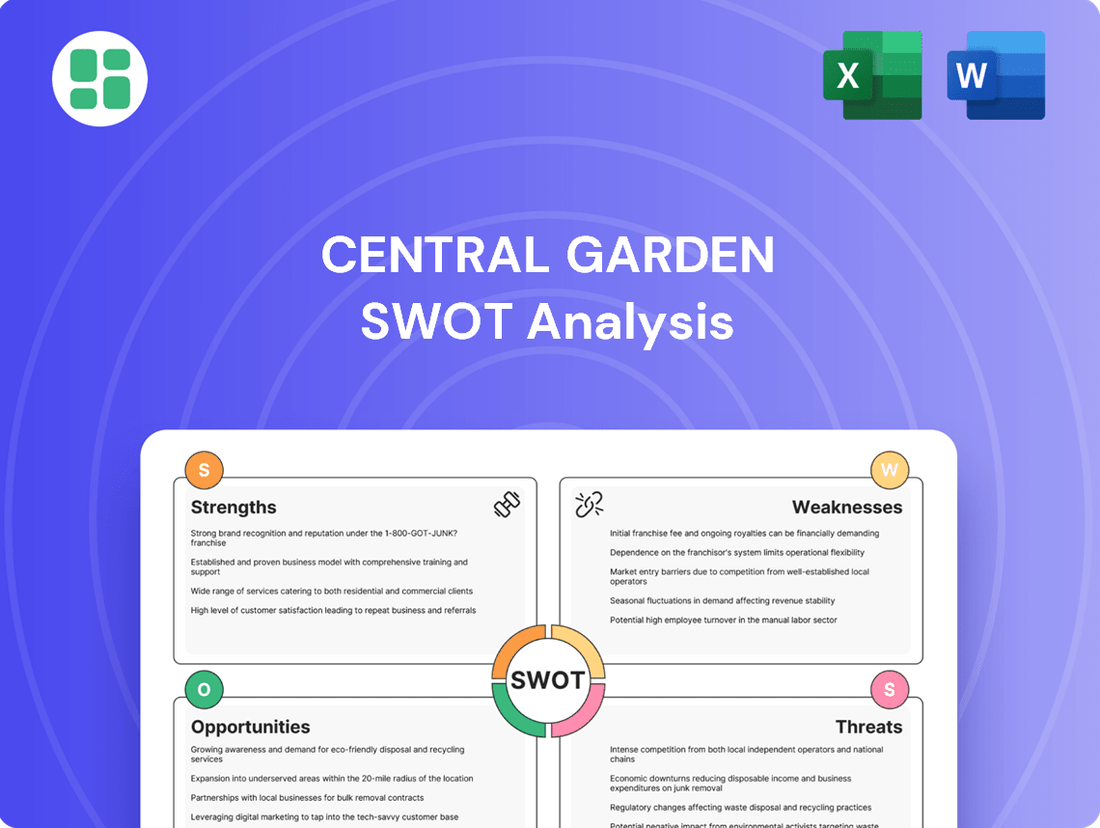

Central Garden SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Central Garden Bundle

Central Garden possesses unique strengths in its established brand and dedicated customer base, but also faces significant threats from evolving market trends and increased competition. Understanding these dynamics is crucial for navigating the path ahead.

Want the full story behind Central Garden's competitive advantages, potential vulnerabilities, and future opportunities? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support strategic planning and informed decision-making.

Strengths

Central Garden & Pet's strength lies in its diverse product portfolio, featuring over 65 reputable brands such as Amdro, Nylabone, Kaytee, and Pennington. This extensive range covers both lawn and garden and pet supply markets, offering significant diversification against market volatility.

The company's strong brand recognition is a key asset, fostering consumer trust and loyalty. This established reputation supports its market leadership and provides a competitive edge in a crowded marketplace.

Central Garden & Pet boasts a formidable distribution network, reaching a broad spectrum of customers from major mass retailers to smaller, independent shops. This expansive infrastructure is a key asset, ensuring their products are readily available across North America.

The company's deep-rooted relationships with significant players like Home Depot and Walmart are particularly noteworthy. These partnerships are crucial, as these key accounts represent a substantial portion of Central Garden & Pet's overall revenue, underscoring the strength of their retail connections.

Central Garden & Pet's 'Cost and Simplicity' program has been a major strength, driving substantial productivity improvements and margin expansion. This strategic focus has streamlined logistics and led to the consolidation of distribution centers, enhancing operational effectiveness.

