CG Power and Industrial Solutions Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CG Power and Industrial Solutions Bundle

CG Power and Industrial Solutions operates in a dynamic environment shaped by intense rivalry, significant buyer power, and the looming threat of substitutes. Understanding these forces is crucial for navigating the competitive landscape effectively.

The complete report reveals the real forces shaping CG Power and Industrial Solutions’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

CG Power and Industrial Solutions, like many in the electrical equipment manufacturing sector, faces potential supplier leverage when dealing with highly specialized components or critical raw materials such as high-grade copper or electrical steel. The limited number of manufacturers capable of producing these essential inputs can significantly shift bargaining power towards the suppliers.

For instance, in 2024, the global supply chain for specialized electrical steel, a key component in transformers and motors, experienced price volatility due to geopolitical factors and concentrated production capacity in a few regions. This situation directly impacts companies like CG Power, as these suppliers can potentially dictate terms, influencing material costs and delivery timelines, thereby affecting CG Power's production efficiency and profitability.

High switching costs significantly bolster the bargaining power of suppliers to CG Power and Industrial Solutions. For instance, if CG Power relies on a supplier for highly specialized electrical components or custom-engineered motors, the expense and time involved in finding, qualifying, and integrating a new supplier can be substantial. This might include costs for retooling manufacturing lines, obtaining new certifications for components, and extensive testing to ensure compatibility and performance. In 2023, the global industrial automation market, a key sector for CG Power, saw continued investment in specialized machinery, highlighting the unique nature of many components.

Suppliers offering unique or highly specialized inputs for CG Power and Industrial Solutions, like proprietary insulation for their transformers or advanced control systems for their automation products, hold significant bargaining power. These specialized components are difficult for CG Power to source elsewhere, creating a dependency that strengthens the suppliers' position.

Threat of Forward Integration

The threat of forward integration by suppliers significantly amplifies their bargaining power over CG Power and Industrial Solutions. If suppliers possess the capability and motivation to start producing electrical and industrial products themselves, they can exert greater control over pricing and terms. This potential competition compels CG Power to cultivate robust supplier relationships and potentially offer advantageous conditions to mitigate the risk of facing its own suppliers as direct rivals.

For instance, a key raw material supplier to CG Power, if possessing advanced manufacturing technology and a strong distribution network, could decide to enter the market for motors or transformers. This would directly challenge CG Power's existing business.

- Supplier Integration Risk: Suppliers can leverage their expertise and resources to enter CG Power's product markets, increasing their leverage.

- Competitive Pressure: The possibility of suppliers becoming direct competitors forces CG Power to manage these relationships proactively.

- Strategic Importance: CG Power must ensure favorable terms and maintain strong partnerships to deter suppliers from pursuing forward integration.

Impact of Commodity Prices

Fluctuations in global commodity prices for essential raw materials such as copper, steel, and aluminum significantly influence supplier costs. These increased costs are frequently transferred to CG Power and Industrial Solutions, impacting their overall expenses.

Suppliers can leverage their power by adjusting prices in response to volatile commodity markets. This directly affects CG Power's production costs, potentially squeezing profit margins.

- Copper prices: As of late 2023 and early 2024, copper prices have seen upward trends, influenced by supply constraints and increasing demand from the energy transition sector. For instance, LME copper prices have traded in the range of $8,000 to $9,000 per metric ton during this period.

- Steel prices: Global steel prices have experienced moderate volatility, with benchmarks like rebar and hot-rolled coil prices showing regional variations. For example, in China, a major steel producer, prices have fluctuated, impacting costs for manufacturers globally.

- Aluminum prices: Aluminum prices have also been subject to market dynamics, with factors like energy costs for production and geopolitical events influencing their trajectory. LME aluminum prices have generally traded between $2,100 and $2,400 per metric ton in the recent past.

- Impact on CG Power: These commodity price movements directly translate into higher input costs for CG Power, potentially reducing their ability to maintain competitive pricing or impacting their profitability if these costs cannot be fully passed on to customers.

