CenterPoint Energy Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CenterPoint Energy Bundle

CenterPoint Energy operates in a sector with moderate bargaining power from buyers, as electricity and gas are essential services. The threat of new entrants is generally low due to high capital requirements and regulatory hurdles, but this can vary by specific service offerings. Understanding these dynamics is crucial for strategic planning.

The complete report reveals the real forces shaping CenterPoint Energy’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

CenterPoint Energy's reliance on a select group of specialized suppliers for crucial infrastructure, like high-voltage transformers and advanced metering systems, significantly influences supplier power. The unique technology and limited market availability of these components mean suppliers can exert considerable leverage, as CenterPoint has few viable alternatives.

This supplier concentration directly impacts CenterPoint's operational flexibility and financial planning. For instance, in 2023, the utility sector experienced supply chain challenges impacting the availability and cost of specialized equipment, a trend expected to continue influencing capital expenditure budgets into 2024.

The process of switching suppliers for critical infrastructure in electric transmission, distribution, and natural gas networks is incredibly complex and expensive. This involves significant re-engineering of systems, extensive re-training of personnel, and the potential for compatibility issues with existing technology. These factors create substantial barriers to entry for new suppliers and reinforce the leverage of established providers.

These high switching costs directly empower incumbent suppliers, as CenterPoint Energy faces considerable financial and operational risks in changing its core equipment providers. For instance, the replacement of a primary substation control system could cost millions of dollars in equipment, installation, and testing, not to mention the disruption to service. This discourages frequent supplier changes, even when alternative options might appear on the surface.

Suppliers of natural gas, though a commodity, hold sway through pricing and availability, particularly during high demand. For CenterPoint Energy, a regulated utility, the capacity to recover a portion of these rising input expenses via approved rate cases offers some buffer against direct profit erosion. Nevertheless, the fundamental cost of these vital inputs remains largely tethered to supplier market forces and broader energy market shifts.

Limited Threat of Forward Integration by Suppliers

Suppliers to CenterPoint Energy's regulated electric and natural gas delivery operations face substantial barriers to forward integration. The sheer scale of capital required for utility infrastructure, coupled with stringent regulatory approvals and the need for specialized operational knowledge, makes it exceedingly difficult for suppliers to directly enter CenterPoint's core business. For instance, building a new regulated transmission line can cost hundreds of millions, if not billions, of dollars, a significant deterrent for most equipment or service providers.

This structural limitation effectively neutralizes a significant lever of supplier power. Because suppliers are highly unlikely to replicate CenterPoint's extensive distribution networks and customer bases, their ability to leverage potential entry into the utility market as a bargaining tool is severely diminished. This protects CenterPoint from the threat of its suppliers becoming direct competitors in the delivery of essential energy services.

Consider the 2024 landscape: The energy infrastructure sector continues to demand massive upfront investment. For example, projects like upgrading aging natural gas pipelines or modernizing the electric grid often require multi-year construction timelines and capital expenditures in the billions. This economic reality reinforces the difficulty for suppliers, who typically operate with different business models and capital structures, to undertake such ventures.

- Limited Forward Integration Threat: Suppliers face prohibitive barriers to entering CenterPoint Energy's regulated utility market due to immense capital requirements and regulatory complexities.

- High Capital Investment: Building and maintaining regulated energy infrastructure, such as transmission lines or distribution networks, demands billions in capital, deterring potential supplier entry.

- Regulatory Hurdles: Obtaining necessary permits and approvals from bodies like the Public Utility Commission is a lengthy and complex process, acting as a significant barrier to entry for new players.

- Specialized Expertise: Operating a regulated utility requires unique technical, safety, and customer service expertise that suppliers typically do not possess, further limiting their ability to integrate forward.

Impact of Industry Trends on Supplier Demands

The utility sector's move towards modernization, resilience, and renewables is fueling demand for specialized equipment and materials. This trend can elevate the bargaining power of suppliers who offer these advanced solutions.

CenterPoint Energy's substantial capital expenditure plan, projecting $53 billion through 2030, highlights its need for sophisticated grid components and storm-resistant materials. This significant investment directly translates into increased purchasing power for suppliers in these niche markets.

