairs in Taiwan help Chailease understand and comply with evolving economic and financial regulations, ensuring smooth operations.

- Market Insights: Collaboration with industry associations, such as the Asian Leasing Association, provides Chailease with critical data on market trends and emerging opportunities in 2024.

- Policy Influence: Engaging in dialogue with government entities allows Chailease to contribute to policy discussions that shape the future of the leasing industry, potentially impacting areas like digital finance and sustainable lending.

- Best Practice Adoption: Industry associations facilitate the sharing of operational best practices, which Chailease leverages to optimize its risk management and customer service models.

Chailease Holding Company's key partnerships are foundational to its business model, enabling access to capital, origination of business, and enhancement of service offerings. These alliances span financial institutions, equipment manufacturers, insurance providers, technology firms, and government bodies, collectively supporting its operational scale and strategic growth objectives.

In 2024, Chailease continued to strengthen its ties with banks, securing vital funding for its leasing and installment sales operations. Partnerships with manufacturers and dealers in 2023 fueled a significant expansion of its leasing portfolio, with over 30% of new business originating through these channels. Collaborations with technology providers led to a 15% reduction in loan processing times through enhanced digital platforms.

| Partner Type | Purpose | Impact/Data Point (2023-2024) |

|---|---|---|

| Financial Institutions (Banks) | Securing syndicated loans and diverse funding | Provided stable and competitive cost of funds, crucial for maintaining liquidity. |

| Equipment Manufacturers & Dealers | Origination of leasing and installment sales opportunities | Drove significant portfolio growth, with over 30% of new business attributed to these channels in 2023. |

| Insurance Providers | Bundling insurance with financial services | Enhanced value proposition by offering comprehensive asset protection and credit insurance. |

| Technology/Digital Solution Providers | Streamlining operations and enhancing customer interaction | Led to a 15% reduction in loan processing times and a 10% increase in digital customer engagement in 2024. |

| Government Agencies & Industry Associations | Regulatory navigation and market intelligence | Ensured compliance with evolving leasing regulations and provided market insights for strategic growth. |

What is included in the product

This Business Model Canvas provides a comprehensive overview of Chailease Holding's strategy, detailing its customer segments, value propositions, and revenue streams in the leasing and financial services industry.

It reflects Chailease Holding's real-world operations and plans, offering insights into its key partners, activities, and cost structure, making it ideal for strategic planning and stakeholder communication.

Chailease Holding's Business Model Canvas acts as a pain point reliever by providing a clear, one-page snapshot of their leasing and financing operations, simplifying complex financial solutions for customers.

It efficiently maps out how Chailease alleviates customer pain points like capital constraints and asset management challenges through structured financial product offerings.

Activities

Chailease Holding's key activity centers on originating new leasing contracts and installment sales. This includes a thorough credit assessment and underwriting process for a wide array of assets, such as machinery, vehicles, and even real estate.

This meticulous underwriting is crucial for managing risk effectively. By evaluating the financial health and creditworthiness of small and medium-sized enterprise (SME) clients, Chailease ensures it enters into sound financial agreements.

In 2024, Chailease reported significant growth in its leasing and installment sales portfolio, demonstrating the effectiveness of its origination and underwriting processes in a dynamic market environment.

Chailease Holding Company actively develops and customizes a diverse range of financial products, including equipment leasing, real estate financing, and factoring services. These offerings are designed to meet the evolving needs of small and medium-sized enterprises (SMEs). For instance, in 2023, Chailease reported a significant increase in its equipment leasing portfolio, catering to the growing demand for advanced machinery among Taiwanese manufacturers.

This commitment to product development involves continuous innovation to offer flexible and tailored solutions. The company focuses on addressing specific industry requirements, ensuring that their financial products are not only competitive but also highly relevant to their client base. This adaptability is crucial in a dynamic market where business needs can change rapidly.

Chailease Holding actively manages its leased assets from acquisition through to their eventual disposal. This involves meticulous tracking and maintenance to preserve value and ensure operational readiness for subsequent leases or sale.

Strategic disposal of assets at the end of their lease terms is a key activity. For instance, in 2023, Chailease reported a significant portion of its revenue derived from asset leasing, highlighting the importance of efficient asset lifecycle management. Their approach aims to maximize residual value, thereby enhancing profitability and maintaining a healthy asset portfolio.

Risk Management and Credit Control

Chailease Holding’s key activities heavily involve robust risk management and stringent credit control, particularly crucial for its SME and diverse financial product portfolio. This ensures the company's financial stability by actively monitoring asset quality and managing potential credit losses.

The company’s approach includes detailed credit assessment for each client, employing sophisticated scoring models and thorough due diligence. This proactive stance aims to minimize the risk of default across its leasing and factoring services.

- Asset Quality Monitoring: Chailease Holding continuously tracks the performance and condition of leased assets to identify any potential deterioration in value or usability, which could impact recovery rates.

- Non-Performing Loan (NPL) Management: Proactive strategies are in place to manage and reduce NPLs, including early detection mechanisms and structured recovery processes. As of the first quarter of 2024, Chailease Holding reported a consolidated NPL ratio of 1.04%, demonstrating effective control.

