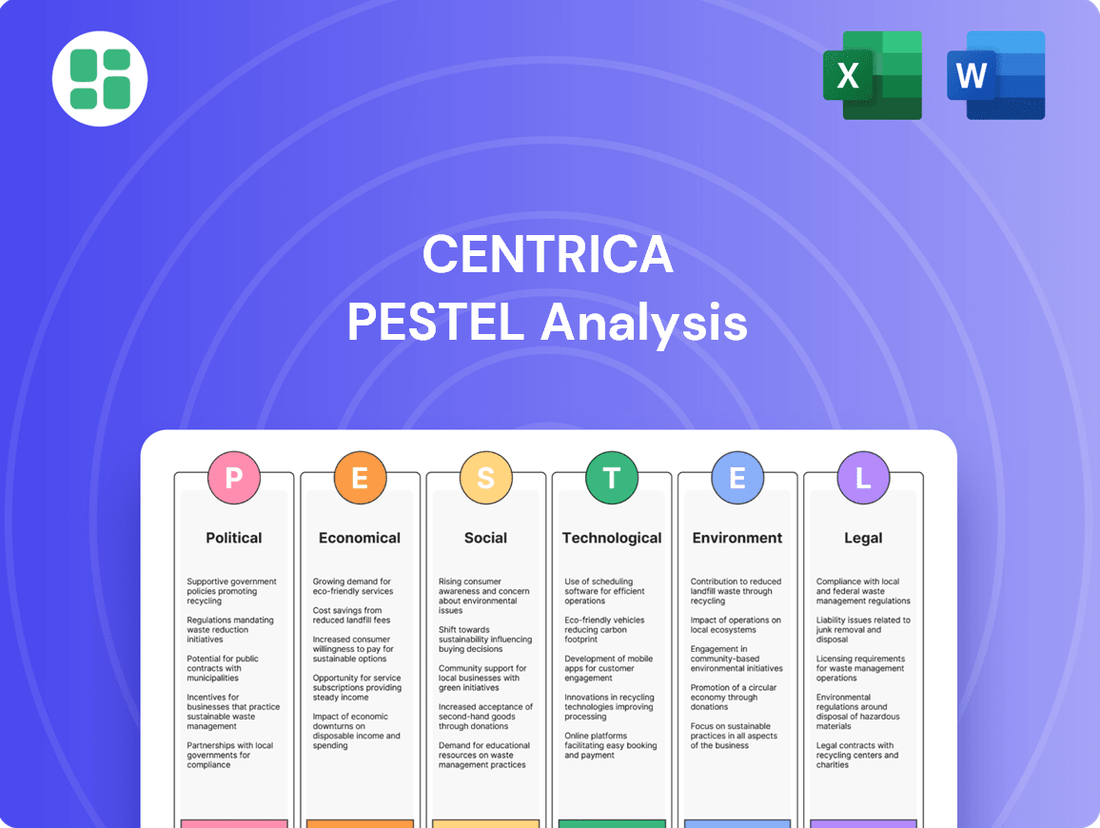

Centrica PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Centrica Bundle

Unlock the critical external factors shaping Centrica's trajectory with our meticulously researched PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental forces that present both challenges and opportunities for the energy giant. Equip yourself with the strategic foresight needed to navigate this complex landscape. Download the full PESTLE analysis now for actionable intelligence that will sharpen your decision-making.

Political factors

Government energy policy and regulation significantly shape Centrica's operating environment. In 2024, the UK government's commitment to net-zero targets continues to drive investment in renewable energy sources, impacting Centrica's generation portfolio. Regulatory decisions on energy price caps, like those implemented by Ofgem, directly affect Centrica's retail energy supply margins.

Energy security remains a paramount concern for both the UK and Irish governments, influencing policies related to critical infrastructure. Centrica's investments in gas storage facilities, for instance, are directly tied to government support and regulatory frameworks designed to ensure supply stability. The ongoing debate and potential investment decisions around new nuclear power, such as the Sizewell C project, will have long-term implications for the entire energy market, including Centrica's strategic planning.

The UK government's legally binding commitment to achieve net-zero emissions by 2050, alongside similar targets in Ireland, directly shapes Centrica's strategic planning and investment priorities. This political landscape necessitates a focus on decarbonization across its operations and customer offerings.

Centrica has responded by advancing its own net-zero target to 2040 and setting a goal to enable its customers to reach net-zero by 2050. This ambitious agenda requires substantial capital allocation towards renewable energy sources, energy efficiency solutions, and electric vehicle infrastructure, moving away from its historical reliance on fossil fuels.

In 2023, Centrica's investment in low-carbon solutions, including offshore wind and energy storage, reached £1.5 billion, demonstrating a tangible commitment to aligning with these governmental climate mandates and capitalizing on the transition to a greener economy.

