Centrica Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Centrica Bundle

Centrica faces significant competitive pressures, from the bargaining power of its substantial customer base to the constant threat of new entrants disrupting the energy market. Understanding these dynamics is crucial for any stakeholder.

The complete report reveals the real forces shaping Centrica’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Centrica's reliance on wholesale energy markets, particularly gas and electricity, exposes it to significant supplier power due to the concentration of major producers and international trading hubs. This limited supplier base means fewer options for Centrica to source its core commodities, directly impacting its cost structure.

The energy sector in 2024 continues to be shaped by global supply and demand, amplified by geopolitical tensions. For instance, fluctuations in natural gas prices, heavily influenced by events in regions like Eastern Europe, directly translate into higher input costs for Centrica. In Q1 2024, European natural gas prices saw considerable volatility, with benchmarks like TTF reaching levels that significantly squeezed margins for energy retailers.

This concentration grants primary energy suppliers substantial leverage, often forcing energy retailers like Centrica to accept prevailing market prices rather than negotiate favorable terms. Consequently, Centrica's profitability can be directly impacted by the pricing power of these concentrated wholesale energy sources, limiting its ability to control its own costs.

Centrica's Rough gas storage facility, a cornerstone of UK energy security, holds roughly half of the nation's gas storage capacity. Its continued operation, especially beyond 2025, is heavily reliant on government support for crucial upgrades and potential conversion to hydrogen storage.

This reliance positions the government and the broader energy system as significant suppliers, influencing Centrica's strategic decisions through regulatory frameworks and financial stability. Without this essential backing, the facility's future remains uncertain, underscoring the substantial supplier power at play.

As Centrica ventures deeper into smart home tech and energy efficiency, its dependence on specialized tech and service providers grows. Suppliers offering unique smart meter tech or advanced digital platforms can wield considerable influence, especially if their solutions are proprietary or demand intricate integration. Centrica's commitment to installing smart meters, with a target of 8 million by 2028, highlights this crucial reliance.

Labour and Specialist Skills

The availability of skilled labour, particularly for specialized roles like field service engineers for boiler servicing and smart home installations, grants significant bargaining power to this supplier group. A scarcity of qualified professionals within the energy services sector could lead to increased labor expenses or negatively affect the quality and timeliness of service delivery. Centrica's substantial workforce of approximately 6,800 field service engineers underscores the critical importance of this human capital. In 2024, the demand for these specialized skills remained high, with reports indicating a persistent shortage in the UK's energy services sector, potentially pushing average engineer salaries upwards by 5-10% compared to the previous year.

This reliance on a skilled workforce presents a key challenge for Centrica.

- Skilled Labour Availability: Shortages in field service engineers for boiler servicing and smart home tech directly impact operational capacity.

- Cost Pressures: A tight labor market can drive up wages, affecting Centrica's cost structure.

- Service Quality: Insufficient skilled personnel can compromise the speed and quality of customer service.

- Centrica's Workforce: The company employs around 6,800 field service engineers, highlighting their dependence on this talent pool.

Regulatory and Compliance Suppliers

Regulatory and compliance entities, such as Ofgem in the UK and CRU in Ireland, along with legal and compliance service providers, act as significant suppliers to companies like Centrica. Their mandates and frameworks, including the energy price cap and financial resilience requirements, directly shape Centrica's operational freedom and pricing strategies. For instance, in 2024, the energy sector continued to navigate stringent regulatory landscapes, impacting investment in new infrastructure and operational costs.

The influence of these regulatory suppliers is substantial, as their policies dictate the very parameters within which Centrica must operate. Evolving net-zero targets and energy transition mandates, for example, introduce considerable cost pressures and necessitate strategic adjustments to comply with new environmental standards. These compliance costs, often passed on through operational expenses, can directly affect Centrica's profitability and its ability to compete effectively in the market.

- Regulatory Oversight: Bodies like Ofgem set crucial operating conditions and pricing controls for energy suppliers.

- Compliance Costs: Adherence to net-zero targets and energy transition mandates in 2024 added significant operational expenses for energy firms.

- Policy Impact: Changes in regulations, such as financial resilience measures, directly influence business strategy and investment decisions.