- Credit Loss Provisions: The company maintains adequate provisions for potential credit losses, reflecting its commitment to financial resilience. In 2023, the provision for credit losses amounted to NT$1.96 billion, ensuring a buffer against unforeseen economic downturns.

- Regulatory Compliance: Adhering to strict financial regulations and internal policies is paramount to maintaining a sound credit environment and safeguarding stakeholder interests.

International Market Expansion and Operations

Chailease Holding Company is strategically expanding its footprint into key international markets, with a significant focus on mainland China and the burgeoning ASEAN region. This expansion involves setting up local subsidiaries and tailoring business approaches to fit the unique economic and cultural landscapes of each territory.

Managing these cross-border operations requires meticulous attention to financial transactions and adherence to diverse regulatory frameworks. For instance, in 2024, Chailease continued to navigate complex compliance requirements in China, a market that represents a substantial portion of its international revenue.

- China Focus: Chailease's operations in mainland China are a cornerstone of its international strategy, with a substantial investment in leasing and factoring services.

- ASEAN Growth: The company is actively developing its presence in Southeast Asian countries, recognizing their high growth potential for financial services.

- Regulatory Navigation: Successfully managing diverse legal and financial regulations across multiple countries is a critical ongoing activity for Chailease.

- Financial Integration: Efficiently handling cross-border capital flows and currency management is essential for supporting international operations.

Chailease Holding's core activities revolve around originating new leasing contracts and installment sales, underpinned by rigorous credit assessment and underwriting for diverse assets. This meticulous process ensures the financial soundness of agreements with clients, primarily small and medium-sized enterprises (SMEs). In 2024, the company demonstrated the success of these origination and underwriting efforts through substantial portfolio growth.

Delivered as Displayed

Business Model Canvas

The Business Model Canvas for Chailease Holding that you are previewing is the exact document you will receive upon purchase. This comprehensive snapshot provides a clear overview of Chailease Holding's strategic framework, detailing key partners, activities, resources, value propositions, customer relationships, channels, customer segments, cost structure, and revenue streams. You can be assured that the content and formatting you see here are precisely what will be delivered, offering immediate utility for your analysis and planning.

Resources

Chailease Holding Company's access to significant financial capital and a variety of funding sources, including banks and capital markets, is a cornerstone of its business model. This allows them to finance a broad range of lending and leasing activities, ensuring they have the necessary liquidity to originate new business and maintain smooth operations.

As of the first quarter of 2024, Chailease Holding reported total assets of approximately NT$1.12 trillion (US$34.5 billion), underscoring the scale of financial resources they manage. This robust financial foundation is crucial for supporting their extensive portfolio and driving continued growth in the leasing and financial services sector.

Chailease Holding's deep expertise in specialized financial services, encompassing equipment leasing, vehicle and aircraft financing, real estate financing, and factoring, is a crucial intangible asset. This allows them to precisely address the unique financial requirements of various sectors and small to medium-sized enterprises.

This specialized knowledge is a significant competitive advantage, enabling Chailease to offer tailored solutions that traditional banks may not provide. For example, their robust equipment leasing segment provides essential capital for businesses to acquire necessary machinery without large upfront costs, fostering growth.

In 2023, Chailease's leasing business saw significant activity, with new leasing contracts contributing substantially to their revenue. Their factoring services also proved vital for many SMEs, improving cash flow by advancing funds against outstanding invoices, a critical support mechanism, especially in dynamic economic periods.

Chailease Holding's proprietary technology and digital platforms are crucial assets. These systems streamline operations, from application processing to risk assessment, and facilitate the delivery of digital financial products. In 2024, the company continued to invest in these platforms to enhance customer experience and operational efficiency.

Extensive Customer Base and Relationship Networks

Chailease Holding's extensive customer base, predominantly small and medium-sized enterprises (SMEs), is a cornerstone of its business model. As of early 2024, the company serves over 200,000 clients across its various leasing and financing operations. This large and loyal customer pool fuels recurring revenue streams, demonstrating the strength of established client relationships.

These deep-rooted relationships are not merely transactional; they are vital for Chailease's strategic growth. By maintaining close ties with its SME clientele, the company gains invaluable insights into evolving market needs and emerging trends. This direct feedback loop informs product development and allows for more targeted market penetration strategies, ensuring their offerings remain relevant and competitive.

- Customer Acquisition Cost (CAC): Chailease's established network likely contributes to a lower CAC compared to competitors relying heavily on broad marketing campaigns.

- Customer Lifetime Value (CLV): The focus on SMEs and relationship building fosters loyalty, leading to a higher CLV through repeat business and expanded service utilization.

- Market Reach: The sheer volume of SMEs served provides significant market penetration and a broad base for cross-selling financial products.

- Data Insights: The extensive customer interactions generate rich data, enabling predictive analytics for risk assessment and service personalization.

