Centrica Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Centrica Bundle

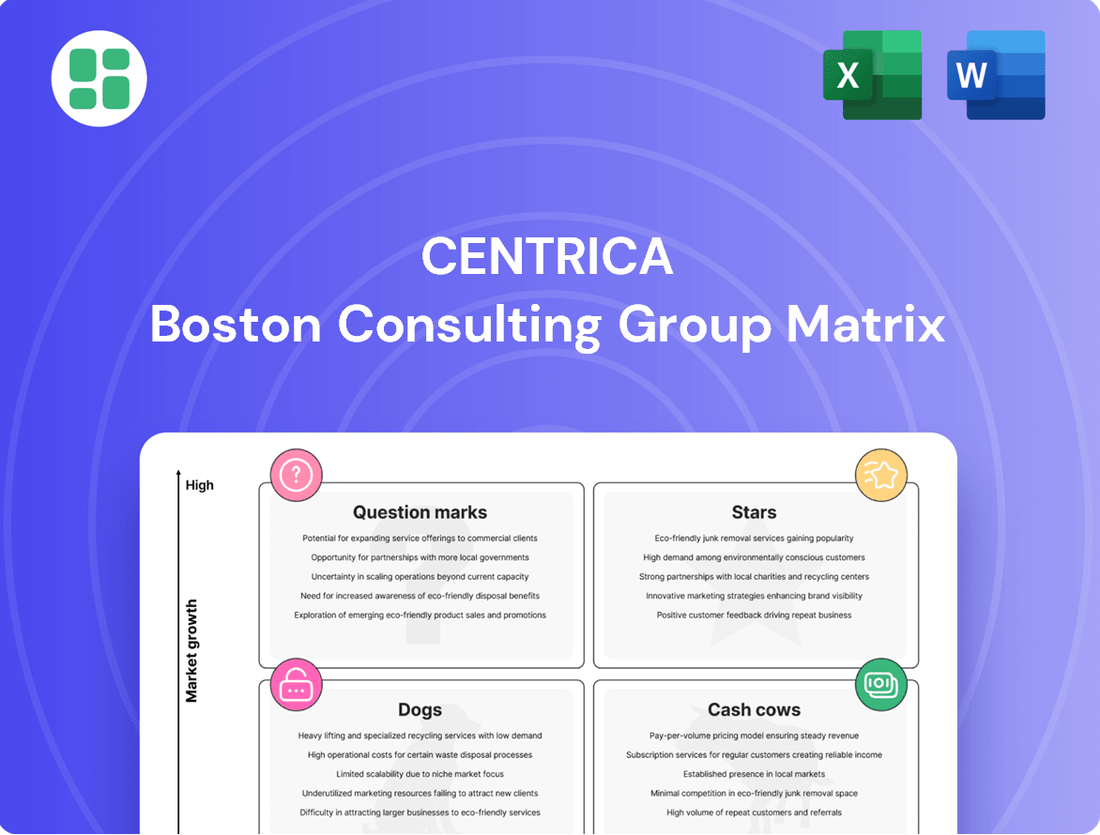

Discover how Centrica's diverse portfolio is performing in the market. This snapshot highlights key product categories, but to truly understand their strategic positioning—whether as Stars, Cash Cows, Dogs, or Question Marks—you need the full picture.

Unlock actionable insights by purchasing the complete Centrica BCG Matrix. Gain a detailed quadrant-by-quadrant breakdown, data-driven recommendations, and a clear roadmap for optimizing your investments and product strategy.

Don't just guess where Centrica's future lies. The full BCG Matrix report provides the essential clarity to make informed decisions, identify growth opportunities, and manage resources effectively.

Stars

Centrica's investment in hydrogen energy, exemplified by projects like the Humber Hydrogen Hub, positions it strongly in a high-growth sector. This strategic focus on hydrogen-ready power plants and production hubs indicates a belief in hydrogen's significant role in the future energy mix.

The potential redevelopment of the Rough gas storage facility into Europe's largest hydrogen storage site underscores Centrica's ambition to be a leader in this burgeoning market. Such large-scale infrastructure plays are crucial for the widespread adoption of hydrogen.

