CenterPoint Energy PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CenterPoint Energy Bundle

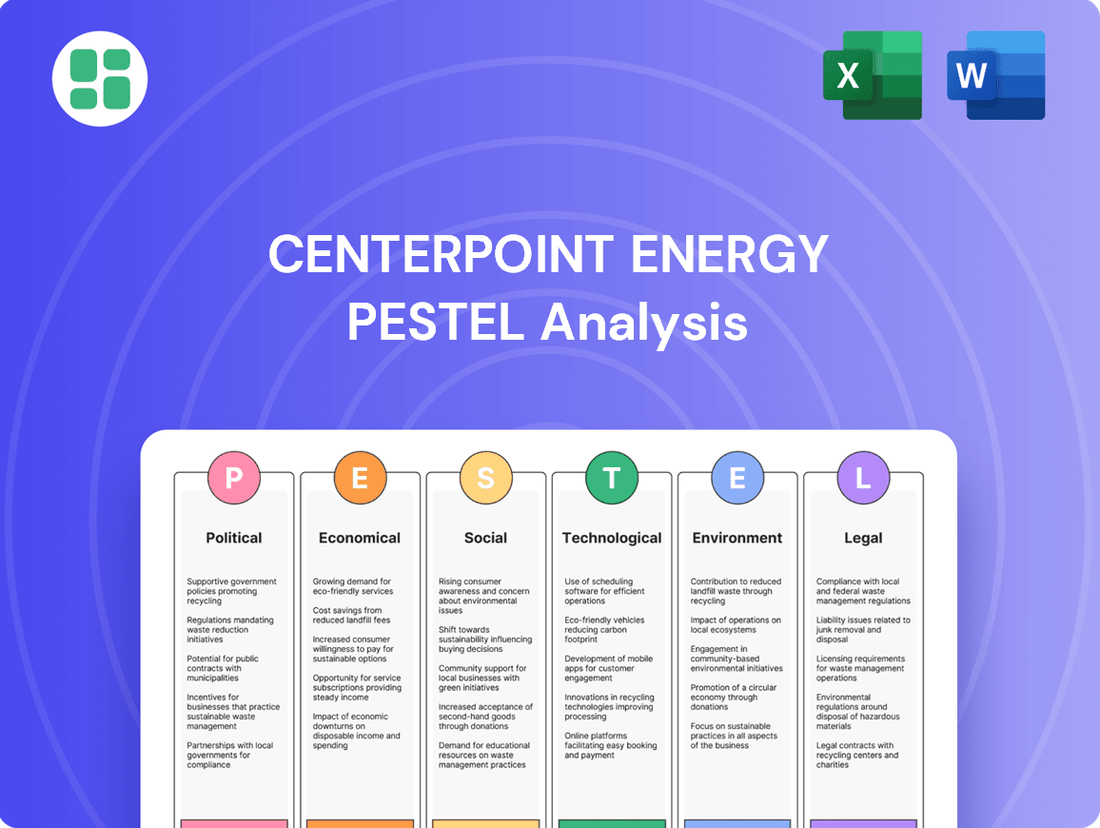

Navigate the complex external forces impacting CenterPoint Energy with our detailed PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors shaping its operations and future growth. Gain a competitive advantage by leveraging these expert insights for strategic planning. Download the full analysis now and unlock actionable intelligence.

Political factors

The utility sector's heavy regulation means changes in energy policies, especially rate-setting, directly affect CenterPoint Energy's earnings. For instance, a recent rate case in Texas sought to recover significant capital investments, with the Public Utility Commission of Texas ultimately approving a substantial portion of these planned expenditures, impacting the company's financial outlook for 2024 and beyond.

Government support for grid modernization, particularly in enhancing resilience against extreme weather, presents a significant opportunity for CenterPoint Energy. Initiatives like the Infrastructure Investment and Jobs Act of 2021, which allocated billions towards grid upgrades, provide a favorable backdrop for such investments.

CenterPoint Energy's strategic focus on strengthening its infrastructure, evidenced by its $1.6 billion investment in storm hardening and resilience projects in 2023 alone, aligns directly with these governmental priorities. Regulatory frameworks allowing for cost recovery on these essential upgrades are crucial political drivers, directly impacting the company's ability to execute its long-term modernization plans.