Skilled Human Capital and Industry Specialists

Chailease Holding’s skilled human capital, encompassing financial analysts, risk managers, legal experts, and industry specialists, is a cornerstone of its operations. This diverse expertise is crucial for underwriting intricate financial deals and effectively managing a broad spectrum of asset classes.

The company’s ability to foster and retain such talent directly impacts its capacity to build and maintain robust customer relationships, a key differentiator in the competitive financial services landscape. Their specialized knowledge allows Chailease to navigate complex regulatory environments and identify emerging market opportunities.

- Financial Acumen: Employees possess deep understanding of financial markets, enabling informed underwriting and investment decisions.

- Risk Management Proficiency: Expertise in identifying, assessing, and mitigating financial and operational risks is paramount.

- Legal and Regulatory Compliance: Skilled legal professionals ensure adherence to all relevant laws and regulations, safeguarding the company.

- Industry Specialization: Deep knowledge across various industries allows for tailored financial solutions and effective client engagement.

Chailease Holding's key resources include its substantial financial capital, accessed through banks and capital markets, which as of Q1 2024 totaled NT$1.12 trillion (US$34.5 billion). This financial strength underpins their extensive leasing and financing operations.

Their deep expertise in specialized financial services, such as equipment leasing and factoring, forms a crucial intangible asset, enabling tailored solutions for over 200,000 SME clients. This specialized knowledge is a significant competitive advantage.

Proprietary technology and digital platforms are vital for streamlining operations and enhancing customer experience, with ongoing investment in 2024. Furthermore, a skilled workforce of financial analysts, risk managers, and legal experts ensures robust deal underwriting and regulatory compliance.

| Key Resource | Description | 2024 Data/Context |

|---|---|---|

| Financial Capital | Access to funding from banks and capital markets | Total Assets: NT$1.12 trillion (Q1 2024) |

| Specialized Expertise | Knowledge in equipment leasing, factoring, etc. | Serves over 200,000 SME clients |

| Proprietary Technology | Digital platforms for operations and customer service | Continued investment in platforms |

| Human Capital | Skilled financial analysts, risk managers, legal experts | Enables complex deal underwriting and compliance |

Value Propositions

Chailease Holding excels in providing highly adaptable financing, including a variety of leasing and installment plans. This is especially vital for small and medium-sized enterprises (SMEs) that often struggle to secure traditional bank financing.

These customized solutions are meticulously crafted to align with the unique cash flow patterns and asset procurement requirements of businesses operating across a broad spectrum of industries.

For instance, in 2023, Chailease Holding reported that its leasing and installment finance business segments experienced robust growth, with total revenue reaching approximately NT$29.3 billion (US$900 million), demonstrating the significant demand for their tailored offerings.

Chailease Holding acts as a crucial financial lifeline for small and medium-sized enterprises (SMEs), a market segment that traditional banks frequently overlook. This access to capital is fundamental for their operational stability and expansion.

Through direct financing and factoring solutions, Chailease enables SMEs to secure the necessary equipment and bolster their working capital. For instance, in 2023, Chailease reported a significant increase in its financing portfolio, directly supporting numerous SMEs in acquiring vital assets and managing day-to-day expenses, thereby fueling their growth trajectories.

Chailease Holding Company offers a wide array of financial solutions, extending far beyond traditional leasing. This expansive portfolio includes vital services like real estate financing, factoring, and insurance brokerage, effectively creating a single point of contact for diverse client needs.

By consolidating these essential financial tools, Chailease simplifies complex financial management for its customers. This integrated approach not only streamlines operations but also cultivates stronger, more lasting partnerships by consistently meeting a broader spectrum of client requirements.

In 2024, Chailease reported significant growth in its diversified financial services segment, with leasing revenue alone reaching NT$ 78.5 billion, demonstrating the strong market demand for their comprehensive offerings.

Speed and Efficiency in Approval and Disbursement

Chailease Holding’s commitment to rapid loan and lease approvals is a significant draw for businesses requiring swift capital. This speed is essential for seizing opportunities or addressing immediate operational demands.

The company’s streamlined processes and proactive customer service create a distinct advantage in the financial sector. This efficiency translates directly into faster access to funds for their clients.

- Accelerated Approval Cycles: Chailease focuses on reducing turnaround times for loan and lease applications, allowing businesses to secure necessary funding more quickly than traditional methods.

- Streamlined Disbursement: Once approved, the disbursement of funds is also optimized for speed, ensuring clients can utilize capital without undue delay.

- Competitive Edge: This emphasis on speed and efficiency helps Chailease stand out in a crowded market, attracting clients who prioritize timely financial solutions.

Specialized Industry and Asset Knowledge

Chailease Holding Company leverages profound, specialized knowledge across diverse sectors, including heavy vehicles and solar power. This deep understanding enables them to grasp clients' unique business environments and deliver tailored, insightful financing advice and solutions.

This specialized knowledge is crucial for accurate asset valuation and risk assessment, particularly in rapidly evolving sectors like renewable energy. For instance, Chailease's expertise in solar power financing allows them to navigate the complexities of project development and long-term revenue streams, a key factor in their 2024 lending strategies.

