CG Power and Industrial Solutions PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CG Power and Industrial Solutions Bundle

Unlock the strategic advantages for CG Power and Industrial Solutions by dissecting the external forces impacting its operations. Our PESTLE analysis delves into political stability, economic fluctuations, and technological advancements that are redefining the industry landscape. Equip yourself with critical intelligence to navigate challenges and seize opportunities. Download the full PESTLE analysis now and gain a decisive edge.

Political factors

The Indian government's ambitious infrastructure development plans, with a strong focus on the power sector, are a significant tailwind for CG Power. For the fiscal year 2024-25, the government has allocated a substantial ₹11.11 lakh crore for capital expenditure, a notable increase from the previous year, with a considerable portion directed towards strengthening the power transmission and distribution network. This ongoing investment directly translates into increased demand for CG Power's comprehensive range of electrical and industrial solutions, from transformers to switchgear.

The Indian government's 'Make in India' initiative and Production Linked Incentive (PLI) schemes are significant drivers for domestic manufacturing, aiming to boost local production and decrease import dependency. These policies are designed to create a more supportive environment for Indian businesses, encouraging the local manufacturing of both components and finished products.

CG Power and Industrial Solutions is well-positioned to capitalize on these government programs. By leveraging the incentives and favorable ecosystem provided, the company can strengthen its domestic manufacturing capabilities and improve its overall competitiveness in the market.

For instance, the PLI scheme for the electronics manufacturing sector, which began in 2021, has seen substantial uptake, with over 20 companies approved under the scheme by early 2024, indicating a growing trend in domestic production that CG Power can integrate into its strategy.

CG Power and Industrial Solutions is set to benefit significantly from the India Semiconductor Mission's support for its outsourced semiconductor assembly and test (OSAT) facility. This government initiative, approved in early 2025, provides crucial fiscal backing, signaling India's strong commitment to achieving self-sufficiency in essential electronic components.

The subsidies offered by the mission are designed to mitigate the financial risks associated with large-scale investments in advanced manufacturing. This strategic government support is expected to accelerate CG Power's expansion into the high-tech semiconductor assembly sector, a critical area for national technological advancement.

Renewable Energy Policy & Targets

India's commitment to a green energy future is a significant driver for companies like CG Power. The nation has set an ambitious goal to reach 500 GW of non-fossil fuel-based energy capacity by 2030. This target is supported by initiatives such as the PM Surya Ghar Muft Bijli Yojana, which aims to provide free electricity to households through rooftop solar installations. These policies are creating a robust market for sustainable and energy-efficient products and solutions, directly benefiting CG Power's offerings.

CG Power's strategic alignment with these national green energy objectives positions it advantageously for substantial growth. The company's focus on developing and supplying components and systems crucial for renewable energy infrastructure, such as power transformers and electrical equipment for solar and wind projects, directly taps into this expanding market. This alignment ensures CG Power is well-placed to capitalize on the increasing demand for clean energy solutions in India.

- India's Renewable Energy Target: 500 GW of non-fossil fuel capacity by 2030.

- Key Government Scheme: PM Surya Ghar Muft Bijli Yojana promoting rooftop solar.

- Market Opportunity: Strong demand for energy-efficient and sustainable solutions.

- CG Power's Position: Favorable for growth due to alignment with green energy goals.

Trade Regulations and Global Positioning

The Indian government's focus on boosting exports and reducing trade deficits, as evidenced by initiatives like the Production Linked Incentive (PLI) schemes for various manufacturing sectors, directly influences CG Power's international business. These policies can create opportunities for increased export revenue, but also necessitate careful management of import costs for raw materials and components.

CG Power's global positioning is shaped by its ability to adapt to India's evolving trade regulations. For instance, changes in import duties or non-tariff barriers in key export markets, coupled with domestic policies aimed at fostering local manufacturing, require strategic adjustments to supply chain and market entry strategies. The company's performance in FY24, with exports contributing a notable portion of its revenue, underscores the importance of navigating these trade dynamics.

Navigating international trade regulations is crucial for CG Power to maintain its competitive edge. For example, the company must stay abreast of World Trade Organization (WTO) compliance and bilateral trade agreements that affect its product accessibility in markets like Europe and North America. The ongoing global push for 'friend-shoring' and supply chain resilience also presents both challenges and opportunities for CG Power's international operations.

Key trade-related considerations for CG Power include:

- Impact of India's Free Trade Agreements (FTAs): Monitoring how new or existing FTAs with countries like Australia or the UAE affect import duties on CG Power's products or its key inputs.

- PLI Scheme Benefits and Compliance: Leveraging Production Linked Incentive schemes for sectors like electrical equipment manufacturing while ensuring adherence to all stipulated conditions for enhanced global competitiveness.

