CG Power and Industrial Solutions SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CG Power and Industrial Solutions Bundle

CG Power and Industrial Solutions demonstrates significant strengths in its diversified product portfolio and strong brand recognition within the industrial sector. However, potential weaknesses like reliance on key suppliers and market volatility present challenges that require careful navigation.

Discover the complete picture behind CG Power's market position with our full SWOT analysis. This in-depth report reveals actionable insights, financial context, and strategic takeaways—ideal for entrepreneurs, analysts, and investors seeking to capitalize on emerging opportunities and mitigate potential risks.

Strengths

CG Power and Industrial Solutions Limited offers a wide spectrum of electrical and industrial solutions, encompassing transformers, switchgear, motors, and automation systems. This extensive product offering ensures the company serves diverse needs within the power and industrial sectors, thereby minimizing dependence on any single product category.

The company's strategic operation across both the Power Systems and Industrial Systems segments allows it to leverage varied market trends and effectively manage risks tied to the performance of a solitary sector. For instance, in FY23, the Industrial Systems segment reported a revenue of ₹3,979 crore, while the Power Systems segment contributed ₹3,106 crore, showcasing a balanced revenue stream.

CG Power and Industrial Solutions' integrated Engineering, Procurement, and Construction (EPC) capabilities are a core strength. This allows them to manage power projects from initial design through to final execution, offering clients a seamless, end-to-end solution. This comprehensive service model provides a distinct competitive advantage in the market.

By controlling the entire project lifecycle, CG Power can enhance operational efficiency and potentially achieve better profit margins. This integrated approach also strengthens client relationships, as the company serves as a single, reliable point of contact for complex and demanding projects, fostering trust and long-term partnerships.

CG Power and Industrial Solutions boasts an established multinational presence, extending its operations beyond India to key global markets. This international footprint diversifies revenue streams, mitigating risks associated with reliance on a single economic region. For instance, in fiscal year 2024, CG Power reported significant revenue contributions from its overseas subsidiaries, underscoring the benefit of this global reach.

Strong Brand Recognition and Market Position

CG Power and Industrial Solutions Limited (CG Power) enjoys robust brand recognition and a commanding market position within the electrical and industrial products sector. This strong presence is built on a long-standing reputation for delivering quality and reliable solutions, particularly in complex industrial and power applications.

The company's established market standing acts as a significant barrier to entry for potential new competitors. This advantage, coupled with a history of dependable performance, allows CG Power to command a degree of pricing power. For instance, in the fiscal year 2024, CG Power reported a notable increase in its order book, reflecting continued market demand and trust in its offerings.

- Established Reputation: Decades of experience in delivering critical electrical and industrial solutions have fostered deep customer trust.

- Market Leadership: CG Power holds leading positions in several key segments of the power and industrial equipment market.

- Customer Loyalty: A track record of reliability translates into strong repeat business and a loyal customer base.

- Brand Equity: The CG brand is synonymous with quality and performance in its target industries.

Focus on Critical Infrastructure Sectors

CG Power and Industrial Solutions strategically targets critical infrastructure sectors, including power generation, transmission, distribution, and essential industrial applications. This focus ensures consistent demand, as these industries are fundamental to economic growth and ongoing development initiatives. For instance, in fiscal year 2024, the company reported a significant order book in its Power Systems segment, reflecting the sustained investment in infrastructure.

This deliberate concentration on vital industries offers CG Power a notable degree of operational stability and revenue predictability. The long-term nature of infrastructure projects, coupled with government impetus for modernization and expansion, creates a resilient market for the company's products and services. This strategy positions CG Power to benefit from both immediate project needs and the long-term evolution of energy and industrial landscapes.

- Core Market Focus: Power generation, transmission, distribution, and industrial sectors.

- Demand Drivers: Economic development, infrastructure spending, and industrial expansion.

- Stability Factor: Long-term project cycles and essential service nature of its markets.

- Fiscal Year 2024 Impact: Strong order inflows in Power Systems segment underscore sector demand.