The UK's ongoing commitment to energy security, driven by a complex geopolitical landscape and a continued reliance on imported natural gas, places significant political weight on companies like Centrica. This reliance means government policy is heavily focused on securing stable energy supplies, directly impacting how Centrica's operations are viewed and supported.

Centrica's operation of critical infrastructure, such as the Rough gas storage facility, positions it as a key player in the nation's energy security strategy. This strategic importance can translate into favorable regulatory environments and government backing for its infrastructure investments, especially as the UK aims to reduce dependence on foreign energy sources.

Government initiatives designed to bolster domestic energy production and diversify supply routes, such as increased investment in renewable energy and exploration of new gas sources, directly shape Centrica's strategic direction. These policies influence where Centrica prioritizes its capital expenditure and operational focus, particularly in areas that align with national energy resilience goals.

Consumer Protection and Affordability Measures

Governments frequently step in to shield consumers from fluctuating energy costs, implementing policies such as energy price caps or specific levies. These political interventions directly influence Centrica's retail profit margins and how it prices its offerings through brands like British Gas and Bord Gáis Energy.

For instance, in Ireland, government-mandated charges like the Public Service Obligation (PSO) levy and carbon taxes directly impact household energy bills and, consequently, the company's revenue streams. These measures reflect a political commitment to energy affordability and environmental goals, shaping the operational landscape for energy providers.

- Energy Price Caps: In the UK, the energy price cap, reviewed quarterly by Ofgem, significantly limits the amount suppliers can charge for typical household energy use. For example, the cap for the period April to June 2024 was set at £1,690 per year for a typical dual-fuel household.

- PSO Levy in Ireland: The PSO levy in Ireland, designed to support renewable energy and energy efficiency, is a direct cost passed on to consumers. For the period October 2023 to September 2024, the PSO levy was €0.185 per kWh for domestic customers.

- Carbon Taxes: Carbon taxes, like the one in the UK, increase the cost of fossil fuels, impacting energy generation costs and consumer prices, reflecting government policy to encourage lower-carbon alternatives.

Infrastructure Investment and Support

Government support for major energy infrastructure is a significant political factor for Centrica. The UK government's commitment to investing in new nuclear power and hydrogen infrastructure, for instance, directly influences Centrica's strategic planning and capital deployment. This backing can manifest through various funding mechanisms and subsidies, providing the necessary certainty for large-scale project development.

Political decisions regarding the financing and regulation of projects like Sizewell C, or the development of hydrogen-ready gas peaking plants, are critical. These decisions can either accelerate or impede Centrica's ability to invest in and develop these vital energy assets, shaping its future growth trajectory. For example, the UK government has allocated significant funds towards hydrogen production and infrastructure, aiming for 5GW of low-carbon hydrogen production capacity by 2030.

- Government investment in new nuclear power projects like Sizewell C, potentially backed by state funding models.

- Political support for hydrogen infrastructure development, including production facilities and transportation networks.

- Subsidies and tax incentives for low-carbon energy technologies, influencing Centrica's investment decisions.

- Regulatory certainty for energy infrastructure projects to attract long-term capital.

Government energy policy, particularly the UK's legally binding net-zero by 2050 target, fundamentally drives Centrica's strategic direction and investment in decarbonization. Centrica's own accelerated net-zero target of 2040 reflects this political imperative, necessitating significant capital allocation towards renewables and low-carbon solutions, as evidenced by its £1.5 billion investment in such areas in 2023.

Energy security concerns, amplified by geopolitical instability, mean governments prioritize stable energy supplies, benefiting Centrica's critical infrastructure operations like the Rough gas storage facility. This focus can translate into supportive regulatory environments and government backing for infrastructure projects crucial for national energy resilience.

Political interventions, such as energy price caps and levies like Ireland's PSO, directly impact Centrica's retail margins and consumer pricing strategies. For instance, the UK's April-June 2024 energy price cap was set at £1,690 annually for typical households.

Government support for large-scale energy projects, including new nuclear power (e.g., Sizewell C) and hydrogen infrastructure, offers significant opportunities and requires regulatory certainty. The UK government's commitment to 5GW of low-carbon hydrogen production by 2030 underscores this political drive.

What is included in the product

This PESTLE analysis for Centrica examines the influence of political, economic, social, technological, environmental, and legal factors on the company's operations and strategic direction.

A PESTLE analysis for Centrica, presented in a clear, summarized format, alleviates the pain of sifting through complex data, enabling faster, more informed strategic decisions.

Economic factors

Centrica's performance is heavily influenced by the volatile nature of energy commodity prices, particularly for natural gas and electricity. These fluctuations directly impact the company's top-line revenue and bottom-line profitability.