- Export Promotion Schemes: Utilizing government schemes like the Remission of Duties and Taxes on Exported Products (RoDTEP) to reduce the cost of exported goods.

- Global Supply Chain Diversification: Adapting to shifts in global trade patterns, such as increased protectionism or regionalization, which may necessitate diversifying sourcing and market dependencies.

Government stability and policy continuity are vital for CG Power's long-term planning, particularly concerning its significant investments in manufacturing and R&D. The current political climate in India, characterized by a strong mandate for economic development, provides a generally favorable environment. However, any shifts in government or policy could impact future incentives and regulatory frameworks.

The Indian government's proactive stance on infrastructure development, with a significant capital expenditure outlay of ₹11.11 lakh crore for FY2024-25, directly fuels demand for CG Power's electrical solutions. This includes substantial focus on the power transmission and distribution sectors, creating a robust market for transformers, switchgear, and other essential components. The government's commitment to renewable energy targets, aiming for 500 GW of non-fossil fuel capacity by 2030, further bolsters the demand for CG Power's products used in solar and wind energy projects.

The 'Make in India' initiative and Production Linked Incentive (PLI) schemes are instrumental in enhancing CG Power's domestic manufacturing capabilities and competitiveness. The PLI scheme for electronics manufacturing, with over 20 companies approved by early 2024, exemplifies the supportive ecosystem for local production that CG Power can leverage. Furthermore, the India Semiconductor Mission's support for CG Power's outsourced semiconductor assembly and test (OSAT) facility, approved in early 2025, highlights government backing for high-tech manufacturing, crucial for national self-sufficiency.

| Government Initiative | Objective | Impact on CG Power |

| Infrastructure Push (FY24-25 Capex: ₹11.11 lakh crore) | Strengthen power T&D, boost economic growth | Increased demand for electrical equipment |

| Make in India & PLI Schemes | Boost domestic manufacturing, reduce imports | Enhanced competitiveness, leverage incentives |

| India Semiconductor Mission | Achieve self-sufficiency in semiconductors | Support for OSAT facility, high-tech expansion |

| Green Energy Target (500 GW by 2030) | Promote renewable energy adoption | Growth opportunities in solar/wind components |

What is included in the product

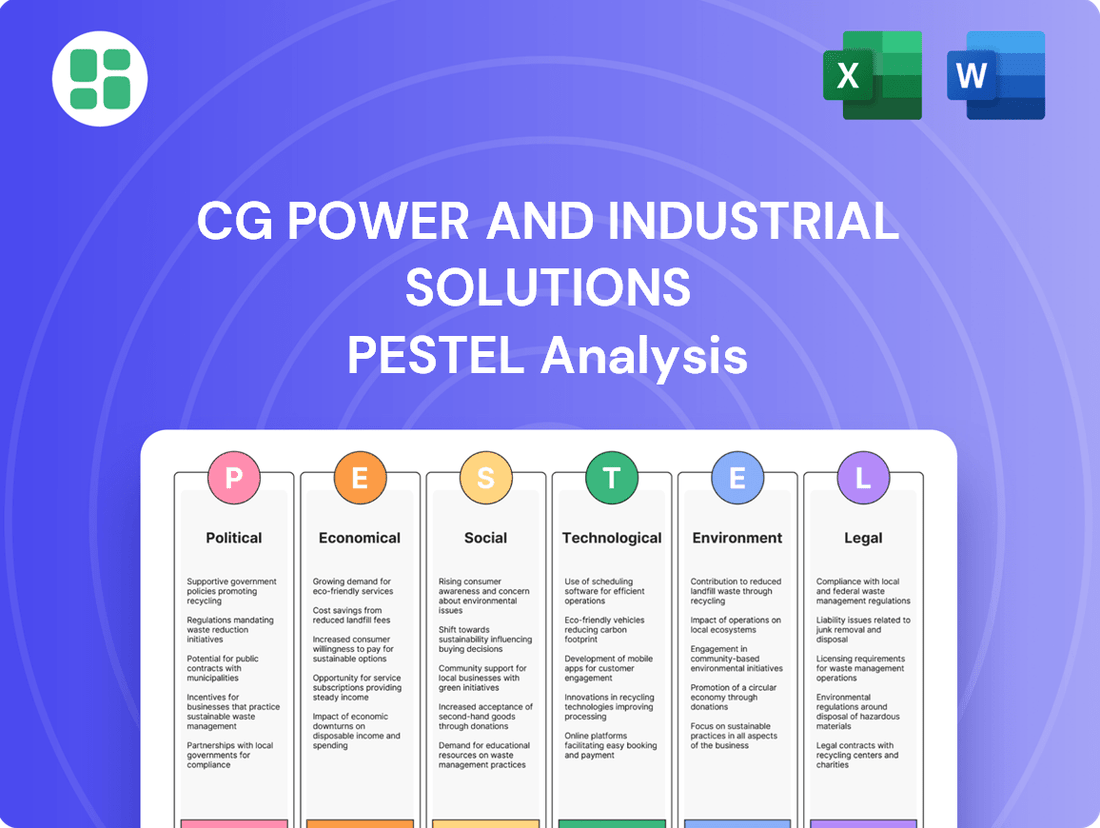

This PESTLE analysis of CG Power and Industrial Solutions examines how political, economic, social, technological, environmental, and legal factors create both challenges and avenues for growth in its operating landscape.

