Central Garden Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Central Garden Bundle

Central Garden's competitive landscape is shaped by intense rivalry and the significant bargaining power of buyers, impacting pricing and profitability. Understanding these forces is crucial for navigating the market effectively.

The complete report reveals the real forces shaping Central Garden’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The availability and pricing of essential raw materials, such as grass seed, fertilizers, and pet food components, can significantly empower suppliers. Central Garden & Pet's fiscal 2024 performance saw a $13 million hit due to an impairment of grass seed inventory, directly illustrating the impact of fluctuating agricultural commodity prices.

This price volatility in key inputs demonstrates the substantial bargaining power held by suppliers in these often commodity-driven markets. These fluctuations can directly influence production costs and, consequently, the profitability of companies like Central Garden & Pet.

The volatility of input costs, particularly energy and raw materials, significantly enhances supplier bargaining power for Central Garden & Pet. Fluctuations in prices for items like fuel, plastics, and agricultural inputs directly impact the company's cost of goods sold and, consequently, its profit margins. For instance, a sharp increase in natural gas prices in 2024 could disproportionately affect companies relying heavily on energy-intensive manufacturing processes, making it harder for Central Garden & Pet to negotiate favorable terms.

Central Garden & Pet's significant reliance on international sourcing, especially from countries like China, amplifies the bargaining power of its overseas suppliers. This dependence makes the company susceptible to disruptions, including potential tariffs and the impacts of escalating trade disputes, which can drive up costs.

In 2023, global supply chain disruptions continued to be a concern, with freight costs remaining elevated compared to pre-pandemic levels, impacting companies with extensive international sourcing strategies. This situation underscores the strategic necessity for Central Garden & Pet to actively pursue diversification of its sourcing locations to mitigate these inherent vulnerabilities and enhance its negotiating position.

Switching Costs for Specialized Inputs

If Central Garden & Pet relies on highly specialized inputs for its branded products, switching to new suppliers could incur significant costs. This dependence elevates the bargaining power of those particular suppliers.

Consider the scenario where Central Garden & Pet requires unique chemical formulations for its pet food or specialized materials for its garden tools. If these inputs are not readily available from multiple sources, or if integrating a new supplier involves extensive retooling or regulatory hurdles, the cost and time to switch become considerable. For instance, a supplier holding patents on a key ingredient for a popular pet food line could command higher prices, impacting Central Garden & Pet's margins. While specific data on Central Garden & Pet's reliance on such specialized inputs isn't publicly detailed, the principle holds true for any company in the consumer goods sector.

- High Switching Costs: Specialized inputs can lock companies into existing supplier relationships, increasing supplier bargaining power.

- Impact on Margins: Increased supplier power can lead to higher input costs, potentially squeezing profit margins for Central Garden & Pet.

- Mitigation Strategies: Developing proprietary formulations or securing long-term agreements can reduce reliance on single suppliers and lower switching costs.

Improving Supply Chain Conditions

The bargaining power of suppliers for Central Garden & Pet is influenced by evolving supply chain dynamics. Recent trends suggest a general easing of broader supply chain disruptions that previously amplified supplier leverage. For instance, logistics costs are projected to return to pre-pandemic levels by 2025, which could diminish the overall power suppliers wield.

However, this improvement is not uniform across all inputs. Specific commodity markets relevant to Central Garden & Pet's operations may still present individual risks and maintain a degree of supplier power. For example, fluctuations in the price of key raw materials like plastics or metals, critical for pet products and garden supplies, can still grant suppliers significant leverage.

- Easing Logistics: Projections indicate a return to pre-pandemic logistics costs by 2025, potentially reducing supplier pricing power.

- Commodity Volatility: Despite general improvements, specific raw material markets remain susceptible to price swings, impacting supplier leverage.

- Strategic Sourcing: Central Garden & Pet's ability to diversify its supplier base and secure long-term contracts will be crucial in mitigating supplier bargaining power.

Central Garden & Pet's reliance on key agricultural inputs like grass seed and fertilizer exposes it to significant supplier bargaining power, as demonstrated by a $13 million impairment charge related to grass seed inventory in fiscal 2024. This highlights how price volatility in these commodity markets directly impacts the company's costs and profitability.