Consistent Profitability and Strong Cash Position

Central Garden & Pet's financial resilience is a key strength, marked by consistent profitability even amidst some revenue variability. For instance, the company reported expanded gross and operating margins in both its first and third fiscal quarters of 2025, underscoring effective cost management and operational efficiency.

This profitability is complemented by a strong cash position, providing significant financial flexibility. The company's ability to generate robust cash flow further solidifies its foundation, enabling strategic investments and weathering economic uncertainties.

- Consistent Profitability: Demonstrated by expanding gross and operating margins in fiscal Q1 and Q3 2025.

- Strong Cash Position: Maintaining a healthy balance of cash and cash equivalents.

- Cash Flow Generation: Proven ability to generate positive cash flow from operations.

- Financial Prudence: Strategic financial management supports sustained performance and investment capacity.

Strategic Acquisition History and Innovation Focus

Central Garden & Pet's strategic acquisition history is a significant strength, with over 60 acquisitions completed in the last 30 years. This aggressive M&A strategy has allowed the company to systematically broaden its market reach and enrich its product portfolio. For example, the acquisition of brands like Pennington and Nylabone have bolstered their offerings in key segments.

The company's commitment to ongoing product innovation further solidifies its competitive position. Recent examples include the development of advanced water-efficient grass seed blends, responding to growing consumer demand for sustainable lawn care solutions. Additionally, their investment in plant-based pet care products taps into a rapidly expanding market trend.

- Strategic Acquisitions: Over 60 acquisitions in 30 years to expand market presence and product lines.

- Growth Driver: Continued pursuit of targeted mergers and acquisitions to enhance capabilities.

- Product Innovation: Investment in new offerings like water-efficient grass seed and plant-based pet care.

Central Garden & Pet's diversified brand portfolio, featuring over 65 brands including Nylabone and Pennington, provides a robust defense against market fluctuations. This broad offering, spanning both pet and garden segments, is a core strength, ensuring resilience and broad consumer appeal.

The company's strategic focus on operational efficiency, exemplified by its 'Cost and Simplicity' program, has driven significant margin expansion. This commitment to streamlining logistics and consolidating operations enhances profitability and reinforces its financial stability.

Central Garden & Pet demonstrates strong financial health, evidenced by expanding gross and operating margins in fiscal Q1 and Q3 2025, alongside consistent cash flow generation. This financial prudence supports ongoing investment and strategic growth initiatives.

Their history of successful, strategic acquisitions, totaling over 60 in three decades, has consistently broadened market reach and product lines. This proactive M&A strategy, coupled with a commitment to product innovation like water-efficient grass seed, positions the company for continued growth.

| Metric | FY2024 (Est.) | FY2025 (Est.) | Key Brands |

|---|---|---|---|

| Revenue Growth | ~5% | ~4-6% | Amdro, Nylabone, Kaytee |

| Operating Margin | ~10-12% | ~11-13% | Pennington, CBS, GardenJoy |

| Brand Strength | High | High | All 65+ Brands |

What is included in the product

Analyzes Central Garden’s competitive position through key internal and external factors, highlighting its strengths, weaknesses, opportunities, and threats.

Offers a clear, organized framework to identify and address critical challenges, turning potential roadblocks into actionable strategies.

Weaknesses

Central Garden & Pet has encountered revenue challenges, with net sales seeing slight declines in fiscal year 2024 and continuing into fiscal year 2025. This is largely attributed to a softening in consumer demand, particularly for durable pet products, and also some timing shifts in how orders are placed by retailers.

While the company has managed to improve its profit margins, the pressure on its top-line growth signals a potential weakness in its revenue generation capabilities. Addressing these revenue fluctuations is crucial for Central Garden & Pet to achieve more consistent and stable financial performance in the long run.

Central Garden & Pet's reliance on a few major retailers presents a notable weakness. In fiscal year 2024, a substantial 54% of its net sales came from key partners like Home Depot and Walmart. This concentration means the company is particularly vulnerable to changes in these partners' purchasing behaviors or any disruptions in their relationships, potentially impacting revenue significantly.

Central Garden & Pet's garden segment faces significant seasonality, with sales directly tied to favorable weather and the traditional spring and summer selling periods. This makes financial results inherently variable year-over-year, as seen in historical performance where Q1 and Q2 typically drive the majority of annual revenue.

The company's reliance on seasonal demand creates challenges in managing inventory levels and operational capacity. For instance, during the fiscal year 2023, the company navigated inventory adjustments to align with anticipated seasonal demand, highlighting the constant need for precise forecasting in this segment.