These developments are directly tied to Centrica's broader strategy of accelerating the energy transition and bolstering energy security. By investing in hydrogen, Centrica is not only diversifying its energy portfolio but also preparing for a decarbonized future, a move that aligns with global sustainability goals and increasing demand for cleaner energy solutions.

Centrica is making significant strides in large-scale Battery Energy Storage Systems (BESS), recognizing their vital role in grid stability. The company's commitment of £120 million in 2024 for BESS and flexible generation highlights this strategic focus. This investment is aimed at bolstering the grid's capacity to handle the increasing integration of intermittent renewable energy sources.

The growth of Centrica's BESS portfolio, which includes established facilities such as Roosecote and Brigg, positions them favorably in a market experiencing rapid expansion. This expansion is driven by the need for grid flexibility and the increasing adoption of renewables, making BESS a critical component of the future energy landscape.

Centrica Business Solutions is a key player in the decarbonisation and flexible assets sector, offering energy supply and green-focused solutions for businesses. In 2024, this segment saw its order intake grow by 3%, reflecting a strong market demand for sustainable energy transitions.

This business unit directly addresses the growing need for businesses to achieve net-zero targets, providing them with the necessary tools and energy services. Their strategic emphasis on flexible, green assets places them advantageously within the rapidly expanding market for industrial and commercial decarbonisation initiatives.

Electric Vehicle (EV) Charging Solutions

Centrica is making significant strides in the electric vehicle (EV) charging sector, a key growth area for the company. Their strategy involves strategic partnerships with prominent players like Pod Point and Zapmap, alongside offering domestic charging point installations through their Local Heroes service.

The company has set an ambitious target to capture a substantial portion of the domestic charge point installation market. This expansion is further bolstered by Centrica's commitment to electrifying its own substantial vehicle fleet, demonstrating a clear belief in the future of EVs. As EV adoption continues to surge across the UK, this segment is poised for considerable expansion.

- Market Expansion: Centrica is actively growing its EV charging services through collaborations with Pod Point and Zapmap, and by providing home charging solutions via Local Heroes.

- Fleet Electrification: Centrica plans to electrify its own large vehicle fleet, signaling a strong commitment to the EV transition.

- Growth Potential: The UK EV market is experiencing rapid growth, with over 900,000 battery electric vehicles (BEVs) registered by the end of 2023, indicating substantial opportunities for charging infrastructure providers.

- Domestic Focus: The company aims to secure a significant share of the domestic charge point installation market, capitalizing on the increasing demand for home charging solutions.

Strategic Nuclear Power Investment

Centrica's strategic nuclear power investment, particularly its £1.3 billion commitment to Sizewell C, places it firmly within the Stars category of the BCG Matrix. This move reflects a significant bet on a high-growth, high-value segment of the energy market.

The company has also extended the operational lives of its existing nuclear fleet, demonstrating a commitment to leveraging its current nuclear assets while building future capacity. This dual approach is crucial in a market increasingly prioritizing stable, low-carbon baseload power.

- Nuclear Power's Role: Provides consistent, carbon-free electricity, essential for energy security and meeting net-zero targets.

- Centrica's Investment: A £1.3 billion stake in Sizewell C signifies a major commitment to new nuclear build.

- Extended Lifespans: Upgrades to existing stations ensure continued contribution to the grid.

- Market Position: Strategic focus on nuclear aligns with growing demand for reliable, low-carbon energy sources.

Centrica's significant investment in nuclear power, notably its £1.3 billion commitment to Sizewell C, firmly places nuclear within its Stars category in the BCG Matrix. This strategic move into a high-growth, high-value energy sector underscores the company's long-term vision.

By also extending the operational lives of its existing nuclear fleet, Centrica demonstrates a dual strategy of leveraging current assets while building future capacity. This approach is critical in a market that increasingly values stable, low-carbon baseload power generation.

Nuclear power's inherent ability to provide consistent, carbon-free electricity is vital for energy security and achieving net-zero ambitions. Centrica's substantial stake in Sizewell C and the continued operation of its current nuclear stations highlight its commitment to this reliable energy source.