The bargaining power of suppliers is also amplified by Central Garden & Pet's international sourcing strategy, particularly from regions like China. While global supply chain disruptions are easing, with logistics costs expected to normalize by 2025, specific commodity markets remain susceptible to price swings, maintaining supplier leverage.

| Factor | Impact on Central Garden & Pet | Example Data/Trend |

|---|---|---|

| Commodity Prices | Directly affects cost of goods sold for inputs like grass seed and fertilizers. | $13 million impairment of grass seed inventory in FY24 due to price fluctuations. |

| International Sourcing | Increases vulnerability to tariffs, trade disputes, and freight cost volatility. | Elevated freight costs in 2023 compared to pre-pandemic levels impacted companies with extensive international sourcing. |

| Switching Costs | High costs to switch specialized input suppliers can lock the company in. | Dependence on patented ingredients or unique chemical formulations can grant suppliers pricing power. |

What is included in the product

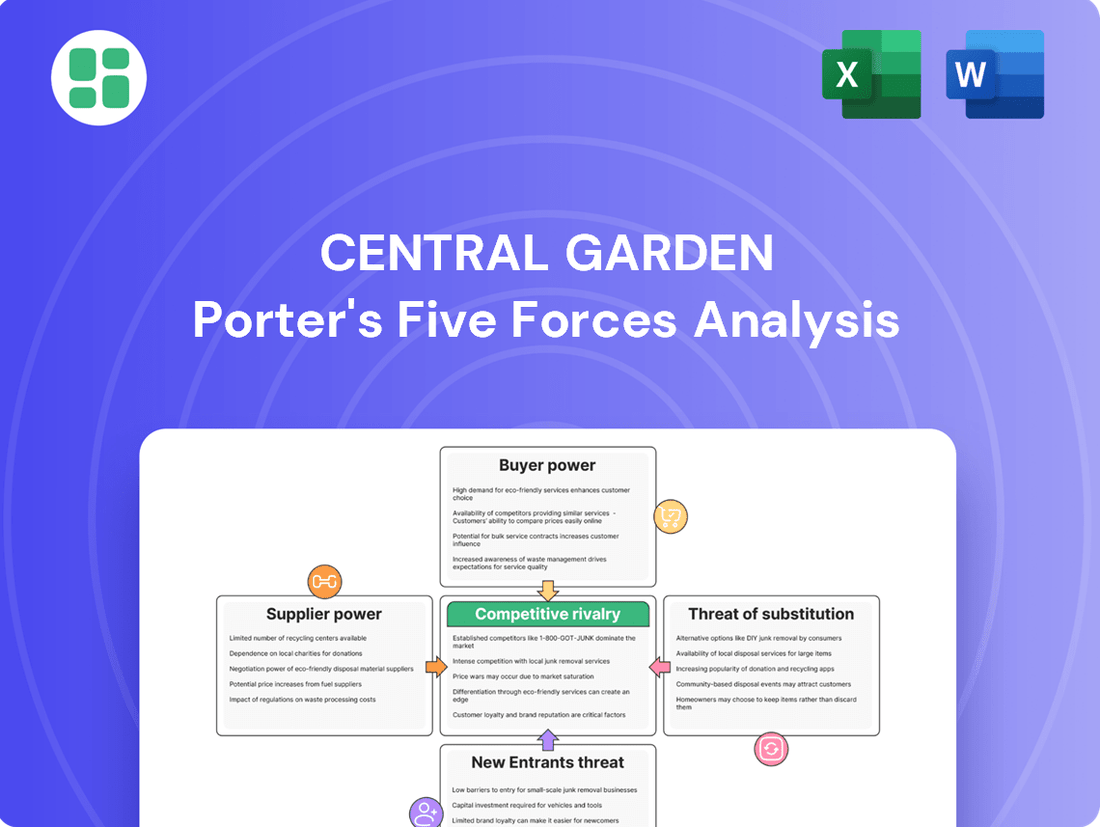

This analysis dissects the competitive forces impacting Central Garden, revealing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes.