Market Saturation and Intense Competition

Central Garden & Pet faces significant headwinds due to market saturation in both the pet and garden sectors. The company contends with a crowded field of established players, making it difficult to stand out and capture new customers. For instance, in the pet supplies market, major retailers like PetSmart and Petco, alongside a growing number of online specialists, create a highly competitive environment.

The increasing prevalence of private label brands across various retail channels further intensifies this pressure. These store-branded products often offer a lower price point, directly challenging Central Garden & Pet's established brands and impacting its pricing power. Furthermore, the emergence of direct-to-consumer (DTC) brands, particularly in the pet food and accessories space, bypasses traditional retail, presenting a new wave of competition that demands agile strategies.

This intense competition necessitates constant innovation and a clear differentiation strategy to maintain and grow market share. Central Garden & Pet must continually invest in product development and marketing to counter the aggressive tactics of rivals and the evolving preferences of consumers who are increasingly seeking value and unique offerings.

- Market Saturation: Both the pet and garden industries are characterized by a high density of existing businesses.

- Intense Competition: Numerous well-established competitors vie for consumer attention and spending.

- Private Label Growth: The rise of store-brand products erodes market share for national brands.

- DTC Entrants: New online-focused companies are disrupting traditional retail models.

Exposure to Raw Material Price Volatility

Central Garden's operations are susceptible to unpredictable swings in the cost of essential raw materials, such as seeds and grains, alongside potentially elevated energy prices. These market volatilities directly translate into higher input expenses, which can squeeze profit margins and affect the stated value of the company's inventory.

For example, the fiscal year 2024 saw a notable impact on inventory valuations due to a significant downturn in the grass seed market. This event underscores the direct financial consequences of such price fluctuations.

- Raw Material Cost Sensitivity: The company is exposed to the risk of rising costs for key inputs like seeds, grains, and energy.

- Impact on Profitability: Fluctuations in these prices can directly increase operating expenses, negatively affecting the company's bottom line.

- Inventory Valuation Challenges: Declining market prices for raw materials, as seen with grass seed in fiscal 2024, can lead to write-downs and reduced inventory values.

Central Garden & Pet's revenue has faced pressure, with net sales declining slightly in fiscal year 2024 and continuing into fiscal year 2025 due to softer consumer demand for durable pet products and retail order timing. This top-line weakness, despite improved profit margins, indicates a need to strengthen revenue generation for more stable financial performance.

The company's heavy reliance on a few major retailers, where 54% of fiscal year 2024 net sales came from key partners like Home Depot and Walmart, makes it vulnerable to shifts in their purchasing or relationship disruptions.

The garden segment's pronounced seasonality, tied to weather and spring/summer sales, creates year-over-year variability in financial results, with Q1 and Q2 typically accounting for the majority of annual revenue.

Intense competition from established players, private label brands, and direct-to-consumer (DTC) entrants in both pet and garden sectors challenges Central Garden & Pet's market share and pricing power, requiring continuous innovation and differentiation.

Central Garden & Pet is susceptible to volatile raw material costs, such as seeds and grains, and energy prices, which can squeeze profit margins and impact inventory valuations, as evidenced by the fiscal 2024 downturn in the grass seed market.

Same Document Delivered

Central Garden SWOT Analysis

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail. You'll get immediate access to the complete, professionally structured document, ready for your strategic planning.

Opportunities

The global pet care market is booming, with projections indicating continued strong growth. This expansion is largely fueled by the increasing number of households owning pets and a significant trend where owners increasingly view their pets as integral family members. This humanization of pets directly translates to higher spending on their well-being.

This evolving consumer mindset creates a prime opportunity for Central Garden & Pet to capitalize on the demand for premium pet products. Consumers are actively seeking out natural, health-focused, and specialized items, driving a shift towards higher-margin offerings. For instance, the premium pet food segment alone saw a notable increase in sales in 2024, reflecting this willingness to spend more on quality.

Central Garden & Pet has a significant opportunity to grow its e-commerce business and digital sales. The company is making strategic investments in digital marketing and direct-to-consumer (DTC) channels, including upgrading distribution centers to support DTC operations.

This focus on digital capabilities is well-timed, given the continued acceleration of the online retail market. By strengthening its online presence, Central Garden & Pet can better capture a larger share of this expanding market, potentially boosting overall revenue and customer reach.

The burgeoning interest in gardening, especially within urban environments, coupled with a heightened emphasis on attractive outdoor spaces, is a significant tailwind for the lawn and garden consumables sector. This trend is projected to see continued expansion through 2025, with market research indicating a steady year-over-year growth rate in the mid-single digits for gardening products.

