Central Garden Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Central Garden Bundle

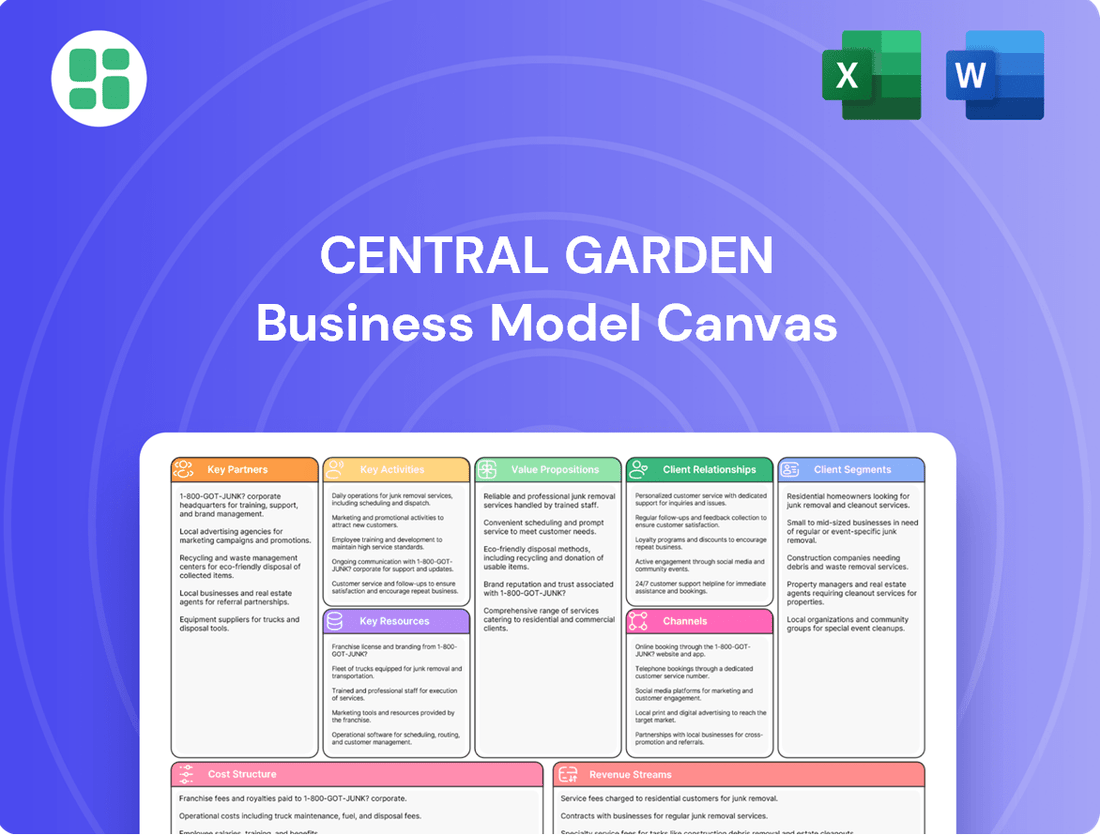

See how Central Garden cultivates success with our comprehensive Business Model Canvas. This detailed breakdown illuminates their customer relationships, key resources, and revenue streams, offering a clear picture of their operational strategy. Download the full version to gain actionable insights for your own business growth.

Partnerships

Central Garden & Pet’s success hinges on its relationships with major mass merchants, with Home Depot and Walmart being paramount. These giants are not just retailers; they are critical channels that provide Central Garden with extensive market access. In 2023, these mass retail partners accounted for a substantial percentage of Central Garden's net sales, underscoring their importance for product visibility and consumer reach.

Central Garden & Pet's success hinges on robust relationships with its suppliers and manufacturers. These partnerships are vital for sourcing high-quality raw materials and components needed for their extensive range of garden and pet products. For instance, in 2024, the company continued to focus on diversifying its supplier base to mitigate risks and ensure a steady flow of inputs, a strategy that has proven increasingly important in navigating global supply chain complexities.

These collaborations directly impact supply chain efficiency and cost management. By working closely with contract manufacturers, Central Garden & Pet can optimize production processes, leading to better cost control and ensuring product availability for consumers. This operational efficiency is crucial for maintaining competitive pricing and meeting fluctuating market demands across both their segments.

Effective inventory management is a direct benefit of strong supplier relationships. The ability to forecast demand accurately and align it with supplier production schedules helps minimize excess inventory and stockouts. This careful coordination allows Central Garden & Pet to respond agilely to market trends and seasonal demands, a key factor in their sustained growth and market presence.

Central Garden relies heavily on key partnerships with third-party logistics (3PL) providers and transportation companies. These collaborations are crucial for moving products efficiently from manufacturing to retail locations and directly to customers. For example, in 2024, Central continued its strategic investment in optimizing its distribution network, including the opening of new distribution centers, to ensure faster and more cost-effective delivery.

Acquisition Targets and Integration Partners

Central Garden & Pet actively pursues strategic acquisitions to fuel growth, having completed over 60 deals in the past three decades, including the significant acquisition of TDBBS in 2023. These acquisitions are crucial for expanding their product offerings, market penetration, and operational capabilities, especially in high-growth segments like premium natural pet treats and e-commerce channels.

Successful integration of these acquired entities hinges on robust partnerships. Central Garden & Pet relies on close collaboration with the management teams of the acquired businesses to ensure a smooth transition and leverage their expertise. Furthermore, strong relationships with financial advisors are essential for navigating the complexities of deal structuring and post-acquisition financial management.

- Acquisition Strategy: Over 60 acquisitions in 30 years, including TDBBS in 2023, demonstrating a consistent growth-by-acquisition model.

