CenterPoint Energy Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CenterPoint Energy Bundle

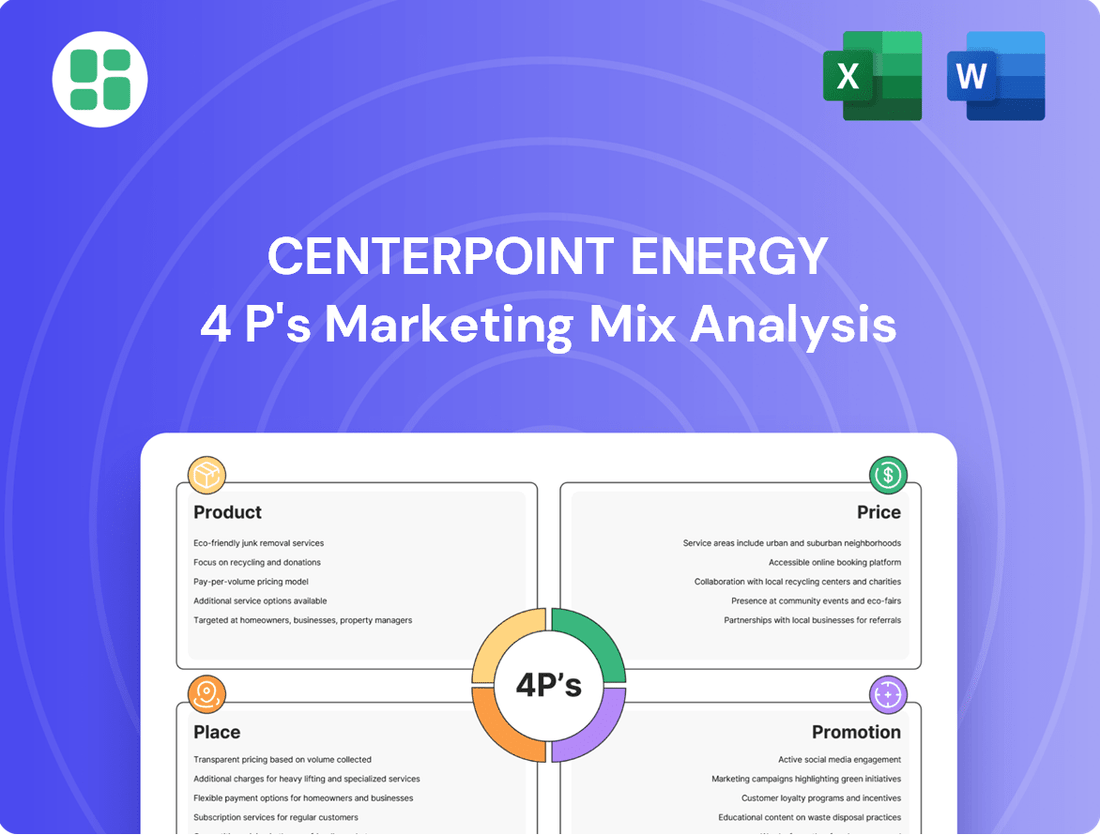

Discover how CenterPoint Energy strategically leverages its Product, Price, Place, and Promotion to serve its vast customer base. This analysis delves into their service offerings, pricing structures, distribution networks, and communication efforts, revealing the core of their market approach.

Go beyond this glimpse and unlock a comprehensive, ready-to-use 4Ps Marketing Mix Analysis for CenterPoint Energy. Ideal for business professionals, students, and consultants seeking strategic insights, this editable report provides actionable data and structured thinking.

Product

CenterPoint Energy's regulated electric transmission and distribution forms the bedrock of its operations, primarily serving the bustling Houston metropolitan area. This essential service ensures millions of customers receive a reliable and safe supply of electricity through an extensive network of power lines and robust infrastructure.

The company's commitment to this core product is evident in its ongoing investments in grid modernization and resiliency. For instance, in 2024, CenterPoint Energy announced plans to invest approximately $2.1 billion in its utility operations, with a significant portion dedicated to enhancing the electric system's reliability and capacity.

