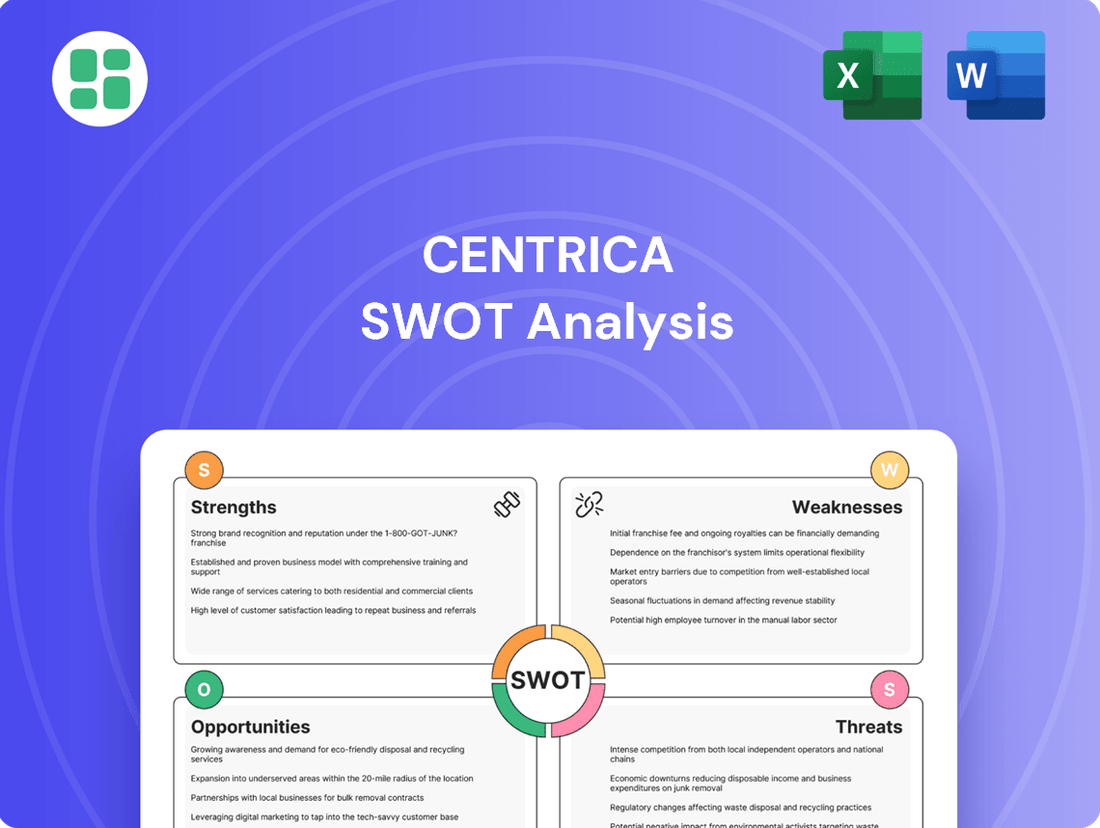

Centrica SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Centrica Bundle

Centrica, a titan in the energy sector, navigates a dynamic landscape, leveraging its established brand and diversified services. However, it faces significant challenges from evolving market demands and increasing competition.

Want the full story behind Centrica’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Centrica benefits from highly recognized and trusted brands like British Gas in the UK and Bord Gáis Energy in Ireland, serving a substantial customer base. This established brand presence and market share, particularly in residential energy supply and services, provide a significant competitive advantage and foster customer loyalty.

The company's British Gas residential arm remains one of the largest energy suppliers in the UK as of early 2024, a testament to its enduring market position. This strong brand equity translates into consistent customer acquisition and retention, underpinning its revenue streams.

Centrica's strength lies in its diversified business model, spanning energy supply, services, and trading. This integration allows for effective commodity risk management and energy optimization services.

The company's diverse portfolio of contracted physical positions enables it to capitalize on various stages of the energy value chain and navigate market shifts adeptly. For instance, the British Gas Services & Solutions segment reported enhanced financial performance in 2024, driven by improved customer retention and stringent cost management.

Centrica's commitment to the energy transition is a significant strength, with a clear strategy to achieve net-zero by 2040 and supply 100% renewable or zero-carbon power to UK and Ireland customers by 2030. This proactive approach aligns with global sustainability goals and positions the company favorably in a rapidly evolving market.

The company's investment plans underscore this commitment, with over 50% of capital expenditure from 2023 to 2028 earmarked for green initiatives. These investments span critical areas like nuclear power, hydrogen storage, battery storage, and solar PV, demonstrating a diversified and substantial push towards a sustainable energy future.