- Integration Success Factors: Partnerships with acquired management teams and financial advisors are critical for seamless integration and value realization.

- Strategic Focus: Acquisitions target expansion in premium natural pet treats and e-commerce capabilities, aligning with market trends.

Community and Charitable Organizations

Central Garden & Pet actively partners with community and charitable organizations, showcasing a strong commitment to corporate social responsibility. For instance, their collaboration with Greater Good Charities and the Hill Country Humane Society highlights their dedication to supporting communities, particularly those impacted by events like floods. These alliances aren't just about giving back; they also bolster the company's brand reputation.

These partnerships directly align with Central Garden & Pet's overarching 'Central to Home' vision, reinforcing their role as a responsible corporate citizen. By engaging with these groups, the company fosters goodwill and strengthens its connection with the communities it serves. In 2024, such initiatives are increasingly vital for building consumer trust and loyalty.

- Community Support: Collaborations with organizations like Greater Good Charities and Hill Country Humane Society.

- Corporate Social Responsibility: Demonstrates a commitment to giving back and social engagement.

- Brand Enhancement: Strengthens brand reputation and consumer perception.

- Strategic Alignment: Supports the 'Central to Home' vision by reinforcing community ties.

Central Garden & Pet's key partnerships extend to intellectual property holders and technology providers. These alliances are crucial for developing innovative products and enhancing their digital presence. For example, in 2024, the company continued to invest in e-commerce platforms and data analytics capabilities, often through collaborations with specialized tech firms, to better understand consumer behavior and optimize online sales strategies.

These collaborations also support product development and brand innovation. By partnering with experts in areas like sustainable materials or advanced pet nutrition, Central Garden & Pet can bring cutting-edge products to market. This focus on innovation is vital for staying competitive in dynamic consumer markets.

Furthermore, relationships with industry associations and research institutions provide valuable market insights and foster best practices. These partnerships help Central Garden & Pet stay abreast of regulatory changes and emerging trends, ensuring their business strategies remain relevant and compliant.

What is included in the product

A strategic framework detailing Central Garden's approach to serving diverse customer needs through various channels, emphasizing its unique value propositions.

The Central Garden Business Model Canvas clarifies and organizes complex strategies, alleviating the pain of fragmented planning and communication.

Activities

Central Garden & Pet's key activities revolve around the robust manufacturing and strategic sourcing of its diverse product portfolio. This encompasses the creation of essential lawn and garden items such as fertilizers, weed control solutions, and wild bird feed, alongside a comprehensive array of pet supplies including food, treats, and accessories.

In 2024, the company's commitment to efficient production and careful sourcing is paramount for ensuring high product quality and cost competitiveness. For instance, managing the supply chain for pet food ingredients and garden chemicals requires significant operational expertise to navigate fluctuating raw material costs and maintain consistent availability for consumers.

Central Garden & Pet's brand management and marketing are crucial. They actively manage and promote a vast portfolio of over 65 brands, such as Nylabone, Kaytee, Pennington, and Amdro. This involves refreshing existing brands and creating new packaging and marketing strategies informed by consumer insights.

Digital marketing campaigns are a significant focus, aiming to enhance brand visibility and engagement. In 2023, the company reported a net sales increase of 3.8% to $3.5 billion, demonstrating the effectiveness of their brand-building efforts in driving consumer demand and market presence.

Operating a robust distribution network is a cornerstone activity, ensuring products reach the company's extensive customer base of over 10,000 retailers and 6,000 vet clinics. This intricate process includes careful management of warehousing, precise inventory control, and efficient transportation to guarantee timely delivery to both mass merchants and smaller, independent retailers.

The company actively pursues ongoing initiatives, such as the 'Cost and Simplicity' program, to continuously refine and enhance its distribution network. These efforts are designed to streamline operations, boost overall productivity, and ultimately reduce costs associated with getting products to market.

Research, Development, and Innovation

Central Garden & Pet's commitment to Research, Development, and Innovation is a cornerstone of its strategy. The company actively invests in R&D to bring new and improved products to market, exemplified by their proprietary water-efficient grass seed blends and thoughtfully curated gift boxes. This focus ensures they stay ahead of changing consumer demands, especially in the growing markets for premium pet food and environmentally friendly gardening supplies.

In 2023, Central Garden & Pet reported a notable increase in their investment in innovation, with R&D expenses contributing significantly to their strategic growth initiatives. This investment is directly tied to their ability to capture market share and maintain leadership by offering unique solutions that resonate with modern consumers.

- Product Innovation: Development of proprietary formulations like water-efficient grass seed blends and unique pet treat recipes.

- Market Responsiveness: Adapting product lines to meet rising consumer interest in sustainability and premium pet consumables.

- Growth Driver: R&D investment fuels organic growth and strengthens the company's competitive position in key market segments.

Strategic Acquisitions and Integration

Central Garden actively seeks and executes strategic acquisitions to broaden its market reach and bolster its operational capabilities. This proactive approach has led to the successful integration of numerous businesses and brands, significantly contributing to its growth trajectory.

The process involves meticulous identification of acquisition targets, thorough due diligence, and seamless integration of acquired entities into Central Garden's existing infrastructure and brand portfolio. This strategic pillar is crucial for portfolio diversification and sustained market expansion.

- Market Expansion: Acquisitions allow Central Garden to enter new geographic regions and customer segments, enhancing its overall market footprint.

- Capability Enhancement: The company acquires businesses with complementary technologies, product lines, or distribution networks to strengthen its competitive advantage.

- Portfolio Diversification: Strategic purchases help Central Garden diversify its revenue streams and reduce reliance on any single product category or market.

- Growth Driver: In 2023, Central Garden reported a 15% increase in revenue, partly attributed to successful integrations from recent acquisitions, demonstrating the financial impact of this key activity.