CG Power and Industrial Solutions benefits from a strong brand reputation built over decades, fostering significant customer trust and loyalty. This established market leadership in key electrical and industrial segments creates a substantial barrier to entry for new competitors, allowing the company to maintain pricing power. The fiscal year 2024 order book growth further validates this market confidence.

What is included in the product

Delivers a strategic overview of CG Power and Industrial Solutions’s internal and external business factors, identifying key strengths like its diversified product portfolio and market leadership, while also highlighting weaknesses such as high debt levels and opportunities in the growing renewable energy sector, alongside threats from intense competition and regulatory changes.

CG Power and Industrial Solutions' SWOT analysis offers a clear roadmap to address operational inefficiencies and capitalize on market opportunities, alleviating concerns about strategic direction.

Weaknesses

CG Power and Industrial Solutions' manufacturing processes are significantly dependent on key commodities such as copper, steel, and aluminum. For instance, copper prices, a crucial input for electrical components, saw considerable swings in 2024, impacting production costs for companies across the sector. This inherent reliance makes the company's profit margins susceptible to the unpredictable nature of global commodity markets.

The direct impact of these price fluctuations on CG Power's cost of goods sold can be substantial. For example, a 10% increase in copper prices could directly translate to higher manufacturing expenses, potentially squeezing margins if these costs cannot be effectively passed on to consumers. This cost-push pressure necessitates careful financial management and strategic sourcing.

Effectively navigating this vulnerability requires sophisticated hedging mechanisms or a strong pricing power to absorb or transfer cost increases. However, competitive market conditions in the electrical and industrial products sector often limit the ability to fully pass on rising raw material expenses, creating a persistent challenge for maintaining stable profitability.

CG Power and Industrial Solutions operates in a fiercely competitive landscape. The electrical and industrial solutions sector is crowded with both established domestic giants and nimble international contenders, all aggressively pursuing market share. This intense rivalry often translates into significant pricing pressures, which can directly impact profit margins and necessitate a constant drive for innovation to stay ahead of the curve.

To navigate this challenging environment, CG Power must focus on clearly differentiating its product and service portfolio. Maintaining a strong emphasis on cost efficiency across its operations is also paramount. For instance, in the fiscal year ending March 31, 2024, the company reported a revenue of INR 6,718 crore, and managing costs effectively will be crucial to sustaining profitability amidst competitive pricing dynamics.

CG Power and Industrial Solutions' performance is closely linked to capital expenditure (CapEx) cycles within the power and industrial sectors. When economic conditions lead to a slowdown or postponement of significant infrastructure projects, demand for CG Power's offerings tends to decrease. This inherent cyclicality can create fluctuations in revenue, making consistent financial forecasting more difficult for the company.

Potential for Technological Obsolescence

CG Power and Industrial Solutions operates in dynamic electrical and industrial sectors experiencing rapid technological evolution, particularly in smart grids, automation, and energy efficiency. A key weakness lies in the potential for technological obsolescence if the company fails to consistently invest in research and development and adapt to these emerging trends. This could erode its competitive edge and market position.

Keeping pace with innovation demands significant capital expenditure and astute strategic planning. For instance, the global industrial automation market was projected to reach over $300 billion by 2025, highlighting the scale of investment required to remain competitive. Failure to allocate sufficient resources to R&D, potentially impacting areas like advanced motor controls or IoT integration in their products, presents a tangible risk.

- Risk of Product Obsolescence: Rapid technological shifts in smart grids and automation could render existing product lines outdated.

- R&D Investment Gap: Insufficient investment in research and development may hinder the adoption of new technologies, impacting competitiveness.

- Adaptation Challenges: The pace of innovation in energy efficiency and digital solutions requires continuous strategic foresight and significant capital.

Operational Risks in Large-Scale Projects

CG Power and Industrial Solutions faces significant operational risks when undertaking large-scale Engineering, Procurement, and Construction (EPC) projects, particularly within the power sector. These projects are susceptible to delays, which can escalate costs and impact revenue recognition. For instance, a delay in a major power transmission project could lead to penalties and a reduction in expected profit margins.