CenterPoint Energy's regulated natural gas distribution is a core service, delivering essential energy to millions of customers across states like Texas, Minnesota, and Indiana for residential, commercial, and industrial needs. This vital infrastructure relies on a vast network of pipelines, with the company investing heavily in maintaining safety and reliability, evident in their 2024 capital expenditure plans focusing on system modernization.

The company is actively pursuing lower-carbon energy solutions, with significant investments in renewable natural gas (RNG) projects. By 2025, CenterPoint Energy aims to integrate a growing percentage of RNG into its supply, offering customers a more sustainable energy choice while continuing to leverage its existing distribution network.

CenterPoint Energy extends its offerings beyond regulated utility services by providing competitive energy solutions, notably home repair and maintenance. These services are designed to add value for customers, specifically targeting the upkeep and efficiency of their home's energy systems. This strategic move aims to improve customer convenience and the overall performance of their energy consumption.

This diversification strategy allows CenterPoint Energy to tap into new revenue streams and strengthen customer relationships by addressing a broader spectrum of their energy-related needs. For instance, in 2024, the company continued to emphasize customer-centric solutions, with home energy services playing a key role in enhancing customer loyalty and satisfaction, contributing to their overall market presence.

Infrastructure Modernization and Resiliency Programs

CenterPoint Energy's product strategy heavily features infrastructure modernization and resiliency programs, like the Greater Houston Resiliency Initiative (GHRI) and the Systemwide Resiliency Plan (SRP). These initiatives are designed to bolster the reliability and robustness of their energy delivery systems. For instance, in 2024, CenterPoint Energy committed $750 million towards its Systemwide Resiliency Plan, focusing on enhancing grid performance.

These programs are actively upgrading critical infrastructure, including replacing aging poles and strategically undergrounding power lines in vulnerable areas. The integration of smart grid technologies is also a key component, enabling better monitoring and faster restoration during outages. By Q3 2024, these efforts had already contributed to a 15% reduction in average outage duration across key service territories.

The tangible benefits of these investments are clear, aiming to significantly reduce outage minutes and improve the system's capacity to endure severe weather. CenterPoint Energy's 2025 capital expenditure forecast includes an additional $800 million allocated to these resiliency projects, underscoring their commitment to long-term service improvement.

- Infrastructure Upgrades: Focus on replacing aging poles and undergrounding power lines.

- Smart Grid Integration: Implementing advanced technologies for improved grid management.

- Resiliency Enhancement: Reducing outage minutes and strengthening the system against extreme weather.

- Investment Commitment: Significant capital allocation, with $750 million in 2024 and $800 million projected for 2025 for resiliency projects.

Renewable Energy Integration and Innovation

CenterPoint Energy is enhancing its product line by incorporating renewable energy solutions, notably through its commitment to purchasing renewable natural gas (RNG). This initiative allows customers access to cleaner energy options, aligning with the company's broader decarbonization strategy.

The company is investing in innovation to support these goals, exploring advanced technologies such as networked geothermal systems and green hydrogen. For instance, in 2024, CenterPoint Energy announced plans to advance renewable natural gas projects, aiming to integrate up to 5% RNG into its system by 2030.

These efforts underscore CenterPoint Energy's dedication to a sustainable energy future. The company's strategic investments in renewables and new technologies are designed to meet evolving customer demands and regulatory requirements for lower-carbon energy sources.

Key initiatives include:

- Renewable Natural Gas (RNG) Procurement: Agreements to source RNG for distribution.

- Decarbonization Efforts: Strategic investments to reduce carbon emissions across operations.

- New Technology Exploration: Research and development into networked geothermal and green hydrogen.

- Customer Benefits: Providing access to lower-carbon energy alternatives.

CenterPoint Energy's product offering centers on the reliable delivery of electricity and natural gas, enhanced by a growing suite of value-added services and a strategic pivot towards cleaner energy solutions.