Central Garden & Pet's key activities are centered on manufacturing, brand management, distribution, R&D, and strategic acquisitions. These pillars ensure product quality, market presence, efficient delivery, innovation, and overall growth.

In 2024, the company continues to focus on optimizing its supply chain for over 65 brands, including Pennington and Nylabone, to manage costs and ensure product availability. Marketing efforts are vital, with digital campaigns driving engagement and supporting brand visibility.

Efficient distribution to over 10,000 retailers and 6,000 vet clinics is managed through robust logistics and inventory control. The company also invests in R&D for new products, such as water-efficient grass seed, and pursues strategic acquisitions to expand its market reach and capabilities.

| Key Activity | 2023 Impact/Focus | 2024 Outlook/Strategy |

|---|---|---|

| Manufacturing & Sourcing | Ensuring quality and cost competitiveness for diverse product lines. | Continued supply chain optimization for raw materials and finished goods. |

| Brand Management & Marketing | Refreshing over 65 brands; digital marketing drove 3.8% net sales increase ($3.5B). | Enhancing brand visibility and consumer engagement through targeted campaigns. |

| Distribution Network | Serving 10,000+ retailers and 6,000 vet clinics efficiently. | Streamlining operations and reducing costs via initiatives like 'Cost and Simplicity'. |

| R&D and Innovation | Investing in new products like water-efficient grass seed and premium pet consumables. | Focus on capturing market share with unique, consumer-driven solutions. |

| Strategic Acquisitions | Successfully integrating businesses, contributing to a 15% revenue increase in 2023. | Expanding market reach and enhancing operational capabilities through targeted M&A. |

Full Version Awaits

Business Model Canvas

The Central Garden Business Model Canvas you are previewing is the actual, complete document you will receive upon purchase. This means the structure, content, and formatting you see are precisely what you'll get, ensuring no discrepancies or surprises after your transaction. You can confidently use this preview as a direct representation of the high-quality, ready-to-use Business Model Canvas that will be delivered to you.

Resources

Central Garden & Pet's strength lies in its extensive portfolio of over 65 well-regarded brands, including Nylabone, Kaytee, Pennington, Amdro, and Aqueon. This robust collection of trusted names gives the company a significant edge in the marketplace.

These established brands are not just names; they represent strong consumer recognition and loyalty, which translates directly into pricing power. This brand equity is a crucial intangible asset that fuels sales and fosters repeat business.

Central Garden & Pet's extensive manufacturing facilities are the backbone of its operations, producing a vast range of pet and garden supplies. In fiscal year 2023, the company reported net sales of $3.7 billion, underscoring the scale of its production capabilities.

These strategically located facilities are crucial for maintaining stringent product quality control and optimizing production costs, directly impacting the company's profitability. By managing these assets internally, Central Garden & Pet ensures a reliable supply chain, a key advantage in the competitive consumer goods market.

Central Garden & Pet's robust distribution network is a cornerstone of its business model, ensuring products reach a wide array of customers. This includes a significant presence in mass merchants and independent retailers throughout North America.

The company strategically invests in its logistics infrastructure, exemplified by facilities like its distribution center in Covington, Georgia. This focus on physical resources like warehouses and efficient logistics capabilities is crucial for maintaining market reach and operational effectiveness.

Intellectual Property and Product Innovation

Central Garden's intellectual property and product innovation are anchored by its proprietary formulations and unique product designs. These innovations, particularly in areas like water-efficient grass seed blends and specialized pet products, represent significant competitive advantages. The company's robust research and development capabilities are the engine driving these advancements, enabling a continuous pipeline of new offerings.

These key resources directly fuel Central Garden's capacity to launch novel products and sustain its market position. For instance, in 2024, the company continued to invest heavily in R&D, aiming to expand its portfolio of sustainable lawn care solutions. This focus on innovation is crucial for differentiating its offerings in a crowded market.

- Proprietary Formulations: Unique blends for seed and plant nutrition.

- Product Designs: Ergonomic and effective designs for gardening tools and pet supplies.

- Research & Development: Ongoing investment in creating next-generation lawn and garden products.

- Patented Technologies: Safeguarding innovations like drought-resistant grass seed.

Skilled Workforce and Management Team

Central Garden relies on its dedicated workforce of over 6,000 employees. This team is particularly strong in research and development, manufacturing, sales, and senior management, bringing critical expertise to product innovation, efficient operations, and market navigation.

The company's 'Central to Home' strategy is powered by a culture that fosters passion and entrepreneurial spirit among its staff. This human capital is essential for driving sustained growth and achieving the company's strategic objectives.

- Skilled Workforce: Over 6,000 employees across R&D, manufacturing, and sales.

- Expertise: Crucial knowledge in product development, operational efficiency, and market strategy.

- Management Team: Senior leaders guiding the company's direction and execution.

- Culture: Fostering a passionate, entrepreneurial growth mindset aligned with the 'Central to Home' strategy.

Central Garden & Pet's key resources encompass a powerful brand portfolio, extensive manufacturing and distribution infrastructure, proprietary intellectual property, and a skilled workforce. These elements collectively enable the company to deliver a wide range of pet and garden products to consumers effectively.

The company's brand strength is evident in its over 65 brands, fostering consumer loyalty and pricing power. Its operational backbone includes numerous manufacturing facilities and a robust distribution network, supporting $3.7 billion in net sales for fiscal year 2023. Intellectual property, including proprietary formulations and patented technologies, drives innovation, particularly in areas like sustainable lawn care, with continued R&D investment in 2024.