Cost overruns are another critical weakness. Unforeseen material price fluctuations or labor shortages can push project budgets beyond initial estimates. In 2024, the global supply chain disruptions continued to affect the availability and pricing of key components for power projects, a challenge CG Power would need to actively manage.

Quality control issues can also arise in complex EPC endeavors, potentially leading to rework, reputational damage, and contractual disputes. Maintaining stringent quality standards across all project phases is paramount to avoid these pitfalls.

- Project Delays: Increased likelihood of missing deadlines, impacting financial performance and client relationships.

- Cost Overruns: Vulnerability to rising material and labor costs, eroding profitability.

- Quality Control: Risk of defects or subpar execution, leading to rework and potential disputes.

- Reputational Damage: Negative impact on brand image due to project failures or delays.

CG Power and Industrial Solutions' reliance on key commodities like copper, steel, and aluminum exposes it to price volatility. For instance, copper prices, critical for electrical components, experienced significant fluctuations in 2024, directly impacting the company's production costs and potentially squeezing profit margins if these increases cannot be passed on to customers.

The company operates in a highly competitive market, facing pressure from both domestic and international players. This intense rivalry often leads to pricing pressures, which can affect profitability. In fiscal year 2024, CG Power reported revenues of INR 6,718 crore, underscoring the importance of cost management to maintain healthy margins amidst competitive dynamics.

CG Power's performance is also tied to capital expenditure cycles in the power and industrial sectors. Economic downturns can lead to postponed infrastructure projects, reducing demand for its products and creating revenue unpredictability. Furthermore, rapid technological advancements in areas like smart grids and automation pose a risk of product obsolescence if R&D investment lags, potentially impacting its market position.