The bargaining power of suppliers to CG Power and Industrial Solutions is significantly influenced by the concentration of key component manufacturers and the specialized nature of critical inputs. When few suppliers can produce essential materials like high-grade copper or specialized electrical steel, they gain leverage, potentially dictating terms and impacting CG Power's production costs and schedules. This was evident in 2024 with price volatility in specialized electrical steel due to concentrated production capacity.

High switching costs for CG Power further empower suppliers. If the company relies on unique, custom-engineered components, the expense and time to find and integrate a new supplier can be substantial, creating a dependency. This is underscored by the continued investment in specialized machinery within the industrial automation market, a key sector for CG Power, as seen in 2023.

Suppliers offering proprietary or highly specialized inputs, such as unique transformer insulation or advanced control systems, wield considerable bargaining power. This is because CG Power finds it difficult to source these critical items elsewhere, leading to a reliance that strengthens the suppliers' negotiating position.

The threat of forward integration by suppliers also amplifies their leverage. If suppliers can enter CG Power's product markets, they gain greater control over pricing and terms, compelling CG Power to manage these relationships carefully to avoid direct competition. For example, a raw material supplier with advanced manufacturing capabilities might enter the motor or transformer market, directly challenging CG Power.

| Raw Material | Approximate Price Range (Late 2023/Early 2024) | Key Influencing Factors |

|---|---|---|

| Copper | $8,000 - $9,000 per metric ton (LME) | Supply constraints, energy transition demand |

| Steel (Rebar/HRC) | Regional variations, moderate volatility | Geopolitical factors, production capacity (e.g., China) |

| Aluminum | $2,100 - $2,400 per metric ton (LME) | Energy costs for production, geopolitical events |

What is included in the product

CG Power and Industrial Solutions faces moderate bargaining power from suppliers and buyers, with significant threat from substitutes and intense rivalry from established players in the power and industrial solutions sector.

Navigate the competitive landscape of CG Power and Industrial Solutions with a dynamic, interactive model that visually highlights the impact of each of Porter's Five Forces, enabling proactive strategic adjustments.

Customers Bargaining Power

CG Power and Industrial Solutions caters to a broad customer base, encompassing power utilities, various industrial sectors, and both commercial and residential markets. This wide reach extends to providing Engineering, Procurement, and Construction (EPC) services for significant power projects.

The company's diversified customer portfolio is a key factor in managing customer bargaining power. By serving multiple distinct segments, CG Power avoids over-dependence on any single buyer or industry group, which inherently reduces the leverage any one customer segment can exert.

For instance, in fiscal year 2024, CG Power's revenue streams were distributed across different end-user industries, preventing a scenario where a downturn or demand shift in one sector would disproportionately impact overall sales. This strategic diversification acts as a buffer against concentrated customer influence.

For standardized electrical products such as certain transformers and switchgear, CG Power and Industrial Solutions likely faces customers who are highly sensitive to price. This is especially true in markets with numerous suppliers, where buyers can easily switch to a competitor offering a better deal. In 2023, the global electrical equipment market saw significant price competition, with reports indicating average price increases of 3-5% for many standard components due to raw material costs, but this did not always translate to higher margins for manufacturers if demand softened.

For complex, integrated solutions or large-scale Engineering, Procurement, and Construction (EPC) projects, customers often encounter substantial switching costs once a project is underway. These costs stem from specialized design requirements, intricate installation processes, and the necessity of long-term service agreements that are specific to the initial supplier. This lock-in effect significantly diminishes a customer's bargaining power once a contract is secured, thereby ensuring a stable revenue stream for CG Power and Industrial Solutions throughout the project's lifecycle.