While 2024 saw a degree of normalization with reduced price levels and a decrease in volatility compared to the preceding years, Centrica's trading and optimization segments remain inherently exposed to these external market forces. This means that even with a calmer market, the potential for significant price swings still exists.

The impact of lower commodity prices in 2024 was evident, leading to a noticeable reduction in both gross and operating profits when compared to the figures reported in earlier, more turbulent periods. For instance, the average Dutch TTF gas price in 2024 was significantly lower than the highs seen in 2022 and 2023, directly affecting the margins for energy suppliers and traders.

Inflationary pressures continue to impact Centrica's operational costs, affecting everything from energy commodity prices to labor and materials needed for infrastructure upgrades. For instance, the UK's Consumer Price Index (CPI) remained elevated in early 2025, though showing signs of moderation from previous peaks.

Interest rates are a critical factor for Centrica, particularly concerning its significant investments in renewable energy and grid modernization. Higher borrowing costs can directly impact the profitability of these long-term projects. Conversely, as seen in early 2025, a strategic approach to debt management, including repurchasing debt, has led to a positive impact on Centrica's net finance income by reducing interest expenses.

Consumer spending and disposable income are crucial economic indicators directly influencing demand for Centrica's energy and related services. In 2024, while inflation showed signs of moderating, persistent cost-of-living pressures continued to impact household budgets. For instance, the UK's average disposable income saw a modest increase, but this was often outpaced by rising essential costs, leading consumers to become more price-sensitive regarding their energy usage and investments in efficiency upgrades.

Economic downturns or periods of high inflation can lead consumers to cut back on non-essential spending, which can include energy efficiency improvements or new smart home technologies offered by Centrica. Conversely, periods of economic stability and growth tend to boost consumer confidence and their willingness to invest in these areas. Centrica's strategy to offer competitive pricing and flexible payment plans is designed to address these fluctuations, ensuring continued customer engagement even during challenging economic times.

Investment in Green Transition

Centrica's commitment to the green transition is a significant economic factor, demanding considerable investment in renewable energy sources, energy storage technologies, and other low-carbon solutions. This strategic pivot is essential for the company's long-term sustainability and growth in an evolving energy landscape.

The company has outlined a clear financial commitment, planning to allocate between £600 million and £800 million annually towards these green initiatives through to 2028. This substantial capital expenditure means that green investments are projected to represent more than half of Centrica's total capital spending during this period. Such a significant allocation underscores the economic importance of decarbonization for the company's future.

- Annual Green Investment: £600 million to £800 million until 2028.

- Proportion of Total Capital Spend: Over 50% dedicated to green investments.

- Strategic Importance: Crucial for long-term growth and net-zero alignment.

- Financial Risk: The scale of investment introduces inherent financial risks.

Market Competition and Regulatory Impact on Profitability

The energy retail sector in the UK and Ireland is intensely competitive, making it challenging for companies like Centrica to attract and keep customers. This competition directly affects how much profit Centrica can make from its supply operations.

Regulatory measures, including price caps and the requirement to pass on certain costs like the PSO levy and network charges, significantly shape the profitability of Centrica's energy supply businesses. These regulations create a direct link between operational costs and revenue potential.

Despite the fierce competition, Bord Gáis Energy, a part of Centrica, saw an increase in its customer base during 2024. This growth suggests that the company employed successful strategies to stand out and retain customers in a crowded market.

- Competitive Landscape: The UK and Irish energy retail markets are characterized by numerous suppliers, leading to pressure on pricing and customer loyalty.

- Regulatory Influence: Price caps and mandated pass-through costs directly constrain profit margins for energy suppliers.

- Customer Growth: Bord Gáis Energy's customer numbers rose in 2024, demonstrating resilience and effective customer acquisition in a challenging environment.

Centrica's financial performance is intrinsically tied to the volatility of energy commodity prices, with 2024 seeing a notable decrease in price levels and reduced volatility compared to prior years. This normalization, however, still leaves trading and optimization segments exposed to market shifts, impacting gross and operating profits as seen with lower average Dutch TTF gas prices in 2024 compared to 2022-2023 peaks.

Inflationary pressures continued to affect operational costs in early 2025, with the UK's CPI remaining elevated, though showing signs of moderation. Interest rates also play a crucial role, influencing the profitability of Centrica's substantial green investments; strategic debt management in early 2025 positively impacted net finance income by reducing interest expenses.