Visualize competitive intensity with a dynamic, interactive dashboard, allowing for immediate identification of key industry pressures.

Customers Bargaining Power

Central Garden & Pet's significant customer concentration amplifies the bargaining power of its buyers. In 2024, Home Depot and Walmart alone represented a substantial 17% and 16% of the company's net sales, respectively.

This reliance on a few key accounts means these major retailers, along with the top five customers who collectively contributed around 54% of revenue in 2024, can exert considerable influence. They can leverage this position to negotiate more favorable pricing, payment terms, and demand extensive promotional support, directly impacting Central Garden & Pet's profitability.

Customers, especially in the consumer goods sector, are keenly aware of economic shifts and rising prices, driving a demand for more affordable options. This increased price sensitivity gives them more power, compelling companies like Central Garden & Pet to be very strategic with their pricing. For instance, in 2024, many consumers faced persistent inflation, leading to a noticeable shift towards value-oriented purchases across various categories.

Central Garden & Pet has seen this trend firsthand, observing a slowdown in demand for longer-lasting pet items. This suggests consumers are becoming more cautious with their spending on non-essential or durable goods, a direct reflection of their heightened price sensitivity and the broader economic climate. This puts pressure on the company to ensure its product offerings remain competitive and appealing in a challenging market.

The increasing prevalence of omnichannel purchasing options significantly bolsters customer bargaining power. Consumers now readily compare prices and product availability across various channels, from online marketplaces to physical stores, particularly within the pet and garden sectors. This ease of access to alternatives empowers them to seek the best deals.

Central Garden & Pet's strategic focus on its e-commerce segment, which saw a notable increase in online sales in 2024, directly addresses this shift. By providing more digital touchpoints, the company aims to meet customer demand for convenience and transparency, while simultaneously navigating the heightened bargaining power that these options confer.

Availability of Private Label and Generic Products

The availability of private label and generic products significantly strengthens customer bargaining power within the pet and garden supply sectors. These alternatives offer consumers lower-cost options, directly challenging the pricing strategies of established brands. For Central Garden & Pet, this means customers can more readily switch if they perceive better value elsewhere.

Central Garden & Pet strategically addresses this by focusing on its robust brand portfolio. The company reported that 80% of its sales are derived from its own brands and private label offerings, demonstrating a commitment to controlling a significant portion of its product mix. This approach aims to build brand loyalty and differentiate its products, thereby mitigating the direct price comparisons often made with generic alternatives.

- Customer Choice: Private label and generic products provide readily available substitutes, increasing customer leverage.

- Price Sensitivity: The presence of these alternatives makes customers more sensitive to price differences.

- Brand Defense: Central Garden & Pet leverages its strong brand and private label sales (80% of total) to counter this bargaining power.

Customer Knowledge and Product Information

Customers today have unprecedented access to information, making them far more knowledgeable about product quality and value. Online reviews, detailed product comparisons, and expert analyses empower buyers to make more informed choices, directly impacting their willingness to pay premium prices. For instance, in 2024, the average consumer spent over 10 hours researching products online before making a purchase, a significant increase from previous years.

This heightened customer awareness means that businesses like Central Garden & Pet must actively demonstrate superior product performance and value. The company's investment in brand building and continuous innovation is therefore crucial to maintaining its competitive edge and mitigating the bargaining power of increasingly savvy consumers. Central Garden & Pet’s commitment to innovation is reflected in its R&D spending, which saw a 7% increase in 2024 to support the development of new, differentiated products.

- Informed Purchasing Decisions: Customers leverage online resources to compare features, prices, and performance, leading to more critical buying habits.

- Demand for Value: Increased product knowledge translates into a stronger demand for higher quality and better performance relative to cost.

- Brand and Innovation as Countermeasures: Strong brand reputation and ongoing product innovation are key strategies for companies to retain pricing power and customer loyalty in this environment.