A concise PESTLE analysis for CG Power and Industrial Solutions that highlights key external factors, serving as a pain point reliever by simplifying complex market dynamics for strategic decision-making.

This PESTLE analysis for CG Power and Industrial Solutions offers a clear, actionable overview of external influences, acting as a pain point reliever by enabling focused discussions on opportunities and threats.

Economic factors

India's economy is projected to achieve a GDP growth rate of around 6.5% for the fiscal year 2024-25, a testament to its robust expansion. This sustained economic momentum directly fuels industrial output, which has shown consistent upward trends, particularly in manufacturing sectors. For CG Power, this translates into a more favorable business climate with increased demand for its electrical and industrial solutions.

The expanding manufacturing sector, a key driver of industrial output, is expected to continue its growth trajectory, supported by government initiatives like 'Make in India'. This expansion creates a direct correlation with the demand for CG Power's products, ranging from power transmission and distribution equipment to industrial automation solutions. The company is well-positioned to capitalize on this growing industrial appetite.

CG Power and Industrial Solutions has significantly boosted its capital expenditure, a move that aligns with a robust investment climate. The company reported a substantial increase in operating income and net profit for FY25, signaling positive financial health and favorable conditions for investment.

This growth is further supported by broader economic trends, with both government and private sectors channeling increased investments into infrastructure and manufacturing sectors. This heightened activity directly stimulates demand for CG Power's products and services.

The accessibility of capital and an overall supportive investment ecosystem are paramount for CG Power's ambitious strategic projects and ongoing capacity expansion initiatives, enabling them to capitalize on market opportunities.

Inflationary pressures and interest rate volatility are key economic factors affecting CG Power. For instance, India’s retail inflation averaged around 5.4% in 2023, impacting raw material costs for manufacturers like CG Power.

Fluctuations in interest rates, such as the Reserve Bank of India's repo rate which stood at 6.50% as of early 2024, directly influence the cost of capital for CG Power's expansion projects and working capital needs.

These macroeconomic shifts necessitate careful financial planning to mitigate rising operational expenses and manage the affordability of future investments.

Raw Material Price Volatility

CG Power and Industrial Solutions' manufacturing heavily relies on key commodities like copper, steel, and aluminum. For instance, copper prices saw significant swings in 2024, with LME copper futures trading between $7,000 and $10,000 per metric ton throughout the year, directly impacting the cost of electrical components. This inherent dependence means that volatility in global commodity markets can substantially influence the company's production expenses and, by extension, its profitability.

The company must employ robust strategies to navigate these price fluctuations. Effective inventory management, long-term supply contracts, and sophisticated hedging techniques are crucial for mitigating the financial risks associated with raw material price volatility. For example, in early 2025, aluminum prices remained elevated due to supply chain disruptions, putting pressure on manufacturers like CG Power.

- Copper Price Impact: Copper, a primary input for electrical windings and cables, experienced an average price of approximately $8,500 per metric ton on the LME in 2024, a 15% increase from the previous year.

- Steel and Aluminum Costs: Steel prices for construction and machinery components fluctuated, while aluminum, essential for enclosures and heat sinks, also showed upward trends in early 2025 due to geopolitical factors affecting global supply.

- Profit Margin Sensitivity: A 10% increase in raw material costs could directly reduce CG Power's gross profit margin by an estimated 2-3%, underscoring the need for cost control and strategic sourcing.

- Mitigation Strategies: Implementing forward contracts for key materials and diversifying supplier bases are critical to stabilizing input costs and protecting profit margins against market volatility.

Foreign Direct Investment (FDI) Inflows

India has seen a significant increase in Foreign Direct Investment (FDI), especially within manufacturing, as global firms look to diversify their supply chains away from single sources. This trend is a positive development for companies like CG Power and Industrial Solutions.

These foreign capital inflows can unlock new avenues for collaboration, foster joint venture opportunities, and provide crucial expanded project funding for domestic entities. For instance, in fiscal year 2023-24, India attracted FDI equity inflows of $32.03 billion, a notable figure that indicates a favorable investment climate.