- Increased Demand: The utility industry's focus on grid modernization and renewable integration drives higher demand for specific technologies and materials.

- Supplier Leverage: Companies providing smart grid components, storm-hardening materials, and renewable energy integration solutions are well-positioned due to this demand.

- Capital Investment Impact: CenterPoint Energy's planned $53 billion investment through 2030 for grid enhancements directly boosts the bargaining power of its key equipment suppliers.

Suppliers of specialized infrastructure components, such as advanced metering systems and high-voltage transformers, hold significant bargaining power over CenterPoint Energy due to the limited availability and unique nature of these products.

The substantial costs and technical complexities associated with switching suppliers for critical utility infrastructure further solidify the leverage of incumbent providers.

While suppliers of commodities like natural gas can exert influence through pricing, CenterPoint's regulated status allows some cost recovery, mitigating direct profit impact.

The high barriers to forward integration for suppliers, stemming from immense capital needs and regulatory complexities, effectively neutralize a key potential source of their bargaining power.

| Factor | Impact on Supplier Bargaining Power | Supporting Data/Observation |

|---|---|---|

| Supplier Concentration & Specialization | High | Reliance on few suppliers for unique tech (e.g., advanced metering). |

| Switching Costs | High | Millions in costs for re-engineering, training, and compatibility for critical infrastructure. |

| Forward Integration Threat | Low | Prohibitive capital ($ billions) and regulatory hurdles deter suppliers from entering utility market. |

| Demand for Modernization | Increasing | CenterPoint's $53 billion capex through 2030 drives demand for specialized grid components. |

What is included in the product

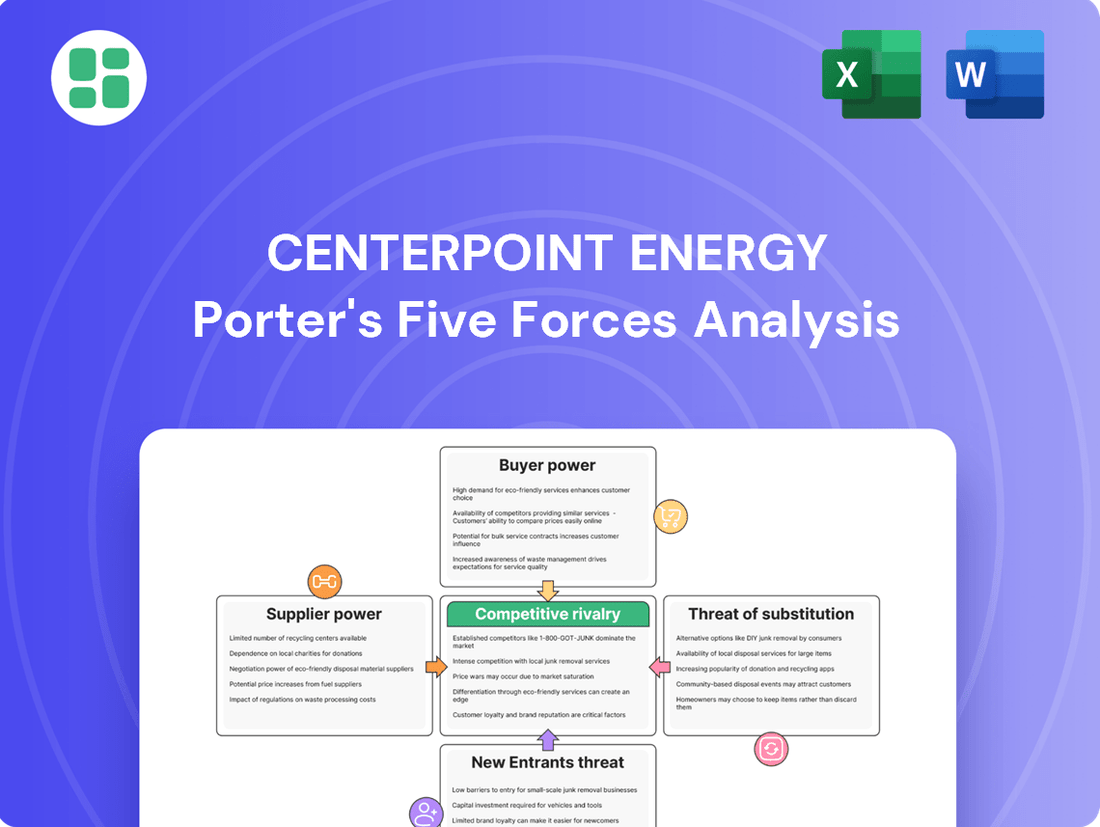

This analysis meticulously examines the five forces impacting CenterPoint Energy's competitive environment, detailing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the presence of substitute products.