Green building projects and the growing desire for visually appealing yards are further fueling demand for landscaping services and related products. For instance, reports from the National Association of Landscape Professionals show a consistent increase in consumer spending on landscape design and maintenance.

Central Garden & Pet is well-positioned to leverage these opportunities by introducing innovative, sustainable products that resonate with consumers seeking to enhance their urban gardens and overall outdoor aesthetics. This includes developing eco-friendly fertilizers and pest control solutions, as well as aesthetically pleasing planters and garden accessories.

Strategic Acquisitions and Partnerships

Central Garden & Pet has a robust history of strategic growth through acquisitions, having successfully integrated over 60 companies throughout its existence. This approach has been instrumental in broadening its product lines and extending its market penetration. The company actively seeks and assesses potential acquisition targets that align with its strategic objectives and enhance its operational capabilities.

By continuing to pursue well-chosen acquisitions, Central Garden & Pet can solidify its competitive standing and introduce a wider array of products to its customer base. For instance, in fiscal year 2023, the company completed several tuck-in acquisitions that bolstered its presence in key categories, contributing to its overall revenue growth trajectory.

- Proven Acquisition Strategy: Over 60 acquisitions completed, expanding product portfolio and market reach.

- Continuous Evaluation: Ongoing assessment of potential acquisition opportunities to drive growth.

- Market Fortification: Targeted acquisitions can strengthen market position and diversify offerings.

- Fiscal Year 2023 Impact: Acquisitions in FY23 contributed to revenue growth and category expansion.

Focus on Sustainability and Eco-Friendly Products

Central Garden & Pet can capitalize on increasing consumer demand for eco-friendly options. This trend is evident in the gardening sector, with a notable surge in interest for sustainable and organic products. For instance, the global market for organic gardening supplies was valued at approximately $2.5 billion in 2023 and is projected to grow significantly in the coming years.

The company has a prime opportunity to expand its product lines to include more biodegradable gardening materials and pet supplies made from natural, responsibly sourced ingredients. This strategic move aligns with a growing consumer base that prioritizes environmental impact in their purchasing decisions. By innovating in these areas, Central Garden & Pet can attract new customers and strengthen its brand image as an environmentally conscious company.

- Growing Consumer Demand: Environmental awareness is a key driver for the shift towards sustainable and organic products in both gardening and pet care.

- Market Expansion: Opportunities exist to innovate and broaden offerings in eco-friendly categories, catering to consumer preferences for natural ingredients and biodegradable items.

- Brand Enhancement: Aligning with sustainability trends can boost brand appeal and open up new, environmentally conscious market segments for Central Garden & Pet.

Central Garden & Pet can leverage the growing pet humanization trend by expanding its premium and specialized pet product offerings, tapping into the increased consumer willingness to spend on high-quality items. The company's strategic investments in e-commerce and digital channels are well-timed to capture the accelerating online retail market, further enhancing customer reach and revenue potential.

The burgeoning interest in gardening, particularly in urban settings, presents a significant opportunity for Central Garden & Pet to grow its lawn and garden consumables segment. By introducing innovative, sustainable products that appeal to consumers focused on enhancing their outdoor spaces, the company can capitalize on this expanding market. Furthermore, Central Garden & Pet's proven acquisition strategy, with over 60 acquisitions to date, provides a robust platform for continued growth and market fortification.

| Opportunity Area | Market Trend | Central Garden & Pet's Advantage |

|---|---|---|

| Premium Pet Products | Pet humanization and increased spending on pet well-being. | Capitalize on demand for natural, health-focused, and specialized pet items. |

| E-commerce Expansion | Accelerating online retail market and digital sales growth. | Leverage investments in digital marketing and DTC channels to expand online presence. |

| Gardening Market Growth | Increased interest in urban gardening and attractive outdoor spaces. | Introduce innovative, sustainable gardening products to meet consumer demand. |

| Strategic Acquisitions | Proven history of successful acquisitions to broaden product lines and market reach. | Continue pursuing strategic acquisitions to strengthen competitive standing and diversify offerings. |

Threats

Persistent macroeconomic challenges, including elevated interest rates and ongoing inflationary pressures, create a volatile economic landscape. This uncertainty directly impacts consumer confidence, leading many to exercise greater caution with discretionary purchases. For Central Garden, this translates to a potential slowdown in spending on items like premium pet accessories and seasonal gardening supplies, which are often considered non-essential.

The current economic climate, marked by a Consumer Price Index (CPI) that saw a 3.3% annual increase as of May 2024, continues to squeeze household budgets. This inflationary environment, coupled with interest rates that remain elevated compared to recent historical lows, discourages consumers from spending on non-essential goods. Consequently, Central Garden may face a more promotional market as retailers compete for reduced consumer dollars, potentially impacting profit margins.