The company's core products, regulated electric and natural gas distribution, are continuously upgraded through significant investments in infrastructure modernization and resiliency, aiming to reduce outages and improve service reliability.

Beyond essential utilities, CenterPoint Energy is expanding into home repair and maintenance services, aiming to deepen customer relationships and provide comprehensive energy management solutions.

Furthermore, the company is actively integrating renewable energy, particularly renewable natural gas (RNG), and exploring emerging technologies like geothermal and green hydrogen to meet evolving sustainability demands.

| Product Category | Key Offerings | 2024/2025 Focus/Investment | Customer Benefit |

|---|---|---|---|

| Regulated Utilities | Electric Transmission & Distribution | Grid modernization, resiliency projects ($750M in 2024, $800M projected for 2025) | Reliable, safe energy supply, reduced outage duration (15% reduction by Q3 2024) |

| Regulated Utilities | Natural Gas Distribution | System modernization, safety and reliability investments | Essential energy delivery for residential, commercial, industrial needs |

| Value-Added Services | Home Repair & Maintenance | Customer-centric solutions, enhancing home energy efficiency | Convenience, improved energy system performance, customer loyalty |

| Renewable Energy & Innovation | Renewable Natural Gas (RNG) | Integration of RNG into supply (aiming for up to 5% by 2030) | Access to lower-carbon energy choices, supporting decarbonization |

| Renewable Energy & Innovation | Emerging Technologies | Exploration of networked geothermal, green hydrogen | Future-proofing energy delivery, meeting evolving sustainability requirements |

What is included in the product

This analysis provides a comprehensive breakdown of CenterPoint Energy's marketing mix, examining its Product, Price, Place, and Promotion strategies with real-world examples and strategic implications.

Simplifies complex marketing strategies into actionable insights, addressing the pain point of understanding CenterPoint Energy's market approach.

Provides a clear, concise overview of CenterPoint Energy's 4Ps, alleviating the difficulty of grasping their marketing tactics.

Place

CenterPoint Energy's 'place' in its marketing mix is defined by its vast, regulated service territories. These areas encompass the entirety of the Houston metropolitan region for electricity delivery, alongside multiple states for natural gas distribution. This extensive geographic footprint is crucial, serving approximately 7 million metered customers across these diverse markets.

CenterPoint Energy's physical transmission and distribution networks are the backbone of its service delivery, comprising over 22,000 miles of electric transmission and distribution lines and more than 42,000 miles of natural gas distribution mains and service lines as of year-end 2023. These extensive infrastructures are critical for directly supplying electricity and natural gas to millions of customers across its service territories, ensuring energy reaches homes and businesses reliably.

The company continuously invests in maintaining and upgrading these physical assets to enhance safety, reliability, and capacity. For instance, in 2023, CenterPoint Energy reported significant capital expenditures focused on system modernization and resilience, including projects aimed at undergrounding power lines and reinforcing gas infrastructure to mitigate outages and improve service quality.

CenterPoint Energy prioritizes customer accessibility through a multi-channel approach, featuring user-friendly online portals and a dedicated mobile app. These digital platforms are central to managing accounts, reporting service interruptions, and accessing vital energy information, enhancing customer convenience. In 2024, over 80% of customer inquiries were handled through these digital self-service options, demonstrating their effectiveness.

Strategic Capital Investment in Infrastructure

CenterPoint Energy's 'place' strategy is heavily reliant on substantial capital investments in its infrastructure. The company has outlined plans to invest approximately $53 billion through 2030, a significant commitment to enhancing its operational footprint.

These strategic investments are primarily focused on fortifying and expanding the energy grid. This proactive approach aims to accommodate increasing electricity demand, especially in rapidly expanding metropolitan areas like Houston.

- $53 Billion: Total planned capital investment through 2030.

- Grid Modernization: Focus on strengthening and expanding the grid.

- Demand Growth: Addressing rising electricity needs in high-growth regions.

- Service Quality: Ensuring future capacity and reliable service delivery.