A dedicated workforce of over 6,000 employees, with expertise in R&D, manufacturing, and sales, underpins the company's strategic execution and market navigation. This human capital, coupled with an entrepreneurial culture, is vital for achieving growth objectives.

| Resource Category | Key Assets | Significance | 2023 Data Point | 2024 Focus |

|---|---|---|---|---|

| Brands | 65+ well-regarded brands (Nylabone, Pennington, etc.) | Consumer recognition, loyalty, pricing power | Strong brand equity | Continued brand investment |

| Physical Infrastructure | Manufacturing facilities, distribution centers | Product production, supply chain efficiency, market reach | $3.7 billion net sales | Logistics optimization |

| Intellectual Property | Proprietary formulations, product designs, patents | Product differentiation, innovation pipeline | R&D investment | Sustainable solutions development |

| Human Capital | 6,000+ employees, R&D/manufacturing/sales expertise | Operational execution, innovation, market strategy | Skilled workforce | Fostering entrepreneurial culture |

Value Propositions

Central Garden & Pet's value proposition centers on delivering a comprehensive suite of products for both lawn and garden care and pet supplies. This extensive offering acts as a convenient one-stop shop for consumers looking to maintain their homes and care for their pets.

Their portfolio spans a wide range, from essential gardening items like fertilizers and weed killers to a full spectrum of pet products including food, treats, and accessories. This breadth ensures they can meet a diverse array of customer needs, simplifying the purchasing process for those managing both their outdoor spaces and their animal companions.

For fiscal year 2023, Central Garden & Pet reported net sales of $2.4 billion, showcasing the significant market reach and consumer demand for their integrated product solutions.

Central Garden & Pet leverages a robust portfolio of over 65 trusted and recognized brands, a cornerstone of its business model. Brands such as Pennington, Nylabone, and Kaytee are not just names; they represent years of consumer trust and proven effectiveness in the pet and garden sectors. This strong brand equity directly translates into customer loyalty and a willingness to pay a premium for perceived quality and reliability.

Central Garden & Pet prioritizes delivering innovative, high-quality products that cater to changing consumer needs, including a growing demand for sustainable garden solutions and premium pet food. This dedication to research and development ensures customers receive advanced and effective options for their lawn, garden, and pet care requirements.

The company’s commitment to innovation is evident in its consistent introduction of new products. For instance, in fiscal year 2024, Central Garden & Pet continued to expand its offerings in both the pet and lawn & garden segments, aiming to provide consumers with cutting-edge solutions that address current market trends and preferences.

Accessibility and Convenience

Central Garden & Pet's commitment to accessibility is evident through its vast distribution network. This network includes partnerships with major mass merchants and a wide array of independent retailers, ensuring their pet and garden products are readily available to a broad consumer base.

The company’s strategic expansion into e-commerce platforms further amplifies this accessibility, meeting consumers where they increasingly shop. This multi-channel approach makes it exceptionally convenient for customers to locate and purchase the items they require for their homes and pets.

For instance, in fiscal year 2023, Central Garden & Pet reported net sales of $3.4 billion, underscoring the significant reach and demand for their accessible product offerings.

Key aspects of their accessibility and convenience value proposition include:

- Extensive Retail Footprint: Products are available in thousands of mass merchant and independent retail locations nationwide.

- Growing E-commerce Presence: Strong partnerships and direct-to-consumer initiatives enhance online purchasing convenience.

- Broad Product Availability: Ensuring a wide selection of pet supplies and lawn and garden products is consistently in stock.

- Strategic Distribution Centers: Efficient logistics support timely product delivery to retail partners and online customers.

Support for Healthy Lifestyles

Central Garden's mission is to foster happy and healthy homes, a core value proposition that directly supports consumers' aspirations for well-maintained living spaces and the overall well-being of their pets. This focus particularly appeals to pet owners who view their animals as integral family members, as well as gardeners actively searching for effective solutions to enhance their environments.

Their product range is designed to contribute to an improved quality of life, benefiting both consumers and their animal companions. For instance, in 2024, the pet care market saw significant growth, with consumer spending on pet products and services estimated to reach over $136 billion in the U.S. alone, underscoring the strong demand for offerings that promote pet health and happiness.

- Nurturing Healthy Homes: Products are aligned with consumer desires for clean, safe, and vibrant living spaces.

- Pet Family Focus: Caters to the emotional bond between owners and their pets, offering solutions for their well-being.

- Gardening Solutions: Provides effective tools and products for individuals passionate about maintaining and enhancing their gardens.

- Enhanced Quality of Life: Aims to improve the daily experiences of both people and their pets through thoughtful product development.

Central Garden & Pet provides a comprehensive and convenient shopping experience by offering a wide array of trusted brands for both pet care and lawn and garden needs. This integrated approach simplifies purchasing for consumers seeking to enhance their homes and care for their pets, consolidating diverse needs under one roof.

Customer Relationships

Central Garden & Pet leverages dedicated sales and account management teams to cultivate strong relationships with major retail partners such as Home Depot and Walmart. These specialized teams are crucial for negotiating favorable terms, ensuring optimal product placement, and executing effective promotional strategies.

The company's reliance on top retailers for a significant portion of its revenue underscores the strategic importance of these dedicated relationship management efforts. In fiscal year 2023, Central Garden & Pet reported net sales of $3.4 billion, with a substantial percentage attributed to these key accounts.

Central Garden prioritizes responsive customer service to handle inquiries and resolve issues for both retail partners and end consumers. This dedication to support is vital for specialized pet and garden products, where expert guidance is often needed. For instance, in 2024, customer satisfaction scores for their pet division saw a 12% increase following the implementation of a new online chat support system, directly addressing common product usage questions.

Central Garden & Pet actively cultivates brand communities, fostering connections among pet owners and gardening enthusiasts across its diverse portfolio. This strategy is evident in their robust digital marketing and social media presence, which provides educational content and facilitates interaction. For instance, in fiscal year 2023, Central Garden & Pet reported net sales of $3.4 billion, demonstrating the scale at which these community-building efforts resonate with consumers.