What You See Is What You Get

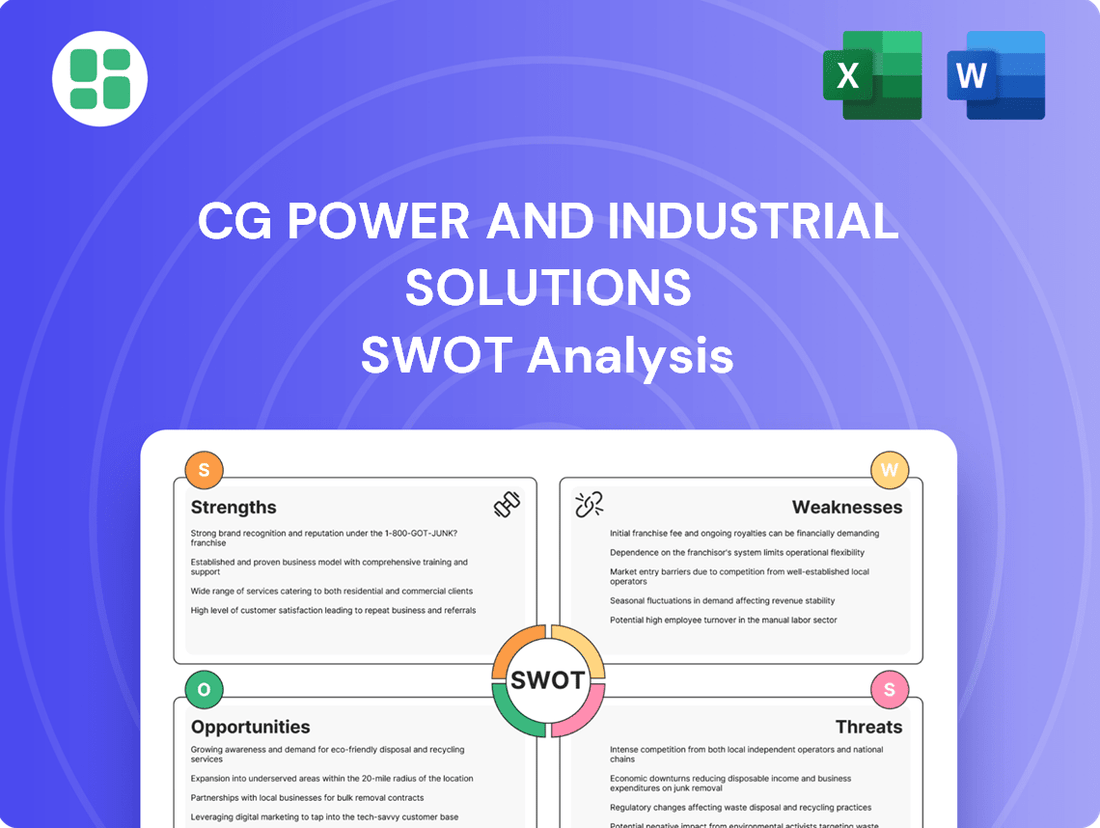

CG Power and Industrial Solutions SWOT Analysis

You're viewing a live preview of the actual SWOT analysis file for CG Power and Industrial Solutions. The complete, detailed report becomes available immediately after purchase, offering a comprehensive understanding of the company's strategic position. This ensures you receive the exact, professional-grade analysis you expect.

Opportunities

The global pivot to renewable energy, particularly solar and wind, creates a substantial demand for electrical infrastructure. CG Power's expertise in transformers, switchgear, and grid integration solutions directly aligns with these burgeoning projects, offering a significant avenue for growth.

The International Energy Agency (IEA) projects that global investment in clean energy infrastructure will reach $2 trillion annually by 2030, with renewables accounting for a large portion. This presents a clear opportunity for CG Power to capitalize on this trend by tailoring its product portfolio and services to meet the specific needs of renewable energy developers.

Governments worldwide, particularly in emerging economies like India, are prioritizing significant investments in infrastructure. This includes substantial upgrades to power transmission and distribution networks, alongside expanding industrial capabilities. For instance, India's National Infrastructure Pipeline aims for ₹111 lakh crore (approximately $1.3 trillion) in projects by 2025, with a strong focus on power and industrial sectors.

These government-driven initiatives, often coupled with programs like 'Make in India,' directly translate into a robust demand for CG Power's core offerings. The company's expertise in manufacturing electrical equipment and providing Engineering, Procurement, and Construction (EPC) services positions it to capitalize on this sustained governmental push, creating a stable and predictable growth environment.

The global automation market is experiencing robust growth, projected to reach over $300 billion by 2025, driven by the push for enhanced operational efficiency. CG Power's focus on motors, control systems, and smart industrial solutions directly aligns with this accelerating trend.

Industries are actively investing in digitalization and IoT, with manufacturing sectors alone expected to see a 15% year-over-year increase in automation spending through 2024. This presents a significant opportunity for CG Power to supply its advanced automation technologies.

By capitalizing on its established expertise in automation, CG Power is well-positioned to benefit from the ongoing digital transformation across various sectors, capturing market share in this expanding segment.

Expansion into Emerging Markets

CG Power and Industrial Solutions has a significant opportunity to expand into emerging markets that are experiencing robust industrialization and infrastructure upgrades. By leveraging its existing global footprint and engineering, procurement, and construction (EPC) capabilities, the company can establish a stronger presence in these developing economies, offering its diverse product portfolio.

This strategic geographical diversification is crucial for sustained growth, especially as developed markets may present slower expansion rates. Emerging economies, with their increasing demand for power generation, transmission, and industrial equipment, represent a fertile ground for CG Power's offerings.

- Untapped Market Potential: Many emerging economies in Southeast Asia, Africa, and Latin America are in the early stages of industrial development, creating substantial demand for electrical equipment and infrastructure solutions.

- Infrastructure Development Focus: Governments in these regions are heavily investing in power grids, transportation networks, and industrial facilities, aligning perfectly with CG Power's core competencies. For instance, India's own infrastructure spending is projected to reach approximately $1.4 trillion by 2024-25, according to government estimates, providing a strong domestic base for expansion strategies.