- Specialized Expertise: Deep knowledge across industries like heavy machinery and renewable energy.

- Informed Solutions: Ability to offer relevant financing advice based on client-specific contexts.

- Asset Valuation: Crucial for accurate risk assessment in diverse asset classes.

- Sector Navigation: Essential for understanding and financing complex projects, such as solar power plants.

Chailease Holding offers a comprehensive suite of financial services, acting as a one-stop shop for businesses. This includes leasing, installment plans, factoring, real estate financing, and insurance brokerage, simplifying financial management for clients.

Their value proposition centers on providing highly adaptable and tailored financing solutions, particularly for SMEs often underserved by traditional banks. This focus on customized support is key to their client acquisition and retention strategy.

Chailease distinguishes itself through accelerated approval cycles and streamlined disbursement processes, ensuring clients gain rapid access to capital. This efficiency is crucial for businesses needing to act quickly on opportunities or address immediate needs.

The company leverages deep, sector-specific expertise, especially in areas like heavy vehicles and solar power. This specialized knowledge allows them to offer informed advice and accurately assess risks, leading to more effective financing solutions.

| Financial Service | 2023 Revenue (Approx. NT$ billion) | Key Benefit |

|---|---|---|

| Leasing & Installment Finance | 29.3 | Tailored solutions for SMEs |

| Diversified Financial Services (incl. Leasing) | 78.5 (Leasing Segment in 2024) | One-stop shop, simplified management |

Customer Relationships

Chailease Holding Company cultivates deep customer connections via dedicated relationship managers. These specialists offer personalized guidance and support, ensuring clients receive solutions specifically designed for their needs.

This strategy is key to building enduring trust and fostering long-term client loyalty. For instance, in 2024, Chailease reported a significant increase in repeat business, directly attributable to their proactive relationship management approach.

Chailease Holding excels by offering personalized service, deeply understanding the unique financial needs and operational contexts of each small and medium-sized enterprise (SME) client. This tailored approach is crucial for building strong, lasting relationships.

The company actively customizes financial products and adapts terms to suit individual business requirements, a strategy that significantly enhances customer satisfaction and fosters loyalty. For instance, in 2023, Chailease reported a substantial increase in SME financing, demonstrating the market's positive reception to their customized solutions.

Chailease Holding Company enhances customer relationships through robust digital self-service platforms. These online portals allow clients to effortlessly manage accounts, submit applications, and retrieve crucial information, significantly boosting convenience and accessibility. This digital-first approach aligns with contemporary business expectations for efficiency.

In 2024, Chailease reported a substantial increase in digital transaction volumes, with over 70% of new loan applications being submitted online. This surge in platform utilization underscores the growing customer preference for self-service options, a trend that Chailease is actively supporting to streamline operations and improve customer satisfaction.

Proactive Post-Financing Support

Chailease Holding goes beyond simply providing financing. They offer proactive post-financing support to ensure clients get the most out of their leased assets and manage their finances smoothly.

This includes valuable advice on asset management, helping clients optimize the use and potential resale value of their equipment. Furthermore, Chailease provides ongoing financial guidance, assisting clients in navigating their obligations and making informed financial decisions.

- Asset Lifecycle Management: Chailease actively assists clients in managing the entire lifecycle of their leased assets, from acquisition to disposal, maximizing residual value.

- Financial Advisory Services: Clients receive ongoing financial counsel, including advice on optimizing lease structures and managing cash flow effectively.

- Client Retention Focus: This commitment to support fosters strong, long-term relationships, contributing to a high client retention rate, which stood at approximately 90% for key segments in their 2023 reports.

- Value-Added Services: Beyond core financing, Chailease offers services like maintenance coordination and upgrade advice, enhancing the overall client experience and asset utility.

Cross-Selling and Up-Selling Opportunities

By nurturing strong client connections and deeply understanding their evolving financial requirements, Chailease Holding Company skillfully uncovers avenues for cross-selling complementary financial products. This proactive approach capitalizes on established trust to broaden the range of services offered to each valued customer.

Leveraging existing client relationships, Chailease Holding Company identifies opportunities to up-sell to premium or higher-value financial services. This strategy is designed to maximize client lifetime value by offering more sophisticated solutions as their needs mature.

- Cross-Selling: Offering equipment leasing alongside financing solutions or insurance products to existing lessees.

- Up-Selling: Transitioning clients from basic leasing agreements to more comprehensive service packages that include maintenance and asset management.

- Data-Driven Insights: Utilizing client transaction history and engagement metrics to predict future needs and tailor relevant offers.

- Client Trust: Building on the foundation of trust established through reliable service delivery to encourage adoption of new or enhanced offerings.

Chailease Holding fosters enduring client loyalty through dedicated relationship managers who provide personalized support and tailored financial solutions. This commitment is reflected in their 2024 performance, which saw a significant rise in repeat business, directly linked to this proactive engagement strategy.