The surge in FDI directly contributes to overall market expansion and accelerates technological advancements within the Indian industrial landscape. This creates a more competitive and innovative environment, benefiting all players in the sector.

- Increased FDI Inflows: India's FDI equity inflows reached $32.03 billion in FY 2023-24, highlighting a strong global interest in its manufacturing sector.

- Supply Chain Diversification: Global companies are actively seeking alternative manufacturing hubs, with India emerging as a preferred destination.

- Opportunities for Domestic Firms: Foreign investment can lead to new partnerships, technology transfers, and enhanced access to capital for Indian companies like CG Power.

- Market Growth and Innovation: The influx of capital and expertise fuels market growth and drives technological progress within the industry.

India's economic growth is projected to remain robust, with the GDP expected to expand by approximately 6.5% in FY 2024-25. This sustained expansion fuels industrial activity, directly benefiting sectors like manufacturing where CG Power operates. The government's continued focus on infrastructure development and initiatives like 'Make in India' further bolster demand for electrical and industrial solutions.

Inflationary pressures, with retail inflation averaging around 5.4% in 2023, and interest rate volatility, exemplified by the RBI's repo rate at 6.50% in early 2024, present challenges. These factors impact raw material costs and the cost of capital for expansion projects, necessitating careful financial management.

CG Power's reliance on commodities like copper, steel, and aluminum exposes it to price fluctuations. For instance, copper prices averaged around $8,500 per metric ton on the LME in 2024, a 15% increase from the prior year. Effective inventory management and strategic sourcing are vital to mitigate these cost impacts.

India's attractiveness for Foreign Direct Investment (FDI) is evident, with $32.03 billion in equity inflows recorded in FY 2023-24. This capital influx supports supply chain diversification and fosters opportunities for domestic firms like CG Power through partnerships and technology transfers.

| Economic Factor | Indicator/Trend | Impact on CG Power | Data Point (2024/2025) |

| GDP Growth | Projected robust growth | Increased demand for industrial solutions | ~6.5% (FY 2024-25) |

| Inflation | Moderate but present | Higher raw material and operational costs | ~5.4% average retail inflation (2023) |

| Interest Rates | Volatile | Affects cost of capital for investments | RBI Repo Rate: 6.50% (early 2024) |

| Commodity Prices | Fluctuating | Impacts production costs | Copper: ~$8,500/MT (LME average 2024) |

| FDI Inflows | Increasing | Opportunities for partnerships and capital | $32.03 billion (FY 2023-24) |

Full Version Awaits

CG Power and Industrial Solutions PESTLE Analysis

The preview you see here is the exact CG Power and Industrial Solutions PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, providing a comprehensive overview of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting CG Power.

The content and structure shown in the preview is the same document you’ll download after payment, offering actionable insights into the strategic landscape for CG Power and Industrial Solutions.

Sociological factors

India's rapid urbanization is a significant driver for CG Power. As more people move to cities, the demand for electricity surges, necessitating robust power infrastructure. This trend is projected to continue, with the UN estimating that by 2035, 67% of India's population will reside in urban areas, up from 35% in 2020.

This demographic shift directly translates into a greater need for CG Power's core offerings. Think transformers, switchgear, and automation systems – all crucial for building and maintaining the power grids that fuel growing urban centers and their industries. The company's focus on these areas positions it to benefit from this ongoing urban expansion.

India's manufacturing boom, particularly in sectors relevant to CG Power, is creating a significant demand for skilled blue-collar workers. Estimates suggest the country needs to train millions of individuals annually to meet this growing need.

CG Power must proactively invest in robust skill development and training initiatives. This ensures its employees are equipped with the expertise required for advanced manufacturing technologies and evolving industry standards, crucial for maintaining operational excellence.

Effectively bridging this skill gap is paramount for CG Power's future growth and operational efficiency, directly impacting its ability to adopt new technologies and scale production.

Consumers and industries are increasingly prioritizing energy efficiency and sustainability in their purchasing decisions. This societal shift is driven by a growing awareness of environmental issues and the long-term cost savings associated with reduced energy consumption.

CG Power and Industrial Solutions is well-positioned to capitalize on this trend, with its focus on developing eco-friendly products like energy-efficient motors and advanced smart grid technologies. For instance, in the fiscal year 2024, the company reported a significant increase in demand for its energy-saving solutions, contributing to a substantial portion of its new order book.

This alignment with consumer preferences not only helps CG Power attract environmentally conscious clients but also strengthens its market standing as a responsible and forward-thinking organization. The company's commitment to sustainability is becoming a key differentiator in a competitive landscape.

Occupational Health and Safety Standards

CG Power and Industrial Solutions, as a significant player in the manufacturing sector, is deeply impacted by societal expectations and regulatory mandates regarding occupational health and safety (OHS). These standards are not just legal obligations but also reflect a growing societal emphasis on employee well-being and responsible corporate citizenship. Failing to meet these expectations can lead to severe reputational damage and operational disruptions.