Government policies actively encouraging renewable energy adoption and decarbonization significantly shape CenterPoint Energy's strategic planning. For instance, the Inflation Reduction Act of 2022 provides substantial tax credits for clean energy projects, directly impacting the economics of integrating more solar and wind power into the grid.

As an energy delivery company, CenterPoint must invest in modernizing its infrastructure to effectively manage and transmit electricity from diverse, often intermittent, renewable sources. This includes upgrades to transmission lines and grid management systems to handle the increased variability associated with solar and wind power generation, which is crucial for maintaining grid stability.

Local and State Political Stability

The political stability and priorities within states like Texas, Indiana, Ohio, and Minnesota, where CenterPoint Energy operates, significantly influence local permitting processes, community engagement, and the broader operational landscape. A stable political environment with clear regulatory priorities fosters confidence for long-term infrastructure investments, crucial for utilities like CenterPoint. For instance, Texas's ongoing focus on grid modernization and renewable energy integration, as evidenced by continued investment in transmission infrastructure, creates a favorable environment for utility expansion and upgrades.

Consistent policy frameworks are essential for the successful execution of large-scale infrastructure projects and reliable service delivery. CenterPoint Energy's substantial capital expenditure plans, projected to be around $12.0 billion for 2024-2028, are directly impacted by the predictability of state and local political decisions regarding rate cases, environmental regulations, and infrastructure development.

- Texas: Continued emphasis on grid resilience and energy transition policies.

- Indiana: Focus on infrastructure modernization and reliability improvements.

- Ohio: Regulatory environment supporting utility investments in grid modernization and clean energy.

- Minnesota: State policies encouraging renewable energy integration and decarbonization efforts.

Federal Energy Policy and Oversight

Federal energy policies, particularly those from the Federal Energy Regulatory Commission (FERC) and the Department of Energy, significantly shape the landscape for interstate natural gas pipelines and transmission infrastructure. These agencies set the rules of the road for energy markets and environmental standards, directly impacting how companies like CenterPoint Energy operate. For instance, FERC's decisions on rate setting for interstate pipelines are crucial for revenue streams.

Changes in federal regulations can create both opportunities and challenges. For example, evolving environmental standards might necessitate investments in new technologies or operational adjustments. In 2024, the Department of Energy continued to emphasize grid modernization and energy efficiency initiatives, which could influence future infrastructure investments and regulatory compliance for CenterPoint Energy.

CenterPoint Energy's operations are subject to a complex web of federal oversight. Key areas include:

- FERC Regulations: Oversight of interstate natural gas transportation rates and services, impacting pipeline profitability.

- Department of Energy Initiatives: Focus on energy security, grid modernization, and the transition to cleaner energy sources, influencing long-term strategic planning.

- Environmental Standards: Compliance with federal environmental protection laws, such as those managed by the EPA, affects emissions and operational practices.

Governmental support for grid modernization, like the Infrastructure Investment and Jobs Act of 2021, provides billions for upgrades, directly benefiting CenterPoint Energy's resilience efforts. Federal policies, such as the Inflation Reduction Act of 2022, offer tax credits for clean energy, influencing the economics of renewable integration for the company.

State-level political stability and priorities in Texas, Indiana, Ohio, and Minnesota are crucial for CenterPoint's infrastructure investments, with Texas showing continued focus on grid resilience and renewable integration. Federal oversight from FERC and the Department of Energy shapes interstate pipeline rates and the company's strategic planning for energy security and modernization.

CenterPoint Energy's capital expenditure plans, around $12.0 billion for 2024-2028, are heavily influenced by predictable state and local political decisions on rate cases and environmental regulations. The company's 2023 investments of $1.6 billion in storm hardening align with governmental priorities for grid resilience.

What is included in the product

This PESTLE analysis offers a comprehensive examination of the external macro-environmental forces impacting CenterPoint Energy, detailing how Political, Economic, Social, Technological, Environmental, and Legal factors present both challenges and strategic advantages.

A clear, actionable summary of CenterPoint Energy's PESTLE factors, designed to streamline strategic planning and mitigate external risks.

This PESTLE analysis offers a concise, easily digestible format, perfect for quick team alignment and informed decision-making during strategic discussions.

