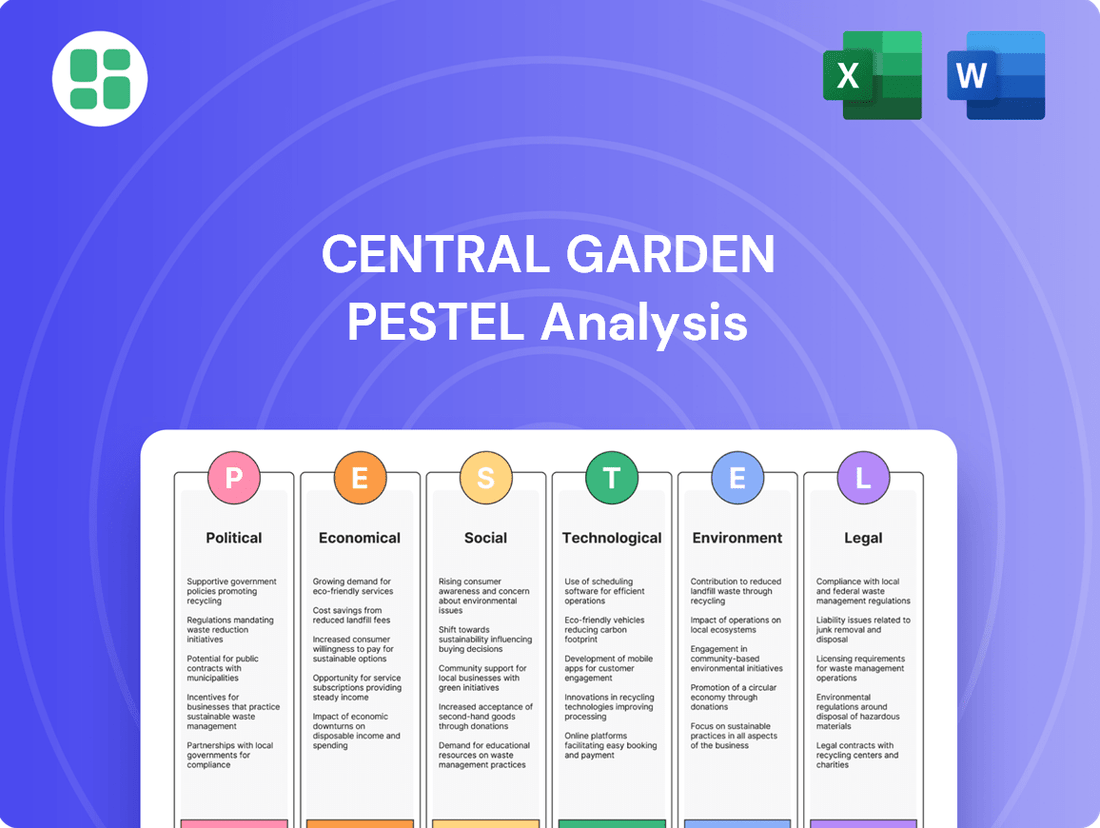

Central Garden PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Central Garden Bundle

Unlock the critical external factors shaping Central Garden's trajectory with our comprehensive PESTLE analysis. Understand how political shifts, economic fluctuations, and technological advancements are creating both opportunities and challenges for the company. Equip yourself with actionable intelligence to refine your market strategy and anticipate future trends. Download the full analysis now for a decisive competitive advantage.

Political factors

Governmental regulations significantly shape the market for pet food and garden products, with both federal and state agencies involved. The Federal Food, Drug and Cosmetic Act (FD&CA) and the Food Safety Modernization Act (FSMA) are key pieces of legislation ensuring pet food safety, hygienic production, and accurate labeling. For instance, FSMA's focus on preventative controls aims to reduce contamination risks in food production facilities, impacting how companies like Central Garden & Pet must operate.

The proposed Pet Food Uniform Regulatory Reform Act of 2025 (PURR Act) represents a potential shift towards a more centralized regulatory framework for pet food. This legislation, if enacted, could streamline compliance by consolidating labeling and ingredient approval processes under the FDA, moving away from the current patchwork of state-specific rules. This simplification could reduce operational complexities and costs for manufacturers operating across multiple states.

Changes in international trade policies, particularly tariffs, directly affect Central Garden & Pet's operational costs. For instance, the company's fiscal 2025 outlook accounts for the anticipated impact of recently enacted tariffs, signaling their material influence on financial planning. These policies can reshape global sourcing strategies and necessitate adjustments in supply chain logistics, ultimately influencing product pricing and profit margins.

