CenterPoint Energy Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CenterPoint Energy Bundle

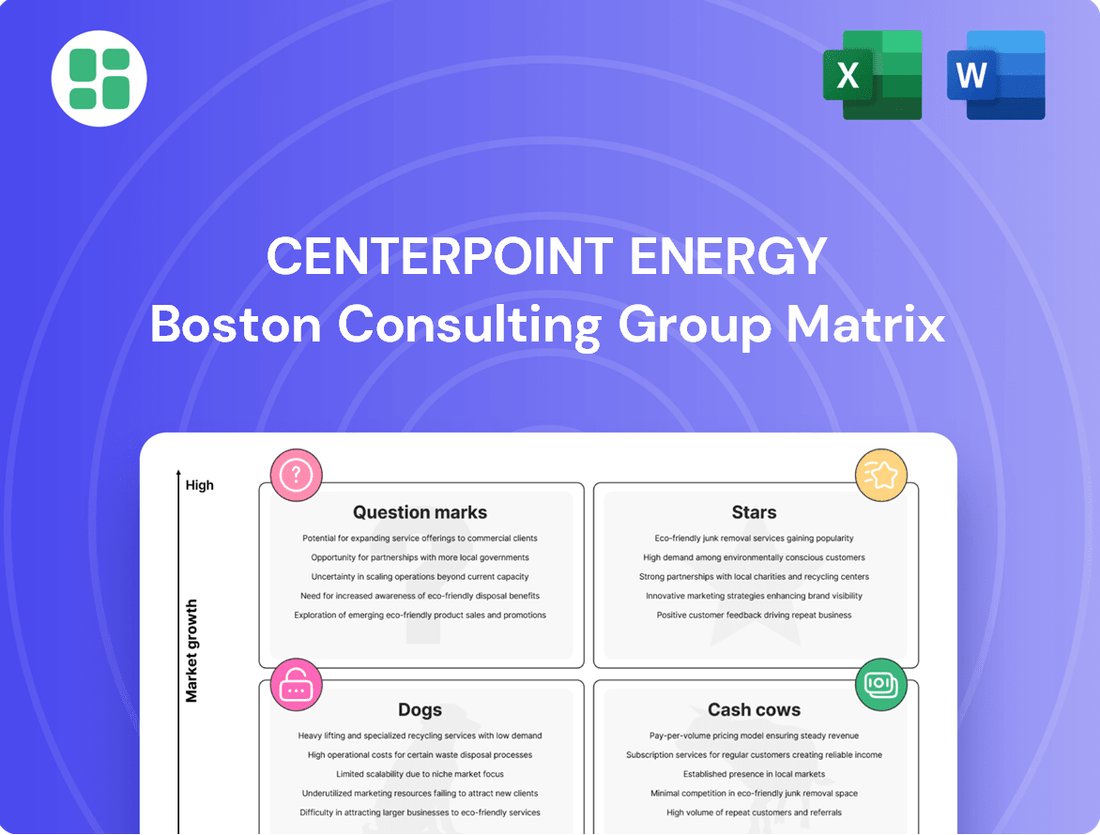

Curious about CenterPoint Energy's strategic positioning? Our BCG Matrix preview offers a glimpse into their product portfolio, highlighting potential Stars, Cash Cows, Dogs, or Question Marks within the competitive energy landscape.

Unlock the full potential of this analysis by purchasing the complete CenterPoint Energy BCG Matrix. Gain a comprehensive understanding of each product's market share and growth rate, empowering you to make informed investment and resource allocation decisions.

Don't miss out on actionable insights! The full report provides detailed quadrant placements and strategic recommendations tailored to CenterPoint Energy's current market standing, giving you the competitive edge you need.

Stars

CenterPoint Energy is making a substantial commitment to enhancing the Houston electric grid's resilience. Their Systemwide Resiliency Plan (SRP) involves a $3.2 billion investment between 2026 and 2028. This initiative is projected to cut down outage minutes by almost a billion by 2029.

The SRP focuses on tangible improvements like installing storm-resistant poles and burying power lines underground, alongside enhanced vegetation management. These efforts are crucial for a region frequently facing extreme weather events. This strategic focus on modernization and resilience positions this segment as a high-growth area for CenterPoint Energy.