Instantly grasp the competitive landscape of CenterPoint Energy's Porter's Five Forces with a visually intuitive dashboard, simplifying complex market dynamics for strategic planning.

Customers Bargaining Power

CenterPoint Energy serves a vast number of residential customers, numbering in the millions across its service areas. This sheer volume creates a highly fragmented customer base, meaning no single customer holds significant sway.

Individually, these millions of residential customers have very little to no bargaining power when it comes to CenterPoint Energy's rates or the terms of service. Their individual impact is negligible.

This widespread distribution of customers is a key strength for CenterPoint. It prevents any one customer or small group from effectively pressuring the company, thereby protecting its operational stability and financial health.

Customers face extremely high switching costs for essential utility services like electricity and natural gas. Because homes and businesses are physically connected to CenterPoint Energy's existing infrastructure, switching to a different provider for primary energy delivery is practically impossible. This inherent lock-in significantly reduces customers' ability to negotiate or seek out alternative options, thereby strengthening CenterPoint's bargaining power.

CenterPoint Energy's regulated pricing structure significantly limits customer bargaining power. Prices for its electric transmission and distribution, along with natural gas distribution, are determined by state and local regulatory commissions, not by direct negotiation with individual customers. This regulatory framework effectively removes price as a primary bargaining chip for consumers.

While customers have avenues to voice concerns, such as participating in public hearings or advocating for rate reviews, their direct impact on the final approved tariffs remains minimal. For instance, in 2024, regulatory proceedings often involve extensive data submissions and analysis by utilities like CenterPoint, with customer input being one of many factors considered by regulators who ultimately set rates based on cost recovery and return on investment principles.

Essential and Inelastic Demand

Electricity and natural gas are fundamental to modern life, serving critical functions like heating, cooling, and lighting. For businesses, these utilities are indispensable for a wide range of industrial processes. This essential nature translates into demand that is highly inelastic, meaning customers cannot easily cut back on their usage without significant disruption.

For instance, residential customers rely on electricity for basic comfort and safety, making it difficult to reduce consumption. Similarly, many industrial operations have processes that are directly tied to continuous energy supply. This lack of substitutability for essential needs significantly limits the bargaining power of CenterPoint Energy's customers.

- Essential Nature: Electricity and natural gas are non-discretionary for most households and businesses.

- Inelastic Demand: Customers are unlikely to reduce consumption significantly even if prices rise slightly, as alternatives are limited or non-existent for core needs.

- Reduced Bargaining Power: This inelasticity means customers have less leverage to negotiate prices or terms with CenterPoint Energy.

- Example Data: In 2023, residential customers accounted for a substantial portion of CenterPoint Energy's revenue, highlighting their dependence on the service.

Growing Demand from Key Customer Segments

CenterPoint Energy is experiencing robust electric load growth, especially from major commercial and industrial clients like data centers and manufacturing plants within its Houston Electric service area. This surge in demand, anticipated to climb by almost 50% by 2031, suggests CenterPoint is well-positioned to accommodate expanding needs, rather than facing customer pressure for lower prices due to surplus capacity.

The increasing reliance on electricity by these key sectors, driven by technological advancements and economic expansion, strengthens CenterPoint's bargaining power. As these customers require substantial and reliable power, they are less likely to switch providers or demand significant price concessions.

- Significant Electric Load Growth: CenterPoint's Houston Electric territory is seeing substantial increases in electricity demand.

- Key Customer Segments Driving Growth: Data centers and manufacturing facilities are major contributors to this expanding demand.

- Projected Demand Increase: Load is expected to grow by nearly 50% by 2031.