Changes in agricultural and environmental policies significantly impact Central Garden & Pet's garden business. Regulations from bodies like the U.S. Environmental Protection Agency (EPA) are continually reviewing and potentially limiting the use of certain pesticides. For instance, the EPA's ongoing reviews of neonicotinoids, a common class of insecticides, could lead to further restrictions impacting product availability and formulation.

The increasing consumer demand for sustainable and organic gardening solutions also plays a crucial role. This trend is pushing companies like Central Garden & Pet to innovate and possibly reformulate their product lines to align with stricter environmental standards and eco-conscious preferences. By 2024, the market for organic pesticides and fertilizers was already showing robust growth, indicating a clear shift in consumer priorities that businesses must address.

Political Stability and Geopolitical Uncertainty

Political stability significantly impacts consumer spending and the smooth operation of supply chains, both critical for Central Garden & Pet. In uncertain times, consumers may become more cautious with discretionary spending on items like pet supplies and garden products.

Central Garden & Pet's leadership has directly addressed the volatile landscape, with CEO Glenn Welling noting the company's reaffirmation of its fiscal year outlook amidst a complex macroeconomic and geopolitical climate. This highlights the company's awareness of external political pressures.

Geopolitical events, such as trade disputes or regional conflicts, can create ripples throughout global markets. These events can disrupt international trade routes, affect the cost of raw materials and finished goods, and ultimately influence the demand for Central Garden & Pet's diverse product offerings, necessitating adaptive business strategies.

- Consumer Confidence: Political instability often correlates with lower consumer confidence, potentially reducing discretionary spending on non-essential pet and garden items.

- Supply Chain Disruption: Geopolitical tensions can lead to port congestion, shipping delays, and increased transportation costs, impacting the availability and price of Central Garden & Pet's inventory.

- Commodity Price Volatility: Political events can influence global commodity markets, affecting the cost of inputs like lumber, plastics, and agricultural products used in Central Garden & Pet's manufacturing processes.

Consumer Protection and Product Safety Legislation

Ongoing legislative efforts focused on consumer protection and product safety, especially within the pet and garden industries, present potential new compliance burdens for companies like Central Garden. These regulations frequently impose rigorous testing protocols, demand transparent labeling, and establish clear recall processes to guarantee products meet elevated safety benchmarks. For instance, the U.S. Consumer Product Safety Commission (CPSC) actively enforces standards, and in 2023, they issued numerous recalls affecting various consumer goods, highlighting the critical need for adherence.

Companies are compelled to stay abreast of these evolving regulations and adjust their operations accordingly to preserve consumer confidence and sidestep legal repercussions. Failure to comply can result in significant fines; for example, violations of CPSC regulations can incur civil penalties that can reach tens of thousands of dollars per violation. Proactive adaptation is key to maintaining market integrity and brand reputation.

- Increased Compliance Costs: New safety mandates can necessitate investment in enhanced product testing and quality control measures.

- Stricter Labeling Requirements: Regulations may demand more detailed ingredient lists, usage instructions, and hazard warnings.

- Potential for Recalls: Non-compliance with safety standards could lead to costly product recalls, impacting sales and brand image.

Governmental regulations continue to be a significant factor, with potential shifts like the proposed Pet Food Uniform Regulatory Reform Act of 2025 (PURR Act) aiming to centralize FDA oversight. Trade policies, including tariffs, directly influence Central Garden & Pet's fiscal 2025 outlook, impacting sourcing and pricing. Furthermore, environmental regulations, such as EPA reviews of pesticides, shape the garden product sector, pushing for more sustainable formulations as seen in the robust 2024 organic pesticide market growth.

What is included in the product

This PESTLE analysis examines the external macro-environmental factors influencing Central Garden, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

A concise PESTLE analysis that highlights key external factors impacting Central Garden, enabling proactive strategy adjustments and mitigating potential disruptions.

Economic factors

Consumer spending on pet and garden supplies is closely tied to how much extra money people have, known as disposable income. The pet industry, for instance, saw spending reach an estimated $152 billion in 2024 and is expected to grow to $157 billion in 2025, showing its strength. However, many consumers are still feeling the pinch of economic challenges.

This caution was reflected in Central Garden & Pet's Q2 fiscal 2025 performance, which showed weaker sales. Factors like when orders are placed and a slowdown in demand for more expensive pet items suggest consumers are being more careful about discretionary purchases, impacting categories beyond essential pet care.

Inflationary pressures continue to be a significant factor impacting both the pet and garden industries. These pressures affect the cost of raw materials and manufacturing for companies like Central Garden & Pet, while also influencing consumer spending habits. For instance, the U.S. Consumer Price Index (CPI) for all urban consumers saw a notable increase in 2023, affecting household budgets across various sectors.