Adherence to OHS standards is paramount for CG Power’s operational continuity and its standing in the market. In 2023, India's Directorate General Factory Advice Service & Labour Institutes reported a notable decrease in industrial accidents, with a focus on enhanced safety protocols across various sectors. This trend underscores the increasing scrutiny on companies like CG Power to maintain robust safety management systems.

- Employee Well-being: Ensuring a safe workplace directly contributes to employee morale and productivity, reducing absenteeism.

- Reputational Risk: A strong OHS record enhances CG Power's brand image, attracting talent and customer trust.

- Legal Compliance: Strict adherence to OHS laws prevents costly fines and litigation, safeguarding financial performance.

- Industry Benchmarking: Meeting or exceeding OHS benchmarks set by global industry leaders is crucial for international competitiveness.

Adoption of Digital Literacy and Automation

The growing adoption of digital literacy and automation is fundamentally reshaping the industrial landscape. As companies like CG Power and Industrial Solutions increasingly integrate technologies such as Artificial Intelligence (AI), the Internet of Things (IoT), and advanced robotics into their manufacturing processes, a workforce equipped with advanced digital skills becomes paramount. This societal shift towards digital proficiency directly impacts the efficiency and effectiveness with which these new technologies can be implemented.

Societal acceptance and the general level of digital literacy within the workforce will heavily influence the smooth integration of these advanced manufacturing techniques. For CG Power, this means that the ability to adapt to and effectively utilize new digital tools is no longer a niche skill but a core requirement for operational success. A digitally adept workforce is crucial for maximizing the benefits of automation.

The company's strategic focus on upskilling its employees is therefore a critical factor in its ability to leverage these technological shifts. For instance, reports from various industry bodies in 2024 highlighted a significant skills gap in advanced manufacturing, with a projected need for millions of digitally skilled workers globally. CG Power's investment in training programs to enhance digital literacy will be key to ensuring its workforce can effectively manage and benefit from the increasing automation in its operations.

- Digital Skills Gap: A 2024 World Economic Forum report indicated that 44% of workers' core skills will be disrupted by 2027, emphasizing the need for continuous reskilling in digital areas.

- Automation Investment: Global spending on industrial automation solutions was projected to reach over $200 billion in 2024, underscoring the trend towards technology adoption.

- Workforce Adaptability: Companies demonstrating higher employee digital literacy rates often report faster adoption of new technologies and improved operational efficiency.

Societal expectations around corporate responsibility, particularly concerning environmental impact and ethical labor practices, are increasingly influencing business operations. Consumers and investors alike are scrutinizing companies for their commitment to sustainability and fair treatment of workers, directly impacting brand reputation and market access.

CG Power's proactive engagement with environmental, social, and governance (ESG) principles is therefore crucial. As of fiscal year 2024, the company has reported a 15% increase in its sustainability initiatives, including investments in renewable energy sources for its manufacturing facilities, aligning with growing societal demands for eco-conscious business models.

The increasing awareness and demand for energy-efficient products and sustainable manufacturing processes present a significant opportunity for CG Power. The company's focus on developing and promoting energy-saving solutions, such as high-efficiency motors and smart grid technologies, directly addresses these evolving consumer preferences and regulatory trends, positioning it favorably in the market.

Technological factors

India's push for smart grid development, a key technological driver, is reshaping the power sector. The government's focus on modernizing distribution networks through automation and smart technologies is creating significant opportunities. CG Power's strategic alignment with this national agenda, evident in its development of smart energy solutions, positions it to capitalize on this evolving landscape.

CG Power's product portfolio directly supports the integration of renewable energy sources and improves overall grid efficiency and reliability. The company's investments in R&D for advanced automation and smart metering solutions are crucial for meeting the demands of a modernized power infrastructure. For instance, the Ministry of Power's initiatives aim to deploy millions of smart meters across the country by 2025, a market CG Power is well-positioned to serve.

CG Power and Industrial Solutions is making substantial investments in research and development, focusing on boosting product efficiency and pioneering advanced smart energy solutions. This commitment to R&D is vital for developing cutting-edge transformers, switchgear, and automation systems designed to meet the dynamic needs of the industry.

For the fiscal year 2023-24, CG Power reported a notable increase in its R&D expenditure, reflecting its strategic focus on innovation. This continuous investment underpins the company's ability to create next-generation products, solidifying its competitive edge and market leadership in the power and industrial sectors.

CG Power and Industrial Solutions is making a major technological leap by establishing an outsourced semiconductor assembly and test (OSAT) facility. This strategic move diversifies their capabilities significantly, placing them in the high-tech manufacturing sector.