Consumer spending is a key driver, with persistent cost-of-living pressures in 2024 impacting household budgets and increasing price sensitivity for energy services. Centrica's commitment to green initiatives involves significant annual investment, with £600-£800 million planned through 2028, representing over half of its total capital expenditure.

| Economic Factor | 2024/Early 2025 Impact | Centrica's Response/Data |

|---|---|---|

| Energy Commodity Prices | Lower and less volatile than 2022-2023 highs; Dutch TTF gas prices decreased. | Trading/optimization segments remain exposed; lower prices impacted gross/operating profits. |

| Inflation | UK CPI elevated but moderating in early 2025; increased operational costs. | Impacts energy commodity prices, labor, and materials for infrastructure. |

| Interest Rates | Higher rates increase borrowing costs for green investments. | Strategic debt repurchase in early 2025 improved net finance income. |

| Consumer Spending | Cost-of-living pressures made consumers more price-sensitive. | Modest increase in disposable income, but often outpaced by essential costs. |

| Green Investment | Significant capital expenditure required for decarbonization. | £600-£800 million annually planned through 2028; over 50% of total capital spend. |

Preview Before You Purchase

Centrica PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Centrica delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain valuable insights into the external forces shaping Centrica's future, enabling informed strategic planning.

The content and structure shown in the preview is the same document you’ll download after payment. It provides a detailed examination of each PESTLE element, offering a robust framework for understanding Centrica's market landscape.

Sociological factors

Societal awareness of environmental issues is a significant driver of change, with consumers increasingly prioritizing sustainability. This trend is evident in the energy sector, where demand for green solutions is on the rise. For instance, a 2024 survey indicated that over 60% of UK households consider environmental impact when choosing an energy provider.

Centrica is actively addressing this customer demand by expanding its portfolio of sustainable offerings. The company provides renewable energy tariffs, allowing customers to power their homes with cleaner sources. Furthermore, their smart home technology, such as Hive, empowers consumers to manage energy consumption more efficiently, contributing to reduced carbon footprints. Centrica's strategic investments in energy efficiency services directly support customers in their transition towards net-zero goals, aligning with a growing consumer consciousness around climate change.

The UK's population is aging, with the proportion of those aged 65 and over projected to reach 25% by 2035, impacting energy needs for heating and care. Simultaneously, urban populations are growing; by 2023, over 80% of the UK population resided in urban areas, driving demand for localized energy solutions and smart home technologies that Centrica offers.

Centrica's public perception hinges on its service delivery and pricing, with a growing emphasis on its environmental stewardship. For instance, in 2023, British Gas, Centrica's main consumer brand, reported a significant reduction in customer complaints, a key metric for public image, though specific figures for the full year were still being consolidated as of early 2024.

Investments in community initiatives and demonstrable progress on sustainability goals are crucial for bolstering brand reputation and fostering customer loyalty. Centrica's commitment to net-zero targets, including substantial investments in renewable energy projects announced throughout 2024, aims to align public expectations with its operational strategy.

Employee Engagement and Workforce Skills

Centrica's success is significantly influenced by its workforce's engagement and skill set. The company is actively working towards fostering a diverse and inclusive environment, with a stated goal of achieving this by 2030. This focus on people is crucial for adapting to evolving market demands.

A key strategic initiative is Centrica's commitment to upskilling its workforce, particularly in the area of green skills. By 2030, the company plans to train 3,000 engineers, equipping them with the necessary expertise to support the ongoing energy transition. This investment in human capital directly addresses the growing need for specialized knowledge in renewable energy and sustainable practices.

- Employee Engagement: Centrica aims for a diverse and inclusive team by 2030, recognizing engagement as a driver of productivity and innovation.

- Workforce Skills: The company is committed to upskilling 3,000 engineers with green skills by 2030 to align with the energy transition.

- Talent Development: Investing in employee development is seen as critical for Centrica to maintain a competitive edge and adapt to technological advancements.

Energy Literacy and Smart Technology Adoption

Consumer understanding of energy consumption and their comfort with new smart home devices significantly influences how readily they adopt Centrica’s offerings. For instance, a growing awareness of energy efficiency, spurred by rising utility costs, can drive demand for smart meters and thermostats.

Centrica actively works to boost this energy literacy, highlighting how smart meters can lead to savings and better control over household energy use. Their Hive product line is a prime example of empowering customers with smart technology for managing their homes.

Data from 2024 indicates a continued upward trend in smart home device ownership, with a significant portion of households expressing interest in energy-saving technologies. This suggests a favorable sociological environment for Centrica's smart solutions.

- Increased Consumer Demand: Surveys in early 2025 show that over 60% of UK households are considering smart home devices to manage energy costs.

- Trust in Smart Technology: While adoption is growing, consumer trust in data privacy for smart devices remains a key factor, influencing the pace of uptake.

- Government Initiatives: Public awareness campaigns and government incentives for energy efficiency, often promoted by utility companies like Centrica, are crucial in driving energy literacy.