Central Garden & Pet has been actively managing these challenges through strategic initiatives. The company’s ‘Cost and Simplicity’ program, alongside broader productivity efforts, has been instrumental in expanding gross margins, even amidst fluctuating sales volumes. This demonstrates a commitment to operational efficiency as a bulwark against rising input costs, aiming to maintain profitability despite economic headwinds.

However, the sustained elevated price levels pose a risk of consumers shifting towards more budget-friendly alternatives or curtailing discretionary spending. This could lead to a slowdown in demand for certain premium products within the pet and garden categories, necessitating a careful balance between pricing strategies and consumer affordability.

Fluctuations in interest rates directly impact Central Garden & Pet's borrowing costs. For instance, if the Federal Reserve maintains its target range for the federal funds rate at 5.25%-5.50% as seen in early 2024, higher rates can increase the expense of new debt financing, potentially slowing capital expenditure plans.

The company's financial health, particularly its cash reserves and existing debt levels, is a critical economic consideration. As of the first quarter of fiscal year 2024, Central Garden & Pet reported cash and cash equivalents of approximately $195 million, a figure that influences its ability to manage debt obligations and invest in growth.

Maintaining stable access to capital at favorable rates is essential for Central Garden & Pet to fund strategic initiatives, such as potential acquisitions or significant operational upgrades. For example, if the company needs to raise capital for a major expansion, a higher interest rate environment could make that more costly, impacting the return on investment for such projects.

E-commerce Growth and Channel Shifts

The relentless expansion of e-commerce continues to reshape consumer habits across both the pet care and home and garden sectors, presenting a dual landscape of opportunity and strategic imperative for companies like Central Garden & Pet. The global pet care e-commerce market, a significant area for Central Garden, was valued at an estimated $94.89 billion in 2024 and is anticipated to climb to $147.59 billion by 2030. This growth trajectory underscores the increasing preference for online purchasing of pet supplies.

Simultaneously, the home and garden B2C e-commerce market is also experiencing robust expansion, with projections indicating an increase of $49.62 billion between 2024 and 2029. This suggests a broader consumer shift towards digital channels for a wide array of household and outdoor living products. Central Garden & Pet's own performance reflects this trend, with its pet segment reporting a 3% year-over-year e-commerce growth in 2024. This digital channel now accounts for a substantial 26% of their total pet sales, emphasizing the critical need for a well-executed omnichannel strategy to capture these evolving consumer demands.

- Pet Care E-commerce Growth: Projected to reach $147.59 billion by 2030, up from $94.89 billion in 2024.

- Home & Garden E-commerce Growth: Expected to increase by $49.62 billion between 2024 and 2029.

- Central Garden's Pet E-commerce: Grew 3% YoY in 2024, representing 26% of pet segment sales.

- Strategic Importance: Highlights the necessity of a strong omnichannel approach to capitalize on digital channel shifts.

Market Size and Growth Projections

The overall size and projected growth of the pet and garden markets are critical indicators for Central Garden & Pet's revenue potential. The U.S. pet industry, a significant sector for the company, was estimated at $152 billion in 2024 and is anticipated to reach $157 billion in 2025, showcasing sustained expansion and robustness.

Concurrently, the U.S. lawn and garden market is poised for growth, with a projected increase of 2.7% in 2025, bringing its value to $83 billion. This market is further expected to climb to $102 billion by 2028, largely fueled by ongoing home-focused consumer lifestyles.

These favorable market outlooks create a positive landscape for Central Garden & Pet's long-term strategic planning and growth initiatives.

- U.S. Pet Industry Value (2024): $152 billion

- U.S. Pet Industry Projected Value (2025): $157 billion

- U.S. Lawn & Garden Market Projected Growth (2025): 2.7%

- U.S. Lawn & Garden Market Projected Value (2025): $83 billion

- U.S. Lawn & Garden Market Projected Value (2028): $102 billion

Consumer spending is directly influenced by economic conditions, with disposable income playing a key role. The pet industry, valued at an estimated $152 billion in 2024 and projected to reach $157 billion in 2025, demonstrates resilience, though consumers are showing increased caution with discretionary spending, impacting sales of non-essential items.

Inflationary pressures continue to affect both raw material costs and consumer purchasing power, necessitating strategic cost management. Central Garden & Pet's 'Cost and Simplicity' program aims to mitigate these impacts by improving gross margins through operational efficiencies.

Interest rates impact borrowing costs, potentially affecting capital expenditure. Central Garden & Pet reported $195 million in cash and cash equivalents in Q1 fiscal 2024, influencing its ability to manage debt and fund growth initiatives in a fluctuating rate environment.