The strategic focus on nuclear aligns perfectly with the escalating demand for dependable, low-carbon energy solutions, positioning Centrica to capitalize on this trend.

| Business Area | Market Growth | Relative Market Share | BCG Category |

|---|---|---|---|

| Hydrogen Energy | High | High | Star |

| Battery Energy Storage Systems (BESS) | High | High | Star |

| Electric Vehicle (EV) Charging | High | High | Star |

| Nuclear Power | High | High | Star |

What is included in the product

The Centrica BCG Matrix analyzes its business units based on market share and growth, guiding investment decisions.

The Centrica BCG Matrix simplifies complex portfolios, offering a clear visual for strategic decision-making and resource allocation.

Cash Cows

British Gas Residential Energy Supply (Gas) is a cornerstone of Centrica's portfolio, firmly positioned as a cash cow. As of June 2025, it continues to be the UK's largest gas supplier, a title it held throughout 2024, serving a substantial 7.53 million residential customers.

This segment operates within a mature market, characterized by a high market share and consistent cash generation. The sheer scale of its customer base, coupled with strong brand recognition, ensures a stable and predictable revenue stream for Centrica, even amidst evolving energy market conditions.

British Gas Residential Energy Supply (Electricity) is a classic cash cow for Centrica. As the UK's second-largest electricity supplier in June 2025, it commands a significant share of a mature market, consistently generating substantial profits and free cash flow for the parent company.

The segment benefits from a powerful brand, a vast customer network, and efficient operations, enabling it to sustain strong profit margins despite a competitive landscape. This reliability makes it a cornerstone of Centrica's financial stability.

Bord Gáis Energy is a prime example of a Cash Cow within Centrica's portfolio. In 2024, it delivered a robust operating profit of €75 million, underscoring its consistent financial strength.

This Irish energy provider boasts the largest market share for domestic gas and a substantial presence in the business electricity sector. Its established leadership position in the Irish market translates directly into reliable and predictable cash flow generation for Centrica.

Traditional Boiler Servicing and Home Services

British Gas's traditional boiler servicing and home services operate as a classic Cash Cow within Centrica's portfolio. This segment leverages a vast network of field service engineers, a significant advantage in delivering consistent boiler servicing, repairs, and broader home energy solutions.

The established nature of this service, coupled with a substantial installed customer base, fuels recurring demand and predictable revenue streams. In 2024, this segment continued to be a bedrock of profitability for Centrica, characterized by high margins and dependable cash generation, despite its mature market status.

- Established Infrastructure: British Gas maintains a significant presence with over 6,000 field engineers across the UK, enabling widespread service delivery.

- Recurring Revenue Model: A large portion of revenue comes from annual service contracts, providing stability. In 2023, Centrica reported strong customer retention in its services division.

- High Profitability: The mature nature of boiler servicing, with established operational efficiencies, typically yields higher profit margins compared to growth-oriented segments.

- Customer Satisfaction: Consistent service delivery contributes to high customer satisfaction scores, further reinforcing the recurring revenue base.

Existing Gas and Power Trading & Optimisation

Centrica's existing gas and power trading and optimisation operations are a significant cash cow for the company. In 2024, this segment demonstrated robust performance, contributing substantially to the company's operating profit. This strength stems from its integrated approach across the entire energy value chain, allowing it to capitalize on market dynamics.

The trading and optimisation business is crucial for managing the inherent volatility in energy markets. Despite these fluctuations, the segment consistently generates cash by providing essential liquidity and effective risk management for Centrica's broader energy asset portfolio. Its deep-seated expertise and considerable scale in trading are key drivers of this reliable cash generation, allowing the company to profit from market opportunities.

- 2024 Operating Profit: Centrica's trading and optimisation segment reported a strong operating profit, underscoring its value.

- Integrated Portfolio: The business leverages its position across the energy value chain to maximize profitability.

- Risk Management: It plays a vital role in managing market volatility and providing liquidity for Centrica's assets.