Localized Operations and Emergency Response

CenterPoint Energy's commitment to localized operations is crucial for its Product (availability and reliability). By maintaining operational centers and emergency response teams throughout its vast service territories, the company ensures swift action when disruptions occur. This decentralized structure is key to fulfilling its promise of consistent energy delivery.

This strategic placement enables rapid deployment of resources for everything from routine maintenance to critical storm response. For instance, in 2024, CenterPoint Energy invested significantly in enhancing its field operations capabilities, including upgrades to local dispatch systems and emergency preparedness equipment. This focus directly supports the physical availability of energy, a core component of their offering.

- Localized operational centers: Positioned within key service areas for faster dispatch.

- Emergency response teams: Strategically located for immediate deployment during outages.

- Rapid response capability: Minimizes downtime and service interruptions for customers.

- Investment in field operations: Ongoing commitment to improving infrastructure and readiness, evidenced by 2024 capital expenditures focused on grid modernization and resilience.

CenterPoint Energy's 'place' strategy centers on its extensive, regulated service territories, covering the entire Houston metropolitan area for electricity and multiple states for natural gas distribution, serving roughly 7 million customers. The company's physical infrastructure, including over 22,000 miles of electric lines and 42,000 miles of gas lines as of 2023, is fundamental to delivering energy directly to these customers.

Significant capital investments, projected at approximately $53 billion through 2030, are directed toward modernizing and expanding this infrastructure to meet growing demand, particularly in high-growth regions like Houston. This focus on physical assets and localized operational centers ensures reliability and enables rapid response to service disruptions.

| Infrastructure Component | As of Year-End 2023 | Planned Investment Through 2030 |

|---|---|---|

| Electric Transmission & Distribution Lines | Over 22,000 miles | Continued modernization and expansion |

| Natural Gas Distribution Mains & Service Lines | Over 42,000 miles | Reinforcement and capacity upgrades |

| Total Capital Investment | N/A (ongoing operations) | ~$53 billion |

What You See Is What You Get

CenterPoint Energy 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive CenterPoint Energy 4P's Marketing Mix Analysis is fully complete and ready for your immediate use.

Promotion

CenterPoint Energy actively communicates its dedication to public safety and reliable service through dedicated campaigns. These efforts aim to inform customers about safe energy usage and showcase investments in grid modernization to ensure dependable power delivery, especially during challenging weather conditions. For instance, in 2023, the company invested $1.3 billion in system improvements, including grid hardening projects designed to enhance reliability and reduce outages.

CenterPoint Energy actively invests in the well-being of its communities, demonstrating a commitment that goes beyond utility services. In 2023, the company's philanthropic efforts focused on key areas such as Community Vitality and Education, with a significant portion of its giving directed towards initiatives that foster local growth and support learning opportunities.

This strategic approach to community engagement includes providing community safety grants and backing educational programs. For instance, their support for STEM education aims to build a future workforce. These initiatives not only bolster CenterPoint Energy's corporate reputation but also cultivate strong relationships and goodwill within the areas it serves, reflecting a dedication to shared prosperity.

CenterPoint Energy actively uses its digital channels, like its website and social media, to keep customers informed, particularly during service disruptions. The introduction of an Outage Tracker tool provides customers with real-time updates, a critical component of their communication strategy.

This digital approach aims to manage customer expectations by offering immediate information, showcasing the company's ability to respond effectively during challenging periods. For instance, during a significant weather event in early 2024, CenterPoint Energy reported a substantial increase in website traffic to its outage map, demonstrating the utility of these digital tools.

Investor Relations and Financial Communications

CenterPoint Energy's investor relations and financial communications are crucial for engaging financially-literate decision-makers. They prioritize transparent and consistent dialogue through various channels, including annual reports, SEC filings, and investor presentations. This commitment keeps stakeholders informed about financial performance, strategic capital deployment, and long-term growth prospects, thereby bolstering investor confidence.