The expanding e-commerce landscape is crucial, with the pet care sector's online market expected to grow from $94.89 billion in 2024 to $147.59 billion by 2030. Central Garden's pet segment saw 3% year-over-year e-commerce growth in 2024, now representing 26% of its pet sales, highlighting the need for a strong omnichannel strategy.

| Metric | 2024 Data | 2025 Projection |

|---|---|---|

| U.S. Pet Industry Value | $152 billion | $157 billion |

| U.S. Lawn & Garden Market Growth | N/A | 2.7% |

| U.S. Lawn & Garden Market Value | N/A | $83 billion |

| Pet Care E-commerce Market Value | $94.89 billion | N/A |

| Central Garden Pet E-commerce Share | 26% | N/A |

Full Version Awaits

Central Garden PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Central Garden provides actionable insights into the political, economic, social, technological, legal, and environmental factors impacting the business. You can trust that the detailed breakdown and strategic recommendations are precisely what you'll get.

Sociological factors

The growing trend of pet humanization, where pets are increasingly viewed as family members, is a major driver for the premiumization of pet products. This shift means consumers are willing to spend more on high-quality, health-focused items for their animal companions. In fact, a significant 95% of pet owners consider their pets to be integral parts of their families, underscoring the depth of this emotional connection.

Central Garden & Pet is well-positioned to capitalize on this trend through its portfolio of diverse pet supply brands. As consumers prioritize their pets' well-being, they are actively seeking out specialized foods, treats, and other premium offerings, creating a robust market for companies that cater to these elevated demands.

Generational shifts are profoundly impacting the pet industry. Notably, Gen Z and Millennials are driving a significant surge in pet ownership. From 2023 to 2024, Gen Z households with pets saw a substantial 43.5% increase, with this group also leading in owning multiple pets.

This demographic trend directly influences how companies like Central Garden approach product development and marketing. Strategies are increasingly tailored to appeal to younger generations, often through social media platforms, and demand is shifting towards products that accommodate multiple pets or align with specific, often urban, lifestyles.

The ongoing shift towards home-centric living continues to drive significant interest in enhancing both indoor and outdoor living areas. This trend directly benefits the lawn and garden sector, as more people invest time and resources into their personal spaces. A substantial 88% of Americans are actively engaged in growing plants or grass at home, underscoring a deep-seated demand for products that beautify and maintain properties.

This robust engagement translates into increased spending on a variety of garden care essentials. Consumers are readily investing in fertilizers, weed control solutions, and other products that support their outdoor transformations and property aesthetics. These are precisely the types of offerings that Central Garden & Pet specializes in, positioning the company to capitalize on this sustained consumer behavior.

Sustainability and Ethical Consumerism

Consumers are increasingly scrutinizing the environmental and social impact of their purchases, a trend significantly affecting the pet and garden sectors. This growing awareness translates into a demand for products that are not only effective but also sustainable and ethically produced. For instance, a 2024 survey indicated that over 60% of consumers consider sustainability a key factor when choosing pet food, and a similar sentiment is seen in gardening supplies, with a marked preference for organic and eco-friendly options.

Central Garden & Pet is actively responding to these shifts through its Central Impact program. This initiative underscores the company's commitment to environmental stewardship and community well-being. Examples of this commitment include the development of vegan dog treats, catering to a growing ethical consumer base, and efforts to optimize shipping logistics to reduce their carbon footprint. These actions directly address the consumer desire for brands that align with their personal values.

The company's strategic alignment with these sociological factors is crucial for maintaining market relevance and driving growth. By investing in sustainable practices and transparent sourcing, Central Garden & Pet can build stronger customer loyalty and attract new segments of the market. This proactive approach positions them favorably in a landscape where ethical considerations are becoming as important as product quality and price.

- Growing Demand for Eco-Friendly Options: A 2024 Nielsen report found that 73% of global consumers would change their consumption habits to reduce their environmental impact.

- Ethical Sourcing Preferences: Consumer surveys in 2024 show a significant rise in willingness to pay a premium for products with clear ethical sourcing certifications in both pet and garden categories.

- Central Garden's Sustainability Initiatives: The company's Central Impact program directly addresses these trends, with specific product lines like vegan pet treats gaining traction among conscious consumers.

- Brand Reputation and Consumer Trust: Companies demonstrating genuine commitment to sustainability and ethical practices are increasingly rewarded with enhanced brand reputation and consumer trust, impacting purchasing decisions.

Health and Wellness Consciousness

The increasing emphasis on health and wellness is significantly shaping consumer behavior, extending to pet care. This trend is driving demand for products that support a healthy lifestyle, from organic pet food to eco-friendly pest management solutions. For instance, the global pet food market is projected to reach $170.8 billion by 2025, with a notable segment focused on health-conscious options.

Central Garden & Pet can leverage this by innovating in areas like:

- Nutritionally enhanced pet foods: Offering options with natural ingredients, limited allergens, and specific health benefits.