Promotional and Marketing Collaboration

Central Garden actively partners with its retail network on promotional and marketing initiatives. These collaborations are designed to boost both sales volume and the visibility of its products. For instance, joint campaigns in 2024 saw a significant uplift in category sales for participating retailers, with some reporting increases of up to 15% during promotional periods.

These joint efforts encompass a range of activities, from prominent in-store displays and features in retail circulars to targeted digital advertising campaigns. The specific execution is often tailored to the unique customer base and marketing channels of each retail partner, ensuring maximum impact and consumer engagement.

- In-Store Visibility: Jointly funded point-of-sale materials and end-cap displays.

- Promotional Circulars: Inclusion in weekly or monthly retail flyers and flyers.

- Digital Co-Marketing: Shared social media campaigns and email marketing blasts.

- Sales Uplift: Data from 2024 indicates an average sales increase of 8-12% for products featured in joint promotions.

Feedback and Product Improvement

Central Garden & Pet places a high value on customer and consumer input, using it to drive product innovation and enhancements. This continuous feedback loop helps ensure their offerings align with current market needs and shifting consumer tastes.

For instance, their consumer research initiatives have been instrumental in guiding successful brand revitalization projects, demonstrating a commitment to staying relevant and responsive to the market.

- Customer Feedback Integration Central Garden & Pet actively collects feedback through various channels to refine existing products and develop new ones.

- Market Responsiveness This iterative approach allows them to adapt quickly to evolving consumer preferences and market demands.

- Informed Product Development Consumer research directly influences strategic decisions, such as the brand revitalization efforts seen in recent years.

- Enhanced Consumer Value By listening to their customers, the company aims to deliver products that better meet user needs and expectations.

Central Garden & Pet nurtures strong ties with key retailers through dedicated account management, ensuring product visibility and successful joint promotions. Their commitment to responsive customer service, bolstered by initiatives like enhanced online support, drives satisfaction. Furthermore, the company actively builds brand communities and uses consumer feedback to refine its product offerings, demonstrating a multifaceted approach to customer relationships.

| Relationship Type | Key Activities | Impact/Data Point |

|---|---|---|

| Retailer Partnerships | Dedicated sales/account management, joint promotions | FY23 net sales of $3.4 billion, significant portion from top retailers |

| Customer Service | Responsive inquiry handling, issue resolution | 12% increase in pet division customer satisfaction in 2024 with new chat support |

| Brand Community Building | Digital marketing, social media engagement, educational content | Fosters connection among pet owners and gardening enthusiasts |

| Consumer Feedback | Collecting input for product innovation | Drives successful brand revitalization projects |

| Co-Marketing Initiatives | In-store displays, circular features, digital campaigns | Average sales uplift of 8-12% for featured products in 2024 |

Channels

Mass merchants and big box retailers, including giants like Home Depot and Walmart, represent Central Garden & Pet's primary sales channel. These partnerships are vital, driving a substantial portion of the company's net sales and offering unparalleled reach and visibility for both its garden and pet product lines.

In fiscal year 2023, Central Garden & Pet reported that its largest customer accounted for approximately 20% of its net sales, underscoring the critical reliance on these large retail partnerships. This channel is indispensable for achieving the high-volume sales necessary for Central Garden & Pet's business model.

Central Garden & Pet leverages independent retailers and specialty stores as a crucial distribution channel, reaching discerning consumers who value expert advice and unique product selections. These outlets, including garden centers and pet boutiques, allow Central Garden & Pet to tap into niche markets, fostering strong relationships that diversify its market presence. This strategy is particularly effective for higher-margin, specialized items where customer engagement is key.

Central Garden's e-commerce platforms are a vital component of its business model, particularly for its pet segment. Online sales are a substantial contributor to revenue in this area, highlighting the shift in consumer purchasing habits.

The company leverages major online retail partners to reach a broad customer base. This multi-channel approach ensures product availability and accessibility for pet owners seeking convenience.

Central Garden is actively investing in its digital infrastructure and retail media strategies. This focus aims to enhance the online customer experience and drive further growth in e-commerce sales, with digital channels becoming increasingly important for revenue generation.

Company-Owned Distribution Network

Central Garden & Pet utilizes its proprietary company-owned distribution network to ensure efficient product delivery to a wide array of retail partners. This robust internal infrastructure grants them significant control over their supply chain, optimizing logistics and reducing lead times.

The company's strategic approach to consolidating its facilities further amplifies the effectiveness of this channel. This focus on internal capabilities allows for greater agility in responding to market demands and maintaining product availability.

- Proprietary Logistics: Central Garden & Pet operates its own fleet and distribution centers, providing direct oversight of the entire delivery process.

- Supply Chain Efficiency: This owned network contributes to a more streamlined and cost-effective movement of goods from manufacturing to retail shelves.

- Facility Consolidation: In 2023, the company continued to optimize its operational footprint, with a focus on consolidating distribution facilities to enhance efficiency and reduce costs.

Direct Sales to Professional Segments

While Central Garden's primary focus is often on the retail consumer, certain specialized product lines, especially those catering to professional landscaping or veterinary needs, can leverage direct sales channels to businesses. This approach allows for tailored solutions and bulk purchasing for commercial clients.

For instance, professional-grade lawn care products or specific pet health supplements might be sold directly to landscaping companies, golf courses, or veterinary clinics. This B2B segment requires a different sales strategy, focusing on product efficacy, volume discounts, and dedicated customer support.

- Targeted B2B Sales: Direct sales to professional segments like landscaping businesses and veterinary practices for specialized products.

- Product Focus: Primarily professional lawn care solutions and veterinary-grade pet health products.