Operational Excellence and Customer Service Improvements

Centrica is making significant strides in operational excellence and customer service. In 2024, British Gas Services & Solutions reported a notable increase in its engineer Net Promoter Score (NPS), alongside a reduction in complaints per customer. This focus on customer experience is a key strength.

The strategic acquisition of ENSEK in 2024 is a prime example of Centrica’s commitment to digital transformation. This move is facilitating the migration of residential customers to a more efficient, digital-first platform. Such a transition is expected to yield cost reductions and bolster customer retention rates.

These operational improvements and digital advancements are crucial for Centrica's competitive positioning. The company's proactive approach to enhancing customer satisfaction, evidenced by rising NPS and falling complaint ratios, directly supports its service-oriented business model.

Key metrics demonstrating these strengths include:

- Improved Customer Satisfaction: Rising engineer Net Promoter Score (NPS) in 2024 for British Gas Services & Solutions.

- Reduced Customer Issues: A decrease in complaints per customer reported in 2024.

- Digital Migration: The 2024 acquisition of ENSEK enabling a digital-first platform for residential customers.

- Enhanced Efficiency: Expected cost reductions and improved retention through digital platform adoption.

Robust Financial Position and Shareholder Returns

Centrica has maintained a robust financial position, even amidst market fluctuations. This resilience is underscored by a strong net cash balance and a commitment to rewarding shareholders. For instance, the company announced a significant increase in its full-year 2024 dividend and plans further growth for its 2025 dividend, complemented by an active share buyback program.

This financial health not only offers stability but also equips Centrica with the capacity for strategic investments and operational enhancements.

- Strong Net Cash Position: Centrica's financial statements consistently show a healthy net cash balance, providing operational flexibility.

- Dividend Growth: The company has committed to increasing its dividend, with a notable rise announced for 2024 and further planned for 2025.

- Share Buybacks: An ongoing share repurchase program demonstrates confidence in the company's valuation and aims to boost shareholder value.

Centrica's established brands, particularly British Gas, provide a significant competitive edge, serving a vast customer base in the UK and Ireland. This strong market presence translates into consistent revenue and customer loyalty, bolstered by operational improvements like a rising engineer Net Promoter Score in 2024.

The company's diversified business model, encompassing energy supply, services, and trading, allows for effective risk management and revenue optimization. Strategic acquisitions, such as ENSEK in 2024, are driving digital transformation, aiming for cost reductions and enhanced customer retention.

Centrica's commitment to the energy transition is a key strength, with substantial investments in green initiatives and a net-zero target by 2040. This forward-looking strategy positions the company well for future market demands.

Financially, Centrica demonstrates resilience with a strong net cash position. The company's commitment to shareholder returns is evident in its increased 2024 dividend and planned 2025 growth, alongside an active share buyback program.

| Metric | 2024 Performance | Significance |

|---|---|---|

| Engineer NPS (British Gas Services & Solutions) | Increased | Improved customer service and operational efficiency |

| Complaints per customer | Decreased | Enhanced customer experience |

| Capital Expenditure on Green Initiatives | >50% (2023-2028) | Commitment to energy transition and sustainability |

| Dividend | Increased for 2024, planned growth for 2025 | Strong financial health and shareholder value |

What is included in the product

Delivers a strategic overview of Centrica’s internal and external business factors, highlighting its strengths in energy supply and operational efficiency, while acknowledging weaknesses in its retail margins and opportunities in the net-zero transition, alongside threats from market volatility and regulatory changes.

Uncovers critical vulnerabilities and untapped opportunities within Centrica's operations, enabling proactive risk mitigation and strategic advantage.

Weaknesses

Centrica's earnings are significantly impacted by the inherent volatility of global wholesale energy prices. While the company's trading division actively manages these risks, its profitability is still directly tied to these fluctuating market conditions.

For instance, the normalization of market prices in 2024, which saw a decrease in both prices and volatility compared to the previous year, directly resulted in lower gross and operating profits for Centrica Energy Trading. This downturn in its trading segment consequently affected the group's overall earnings for the period.

Centrica faces considerable regulatory headwinds, particularly from Ofgem's energy price cap. This cap directly influences the profitability of its retail division, British Gas. For instance, the unwinding of energy crisis allowance payments in 2024 contributed to a notable downturn in household supply earnings for the company.