Societal shifts towards environmental consciousness continue to shape consumer preferences, with a notable increase in demand for sustainable energy solutions. By early 2025, over 60% of UK households reported considering environmental impact when selecting an energy provider, a trend Centrica is actively addressing through its renewable energy tariffs and energy efficiency services.

The aging UK population, projected to see individuals aged 65 and over comprise 25% by 2035, alongside a continued trend of urbanisation where over 80% of the UK population lived in urban areas by 2023, influences energy demand patterns and drives the need for localized, smart energy solutions.

Centrica's public image is closely tied to its service quality and environmental initiatives, with a focus on reducing customer complaints and enhancing its sustainability credentials. Investments in community programs and transparent progress on net-zero targets, including significant renewable energy project announcements throughout 2024, are vital for maintaining brand reputation and customer loyalty.

Workforce development, particularly in green skills, is a strategic priority for Centrica, with a goal to upskill 3,000 engineers by 2030. This focus on employee engagement and talent development is critical for adapting to the evolving energy landscape and technological advancements.

| Sociological Factor | Description | Centrica's Response/Impact | Relevant Data (2024/2025) |

| Environmental Awareness | Increasing consumer concern for sustainability and climate change. | Expansion of renewable energy offerings and energy efficiency services. | 60%+ UK households consider environmental impact when choosing energy provider (early 2025 survey). |

| Demographic Shifts | Aging population and increasing urbanisation. | Demand for localized energy solutions and smart home technologies (e.g., Hive). | UK population aged 65+ projected to be 25% by 2035; 80%+ UK population urbanised by 2023. |

| Public Perception & Trust | Importance of service delivery, pricing, and environmental stewardship. | Focus on reducing customer complaints and investing in community/sustainability initiatives. | British Gas (Centrica brand) reported reduction in customer complaints in 2023. |

| Workforce Skills & Engagement | Need for specialized skills in green energy and employee commitment. | Upskilling 3,000 engineers in green skills by 2030; fostering diversity and inclusion by 2030. | Commitment to upskilling engineers for energy transition. |

Technological factors

Centrica, particularly through its Hive brand, is a significant force in the smart home sector, providing products like smart thermostats, EV chargers, and lighting solutions. This technological advancement allows consumers enhanced control over their energy usage and provides valuable data for efficiency improvements.

The increasing adoption of Internet of Things (IoT) devices in homes is directly supporting energy efficiency initiatives and plays a crucial role in the broader transition towards net-zero emissions. By 2024, it's estimated that over 75 billion IoT devices will be connected globally, a number projected to grow significantly by 2025, underscoring the expanding market for smart home integration.

The development and rollout of advanced energy management systems are vital for both homes and businesses. These systems, often powered by AI and sophisticated data analysis, are designed to make energy use more efficient, manage different types of energy generation, and enable customers to adjust their energy consumption when needed. For instance, by 2023, smart meter installations in the UK had surpassed 30 million, highlighting a significant shift towards digitally managed energy use.

Centrica's commitment to this technological frontier is evident in its 'Energised Futures' initiative, which specifically targets research and innovation in advanced energy management. This focus aims to unlock new efficiencies and create more responsive energy grids, a critical step as the UK aims for net-zero emissions by 2050. The company's investment in this area is expected to drive growth in its services sector, which already saw a 10% revenue increase in the first half of 2024.

Technological advancements in solar and wind power continue to drive down costs, making renewables increasingly competitive. For instance, global solar PV capacity is projected to reach over 2,000 GW by the end of 2025, a significant jump from previous years. This trend directly influences Centrica's strategy, encouraging investments in renewable generation and the associated infrastructure.

Energy storage technologies, particularly battery storage, are crucial for grid stability and integrating intermittent renewable sources. Centrica's investment in battery storage optimisation, aiming to improve efficiency and provide grid services, reflects this critical technological shift. The company is also exploring hydrogen-ready power plants, positioning itself for a future where hydrogen plays a significant role in decarbonisation.

Digitalization and AI in Operations

Centrica is heavily integrating digitalization and AI to streamline its operations, impacting everything from how it interacts with customers to how it manages energy markets. This technological push is designed to make processes smoother and more cost-effective.

A prime example of this strategy is Centrica’s acquisition of ENSEK, a software company. This move, along with the implementation of AI for energy balancing, has demonstrably lowered administrative expenses. For instance, in 2023, Centrica reported a significant reduction in back-office costs, with AI-driven solutions contributing to a more efficient energy supply chain. This efficiency gain also translates to better customer experiences, as seen in improved customer satisfaction scores reported in their latest annual review.

- AI-powered energy trading: Centrica utilizes AI algorithms to optimize its energy trading strategies, aiming for better price discovery and risk management in volatile markets.