- Stronger Bargaining Position: High demand from essential customers reduces their power to negotiate lower prices.

CenterPoint Energy's customers, particularly residential users, have minimal individual bargaining power due to the sheer volume of millions of customers across its service territories. This fragmentation means no single customer can significantly influence rates or terms. Furthermore, the essential nature of electricity and natural gas, coupled with high switching costs stemming from physical infrastructure connections, creates inelastic demand. Customers are largely unable to reduce consumption or find viable alternatives, limiting their leverage.

The regulatory environment further curtails customer bargaining power. State and local commissions, not direct customer negotiation, set utility rates. While customers can participate in public hearings, their input is one of many factors regulators consider when approving tariffs, which are based on cost recovery and return on investment principles. This structure effectively removes price as a primary negotiation point for consumers.

CenterPoint Energy's strong position is also bolstered by significant electric load growth, especially from large commercial and industrial clients like data centers and manufacturing plants in its Houston Electric service area. This demand, projected to increase by nearly 50% by 2031, means these key customers require substantial and reliable power, making them less likely to demand price concessions or switch providers.

| Factor | Impact on Customer Bargaining Power | Supporting Data/Reasoning |

| Customer Volume & Fragmentation | Very Low | Millions of residential customers; no single customer holds significant sway. |

| Switching Costs | Very Low | High costs due to physical infrastructure connections; practically impossible to switch primary energy providers. |

| Essential Nature of Service | Very Low | Electricity and natural gas are fundamental needs with limited substitutes, leading to inelastic demand. |

| Regulatory Pricing | Very Low | Rates set by commissions, not direct customer negotiation; customer input is one of many factors. |

| Electric Load Growth (Houston Electric) | Very Low | Projected ~50% growth by 2031 driven by data centers and manufacturing, increasing demand and reducing customer leverage. |

What You See Is What You Get

CenterPoint Energy Porter's Five Forces Analysis

This preview shows the exact CenterPoint Energy Porter's Five Forces Analysis you'll receive immediately after purchase—no surprises, no placeholders. You'll gain a comprehensive understanding of the competitive landscape, including the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the energy sector. This detailed analysis is ready for your immediate use.

Rivalry Among Competitors

CenterPoint Energy operates as a regulated natural monopoly in its core electric transmission and distribution and natural gas distribution service areas. This structure means direct competition for the same customers within its defined territories is essentially absent. The regulatory environment prohibits the creation of duplicate infrastructure, significantly limiting competitive rivalry in its primary operations.

The utility sector, including CenterPoint Energy, faces exceptionally high barriers to entry. Developing and maintaining essential infrastructure like power grids and gas pipelines demands massive capital investment, often in the billions. For instance, CenterPoint's 2024 capital expenditure plan is projected to be around $2.5 billion, underscoring this point.

Beyond capital, stringent regulatory approvals and lengthy project timelines create further deterrents for potential new entrants. These significant hurdles, combined with the sheer scale of investment, effectively limit direct competition within CenterPoint's core, regulated service areas.

CenterPoint Energy's core utility operations, primarily regulated electricity and natural gas distribution, experience minimal direct rivalry due to the nature of utility services being natural monopolies. However, in its competitive energy services segment, which includes offerings like home repair and maintenance, the company faces more traditional competitive pressures. Here, rivals such as local plumbing companies, HVAC contractors, and national home warranty providers compete directly for customer attention and business.

In these ancillary services, CenterPoint Energy must actively differentiate itself. This often involves focusing on service quality, competitive pricing, and delivering a superior customer experience to stand out. For instance, in 2024, the home services market continues to see a proliferation of providers, making brand reputation and customer trust crucial differentiators. Companies that can offer reliable, timely service and transparent pricing are better positioned to capture market share in this segment.

Focus on Infrastructure Investment and Reliability

For utilities like CenterPoint Energy, the competitive battlefield isn't typically about slashing prices to win customers in regulated markets. Instead, the rivalry centers on securing capital for crucial infrastructure upgrades and gaining regulatory approval for these projects. This means companies compete to demonstrate the greatest need and most effective plans for modernizing their grids and boosting reliability.