Centrica's gas storage operations, notably the Rough facility, are encountering headwinds due to compressed summer-winter gas price differentials. This squeeze on price spreads directly diminishes the profitability of the traditional gas storage model, making it less attractive to inject gas during warmer months and withdraw it during colder periods, as the margin for profit shrinks considerably.

The economic viability of gas storage is further threatened by the narrow price spreads, which in 2024 and projected into 2025, have been observed to be significantly tighter than in previous years. This trend directly impacts the core profitability driver for storage services, creating a need for alternative revenue streams or enhanced operational efficiencies to maintain financial health.

Securing future government support or successfully transitioning Rough to hydrogen storage are critical factors for Centrica's storage segment. Without these strategic shifts, the business faces continued profitability challenges, as the current market conditions for gas storage alone may not be sufficient to generate adequate returns, especially given the ongoing energy transition.

Customer Losses in a Competitive Market

Centrica's retail division faced a notable challenge in the first half of 2025, reporting customer losses despite growth in other areas. This decline underscores the intense pressure within the UK energy market. A significant portion of households, estimated to be around 20% annually, switch energy providers, creating a constant churn that Centrica must navigate.

The competitive landscape is fierce, with numerous new entrants and established players offering aggressive pricing and innovative packages. This dynamic environment makes customer retention a critical weakness for Centrica, as evidenced by the first-half 2025 figures. The company must continually adapt its strategies to counter the allure of competitor offerings and maintain its market share.

- Customer Churn: Approximately 20% of UK households switch energy suppliers each year, a persistent challenge for Centrica.

- Competitive Pressure: New market entrants and aggressive pricing from rivals intensified the struggle to retain customers in early 2025.

- Retail Segment Decline: Centrica reported customer losses in its retail segment during the first half of 2025, highlighting a key area of weakness.

Dependence on Aging Infrastructure and Transition Costs

Centrica's reliance on aging infrastructure presents a significant challenge. While the company is investing in new low-carbon assets, a substantial portion of its operations still depends on older facilities, including nuclear power stations. These existing assets may require costly life extensions and ongoing significant investment to remain operational and compliant with evolving environmental standards.

The necessary transition to a greener energy system also introduces considerable financial strain. Centrica faces substantial capital expenditure requirements for developing and implementing new technologies and infrastructure. This transition, while strategic, represents a financial burden and a complex undertaking to manage effectively, impacting near-term profitability.

- Infrastructure Reliance: Centrica's continued dependence on older infrastructure, such as its nuclear fleet, necessitates ongoing investment for maintenance and potential life extensions.

- Transition Costs: The shift towards low-carbon energy sources requires significant capital outlay for new technologies and infrastructure development, posing a financial challenge.

- Asset Management Complexity: Managing the lifecycle of both aging and new energy assets adds layers of operational and financial complexity for the company.

Centrica's profitability is highly sensitive to fluctuations in global wholesale energy prices, as seen in 2024 when normalized prices led to lower earnings for its trading division. The company also faces regulatory pressures, like Ofgem's energy price cap, which directly impacts the profitability of its retail arm, British Gas. For example, the unwinding of energy crisis allowance payments in 2024 negatively affected household supply earnings.

Furthermore, compressed summer-winter gas price differentials in 2024 and projected for 2025 significantly reduce the profitability of Centrica's gas storage operations, particularly the Rough facility, making the traditional storage model less attractive. The retail segment also experienced customer losses in the first half of 2025 due to intense competition and customer churn, with around 20% of UK households switching providers annually.

Centrica's reliance on aging infrastructure, including its nuclear fleet, necessitates substantial ongoing investment for maintenance and potential life extensions. The transition to a greener energy system also demands significant capital expenditure for new technologies and infrastructure, creating a financial burden.

| Segment | Key Weakness | Impact/Data Point |

|---|---|---|

| Energy Trading | Price Volatility | Lower gross and operating profits in 2024 due to normalized market prices. |

| Retail (British Gas) | Regulatory Price Cap & Competition | Downturn in household supply earnings in 2024; customer losses in H1 2025 due to ~20% annual churn. |

| Gas Storage | Compressed Price Differentials | Reduced profitability for Rough facility in 2024/2025 due to tighter summer-winter spreads. |

| Infrastructure | Aging Assets & Transition Costs | Need for costly maintenance/life extensions on older facilities; significant CAPEX for low-carbon transition. |

What You See Is What You Get

Centrica SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You'll gain a comprehensive understanding of Centrica's Strengths, Weaknesses, Opportunities, and Threats, enabling informed strategic decisions.

The content below is pulled directly from the final SWOT analysis. Unlock the full report when you purchase to delve deeper into each section and uncover actionable insights for Centrica's future growth and stability.