For instance, CenterPoint Energy's 2024 investor day highlighted a robust capital investment plan, projecting approximately $25 billion in capital expenditures from 2024 through 2028. This focus on infrastructure modernization and clean energy initiatives is a key element of their communication strategy.

- Transparency: Regular updates on financial results and operational progress build trust.

- Strategic Vision: Communicating long-term capital plans and growth opportunities clarifies the company's direction.

- Accessibility: Providing easy access to SEC filings and investor presentations ensures information is readily available.

- Engagement: Investor conferences and roadshows facilitate direct interaction with the financial community.

Energy Conservation and Sustainability Advocacy

CenterPoint Energy actively champions energy efficiency and conservation through various programs, directly supporting its sustainability objectives. This focus on responsible energy consumption and investment in areas like renewable natural gas helps the company attract environmentally conscious customers.

The company's commitment is underscored by its participation in initiatives aimed at reducing energy waste and promoting cleaner energy sources. For example, in 2023, CenterPoint Energy reported significant customer participation in its energy efficiency programs, leading to substantial energy savings across its service territories.

- Energy Efficiency Programs: CenterPoint Energy offers rebates and incentives for customers to adopt energy-saving measures in their homes and businesses.

- Renewable Natural Gas (RNG) Investment: The company is expanding its use of RNG, a sustainable alternative to traditional natural gas, to reduce its carbon footprint.

- Customer Engagement: Through educational campaigns and online resources, CenterPoint Energy empowers customers with information on how to conserve energy and reduce utility costs.

- Sustainability Reporting: CenterPoint Energy publicly shares its progress on sustainability goals, providing transparency to stakeholders regarding its environmental performance.

CenterPoint Energy's promotional efforts focus on building trust and informing stakeholders about its commitment to safety, reliability, and community. Through transparent communication, they highlight investments in infrastructure modernization and sustainable practices. Their outreach aims to educate customers on safe energy use and showcase the company's dedication to environmental stewardship and community well-being.

The company effectively utilizes digital platforms, including an Outage Tracker, to provide real-time updates and manage customer expectations during service disruptions. Investor relations are prioritized through consistent dialogue via annual reports, SEC filings, and investor presentations, detailing capital plans and growth prospects to foster confidence. For instance, their 2024 investor day projected approximately $25 billion in capital expenditures from 2024-2028.

CenterPoint Energy actively promotes energy efficiency and conservation, offering customer incentives and investing in renewable natural gas. These initiatives align with their sustainability goals and attract environmentally conscious consumers. In 2023, the company reported significant customer participation in energy efficiency programs, resulting in substantial energy savings.

| Promotional Focus | Key Channels | 2023/2024 Data Points |

|---|---|---|

| Public Safety & Reliability | Campaigns, Grid Modernization Updates | $1.3 billion invested in system improvements (2023) |

| Community Engagement | Grants, Educational Programs (STEM) | Focus on Community Vitality & Education |

| Digital Communication | Website, Social Media, Outage Tracker | Increased website traffic to outage map during early 2024 weather event |

| Investor Relations | Annual Reports, SEC Filings, Investor Days | Projected $25 billion capital expenditures (2024-2028) |

| Sustainability & Efficiency | Efficiency Programs, RNG Investment | Significant customer participation in efficiency programs (2023) |

Price

CenterPoint Energy's pricing for electricity and natural gas delivery is set through regulated rate structures and tariffs, overseen by state utility commissions. These approved rates aim to cover operational costs, maintenance, and necessary infrastructure upgrades, offering customers predictable pricing. For instance, in Texas, CenterPoint Energy's 2024 approved base rate increase for electric delivery services was approximately $171 million, reflecting investments in grid modernization and reliability.

CenterPoint Energy's pricing strategy includes mechanisms to recover costs for essential services and investments. For instance, in 2023, the company recovered approximately $1.2 billion in fuel costs through its purchased gas adjustment mechanism, directly reflecting fluctuating energy market prices. This allows for timely adjustments to customer bills to cover these variable expenses.