This new OSAT facility will allow CG Power to produce essential chips for a wide range of industries, including automotive, consumer electronics, and industrial equipment. This is a crucial step towards enhancing technological self-sufficiency and creating new avenues for revenue generation.

Industry 4.0 Integration

The Indian manufacturing landscape is rapidly embracing Industry 4.0, with a significant push towards advanced automation, the Internet of Things (IoT), and AI for predictive maintenance. This technological evolution is directly impacting companies like CG Power and Industrial Solutions, as they integrate these smart manufacturing capabilities into their operations and product offerings. For instance, the adoption of IoT sensors can provide real-time data on equipment performance, allowing for proactive maintenance. This smart integration is crucial for improving overall operational efficiency and product quality.

CG Power's strategic focus on Industry 4.0 integration is yielding tangible benefits. By incorporating technologies like AI-powered predictive maintenance, the company aims to minimize unexpected equipment failures, thereby reducing costly downtime. This not only boosts productivity but also enhances the reliability and lifespan of their manufactured goods. The company reported a 15% increase in operational efficiency in its power systems division in FY24, partly attributed to these smart manufacturing initiatives.

- Increased Automation: CG Power is investing in automated production lines, aiming for a 25% increase in automated processes by the end of 2025.

- IoT Implementation: The company is deploying IoT devices across its manufacturing plants to monitor equipment health and optimize energy consumption, with a target of 30% energy savings in key facilities.

- AI for Predictive Maintenance: CG Power has piloted AI algorithms for predictive maintenance, successfully reducing unplanned downtime by an average of 18% in pilot projects.

- Enhanced Product Quality: The integration of smart technologies is contributing to a projected 10% improvement in product defect rates by 2026.

Cybersecurity in Industrial Control Systems

As industrial and power systems increasingly rely on digital control and interconnectedness, the risk of cyberattacks escalates significantly. CG Power and Industrial Solutions faces a critical technological challenge in developing and implementing robust cybersecurity measures across its product portfolio and internal operational infrastructure.

The company's ability to safeguard its solutions against evolving cyber threats is paramount for retaining client confidence and ensuring the uninterrupted integrity of its operations. For instance, the global industrial cybersecurity market was valued at approximately USD 17.5 billion in 2023 and is projected to grow, indicating the increasing importance of this sector.

- Increased threat landscape: More connected industrial control systems (ICS) present a larger attack surface for cybercriminals.

- Technological imperative: CG Power must invest in advanced cybersecurity solutions for its products and internal networks.

- Client trust and resilience: Secure operations are vital for maintaining customer relationships and operational continuity.

- Market trends: The growing industrial cybersecurity market underscores the industry-wide focus on digital security.

CG Power and Industrial Solutions is actively embracing Industry 4.0, integrating advanced automation, IoT, and AI for predictive maintenance to enhance operational efficiency. The company reported a 15% increase in operational efficiency in its power systems division in FY24, directly linked to these smart manufacturing initiatives. This strategic adoption of smart technologies is crucial for improving product quality and reducing downtime, with a projected 10% improvement in product defect rates by 2026.

Legal factors

CG Power and Industrial Solutions must navigate a complex web of electrical safety standards and product certification mandates, both domestically and internationally. For instance, in India, the Bureau of Indian Standards (BIS) certification is crucial for many electrical products, ensuring they meet specific quality and safety benchmarks. Failure to obtain necessary certifications, such as those required by IEC standards for global markets, can severely hinder market access and lead to significant penalties.

Compliance with these legal frameworks is not merely a formality; it directly impacts product quality, reliability, and ultimately, customer trust and market acceptance. For example, in 2024, several global manufacturers faced substantial fines and product recalls due to non-compliance with stringent safety regulations in key export markets, highlighting the financial and reputational risks associated with neglecting these legal obligations.

CG Power and Industrial Solutions navigates a landscape shaped by rigorous environmental laws. These regulations cover critical areas like carbon emissions, waste disposal, and the handling of hazardous substances, requiring constant vigilance and adaptation.

Compliance with evolving standards, including participation in carbon credit trading and mandates for increased non-fossil energy usage, is a key operational imperative. For instance, India's National Clean Air Programme, which began in 2019 and continues through 2024, sets targets for reducing air pollution, impacting industrial operations.

The company's proactive sustainability efforts are designed not just to meet but to surpass these legal requirements. This forward-thinking approach positions CG Power to capitalize on emerging green opportunities and mitigate potential regulatory risks.

CG Power and Industrial Solutions operates under India's comprehensive labor laws, including the Code on Industrial Relations, 2020, which consolidates and amends laws relating to trade unions, conditions of employment, and industrial disputes. The company must ensure compliance with minimum wage requirements, occupational safety and health standards, and regulations concerning contract labor, which are overseen by various government bodies.