Government and Utility Procurement

Government and utility procurement significantly influences CG Power's bargaining power of customers. A substantial part of CG Power's business comes from government entities and large public sector undertakings, which typically engage in competitive bidding for their needs. These large-scale tenders, while offering significant volume, also grant customers considerable leverage. They can dictate strict technical specifications and commercial terms, leveraging the sheer size of their orders to negotiate favorable pricing and conditions.

For instance, during the fiscal year 2023-24, CG Power secured orders from various state electricity boards and government infrastructure projects. These projects often involve multi-year contracts with predefined pricing structures. The competitive nature of these bids means that multiple suppliers vie for the same contracts, further empowering the customer by providing them with a wide array of choices and the ability to pit suppliers against each other.

- High Volume Orders: Government and utility contracts often represent substantial order volumes, giving these customers significant negotiation power.

- Competitive Bidding: The mandatory competitive bidding process for public sector procurement creates an environment where customers can solicit multiple bids and choose the most advantageous offer.

- Stringent Requirements: Customers can impose rigorous technical, quality, and delivery standards, which suppliers must meet, thereby increasing customer leverage.

- Price Sensitivity: Public sector entities are often highly price-sensitive, especially when dealing with taxpayer money, leading to intense price negotiations.

Customer Information and Transparency

Customers today have unprecedented access to information. Digital platforms and industry benchmarks allow them to easily compare prices and features across various manufacturers. This transparency significantly boosts their bargaining power.

For CG Power and Industrial Solutions, this means customers can readily identify the most competitive offerings. They can leverage this knowledge to negotiate better terms, pushing CG Power to maintain competitive pricing and product innovation to retain market share.

- Information Accessibility: Digital platforms and industry reports provide customers with detailed insights into product specifications, performance, and pricing. For instance, in the electrical equipment sector, online marketplaces and comparison sites allow buyers to view multiple vendors simultaneously.

- Price Sensitivity: Customers can easily benchmark prices for similar products, such as transformers or industrial motors, from different suppliers. This makes them less reliant on a single vendor and more inclined to switch if better value is offered.

- Demand for Value: The enhanced transparency forces companies like CG Power to justify their pricing through superior quality, service, or unique features. Failure to do so can lead to customers opting for competitors, impacting sales volume and potentially revenue.

- Impact on Margins: Increased customer bargaining power can put pressure on profit margins as companies may need to reduce prices or offer additional incentives to secure deals. This necessitates efficient operations and cost management for CG Power.

CG Power and Industrial Solutions faces moderate bargaining power from its customers, largely influenced by the specific product or service segment. For standardized electrical components, where numerous suppliers exist, customers can easily switch, leading to price sensitivity and increased negotiation leverage for buyers. This is evident in the broader electrical equipment market, where price competition remains a significant factor, impacting manufacturers' ability to command higher margins, especially when demand fluctuates.

However, for large-scale, customized projects like EPC contracts, customer bargaining power is significantly reduced due to high switching costs. Once a project is underway, the specialized nature of the installation and design makes it difficult and expensive for customers to change suppliers, thus securing CG Power's revenue stream for the duration of the project.

Government and utility sector clients, a substantial customer base for CG Power, wield considerable bargaining power through competitive bidding processes. These entities can dictate stringent specifications and commercial terms, leveraging the large order volumes to negotiate favorable pricing. For example, in fiscal year 2023-24, securing contracts with state electricity boards involved intense price negotiations due to the competitive tender environment.

The increasing transparency in pricing and product information available through digital platforms further empowers customers. They can readily compare offerings, forcing companies like CG Power to focus on value, quality, and service differentiation to maintain competitiveness and protect profit margins.

| Customer Segment | Bargaining Power Level | Key Influencing Factors |

|---|---|---|

| Standardized Electrical Products | Moderate to High | Price sensitivity, availability of substitutes, ease of switching |

| Large-Scale EPC Projects | Low to Moderate | High switching costs, project-specific designs, long-term service agreements |

| Government & Utilities | High | Competitive bidding, large order volumes, stringent specifications, price sensitivity |

| General Industrial & Commercial | Moderate | Information accessibility, demand for value, supplier competition |

