CG Power and Industrial Solutions Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CG Power and Industrial Solutions Bundle

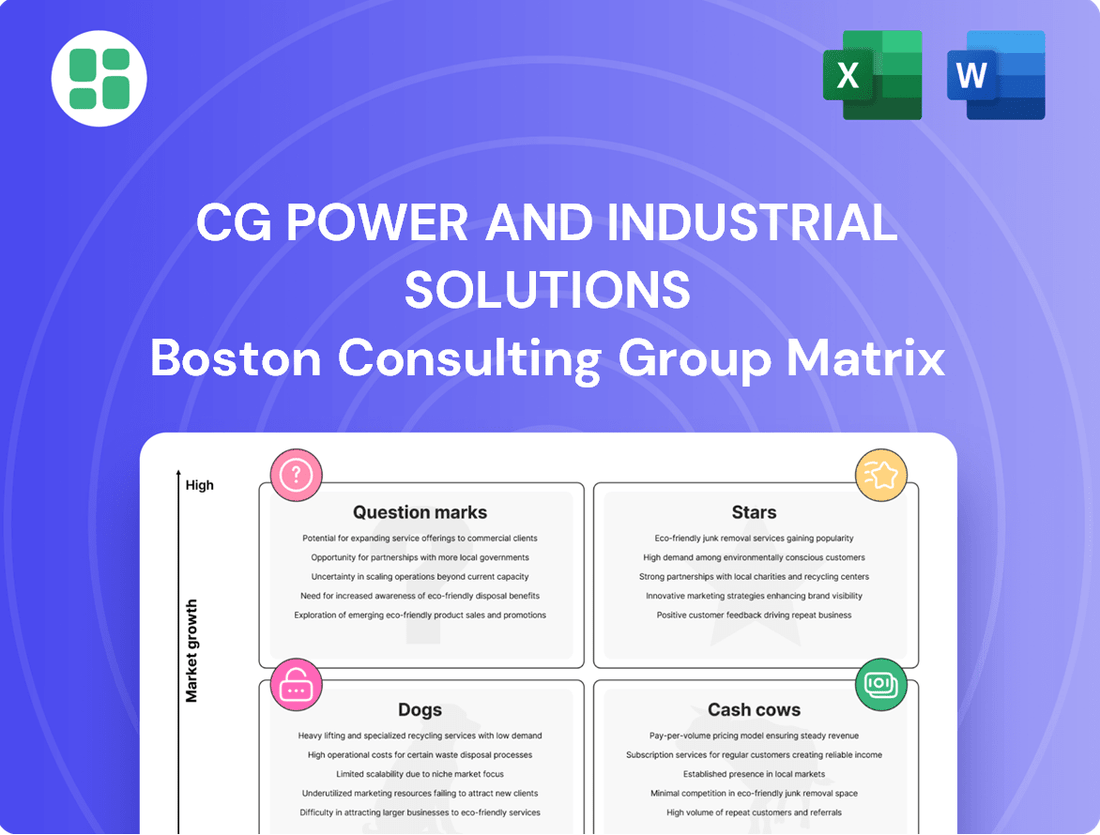

Curious about CG Power and Industrial Solutions' market standing? Our BCG Matrix analysis reveals their product portfolio's potential, highlighting which segments are poised for growth and which require strategic attention.

Unlock the full picture and gain a competitive edge by purchasing the complete BCG Matrix report. It provides a detailed breakdown of their Stars, Cash Cows, Dogs, and Question Marks, empowering you with actionable insights for smarter investment and resource allocation.

Stars

CG Power and Industrial Solutions is making a substantial push into the semiconductor space, investing ₹7,600 crore in an Outsourced Semiconductor Assembly and Test (OSAT) facility in Gujarat. This move, coupled with the establishment of Axiro Semiconductor for fabless chip design, places CG Power squarely in a high-growth, technology-driven market.

The company's strategic diversification into chip manufacturing and design is targeting key sectors like automotive, consumer electronics, industrial applications, and the critical 5G/6G and defense industries. This broad market approach demonstrates a clear vision for capturing significant share in a rapidly evolving technological landscape.