CenterPoint Energy's electric transmission and distribution expansion in Texas positions it strongly within its Houston service territory. This area is seeing a consistent customer growth rate of approximately 2% annually.

The demand for electricity is projected to surge, with a 50% increase in peak electric load anticipated by 2031. This significant rise is fueled by burgeoning industries like data centers, advanced manufacturing, and energy exports, all requiring extensive new infrastructure.

To meet this demand, CenterPoint has amplified its 10-year capital investment plan to $53 billion through 2030, primarily focusing on these Texas electric operations. This substantial investment underscores the high-growth nature of this market, where CenterPoint maintains a leading presence.

CenterPoint Energy is heavily investing in advanced grid technologies and automation. This includes deploying automated reliability devices and intelligent grid switching devices. These investments are crucial for transforming their electric system into a self-healing grid, capable of faster outage response and enhanced overall reliability.

As of 2024, CenterPoint has already installed 5,150 automated devices across its network. The company has ambitious plans to equip 100% of its high-traffic lines with these advanced technologies by 2028. This strategic push positions grid modernization as a high-growth segment for CenterPoint, where they are actively building a leading market share.

Renewable Energy Integration Infrastructure

CenterPoint Energy's significant investments in electric transmission and distribution (T&D) infrastructure are pivotal for incorporating more renewable energy sources into the grid, especially in key markets like Texas and Indiana. These upgrades are essential as the energy sector pivots towards cleaner power generation.

The company's proactive strategy in enhancing its T&D systems positions it favorably within a burgeoning market for grid modernization and renewable energy integration. This focus not only supports the ongoing clean energy transition but also bolsters future grid resilience.

- Grid Modernization Investments: CenterPoint Energy has committed billions to upgrade its T&D infrastructure, a crucial step for accommodating the intermittent nature of renewables.

- Renewable Energy Enablement: By strengthening its grid, CenterPoint facilitates the connection of new solar and wind projects, contributing to a cleaner energy mix.

- Market Growth: The demand for advanced grid infrastructure to support renewables is a rapidly expanding sector, offering significant growth potential for companies like CenterPoint.

- Texas Focus: In Texas, CenterPoint is particularly active, investing in projects that will allow for greater integration of renewable energy into the state's power grid.

Strategic Workforce Development

Strategic workforce development is crucial for CenterPoint Energy's ambitious $53 billion infrastructure expansion. To meet this need, the company is actively recruiting, aiming to hire approximately 800 new employees by 2030. This includes a specific target of 200 lineworkers by the end of 2025, ensuring they have the skilled personnel to execute critical projects.

CenterPoint's 'Energy Expressway™' program exemplifies this commitment, focusing on training and development to build a specialized workforce. This initiative is designed to support the surging electricity demand and the company's high-growth capital projects. By investing in talent, CenterPoint aims to solidify its market leadership in infrastructure development.

- Target Hiring: ~800 new workers by 2030.

- Lineworker Focus: 200 lineworkers by the end of 2025.

- Program Example: Energy Expressway™ for talent acquisition and training.

- Strategic Goal: Support $53 billion infrastructure plan and meet electricity demand.

CenterPoint Energy's investments in grid modernization, particularly in its Texas operations, position its electric utility segment as a "Star" in the BCG Matrix. The company is making substantial capital investments to enhance grid resilience and accommodate future demand.

These investments are driven by a projected 50% increase in peak electric load by 2031, fueled by data centers, advanced manufacturing, and energy exports. CenterPoint's commitment to deploying advanced grid technologies and automation further solidifies this segment's strong growth trajectory.

The company's proactive approach to upgrading its transmission and distribution infrastructure also supports the integration of renewable energy sources, a key growth driver in the current energy landscape.

CenterPoint Energy's strategic workforce development, including hiring targets for new employees and lineworkers, directly supports the execution of these high-growth infrastructure projects.

| Segment | BCG Matrix Category | Key Growth Drivers | Key Investments/Initiatives |

|---|---|---|---|

| Electric T&D (Texas) | Star | Customer growth (~2% annually), projected 50% peak load increase by 2031, data centers, advanced manufacturing, energy exports. | $53 billion capital plan through 2030 (focused on Texas electric), Systemwide Resiliency Plan ($3.2 billion for Houston grid), advanced grid technologies (automated reliability devices). |

What is included in the product

This BCG Matrix overview analyzes CenterPoint Energy's business units, identifying Stars for investment, Cash Cows for funding, Question Marks for evaluation, and Dogs for divestment.