Preview the Actual Deliverable

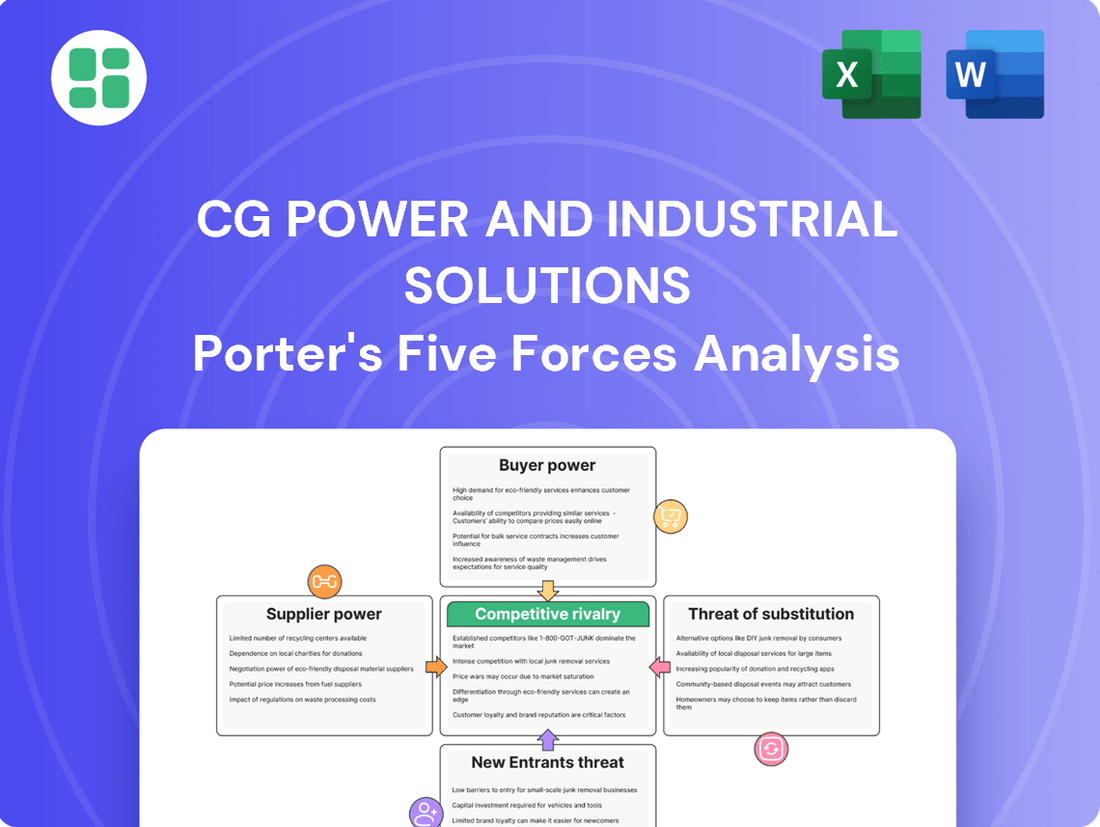

CG Power and Industrial Solutions Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces analysis for CG Power and Industrial Solutions, detailing the competitive landscape and strategic implications. You're viewing the exact document you'll receive, offering insights into buyer power, supplier power, threat of new entrants, threat of substitutes, and industry rivalry. This comprehensive analysis is ready for immediate download and use upon purchase.

Rivalry Among Competitors

CG Power and Industrial Solutions operates within a highly competitive Indian electrical equipment market, which is populated by a multitude of domestic and international entities. This crowded field includes well-established global conglomerates and robust local manufacturers, all striving to capture market share. For instance, the Indian electrical equipment market saw significant growth, with the power sector alone attracting substantial investment, creating a dynamic environment where companies like CG Power must continuously innovate and compete aggressively.