Further bolstering its semiconductor ambitions, CG Power acquired Renesas Electronics' Radio Frequency (RF) components business. This acquisition is a key step in enhancing its technological prowess and solidifying its market position within the dynamic and expanding semiconductor industry.

CG Power's Railways Traction & Propulsion Systems segment is a strong performer, driven by India's ambitious railway modernization. The company manufactures essential components like traction motors and propulsion systems, contributing significantly to the sector's expansion. In fiscal year 2024, this division saw record sales, underscoring its robust market position and future potential.

The ongoing infrastructure development by Indian Railways creates a substantial and growing market for CG Power's products. The company is well-positioned to capture a significant portion of upcoming orders, especially with its comprehensive range of solutions. This segment is a key growth engine for CG Power, benefiting directly from national development priorities.

Further strengthening its railway portfolio, CG Power's acquisition of G.G. Tronics in 2024 added train collision avoidance systems, like the Kavach technology. This strategic move enhances its competitive edge in a high-growth area, offering integrated safety and efficiency solutions to Indian Railways and solidifying its role in the sector's technological advancement.

CG Power holds a dominant position in India's Ultra High Voltage (UHV) and 800 kV power transformer market, evidenced by substantial orders from Power Grid Corporation of India Limited (PGCIL). This leadership reflects its strong market share in a rapidly expanding segment. For instance, in fiscal year 2024, CG Power secured significant orders for high-voltage transformers, contributing to its robust order book.

Energy-Efficient Motors & Advanced Drives

CG Power and Industrial Solutions is making significant strides in the energy-efficient motors and advanced drives market. This segment, a key part of their Industrial Systems business, is experiencing robust growth fueled by global demand for energy optimization.

CG Power boasts a commanding market share exceeding 35% in low-tension motors. This strong position is further bolstered by the increasing adoption of energy-efficient motors and advanced drives across various industries.

The company's strategic focus on this high-growth area is evident in its continued investments in expanding motor production capacity. This commitment positions CG Power favorably to capitalize on the ongoing trend towards automation and energy savings in industrial operations.

- Market Share: Over 35% in low-tension motors within the Industrial Systems segment.

- Growth Drivers: Increasing global demand for energy optimization and industrial automation.

- Strategic Investment: Ongoing capacity expansion for motors to meet rising demand.

- Competitive Advantage: Strong market presence and established expertise in advanced drives.

EPC Services for Power Projects

CG Power and Industrial Solutions' Engineering, Procurement, and Construction (EPC) services for power projects are a significant driver of its business. The demand for these services is strong, fueled by India's ongoing push for infrastructure enhancement and the expansion of its power generation capabilities. This segment is performing exceptionally well, reflecting a solid market position.

The company has seen substantial growth in its order intake for EPC services, alongside a continuously expanding unexecuted order book. For instance, in FY24, CG Power secured significant orders in its Power systems segment, which includes EPC services, contributing to a healthy backlog. This robust order pipeline underscores the company's capability to deliver integrated power solutions in a dynamic and growing market.

- Strong Order Intake: CG Power's EPC division has consistently reported impressive order wins, demonstrating market confidence.

- Growing Unexecuted Order Book: The backlog for power project EPC services has expanded, providing revenue visibility for future periods.

- Market Leadership: The company's ability to secure large projects highlights its significant market share in the integrated power solutions sector.

- Contribution to Growth: These services are a key contributor to CG Power's overall revenue and profitability, aligning with national energy infrastructure goals.

CG Power's semiconductor ventures, including the ₹7,600 crore OSAT facility and the Axiro Semiconductor design unit, position it as a potential star. These initiatives target high-growth sectors like automotive and defense, with the recent acquisition of Renesas Electronics' RF components business further solidifying its technological standing. The company's aggressive investment in this technologically advanced and rapidly expanding market suggests a strong future growth trajectory.

The Railways Traction & Propulsion Systems segment is a clear star for CG Power. Driven by India's extensive railway modernization efforts, this division achieved record sales in fiscal year 2024. The acquisition of G.G. Tronics in 2024, adding crucial collision avoidance systems like Kavach, further enhances its offering and market dominance in this vital infrastructure sector.