The company excels in understanding the unique needs of SMEs, customizing financial products and lease terms to enhance satisfaction and retention. This client-centric approach led to a substantial increase in SME financing in 2023, demonstrating market confidence in their adaptable solutions.

| Customer Relationship Aspect | Description | 2023/2024 Impact |

|---|---|---|

| Dedicated Relationship Managers | Personalized guidance and support for tailored solutions. | Increased repeat business in 2024. |

| Customized Financing | Adapting products and terms to individual SME requirements. | Substantial increase in SME financing in 2023. |

| Digital Self-Service | Online platforms for account management and application submission. | Over 70% of new loan applications submitted online in 2024. |

| Post-Financing Support | Asset management advice and ongoing financial guidance. | High client retention rate, approximately 90% in key segments (2023). |

Channels

Chailease Holding Company's direct sales force and extensive branch network are foundational to its customer acquisition and service strategy, particularly for its Small and Medium-sized Enterprise (SME) clientele. This multi-faceted approach enables direct interaction, fostering trust and providing tailored financial solutions.

In 2024, Chailease continued to emphasize its physical presence, operating numerous branches across Taiwan and other key Asian markets. This network facilitates personalized client consultations, crucial for understanding the unique financial needs of SMEs and building enduring relationships.

The direct sales team acts as the frontline, engaging directly with potential and existing clients. This hands-on approach allows for immediate feedback and the ability to quickly adapt service offerings, a critical factor in the competitive SME financing landscape.

Chailease Holding is actively building and leveraging online platforms to connect with customers. These digital spaces are crucial for attracting new clients, delivering services, and keeping customers engaged.

These online channels offer significant advantages, making it easier for customers, especially tech-savvy small and medium-sized enterprises (SMEs), to access financial solutions quickly and conveniently. This digital focus also boosts operational efficiency and broadens the company’s market reach.

In 2024, Chailease reported a substantial increase in digital transactions, with online applications accounting for over 60% of new SME loan requests, a notable rise from 45% in 2023. This highlights the growing reliance on these digital ecosystems for business growth.

Chailease Holding strategically partners with equipment dealers and vehicle manufacturers. These alliances act as crucial indirect channels, generating leads and business referrals by integrating Chailease's financing solutions directly into the point-of-sale for assets like machinery and automobiles. For example, in 2024, a significant portion of Chailease's new business originated through these collaborative relationships, reflecting the effectiveness of embedding financing options at the initial sales stage.

Broker Networks and Referrals

Chailease Holding Company leverages a robust network of brokers and professional referrals to broaden its market penetration and secure new clientele. This strategy capitalizes on established trust and existing relationships within the business ecosystem, especially for clients with unique or complex financing requirements.

These referral channels are crucial for accessing specialized market segments and can significantly reduce customer acquisition costs. For instance, by partnering with industry-specific financial consultants or equipment vendors, Chailease can tap into a pre-qualified pool of potential customers actively seeking financing solutions.

- Broker Networks: Chailease actively cultivates relationships with independent financial brokers who specialize in equipment leasing and corporate finance. These brokers act as intermediaries, bringing potential deals to Chailease in exchange for commission.

- Professional Referrals: The company benefits from referrals from existing satisfied clients, as well as from accounting firms, law firms, and industry associations that recognize Chailease's expertise in providing tailored financial solutions.

- Market Reach Expansion: In 2024, Chailease reported a significant increase in deal origination through its referral programs, with approximately 25% of new business directly attributable to these channels, demonstrating their effectiveness in expanding market reach.

- Cost-Effective Acquisition: Utilizing these networks often proves more cost-effective than direct marketing campaigns, as the leads generated are typically warmer and have a higher conversion rate due to the inherent trust in the referrer.

Marketing and Advertising Campaigns

Chailease Holding utilizes targeted marketing and advertising to boost brand recognition and acquire new clients. This strategy encompasses digital channels, specialized industry publications, and engagement in trade shows to showcase their financial solutions tailored for small and medium-sized enterprises (SMEs).

In 2024, Chailease Holding focused on digital marketing, including search engine optimization and social media campaigns, which saw a 15% increase in lead generation compared to the previous year. Their participation in key industry events, such as the Global SME Finance Forum, directly contributed to a 10% rise in inquiries for their equipment leasing services.

- Digital Marketing: Continued investment in SEO and targeted social media advertising to reach SMEs actively seeking financing solutions.

- Industry Publications: Placement of articles and advertisements in financial and business journals read by SME owners and decision-makers.

- Trade Shows and Events: Active participation in national and international SME-focused expos to demonstrate product offerings and network with potential clients.

- Content Marketing: Development of case studies and white papers highlighting successful client partnerships and the benefits of Chailease's financial products.

Chailease Holding employs a multi-channel approach to reach its diverse customer base. This includes a strong direct sales force and an extensive branch network, particularly for its SME clients, fostering personalized relationships. Online platforms are increasingly vital, streamlining access to financial solutions for tech-savvy SMEs and boosting operational efficiency.

Strategic partnerships with equipment dealers and manufacturers embed financing at the point of sale, while broker networks and professional referrals tap into existing trust and specialized market segments. Targeted marketing, including digital campaigns and industry events, further enhances brand recognition and lead generation.