Centrica faces considerable supplier power from concentrated wholesale energy markets, with limited producers and trading hubs dictating commodity prices. This leverage directly impacts Centrica's cost structure, as seen in the volatility of European natural gas prices in Q1 2024, which significantly squeezed energy retailers' margins.

The company's reliance on specialized technology providers for smart home solutions and advanced digital platforms also grants these suppliers significant influence, particularly when proprietary solutions require intricate integration. Centrica's commitment to installing 8 million smart meters by 2028 underscores this growing dependence.

Furthermore, a shortage of skilled labor, such as field service engineers, empowers this supplier group. In 2024, persistent demand for these specialized skills in the UK's energy services sector led to potential wage increases of 5-10%, impacting Centrica's operational costs and service delivery capacity, given its workforce of approximately 6,800 engineers.

| Supplier Type | Impact on Centrica | 2024 Data/Observation |

|---|---|---|

| Wholesale Energy Producers | Price setting power, margin pressure | European natural gas prices (TTF) showed high volatility in Q1 2024. |

| Technology Providers | Leverage through proprietary solutions | Centrica aims for 8 million smart meter installations by 2028. |

| Skilled Labour (Field Engineers) | Increased labor costs, service delivery risk | Potential 5-10% wage increase for engineers due to sector shortages. |

What is included in the product

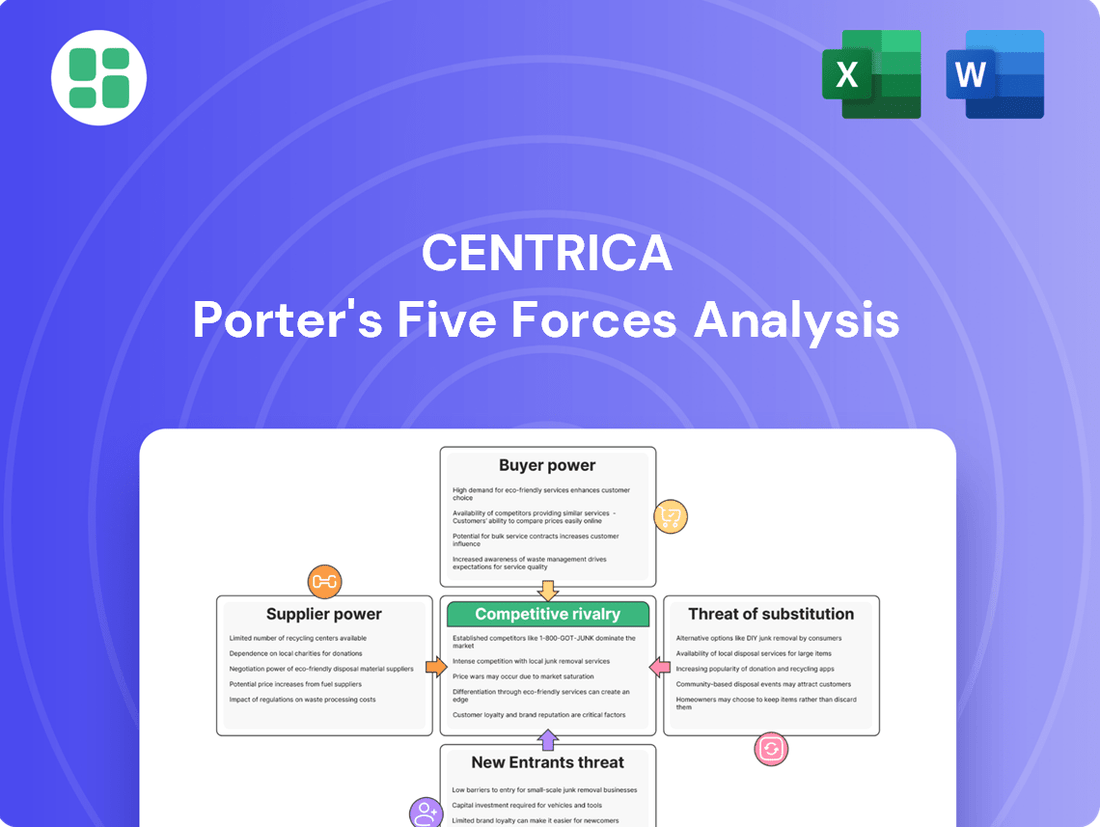

Centrica's Porter's Five Forces Analysis reveals the intense competition within the energy sector, highlights the significant bargaining power of customers, and assesses the threats posed by new entrants and substitute energy sources.