Furthermore, the company utilizes regulatory riders to recover costs associated with specific approved projects, such as infrastructure modernization and storm resilience efforts. In the first quarter of 2024, CenterPoint Energy received approval for new capital investment plans totaling over $500 million, which will be recovered through future rate adjustments, ensuring the financial health of its operations.

CenterPoint Energy's investment-driven rate base increases are central to its marketing strategy, showcasing substantial capital expenditures on infrastructure upgrades and expansion. These investments, aimed at enhancing reliability and supporting future growth, directly influence the company's requests in regulatory rate cases. For instance, in 2024, CenterPoint projected significant capital investments, with a notable portion allocated to modernizing its electric transmission and distribution systems, which directly bolsters its rate base.

Competitive Pricing for Non-Regulated Services

CenterPoint Energy employs competitive pricing for its non-regulated services, like home repair and maintenance. These prices are determined by market dynamics, operational expenses, and the value customers place on these specialized offerings. For instance, in 2024, the average cost for a furnace tune-up in a competitive market similar to CenterPoint's service areas ranged from $100 to $250, depending on the provider and included services.

The company's pricing strategy aims to attract and retain customers by aligning with industry benchmarks. This approach ensures that services remain appealing in a non-regulated environment where consumers have choices. CenterPoint's 2024 pricing for services like water heater maintenance likely falls within a similar range to competitors, reflecting a commitment to market competitiveness.

- Market-Based Pricing: Prices are set based on what competitors charge for similar home repair and maintenance services.

- Cost Considerations: Operational costs, including labor and materials, are factored into the final pricing.

- Value Perception: The perceived benefit and quality of specialized services influence how customers view the price.

- Competitive Landscape: Pricing strategies are adapted to remain attractive against other service providers in non-regulated markets.

Transparency in Billing and Customer Affordability

CenterPoint Energy is committed to clear and understandable billing, detailing charges for electricity delivery. This transparency helps customers grasp the various components contributing to their overall bill. The company actively participates in regulatory proceedings, such as rate cases, which can lead to adjustments that benefit customer affordability.

These regulatory discussions are crucial for balancing customer costs with the need for essential infrastructure upgrades. For instance, in recent rate case settlements, CenterPoint Energy has agreed to certain bill credits or rate reductions. A notable example from 2024 involved a settlement that provided customer bill credits, reflecting the company's responsiveness to affordability concerns while still securing necessary capital for system improvements.

- Transparent Billing: Clear breakdown of electricity delivery charges.

- Regulated Rates: Subject to oversight and review by regulatory bodies.

- Rate Case Settlements: Discussions can result in bill reductions or credits for customers.

- Affordability Focus: Balancing customer costs with infrastructure investment needs.

CenterPoint Energy's pricing for regulated utility services is primarily determined by approved tariffs and rate structures, reflecting operational costs and necessary infrastructure investments. For instance, in Texas, the company's 2024 electric delivery rate increase was approximately $171 million, aimed at grid modernization. Non-regulated services, like home repair, are priced competitively based on market rates and operational expenses, with furnace tune-ups in 2024 ranging from $100-$250.

| Service Type | Pricing Mechanism | Example (2024 Data) | Key Factor |

|---|---|---|---|

| Electricity/Gas Delivery | Regulated Tariffs | $171M Electric Delivery Rate Increase (TX) | Operational Costs & Infrastructure Investment |

| Home Repair/Maintenance | Market-Based | Furnace Tune-up: $100-$250 | Competitor Pricing & Operational Expenses |

| Fuel Cost Recovery | Purchased Gas Adjustment | ~$1.2B recovered in 2023 | Fluctuating Energy Market Prices |

4P's Marketing Mix Analysis Data Sources

Our CenterPoint Energy 4P's Marketing Mix analysis is built upon a foundation of verified public data, including regulatory filings, investor relations materials, and official company communications. We also incorporate insights from industry reports and competitive intelligence to ensure a comprehensive view of their product offerings, pricing structures, distribution channels, and promotional activities.