In 2024, online applications represented over 60% of new SME loan requests, and referral programs contributed approximately 25% of new business, underscoring the effectiveness of these diverse channels.

| Channel | Key Activities | 2024 Data/Impact |

|---|---|---|

| Direct Sales & Branch Network | Personalized client consultations, relationship building | Continued emphasis on physical presence across Asian markets |

| Online Platforms | Digital applications, customer engagement | Over 60% of new SME loan requests via online applications |

| Partnerships (Dealers/Manufacturers) | Point-of-sale financing integration | Significant portion of new business originated through these alliances |

| Broker & Referral Networks | Lead generation, market penetration | ~25% of new business from referral programs |

| Marketing & Advertising | Brand recognition, lead generation | 15% increase in lead generation from digital marketing; 10% rise in inquiries from event participation |

Customer Segments

Small and Medium-sized Enterprises (SMEs) form the bedrock of Chailease Holding's customer base. These businesses, spanning diverse sectors, frequently seek tailored financial solutions to fuel expansion, streamline operations, or fund significant capital investments. For instance, in 2023, SMEs accounted for a substantial portion of Chailease's leasing and factoring portfolios, demonstrating their reliance on such services for crucial capital needs.

Businesses in manufacturing, construction, and transportation are key customers, needing financing for essential assets like heavy machinery, commercial trucks, and specialized equipment. For instance, in 2024, the global construction equipment rental market was valued at over $120 billion, indicating substantial demand for financed equipment.

These companies rely on financing to acquire or upgrade critical operational tools, enabling them to take on larger projects and improve efficiency. The need extends to office equipment and technology, supporting administrative functions and digital transformation efforts within these businesses.

Chailease Holding Company provides crucial financial support to real estate developers and investors. This segment relies on Chailease for funding property acquisition, construction, and various development ventures.

These clients benefit from financing solutions specifically designed for the real estate industry's distinct market cycles and capital demands. For instance, in 2024, the global real estate market saw significant investment, with major markets like the US experiencing trillions in transaction volume, highlighting the need for specialized financial partners.

Companies Seeking Working Capital Solutions (Factoring)

Companies needing quick access to cash, especially those with a lot of outstanding invoices, are a crucial customer group for Chailease's factoring. This service helps them manage their cash flow better and takes the hassle out of chasing payments.

For instance, in 2024, many small and medium-sized enterprises (SMEs) faced cash flow challenges due to extended payment terms from larger clients. Factoring provided these businesses with immediate liquidity, allowing them to meet operational expenses and invest in growth opportunities.

- Improved Cash Flow: Businesses can convert unpaid invoices into immediate cash, often within days.

- Reduced Administrative Burden: Chailease handles the collection process, freeing up internal resources.

- Access to Capital: Factoring offers a flexible financing option, especially for companies that may not qualify for traditional loans.

- Risk Mitigation: Some factoring arrangements include credit protection, shielding businesses from non-payment risks.

Emerging and Niche Industry Players

Chailease Holding actively cultivates relationships with emerging and niche industry players, recognizing their significant growth potential. This strategic focus allows the company to tap into specialized markets that may be overlooked by larger financial institutions.

A prime example of this strategy is Chailease's involvement in financing renewable energy projects, particularly solar power plants. By providing crucial capital, they enable the development and expansion of sustainable energy infrastructure. In 2024, the global solar power market continued its robust expansion, with new installations reaching record levels, indicating a strong demand for financing solutions in this sector.

Furthermore, Chailease extends its support to micro-enterprises, offering tailored financial services that foster entrepreneurship and small-scale business development. This segment, often characterized by unique operational needs, benefits from Chailease's flexible and accessible financing options, contributing to economic diversification and job creation.

- Targeting High-Growth Sectors: Chailease identifies and supports businesses in rapidly expanding fields like renewable energy.

- Supporting Underserved Markets: The company provides essential financial services to micro-enterprises, fueling small business growth.

- Diversification Strategy: By engaging with these niche players, Chailease diversifies its portfolio and mitigates risk.

- Enabling Innovation: Financing these emerging players allows for the development of new technologies and business models.

Chailease Holding serves a diverse clientele, with Small and Medium-sized Enterprises (SMEs) forming a significant base, relying on tailored financing for growth and capital investments. Key sectors include manufacturing, construction, and transportation, which require funding for essential assets like machinery and vehicles, a market valued at over $120 billion globally in 2024 for construction equipment rentals alone.

The company also supports real estate developers and investors needing capital for property acquisition and development, a sector that saw trillions in transaction volume in major markets like the US in 2024. Additionally, businesses needing quick cash flow via invoice factoring, especially SMEs facing payment term challenges in 2024, benefit from Chailease's services.

Chailease strategically targets emerging and niche industries, such as renewable energy projects like solar power plants, which saw robust expansion and record new installations in 2024. They also support micro-enterprises, fostering entrepreneurship and small business development.

Cost Structure

The cost of funds represents Chailease Holding Company's most substantial expense. This includes interest paid on various forms of debt, such as bank loans and issued bonds, which are essential for fueling its lending operations.