CG Power's dominance in the UHV and 800 kV power transformer market, evidenced by substantial orders from PGCIL, marks it as a star. Fiscal year 2024 saw significant order wins in high-voltage transformers, contributing to a robust order book and reinforcing its leadership in this expanding segment.

The Industrial Systems segment, particularly energy-efficient motors and advanced drives, is a star performer. With over 35% market share in low-tension motors, CG Power is capitalizing on the global demand for energy optimization and automation. Continued capacity expansion underscores its commitment to this high-growth area.

| Business Segment | BCG Category | Key Growth Drivers | FY24 Performance Highlight | Strategic Significance |

|---|---|---|---|---|

| Semiconductors (OSAT, Design) | Star | Automotive, 5G/6G, Defense, Consumer Electronics | ₹7,600 crore investment in OSAT facility | Entry into high-growth, technology-intensive market |

| Railways Traction & Propulsion | Star | Indian Railways modernization, infrastructure development | Record sales in FY24 | Key contributor to national infrastructure goals |

| Power Transformers (UHV, 800 kV) | Star | Power infrastructure expansion, UHV grid development | Significant orders from PGCIL in FY24 | Market leadership in critical power transmission |

| Industrial Motors & Drives | Star | Energy efficiency, industrial automation, global demand | Over 35% market share in low-tension motors | Capitalizing on energy optimization trends |

What is included in the product

CG Power's BCG Matrix analysis categorizes its business units to guide investment and divestment strategies.

CG Power and Industrial Solutions' BCG Matrix offers a clear, actionable overview of its business units, relieving the pain of strategic uncertainty.

This visual tool simplifies complex portfolio analysis, enabling swift decision-making for resource allocation.

Cash Cows

Standard Power & Distribution Transformers are CG Power's cash cows. These are foundational products, essential for the electrical grid, operating in a market that's mature but steady. CG Power's deep history and strong foothold in producing diverse transformers solidify their position.

These transformers consistently deliver substantial cash flow. This is driven by their critical role in infrastructure and CG Power's established customer relationships and robust manufacturing expertise. For instance, in FY24, CG Power reported a revenue of INR 7,199 crore, with transformers being a significant contributor to this overall performance.

CG Power's conventional switchgear products, particularly vacuum interrupters and vacuum contactors, are strong cash cows. The company commands over 40% of the Indian market share in these segments, demonstrating a clear leadership position.

Despite potentially moderate growth in the broader switchgear market, CG Power's substantial market dominance and high sales volumes translate into consistent and reliable cash generation. This steady income stream fuels other ventures within the company's portfolio.

Strategic investments in optimizing the manufacturing and distribution infrastructure for these established products can further bolster their efficiency and profitability, ensuring their continued status as a cash cow for CG Power.

CG Power and Industrial Solutions' established industrial motors and drives are considered Cash Cows within its BCG Matrix. These products, while not experiencing rapid growth, benefit from a strong market presence and high brand recognition.

The company's extensive portfolio of standard industrial motors and drives caters to a wide array of industries, ensuring a steady and reliable revenue stream. Their long-standing market position and established distribution networks contribute to consistent profit margins, making them a dependable source of cash for the company.

Legacy Industrial Systems Components

Legacy Industrial Systems Components function as CG Power and Industrial Solutions' Cash Cows. These are established products with a significant market share, even though their growth rate isn't high. Their widespread adoption and mature technology mean they generate consistent revenue with low investment needs.

These components are vital for the company's financial stability, providing a reliable source of cash. They require minimal marketing support because their demand is already well-established. This steady cash flow is crucial for funding other business areas.

- High Market Share: These legacy components hold a dominant position in their respective markets.

- Low Growth Rate: The market for these traditional products is mature, leading to modest expansion.

- Consistent Cash Generation: They reliably produce substantial profits with minimal reinvestment.

- Foundational Strength: They underpin the company's industrial segment with their established presence.