Economic factors

CenterPoint Energy's significant capital expenditure plans, including a projected $53 billion investment through 2030, underscore its commitment to infrastructure modernization and growth. These substantial outlays are essential for upgrading aging systems, accommodating increased energy demand, and bolstering the resilience of its grid against disruptions. The success of these investments directly influences the company's future financial performance and operational capabilities.

Interest rates are a critical factor for CenterPoint Energy, directly influencing how much it costs to borrow money for its extensive infrastructure upgrades. For instance, in early 2024, the Federal Reserve's benchmark interest rate hovered around 5.25%-5.50%, a significant increase from the near-zero rates seen previously. This means that any new debt CenterPoint takes on for projects like grid modernization or pipeline expansion becomes more expensive.

Higher financing costs can squeeze profit margins, as more of the company's revenue goes towards servicing its debt. This could also make some planned capital expenditures less attractive, potentially delaying or scaling back crucial investments in the energy grid. For example, a project that was feasible with a 3% borrowing cost might become marginal or unviable if interest rates climb to 6% or higher.

CenterPoint Energy's service territories, especially the booming Greater Houston area, are experiencing significant economic growth. This expansion directly fuels demand for both electricity and natural gas. For instance, Texas's economy has shown robust growth, with job creation often outpacing national averages, leading to increased energy needs.

A growing customer base, coupled with heightened industrial activity, presents substantial revenue opportunities for CenterPoint. The surge in demand from sectors like data centers and manufacturing, which are energy-intensive, translates into higher energy consumption. In 2023, Texas's GDP growth was notably strong, underscoring the favorable economic climate for energy providers.

Inflation and Operational Costs

Inflationary pressures directly impact CenterPoint Energy by increasing the costs of essential materials like natural gas and electricity, as well as labor and ongoing maintenance. For instance, the Producer Price Index (PPI) for Utilities saw a notable increase in late 2023 and early 2024, reflecting these rising input costs.

The company's financial health hinges on its capacity to pass these escalating operational expenses onto consumers through approved rate adjustments. CenterPoint Energy's regulatory filings demonstrate ongoing efforts to secure these necessary rate increases to offset inflationary impacts and maintain profitability.

- Rising Input Costs: Inflation drives up the price of fuel, construction materials, and specialized labor, directly affecting CenterPoint Energy's capital expenditure and operational budgets.

- Regulatory Lag: The time it takes for regulatory bodies to approve rate increases can create a temporary mismatch between rising costs and revenue recovery, impacting short-term margins.

- Customer Affordability: While rate adjustments are necessary, significant increases can strain customer affordability, potentially leading to political or public opposition to proposed rate hikes.

Commodity Prices (Natural Gas)

CenterPoint Energy, as a natural gas distributor, is directly impacted by the fluctuating prices of natural gas. While regulatory frameworks often allow for the pass-through of these costs to consumers, significant price swings can affect customer affordability and potentially lead to increased regulatory oversight. For instance, in early 2024, natural gas prices saw considerable volatility, with benchmarks like the Henry Hub fluctuating based on weather patterns and storage levels.

These price movements can create challenges. Even with cost recovery mechanisms, rapid increases in natural gas prices can strain household budgets, potentially leading to higher customer delinquency rates or calls for regulatory intervention. For example, a sharp rise in natural gas costs during the winter of 2023-2024 might have prompted discussions about energy assistance programs or rate case reviews.

- Natural gas prices are subject to seasonal demand and supply shocks.

- Regulatory mechanisms allow for cost pass-through, but extreme volatility impacts customer affordability.

- In early 2024, the Henry Hub natural gas price experienced significant fluctuations, underscoring this inherent risk.

- High commodity prices can increase customer arrearages and attract regulatory attention.

Economic growth in CenterPoint Energy's service territories, particularly Texas, is a significant driver for increased energy demand. This expansion, fueled by job creation and industrial activity, presents substantial revenue opportunities. For example, Texas's robust GDP growth in 2023 highlights this favorable economic climate.

Interest rates directly impact CenterPoint's borrowing costs for its extensive capital expenditures. With the Federal Reserve's benchmark rate around 5.25%-5.50% in early 2024, higher financing costs can affect project feasibility and profit margins.