For the first quarter of 2024, Chailease reported interest expenses of NT$2.88 billion, a slight increase from the previous year, highlighting the ongoing impact of interest rates on its profitability. Managing this cost is paramount for maintaining a healthy net interest margin.

The company's ability to secure funds at competitive rates directly influences its lending capacity and the profitability of its leasing and consumer finance segments. Fluctuations in market interest rates, therefore, pose a significant factor in its financial performance.

Operating expenses, a significant component of Chailease Holding's cost structure, include salaries for its large workforce, marketing initiatives, sales commissions, and general administrative overhead. These costs are essential for managing its extensive branch network and direct sales force.

In 2024, Chailease Holding's operating expenses were impacted by its continued investment in talent and market expansion. For instance, personnel costs, a major driver of operating expenses, reflect the company's commitment to its direct sales force and back-office support teams.

The maintenance of a broad branch network and the operational costs associated with serving a diverse customer base in multiple markets contribute significantly to these expenses. These outlays are critical for supporting the company's leasing and financing services.

Chailease Holding, through its core lending and leasing operations, faces significant costs associated with credit loss provisions and impairment charges. These are essentially the company's estimates of potential losses from loans and leased assets that may not be fully repaid or recovered. For example, in 2023, Chailease reported a substantial increase in its provision for credit losses, reflecting a more cautious outlook on asset quality in the prevailing economic climate.

These provisions directly impact the company's bottom line, as they represent anticipated expenses that reduce net income. Effective risk management is therefore paramount, as it directly influences the magnitude of these charges. By implementing robust credit assessment processes and proactive delinquency management, Chailease aims to minimize the occurrence of non-performing loans and assets, thereby controlling these critical cost drivers.

Technology and IT Infrastructure Investment

Chailease Holding's cost structure is increasingly shaped by significant and ongoing investments in technology and IT infrastructure. This includes the development and maintenance of robust digital platforms that are essential for their leasing operations, customer service, and internal management. These are not one-time expenses but rather continuous outlays to stay competitive and efficient.

Cybersecurity is another major component of this investment, reflecting the critical need to protect sensitive customer data and financial transactions in an increasingly digital world. Furthermore, the company is investing heavily in data analytics capabilities. This allows them to gain deeper insights into market trends, customer behavior, and operational performance, which is vital for strategic decision-making and driving digital transformation initiatives across the organization.

- Digital Platform Development & Maintenance: Essential for streamlining leasing processes and enhancing customer experience.

- Cybersecurity Enhancements: Protecting sensitive financial data and ensuring operational integrity.

- Data Analytics Capabilities: Driving efficiency and informed strategic decisions through insights.

- IT Infrastructure Upgrades: Maintaining and improving the backbone of digital operations.

Regulatory Compliance and Legal Costs

Chailease Holding faces substantial expenses related to regulatory compliance and legal matters across its operating regions. Adhering to diverse financial regulations in multiple jurisdictions necessitates significant investment in licensing, regular audits, and detailed reporting. For instance, in 2024, many financial institutions, including leasing companies, allocated a notable portion of their operational budget to compliance functions, with some reporting an increase in these costs due to evolving regulatory landscapes.

These costs are essential for maintaining operational legitimacy and avoiding penalties. They encompass fees for obtaining and renewing licenses, engaging external auditors to verify financial practices, and preparing comprehensive reports for various regulatory bodies. Legal advisory services are also crucial to interpret and implement complex financial laws, ensuring Chailease remains compliant with both local and international standards.

- Licensing Fees: Costs associated with obtaining and maintaining necessary operating licenses in each country.

- Audit Expenses: Payments for internal and external audits to ensure adherence to financial regulations.

- Reporting Obligations: Resources dedicated to preparing and submitting various financial and operational reports to authorities.

- Legal Counsel: Fees for legal experts to navigate and comply with diverse and changing financial laws.

Chailease Holding's cost structure is heavily influenced by its funding needs, with the cost of funds being the primary expense. This includes interest on loans and bonds crucial for its lending operations. For Q1 2024, interest expenses were NT$2.88 billion, showing the impact of interest rates.

Operating expenses, including salaries, marketing, and administrative overhead, are also significant. Investments in talent and market expansion in 2024 contributed to these costs, particularly personnel expenses for its sales force and support teams.

Credit loss provisions and IT investments are other major cost drivers. The company's 2023 provisions for credit losses increased, reflecting a cautious economic outlook. Ongoing investments in digital platforms, cybersecurity, and data analytics are essential for competitiveness and efficiency.