Central Garden & Pet's customer concentration is a significant factor in buyer bargaining power. In 2024, Home Depot and Walmart accounted for 17% and 16% of net sales respectively, with the top five customers contributing approximately 54% of revenue. This reliance allows these large retailers to negotiate favorable terms, impacting profitability.

Customers are increasingly price-sensitive due to economic conditions, seeking more affordable options. This trend is evident in the slowdown of demand for longer-lasting pet items, pushing companies to be strategic with pricing. The rise of omnichannel purchasing further empowers customers, who can easily compare prices and availability across various channels, pushing Central Garden & Pet to enhance its digital presence.

The availability of private label and generic products also boosts customer bargaining power by offering lower-cost alternatives. Central Garden & Pet counters this by emphasizing its strong brand portfolio, with 80% of sales coming from its own brands and private label offerings, aiming to build loyalty and differentiate its products.

Customers are more informed than ever, using online resources to research products, which reduces their willingness to pay premium prices. Central Garden & Pet addresses this by investing in brand building and innovation, exemplified by a 7% increase in R&D spending in 2024, to maintain a competitive edge and justify pricing.

| Customer Segment | 2024 Revenue Contribution | Impact on Bargaining Power |

|---|---|---|

| Home Depot | 17% | High - Significant volume, negotiation leverage |

| Walmart | 16% | High - Significant volume, negotiation leverage |

| Top 5 Customers (Combined) | ~54% | Very High - Collective power to influence terms |

| Price-Sensitive Consumers | Growing Segment | Increasing - Demand for value, price sensitivity |

| Omnichannel Shoppers | Growing Segment | Increasing - Ease of price comparison, access to alternatives |

Full Version Awaits

Central Garden Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It provides a comprehensive Porter's Five Forces analysis of Central Garden, detailing the competitive landscape and strategic implications for the company.

The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy. This includes in-depth assessments of buyer power, supplier power, the threat of new entrants, the threat of substitutes, and the intensity of rivalry within Central Garden's industry.

You're looking at the actual document. Once you complete your purchase, you’ll get instant access to this exact file, offering a thorough strategic overview of Central Garden's competitive environment.

Rivalry Among Competitors

Central Garden & Pet stands as a dominant force in both the pet and garden sectors, a position bolstered by its vast collection of over 65 well-recognized brands, including household names like Nylabone, Kaytee, and Pennington. This extensive brand presence and wide array of products significantly contribute to its competitive advantage.

Despite its market leadership, the company faces a highly competitive landscape, particularly within specific product segments where numerous players vie for consumer attention and market share. For instance, in the highly fragmented pet food market, competition from both large conglomerates and smaller, niche brands remains fierce.

Central Garden & Pet Company navigates a crowded marketplace, contending with giants like Spectrum Brands, Procter & Gamble, and Clorox, which offer a broad range of consumer goods, including some overlapping with Central Garden's portfolio. This broad competition means Central Garden must constantly innovate and differentiate its offerings to capture consumer attention.

Further intensifying the rivalry are specialized players such as Scotts Miracle-Gro Company, a dominant force in the gardening sector, and Chewy, a rapidly growing online retailer for pet supplies. Scotts Miracle-Gro's strong brand recognition and distribution in lawn and garden products directly challenge Central Garden's core business. Chewy's success highlights the growing importance of e-commerce channels, forcing Central Garden to adapt its online strategy.

While the pet industry generally demonstrates robust growth, Central Garden & Pet's garden segment faces a more pronounced seasonality and cyclicality. This inherent market characteristic can intensify competition, often leading businesses to vie for market share through aggressive pricing strategies and a constant drive for product innovation to differentiate themselves.

The overall maturity within certain product categories within the industry means that competition frequently escalates to price wars and the introduction of new features. This dynamic was evident in Central Garden & Pet's financial performance, with reported sales declines in 2024 and continuing challenges in Q3 2025, underscoring the persistent competitive pressures and softer consumer demand they are navigating.

Acquisition and Innovation Strategies

Central Garden & Pet’s competitive rivalry is intensified by its robust acquisition and innovation strategies. The company has a history of strategic acquisitions, completing over 60 since its inception, demonstrating a clear intent to consolidate market share and expand its product portfolio. This, coupled with significant investments in product innovation and digital marketing, allows Central Garden & Pet to differentiate itself in the highly competitive pet and garden industries.