- Natural and safe pest control: Developing products that are effective yet pose minimal risk to humans, pets, and the environment, aligning with consumer preferences for reduced chemical exposure.

- Gardening for well-being: Promoting gardening as a wellness activity with products that encourage healthy soil and plant growth, contributing to a healthier living space.

The increasing focus on pet humanization means owners view pets as family, driving demand for premium, health-conscious products. This sentiment is strong, with 95% of pet owners considering their pets integral family members, directly benefiting companies like Central Garden & Pet that offer specialized, high-quality items.

Generational shifts are also key, with Gen Z and Millennials significantly increasing pet ownership; Gen Z households with pets grew by 43.5% between 2023 and 2024. This demographic trend influences product development and marketing, with a growing demand for products catering to multiple pets and urban lifestyles.

Furthermore, the trend of home-centric living fuels investment in outdoor spaces, benefiting the lawn and garden sector. A substantial 88% of Americans engage in home gardening, boosting sales of fertilizers and pest control solutions, areas where Central Garden & Pet excels.

Consumer scrutiny of environmental and social impact is rising, with over 60% of consumers in a 2024 survey considering sustainability when choosing pet food. Central Garden's Central Impact program, featuring vegan pet treats and logistics optimization, directly addresses this demand for ethical and sustainable options.

Technological factors

Advancements in e-commerce platforms and digital retail strategies are fundamentally reshaping how Central Garden & Pet reaches its customers. The ongoing expansion of online shopping and the rise of omnichannel approaches are increasingly vital for both the pet and garden sectors.

The pet product market, in particular, saw e-commerce significantly outpace brick-and-mortar sales growth in 2024. Central Garden & Pet's strategic emphasis on its e-commerce segment, which achieved 3% growth in 2024 and represented 26% of its total pet sales, highlights its successful adaptation to these evolving digital consumer behaviors.

Technological advancements in supply chain management, particularly automation and sophisticated logistics, are crucial for boosting efficiency and cutting expenses. Central Garden & Pet's focus on its 'Cost and Simplicity' program, which targets procurement, manufacturing, and logistics, underscores the importance of these technological improvements in streamlining operations.

Innovations in areas like automated warehousing and real-time tracking systems are vital for Central Garden & Pet to meet fluctuating customer demand and optimize its distribution networks. For instance, as of fiscal year 2023, the company reported that its supply chain initiatives contributed to a more efficient operational structure, supporting its overall performance.

Technological advancements are a driving force behind product innovation at Central Garden & Pet. This includes the development of smart gardening tools that optimize plant care and advanced fertilizers that improve soil health. The company also leverages technology to create specialized pet nutrition, responding to growing consumer demand for healthier pet food options.

The pet industry is particularly dynamic, with continuous innovation in areas like alternative proteins and functional ingredients shaping product offerings. Central Garden & Pet's success hinges on its ability to introduce novel products, such as the recently launched Nylabone chew treats, which cater to evolving consumer preferences and maintain a competitive edge in the market.

Data Analytics and Consumer Insights

Central Garden & Pet is increasingly leveraging data analytics to deeply understand consumer behavior and market dynamics. This allows for precise identification of purchasing patterns and demographic preferences, crucial for tailoring product development and marketing strategies. For instance, by analyzing social media trends, the company can better target younger consumers who discover products through these platforms.

The company’s investment in advanced analytics provides granular insights into the effectiveness of marketing campaigns. This data-driven approach helps optimize spending and refine messaging to resonate with specific customer segments. In 2024, companies across the consumer goods sector reported significant ROI improvements from personalized marketing driven by data analytics, with some seeing uplifts of 10-15% in campaign effectiveness.

- Enhanced Consumer Understanding: Data analytics allows Central Garden & Pet to gain a sophisticated understanding of individual consumer needs and preferences.

- Optimized Marketing Spend: Insights from campaign performance data enable more efficient allocation of marketing resources.

- Product Development Alignment: Understanding market trends through data helps align product innovation with consumer demand.

- Targeted Outreach: Advanced analytics facilitate the creation of highly targeted marketing efforts, particularly for emerging consumer groups.

Manufacturing Automation and Efficiency

Central Garden & Pet's manufacturing automation efforts are a significant technological factor. By investing in automated processes, the company aims to boost productivity and reduce operational costs. For instance, in fiscal year 2023, Central Garden & Pet reported progress in its supply chain optimization initiatives, which included investments in manufacturing automation to enhance efficiency and reduce emissions. This focus on advanced manufacturing technologies is crucial for maintaining a competitive edge in the industry.

The benefits of this automation are tangible:

- Increased Productivity: Automation streamlines production lines, allowing for higher output with fewer resources.