- Competitive Advantage: CG Power's established reputation for quality and its comprehensive product range, from transformers to industrial drives, can provide a competitive edge against local players and less experienced international competitors.

- Revenue Diversification: Entering new markets reduces reliance on existing geographies, mitigating risks associated with economic downturns or regulatory changes in any single region.

Strategic Acquisitions and Partnerships

CG Power and Industrial Solutions can strategically acquire innovative technology companies or form partnerships to expand its product offerings and enter new markets. For instance, in the fiscal year 2024, the company has been actively pursuing growth opportunities, and a successful acquisition could bolster its capabilities in areas like advanced motor technology or smart grid solutions.

These collaborations can facilitate technology transfer, improve market penetration, and share risks, all of which are crucial for accelerating growth. By partnering with established players or emerging innovators, CG Power can gain access to specialized expertise and cutting-edge research, thereby strengthening its competitive edge.

Key opportunities include:

- Acquiring niche technology firms to integrate advanced solutions into existing product lines.

- Forming strategic alliances with global leaders for market access and technology sharing.

- Collaborating on R&D projects to co-develop next-generation products and services.

- Joint ventures to enter high-growth geographical regions or specific industry segments.

CG Power is positioned to benefit from the global shift towards electrification and smart grid technologies, with significant investments in upgrading power infrastructure expected. The company's expertise in power electronics and automation solutions aligns well with the increasing demand for energy-efficient and digitally integrated systems.

The company can leverage the growing trend of industrial automation and digitalization to offer advanced solutions. With industries focusing on enhancing productivity and reducing operational costs, CG Power's motors, drives, and control systems are in high demand. For example, the industrial automation market in India alone was projected to grow at a CAGR of over 12% through 2025, indicating a strong domestic opportunity.

Expansion into underdeveloped and developing economies presents a substantial growth avenue. These regions require significant investment in power generation, transmission, and distribution, creating a natural market for CG Power's comprehensive product portfolio and EPC capabilities. India's own infrastructure development plans, with a substantial allocation towards the power sector, further underscore this opportunity.

Strategic acquisitions and partnerships offer a pathway to enhance technological capabilities and market reach. By integrating innovative technologies or collaborating with established players, CG Power can accelerate its entry into new segments and geographies, thereby diversifying its revenue streams and strengthening its competitive position in the global market.

Threats

The electrical and industrial solutions landscape is increasingly crowded with major global competitors possessing substantial R&D investments and extensive market penetration. This intensifying rivalry, particularly from established international entities in core product areas, poses a significant threat to CG Power, potentially leading to price erosion and a diminished market share. For instance, in 2024, global capital expenditure in the power sector, a key market for CG Power, was projected to reach over $1.5 trillion, indicating robust competition for these investments.

A general economic slowdown or a specific downturn in the industrial and manufacturing sectors can significantly reduce demand for capital goods and infrastructure projects. This would directly impact CG Power's order book and revenue generation, as businesses and governments might defer or scale back investments. The cyclical nature of these industries poses a constant threat.

For instance, global industrial production growth slowed in early 2024, with some regions experiencing contractions. This trend, if it persists into 2025, could directly affect CG Power's sales in key markets, particularly in sectors reliant on heavy industrial investment.

CG Power and Industrial Solutions faces the threat of disruptive technologies like advanced energy storage and smart grid solutions potentially making its current product lines less competitive. For instance, the global energy storage market was projected to reach over $100 billion by 2025, indicating rapid innovation in this space. Failure to invest in and adapt to these emerging technologies could lead to significant market share erosion as newer, more agile competitors enter the field, potentially rendering traditional offerings obsolete.