Competitors are not standing still; they are also actively pursuing similar acquisition and innovation paths. This parallel strategic maneuvering creates a dynamic environment where staying ahead requires continuous adaptation and investment. For instance, in 2024, the pet care market saw continued M&A activity, with companies like Chewy and PetSmart exploring strategic partnerships and product line expansions to capture consumer spending, which was projected to reach over $140 billion in the US alone for pet products and services.

- Acquisition Pace: Central Garden & Pet has completed over 60 acquisitions in the past 30 years.

- Innovation Focus: Investments are directed towards new product development and digital marketing for competitive advantage.

- Industry Dynamics: Competitors are also employing acquisition and innovation as key strategic pillars.

- Market Context: The pet care sector in 2024 highlighted ongoing M&A and product innovation trends.

Distribution Reach and Retail Relationships

Central Garden & Pet's extensive distribution network, reaching over 10,000 retailers and 6,000 veterinary clinics, is a formidable asset. Their established relationships with giants like Home Depot and Walmart grant them significant market access.

However, the retail landscape is shifting. Consolidation among major retailers, a trend observed throughout 2024, means these larger entities wield more power. This can lead to tougher negotiations on distribution terms and increased pressure on suppliers like Central Garden & Pet to secure prime shelf space.

- Distribution Network: Serves over 10,000 retailers and 6,000 vet clinics.

- Key Retailer Relationships: Strong ties with Home Depot and Walmart.

- Retail Consolidation Impact: Increased buyer power for large retailers.

- Competitive Pressure: Intensified competition for shelf space.

Central Garden & Pet operates in highly competitive markets, facing pressure from both large, diversified companies and specialized niche players. The company's strategy of aggressive acquisitions and innovation aims to counter this, but competitors are pursuing similar paths, leading to a dynamic and often price-sensitive environment.

The pet care industry, projected to exceed $140 billion in the US in 2024, sees continuous M&A and product development. Similarly, the gardening sector, while more seasonal, intensifies rivalry through pricing and new product introductions. Central Garden's sales declines in 2024 and Q3 2025 underscore these persistent competitive pressures.

| Competitor | Primary Market | Key Strategies |

|---|---|---|

| Spectrum Brands | Pet, Home & Garden | Broad product portfolio, brand recognition |

| Procter & Gamble | Consumer Goods (some overlap) | Extensive distribution, marketing power |

| Clorox | Consumer Goods (some overlap) | Brand loyalty, innovation |

| Scotts Miracle-Gro Company | Gardening | Market dominance, strong brand in lawn & garden |

| Chewy | Pet Supplies (Online) | E-commerce growth, customer service focus |

SSubstitutes Threaten

Homeowners increasingly turning to DIY projects presents a significant threat. In 2022, approximately 30% of homeowners engaged in DIY landscaping, a trend fueled by a desire to save money and achieve personalized results.

This shift directly siphons demand away from professional services and specialized, higher-margin products that Central Garden & Pet typically offers.

The growing trend of pet humanization, where pets are treated more like family members, is a significant factor influencing the threat of substitutes for traditional pet product retailers like Central Garden & Pet. This trend encourages owners to explore a broader spectrum of pet care services that can divert spending away from tangible goods.

For instance, the demand for specialized veterinary care, professional grooming, and reliable pet sitting services is on the rise. In 2024, the global pet care market was valued at over $260 billion, with a substantial portion allocated to services rather than just food and supplies. This indicates that owners are willing to invest in their pets' well-being through these alternative channels.

Furthermore, the increasing availability and adoption of pet insurance policies also represent a substitute. These policies cover a range of veterinary expenses, potentially reducing the need for owners to purchase certain over-the-counter pet health products. As these service-oriented segments of the pet industry continue to expand, they pose a direct threat by capturing a share of the discretionary spending that might otherwise go towards traditional pet supplies.