- Cost Savings: Reduced labor costs and minimized waste contribute to overall financial efficiency.

- Improved Product Quality: Automated systems ensure greater precision and consistency in manufacturing, leading to better product quality.

- Environmental Benefits: Efficiency gains often translate to lower energy consumption and reduced emissions, aligning with sustainability goals.

Technological advancements are reshaping Central Garden & Pet's operations, from how it sells products to how it makes them. The company's strategic investment in e-commerce, which saw 3% growth in 2024 and accounted for 26% of its pet sales, demonstrates its ability to adapt to digital consumer trends. Furthermore, technology plays a vital role in optimizing supply chains through automation and advanced logistics, as evidenced by their 'Cost and Simplicity' program aimed at streamlining procurement and manufacturing.

Innovation driven by technology is key to Central Garden & Pet's product development, with smart gardening tools and advanced pet nutrition being prime examples. The company's increasing use of data analytics to understand consumer behavior and refine marketing strategies is also a critical technological factor. For instance, in 2024, companies leveraging data analytics for personalized marketing reported significant ROI improvements, with some seeing campaign effectiveness uplifts of 10-15%.

Manufacturing automation is another significant technological driver, boosting productivity and reducing costs. Central Garden & Pet's progress in supply chain optimization, including investments in automated manufacturing processes reported in fiscal year 2023, highlights its commitment to efficiency and competitiveness.

Legal factors

Central Garden & Pet operates under stringent product safety and labeling laws, particularly for its pet food and garden supplies. These regulations dictate everything from ingredient sourcing and nutritional content to clear hazard warnings, ensuring consumer safety. The U.S. Food and Drug Administration (FDA) enforces these standards, referencing acts like the Federal Food, Drug, and Cosmetic Act and the Food Safety Modernization Act, which require all animal foods to be safe, manufactured hygienically, and accurately labeled. For instance, in 2023, the FDA continued its focus on pet food safety, conducting inspections and issuing guidance to manufacturers to prevent contamination and ensure accurate labeling.

The proposed PURR Act, if enacted, could significantly impact Central Garden & Pet by harmonizing federal regulations. This legislative effort aims to create a more unified framework, potentially easing the burden of compliance that currently arises from varying state-by-state requirements. Such a change could lead to more efficient operations and reduced administrative costs for companies like Central Garden & Pet, allowing them to focus more resources on product innovation and market expansion rather than navigating a complex web of differing state laws.

Central Garden & Pet's garden division navigates a complex web of environmental laws governing its fertilizer and pesticide operations. The U.S. Environmental Protection Agency (EPA) frequently revises pesticide regulations, which can include outright bans or stricter application guidelines, particularly concerning the protection of endangered species. For instance, in 2024, the EPA continued its review of various pesticide active ingredients, with ongoing discussions about potential restrictions on neonicotinoids due to pollinator health concerns.

Adherence to these dynamic environmental mandates is paramount for Central Garden & Pet. Failure to comply can result in significant financial penalties, costly legal battles, and severe damage to the company's public image. The company's 2024 sustainability reports highlighted ongoing investments in research and development to ensure product formulations meet or exceed evolving EPA standards, aiming to mitigate these risks.

Central Garden & Pet, with its substantial workforce of 6,700 employees, navigates a complex landscape of labor laws. These regulations govern everything from minimum wage requirements and overtime pay to workplace safety standards and employee benefits, directly influencing operational expenses and HR strategies.

For instance, a potential federal minimum wage increase in the U.S. to $15 per hour, a topic of ongoing discussion and legislative proposals throughout 2024 and into 2025, could significantly impact Central Garden & Pet's labor costs, particularly for entry-level positions. Similarly, evolving workplace safety regulations, such as those being considered by OSHA regarding heat stress prevention, could necessitate further investments in training and equipment to ensure compliance.

Intellectual Property Rights and Brand Protection

Central Garden & Pet’s extensive portfolio, featuring over 65 distinct brands, relies heavily on robust intellectual property protection. Legal frameworks governing trademarks, patents, and copyrights are critical for preventing infringement and safeguarding these valuable assets. For instance, in 2023, the company continued to invest in brand building and protection initiatives, crucial for maintaining its competitive edge in a crowded market.

Effective legal strategies for brand protection are paramount to preserving Central Garden & Pet's market share and combating the proliferation of counterfeit goods. These measures ensure that consumers receive genuine products, reinforcing brand trust and loyalty. The company's commitment to intellectual property underscores its strategy to differentiate its offerings and command premium pricing.

Key aspects of Central Garden & Pet's intellectual property strategy include:

- Trademark Enforcement: Actively monitoring and defending its brand names and logos against unauthorized use.