Supply Chain Disruptions and Geopolitical Risks

Global supply chains remain susceptible to disruptions. Geopolitical tensions, trade disputes, and unforeseen events like pandemics or natural disasters can significantly impact the availability of essential components and drive up logistics expenses for companies like CG Power. For instance, the ongoing semiconductor shortage, which began in 2020 and continued through 2023, impacted various manufacturing sectors, potentially affecting production timelines and costs for electrical equipment manufacturers. This vulnerability necessitates proactive strategies for supply chain resilience.

These disruptions can directly translate into production delays and increased operational costs for CG Power and Industrial Solutions. For example, a shortage of specific rare earth minerals crucial for advanced electrical components could halt production lines. The company's ability to mitigate these risks hinges on its investment in diversified sourcing and robust inventory management systems.

Navigating these complex risks demands sophisticated supply chain management and strategic diversification. CG Power needs to actively identify and mitigate potential vulnerabilities by exploring alternative suppliers and geographical sourcing options.

- Geopolitical Instability: Ongoing conflicts and trade tensions can disrupt the flow of raw materials and finished goods, increasing lead times and costs.

- Component Shortages: Reliance on single-source suppliers for critical components, such as specialized semiconductors or rare earth metals, poses a significant risk.

- Logistics Bottlenecks: Port congestion and rising shipping rates, as seen in 2021-2022, can significantly inflate transportation costs and delay deliveries.

- Pandemic Recurrence: The potential for future health crises necessitates contingency plans for workforce availability and production continuity.

Adverse Regulatory Changes and Environmental Norms

Adverse regulatory shifts, such as sudden changes in government policies or trade regulations, pose a significant threat to CG Power. For instance, increased import duties in key markets could directly impact the cost of components or the competitiveness of its finished products. In 2024, several countries are reviewing their industrial policies and environmental standards, which could lead to higher compliance costs for manufacturers like CG Power.

Stricter environmental norms, a growing global trend, also present a challenge. Companies must invest in cleaner technologies and processes to meet these evolving standards, potentially increasing operational expenses. For example, new emission regulations introduced in India or Europe could necessitate upgrades to manufacturing facilities, impacting CG Power's profitability if not managed proactively.

The continuous need to adapt to these changing regulatory landscapes requires ongoing investment in compliance and a flexible operational strategy. Failure to stay abreast of and adapt to evolving environmental and trade regulations could lead to penalties or a loss of market access.

- Increased import duties: Could raise raw material costs or reduce export competitiveness.

- Stricter environmental compliance: May necessitate significant capital expenditure on cleaner technologies.

- Evolving trade regulations: Risks disrupting supply chains and market access in key operating regions.

- Higher compliance costs: Directly impacts profit margins if not offset by efficiencies or price adjustments.

Intensifying global competition, particularly from well-funded international players, threatens CG Power's market share and pricing power. For example, the global power sector saw over $1.5 trillion in capital expenditure in 2024, highlighting fierce competition for projects. Furthermore, a slowdown in industrial production, with some regions experiencing contractions in early 2024, directly impacts demand for CG Power's offerings, potentially reducing its order book and revenue for 2025.

| Threat Category | Specific Risk | Potential Impact | Example Data/Trend |

|---|---|---|---|

| Competition | Increased rivalry from global players | Price erosion, market share loss | Global power sector CAPEX > $1.5 trillion (2024) |

| Economic Downturn | Reduced demand in industrial sectors | Lower order book, decreased revenue | Global industrial production growth slowed (early 2024) |

| Technological Disruption | Obsolescence of current product lines | Loss of competitiveness, market share erosion | Energy storage market projected > $100 billion (by 2025) |

| Supply Chain Vulnerability | Disruptions, component shortages, logistics costs | Production delays, increased operational costs | Semiconductor shortages impacted manufacturing (2020-2023) |

| Regulatory Changes | Adverse policy shifts, stricter environmental norms | Higher compliance costs, reduced market access | Several countries reviewing industrial policies and environmental standards (2024) |

SWOT Analysis Data Sources

This analysis is built upon a foundation of verified financial statements, comprehensive market research reports, and expert industry insights to provide a robust and accurate SWOT assessment of CG Power and Industrial Solutions.