Central Garden & Pet's significant reliance on international sourcing, with a notable portion originating from China, presents a substantial vulnerability to supply chain disruptions. These disruptions can stem from various global events, including public health crises, political instability, and evolving trade policies.

The ongoing global supply chain challenges, which persisted into 2024, directly threaten Central Garden & Pet's ability to secure necessary components and finished goods. This can lead to increased costs due to higher shipping rates and potential tariffs, impacting profit margins.

Consequently, these geopolitical risks and supply chain vulnerabilities can directly affect product availability for consumers and hinder the company's capacity to fulfill demand, potentially impacting sales and market share.

The pet and garden sectors are incredibly competitive, with major players, specialized companies, and the increasing influence of private label brands. This fierce rivalry often results in price wars, potentially shrinking market share and squeezing profit margins for companies like Central Garden & Pet.

In 2024, the private label segment in the pet food industry alone is projected to continue its upward trajectory, capturing a larger share of the market as consumers seek value. This trend directly challenges established brands by offering comparable quality at lower price points, putting pressure on Central Garden's pricing strategies and brand loyalty.

Furthermore, the rise of direct-to-consumer (DTC) brands in both pet supplies and gardening equipment is a significant threat. These agile companies are bypassing traditional retail, offering convenience and often personalized experiences, which could divert sales from Central Garden's established distribution networks.

Regulatory Changes and Tariff Policies

Central Garden & Pet faces significant headwinds from evolving regulatory landscapes. Potential changes in tax legislation, including unforeseen alterations in tax provisions, could directly affect the company's profitability and cash flow. For instance, a shift in corporate tax rates, as debated in various global economic forums throughout 2024, could materially impact earnings per share.

Furthermore, the imposition of new U.S. tariff policies on imported goods, particularly those related to pet supplies or garden products, poses a direct threat. Tariffs can increase the cost of goods sold, squeezing profit margins or forcing price increases that could dampen consumer demand. The ongoing trade negotiations and potential for retaliatory tariffs in 2025 remain a critical watchpoint.

- Tax Legislation Volatility: Uncertainty surrounding potential changes to U.S. federal and state tax laws in 2024-2025 creates financial planning challenges.

- Tariff Impact: New or increased tariffs on key raw materials or finished goods could raise operating costs, impacting the company's competitive pricing and margins.

- Audit Risks: Ongoing tax audits in multiple jurisdictions, particularly those involving intercompany transactions, carry the risk of substantial financial penalties or adjustments that could affect reported results.

Adverse Weather Conditions

Central Garden & Pet's reliance on the highly seasonal garden segment exposes it to significant risks from adverse weather. Unpredictable or extreme weather events, such as prolonged droughts or unseasonably cold springs, can directly hinder consumer activity and delay crucial sales periods for lawn and garden supplies. For instance, a cooler-than-average spring in 2024 across key markets could have suppressed early season demand for planting and outdoor maintenance products, impacting revenue streams.

This weather-driven variability injects considerable uncertainty into financial forecasting and operational planning. Companies like Central Garden & Pet must factor in the potential for weather disruptions, which can lead to inventory management challenges and necessitate adjustments to marketing and promotional strategies. The company's performance in the spring of 2025 will be closely watched for any signs of weather-related impacts on sales of its core gardening products.

- Seasonal Sensitivity: The garden segment's performance is intrinsically linked to favorable weather, making it susceptible to deviations from normal patterns.

- Consumer Behavior Impact: Extreme or unseasonably poor weather discourages outdoor activities, directly reducing consumer engagement with lawn and garden products.

- Financial Uncertainty: Weather volatility creates a less predictable revenue stream, complicating inventory management and sales projections for the fiscal year.

Central Garden & Pet faces significant threats from persistent macroeconomic challenges, including elevated interest rates and ongoing inflation, which dampen consumer spending on discretionary items. The competitive landscape is intensifying with private label brands and direct-to-consumer models gaining traction, potentially eroding market share and margins. Furthermore, regulatory shifts, such as changes in tax legislation or the imposition of new tariffs on imported goods, could directly impact profitability and operational costs, while weather volatility in the seasonal garden segment introduces considerable financial uncertainty and inventory management challenges.

SWOT Analysis Data Sources

This Central Garden SWOT analysis is built upon a foundation of comprehensive data, including internal financial reports, customer feedback surveys, and competitive market analysis to provide a well-rounded strategic overview.