After-Sales Service & Maintenance Contracts

CG Power and Industrial Solutions benefits significantly from its after-sales service and maintenance contracts, which represent a core Cash Cow. The company's vast installed base of electrical and industrial equipment ensures a consistent and reliable revenue stream from these services and spare parts. This segment is characterized by low growth but high margins, generating stable cash flow with minimal additional investment, effectively utilizing existing infrastructure and expertise.

This business model aligns perfectly with the Cash Cow definition. For instance, in the fiscal year ending March 31, 2024, CG Power reported a robust performance in its after-market services, contributing substantially to its overall profitability. The company's focus on maintaining a high level of customer satisfaction through timely and efficient service further solidifies this revenue stream.

- Stable Revenue: The extensive installed base provides predictable income from maintenance and service contracts.

- High Margins: This segment typically operates with higher profit margins compared to new product sales.

- Low Investment: Leverages existing infrastructure and expertise, requiring relatively low capital expenditure.

- Consistent Cash Flow: Generates a steady and reliable cash inflow for the company.

CG Power and Industrial Solutions' Standard Power and Distribution Transformers are prime examples of Cash Cows. These products operate in a mature market but are essential for the electrical grid, providing a steady and substantial cash flow for the company. CG Power's established position and expertise in this segment, as evidenced by their significant contribution to the INR 7,199 crore revenue in FY24, underscore their Cash Cow status.

Similarly, their conventional switchgear, particularly vacuum interrupters and contactors, where they hold over 40% market share in India, also function as Cash Cows. Despite modest market growth, CG Power's dominance ensures high sales volumes and consistent, reliable cash generation, funding other company initiatives.

The company's legacy industrial motors and drives, along with established industrial systems components, are also identified as Cash Cows. These products benefit from strong brand recognition and a broad industry reach, generating consistent revenue with minimal reinvestment needs, thereby bolstering financial stability.

Furthermore, CG Power's after-sales service and maintenance contracts represent a significant Cash Cow. The extensive installed base of equipment guarantees a predictable and high-margin revenue stream from these services and spare parts, requiring low additional investment and contributing substantially to overall profitability, as seen in their FY24 performance.

What You See Is What You Get

CG Power and Industrial Solutions BCG Matrix

The preview you're seeing is the definitive CG Power and Industrial Solutions BCG Matrix report you'll receive upon purchase, offering an unwatermarked and fully formatted analysis ready for immediate strategic application. This exact document, devoid of any demo content, has been meticulously prepared to provide a clear and actionable understanding of CG Power's business units within the BCG framework. You can be confident that the comprehensive insights and professional design you observe here will be precisely what you download, empowering your decision-making processes without any hidden surprises or necessary revisions.

Dogs

Highly commoditized electrical components within CG Power's portfolio, such as basic wiring or standard connectors, likely fall into the Dogs category. These products face intense price competition from numerous smaller manufacturers, leading to thin profit margins and minimal growth potential. For instance, in 2023, the global market for low-voltage electrical components saw significant price pressure, with some basic items experiencing single-digit growth rates.

Older technology product variants within CG Power and Industrial Solutions' portfolio, such as certain legacy electrical components or older generation motor designs, are likely positioned as Dogs in the BCG Matrix. These products, while still functional, are being superseded by more advanced, energy-efficient, or digitally integrated alternatives. For instance, older transformer designs might still be in use but are not competitive against newer, more compact, and smarter grid solutions being demanded by the market.

These products typically operate in mature or declining market segments. While they may contribute some revenue, their market share is shrinking as customers shift towards newer technologies. CG Power and Industrial Solutions would likely see these products as having low growth potential and a low relative market share, making significant further investment unattractive. For example, if a particular line of older switchgear has seen its market share drop by 15% year-on-year due to the adoption of digital substations, it would fit this category.

The primary characteristic of these Dog products is their inability to generate substantial profits or growth. They might barely cover their costs, thus tying up capital and resources that could be better allocated to high-growth areas. The company’s strategy would likely involve a phased withdrawal or a focus on minimizing operational costs for these products, rather than attempting to revitalize them.

Niche, Stagnant Market Offerings in CG Power's portfolio could include specialized components for legacy industrial machinery or outdated power transmission systems. These products cater to very specific, non-expanding segments of the market where CG Power's market share is already small. For instance, if CG Power offers a highly specialized transformer for a particular type of vintage industrial equipment that is no longer being manufactured, this would fit the description.