The CenterPoint Energy BCG Matrix offers a clear, one-page overview, alleviating the pain of deciphering complex business unit performance.

Cash Cows

CenterPoint Energy's regulated electric transmission and distribution in Houston are undeniably its cash cows. This segment operates in a mature market where CenterPoint enjoys a dominant market share, acting as the main energy delivery service for the bustling Houston metropolitan area.

The regulated nature of these operations ensures stable and predictable cash flows. This is because the company can recover its costs and earn a return on its investments through rates that are approved by regulatory bodies. For instance, in 2023, CenterPoint reported over $17 billion in total operating revenue, with a significant portion stemming from its regulated utility operations.

These Houston-based transmission and distribution assets form the bedrock of CenterPoint's financial strength, consistently generating the capital needed to fund other business areas and provide reliable returns to shareholders.

CenterPoint Energy's regulated natural gas distribution across multiple states, including Minnesota and Indiana, represents a classic Cash Cow. These operations are in mature, slow-growth markets where the company holds substantial market share, ensuring stable demand.

These regulated utilities consistently generate robust cash flow with minimal need for aggressive marketing or expansion spending. For instance, in 2023, CenterPoint Energy's natural gas distribution segment reported operating income of $1.8 billion, highlighting its strong cash-generating ability.

This reliable cash generation from its gas distribution assets is crucial for funding other strategic investments and maintaining the company's overall financial health. These operations are the bedrock of CenterPoint's profitability, providing the necessary capital for growth initiatives elsewhere.

CenterPoint Energy's existing customer base, numbering around 7 million metered customers, forms a robust foundation. This extensive reach, coupled with its established rate base, translates into a highly predictable and consistent revenue stream.

This mature customer base significantly reduces the need for costly new customer acquisition efforts. It provides a reliable bedrock for earnings, effectively functioning as a cash cow that consistently generates more cash than it requires for ongoing operations and maintenance.

Operational Efficiency and Maintenance Programs

CenterPoint Energy's operational efficiency and maintenance programs are the bedrock of its cash cow strategy. These ongoing, systematic investments, like routine natural gas pipeline replacement and vegetation management for electric lines, are crucial for ensuring the continued reliability and safety of their services.

While these initiatives may not be growth drivers, they are vital for maintaining the company's high market share and consistent cash generation from its mature utility assets. For instance, in 2024, CenterPoint continued its significant capital investments in infrastructure modernization, with a substantial portion allocated to maintaining and upgrading its existing natural gas and electric distribution systems. These efforts directly support the stable, predictable cash flows characteristic of cash cows.

- Infrastructure Modernization: Continued investment in replacing aging natural gas pipelines and upgrading electric distribution systems ensures service reliability.

- Vegetation Management: Ongoing programs to manage vegetation around power lines are critical for preventing outages and maintaining service continuity.

- Regulatory Compliance: Adherence to stringent safety and environmental regulations through maintenance programs supports stable operations and avoids costly penalties.

- Cash Flow Stability: These essential maintenance activities underpin the consistent, predictable cash generation from CenterPoint's core utility businesses.

Consistent Dividend Payouts

CenterPoint Energy's dedication to consistent dividend growth, targeting the mid-to-high end of 6-8% annually through 2030, underscores the strong cash flow generated by its mature, high-market-share regulated utility operations. This consistent payout ability, even while investing heavily in capital projects, demonstrates the stability inherent in its core business. For instance, in 2023, CenterPoint Energy reported a strong financial performance, enabling it to maintain its dividend commitments and reinvest in its infrastructure, a key characteristic of a cash cow.

The company's ability to fund these dividends while simultaneously executing substantial capital expenditure plans is a testament to the stable and predictable cash generation from its essential utility services. This financial resilience allows CenterPoint Energy to be a reliable income-generating asset for its investors.

- Consistent Dividend Growth: Aiming for 6-8% annual growth through 2030.

- Robust Cash Flow: Driven by mature, high-market-share regulated operations.

- Capital Investment Funding: Ability to fund dividends and significant capital expenditures simultaneously.

- Financial Resilience: Demonstrates stability and predictability in core utility services.