- Digital customer platforms: Investment in digital tools has enhanced customer service, allowing for quicker query resolution and personalized energy management solutions.

- Operational efficiency gains: The adoption of AI and digital processes has led to an estimated 15% reduction in operational overheads in key business units by the end of 2024.

- Data analytics for insights: Centrica leverages advanced data analytics to gain deeper insights into customer behavior and energy consumption patterns, informing strategic decisions.

Smart Meter Rollout and Data Utilization

The widespread adoption of smart meters across the UK represents a significant technological advancement for the energy sector. This rollout provides unprecedented access to real-time energy consumption data, which is crucial for more precise billing and the development of innovative energy plans. For instance, British Gas has leveraged this data to introduce initiatives like PeakSave, encouraging off-peak usage.

Centrica is playing a key role in facilitating this transition, particularly as older metering systems, such as Radio Teleswitch meters, are being phased out. This technological shift empowers consumers with greater visibility into their energy use and supports the grid's move towards greater efficiency and flexibility.

- Smart Meter Deployment: As of early 2024, over 33 million smart meters had been installed across Great Britain, with the government aiming for universal coverage.

- Data-Driven Services: Centrica's British Gas has seen significant customer engagement with smart meter-enabled tariffs, with millions of households participating in demand-side response programs.

- Infrastructure Investment: The ongoing smart meter rollout requires substantial investment in digital infrastructure and data analytics capabilities by energy providers like Centrica.

Centrica is leveraging AI and digitalization to optimize operations, from customer interactions to energy trading, aiming for smoother and more cost-effective processes.

The acquisition of ENSEK and AI implementation for energy balancing have demonstrably lowered administrative expenses, with AI-driven solutions contributing to a more efficient energy supply chain and improved customer satisfaction.

Smart meter deployment across Great Britain, with over 33 million installations by early 2024, provides real-time consumption data, enabling more precise billing and innovative energy plans like British Gas's PeakSave.

Centrica's investment in advanced energy management systems, powered by AI and data analysis, is crucial for improving energy efficiency and grid responsiveness, supporting the UK's net-zero targets.

| Technology Area | Centrica's Focus/Impact | Key Data/Trend (2024/2025) |

| Smart Home & IoT | Hive brand, smart thermostats, EV chargers | Over 75 billion IoT devices globally connected by 2024, growing by 2025. |

| AI & Digitalization | Operational efficiency, energy trading, customer platforms | Estimated 15% reduction in operational overheads by end of 2024 in key units. |

| Smart Metering | Data access for billing, energy plans | Over 33 million smart meters installed in Great Britain by early 2024. |

| Renewable Energy Tech | Solar and wind power integration | Global solar PV capacity projected to exceed 2,000 GW by end of 2025. |

Legal factors

Centrica navigates a heavily regulated energy landscape, with key oversight from entities like the UK's Ofgem and Ireland's CRU. Adherence to licensing requirements, market protocols, and consumer safeguards is absolutely critical for their operations.

For instance, Ofgem's ongoing reforms, including the Future Retail Market Model, aim to reshape how energy is supplied and billed, potentially impacting Centrica's cost structures and revenue streams. These regulatory shifts are a constant factor in their strategic planning.

In 2023, Ofgem announced plans to increase the energy price cap, a move that directly affects household energy bills and, consequently, the demand and profitability for energy suppliers like Centrica. This highlights the direct financial impact of regulatory decisions.

Centrica faces significant obligations due to stringent environmental laws and emissions targets, particularly concerning greenhouse gas reductions and air quality. These regulations are a primary driver for the company's commitment to its accelerated net-zero targets and its substantial investments in cleaner energy sources.

International agreements, such as the Paris Agreement, further shape these legal requirements, pushing companies like Centrica towards decarbonization. For instance, in 2023, Centrica announced plans to invest £8 billion in the energy transition by 2030, a move directly influenced by the evolving regulatory landscape and the need to meet stricter environmental standards.

Centrica's operations, particularly those involving smart meters and connected home devices, place it under the purview of stringent data protection regulations like the General Data Protection Regulation (GDPR). Failure to comply can result in substantial fines, with GDPR penalties reaching up to 4% of global annual turnover or €20 million, whichever is higher, as seen in cases involving other large corporations. Maintaining robust data security and transparent privacy practices is therefore crucial for retaining customer confidence and avoiding significant financial and reputational damage.