CG Power and Industrial Solutions operates in an industry characterized by significant upfront investments in manufacturing facilities and advanced machinery. These high fixed costs create a powerful incentive for companies to run their operations at peak capacity. For instance, the capital expenditure for setting up a modern electrical equipment manufacturing unit can run into hundreds of millions of dollars, making every idle hour a direct hit to profitability.

This pressure to achieve high capacity utilization directly fuels intense competition. To ensure their expensive assets are working efficiently, firms like CG Power are compelled to aggressively pursue market share and secure a steady stream of orders. This often translates into price competition and a constant battle for customer contracts, as companies strive to spread their fixed costs over a larger production volume.

The Indian electrical equipment market is poised for substantial growth, with projections indicating a significant expansion driven by ongoing infrastructure development, increasing urbanization, and a greater reliance on renewable energy sources. This robust growth trajectory is attracting considerable investment as companies aim to capitalize on the burgeoning opportunities.

However, this very growth fuels intensified competitive rivalry. As the market expands, more players are entering and existing ones are investing heavily in capacity and technology to secure a larger market share. This dynamic means companies like CG Power and Industrial Solutions face a landscape where competition is not just about market share but also about technological advancement and operational efficiency to stay ahead.

Product Differentiation and Technology

While core products like transformers and switchgear can appear similar, CG Power and Industrial Solutions actively differentiates itself through technological advancements. This focus on innovation, including energy efficiency and smart grid capabilities, creates a distinct advantage. For instance, their development of advanced automation systems allows for greater precision and reliability in industrial processes.

The battle for competitive advantage in this sector increasingly hinges on the ability to offer technologically superior products. CG Power's investment in research and development directly addresses this, enabling them to offer solutions like smart transformers that provide real-time monitoring and predictive maintenance. This technological edge is crucial in attracting customers seeking optimized performance and reduced operational costs.

- Technological Differentiation: CG Power focuses on advanced features like energy efficiency and smart grid integration for products like transformers and switchgear.

- Innovation as a Battleground: The ability to offer technologically superior products, such as smart transformers and advanced automation systems, is a key driver of competitive advantage.

- Customization: Companies also differentiate by offering tailored solutions to meet specific client needs, moving beyond standardized offerings.

Government Initiatives and 'Make in India' Policies

Government initiatives like 'Make in India' and various electrification programs are reshaping the competitive arena. These policies are designed to boost domestic manufacturing, which can create a more favorable environment for companies with established local production capabilities, such as CG Power. However, they also act as a catalyst for domestic competitors to scale up their operations and intensify their rivalry.

The push for electrification, in particular, is a significant driver. For instance, the Indian government's ambitious targets for renewable energy integration and electric vehicle adoption are creating substantial demand for power T&D equipment. This surge in demand is attracting new players and encouraging existing ones to innovate and expand their product portfolios, thereby heightening competitive pressures.

- Government's 'Make in India' initiative aims to transform India into a global manufacturing hub.

- Electrification schemes, like the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) scheme, are driving demand in related sectors.

- These policies can lead to an uneven playing field, potentially favoring domestic manufacturers over imports.

- Increased domestic competition is expected as companies leverage these policy tailwinds to expand their market share.

Competitive rivalry within CG Power and Industrial Solutions' market is intense, fueled by a mix of established global players and a growing number of domestic manufacturers. The Indian electrical equipment sector, projected to reach significant growth figures, sees companies vying for market share through technological innovation and cost-efficiency. For example, the push for electrification and renewable energy integration in India is creating substantial demand, attracting new entrants and intensifying competition among existing firms like CG Power.