- Patent Protection: Securing patents for innovative product designs and manufacturing processes.

- Copyright Safeguarding: Protecting marketing materials, packaging designs, and other creative content.

- Brand Reputation Management: Implementing legal measures to counter misleading advertising or product imitation by competitors.

Consumer Privacy and Data Protection Laws

Central Garden & Pet faces a complex legal landscape regarding consumer privacy. As e-commerce grows, compliance with regulations like the California Consumer Privacy Act (CCPA) and its successor, the California Privacy Rights Act (CPRA), becomes paramount. These laws grant consumers rights over their personal data, influencing how Central Garden & Pet collects, uses, and safeguards customer information for marketing and sales.

Failure to comply can result in significant penalties. For instance, the CCPA allows for statutory damages of $100 to $750 per violation or actual damages, whichever is greater. In 2024, enforcement actions are expected to increase, particularly concerning data breaches and the unauthorized sale of personal information, making robust data protection a critical business imperative for Central Garden & Pet.

- CCPA/CPRA Compliance: Central Garden & Pet must ensure its data handling practices align with California's stringent privacy regulations, impacting its digital marketing and customer relationship management.

- Evolving Data Protection Standards: The company needs to stay ahead of global privacy trends, potentially including stricter interpretations of existing laws or new regulations similar to the EU's GDPR.

- Consumer Trust and Brand Reputation: Adherence to privacy laws is directly linked to maintaining consumer trust, which is vital for customer loyalty and preventing reputational damage from data misuse.

- Legal and Financial Risks: Non-compliance can lead to substantial fines, lawsuits, and operational disruptions, underscoring the need for proactive legal counsel and data governance.

Central Garden & Pet's operations are significantly shaped by product safety and labeling regulations, particularly for its pet food and garden supplies. The U.S. Food and Drug Administration (FDA) and the Environmental Protection Agency (EPA) enforce these, with the FDA focusing on animal food safety and the EPA on pesticides. For example, in 2024, ongoing EPA reviews of pesticide active ingredients, such as neonicotinoids, could lead to stricter application guidelines or potential restrictions, impacting Central Garden & Pet's garden division.

Environmental factors

Central Garden & Pet's operations are increasingly susceptible to shifting climate patterns, which can directly affect the availability of key raw materials and disrupt intricate supply chains. Extreme weather events, such as prolonged droughts or unseasonable heavy rainfall, have already been noted as contributing factors to weaker sales within the company's garden segment, as seen in recent performance reports.

These unpredictable weather conditions pose a dual threat: they can limit the growing seasons and reduce crop yields for essential ingredients used in pet food production, while simultaneously impacting consumer behavior and demand for gardening supplies.

The availability and cost of essential natural resources like water, agricultural inputs for fertilizers, and key ingredients for pet food directly impact Central Garden & Pet's operational costs and product pricing. Fluctuations in these commodity markets, driven by environmental factors and global demand, present a significant challenge.

There's a noticeable shift in consumer preference towards low-maintenance, drought-tolerant landscaping solutions, alongside a strong demand for products derived from sustainably sourced materials. This trend influences product development and marketing strategies for Central Garden & Pet.

Central Garden & Pet's proactive approach to sustainability, demonstrated through their focus on ethically sourced materials and investments in alternative protein sources for pet food, directly addresses growing concerns about resource scarcity. For instance, their commitment to reducing water usage in their operations aligns with broader environmental goals and consumer expectations for responsible business practices.

Stricter environmental regulations and growing public demand for sustainable practices are significantly influencing Central Garden & Pet's operations. For instance, in 2024, the EPA continued to enforce regulations on manufacturing byproducts and product disposal, requiring companies like Central Garden & Pet to invest in advanced waste treatment technologies and responsible end-of-life product management.

Central Garden & Pet is actively working to reduce its environmental impact. In 2024, the company reported progress in optimizing its shipping routes and logistics, aiming to cut down on greenhouse gas emissions associated with product distribution. This focus on minimizing waste and pollution extends to their packaging strategies as well, with ongoing efforts to incorporate more recyclable and sustainable materials.

Compliance with environmental standards remains a critical aspect for Central Garden & Pet. The company must ensure its manufacturing processes adhere to guidelines concerning air and water pollution, and that its products, particularly pet food and gardening supplies, meet disposal regulations. Failure to comply can result in substantial fines and reputational damage, impacting market trust and investor confidence.

Biodiversity and Ecosystem Protection

Protecting biodiversity and ecosystems is a growing concern, especially with the use of pesticides and their potential harm to non-target species. The U.S. Environmental Protection Agency (EPA) has been actively working to safeguard endangered species from pesticide exposure, indicating a strong regulatory push in this area. For Central Garden & Pet, this means a critical need to ensure its products and operational practices are designed to minimize negative impacts on local ecosystems and actively contribute to biodiversity support.