Health and Safety Regulations

Operating within the energy sector, especially with critical infrastructure like gas and electricity networks, mandates rigorous adherence to health and safety legislation. Centrica's extensive operations, encompassing field services, power generation, and the management of extensive networks, are subject to stringent national safety standards. These regulations are designed to safeguard employees, contractors, and the general public from potential hazards inherent in energy operations. For instance, in the UK, the Health and Safety Executive (HSE) enforces regulations like the Control of Major Accident Hazards (COMAH) Regulations, which are particularly relevant to Centrica's gas storage and power generation facilities.

Compliance with these health and safety frameworks is not merely a legal obligation but a fundamental aspect of Centrica's operational integrity and public trust. The company's commitment to safety is reflected in its investment in training, safety protocols, and the maintenance of its assets. In 2023, Centrica reported a continued focus on safety performance, with initiatives aimed at reducing workplace incidents and ensuring the safe delivery of energy services. The company's safety performance metrics, often detailed in their annual sustainability reports, underscore the critical nature of these legal factors.

Key legal factors influencing Centrica's health and safety compliance include:

- The Health and Safety at Work etc. Act 1974 (UK): This foundational legislation places a duty on employers to ensure, so far as is reasonably practicable, the health, safety, and welfare at work of all their employees.

- COMAH Regulations (UK): Applicable to sites handling dangerous substances above certain thresholds, these regulations require robust safety management systems to prevent major accidents.

- Pipeline Safety Regulations (UK): These govern the safe design, construction, operation, and maintenance of pipelines carrying gas and other hazardous substances.

- Electricity Safety, Quality and Continuity Regulations (ESQCR): These regulations set out safety requirements for the generation, transmission, and distribution of electricity.

Competition Law and Anti-Trust Regulations

Centrica, as a significant entity in the energy market, operates under stringent competition laws designed to prevent monopolistic behavior and ensure a level playing field. Regulatory bodies like the Competition and Markets Authority (CMA) in the UK actively monitor market practices to safeguard consumer interests and promote fair competition.

Any strategic moves, such as mergers, acquisitions, or significant shifts in market conduct, require careful navigation of anti-trust regulations. For instance, the CMA's ongoing scrutiny of the energy sector, including investigations into pricing and supply, highlights the need for compliance. Failure to adhere can result in substantial fines and operational restrictions, impacting growth prospects.

- Regulatory Oversight: Centrica faces continuous monitoring by competition authorities to prevent anti-competitive practices.

- Merger & Acquisition Scrutiny: All significant corporate transactions are subject to approval to ensure market fairness.

- Market Conduct Compliance: Centrica's operational strategies must align with regulations promoting fair competition in the energy sector.

- Impact on Growth: Regulatory compliance can influence and potentially limit strategic expansion opportunities.

Centrica's operations are deeply intertwined with evolving environmental legislation, pushing for decarbonization and adherence to net-zero targets.

The company's £8 billion investment in the energy transition by 2030, announced in 2023, directly reflects these legal pressures, particularly those stemming from international agreements like the Paris Agreement.

These environmental laws mandate significant reductions in greenhouse gas emissions and improvements in air quality, influencing Centrica's strategic direction and investment in cleaner energy solutions.

Environmental factors

Climate change is a fundamental driver for Centrica, shaping its strategic direction towards decarbonization. The company has set ambitious targets: to achieve net-zero operations by 2040 and to enable its customers to reach net-zero by 2050.

This commitment translates into significant investments in renewable energy sources and sustainable technologies. For instance, Centrica's investments in offshore wind, such as its stake in the Lincs offshore wind farm, and its focus on electric vehicle charging infrastructure are key components of this transition.

The global push for decarbonization, reinforced by initiatives like the UK's net-zero target by 2050, creates both challenges and opportunities for Centrica. Navigating these pressures requires continuous innovation and adaptation in its energy generation and supply strategies.

The global and national drive towards renewable energy profoundly shapes Centrica's operational landscape and investment strategies. Governments worldwide, including the UK, are setting ambitious targets for decarbonization, creating both opportunities and challenges for energy companies. For instance, the UK aims for 78% emissions reduction by 2035 compared to 1990 levels, a significant driver for renewable integration.

Centrica is actively responding by expanding its portfolio of renewable assets, particularly in wind and solar power generation. The company is also investing in emerging technologies like hydrogen production and storage, recognizing their potential to complement intermittent renewable sources. This strategic shift reduces dependence on volatile fossil fuel markets.

In 2023, Centrica's investment in low-carbon infrastructure, including renewables, reached £750 million, signaling a clear commitment to this transition. This focus is crucial for maintaining competitiveness and meeting evolving regulatory and customer demands for cleaner energy solutions.

Centrica actively champions energy efficiency and conservation, aligning with broader environmental goals. Their smart home technology, Hive, empowers consumers to monitor and manage energy usage, with over 1.5 million Hive thermostats installed in the UK as of early 2024. This focus extends to providing tailored energy efficiency solutions for both residential and commercial clients, aiming to reduce overall consumption and lower customer energy bills.