CenterPoint's strategic direction underscores this. Their significant capital investment of $53 billion through 2030, particularly focused on initiatives like the Greater Houston Resiliency Initiative (GHRI), illustrates this competitive dynamic. The aim is to improve service quality and meet escalating demand, rather than engaging in direct customer acquisition battles with competitors.

- Infrastructure Investment Focus: Utilities compete for capital to fund grid modernization and reliability, not price wars.

- Regulatory Approval: Gaining approval for infrastructure projects is a key competitive arena.

- CenterPoint's Strategy: The $53 billion capital plan through 2030, including GHRI, exemplifies this focus on enhancement and demand fulfillment.

- Goal: The objective is to improve service and meet growth, rather than out-price rivals.

Industry Growth Reduces Price Pressure

The utility sector is seeing a resurgence in electricity demand. This growth is fueled by several key trends: the ongoing electrification of transportation and heating, the reshoring of manufacturing operations, and the explosive expansion of data centers. For instance, in 2024, the U.S. Energy Information Administration projected a significant increase in electricity consumption, particularly from industrial sectors and new data center builds.

This expanding market fundamentally alters the competitive landscape. When the overall pie is growing, companies are less inclined to engage in aggressive price competition to steal market share. Instead, the focus shifts to securing resources and capacity to meet this burgeoning demand. This dynamic naturally softens the intensity of rivalry that would be prevalent in a mature or shrinking market.

- Electrification: Increased adoption of electric vehicles and heat pumps drives higher electricity consumption.

- Manufacturing Onshoring: Reshoring of industrial production boosts demand from factories.

- Data Centers: The proliferation of data centers, crucial for AI and cloud computing, creates substantial new electricity loads.

- Reduced Price Pressure: Market expansion allows utilities to focus on capacity building rather than price wars.

Competitive rivalry for CenterPoint Energy is largely muted in its core regulated utility operations due to the natural monopoly structure, which limits direct competition. However, in its competitive energy services segment, the company faces more traditional rivals, necessitating a focus on service quality and customer experience to differentiate itself.

The primary competitive battleground for CenterPoint Energy lies in securing capital for infrastructure improvements and obtaining regulatory approvals for these essential projects, rather than engaging in price wars for customers.

The increasing demand for electricity, driven by electrification, manufacturing reshoring, and data center expansion, softens rivalry by expanding the market, allowing companies to focus on capacity building rather than aggressive price competition.

| Aspect | Description | CenterPoint Energy's 2024 Context |

|---|---|---|

| Core Operations Rivalry | Minimal due to natural monopoly status. | Focus on infrastructure investment and regulatory approval. |

| Competitive Services Rivalry | Traditional competition from various service providers. | Emphasis on service quality, pricing, and customer experience. |

| Key Competitive Arena | Securing capital for infrastructure upgrades and regulatory approvals. | $2.5 billion projected capital expenditure for 2024. |

| Market Growth Impact | Softens rivalry by increasing overall demand. | Rising electricity demand from electrification and data centers. |

SSubstitutes Threaten

The rise of distributed energy resources (DERs) like rooftop solar and battery storage poses a significant threat to CenterPoint Energy. As more customers generate their own power, their demand for CenterPoint's grid services decreases. For instance, in 2023, solar installations continued their upward trajectory, with residential solar capacity growing substantially across the US, directly impacting traditional utility revenue streams.

Ongoing advancements in energy-efficient appliances, building insulation, and smart home technologies are empowering customers to reduce their electricity and natural gas consumption. For instance, the U.S. Department of Energy reported that by 2024, the average household could see savings of up to 15% on their energy bills through widespread adoption of smart thermostats and improved insulation, directly impacting the demand for energy services.

Conservation programs, often incentivized by government or utility initiatives, also play a significant role in curbing energy usage. These efforts, while environmentally beneficial, can act as a substitute for increased energy consumption, potentially moderating CenterPoint Energy's revenue growth if not counterbalanced by other demand-increasing factors or strategic initiatives.

For natural gas distribution, the threat of substitutes primarily comes from alternative heating, cooling, and fuel sources. Geothermal systems and highly efficient electric heat pumps are increasingly viable substitutes for residential and commercial heating, especially as electricity grids become greener and more reliable.