Companies differentiate themselves through technological advancements, such as smart grid capabilities and energy-efficient designs for products like transformers and switchgear. CG Power's investment in R&D, leading to solutions like advanced automation systems, highlights this trend. The market's high capital requirements and the need for full capacity utilization also drive aggressive pricing strategies and a constant pursuit of customer contracts, further escalating rivalry.

| Key Competitors | Market Presence | Product Focus |

|---|---|---|

| ABB India | Strong global and domestic | Power grids, electrification products, robotics |

| Siemens India | Extensive global and domestic | Digital industries, smart infrastructure, mobility |

| L&T Electrical & Automation | Dominant domestic | Power, oil & gas, metals, mining equipment |

| KEC International | Growing domestic and international | Transmission towers, cables, EPC services |

SSubstitutes Threaten

The increasing adoption of decentralized power generation, especially rooftop solar and localized microgrids, presents a significant threat by potentially reducing the demand for CG Power's traditional large-scale transmission and distribution equipment. For instance, by 2024, India's rooftop solar capacity is projected to reach over 10 GW, directly impacting the need for conventional grid infrastructure.

While CG Power is actively involved in providing solutions for renewable energy integration, a substantial and rapid transition towards these distributed energy resources could fundamentally alter the market landscape. This shift might lessen the reliance on the very components that have historically formed the core of CG Power's offerings, thereby increasing the threat of substitutes.

The threat of substitutes for CG Power and Industrial Solutions in the energy storage sector is growing. Advancements in battery storage, like lithium-ion and emerging solid-state technologies, provide viable alternatives to traditional grid infrastructure for managing peak demand and ensuring consistent power supply. For instance, the global energy storage market was valued at approximately $150 billion in 2023 and is projected to reach over $300 billion by 2028, indicating significant growth in substitute solutions.

As these energy storage technologies become more cost-effective and efficient, they can directly substitute components within conventional power systems that CG Power traditionally supplies. This includes solutions for grid stabilization and distributed power generation, where battery systems can offer comparable or even superior performance in certain applications, thereby reducing reliance on CG Power's core offerings.

The market for electrical equipment, including that offered by CG Power and Industrial Solutions, faces a notable threat from refurbished and counterfeit products. These items are frequently offered at significantly lower price points, directly appealing to cost-conscious buyers.

These substandard alternatives can lead to compromised safety and diminished performance, thereby eroding the market share for genuine, high-quality products. This situation presents a substantial challenge to the reputation and sales of established manufacturers like CG Power.

For instance, in 2024, reports indicated a rise in the seizure of counterfeit electrical components across various global markets, highlighting the growing prevalence of this threat. Such illicit goods often fail to meet stringent safety and quality standards, putting end-users at risk.

Direct Current (DC) Technologies

While Alternating Current (AC) remains dominant for most power transmission, emerging Direct Current (DC) technologies pose a potential threat. Advancements in High Voltage Direct Current (HVDC) and the development of localized DC microgrids are gaining traction, offering alternatives for specific applications.

These DC solutions could gradually reduce the reliance on traditional AC infrastructure, impacting demand for certain AC-centric equipment. For instance, the global HVDC market was valued at approximately USD 12.5 billion in 2023 and is projected to grow significantly, indicating a shift in infrastructure investment.

- HVDC technology offers lower transmission losses over long distances compared to AC.

- DC microgrids are efficient for localized power distribution and integration of renewable energy sources.

- The increasing adoption of electric vehicles and digital devices, which utilize DC power, could further drive DC infrastructure development.

- CG Power’s extensive AC product portfolio might face substitution pressure as DC solutions mature.

Digitalization and Software-Defined Solutions

The increasing digitalization of the industrial sector presents a significant threat of substitutes for traditional hardware-centric solutions offered by CG Power and Industrial Solutions. As more systems become software-defined, there's a growing possibility that virtualized control platforms and integrated digital services could replace certain physical components. This shift means customers might opt for solutions that offer greater flexibility and remote management capabilities, potentially bypassing the need for some of CG Power's core product lines.

For instance, the rise of smart grids and the Internet of Things (IoT) in power management allows for greater remote monitoring and control. This could mean that a utility company might invest in advanced software platforms that manage distributed energy resources rather than upgrading or replacing physical switchgear with newer, but still hardware-dependent, models. This trend is evident across various industrial automation sectors, where software upgrades often provide functionalities previously requiring hardware changes.