CenterPoint Energy's regulated electric transmission and distribution in Houston, along with its natural gas distribution across several states, are its prime cash cows. These segments operate in mature markets with high market share, ensuring stable demand and predictable cash flows. For example, in 2023, CenterPoint's regulated utility operations were a significant contributor to its over $17 billion in total operating revenue, with natural gas distribution alone reporting $1.8 billion in operating income.

These operations require minimal aggressive marketing or expansion spending, allowing for consistent cash generation to fund other strategic investments and provide shareholder returns. The company's commitment to infrastructure modernization and vegetation management, with substantial capital allocated in 2024, further solidifies the stability of these cash cows by ensuring service reliability and regulatory compliance.

The company's ability to consistently grow its dividend, targeting 6-8% annually through 2030, is a direct result of the robust and predictable cash flow generated by these mature, high-market-share utility businesses. This financial resilience allows CenterPoint Energy to reliably fund both dividends and significant capital expenditures.

| Segment | Market Maturity | Market Share | Cash Flow Generation | Investment Needs |

|---|---|---|---|---|

| Houston Electric T&D | Mature | Dominant | Stable & Predictable | Maintenance & Modernization |

| Multi-State Natural Gas Distribution | Mature | Substantial | Robust & Consistent | Maintenance & Regulatory Compliance |

Preview = Final Product

CenterPoint Energy BCG Matrix

The CenterPoint Energy BCG Matrix preview you are viewing is the definitive document you will receive upon purchase, offering an uncompromised and fully formatted strategic analysis. This preview is not a sample or a mockup; it represents the exact, ready-to-use report that will be delivered to you, free of any watermarks or demo content, ensuring immediate applicability for your business planning needs.

Dogs

CenterPoint Energy's divestiture of natural gas LDC businesses in Louisiana, Mississippi, Arkansas, and Oklahoma, along with the planned sale of its Ohio utility, clearly places these segments in the 'Dogs' category of the BCG Matrix. This strategic move suggests these operations were viewed as having low growth potential and market share, making them candidates for divestment.

These sales, including the Ohio gas distribution utility, are expected to generate significant proceeds. For instance, the sale of its Louisiana gas LDC business in 2023 alone contributed to a substantial reduction in the company's debt, enabling reinvestment in higher-growth areas.

CenterPoint Energy's legacy, non-strategic competitive energy services, such as home repair and maintenance, operate in intensely competitive, low-margin sectors. Unlike their core utility operations, these segments lack regulatory stability.

Company reports from 2024 indicate minimal recent investment or strategic focus on these non-utility services. This suggests they likely hold a small market share and contribute insignificantly to CenterPoint's overall profitability, potentially operating at break-even or even as cash drains.

Before significant upgrades, older sections of CenterPoint Energy's grid, especially those vulnerable to severe weather, fit the 'Dog' category. These aging assets incurred high upkeep expenses and suffered from frequent disruptions, such as those experienced during Hurricane Beryl in 2024, leading to customer complaints and minimal growth potential.

These segments required substantial capital for modernization or replacement rather than continued operational investment, as their low reliability and high costs outweighed any perceived benefits. This strategic approach was crucial for improving overall service quality and reducing future operational risks.

Underperforming Niche Segments

Underperforming niche segments within CenterPoint Energy's portfolio are those small, non-core investments or minor business lines that don't fit with the company's primary focus on regulated utility growth. These are essentially non-strategic assets that might just cover their costs without contributing meaningfully to overall profitability or market impact.

While specific data for these niche segments isn't publicly detailed, their classification as underperformers suggests they offer little to no significant return or growth potential. For instance, if a segment’s contribution to total revenue is less than 1%, and its profit margin is below 2%, it would likely be considered an underperformer in the context of a utility company focused on stable, regulated returns.

- Negligible Market Impact: These segments often represent a very small fraction of CenterPoint's overall operations, perhaps less than 0.5% of total assets.

- Low Profitability: Their profit margins are typically minimal, potentially even negative in some periods, failing to meet the company's hurdle rates for investment.

- Lack of Strategic Alignment: They do not support or enhance CenterPoint's core regulated utility business or its long-term strategic objectives.

- Limited Growth Prospects: The markets these niche segments operate in are often mature or declining, offering little opportunity for expansion or increased returns.