Opportunities

The intensifying global and national drive towards net-zero emissions creates a substantial avenue for Centrica to bolster its green investments. This encompasses advancing renewable energy generation, developing innovative clean energy storage such as liquid air energy storage, and investigating promising sectors like hydrogen and carbon capture technologies, all of which align with government climate targets and the burgeoning demand for sustainable energy solutions.

The burgeoning smart home market presents a significant opportunity for Centrica. As consumers increasingly seek ways to manage their energy use and reduce costs, smart home technologies are seeing rapid adoption. This trend is fueled by a growing awareness of climate change and the desire for greater control over household expenses.

Centrica is well-positioned to capitalize on this growth, leveraging its established smart meter infrastructure and its Hive brand, a leader in smart home energy management. The company's expansion into heat pumps further aligns with the demand for energy efficiency solutions, offering customers a pathway to lower carbon emissions and reduced energy bills. For instance, the UK government's Boiler Upgrade Scheme, which offers grants for heat pump installations, is expected to drive significant demand in the coming years.

Centrica is well-positioned to capitalize on the expanding market for energy services and solutions, moving beyond traditional energy supply. This presents a significant opportunity for growth in areas like boiler servicing, smart home technology installation, and electric vehicle charging infrastructure. For instance, the UK's smart meter rollout, aiming for 100% coverage by 2025, creates a foundation for enhanced home energy management services.

By deepening its offerings in these service sectors, Centrica can cultivate new revenue streams and foster stronger, more loyal customer relationships. The company's existing customer base provides a ready market for these value-added services, potentially increasing customer lifetime value and reducing churn. In 2023, Centrica's Consumer division saw adjusted operating profit rise significantly, partly driven by increased service and maintenance revenues.

Leveraging Data and Digitalisation for Operational Efficiency

Centrica's ongoing investment in data analytics and digital transformation presents a significant opportunity to streamline operations. By enhancing these capabilities, the company can achieve greater efficiency and improve customer interactions. For instance, the successful onboarding of millions of residential customers onto digital platforms in 2023 highlights this potential, with further optimization expected through AI-powered energy trading.

The company's focus on digital platforms and AI for energy balancing is a key area for growth. This strategy can lead to more sophisticated trading operations and improved resource allocation. Centrica's commitment to this digital-first approach is expected to yield substantial operational benefits as they continue to integrate advanced analytical frameworks.

- Enhanced Customer Experience: Digital platforms facilitate more personalized and efficient customer service.

- Optimized Trading: AI-driven energy balancing improves trading accuracy and profitability.

- Cost Reduction: Automation and data-driven insights can lower operational expenditures.

- Scalability: Digital infrastructure allows for easier expansion and adaptation to market changes.

Strategic Partnerships and International Expansion in Green Energy

Centrica's strategic partnerships are a key avenue for growth in the green energy space. For instance, its investment in Highview Power, a leader in liquid air energy storage, provides access to cutting-edge technology and bolsters its presence in the burgeoning clean energy sector. This move aligns with the global trend towards advanced energy storage solutions, a market projected to reach over $100 billion by 2030.

Expanding beyond its established markets in the UK and Ireland presents significant opportunities for Centrica. By venturing into global green energy markets, the company can diversify its revenue streams and tap into new growth potentials. For example, the renewable energy sector in North America and Europe saw substantial investment in 2024, with offshore wind and solar projects attracting billions. Centrica's strategic expansion could leverage these trends.

- Strategic Investment: Centrica's investment in Highview Power's liquid air energy storage technology enhances its capabilities in grid-scale energy solutions.

- Market Diversification: Exploring international green energy markets can reduce reliance on specific regions and capture global demand for decarbonization solutions.

- Technological Access: Partnerships provide a pathway to acquire or co-develop innovative technologies crucial for the energy transition.

Centrica is poised to benefit from the increasing demand for distributed energy solutions and energy efficiency services, leveraging its smart meter infrastructure and Hive brand. The company's expansion into heat pumps, supported by government incentives like the UK's Boiler Upgrade Scheme, taps into a growing market for low-carbon home heating. Furthermore, Centrica's digital transformation and AI investments are set to enhance operational efficiency and trading capabilities, as evidenced by the significant increase in adjusted operating profit in its Consumer division in 2023, partly due to higher service and maintenance revenues.