Quickly identify and mitigate competitive threats with a visual representation of all five forces, enabling proactive strategic adjustments.

Customers Bargaining Power

Customers in the UK and Ireland energy markets, both residential and business, show a high degree of price sensitivity. This is particularly true given that energy bills remain elevated compared to pre-crisis periods, making cost a primary consideration.

The availability of comparison websites and relatively low switching costs empower customers to easily move between energy suppliers. This ease of comparison and switching directly influences their bargaining power, as they can readily seek out better deals.

Switching rates have been dynamic, with notable surges observed in late 2024 and early 2025. These increases were largely spurred by adjustments to price caps and the reappearance of more attractive fixed-rate tariffs, demonstrating a clear customer response to price incentives.

Even with a few dominant players like Centrica's British Gas, the UK energy market in 2024 and early 2025 boasted a significant number of active suppliers. By March 2025, there were 21 domestic energy suppliers operating, offering consumers a real choice. This competition directly impacts Centrica's bargaining power with its customers.

The sheer volume of suppliers available means customers aren't locked into a single provider. They can actively switch to find better prices or improved service, a dynamic that significantly strengthens their position. We saw this play out with customer movements between both large and smaller energy firms throughout 2024.

The energy price cap, implemented by Ofgem, significantly curtails Centrica's ability to set prices for customers on standard variable tariffs. This directly reduces the bargaining power of these customers, as their options for price comparison are limited by the regulated ceiling. For instance, in early 2024, the Ofgem price cap for typical household energy bills was set at £1,928 annually, a reduction from previous periods, impacting supplier revenue streams.

Smart Meter Adoption and Data Access

The increasing rollout of smart meters significantly enhances customer bargaining power. By the end of 2024, over 66% of domestic meters in Great Britain are expected to be smart meters, giving consumers unprecedented visibility into their energy usage. This data empowers them to make more informed decisions regarding consumption patterns and tariff selections, such as opting for time-of-use tariffs.

This enhanced data access allows customers to actively manage their energy consumption and participate in demand-side response programs. Such participation can lead to cost savings and a greater ability to negotiate better terms or switch providers more readily. Consequently, suppliers must offer more competitive pricing and services to retain these informed customers.

- Smart Meter Penetration: Over 66% of domestic meters in Great Britain by end of 2024.

- Customer Empowerment: Increased visibility into energy consumption and costs.

- Informed Decisions: Ability to choose optimal tariffs, including time-of-use.

- Demand-Side Response: Greater customer engagement in managing grid load.

Demand for Sustainable and Innovative Solutions

Customers are increasingly vocal about their desire for sustainable and energy-efficient products, a trend that directly benefits Centrica's commitment to net-zero goals. This growing demand empowers consumers who are actively seeking out green energy tariffs and smart home technologies. For instance, in 2024, a significant portion of consumers expressed a willingness to switch energy providers based on sustainability credentials, with some surveys indicating over 60% prioritizing eco-friendly options.

This shift in customer preference means that companies like Centrica gain leverage by offering attractive propositions in areas such as electric vehicle (EV) charging tariffs or the installation of heat pumps. The ability to meet these evolving needs directly impacts customer acquisition and retention rates. In 2023, Centrica reported a substantial increase in demand for its home energy solutions, including smart thermostats and insulation services, reflecting this customer-driven push towards efficiency.

- Growing Demand for Green Energy: By 2024, consumer surveys consistently showed a preference for energy providers with strong sustainability commitments.

- Smart Home Technology Adoption: Centrica's smart home offerings, like smart meters and controls, saw increased uptake as customers sought greater energy efficiency.

- EV Charging Solutions: The expansion of EV infrastructure and associated tariffs became a key differentiator for energy providers.

- Heat Pump Installations: Government incentives and consumer awareness drove a surge in demand for heat pump installations, an area Centrica actively developed.

The bargaining power of customers in the UK energy market is significant, driven by price sensitivity and the ease of switching between a multitude of suppliers. By March 2025, 21 domestic energy suppliers were active, offering consumers ample choice. This competitive landscape, coupled with the increasing adoption of smart meters—over 66% of Great Britain's domestic meters by the end of 2024—empowers customers with greater visibility into their energy usage and costs, enabling informed decisions about tariffs and consumption.