Non-Renewable Power Generation Assets Slated for Retirement

CenterPoint Energy is actively retiring its coal-fired power generation assets in Indiana. This strategic move aligns with the company's commitment to transitioning towards cleaner energy sources. These aging facilities face significant environmental regulations and operate within a market that is increasingly shifting away from fossil fuels.

The retirement of these assets signifies their classification as 'Dogs' within CenterPoint Energy's portfolio. Instead of allocating capital for growth or modernization, the focus is on phasing them out. For instance, as of 2024, CenterPoint Energy's Indiana operations are continuing this planned retirement process, reflecting a broader industry trend towards decarbonization.

- Coal Asset Retirement: CenterPoint Energy is retiring its Indiana coal-fired power plants.

- Clean Energy Transition: This action supports the company's clean energy goals.

- Market Pressures: Assets face environmental and regulatory challenges in a declining market.

- Portfolio Classification: These assets are considered 'Dogs' due to lack of growth investment.

CenterPoint Energy's divestiture of several natural gas distribution businesses and the planned sale of its Ohio utility firmly place these operations in the 'Dogs' category. These segments, characterized by low growth and market share, are being divested to reallocate capital to more promising ventures.

The company's legacy non-utility services, such as home repair, also fall into the 'Dogs' quadrant. These are high-competition, low-margin sectors lacking regulatory stability, with minimal recent investment or strategic focus reported in 2024, suggesting they contribute little to overall profitability.

Aging grid infrastructure, particularly sections prone to weather disruptions like those seen during Hurricane Beryl in 2024, are also 'Dogs.' These assets incur high maintenance costs and offer limited growth potential, necessitating replacement rather than continued investment.

CenterPoint's coal-fired power generation assets in Indiana are being retired, aligning with its clean energy transition. These assets are classified as 'Dogs' due to environmental regulations and a market shift away from fossil fuels, with retirement ongoing as of 2024.

| Segment | BCG Category | Rationale | 2024 Data/Context |

|---|---|---|---|

| Louisiana, Mississippi, Arkansas, Oklahoma Gas LDCs | Dogs | Divested due to low growth potential and market share. | Divestitures completed, contributing to debt reduction. |

| Ohio Utility | Dogs | Planned sale indicates low growth prospects. | Sale process ongoing as of 2024. |

| Legacy Non-Utility Services (e.g., Home Repair) | Dogs | Intensely competitive, low-margin, lacks regulatory stability. | Minimal recent investment or strategic focus. |

| Aging Grid Infrastructure | Dogs | High upkeep costs, prone to disruptions, low reliability. | Frequent disruptions noted, e.g., Hurricane Beryl impact. |

| Indiana Coal-Fired Power Assets | Dogs | Facing environmental regulations and market shift to clean energy. | Planned retirement process ongoing as of 2024. |

Question Marks

CenterPoint Energy is actively pursuing investments in Renewable Natural Gas (RNG) and green hydrogen as key components of its decarbonization strategy. These initiatives are positioned within a high-growth market driven by increasing demand for low- and zero-carbon energy sources. The company's commitment extends to supporting innovative technologies like networked geothermal systems, reflecting a forward-looking approach to the energy transition.

While these ventures represent a significant growth opportunity, they are currently in their nascent stages, characterized by pilot projects and early-stage development. Market penetration remains relatively low, and profitability is yet to be fully established, necessitating substantial capital investment to achieve scalability and capture considerable market share. For instance, the global RNG market was valued at approximately $5.5 billion in 2023 and is projected to reach over $15 billion by 2030, indicating substantial growth potential but also the significant investment required to tap into it.

CenterPoint Energy is rolling out 3 million Intelis natural gas smart meters, a move designed to significantly boost safety and reliability across its network. This deployment is a cornerstone of modernizing its infrastructure.

Beyond basic modernization, the true value lies in leveraging advanced features. Detailed consumption data can empower customers with better energy management tools, and the utility can proactively identify and address potential issues before they escalate, creating a more efficient and responsive system.

The market for sophisticated energy analytics and tailored customer services is expanding rapidly. While CenterPoint's smart meter initiative is a strong foundation, fully realizing the revenue potential and solidifying its competitive edge in these advanced data utilization areas is an ongoing developmental phase.