This heightened environmental scrutiny impacts product development and marketing strategies. Companies are increasingly expected to demonstrate a commitment to sustainability, which includes responsible sourcing and manufacturing processes. Central Garden & Pet's approach to pest control solutions must align with these expectations, potentially leading to investment in research and development for more eco-friendly alternatives. For instance, the market for biological pest control solutions, which are generally considered less harmful to non-target species, is projected to grow significantly, with some estimates suggesting a compound annual growth rate of over 10% in the coming years.

- Regulatory Compliance: Adherence to EPA regulations concerning pesticide use and endangered species protection is paramount.

- Product Innovation: Development of pest control solutions with reduced environmental impact and enhanced biodiversity support is crucial.

- Ecosystem Impact: Minimizing harm to local flora and fauna and promoting the health of surrounding ecosystems is a key operational consideration.

- Market Trends: The increasing consumer demand for sustainable and environmentally responsible products influences product design and marketing.

Energy Consumption and Greenhouse Gas Emissions

Reducing energy consumption and greenhouse gas (GHG) emissions is a significant focus for companies like Central Garden & Pet, driven by both regulatory pressures and growing consumer demand for sustainable practices. In 2023, the company reported progress in its sustainability efforts, aiming to align with broader climate goals. This commitment is not just about environmental stewardship but also about enhancing operational efficiency and potentially lowering long-term costs.

Central Garden & Pet has actively pursued initiatives to improve its energy footprint. A notable example is the conversion of over 60% of its forklift fleet to electric power, a move that directly reduces reliance on fossil fuels and lowers direct emissions at its facilities. Furthermore, the automation of manufacturing processes is being implemented to optimize energy usage and decrease GHG output.

- Electric Forklift Conversion: Over 60% of Central Garden & Pet's forklift fleet has been transitioned to electric.

- Manufacturing Automation: Initiatives to automate production lines are underway to improve energy efficiency.

- Operational Cost Savings: These sustainability efforts are expected to contribute to reduced operational expenses through lower energy consumption.

- GHG Emission Reduction: The company's actions are designed to meet its internal sustainability targets and contribute to broader environmental goals.

Central Garden & Pet's operations are significantly influenced by environmental factors, from climate change impacting raw material availability to evolving consumer demand for sustainable products. The company's reliance on agriculture for pet food ingredients and its gardening supplies segment make it particularly sensitive to weather patterns and resource availability.

The company is actively addressing these challenges by investing in sustainable practices and product innovation. For example, their focus on drought-tolerant landscaping solutions and the development of eco-friendly pest control options reflect a strategic response to environmental trends and regulatory pressures. In 2024, the U.S. Environmental Protection Agency (EPA) continued to emphasize regulations on pesticide use and biodiversity protection, requiring companies like Central Garden & Pet to adapt their product lines and operational strategies.

Central Garden & Pet is also committed to reducing its operational environmental footprint. Initiatives such as converting over 60% of its forklift fleet to electric power and optimizing logistics to cut greenhouse gas emissions demonstrate a proactive approach to sustainability, aiming for both environmental responsibility and operational efficiency.

| Environmental Factor | Impact on Central Garden & Pet | Company Response/Strategy | Relevant Data/Trends (2024-2025) |

|---|---|---|---|

| Climate Change & Weather Volatility | Disrupts supply chains, affects raw material availability, impacts gardening sales. | Focus on drought-tolerant products, supply chain resilience. | Noted weaker sales in garden segment due to extreme weather events. |

| Resource Availability (Water, Agricultural Inputs) | Increases operational costs, affects product pricing. | Emphasis on water conservation, exploring alternative ingredients. | Fluctuations in commodity markets driven by environmental factors. |

| Environmental Regulations (EPA) | Requires investment in waste treatment, responsible product management, and compliance with pesticide use. | Adherence to EPA guidelines, investment in eco-friendly product development. | Continued enforcement of regulations on manufacturing byproducts and disposal. |

| Consumer Demand for Sustainability | Drives demand for low-maintenance, sustainably sourced products. | Product innovation in eco-friendly alternatives, responsible sourcing. | Projected significant growth in biological pest control solutions (over 10% CAGR). |

| Greenhouse Gas Emissions | Regulatory pressure and consumer demand to reduce emissions. | Fleet electrification, logistics optimization, manufacturing automation. | Over 60% of forklift fleet converted to electric; ongoing automation for energy efficiency. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Central Garden is meticulously crafted using data from governmental agricultural departments, environmental protection agencies, and leading horticultural industry publications. We incorporate market research reports on consumer trends in gardening and landscaping, alongside economic indicators relevant to the sector.