Customers are also increasingly prioritizing sustainability, with a substantial portion willing to switch providers based on eco-friendly credentials. This trend, evident in 2024 consumer surveys where over 60% favored green options, pushes companies like Centrica to innovate with offerings such as EV charging tariffs and heat pump installations to retain and attract business. The energy price cap, while limiting customer choice on standard variable tariffs, still operates within a market where informed consumers can leverage data and competitive offerings to their advantage.

| Factor | Impact on Customer Bargaining Power | Supporting Data (as of early-mid 2025) |

|---|---|---|

| Price Sensitivity | High | Energy bills remain elevated; customers actively seek lower costs. |

| Switching Costs & Ease | Low | Comparison websites and minimal exit fees facilitate easy supplier changes. |

| Number of Suppliers | High | 21 domestic energy suppliers operating in the UK market (March 2025). |

| Smart Meter Penetration | Increases Power | Over 66% of domestic meters in Great Britain are smart meters (end of 2024). |

| Sustainability Demand | Increases Power | Over 60% of consumers prioritize eco-friendly providers (2024 surveys). |

Preview the Actual Deliverable

Centrica Porter's Five Forces Analysis

This preview showcases the complete Centrica Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the energy sector. The document you see here is precisely the same professionally formatted and ready-to-use analysis that you will receive immediately after purchase, ensuring no surprises and full immediate access.

Rivalry Among Competitors

The UK domestic retail energy market presents a paradox: while 21 suppliers are active, a significant concentration exists. In late 2024, the top six suppliers, including Centrica's British Gas, collectively controlled a commanding 91% of the market. This means intense rivalry primarily plays out among these dominant entities, shaping competitive strategies.

This concentrated structure fuels fierce competition among the major players. They actively vie for customer acquisition and retention, often through aggressive pricing strategies and enhanced service packages. The battle for market share among these few giants is a defining characteristic of the industry's competitive rivalry.

The Ofgem energy price cap is a major driver of intense competition among energy suppliers, forcing them to compete on factors beyond just price. This regulatory measure limits how much suppliers can charge customers, pushing them to find efficiencies in their operations and to differentiate through customer service or innovative products rather than aggressive pricing strategies.

While wholesale energy prices saw some stabilization in late 2024 and into 2025, allowing for the reintroduction of a few fixed-rate tariffs, the overall margin pressure on suppliers remains considerable. This environment necessitates a keen focus on cost control and operational excellence to maintain profitability under the price cap.

Customer switching rates in the energy sector remain a significant factor in competitive rivalry, especially among larger providers. In 2023, for instance, Ofgem data indicated that around 4.4 million domestic energy accounts switched suppliers, a notable figure, though down from the peak years of the energy crisis.

Centrica, like its peers, faces the challenge of retaining customers in this environment. This necessitates ongoing investment in customer service excellence, the development of attractive loyalty schemes, and the creation of compelling product bundles that go beyond basic energy supply to foster customer stickiness.

The landscape of customer switching has been dynamic. Following the extreme volatility of the energy crisis, there was a period of subdued switching. However, shifts in the price cap, such as the one implemented in April 2024, tend to trigger renewed interest in switching as consumers seek better value.

Diversification into Energy Services and Solutions

Competitive rivalry in the energy sector is intensifying as companies like Centrica expand beyond traditional energy supply. This shift into comprehensive energy services and solutions, such as boiler servicing, smart home technology, and energy efficiency programs, pits Centrica against a broader array of competitors, including specialized service providers and technology firms, not just other utility companies.

This diversification creates a new battleground for customer loyalty and future revenue streams. For instance, Centrica's British Gas Home Services division competes with numerous independent boiler repair and installation companies. The market for smart home energy management systems also sees intense competition from tech giants and dedicated smart home solution providers, all vying for a share of the growing demand for integrated home energy management.

- Diversification: Energy companies are moving beyond supply to offer services like installation, maintenance, and smart home technology.

- New Competitors: This expansion brings competition from specialized service providers and tech companies.

- Customer Loyalty: Services and solutions are becoming key differentiators for retaining customers.