The shift towards electric vehicles (EVs) is a major growth area, and CenterPoint Energy anticipates this will boost electricity demand. While the company is forecasting increased load from EV adoption, it's also looking at potential direct investments in public EV charging networks and advanced grid solutions tailored for EVs.

These areas represent burgeoning high-growth markets where CenterPoint Energy is actively assessing its strategic positioning and opportunities to capture market share. For instance, the U.S. Department of Energy projected in early 2024 that the nation could need over 1.2 million public charging ports by 2030 to meet projected EV demand.

New Industrial & Data Center Interconnections

CenterPoint Energy is seeing a significant increase in requests to connect new industrial facilities, especially data centers and advanced manufacturing plants. This surge is a key indicator of substantial future demand for electricity. For instance, in 2024, the company reported a backlog of interconnection requests that represents potential load growth far exceeding historical averages.

These new industrial customers, while promising, can initially be viewed as question marks in a BCG matrix. The upfront capital expenditure required to build out the necessary infrastructure to serve them is considerable. Furthermore, integrating these large and specialized loads often demands unique engineering solutions and grid upgrades before they translate into consistent, high-value revenue streams.

- High Growth Potential: Data centers and advanced manufacturing represent major drivers of future energy demand for CenterPoint.

- Substantial Upfront Investment: Connecting these entities requires significant capital for grid enhancements and specialized infrastructure.

- Integration Challenges: Tailored solutions and grid modernization are necessary before these customers become stable, high-revenue contributors.

- 2024 Data Highlight: CenterPoint's 2024 filings indicated a substantial increase in interconnection requests, signaling a shift in its customer load profile.

Emerging Technologies for Enhanced Customer Experience

CenterPoint Energy is actively upgrading its technology infrastructure, including migrating customer-facing websites to cloud-based platforms. This strategic move aims to foster more effective communication and significantly enhance the overall customer experience. For instance, in 2024, the company continued its investment in digital transformation initiatives, with a focus on improving online self-service options and communication channels.

These foundational improvements, while supporting existing operations, pave the way for more innovative digital services. CenterPoint Energy is exploring new, cutting-edge digital platforms designed to fundamentally change how customers interact with their energy usage and management. Such advancements would position the company within a rapidly expanding digital services market, striving to gain significant customer adoption and build lasting loyalty.

The potential for these emerging technologies places them in a high-growth segment of the digital market. By offering revolutionary digital services and platforms, CenterPoint Energy can tap into a growing demand for personalized energy management tools and seamless digital interactions. This focus on innovation is crucial for capturing market share and fostering customer retention in an increasingly competitive landscape.

- Cloud Migration: Enhancing website performance and reliability for better customer access.

- Digital Service Platforms: Developing new tools for improved customer interaction and energy management.

- Customer Adoption: Aiming to capture a larger share of customers through innovative digital offerings.

- Market Growth: Positioning within a high-growth digital market to drive loyalty and engagement.

CenterPoint Energy's expansion into new industrial connections, particularly data centers and advanced manufacturing, presents significant growth potential but also considerable upfront investment and integration challenges. These ventures are considered question marks because the substantial capital required for infrastructure upgrades and specialized engineering solutions must be in place before they can yield consistent, high-value revenue. The company's 2024 reports highlighted a backlog of interconnection requests that far outpaced historical averages, underscoring the evolving nature of its customer base and the associated investment needs.

The integration of these large industrial loads is crucial for transforming potential into profit. Until the necessary grid enhancements and tailored engineering solutions are implemented, these new customers represent an investment rather than a guaranteed return. This phase requires careful management of capital expenditure and a strategic approach to infrastructure development to ensure these connections become stable, high-revenue contributors.

The sheer volume of new industrial connection requests in 2024 signifies a critical juncture for CenterPoint Energy. This surge in demand necessitates a proactive strategy to address the question mark status of these opportunities, turning potential load growth into tangible financial gains through targeted infrastructure investment and operational efficiency.

While these industrial connections are in their early stages, they are vital for CenterPoint's future growth trajectory. The company must navigate the complexities of infrastructure development to capitalize on this expanding industrial demand, ensuring these question marks evolve into profitable assets.

BCG Matrix Data Sources

Our CenterPoint Energy BCG Matrix is built on verified market intelligence, combining financial data from company filings, industry research on market share, and official reports on growth rates.