Inflationary pressures increase operational costs for materials, labor, and maintenance. While CenterPoint seeks rate adjustments to offset these rising expenses, regulatory lag and customer affordability remain key considerations.

| Economic Factor | Impact on CenterPoint Energy | Supporting Data/Context |

|---|---|---|

| Economic Growth | Increased energy demand and revenue opportunities | Texas GDP growth strong in 2023; Houston area expansion |

| Interest Rates | Higher borrowing costs for capital projects | Federal Funds Rate ~5.25%-5.50% (early 2024) |

| Inflation | Increased operational and material costs | Producer Price Index (PPI) for Utilities rising; Natural gas price volatility |

Same Document Delivered

CenterPoint Energy PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, detailing the political, economic, social, technological, legal, and environmental factors impacting CenterPoint Energy.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, offering a comprehensive PESTLE analysis of CenterPoint Energy.

The content and structure shown in the preview is the same document you’ll download after payment, providing actionable insights into the external forces shaping CenterPoint Energy's business environment.

Sociological factors

CenterPoint Energy is experiencing significant population growth and urbanization, particularly in its core Texas service areas. The Houston metropolitan area, a key market, saw its population grow by approximately 1.5% annually between 2020 and 2023, reaching over 7.3 million residents. This demographic surge directly translates to increased demand for electricity and natural gas, putting pressure on existing infrastructure.

This demographic shift requires continuous investment in expanding and upgrading CenterPoint Energy's infrastructure. For instance, the company has committed billions to grid modernization and expansion projects to reliably serve a growing customer base and higher load demands. Meeting the energy needs of these expanding communities is crucial for economic development and maintaining service quality.

Customers now demand unwavering energy reliability, especially after experiencing widespread outages during severe weather events. CenterPoint Energy's commitment to enhancing grid resilience, such as their investment in the Greater Houston Resiliency Initiative, directly responds to these heightened expectations. This initiative aims to significantly decrease how often and for how long customers face power disruptions.

CenterPoint Energy prioritizes robust community relations, understanding that public trust is foundational for a utility. This commitment is demonstrated through their active engagement in community vitality and education initiatives, aiming to foster positive relationships and ensure transparent communication, especially during critical events like power outages.

The company's approach involves proactive community outreach, philanthropic endeavors, and addressing public concerns regarding infrastructure projects, which is crucial for maintaining social license to operate. For instance, in 2023, CenterPoint Energy invested over $20 million in community and economic development programs across its service territories, underscoring their dedication to local well-being.

Workforce Development and Skilled Labor Availability

The availability of a skilled workforce is paramount for CenterPoint Energy, given the intricate nature of managing, constructing, and maintaining its energy infrastructure. This sociological factor directly impacts the company's ability to execute its ambitious capital expenditure plans and maintain reliable service delivery.

CenterPoint Energy actively addresses this by investing in workforce development programs. For instance, in 2023, the company highlighted its commitment to training and recruiting new technicians and lineworkers, aiming to bolster its operational capacity. These initiatives are vital for ensuring the company can meet the demands of its ongoing projects and future growth.

- Skilled Labor Demand: The energy sector, particularly utilities like CenterPoint, requires specialized skills for operating and maintaining advanced technologies and infrastructure.

- Training Initiatives: CenterPoint's ongoing recruitment and training programs are designed to fill critical roles, such as electrical lineworkers and gas technicians, to support capital investments.

- Operational Continuity: A robust and well-trained workforce is essential for preventing service disruptions and ensuring the safety and efficiency of operations across its service territories.

Changing Consumer Energy Habits

Consumer energy habits are rapidly evolving, driven by a growing awareness of sustainability and technological advancements. This shift necessitates a more dynamic and responsive energy infrastructure. For instance, the adoption of electric vehicles (EVs) is on the rise, with projections indicating significant growth in the coming years. In 2024, the global EV market is expected to continue its upward trajectory, with sales potentially reaching over 15 million units, a substantial increase from previous years. This surge in EVs directly impacts electricity demand and requires utilities like CenterPoint Energy to manage charging loads effectively.

Furthermore, the proliferation of smart home technologies and distributed energy resources (DERs), such as rooftop solar panels, is reshaping how energy is consumed and managed. By 2025, it's estimated that over 50% of U.S. households will have at least one smart home device, contributing to more complex energy patterns. These DERs allow consumers to generate their own power, feeding excess energy back into the grid. This decentralization demands greater grid flexibility to accommodate bidirectional energy flows and ensure reliability.