- Digitalization Trend: Growing adoption of software-defined power management and virtualized control systems.

- Impact on Hardware: Potential reduction in reliance on traditional physical hardware components.

- Competitive Necessity: CG Power must integrate software and digital services to remain competitive.

- Market Adaptation: Companies may choose software-centric solutions over hardware upgrades.

The threat of substitutes for CG Power and Industrial Solutions is multifaceted, stemming from evolving energy technologies and market dynamics. Decentralized power generation, such as rooftop solar, and advancements in energy storage, like improved battery technologies, offer viable alternatives to traditional grid infrastructure. Furthermore, the increasing prevalence of refurbished and counterfeit electrical components, often at lower price points, directly challenges CG Power's market share and brand reputation.

Emerging DC technologies, particularly HVDC and DC microgrids, present a substitution threat to CG Power's AC-centric product lines, especially for long-distance transmission and localized distribution. The ongoing digitalization of the industrial sector also introduces software-defined solutions that could replace physical hardware components, necessitating a strategic integration of digital services by CG Power to maintain competitiveness.

| Substitute Area | Key Technology/Trend | 2024/2023 Data/Projection | Impact on CG Power |

|---|---|---|---|

| Decentralized Power | Rooftop Solar Capacity (India) | Projected > 10 GW by 2024 | Reduced demand for traditional grid equipment |

| Energy Storage | Global Market Value | Approx. $150 billion (2023) | Viable alternative for grid stabilization |

| Counterfeit Products | Prevalence | Reports of increased seizures in 2024 | Erosion of market share, reputational risk |

| Transmission Technology | HVDC Market Value | Approx. USD 12.5 billion (2023) | Potential substitution for AC infrastructure |

Entrants Threaten

CG Power and Industrial Solutions operates in an industry where the threat of new entrants is significantly mitigated by the sheer scale of capital required. Establishing state-of-the-art manufacturing plants for products like large power transformers and high-voltage switchgear demands hundreds of millions of dollars. For instance, setting up a new, competitive transformer manufacturing unit can easily exceed $200 million, encompassing advanced machinery, specialized testing equipment, and robust safety infrastructure.

This substantial financial outlay creates a formidable barrier, effectively deterring smaller players or those without significant backing from entering the market. Furthermore, the need for extensive research and development to keep pace with technological advancements in areas like grid modernization and renewable energy integration adds another layer of investment, reinforcing the high entry threshold.

The electrical equipment manufacturing industry, where CG Power and Industrial Solutions operates, demands substantial technological expertise and a significant commitment to research and development. New entrants face a steep climb, needing to invest heavily in advanced manufacturing processes and innovative product development to even approach the capabilities of established players. For instance, the global electrical equipment market was valued at approximately $280 billion in 2023 and is projected to grow, indicating ongoing innovation needs.

To effectively challenge incumbents like CG Power, new companies must rapidly acquire or develop cutting-edge technological capabilities, including sophisticated design software, automation, and specialized materials science. Furthermore, adherence to rigorous safety and performance standards, such as those set by IEC or IEEE, necessitates extensive testing and certification, adding another layer of complexity and cost for any potential new entrant.

CG Power and Industrial Solutions benefits significantly from established brand loyalty and deep customer relationships, particularly with large industrial clients, utilities, and government entities. These long-standing connections are difficult for new entrants to replicate, creating a substantial barrier to entry. Displacing entrenched suppliers requires more than just competitive pricing; it necessitates building trust and demonstrating reliability over time, a process that can take years.

Complex Distribution Channels and Supply Chains

For new companies entering the electrical equipment manufacturing sector, establishing effective distribution channels and resilient supply chains presents a substantial hurdle. CG Power and Industrial Solutions, like its peers, has cultivated extensive networks over decades, allowing for optimized logistics and sourcing. For instance, in FY23, CG Power reported robust inventory management, with its trade receivables days standing at 88 days, indicating efficient cash conversion from sales, a feat difficult for newcomers to replicate quickly.