- Consistent Cash Generation: Established expertise and scale ensure reliable cash flow from market activities.

These cash cow segments are vital for Centrica, providing stable and predictable income streams. Their mature market positions, substantial customer bases, and efficient operations ensure consistent profitability. This reliability allows Centrica to fund investments in other areas of its business.

| Business Segment | Market Position | Key Strengths | Contribution to Centrica |

|---|---|---|---|

| British Gas Residential Energy Supply (Gas) | UK's largest gas supplier | Vast customer base, strong brand | Stable revenue, predictable cash flow |

| British Gas Residential Energy Supply (Electricity) | UK's second-largest electricity supplier | Significant market share, efficient operations | Substantial profits, free cash flow |

| Bord Gáis Energy | Ireland's largest domestic gas supplier | Market leadership, established presence | Reliable and predictable cash generation |

| British Gas Home Services | Leading provider of boiler servicing | Extensive engineer network, recurring contracts | Bedrock of profitability, dependable cash |

| Trading and Optimisation | Integrated energy value chain operations | Market expertise, risk management | Robust performance, capitalizes on market dynamics |

What You See Is What You Get

Centrica BCG Matrix

The Centrica BCG Matrix preview you are currently viewing is the exact, fully formatted document you will receive immediately after purchase. This comprehensive analysis, detailing Centrica's business units categorized by market share and growth rate, is ready for immediate strategic application. You can confidently expect the same high-quality, watermark-free report to be delivered, enabling you to make informed decisions about resource allocation and future investments.

Dogs

Legacy inefficient energy tariffs represent older, less competitive offerings that British Gas may still provide to a shrinking customer base. These tariffs often struggle with lower profit margins and experience higher customer turnover as consumers shift to newer, more cost-effective, or environmentally friendly options. For instance, in 2024, the UK energy market continued to see significant customer migration, with reports indicating millions of households switching suppliers, often driven by price and green credentials, directly impacting the viability of these legacy plans.

Outdated home energy products, like older gas boilers or early-generation smart thermostats, often fall into the Dogs category of the BCG Matrix. These items typically experience declining sales volume and market share as newer, more efficient, or feature-rich alternatives emerge. For instance, in 2024, the demand for traditional combi boilers continued to wane as heat pumps gained traction, with government incentives further accelerating this shift.

These legacy products require significant investment in terms of customer support, spare parts, and maintenance, yet they generate minimal revenue or profit. Centrica, for example, might find that maintaining service contracts for a dwindling base of older heating systems diverts resources that could be better allocated to growing areas like smart home energy management or renewable energy solutions.

Certain niche B2B energy contracts within Centrica, perhaps those tied to specific industrial processes or older energy technologies, may be struggling. These could be facing profitability challenges due to evolving client demands for greener solutions or increased operational expenses. For instance, contracts for supplying natural gas to legacy industrial sites might be seeing reduced margins as clients shift towards electrification or renewable energy sources.

Gas Storage Operations (Rough - Short-term Outlook)

Centrica's Rough gas storage facility faced a difficult financial period in the first half of 2025. This was primarily due to narrow seasonal gas price differences and a general decrease in market volatility. Consequently, operating profit saw a substantial decline.

Despite its substantial storage capacity, which is crucial for the UK's energy security, the financial performance of Rough has been negatively impacted. The challenging market conditions for gas storage, expected to persist in the short to medium term, have placed this segment in the 'Dog' category from a purely financial perspective.

- Strategic Importance: Vital for UK energy security.

- Financial Performance (H1 2025): Challenging due to low seasonal price spreads and reduced volatility.

- Operating Profit: Experienced a significant drop.

- BCG Matrix Classification: Positioned as a 'Dog' due to reduced profitability and market conditions, despite strategic value.

Divested Non-Core Assets

Centrica has been strategically divesting non-core assets to sharpen its focus. A notable example is the sale of its 46.25% stake in the Cygnus gas field. This move, completed in recent years, signals a deliberate effort to streamline its portfolio and concentrate on areas with higher growth potential or strategic importance.