- Market Growth: The market for energy efficiency and smart home solutions is a significant growth area for competitive focus.

Strategic Investments in Decarbonisation and Infrastructure

Competitive rivalry in the energy sector is intensifying as players strategically invest in the transition to a low-carbon future. This includes significant outlays in renewable energy generation, advanced energy storage solutions, and emerging low-carbon technologies.

Centrica's own substantial commitment of £4 billion by 2028 underscores this trend. These investments, such as those in the Sizewell C nuclear project and the burgeoning hydrogen energy sector, are designed to secure long-term market leadership in the evolving energy landscape.

- Renewable Energy Investments: Competitors are channeling capital into solar, wind, and other renewable sources to build substantial generation capacity.

- Energy Storage Solutions: Significant investments are being made in battery storage and other technologies to manage the intermittency of renewables.

- Low-Carbon Technology Development: Companies are funding research and deployment of technologies like hydrogen, carbon capture, and advanced nuclear power.

- Infrastructure Upgrades: Investments extend to modernizing grids and developing new infrastructure to support decentralized and cleaner energy systems.

The UK domestic energy market is highly concentrated, with the top six suppliers, including Centrica, holding 91% of the market share as of late 2024. This intense rivalry is primarily between these major players, who compete aggressively on price and service to attract and retain customers. The regulatory environment, particularly Ofgem's energy price cap, further intensifies this competition by limiting price increases and pushing suppliers to differentiate through efficiency and customer service.

Customer switching remains a significant competitive lever, with approximately 4.4 million domestic energy accounts changing suppliers in 2023. This dynamic necessitates that companies like Centrica focus on enhancing customer loyalty through superior service, loyalty programs, and bundled offerings beyond basic energy supply. The market is also evolving with companies expanding into services like boiler maintenance and smart home technology, creating new competitive fronts against specialized providers and tech firms.

Centrica's strategic investments, such as its £4 billion commitment by 2028 in areas like renewable energy generation and hydrogen technology, highlight the industry's shift towards low-carbon solutions. This focus on future energy infrastructure and technology creates a new arena for competition, where companies vie for leadership in the evolving energy landscape.

| Metric | Value (Late 2024/Early 2025) | Source/Context |

|---|---|---|

| Market Share of Top 6 Suppliers | 91% | UK Domestic Retail Energy Market |

| Customer Switches (2023) | 4.4 million | Ofgem Data |

| Centrica Investment (by 2028) | £4 billion | Low-Carbon Transition |

SSubstitutes Threaten

The rise of self-generation and decentralized energy presents a significant threat of substitutes for traditional grid-supplied electricity. Rooftop solar panels and battery storage systems are becoming more affordable and accessible, allowing consumers and businesses to produce their own power.

Government policies are actively encouraging this shift. For instance, the Future Homes Standard, effective from autumn 2025, will require solar panels on all new homes in the UK, further normalizing and promoting self-generation.

Businesses are also embracing onsite generation to enhance energy security and reduce reliance on the grid. This trend is driven by a desire for greater control over energy costs and supply, directly impacting demand for utility services.

The threat of substitutes for energy consumption itself is significant, driven by the increasing adoption of energy efficiency measures. Innovations like smart thermostats and advanced insulation technologies directly reduce the need for purchased energy, impacting sales volumes for companies like Centrica. For instance, in the UK, government initiatives and consumer awareness have led to a notable decrease in domestic energy consumption per household over the past decade, even as the number of households has grown.

Centrica's own offerings in energy efficiency services present a complex dynamic. While these services aim to reduce customers' overall energy usage, thereby acting as a substitute for traditional energy supply, they also create a new avenue for revenue generation. This dual role means Centrica must strategically balance promoting efficiency with maintaining its core energy sales.

The threat of substitutes for traditional heating and cooling systems is growing, directly impacting Centrica. Heat pumps, for instance, are increasingly viable alternatives to gas boilers, supported by government initiatives.

In 2024, the UK government's commitment to reducing carbon emissions is driving adoption of low-carbon heating. For example, new build regulations often mandate these technologies, and the removal of planning hurdles for heat pump installations in 2024 further lowers barriers to entry for these substitutes. This shift directly challenges Centrica's core business in gas supply and boiler maintenance.