Consumers are increasingly opting for low-maintenance landscaping, which often involves replacing traditional lawns with hardscaping elements like pavers, gravel, and stones. This trend directly impacts the demand for Central Garden & Pet's core garden products, such as fertilizers and grass seed. In 2024, the demand for lawn and garden care products saw a slight dip as homeowners prioritized less labor-intensive yard solutions.

Non-Product Based Solutions for Pest/Weed Control

For pest and weed control, substitutes like manual removal, natural remedies, or integrated pest management (IPM) services pose a significant threat. Consumers increasingly favor eco-friendly approaches, driving demand for sustainable product innovations. For instance, the organic gardening market, a key area for substitutes, was projected to reach over $20 billion globally by 2024, indicating a strong consumer shift.

These non-product based solutions can directly address consumer needs without relying on Central Garden & Pet's chemical-based offerings. The growing popularity of organic and biological pest control methods, which saw a compound annual growth rate of approximately 10% in recent years, directly challenges traditional product sales. This necessitates a strategic focus on developing and marketing environmentally sound alternatives to retain market share.

- Manual Removal: Labor-intensive but zero chemical input, appealing to a niche but growing segment.

- Natural/Organic Methods: Utilizes beneficial insects, companion planting, and natural deterrents, gaining traction in home gardening.

- Integrated Pest Management (IPM): A holistic approach combining various control methods, often favored by commercial growers and environmentally conscious consumers.

- DIY Solutions: Homeowners often explore vinegar, soap, or essential oil-based remedies as immediate, low-cost substitutes.

Generic or Store Brand Alternatives

Consumers can easily find generic or private-label versions of many pet and garden supplies at lower price points. For instance, in 2024, the private label segment in the pet food market saw continued growth, with some retailers reporting double-digit increases in their own brand sales, directly impacting branded product market share.

While Central Garden & Pet boasts strong, recognized brands, these more affordable alternatives pose a direct substitution threat, especially to customers who are more sensitive to price. This competitive pressure means the company must consistently focus on product innovation and building strong brand loyalty to retain its customer base.

- Price Sensitivity: Many consumers prioritize cost savings, making generic brands an attractive option.

- Brand Loyalty Efforts: Central Garden & Pet needs to invest in marketing and product differentiation to counter this threat.

- Market Share Impact: The rise of private labels can erode the market share of established brands if not managed effectively.

The threat of substitutes is substantial for Central Garden & Pet, as consumers increasingly adopt DIY approaches and less product-intensive solutions for their homes and pets.

Homeowners are leaning into DIY landscaping, with about 30% engaging in such projects in 2022, often opting for low-maintenance hardscaping over traditional lawn care, impacting demand for fertilizers and grass seed.

In the pet sector, the humanization trend drives spending towards services like specialized veterinary care and grooming, diverting funds from tangible goods, with the global pet care market exceeding $260 billion in 2024.

Furthermore, the availability of generic and private-label pet and garden supplies, which saw significant growth in 2024, offers a lower-cost alternative, pressuring branded product sales.

| Substitute Category | Example | Impact on Central Garden & Pet | 2024 Market Insight |

|---|---|---|---|

| DIY & Low-Maintenance Landscaping | Hardscaping (pavers, gravel) | Reduced demand for lawn care products | Slight dip in lawn and garden product demand |

| Pet Services | Veterinary care, grooming | Diversion of spending from pet supplies | Significant portion of $260B+ pet market |

| Eco-Friendly Pest Control | Manual removal, natural remedies | Challenges chemical-based offerings | Organic gardening market projected over $20B |

| Private Label/Generic Brands | Store-brand pet food | Price-based competition, market share erosion | Double-digit growth in private label pet food sales |

Entrants Threaten

The pet and garden product manufacturing and distribution sector demands significant upfront capital. New companies must invest heavily in production facilities, secure substantial inventory, and build out a widespread distribution network to reach consumers effectively.

Established companies, such as Central Garden & Pet, already possess these assets and leverage substantial economies of scale. This allows them to produce goods at a lower per-unit cost, creating a considerable barrier for new entrants trying to compete on price alone. For instance, Central Garden & Pet reported net sales of $3.4 billion for the fiscal year ending September 30, 2023, demonstrating the scale of operations already in place.