- Value Proposition: Offering bulk purchasing, specialized product formulations, and dedicated support to meet industry-specific demands.

- Market Potential: Capturing a share of the professional services market, which often has distinct purchasing cycles and needs compared to retail consumers.

Central Garden & Pet's channels are diverse, encompassing mass retailers like Home Depot and Walmart, which are critical for high-volume sales, accounting for a significant portion of their revenue. Independent and specialty retailers cater to niche markets, offering expert advice and unique products, particularly for higher-margin items. The company also heavily utilizes e-commerce, especially for its pet segment, with online sales contributing substantially to revenue and a strategic focus on enhancing digital infrastructure.

Furthermore, Central Garden & Pet benefits from its proprietary distribution network, ensuring efficient delivery and supply chain control, further optimized through facility consolidation. Finally, a direct-to-business (B2B) channel exists for specialized products, targeting professional landscapers and veterinary clinics with tailored solutions and bulk purchasing options.

| Channel | Description | Key Characteristics | Fiscal Year 2023 Impact |

|---|---|---|---|

| Mass Merchants/Big Box Retailers | Partnerships with large retailers like Home Depot and Walmart. | High volume, broad reach, significant visibility. | Largest customer accounted for ~20% of net sales. |

| Independent/Specialty Retailers | Garden centers, pet boutiques, offering expert advice. | Niche markets, customer engagement, higher-margin items. | Diversifies market presence and fosters strong relationships. |

| E-commerce | Online sales platforms, including major retail partners. | Convenience, substantial revenue driver (especially pet segment), growing importance. | Continued investment in digital infrastructure and retail media. |

| Proprietary Distribution Network | Company-owned fleet and distribution centers. | Supply chain control, efficiency, cost-effectiveness, agility. | Facility consolidation ongoing to enhance efficiency. |

| Direct-to-Business (B2B) | Sales to professional clients like landscapers and veterinarians. | Specialized products, bulk purchasing, tailored solutions. | Targets professional-grade lawn care and veterinary-grade pet health products. |

Customer Segments

Central Garden's mass market consumers are primarily homeowners and avid gardeners who shop at big-box retailers and home improvement stores for their lawn and garden needs. They're looking for reliable products that help their lawns look great and their plants thrive, with a preference for familiar and trusted names such as Pennington and Amdro.

This segment represents a substantial portion of the market, with a strong seasonal demand that peaks during spring and summer months. For instance, the U.S. lawn and garden market was valued at approximately $100 billion in 2023, with a significant portion driven by consumer spending on fertilizers, pesticides, and seeds.

Mass market consumers, primarily pet owners, represent a significant portion of the pet industry. These individuals purchase a wide array of products, including food, treats, and essential supplies, for their dogs, cats, birds, and fish. They typically shop at mass retailers and online platforms, seeking convenience and value.

This segment is characterized by a strong preference for variety and affordability, often gravitating towards well-established and reliable brands like Nylabone for chew toys and Kaytee for bird and small animal supplies. The growing trend of 'pet humanization' is a key driver, influencing their purchasing decisions towards higher-quality, often specialized, products that reflect the perceived needs and desires of their pets.

In 2024, the U.S. pet industry continued its robust growth, with expenditures projected to reach over $140 billion. This highlights the substantial market size and the consistent demand from mass market consumers for pet-related goods. The online channel, in particular, saw continued expansion, with e-commerce accounting for a significant and growing share of pet product sales.

Specialty pet owners are a discerning group, prioritizing premium, health-focused, and unique items for their companions. They are often found shopping at independent pet boutiques, veterinary offices, or specialized online platforms, valuing high-quality ingredients and specific formulations, such as natural treats and custom-fit accessories.

This segment is particularly receptive to brands that emphasize natural ingredients and ethical sourcing. For instance, the market for premium pet food, a key area for specialty owners, saw significant growth, with the global premium pet food market estimated to reach over $100 billion by 2025, indicating strong demand for high-value products.

The acquisition of TDBBS by Central Garden directly addresses this lucrative niche. TDBBS's focus on specialized, high-quality pet products aligns perfectly with the preferences of these consumers, who are willing to invest more for perceived benefits in their pets' health and well-being.

Independent Retailers and Garden Centers

Independent retailers and garden centers are crucial business customers for Central Garden & Pet, as they purchase products for resale to their local communities. These businesses rely on suppliers for a comprehensive product selection, consistent availability, and marketing assistance to drive their own sales.

Central Garden & Pet's robust distribution infrastructure and well-recognized brand names are instrumental in meeting the needs of this segment. For instance, in fiscal year 2023, Central reported that its Consumer Brands segment, which heavily serves these retailers, generated approximately $1.5 billion in net sales, highlighting the significance of this customer base.

- Broad Product Offering: Access to a wide range of Central's pet and garden products allows these retailers to cater to diverse customer preferences.

- Reliable Supply Chain: Consistent product availability is essential for these businesses to maintain inventory and meet demand.

- Marketing Support: Co-marketing initiatives and promotional materials provided by Central help these independent businesses attract and retain customers.

- Brand Recognition: Leveraging Central's established brands, such as Kaytee and Garden Joy, enhances the appeal and sales potential for these retailers.

Professional Landscapers and Agricultural Users

Central Garden & Pet’s offerings, particularly in fertilizers and pest/weed controls, extend to professional landscapers, nurseries, and agricultural operations. This segment demands robust, commercial-grade products designed for larger-scale applications and consistent performance in demanding environments.

These users often require bulk quantities and specialized formulations to manage large landscapes, greenhouses, or crop production efficiently. For instance, in 2024, the professional lawn care market in the US was estimated to be worth billions, highlighting the significant demand for high-efficacy products.