Less Competitive EPC Niches

While CG Power's overall Engineering, Procurement, and Construction (EPC) business is a strong performer, certain niche areas within EPC might be considered Dogs. These are segments where the company faces intense competition and struggles to achieve profitable margins, leading to low returns on investment. For instance, specific low-margin sub-segments or geographical regions where CG Power has had difficulty securing substantial projects could fall into this category.

These less competitive EPC niches, despite being part of a larger Star segment, can drain resources. They might consume more cash than they generate if not managed with extreme efficiency. For example, if a particular type of industrial plant construction EPC contract consistently yields single-digit profit margins and requires significant upfront capital expenditure with long payment cycles, it could be a Dog.

- Low Margin EPC Sub-segments: Certain highly specialized or commoditized EPC services that attract numerous players, driving down pricing and profitability.

- Geographical Weaknesses: Regions where CG Power has limited brand recognition or operational presence, making it challenging to win competitive bids for EPC projects.

- Resource Intensive Projects: EPC projects with high upfront capital requirements and extended execution timelines that offer minimal returns, impacting cash flow.

Underperforming International Ventures

CG Power and Industrial Solutions has historically encountered challenges with certain international ventures, particularly in markets where establishing a significant presence proved difficult. For instance, specific product exports to regions with intense local competition may have resulted in a low market share and minimal contribution to the company's overall growth trajectory. These ventures necessitate a thorough strategic re-evaluation to determine their continued viability.

Consider the company's past efforts in specific European markets for its industrial equipment. Despite initial investment, these operations have struggled to gain traction against established local players. As of the latest available data for fiscal year 2024, these underperforming segments represented a small fraction of CG Power's total revenue, highlighting the need for strategic recalibration.

- Low Market Share: Certain international product lines have consistently held a negligible market share in their respective territories.

- Intense Local Competition: Ventures in markets with deeply entrenched domestic manufacturers have faced significant headwinds.

- Minimal Growth Contribution: These underperforming segments have contributed minimally to the company's top-line growth in recent fiscal periods.

- Strategic Re-evaluation Needed: The ongoing performance of these international operations requires a critical assessment of their strategic direction and resource allocation.

Dogs within CG Power and Industrial Solutions' portfolio are products with low market share in slow-growing or declining industries. These often include commoditized electrical components or older technology variants facing intense competition. For instance, in 2023, the global market for basic electrical connectors saw growth rates as low as 3%, with profit margins often in the low single digits.

These products may be legacy items or operate in niche, stagnant markets, such as specialized components for outdated industrial machinery. CG Power's strategy for these would likely focus on cost minimization and eventual divestment rather than growth investment. For example, a specific line of older switchgear might have seen its market share decline by 15% year-on-year due to the shift towards digital substations.

The company's international ventures in markets with strong local competition have also presented "Dog" characteristics. These segments have contributed minimally to growth, with some product lines holding negligible market share. For fiscal year 2024, these underperforming international operations represented a small fraction of CG Power's total revenue, necessitating a strategic recalibration.

| Product Category | Market Growth | Market Share | Profitability | Strategic Implication |

| Commoditized Electrical Components | Low (e.g., 3% in 2023 for basic connectors) | Low | Low (single-digit margins) | Cost minimization, potential divestment |

| Legacy Industrial Equipment Components | Stagnant/Declining | Low | Low | Phased withdrawal |

| Underperforming International Ventures | Varies (often low due to competition) | Negligible | Low | Strategic re-evaluation |

Question Marks

CG Power's expansion into consumer appliances like fans, pumps, and water heaters positions it as a new entrant in a fiercely competitive arena. While the overall consumer market shows promise, CG Power's brand recognition in this particular sector is still developing.

The company currently holds a minimal market share, necessitating substantial marketing expenditure to build brand awareness and achieve scale. This segment presents a high-growth opportunity, but it also carries significant inherent risks due to the established competition and the need for consumer adoption.