In industrial settings, a limited threat exists from alternative fuels or processes that bypass the need for natural gas. However, the established infrastructure and generally lower operating costs of natural gas often create a barrier to widespread substitution in the near to medium term.

Continued Grid Dependence

Despite advancements in self-generation and energy efficiency, a significant portion of distributed energy systems still depend on the utility grid. This reliance is primarily for backup power, grid stability, and ensuring a consistent supply when renewable generation is low or demand is exceptionally high.

This continued interdependence means CenterPoint's transmission and distribution infrastructure remains crucial. It plays a vital role in maintaining overall grid reliability and facilitating the seamless integration of these emerging energy technologies.

- Grid Backup Necessity: In 2024, many residential solar installations, for instance, still require grid connection for power when the sun isn't shining, highlighting the ongoing need for utility infrastructure.

- Stability Services: The grid provides essential services like voltage and frequency regulation, which distributed energy resources often cannot fully replicate independently.

- Interconnection Costs: While distributed generation is growing, the cost and complexity of ensuring these systems can safely and reliably connect to the existing grid underscore the grid's foundational importance.

Offset by Electrification Trends

The threat of substitutes for CenterPoint Energy is somewhat mitigated by the powerful trend of electrification. As more vehicles transition to electric and industries convert their processes to run on electricity, the overall demand for power is increasing. This surge in consumption, especially in vibrant markets like Houston, helps to absorb the impact of customers adopting energy efficiency measures or generating their own power.

For instance, in 2024, the continued growth in electric vehicle adoption is a key driver. CenterPoint's service territory in Texas, particularly Houston, is a hub for this transition. This electrification trend is creating new, substantial demand for the electricity distribution services that CenterPoint provides, effectively counterbalancing the potential loss of revenue from individual customer-side substitutions.

CenterPoint's strategic investments in grid modernization and expansion are designed to capitalize on this electrification wave. By ensuring a reliable and robust infrastructure, the company is well-positioned to meet the growing electricity needs of a more electrified economy. This proactive approach helps to solidify its position against substitute energy sources.

- Electrification Growth: Societal shift towards electric vehicles and industrial processes boosts demand for electricity.

- Houston's Role: High-growth areas like Houston are central to this increased electricity consumption.

- Offsetting Substitution: Increased overall demand helps to counter the impact of individual energy efficiency or self-generation.

- Grid Investment: CenterPoint's investments in infrastructure support this growing demand and mitigate substitution threats.

While distributed energy resources and energy efficiency measures present substitution threats, CenterPoint Energy's position is bolstered by the significant trend of electrification. The increasing adoption of electric vehicles and the conversion of industrial processes to electricity are creating substantial new demand for power distribution. This surge in consumption, particularly in growth markets like Houston, helps to offset the impact of customers reducing their reliance on traditional utility services.

For instance, by 2024, the automotive sector's push towards electric vehicles is projected to significantly increase electricity demand across the nation. Texas, a key market for CenterPoint, is at the forefront of this transition, with substantial investments in EV charging infrastructure underway. This growing demand for electricity is a powerful counterforce to individual customer-side substitutions.

CenterPoint's strategic focus on modernizing and expanding its grid infrastructure is designed to capture the benefits of this electrification trend. By ensuring a reliable and robust network, the company is positioned to meet the escalating electricity needs of a more electrified economy, thereby solidifying its market standing against alternative energy solutions.

| Trend | Impact on CenterPoint | Supporting Data (2024 Projections/Trends) |

|---|---|---|

| Electrification (EVs) | Increases electricity demand | Continued strong growth in EV sales nationally; significant build-out of charging infrastructure in Texas. |

| Electrification (Industrial) | Increases electricity demand | Various industries exploring electric alternatives for heating and processes, boosting load. |

| Distributed Generation | Reduces direct demand for grid power | Ongoing growth in residential solar, but often still relies on grid for backup. |

| Energy Efficiency | Reduces overall energy consumption | Advancements in smart home tech and building standards lead to lower per-customer usage. |

Entrants Threaten

The sheer scale of capital needed to establish and operate a utility infrastructure acts as a formidable barrier. Building and maintaining the extensive electric grids and natural gas pipelines requires billions of dollars. For instance, CenterPoint Energy's capital expenditure plans often run into the billions annually, reflecting the immense upfront investment necessary. This financial hurdle makes it exceptionally difficult for potential new entrants to even consider entering the market.