- Electric Vehicle Adoption: Global EV sales are projected to exceed 15 million units in 2024, a significant increase that will strain existing grid capacity.

- Smart Home Integration: By 2025, over half of U.S. homes are expected to use smart home technology, leading to more variable and localized energy demands.

- Distributed Energy Resources (DERs): Increased adoption of rooftop solar and other DERs requires grid modernization to manage two-way power flow and maintain stability.

- Consumer Expectations: Modern consumers expect greater control over their energy usage and demand reliable, sustainable power sources, influencing utility investment and operational strategies.

CenterPoint Energy's operations are significantly influenced by evolving consumer expectations for reliability and sustainability, alongside a growing demand for personalized energy solutions. The company must adapt to these shifts to maintain customer satisfaction and operational efficiency.

Technological factors

CenterPoint Energy is significantly investing in grid modernization, including advanced metering infrastructure (AMI) and automation devices, to boost reliability and efficiency. This strategic deployment aims to reduce outage durations and enhance the grid's ability to self-heal. For instance, the company's 2023 capital expenditures included substantial allocations towards these smart grid initiatives.

CenterPoint Energy is increasingly leveraging data analytics and AI for predictive maintenance, a move that promises to significantly boost grid performance and trim operational expenses. By analyzing vast datasets, the company can anticipate equipment failures before they occur, minimizing costly downtime.

These advanced technologies allow for more accurate demand forecasting, helping CenterPoint Energy optimize energy distribution and reduce waste. For instance, in 2024, utilities investing in AI for grid management reported an average reduction in unplanned outages by up to 15%, directly translating to improved customer satisfaction and operational efficiency.

As CenterPoint Energy's infrastructure increasingly relies on digital systems, the threat landscape for cybersecurity intensifies. The interconnected nature of modern energy grids means a single breach could have widespread consequences, impacting everything from power distribution to customer data security.

Protecting operational technology (OT) systems and sensitive customer information is paramount. In 2023, the US Department of Energy reported that the energy sector experienced a significant increase in cyber incidents, highlighting the critical need for robust defense mechanisms to ensure uninterrupted and secure energy delivery.

Renewable Energy Integration Technologies

The increasing adoption of renewable energy, like solar and wind, necessitates advanced technologies for smooth grid integration. This includes sophisticated energy storage systems and intelligent control mechanisms to manage the intermittent nature of these sources. CenterPoint Energy's infrastructure upgrades are crucial to support this transition to a more sustainable energy landscape.

By 2024, the global renewable energy capacity is projected to reach new heights, driving the demand for grid modernization. For instance, investments in advanced metering infrastructure and smart grid technologies are becoming paramount for utilities like CenterPoint Energy to effectively manage distributed energy resources and ensure grid stability. These technological advancements are key to accommodating a cleaner energy future.

- Grid Modernization Investments: CenterPoint Energy is investing in smart grid technologies to enhance reliability and integrate renewables.

- Energy Storage Solutions: The company is exploring and implementing energy storage to balance renewable energy supply and demand.

- Advanced Control Systems: Sophisticated software and hardware are being deployed to manage the complex flow of electricity from diverse sources.

Natural Gas Infrastructure Modernization

CenterPoint Energy's natural gas infrastructure modernization is heavily influenced by technological advancements. Innovations in pipeline materials, such as advanced plastics and composites, offer greater durability and corrosion resistance compared to older materials like cast iron. For instance, the company has been actively replacing older, leak-prone pipes, a critical step in enhancing safety and reducing methane emissions. In 2023, CenterPoint Energy reported significant progress in its infrastructure improvement programs, aiming to replace thousands of miles of aging pipes across its service territories.

Leak detection technology is also a major focus. Advanced systems, including acoustic leak detection and aerial infrared imaging, allow for faster and more precise identification of gas leaks, minimizing environmental impact and improving operational efficiency. These technologies are crucial for meeting stringent regulatory requirements and public expectations for environmental stewardship. The company's investments in these areas are projected to continue growing through 2025 as it prioritizes safety and sustainability.

Key technological factors driving modernization include:

- Advanced Pipeline Materials: Adoption of stronger, more resilient materials to replace legacy cast-iron and bare-steel pipes.