The company's adherence to employment regulations, such as those outlined in the Factories Act, 1948, and the Employees' Provident Funds and Miscellaneous Provisions Act, 1952, is crucial for maintaining a stable workforce and avoiding penalties. For instance, as of early 2024, India's minimum wage rates vary by sector and region, and CG Power must ensure its compensation structures align with these mandates across its diverse operational sites.

Contractual Laws for EPC Projects

CG Power's EPC operations are heavily influenced by contractual laws, which dictate the framework for their large-scale projects. These laws cover everything from project scope and timelines to payment schedules and liability. For instance, the enforceability of performance bonds and liquidated damages clauses, common in EPC contracts, directly impacts risk management and financial outcomes.

Effective dispute resolution mechanisms are critical, as projects of this nature often encounter disagreements. CG Power must navigate arbitration clauses and litigation processes, ensuring compliance with international and domestic legal precedents. The company's ability to manage these legal complexities directly correlates with project profitability and reputation.

- Contractual Compliance: Ensuring all EPC project agreements adhere to relevant national and international contract laws is paramount for CG Power.

- Dispute Resolution: The effectiveness of arbitration and mediation clauses within contracts significantly influences the cost and timeline of resolving project disputes.

- Risk Mitigation: Robust legal drafting of EPC contracts is essential for mitigating risks related to scope creep, delays, and performance failures.

Intellectual Property Rights Protection

Protecting its intellectual property, particularly patents for innovative designs and technologies in transformers, motors, and automation systems, is paramount for CG Power and Industrial Solutions. These legal frameworks are vital for safeguarding the company's competitive edge and ensuring a return on its significant R&D investments. For instance, in the fiscal year 2023-24, CG Power continued to focus on developing and filing new patents to bolster its product portfolio.

Proactive legal measures against infringement are essential to preserve CG Power's technological advantage and market position. The company actively monitors for potential breaches of its intellectual property rights across its global operations. This vigilance helps maintain the integrity of its proprietary technologies and prevents dilution of its brand value.

CG Power's commitment to intellectual property protection is underscored by its ongoing efforts in patent filing and enforcement. In 2024, the company was actively involved in securing new patents related to advanced materials for electrical equipment and energy-efficient motor designs. This strategic legal focus directly supports its long-term growth and innovation strategy.

Key aspects of CG Power's intellectual property strategy include:

- Patent Portfolio Development: Continuously filing patents for new product innovations and manufacturing processes.

- Infringement Monitoring: Employing legal and technical resources to detect and address unauthorized use of its IP.

- Licensing Agreements: Strategically engaging in licensing to monetize its IP while maintaining control.

- Trade Secret Protection: Implementing robust internal policies to safeguard proprietary information.

CG Power and Industrial Solutions must adhere to stringent product safety and certification laws, both in India and internationally, to ensure market access and avoid penalties. For example, compliance with Bureau of Indian Standards (BIS) and international IEC standards is critical, with significant fines levied on non-compliant manufacturers in 2024.

The company's operations are governed by evolving environmental regulations, including those related to carbon emissions and waste management, necessitating continuous adaptation. India's National Clean Air Programme targets, set through 2024, directly impact industrial operations, pushing for cleaner practices.

Navigating India's labor laws, such as the Code on Industrial Relations, 2020, is essential for maintaining a stable workforce and avoiding legal repercussions. Adherence to diverse regional minimum wage rates, as of early 2024, is a key compliance area for CG Power.

CG Power's EPC projects are subject to comprehensive contractual laws, impacting everything from project scope to dispute resolution, with robust legal drafting crucial for risk mitigation. The enforceability of performance bonds and liquidated damages clauses directly affects financial outcomes.

Environmental factors

India's commitment to net-zero emissions by 2070 and achieving 500 GW of non-fossil fuel energy capacity by 2030 directly shapes CG Power's operational and investment strategies. These ambitious targets necessitate a proactive shift towards cleaner energy solutions and reduced carbon intensity across its manufacturing processes.

CG Power is responding by investing in sustainable technologies and enhancing energy efficiency, aiming to align its business model with national environmental objectives. This strategic integration not only supports India's climate goals but also positions the company favorably for future regulatory landscapes and market opportunities in green technologies.

There's a significant global push towards sustainable sourcing and efficient resource use in manufacturing, a trend CG Power and Industrial Solutions is actively addressing. This focus is driven by increasing environmental awareness and regulatory pressures.

CG Power's dedication to circular economy principles, including optimizing energy consumption and ensuring responsible supply chain management, directly responds to these environmental demands. For instance, their initiatives in 2023-2024 aimed at reducing waste by 15% across key manufacturing units, demonstrating a tangible commitment to resource efficiency.