Shift to Hydrogen and Other Green Gases

The growing momentum behind green gases, particularly hydrogen, presents a significant long-term threat to Centrica's core natural gas business. As the technology matures and infrastructure develops, hydrogen could increasingly displace natural gas in heating and industrial applications, potentially reducing demand for Centrica's existing supply portfolio.

Centrica is actively addressing this by investing in the transition to a hydrogen-based economy. A prime example is the ongoing work at the Rough gas field, which is being repurposed to store hydrogen, positioning Centrica to be a key facilitator of this emerging energy source.

- Hydrogen as a Substitute: Green hydrogen, produced using renewable energy, offers a decarbonized alternative to natural gas for heating and industrial processes.

- Centrica's Investment: Centrica is investing in hydrogen production and storage, exemplified by its plans for the Rough gas field, aiming to capture value in the future energy landscape.

- Market Impact: Widespread adoption of hydrogen could diminish the long-term demand for traditional natural gas, affecting Centrica's established revenue streams.

DIY and Independent Service Providers

For Centrica's services, particularly in areas like boiler maintenance and smart home installations, a significant threat comes from independent local tradespeople and DIY approaches. Customers might choose these less expensive alternatives over contracted services, especially for straightforward smart home setups. For instance, a 2024 survey indicated that over 35% of homeowners were considering or had already undertaken minor home repairs themselves to save costs.

These substitutes directly challenge Centrica's established service models. Independent providers often operate with lower overheads, allowing them to offer more competitive pricing. DIY solutions, while requiring customer effort, eliminate labor costs entirely, appealing to budget-conscious consumers. This pressure can impact Centrica's market share and pricing power within its services division.

Centrica counteracts this threat by focusing on its core strengths: reliability, the value of its comprehensive service plans, and its trusted brand reputation. These elements aim to justify a premium price by offering peace of mind, guaranteed workmanship, and integrated solutions that DIY or individual tradespeople may not provide. The company's investment in customer service and extended warranties further differentiates its offerings.

- DIY Appeal: Approximately 40% of UK households reported undertaking at least one home maintenance task themselves in 2024, driven by cost savings.

- Independent Tradespeople: The market for independent tradespeople remains robust, with many offering specialized services at rates often 15-25% lower than larger service providers for comparable tasks.

- Centrica's Strategy: Centrica emphasizes its "Trust and Reliability" brand pillar, aiming to retain customers through service quality and bundled offerings, particularly for complex systems like central heating.

The threat of substitutes for Centrica's core energy supply business is substantial, driven by decentralized energy generation, like rooftop solar, and increasing energy efficiency measures. These alternatives directly reduce the need for grid-supplied power. Furthermore, the shift towards low-carbon heating, such as heat pumps replacing gas boilers, and the potential future displacement of natural gas by green hydrogen, represent significant substitutes that challenge Centrica's traditional revenue streams.

| Substitute Type | Description | Impact on Centrica | 2024 Data/Trend |

|---|---|---|---|

| Decentralized Generation | Rooftop solar, battery storage | Reduces demand for grid electricity | UK new home solar mandate from 2025 |

| Energy Efficiency | Smart thermostats, insulation | Lowers overall energy consumption | UK domestic energy use per household decreased over the past decade |

| Low-Carbon Heating | Heat pumps | Displaces natural gas boilers | UK planning hurdles for heat pumps removed in 2024 |

| Green Gases | Hydrogen | Potential replacement for natural gas | Centrica repurposing Rough gas field for hydrogen storage |

Entrants Threaten

Entering the energy supply market, especially for generation or large-scale distribution, demands substantial capital for infrastructure like power plants and grid connections. For instance, the construction of a new nuclear power plant can easily cost tens of billions of dollars, creating a significant financial hurdle.

Centrica's own substantial investments, such as those in nuclear power and gas storage facilities, highlight these high barriers to entry. These massive upfront costs and the need for specialized, regulated infrastructure serve as a powerful deterrent for most potential new competitors.

The UK and Irish energy sectors are overseen by strict regulatory bodies such as Ofgem and CRU. These authorities mandate rigorous licensing, robust financial resilience, and comprehensive consumer protection measures. For instance, Ofgem's Supplier Licence Conditions, particularly those concerning financial stability, have become increasingly demanding following a wave of supplier collapses in 2021 and 2022, which saw over 30 companies exit the market.