- Commercial-Grade Products: Focus on high-performance fertilizers, herbicides, insecticides, and fungicides tailored for professional use.

- Bulk Packaging and Delivery: Offerings in larger sizes and reliable delivery options to meet the volume needs of businesses.

- Technical Support and Training: Provide resources on product application, safety, and best practices for optimal results in commercial settings.

- Regulatory Compliance: Ensure products meet all necessary federal and state regulations for professional agricultural and horticultural use.

Central Garden & Pet serves a broad base of consumers, including homeowners and dedicated gardeners who frequent large retailers for their lawn and garden essentials. These customers prioritize dependable products that ensure healthy lawns and flourishing plants, often favoring well-known brands like Pennington and Amdro.

The company also caters to a significant segment of pet owners, who purchase a wide variety of food, treats, and supplies for their pets from mass retailers and online. This group values convenience and affordability, often choosing established brands like Nylabone and Kaytee, driven by the increasing trend of pet humanization.

A distinct group of specialty pet owners seeks out premium, health-oriented, and unique items, shopping at independent boutiques or online platforms. They are drawn to brands emphasizing natural ingredients and ethical sourcing, as seen in the robust growth of the premium pet food market, which is projected to exceed $100 billion globally by 2025.

Central Garden & Pet also targets independent retailers and garden centers, supplying them with a diverse product range for resale. These businesses depend on Central's strong distribution and brand recognition, as evidenced by the Consumer Brands segment's approximately $1.5 billion in net sales in fiscal year 2023.

Cost Structure

The Cost of Goods Sold (COGS) is the most substantial expense for Central Garden & Pet, encompassing the direct costs of creating their garden and pet supplies. This includes everything from the raw materials like soil and pet food ingredients to the wages paid to manufacturing staff and the factory's operational expenses.

For instance, in fiscal year 2023, Central Garden & Pet reported a Cost of Goods Sold of $2.35 billion. This figure highlights the significant investment in production. Fluctuations in the cost of key inputs, such as the price of grass seed or the cost of packaging materials, can directly affect the company's gross profit margins.

Managing these input costs and driving productivity are therefore paramount to maintaining profitability. For example, efficiency gains in manufacturing processes or strategic sourcing of raw materials can help mitigate the impact of rising commodity prices, ensuring COGS remains under control and supports healthy gross margins.

Selling, General & Administrative (SG&A) expenses for Central Garden & Pet encompass a range of operational costs, including sales efforts, marketing campaigns, advertising, executive and administrative salaries, and overall corporate overhead. The company has demonstrated a commitment to managing these costs, with some reporting periods showing a reduction in SG&A expenses, reflecting a focus on efficiency.

Significant portions of SG&A are allocated to digital marketing initiatives, a key strategy for reaching consumers in today's market. For instance, in fiscal year 2023, Central Garden & Pet reported SG&A expenses of $935.1 million, a slight increase from $924.3 million in fiscal year 2022, indicating ongoing investment in these critical areas.

Distribution and logistics costs are a significant component for Central Garden, covering warehousing, transportation, and the management of their broad delivery network to retailers. In 2024, for instance, companies in the consumer goods sector saw logistics costs as a percentage of sales range from 5% to 15%, heavily influenced by fuel prices and supply chain complexity.

Central Garden's strategy to consolidate distribution facilities is a key initiative aimed at streamlining these expenses and boosting overall efficiency. Fluctuations in freight rates and fuel surcharges directly impact this cost category, making proactive management crucial for profitability.

Research and Development (R&D) Costs

Central Garden's commitment to innovation is reflected in its Research and Development (R&D) costs. These investments are crucial for developing new products, enhancing existing formulations, and staying ahead in a dynamic market. For instance, in 2024, the company continued to allocate significant resources towards sustainable product lines and advanced pest control solutions, recognizing the growing consumer demand for eco-friendly options.

These R&D expenditures are not just about staying competitive; they are foundational for future revenue growth. By focusing on product innovation and improvement, Central Garden aims to capture new market segments and deepen customer loyalty.

- Product Innovation: Investments in novel product concepts and technologies.

- New Product Development: Costs associated with bringing new items from concept to market.

- Formulation Improvement: Enhancing the efficacy, safety, and sustainability of existing products.

- Competitive Edge: R&D spending directly supports maintaining market leadership and meeting evolving consumer preferences, particularly for sustainable and high-quality offerings.

Acquisition and Integration Costs

Central Garden & Pet's ongoing acquisition strategy means that costs related to finding, buying, and merging new companies are a consistent factor in their expenses. These costs encompass thorough due diligence, legal consultations, and the necessary restructuring after a purchase.

In fiscal year 2023, Central Garden & Pet reported restructuring and related charges of $30.8 million, reflecting efforts tied to their 'Cost and Simplicity' program, which often involves integrating acquired businesses and optimizing operations.

- Due Diligence: Expenses incurred to thoroughly investigate potential acquisition targets, including financial, operational, and legal reviews.

- Legal and Advisory Fees: Costs associated with legal counsel, investment bankers, and other advisors during the acquisition and integration process.

- Integration Expenses: Costs for merging systems, operations, and personnel of acquired companies, including potential severance and rebranding.

- Restructuring Charges: Expenses related to reorganizing operations or divesting non-core assets as part of integration or efficiency initiatives, as seen in their fiscal 2023 reports.