- Sophisticated Leak Detection: Implementation of acoustic sensors, drone-based infrared, and other real-time monitoring systems.

- Smart Grid Integration: Development of digital monitoring and control systems for enhanced operational oversight and predictive maintenance.

CenterPoint Energy's technological advancements are central to its operational efficiency and future growth. The company's commitment to grid modernization, including substantial investments in smart grid technologies and data analytics, is designed to enhance reliability and integrate renewable energy sources more effectively. These efforts are supported by ongoing infrastructure upgrades, such as the replacement of aging natural gas pipelines with more durable materials and the implementation of advanced leak detection systems.

| Technology Area | Key Initiatives | Impact/Goal |

|---|---|---|

| Grid Modernization | Advanced Metering Infrastructure (AMI), grid automation | Improved reliability, reduced outage duration, enhanced efficiency |

| Data Analytics & AI | Predictive maintenance, demand forecasting | Optimized energy distribution, reduced operational costs, minimized downtime |

| Renewable Energy Integration | Energy storage, advanced control systems | Grid stability with intermittent sources, support for cleaner energy |

| Natural Gas Infrastructure | Advanced pipeline materials, sophisticated leak detection | Enhanced safety, reduced methane emissions, improved operational efficiency |

Legal factors

CenterPoint Energy navigates a complex web of utility regulations at both state and federal levels, impacting everything from service quality and safety standards to the crucial rates it can charge its customers. These regulations are not merely guidelines; they are the bedrock upon which the company's financial health is built.

Crucially, CenterPoint Energy requires regulatory approval for any adjustments to its rates and for the recovery of significant capital investments. For instance, in Texas, the Public Utility Commission of Texas (PUCT) plays a vital role. In 2023, CenterPoint filed for a rate adjustment in Texas, seeking to recover over $2 billion in capital expenditures, highlighting the direct link between regulatory decisions and the company's ability to fund necessary infrastructure upgrades and maintain profitability.

CenterPoint Energy faces ongoing legal requirements to comply with environmental statutes governing air emissions, water quality, and waste disposal. This mandates continuous investment in operational upgrades and adherence to evolving standards.

Specifically, regulations targeting greenhouse gas emissions and the broader energy transition necessitate significant capital outlays for cleaner technologies and practices. For instance, in 2023, CenterPoint Energy reported capital expenditures of approximately $3.2 billion, a portion of which is allocated to modernizing infrastructure and reducing environmental impact, aligning with these legal pressures.

CenterPoint Energy operates under stringent safety regulations for its electric and natural gas infrastructure, critical for protecting its workforce, customers, and the general public. These standards, encompassing areas like pipeline integrity and electrical equipment safety, are not merely guidelines but legal mandates. Failure to comply can result in significant financial penalties and damage to public confidence, directly impacting the company's operational license and reputation.

Land Use and Permitting Laws

CenterPoint Energy's infrastructure projects, from new transmission lines to substation upgrades, are heavily influenced by land use and permitting regulations. These laws operate across local, state, and federal jurisdictions, creating a complex web of compliance requirements. For instance, the process for obtaining permits for large-scale energy infrastructure can involve extensive environmental reviews and public comment periods, significantly impacting project timelines and costs.

Navigating these legal frameworks presents a substantial challenge. The time and resources required to secure necessary approvals can be considerable. In 2024, projects like the proposed transmission line expansions in Texas faced scrutiny under state environmental regulations, highlighting the potential for delays and increased capital expenditure due to permitting processes. CenterPoint Energy must meticulously plan and engage with regulatory bodies to mitigate these risks.

Key considerations for CenterPoint Energy include:

- Federal Regulations: Compliance with the National Environmental Policy Act (NEPA) for projects impacting federal lands or requiring federal permits.

- State-Specific Laws: Adherence to state environmental quality acts and land management policies, which vary significantly by operating region.

- Local Ordinances: Understanding and complying with municipal zoning laws, land use plans, and local permitting requirements for any construction within city limits.

- Permitting Timelines: Factoring in extended permitting review periods, which can add months or even years to project schedules, impacting the return on investment for new infrastructure.

Data Privacy and Consumer Protection Laws

CenterPoint Energy, like all utilities, navigates a complex web of data privacy and consumer protection regulations. These laws dictate how the company collects, stores, and uses customer information, including billing details and energy consumption patterns. Failure to comply can result in significant penalties and reputational damage.