These divested assets, like the Cygnus stake, often represent investments that have either matured, underperformed relative to expectations, or simply no longer fit the company's long-term vision. By shedding these segments, Centrica aims to free up capital and management attention for more promising ventures.

- Divestment of Cygnus Gas Field Stake: Centrica sold its 46.25% interest in the Cygnus gas field, a significant step in its asset rationalization strategy.

- Strategic Portfolio Refinement: This action demonstrates Centrica's commitment to focusing on core businesses and divesting non-essential or underperforming assets.

- Capital Reallocation: The proceeds from such divestitures are typically reinvested into areas deemed more critical for future profitability and growth.

Centrica's legacy energy tariffs and outdated home energy products, such as older gas boilers, are prime examples of 'Dogs' in the BCG Matrix. These offerings face declining demand and market share as newer, more efficient alternatives emerge, impacting profitability and requiring careful management to avoid resource drain.

The Rough gas storage facility, despite its strategic importance for energy security, experienced a significant drop in operating profit in the first half of 2025 due to low market volatility and narrow price spreads. This financial underperformance, projected to continue in the short to medium term, positions it as a 'Dog' from a financial standpoint.

Divestments like Centrica's sale of its stake in the Cygnus gas field exemplify the strategic management of 'Dog' assets. These actions free up capital and focus resources on more promising ventures, reflecting a deliberate portfolio refinement to enhance overall company performance.

| Centrica Business Segments/Products | Market Growth | Relative Market Share | BCG Classification | Rationale |

|---|---|---|---|---|

| Legacy Energy Tariffs | Low | Low | Dog | Shrinking customer base, lower profit margins, high churn. |

| Outdated Home Energy Products (e.g., older boilers) | Low | Low | Dog | Declining sales as efficient alternatives gain traction. |

| Rough Gas Storage Facility (Financial Perspective) | Low (Market Conditions) | Low (Profitability) | Dog | Challenging financial performance due to market dynamics. |

| Divested Assets (e.g., Cygnus Gas Field Stake) | N/A | N/A | Divested | No longer part of the core portfolio, managed for value realization. |

Question Marks

Centrica's early-stage green hydrogen production ventures, such as the Måde facility in Denmark, represent a significant investment in a high-growth potential market. These projects are currently in their infancy, meaning they have a low market share but are poised for substantial expansion as the technology matures and demand increases.

The commercial viability of green hydrogen is still being established, requiring considerable ongoing investment to overcome technological hurdles and build out infrastructure. This positions these initiatives as Question Marks within the BCG matrix, demanding careful strategic evaluation and resource allocation to determine if they can transition into future Stars.

Large-scale heat pump installations, or the mass market segment, represent a significant growth opportunity for Centrica, with an ambitious target of 20,000 installations annually by 2030. This market is fueled by the UK's strong decarbonisation goals, making it a high-growth area.

However, scaling up in this segment faces hurdles. Centrica acknowledges that achieving its target is challenging due to existing UK infrastructure limitations and slower-than-desired consumer adoption rates. Significant investment will be needed in training installers, developing necessary infrastructure, and educating consumers about the benefits of heat pumps.

While the market is expanding rapidly, Centrica's current market share in this mass-market heat pump segment is likely modest. This necessitates a strategic approach to capture a larger portion of this burgeoning market.

Next-generation smart home energy solutions, encompassing integrated appliances, renewable generation, and grid flexibility, represent a significant growth frontier beyond basic smart thermostats. Centrica's Hive brand is strategically positioned in this burgeoning market. However, securing a leading market share within the dynamic and competitive smart home landscape necessitates considerable investment in research and development alongside robust market penetration strategies.

These advanced integrated systems are still in their nascent stages of adoption, indicating substantial potential for future expansion. For instance, the global smart home market was valued at approximately $84.1 billion in 2023 and is projected to reach $200 billion by 2028, with energy management solutions being a key driver of this growth. Centrica's ongoing commitment to innovation in this sector is crucial for capturing a substantial portion of this expanding market.