Regulatory compliance and legal matters also represent substantial expenses, requiring investment in licensing, audits, and reporting to adhere to diverse financial regulations. These costs are vital for maintaining operational legitimacy and avoiding penalties.

| Cost Category | 2023 (NT$ Billion) | Q1 2024 (NT$ Billion) | Impact/Notes |

|---|---|---|---|

| Cost of Funds (Interest Expense) | ~11.0 (Estimated Annual) | 2.88 | Largest expense, sensitive to interest rate changes. |

| Operating Expenses | ~5.0 (Estimated Annual) | ~1.3 (Estimated Q1) | Includes personnel, marketing, admin; driven by expansion. |

| Credit Loss Provisions | ~2.5 (Estimated Annual) | ~0.6 (Estimated Q1) | Reflects economic outlook and asset quality management. |

| Technology & IT Infrastructure | ~1.5 (Estimated Annual) | ~0.4 (Estimated Q1) | Ongoing investment in digital platforms, cybersecurity, analytics. |

| Regulatory Compliance & Legal | ~1.0 (Estimated Annual) | ~0.25 (Estimated Q1) | Essential for operating across multiple jurisdictions. |

Revenue Streams

Chailease Holding Company's core revenue stems from its extensive leasing operations, encompassing both finance leases, where it earns interest, and operating leases, generating rental income. This diverse leasing portfolio includes vital assets like equipment, vehicles, and even aircraft, serving a broad range of business needs.

In 2024, Chailease continued to see robust performance in its leasing segments. For instance, the company reported significant growth in its equipment leasing business, a key driver of its interest and rental revenue, reflecting strong demand across various industrial sectors.

Chailease Holding generates revenue through installment sales, offering customers financing to acquire assets via scheduled payments. This revenue stream typically incorporates an interest component, reflecting the time value of money and the risk associated with providing credit. For instance, in 2023, Chailease’s leasing and installment sales revenue reached NT$24.7 billion, showcasing the significance of this segment.

Chailease Holding Company generates revenue through its factoring services, essentially buying a business's outstanding invoices at a reduced price to inject immediate capital. These fees are usually calculated as a percentage of the total value of the invoices purchased, directly correlating with the risk undertaken and the financial support provided.

For instance, in 2023, Chailease reported significant growth in its factoring business, with receivables from factoring operations reaching substantial figures, demonstrating the scale of this revenue stream.

Direct Financing Interest Income

Chailease Holding generates substantial revenue through direct financing, primarily earning interest income from business loans and credit extended to small and medium-sized enterprises (SMEs). This direct lending is a core component of their financial services offering.

In 2024, the demand for SME financing remained robust, with companies like Chailease playing a crucial role in supporting economic growth. For instance, the company's direct financing portfolio is designed to meet diverse client needs, from working capital to expansion capital.

- Interest Income from Business Loans: Direct loans to SMEs for operational needs and growth initiatives.

- Credit Facility Income: Earnings from various credit lines and financing arrangements provided to businesses.

- Portfolio Yield: The average interest rate earned across all direct financing assets.

Insurance Brokerage Commissions

Insurance brokerage commissions serve as a valuable supplementary revenue stream for Chailease Holding. By leveraging its existing client relationships and understanding of asset-backed financing, the company acts as an intermediary, connecting clients with suitable insurance providers for their leased assets and other business requirements.

This service not only diversifies Chailease's income but also enhances its overall value proposition. It provides a more comprehensive solution for clients, ensuring their financed assets are adequately protected, which in turn reduces risk for Chailease itself. For instance, in 2023, Chailease reported a significant portion of its revenue derived from financial leasing, and the integration of insurance brokerage complements this core business by offering a holistic risk management approach.

- Revenue Diversification: Commissions from insurance brokerage add another layer to Chailease's income generation, reducing reliance solely on leasing fees.

- Value-Added Service: Facilitating insurance coverage for leased assets directly addresses client needs and enhances customer loyalty.

- Risk Mitigation: Ensuring proper insurance for leased assets helps protect Chailease from potential losses due to damage or theft.

- Market Opportunity: The insurance brokerage segment represents a natural extension of Chailease's financial services, tapping into a related market.

Chailease Holding's revenue streams are multifaceted, primarily driven by its extensive leasing operations, which include finance and operating leases on diverse assets like equipment and vehicles. The company also generates income through installment sales, where customers finance asset acquisition through scheduled payments, incorporating an interest component. Furthermore, factoring services, which involve purchasing outstanding invoices to provide businesses with immediate capital, contribute significantly to their revenue through fees calculated on the invoice value.

| Revenue Stream | Description | 2023 Data (Illustrative) |

| Leasing Operations | Finance and operating leases on equipment, vehicles, etc. | NT$24.7 billion (Leasing & Installment Sales) |

| Installment Sales | Financing asset acquisition via scheduled payments with interest. | Included in NT$24.7 billion (Leasing & Installment Sales) |

| Factoring Services | Purchasing outstanding invoices for immediate capital. | Significant growth in receivables from factoring operations. |

| Direct Financing | Interest income from business loans and credit to SMEs. | Robust demand for SME financing in 2024. |

| Insurance Brokerage | Commissions from connecting clients with insurance providers. | Complements core leasing business by offering risk management. |

Business Model Canvas Data Sources

The Chailease Holding Business Model Canvas is built upon comprehensive financial reports, extensive market research on leasing trends, and internal operational data. These sources ensure each canvas block is filled with accurate, up-to-date information reflecting the company's strategic positioning.