In 2024, the focus on data security intensified, with regulators like the FTC actively pursuing enforcement actions against companies mishandling consumer data. For CenterPoint Energy, this means robust cybersecurity measures are not just good practice but a legal necessity. Protecting sensitive customer data is paramount to maintaining trust and avoiding potential fines, which can run into millions of dollars for significant breaches.

- Compliance with GDPR and CCPA-like regulations: CenterPoint must adhere to evolving data privacy frameworks that govern the handling of personal information.

- Customer consent and transparency: Obtaining clear consent for data usage and being transparent about data practices are legal requirements.

- Data breach notification protocols: Promptly notifying affected customers and relevant authorities in the event of a data breach is mandated by law.

- Consumer protection against unfair practices: Ensuring billing practices and service communications are fair and not deceptive is a key legal obligation.

CenterPoint Energy operates under a strict regulatory environment, with state and federal agencies dictating rates, service standards, and capital recovery. For example, in 2023, the company sought to recover over $2 billion in capital expenditures through rate adjustments in Texas, demonstrating the direct impact of regulatory approvals on its financial operations and ability to invest in infrastructure.

Environmental laws mandate significant investments in cleaner technologies and compliance with emission standards, with CenterPoint reporting approximately $3.2 billion in capital expenditures in 2023, partly allocated to modernization and environmental impact reduction.

Safety regulations are paramount, covering pipeline integrity and electrical equipment, with non-compliance potentially leading to substantial financial penalties and reputational damage, impacting its operational license.

Permitting processes for infrastructure projects, influenced by land use and environmental reviews, can significantly impact timelines and costs, as seen with transmission line expansions facing scrutiny in Texas during 2024.

Data privacy laws require robust cybersecurity measures to protect customer information, with the FTC actively enforcing these regulations in 2024, making data security a legal necessity for CenterPoint to avoid significant fines.

| Regulatory Area | Key Legal Factors | Impact on CenterPoint Energy | 2023-2024 Data/Examples |

|---|---|---|---|

| Rate Setting | State Public Utility Commissions (e.g., PUCT) | Approval needed for rate changes and capital investment recovery. | Seeking over $2 billion in capital recovery via rate adjustments (2023). |

| Environmental Compliance | Clean Air Act, Clean Water Act, EPA regulations | Mandates investment in cleaner technologies and emission controls. | Capital expenditures of ~$3.2 billion in 2023, including environmental mitigation. |

| Infrastructure Permitting | NEPA, state environmental acts, local zoning | Affects project timelines, costs, and feasibility of new construction. | Transmission line projects faced regulatory scrutiny in 2024. |

| Data Privacy | FTC regulations, state-specific privacy laws (e.g., CCPA) | Requires strong cybersecurity and transparent data handling practices. | Increased regulatory focus on data security and potential for significant fines. |

Environmental factors

CenterPoint Energy faces substantial operational and financial risks due to the escalating frequency and intensity of extreme weather events. Regions like Houston, a key service territory, are increasingly vulnerable to hurricanes and severe storms, directly impacting infrastructure and service reliability.

In response, CenterPoint Energy is making significant capital investments, with a projected $10.3 billion in capital expenditures for 2024, to bolster grid resiliency and mitigate the disruptive effects of climate change. These investments are crucial for adapting to the evolving environmental landscape and ensuring dependable energy delivery.

CenterPoint Energy is actively pursuing significant reductions in greenhouse gas (GHG) emissions, aiming for net-zero by 2035 for its Scope 1 and specific Scope 2 emissions. This ambitious target drives substantial operational shifts, including phasing out coal-fired power generation and upgrading its natural gas infrastructure to be more efficient and less emissive.

To achieve these reductions, CenterPoint Energy is making considerable investments in renewable energy sources and modernizing its energy delivery systems. For instance, in 2023, the company reported a reduction in its Scope 1 and 2 emissions intensity, reflecting progress in its decarbonization strategy, though specific percentage figures are subject to ongoing reporting and verification.

The societal and regulatory drive towards cleaner energy sources like solar and wind is significantly shaping CenterPoint Energy's strategic direction. This transition necessitates substantial investments in modernizing infrastructure to accommodate intermittent renewable generation and integrate distributed energy resources.