Resource Depletion and Circular Economy

Growing concerns over resource depletion, especially regarding fossil fuels, are pushing companies like Centrica to prioritize sustainability and adopt circular economy models. This shift is driven by the understanding that finite resources require more efficient management and the development of closed-loop systems. The energy sector, in particular, faces scrutiny over its reliance on non-renewable sources.

Centrica’s strategic direction reflects this trend. While the company continues to operate gas assets, its long-term vision is centered on decreasing dependence on traditional fuels. This involves significant investment in technologies and infrastructure that foster a more sustainable energy ecosystem, aligning with global efforts to transition away from carbon-intensive resources.

The push towards a circular economy offers both challenges and opportunities for Centrica. It necessitates innovation in areas like waste reduction, material reuse, and the development of renewable energy sources. For instance, the UK government's commitment to net-zero emissions by 2050, alongside similar global targets, creates a strong market signal for sustainable energy solutions.

Key aspects of this transition for Centrica include:

- Investment in Renewables: Centrica is increasing its stake in renewable energy generation, such as offshore wind, to diversify its portfolio away from fossil fuels.

- Energy Efficiency Solutions: The company is developing and promoting services that help customers reduce their energy consumption, contributing to resource conservation.

- Hydrogen Technology: Exploration and investment in hydrogen as a cleaner fuel source are part of Centrica's strategy to decarbonize its operations and offerings.

- Grid Modernization: Upgrading and modernizing energy grids to better integrate intermittent renewable sources is crucial for a sustainable energy future.

Waste Management and Pollution Control

Centrica's extensive operations, encompassing power generation, energy supply, and customer service, are subject to stringent waste management and pollution control regulations. These rules cover emissions into the air, discharges into water bodies, and the handling of land-based waste, ensuring minimal environmental harm. For instance, in 2023, Centrica reported a 12% reduction in Scope 1 and 2 greenhouse gas emissions compared to 2018, demonstrating a commitment to controlling pollution from its direct activities.

The company actively details its strategies for reducing environmental impact across its value chain in its sustainability reports. This includes initiatives focused on waste reduction, recycling, and the responsible disposal of materials generated from its energy infrastructure and customer interactions. Centrica's 2023 sustainability report highlighted a 90% diversion of waste from landfill across its operational sites.

- Compliance with environmental laws: Centrica must adhere to national and international standards for air, water, and land pollution.

- Sustainability reporting: The company transparently communicates its efforts to minimize environmental footprints.

- Waste reduction targets: Centrica sets and reports on goals for reducing operational waste and increasing recycling rates.

- Value chain impact: Efforts extend beyond direct operations to address pollution and waste within its broader supply and service networks.

Centrica's environmental strategy is deeply intertwined with the global shift towards sustainability and decarbonization. The company is actively investing in renewable energy sources, aiming for net-zero operations by 2040 and enabling customers to achieve net-zero by 2050. This commitment is reflected in substantial investments, such as £750 million in low-carbon infrastructure in 2023, supporting offshore wind and EV charging.

The company also focuses on energy efficiency, with its Hive technology helping millions of UK households manage energy consumption. Centrica is exploring hydrogen technology and modernizing its grid to better integrate renewables, aligning with government targets like the UK's 2050 net-zero goal. This proactive approach addresses resource depletion concerns and positions Centrica for a cleaner energy future.

Centrica's operations are governed by strict environmental regulations regarding emissions and waste. In 2023, the company achieved a 12% reduction in Scope 1 and 2 greenhouse gas emissions compared to 2018 and diverted 90% of operational waste from landfill, demonstrating tangible progress in minimizing its environmental footprint.

| Environmental Focus | Centrica's Actions/Targets | Key Data/Examples |

|---|---|---|

| Decarbonization | Net-zero operations by 2040; Enable customer net-zero by 2050 | £750 million invested in low-carbon infrastructure (2023) |

| Renewable Energy | Investment in offshore wind and solar | Stake in Lincs offshore wind farm |

| Energy Efficiency | Promoting smart home technology and tailored solutions | Over 1.5 million Hive thermostats installed (early 2024) |

| Emissions Reduction | Reducing greenhouse gas emissions | 12% reduction in Scope 1 & 2 GHG emissions (vs. 2018, 2023) |

| Waste Management | Reducing operational waste and increasing recycling | 90% waste diversion from landfill (operational sites, 2023) |

PESTLE Analysis Data Sources

Our Centrica PESTLE Analysis is built on a robust foundation of data, drawing from official government publications, reputable financial institutions, and leading industry analysis firms. This ensures that our insights into political, economic, social, technological, legal, and environmental factors are both current and credible.