Established brand loyalty presents a significant barrier to new entrants in the energy sector. Companies like Centrica, operating under the well-recognized British Gas brand, have cultivated deep customer relationships over many years. This loyalty means that new players must invest heavily to even gain a foothold.

Customer acquisition costs are particularly high in this price-sensitive market. New entrants need substantial marketing budgets to build awareness and trust, often resorting to aggressive pricing strategies to entice consumers away from established providers. For instance, in 2024, the average cost for a utility company to acquire a new customer can range from £50 to £150, a considerable hurdle for startups.

Economies of Scale and Supply Chain Access

Centrica, like other established energy providers, benefits from significant economies of scale. This means they can spread their fixed costs over a larger volume of operations, leading to lower per-unit costs in areas like energy procurement, operational efficiency, and customer service infrastructure. For instance, in 2023, Centrica’s adjusted operating profit was £734 million, reflecting the efficiencies gained from its scale.

New entrants face a substantial hurdle in matching these cost advantages. They often lack the purchasing power to secure competitive wholesale energy contracts, which are crucial for profitability in the energy sector. Furthermore, gaining access to reliable and diverse energy supply chains, including crucial international Liquefied Natural Gas (LNG) agreements, presents a considerable barrier to entry, as these often require substantial upfront investment and established relationships.

- Economies of Scale: Centrica leverages its size to reduce per-unit costs in procurement, operations, and customer service.

- Wholesale Energy Contracts: New entrants struggle to secure the same favorable pricing as large incumbents due to lower purchasing volumes.

- Supply Chain Access: Establishing robust and diverse energy supply chains, including international LNG, is a capital-intensive barrier for newcomers.

Smart Meter Rollout and Data Integration Challenges

The extensive rollout of smart meters presents a significant hurdle for potential new entrants in the energy sector. Establishing the sophisticated IT infrastructure needed to manage the vast amounts of data generated by these meters, implement dynamic pricing models, and adhere to regulatory mandates demands substantial capital and specialized technical know-how. This complexity acts as a powerful deterrent, effectively favoring incumbent companies that have already made these investments.

For instance, in the UK, the government's smart meter rollout program, aiming for every household to have a smart meter by 2025, necessitates massive IT system upgrades for all energy suppliers. Companies like Centrica, through its British Gas subsidiary, are deeply involved in this, requiring ongoing investment in data analytics and customer interface technologies. New market entrants would face the daunting task of replicating this infrastructure from scratch, a considerable financial and operational challenge.

- High IT Infrastructure Costs: The development and maintenance of systems capable of handling smart meter data, including billing, analytics, and customer portals, represent a significant barrier to entry.

- Regulatory Compliance: Meeting the stringent requirements and timelines associated with national smart meter rollout programs demands substantial resources and expertise.

- Technical Expertise: The ability to effectively integrate, analyze, and leverage smart meter data for innovative service offerings requires specialized technical skills that are not easily acquired.

The threat of new entrants into Centrica's energy supply market is generally low, primarily due to the immense capital required for infrastructure and regulatory compliance. For example, building new power generation facilities can cost billions, a significant barrier for most potential competitors. Additionally, stringent licensing and financial resilience requirements, especially after the 2021-2022 supplier collapses where over 30 companies exited the UK market, further deter newcomers.

Existing customer loyalty, cultivated over years by brands like British Gas, necessitates substantial marketing investment for new entrants. Acquiring a new utility customer in 2024 can cost between £50 and £150, a considerable expense. Furthermore, Centrica's economies of scale allow for lower per-unit costs in procurement and operations, a competitive advantage difficult for smaller firms to match, as evidenced by Centrica's £734 million adjusted operating profit in 2023.

The widespread adoption of smart meters also poses a significant challenge. The IT infrastructure needed to manage the vast data generated by these meters and implement dynamic pricing requires substantial capital and technical expertise. New entrants must replicate this complex, regulated system, a daunting task that favors established players like Centrica who have already made these significant investments.

Porter's Five Forces Analysis Data Sources

Our Centrica Porter's Five Forces analysis is built upon a robust foundation of data, drawing from Centrica's annual reports, investor presentations, and regulatory filings. We supplement this with insights from industry-specific market research reports and reputable financial news outlets.