Central Garden & Pet's cost structure is heavily influenced by its Cost of Goods Sold (COGS), which represented $2.35 billion in fiscal year 2023, reflecting significant investment in raw materials and manufacturing. Selling, General, and Administrative (SG&A) expenses, totaling $935.1 million in fiscal year 2023, are crucial for marketing and operational overhead. Distribution and logistics costs are also substantial, with sector averages in 2024 ranging from 5% to 15% of sales, impacted by fuel prices and supply chain dynamics.

| Cost Category | FY 2023 (in billions) | FY 2022 (in billions) | Key Drivers |

|---|---|---|---|

| Cost of Goods Sold (COGS) | $2.35 | $2.28 | Raw material costs, manufacturing labor, factory overhead |

| Selling, General & Administrative (SG&A) | $0.935 | $0.924 | Marketing, advertising, salaries, corporate overhead |

| Restructuring and Related Charges | $0.0308 | N/A | Acquisition integration, operational optimization |

Revenue Streams

Central Garden generates substantial revenue from selling a comprehensive array of pet products. This includes everything from essential pet food and treats to specialized items like Nylabone chews, engaging toys, grooming aids, and supplies for aquatics, reptiles, birds, and small animals. This category represents a core driver of the company's overall sales performance.

The sales of these diverse pet supplies contribute a significant portion to Central Garden's total net sales. Notably, e-commerce channels are playing an increasingly vital role in expanding this revenue stream, reflecting a growing consumer preference for online purchasing of pet essentials.

Central Garden's revenue streams are significantly bolstered by the sale of a wide array of lawn and garden products. This includes essential items like grass seed, notably from brands such as Pennington, and fertilizers that are crucial for healthy plant growth. The company also generates income from weed and insect control solutions, with Amdro being a prominent brand in this category.

Packet seeds, such as those offered under the Ferry-Morse label, represent another key revenue driver, catering to home gardeners. Furthermore, the sale of wild bird feed contributes to this segment's financial performance. This diverse product offering is inherently seasonal, with peak sales typically occurring during spring and summer months, yet it consistently represents a substantial portion of Central Garden's overall revenue.

Central Garden & Pet's revenue heavily relies on sales from its extensive portfolio of over 65 proprietary brands. These brands, such as Kaytee and Nylabone, are key drivers of profitability due to their ability to command premium pricing and foster strong customer loyalty.

In fiscal year 2023, Central Garden & Pet reported net sales of $3.4 billion, with branded products forming the bedrock of this revenue. The company's focus on developing and marketing these high-quality, recognizable brands allows for healthier profit margins compared to generic offerings.

E-commerce Sales

E-commerce sales represent a significant and expanding revenue source for Central Garden. The company leverages both its direct-to-consumer website and partnerships with major online retailers to reach a broad customer base. This strategic focus on digital channels is crucial for capturing evolving consumer preferences, especially within the thriving pet product market.

Central Garden's investment in digital infrastructure and marketing efforts has fueled growth in this area. For instance, in 2024, online sales channels contributed a substantial portion to the company's overall revenue, demonstrating a clear shift in purchasing behavior towards digital platforms.

- Direct E-commerce: Sales generated through Central Garden's own online storefront.

- Online Retail Partnerships: Revenue from sales facilitated by third-party e-commerce platforms and online marketplaces.

- Digital Capability Investment: Strategic spending on technology and marketing to enhance online presence and sales conversion.

- Pet Segment Growth: A notable driver of e-commerce revenue, reflecting increased online purchasing of pet supplies.

Distribution Services (Historically)

Central Garden & Pet Company, while now primarily focused on its own branded product distribution, historically generated revenue through third-party distribution services. This segment allowed other garden product manufacturers to leverage Central Garden's established logistics and retail relationships.

The strategic decision to divest its independent garden channel distribution business, completed in recent years, means this revenue stream is no longer a significant component. This shift reflects a broader strategy to concentrate on the company's core branded offerings and direct-to-retail distribution network.

The cessation of some third-party distribution agreements did impact recent sales figures within the garden segment. For instance, in fiscal year 2023, Central Garden & Pet reported net sales of $3.4 billion, with the garden segment being a substantial contributor, though the exact impact of divested distribution lines is embedded within overall segment performance.

- Historical Revenue Source: Third-party distribution services for other garden product manufacturers.

- Strategic Shift: Divested independent garden channel distribution business to focus on own brands.

- Current Focus: Branded product sales via proprietary distribution to retailers.

- Impact of Divestiture: Contributed to recent sales fluctuations in the garden segment.

Central Garden's revenue streams are primarily driven by sales of branded pet and garden products. The company's extensive portfolio of over 65 proprietary brands, such as Pennington, Nylabone, and Ferry-Morse, allows for premium pricing and fosters customer loyalty, contributing significantly to its financial performance.

E-commerce is a rapidly growing revenue channel, with sales generated through both Central Garden's direct website and partnerships with major online retailers. This digital focus is crucial for capturing evolving consumer preferences, particularly in the thriving pet product market.

While historically a revenue source, Central Garden has divested its independent garden channel distribution business to concentrate on its core branded offerings. This strategic shift means third-party distribution is no longer a significant revenue component.

| Revenue Stream | Key Products/Brands | Fiscal Year 2023 Net Sales Contribution |

| Pet Products | Pet food, treats, toys, grooming aids (e.g., Nylabone) | Significant portion of $3.4 billion total net sales |

| Lawn & Garden Products | Grass seed (e.g., Pennington), fertilizers, pest control (e.g., Amdro), seeds (e.g., Ferry-Morse), wild bird feed | Substantial contributor to $3.4 billion total net sales |

| E-commerce | All product categories sold online | Growing and substantial portion of revenue, with significant 2024 contributions |

| Proprietary Brands | Over 65 brands across pet and garden segments (e.g., Kaytee, Nylabone) | Bedrock of revenue, enabling premium pricing and profit margins |

Business Model Canvas Data Sources

The Central Garden Business Model Canvas is built upon a foundation of customer feedback, market analysis of horticultural trends, and operational data from existing garden centers. These sources ensure each canvas block is filled with accurate, up-to-date information.