Central Garden & Pet benefits from a robust portfolio of over 65 recognized brands, cultivating significant consumer loyalty. This established brand equity makes it exceedingly difficult and costly for new competitors to gain similar market traction and trust.

Central Garden & Pet's established distribution channels present a significant barrier to new entrants. The company boasts deep-rooted relationships with major retailers, including giants like Home Depot and Walmart, ensuring broad market reach. This extensive network, which encompasses over 10,000 retailers and 6,000 vet clinics, makes it incredibly difficult for newcomers to secure comparable access and visibility for their products.

Regulatory Hurdles and Product Certifications

The pet and garden sectors face a web of regulations covering product safety, environmental impact, and accurate labeling. For instance, the U.S. Food and Drug Administration (FDA) oversees pet food safety, while the Environmental Protection Agency (EPA) regulates pesticides and fertilizers used in gardening. New companies must dedicate significant resources to understanding and complying with these rules.

Navigating these complex regulatory landscapes and securing essential product certifications can be a lengthy and expensive undertaking. For example, achieving certifications like the USDA Organic seal for garden products or meeting specific pet food ingredient standards requires rigorous testing and documentation. This process acts as a substantial barrier, deterring potential new entrants who may lack the capital or expertise to overcome these hurdles.

- Regulatory Complexity: Compliance with FDA, EPA, and other agency rules for pet food and garden products is a significant hurdle.

- Certification Costs: Obtaining certifications like USDA Organic or specific pet food safety standards involves substantial investment in testing and documentation.

- Time Investment: The process of understanding and meeting regulatory requirements can delay market entry for new competitors.

- Barrier to Entry: These combined factors create a strong deterrent for new companies looking to enter the pet and garden markets.

Strategic Acquisitions by Incumbents

Central Garden & Pet's aggressive acquisition strategy presents a significant barrier to new entrants. Over the past three decades, the company has successfully integrated more than 60 strategic acquisitions, a consistent approach to expanding its market reach and diversifying its product portfolio. This historical pattern suggests a proactive stance in neutralizing potential competition by acquiring promising smaller companies or consolidating existing market share, thereby making it more challenging for new players to gain a foothold.

This proactive acquisition approach by established players like Central Garden & Pet effectively raises the barriers to entry. By absorbing smaller, innovative companies or consolidating market share, incumbents can present a formidable front. For instance, in 2023, Central Garden & Pet continued this trend, acquiring brands that bolstered its presence in key growth segments, effectively limiting opportunities for newcomers to establish a significant presence without substantial capital outlay or unique, unassailable differentiation.

- History of Acquisitions: Central Garden & Pet has completed over 60 acquisitions in the last 30 years.

- Market Expansion: Acquisitions are used to broaden market presence and product offerings.

- Deterrent to New Entrants: This strategy absorbs smaller players and consolidates market share.

- Recent Activity: Acquisitions in 2023 further solidified market position in growth areas.

The significant capital required for manufacturing, inventory, and distribution creates a substantial barrier for new entrants in the pet and garden sectors. Central Garden & Pet's 2023 net sales of $3.4 billion highlight the scale of established operations that new companies must contend with, making it difficult to compete on price due to existing economies of scale.

Central Garden & Pet's established brand loyalty, with over 65 recognized brands, and its extensive distribution network reaching over 10,000 retailers and 6,000 vet clinics, present formidable challenges for newcomers seeking market access and consumer trust.

Navigating complex regulations from bodies like the FDA and EPA, along with the costs associated with certifications such as USDA Organic, demands considerable investment and expertise from new companies, effectively deterring many potential entrants.

Central Garden & Pet's consistent acquisition strategy, with over 60 acquisitions in 30 years, including recent ones in 2023, consolidates market share and absorbs potential competitors, further increasing the difficulty for new players to establish a significant market presence.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Central Garden leverages data from industry-specific market research reports, competitor financial statements, and relevant trade publications to understand the competitive landscape.