| Opportunity Area | Key Driver | Centrica's Position/Action | Market Data/Projection |

|---|---|---|---|

| Green Energy Investments | Net-zero drive, demand for renewables | Investing in renewables, clean storage (e.g., Highview Power), hydrogen, carbon capture | Global clean energy market projected to exceed $100 billion by 2030. |

| Smart Home Market | Consumer demand for cost/energy management | Leveraging smart meter infrastructure, Hive brand, expanding into heat pumps | UK smart meter rollout aiming for 100% coverage by 2025. |

| Energy Services & Solutions | Shift beyond traditional supply | Expanding boiler servicing, smart home installation, EV charging infrastructure | UK government targets for EV adoption driving charging infrastructure demand. |

| Digital Transformation & AI | Operational efficiency, improved customer interaction | Investing in data analytics, AI for energy balancing, digital platforms | Successful onboarding of millions of residential customers onto digital platforms in 2023. |

Threats

The UK and Irish energy markets are intensely competitive, featuring a mix of legacy providers and agile new entrants. This dynamic environment, characterized by high customer switching rates, directly challenges Centrica's established market position. For instance, Ofgem data frequently shows millions of customers switching suppliers annually, putting downward pressure on Centrica's market share and its ability to maintain pricing power in its core energy supply segments.

The global geopolitical landscape continues to present a significant threat, with ongoing conflicts and shifting international relations capable of causing substantial volatility in energy markets. While wholesale energy prices have shown signs of normalization in 2024, the underlying risk of future price shocks and supply interruptions persists. These disruptions can directly impact Centrica's procurement costs for energy commodities and affect the stability of its operational supply chains, potentially leading to increased expenses and operational challenges.

Centrica faces significant challenges from the UK's dynamic regulatory landscape. Ongoing reviews of electricity market arrangements, known as REMA, alongside the implementation of new policies like the Carbon Border Adjustment Mechanism (CBAM) and evolving planning rules for renewable energy projects, introduce considerable uncertainty.

These shifts necessitate continuous strategic adaptation to ensure compliance, potentially leading to substantial costs and influencing key investment decisions for Centrica as it navigates these evolving frameworks.

Cybersecurity Risks and Data Privacy Concerns

As an energy services firm deeply integrated with digital systems and customer information, Centrica is exposed to significant cybersecurity threats and data privacy issues. A successful cyberattack could disrupt operations, result in financial penalties, and severely damage its reputation, eroding customer confidence and potentially leading to regulatory sanctions.

The increasing sophistication of cyber threats poses a constant challenge. For instance, the global cost of cybercrime was projected to reach $10.5 trillion annually by 2025, highlighting the scale of the risk. Centrica's reliance on smart meter data and online customer portals makes it a potential target for data theft or service disruption.

- Operational Disruption: Ransomware attacks or denial-of-service incidents could halt essential services, impacting millions of customers.

- Financial Losses: Costs associated with incident response, recovery, regulatory fines (like GDPR penalties which can reach 4% of global annual turnover), and potential lawsuits are substantial.

- Reputational Damage: A data breach can lead to a significant loss of customer trust, making it difficult to attract and retain customers in a competitive market.

- Regulatory Compliance: Failure to protect customer data can result in investigations and penalties from data protection authorities.

Public and Political Pressure on Profits and Affordability

Even as energy markets stabilize, large utility companies like Centrica continue to face significant public and political pressure regarding their profitability and the affordability of energy for consumers. This scrutiny intensifies during times of economic difficulty or when energy prices are high, leading to demands for increased regulation or direct intervention.

This pressure can manifest in several ways:

- Regulatory Scrutiny: Governments may impose stricter price caps or profit margins, directly impacting revenue. For instance, the UK government has previously implemented windfall taxes on energy company profits.

- Public Perception: High profits reported by energy firms during periods of consumer hardship can fuel public resentment and calls for action, potentially damaging brand reputation and customer loyalty.

- Policy Changes: Persistent pressure can lead to policy shifts, such as increased investment mandates in renewable energy or requirements for greater consumer protection measures, which could alter Centrica's operational costs and strategic direction.

Centrica operates in a highly competitive UK and Irish energy market, facing constant pressure from customer switching and new entrants, which erodes its market share and pricing power. Geopolitical instability continues to pose a threat, with potential for energy price shocks and supply chain disruptions impacting procurement costs. The company also navigates a dynamic regulatory environment in the UK, with policy shifts like REMA and CBAM introducing uncertainty and potential compliance costs.

SWOT Analysis Data Sources

This Centrica SWOT analysis is built upon a robust foundation of data, including publicly available financial reports, comprehensive market research, and insights from industry experts. These sources provide a well-rounded perspective on the company's internal capabilities and external environment.