New entrants must invest heavily in building relationships with suppliers for critical components and establishing widespread distribution networks to reach diverse customer segments. This requires significant capital outlay and time to develop the same level of operational efficiency and market penetration that established players like CG Power possess. The company's diversified product portfolio, ranging from power transformers to industrial automation solutions, necessitates a complex and well-managed supply chain, which is a barrier to entry.

- High Capital Investment: New entrants need substantial funds to build manufacturing facilities, establish distribution networks, and secure reliable raw material suppliers.

- Established Relationships: Incumbents benefit from long-standing relationships with suppliers and distributors, often securing better terms and guaranteed supply.

- Logistical Expertise: Managing complex global supply chains and efficient distribution requires specialized knowledge and experience, which new firms typically lack.

- Economies of Scale: Established players achieve cost advantages through larger production volumes and optimized logistics, making it difficult for new entrants to compete on price.

Regulatory Hurdles and Certification Processes

The electrical equipment sector faces significant regulatory complexity. New entrants must comply with numerous national and international standards, such as those set by the International Electrotechnical Commission (IEC) and various national bodies. For instance, obtaining certifications like ISO 9001 for quality management is often a prerequisite for market access.

Navigating this intricate web of regulations and certification processes presents a substantial barrier. The time and financial investment required to meet these stringent requirements can deter potential new players. For example, product safety certifications can take months and involve significant testing fees, adding to the initial capital outlay for any aspiring competitor.

CG Power and Industrial Solutions, like other established players, has already invested in meeting these standards. This existing compliance provides a competitive advantage over newcomers who must undertake these costly and time-consuming steps. By 2024, the global electrical equipment market, valued at over $250 billion, continues to see stringent quality and safety mandates as a key entry barrier.

- Regulatory Compliance: Adherence to standards like IEC, UL, and BIS is mandatory.

- Certification Costs: Obtaining product certifications can range from thousands to tens of thousands of dollars per product line.

- Time Investment: The certification process can extend from several months to over a year.

- Market Access: Non-compliance can lead to exclusion from key markets, impacting revenue potential for new entrants.

The threat of new entrants for CG Power and Industrial Solutions is relatively low due to the substantial capital investment required to establish competitive manufacturing capabilities. Setting up a modern plant for electrical equipment can easily cost hundreds of millions of dollars, covering advanced machinery and specialized testing.

Furthermore, the need for continuous research and development to stay current with technological advancements in areas like grid modernization and renewable energy integration adds another significant financial hurdle for potential new players.

The industry demands deep technological expertise and a strong commitment to R&D, making it difficult for newcomers to match the capabilities of established firms like CG Power. For example, the global electrical equipment market was valued at over $250 billion in 2024, underscoring the scale of investment needed.

New entrants also face challenges in building brand recognition and securing long-term customer relationships, which are crucial for market penetration. Established players like CG Power benefit from decades of trust and proven performance, creating a significant barrier for any new company attempting to enter the market.

| Barrier Type | Description | Estimated Cost/Timeframe |

| Capital Investment | Establishing manufacturing facilities and R&D centers | $200 million+ for a competitive transformer plant |

| Technological Expertise | Acquiring advanced design, automation, and materials science capabilities | Significant ongoing investment in R&D |

| Brand & Relationships | Building trust and long-standing customer connections | Years of consistent delivery and service |

| Regulatory Compliance | Meeting national and international safety and quality standards (e.g., IEC, ISO 9001) | Months to over a year for certifications, with costs in thousands per product line |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for CG Power and Industrial Solutions leverages data from annual reports, investor presentations, and industry-specific market research reports. We also incorporate insights from financial news outlets and regulatory filings to capture a comprehensive view of the competitive landscape.