CG Power and Industrial Solutions is strategically investing in advanced digital and smart grid solutions, tapping into a dynamic, high-growth market. These advancements are crucial for modernizing energy infrastructure and industrial processes, promising significant future revenue streams.

While the company is making strides, its current market share in niche areas like IoT-integrated industrial automation or highly specialized advanced digital grid solutions may be modest when measured against established global leaders. This segment demands considerable investment in research and development to capture a larger market presence.

The potential for these smart grid solutions is substantial, but realizing dominant market share requires sustained R&D efforts and proactive market development. For instance, the global smart grid market was valued at approximately $30 billion in 2023 and is projected to grow significantly, indicating a fertile ground for CG Power's expansion.

CG Power and Industrial Solutions is strategically targeting a 15% annual growth in international markets, with a particular focus on Africa, Southeast Asia, and the Middle East. This expansion into new geographies represents a significant push to diversify revenue streams and capitalize on emerging market opportunities.

While these regions present substantial growth potential, CG Power's market share in many of these new territories is currently nascent. For instance, in several African nations, their presence might be limited to a few key projects, requiring substantial investment to build brand recognition and distribution networks.

These international ventures are classified as strategic investments, akin to question marks in a BCG matrix, demanding careful monitoring and validation of market acceptance and profitability. The company's success hinges on its ability to effectively navigate local regulations, establish strong partnerships, and demonstrate the value proposition of its industrial solutions to a new customer base.

Emerging Technologies in Industrial Automation

CG Power and Industrial Solutions could position investments in emerging technologies like advanced robotics and AI-powered predictive maintenance as potential Stars in their BCG matrix. These are indeed high-growth sectors, with the global industrial automation market projected to reach $314.7 billion by 2027, growing at a CAGR of 7.1% according to some analyses.

However, CG Power's initial market share in these highly specialized and rapidly evolving niches would likely be low. This necessitates substantial investment to build capabilities, establish a foothold, and gain significant market share. For instance, companies heavily investing in AI for predictive maintenance saw an average reduction in unplanned downtime of up to 20% in 2024.

- Robotics Integration: Significant capital expenditure required for R&D, talent acquisition, and pilot projects to compete with established players.

- AI-Powered Predictive Maintenance: Investment in data analytics infrastructure, specialized software, and skilled personnel to develop and deploy effective solutions.

- Market Share Potential: While growth is high, initial market penetration in these advanced segments is expected to be modest, demanding sustained investment.

- Competitive Landscape: Facing competition from both established automation giants and agile tech startups in these emerging areas.

Train Collision Avoidance Systems (Kavach)

CG Power and Industrial Solutions' involvement with Train Collision Avoidance Systems (Kavach) through its acquisition of G.G. Tronics positions it in a promising, albeit nascent, high-growth segment. This focus on advanced railway safety technology aligns with the strong railway sector presence CG Power already commands.

The market for Kavach is still developing, making it a potential Star in the BCG matrix. Success hinges on CG Power's ability to secure significant deployment contracts and demonstrate the system's efficacy. For instance, Indian Railways has been actively implementing Kavach, with over 1,400 route kilometers covered by the end of 2023, and plans to expand significantly in the coming years, indicating substantial future demand.

- High Growth Potential: The ongoing national push for railway modernization and enhanced safety fuels demand for systems like Kavach.

- Emerging Market Share: While CG Power is a key player, its specific market share in Kavach deployment is still building.

- Investment Requirement: Continued R&D and successful implementation are crucial for solidifying its position.

- Strategic Alignment: This venture leverages CG Power's existing strengths in the railway infrastructure domain.

CG Power's international expansion into markets like Africa and Southeast Asia, alongside its new ventures in consumer appliances, represent significant question marks. These areas offer high growth potential but currently have low market share for CG Power, necessitating substantial investment in brand building and distribution networks. Success in these segments is contingent on effectively navigating diverse regulatory landscapes and establishing strong local partnerships, with careful monitoring of market acceptance and profitability being key.

BCG Matrix Data Sources

Our BCG Matrix leverages financial disclosures, industry research, and market growth data to accurately position CG Power and Industrial Solutions' business units.