By the end of 2023, CenterPoint Energy reported approximately 10% of its generation capacity came from renewable sources, a figure expected to grow as the company navigates the energy transition. For instance, their Indiana operations are phasing out coal-fired generation, with plans to replace it with cleaner alternatives, demonstrating a concrete step in adapting to environmental shifts.

Environmental Stewardship and Resource Management

CenterPoint Energy's commitment to responsible environmental stewardship is a key operational focus. This includes diligent vegetation management around power lines to ensure service reliability and prevent outages, a critical aspect of their infrastructure maintenance. Protecting biodiversity and conserving water resources are also integral to their ongoing environmental considerations, aligning with regulatory requirements and corporate sustainability goals.

These environmental practices are not just about compliance; they directly impact operational efficiency and resilience. For instance, effective vegetation management can reduce the risk of storm-related damage, a significant factor in service continuity. In 2023, CenterPoint Energy reported significant investments in grid modernization and resilience, which inherently include environmental considerations like reducing the impact of their operations on local ecosystems.

- Vegetation Management: Ongoing efforts to clear vegetation near power lines to enhance reliability and safety.

- Biodiversity Protection: Initiatives aimed at minimizing impact on local wildlife and habitats during infrastructure projects.

- Water Conservation: Practices implemented to reduce water usage in operational processes and power generation, where applicable.

- Environmental Compliance: Adherence to federal, state, and local environmental regulations, ensuring sustainable operations.

Natural Gas as a Transition Fuel

The environmental debate surrounding natural gas as a transition fuel continues. While cleaner than coal, its long-term viability is questioned, impacting CenterPoint Energy's natural gas distribution. This evolving perception necessitates careful navigation of environmental regulations and public opinion.

CenterPoint Energy's operations are directly influenced by environmental concerns. For instance, methane emissions, a potent greenhouse gas, from natural gas infrastructure are under increasing scrutiny. In 2023, the U.S. Environmental Protection Agency (EPA) continued to refine regulations aimed at reducing these emissions, which could necessitate significant capital investments for CenterPoint.

- Methane Emission Reduction: Continued focus on reducing methane leaks across its distribution network.

- Regulatory Compliance: Adapting to stricter EPA regulations and state-level environmental mandates.

- Public Perception: Addressing concerns about natural gas's role in climate change and promoting its lower carbon intensity compared to other fossil fuels.

CenterPoint Energy is heavily investing in grid modernization and resilience, with a projected $10.3 billion in capital expenditures for 2024, to combat the increasing impacts of extreme weather events. The company is also committed to achieving net-zero Scope 1 and specific Scope 2 emissions by 2035, actively phasing out coal and upgrading natural gas infrastructure.

By the end of 2023, approximately 10% of CenterPoint Energy's generation capacity came from renewable sources, a figure expected to rise as they transition away from coal-fired power. This shift is driven by societal and regulatory pressure towards cleaner energy, necessitating infrastructure upgrades to integrate intermittent renewables and distributed energy resources.

Environmental stewardship is a core operational focus, including rigorous vegetation management around power lines for reliability and biodiversity protection during infrastructure projects. CenterPoint Energy is also adapting to stricter regulations on methane emissions from its natural gas network, a key area of focus for 2024 and beyond.

| Environmental Factor | CenterPoint Energy's Response/Impact | Key Data/Initiatives (2023-2025) |

|---|---|---|

| Extreme Weather & Climate Change | Investing in grid resilience to mitigate disruptions. | $10.3 billion projected capital expenditures for 2024. |

| Greenhouse Gas Emissions | Targeting net-zero Scope 1 & specific Scope 2 emissions by 2035. | Phasing out coal, upgrading natural gas infrastructure. Reduced emissions intensity in 2023. |

| Renewable Energy Transition | Integrating solar and wind, modernizing infrastructure. | ~10% renewable generation capacity by end of 2023. Indiana coal phase-out underway. |

| Methane Emissions | Reducing leaks across natural gas distribution network. | Adapting to evolving EPA regulations on methane. |

PESTLE Analysis Data Sources

Our CenterPoint Energy PESTLE Analysis is built upon a robust foundation of data from official government agencies, reputable financial institutions, and leading industry research firms. This ensures that our insights into political, economic, social, technological, legal, and environmental factors are accurate and current.