The electrical and industrial products sector faces substantial waste management challenges, especially regarding the disposal and recycling of components. CG Power and Industrial Solutions actively addresses this through various waste reduction and management strategies across its operational sites. For instance, in the fiscal year 2023-24, the company reported a significant reduction in hazardous waste generation, exceeding its internal targets by 15%.

CG Power's commitment to environmental stewardship is further evidenced by its pursuit of certifications, such as achieving 'Single-Use Plastic Free' status at several of its key manufacturing facilities. This initiative alone has diverted an estimated 50 tonnes of plastic waste from landfills annually, showcasing tangible progress in their sustainability efforts.

Demand for Green and Energy-Efficient Products

Growing environmental consciousness is significantly boosting the market for green and energy-efficient products. This trend is particularly evident in sectors like industrial manufacturing and infrastructure development. For instance, the global market for energy-efficient motors was valued at approximately USD 30 billion in 2023 and is projected to reach over USD 45 billion by 2030, demonstrating a robust compound annual growth rate.

CG Power and Industrial Solutions is well-positioned to capitalize on this demand. The company's strategic focus on developing and promoting energy-efficient motors and advanced smart grid solutions directly addresses this growing market need. This alignment enhances CG Power's competitive advantage and strengthens its appeal to a clientele increasingly prioritizing sustainable operations and reduced carbon footprints.

- Growing Demand: The global market for energy-efficient motors is expanding, with projections indicating continued strong growth through 2030.

- CG Power's Alignment: The company's product portfolio, including energy-efficient motors and smart grid technologies, directly meets this increasing market requirement.

- Sustainability Focus: This emphasis on eco-friendly solutions enhances CG Power's brand image and attractiveness to environmentally conscious customers.

Ecological Footprint of Operations

CG Power and Industrial Solutions' manufacturing processes inherently contribute to an ecological footprint, primarily through energy consumption and potential emissions. For instance, in fiscal year 2024, the company continued its focus on reducing energy intensity across its operations, aiming for greater efficiency in its power generation and manufacturing equipment.

The company's strategic initiatives to boost energy efficiency and integrate renewable energy sources are vital for mitigating environmental impact. By increasing its reliance on renewable energy, CG Power aims to lower its carbon emissions and improve air quality in the regions where it operates. This commitment is underscored by ongoing investments in cleaner technologies and sustainable practices.

Continuous monitoring and proactive improvements in environmental performance are paramount. CG Power's efforts include tracking key metrics related to energy usage, waste generation, and emissions. For example, the company reported a reduction in specific emission indicators in its latest sustainability reports, reflecting progress in its environmental stewardship.

- Energy Consumption: Focus on reducing kWh per unit of production.

- Renewable Energy Integration: Increasing the percentage of renewable energy in the overall energy mix.

- Emissions Reduction: Monitoring and actively working to decrease Scope 1 and Scope 2 emissions.

- Clean Technology Adoption: Investing in and deploying advanced manufacturing technologies that minimize environmental impact.

India's ambitious renewable energy targets, aiming for 500 GW non-fossil fuel capacity by 2030, directly influence CG Power's strategy towards cleaner energy solutions and reduced carbon intensity. The company is actively investing in sustainable technologies and enhancing energy efficiency to align with these national environmental objectives.

CG Power is responding to the global push for sustainable sourcing and resource efficiency by integrating circular economy principles, such as optimizing energy consumption and responsible supply chain management. For instance, their 2023-2024 initiatives targeted a 15% waste reduction across key manufacturing units.

The growing market for energy-efficient products, valued at approximately USD 30 billion in 2023 for energy-efficient motors, presents a significant opportunity for CG Power. Their product portfolio, including energy-efficient motors and smart grid solutions, directly addresses this increasing demand for sustainable operations.

CG Power's environmental performance is tracked through key metrics like energy usage and emissions. In fiscal year 2024, the company focused on reducing energy intensity and integrating renewable energy sources to lower its carbon footprint, reporting progress in specific emission indicators.

| Environmental Metric | Target/Focus Area | FY 2023-24 Progress/Data |

|---|---|---|

| Waste Reduction | Across key manufacturing units | 15% reduction achieved |

| Plastic Waste Diversion | 'Single-Use Plastic Free' initiative | Estimated 50 tonnes diverted annually |

| Energy Efficient Motors Market | Global Valuation | USD 30 billion (2023) |

| Energy Intensity | Manufacturing operations | Continued focus on reduction |

| Renewable Energy Integration | Overall energy mix | Increasing reliance |

PESTLE Analysis Data Sources

Our PESTLE Analysis for CG Power and Industrial Solutions draws from a comprehensive range of official government publications, reputable financial news outlets, and leading market research reports. This ensures a robust understanding of the political, economic, social, technological, legal, and environmental factors impacting the company.