International Renewable Energy Trading & Optimisation (New Markets)

Centrica's expansion into international renewable energy trading and optimization, particularly in emerging markets like the Baltics and Italy, positions it within the Question Marks quadrant of the BCG matrix. The company's goal to manage 30 GW of third-party renewable assets by 2030 signifies a significant growth ambition in a sector experiencing rapid expansion. For instance, the European renewable energy market saw substantial growth in 2023, with offshore wind capacity alone increasing by over 2 GW across the region.

While Centrica is actively building its presence, its market share in these newer international trading arenas is likely nascent. This requires substantial investment to build infrastructure, develop trading expertise, and forge crucial partnerships. The International Energy Agency reported that global renewable energy capacity additions reached a record 510 GW in 2023, highlighting the competitive landscape Centrica is entering.

- Centrica's ambition to manage 30 GW of renewable assets by 2030 underscores a strategic push into high-growth international markets.

- The rapidly expanding global renewable energy trading market presents both significant opportunities and intense competition.

- Centrica's current market share in newer international markets is likely low, necessitating strategic investment to gain traction.

- The company's focus on regions like the Baltics and Italy reflects a targeted approach to capitalize on emerging renewable energy hubs.

Emerging Carbon Capture and Storage (CCS) Ventures

Emerging Carbon Capture and Storage (CCS) ventures fit into Centrica's BCG Matrix likely as Question Marks. Centrica is actively investigating diverse pathways to achieve a net-zero future, and CCS is a key component, particularly when integrated with their hydrogen production and flexible power generation capabilities.

These CCS initiatives represent nascent but rapidly expanding sectors vital for decarbonizing heavy industry. While the potential for growth is substantial, Centrica's current engagement is probably in preliminary development or pilot stages, demanding considerable investment with uncertain immediate financial returns.

- Market Growth: The global CCS market is projected to grow significantly, with estimates suggesting it could reach hundreds of billions of dollars by 2030, driven by net-zero targets.

- Investment: CCS projects often require substantial upfront capital, with individual large-scale facilities costing upwards of $1 billion.

- Technological Maturity: While the concept is established, widespread commercial deployment and cost-effectiveness are still evolving.

- Regulatory Support: Government incentives and regulations play a crucial role in the viability of CCS ventures.

Centrica's early-stage green hydrogen production and international renewable energy trading ventures are prime examples of Question Marks. These initiatives are characterized by high growth potential but currently hold a low market share, demanding significant investment to overcome technological and market entry challenges.

The company's strategic focus on areas like the Baltics and Italy for renewable energy trading, alongside its nascent carbon capture and storage (CCS) projects, highlights its pursuit of future growth engines. While the global market for these technologies is expanding rapidly, Centrica's position is still developing, requiring substantial capital and strategic partnerships to secure a competitive edge.

These ventures, including the Måde facility and next-generation smart home solutions, are crucial for Centrica's long-term strategy. However, their success hinges on navigating evolving technologies, consumer adoption, and regulatory landscapes, making them areas that require careful monitoring and resource allocation to potentially transition into future Stars.

The global smart home market, a key area for Centrica's Hive brand, was valued at approximately $84.1 billion in 2023 and is projected to reach $200 billion by 2028. Similarly, the global CCS market is expected to see substantial growth, with some projections indicating it could reach hundreds of billions of dollars by 2030.

| Business Unit | BCG Quadrant | Market Growth | Market Share | Strategic Focus |

|---|---|---|---|---|

| Green Hydrogen Production | Question Mark | High | Low | Investment in R&D, infrastructure development, and market adoption |

| International Renewable Energy Trading | Question Mark | High | Low (in new markets) | Building expertise, partnerships, and infrastructure in emerging hubs |

| Carbon Capture & Storage (CCS) | Question Mark | High | Low (nascent stage) | Pilot projects, technological advancement, and regulatory engagement |

| Next-Gen Smart Home Solutions | Question Mark | High | Modest (competitive landscape) | Innovation, R&D, and market penetration strategies |

BCG Matrix Data Sources

Our Centrica BCG Matrix leverages a blend of internal financial disclosures, market growth data from industry reports, and competitor performance benchmarks to provide a clear strategic overview.