The utility sector, including companies like CenterPoint Energy, faces a significant threat from new entrants due to the demanding regulatory and licensing requirements. Securing the necessary state and federal approvals, permits, and licenses is a complex and time-consuming process, often taking years and substantial investment. For instance, in 2024, the average time to obtain all necessary permits for a new energy infrastructure project can extend beyond 3-5 years, creating a substantial hurdle for any new player.

Incumbent utilities like CenterPoint Energy possess a formidable advantage due to decades of investment in established infrastructure and the resulting economies of scale. This extensive network of pipelines, power lines, and related assets represents a significant barrier to entry for any potential newcomer. Replicating this vast operational footprint would require immense capital expenditure, making it nearly impossible for new entrants to achieve comparable cost efficiencies.

Natural Monopoly Characteristics

The threat of new entrants for CenterPoint Energy is significantly low, primarily due to the nature of the electric and natural gas distribution industries. These sectors are often characterized as natural monopolies, meaning it is far more efficient for a single entity to manage the extensive infrastructure required. Building duplicate power lines or gas pipelines across the same service area would be prohibitively expensive and redundant.

This high barrier to entry, stemming from massive upfront capital investment in infrastructure, effectively deters potential competitors. For instance, the cost of building new transmission and distribution networks can run into billions of dollars, a sum that most new companies cannot readily access. This economic reality makes direct competition in established service territories economically unfeasible.

CenterPoint Energy's established infrastructure, built over decades, represents a significant competitive advantage. The sheer scale and complexity of these networks, including substations, pipelines, and meters, are assets that new entrants would struggle to replicate. This entrenched infrastructure solidifies the existing market structure and discourages new players from attempting to enter.

- High Infrastructure Costs: Building new electric and gas distribution networks requires immense capital, often in the billions of dollars, making it a significant deterrent for new entrants.

- Natural Monopoly Characteristics: The efficiency of having a single provider for essential utilities like electricity and natural gas limits the economic viability of competing infrastructure.

- Regulatory Hurdles: Gaining the necessary permits and approvals from various regulatory bodies to operate utility services adds another layer of complexity and cost for potential new entrants.

- Economies of Scale: Established utilities like CenterPoint Energy benefit from economies of scale in operations, maintenance, and procurement, which new, smaller entrants cannot match.

Limited Threat in Core Regulated Business

The threat of new entrants into CenterPoint Energy's core regulated electric transmission and distribution and natural gas distribution operations is exceptionally low. This is largely due to the immense capital required to build and maintain such infrastructure, alongside significant regulatory hurdles that new companies must overcome.

These barriers effectively create a natural monopoly in many service areas, shielding CenterPoint from direct competition in its most crucial revenue-generating segments. While ancillary energy services might see some new players, the fundamental utility business remains largely protected.

- Capital Intensity: Building new transmission lines or gas pipelines requires billions of dollars in upfront investment, a significant deterrent for potential new entrants. For instance, utility infrastructure upgrades alone can run into hundreds of millions or even billions of dollars for a single project.

- Regulatory Barriers: Obtaining necessary permits, approvals, and navigating complex state and federal regulations for utility operations is a lengthy and costly process, often favoring established players.

- Natural Monopoly: The economics of utility infrastructure often lead to a single provider being the most efficient, making it difficult for new companies to compete on cost or service in established territories.

The threat of new entrants for CenterPoint Energy remains very low, primarily due to the substantial capital investment required to build and operate utility infrastructure. For example, CenterPoint Energy's 2024 capital expenditure forecast was approximately $3.1 billion, highlighting the immense scale of investment needed in this sector.

Additionally, stringent regulatory approvals and licensing processes act as significant barriers. Obtaining these permits can take years and substantial resources, a hurdle that deters most potential new competitors. The inherent nature of utility services also lends itself to natural monopolies, where duplication of infrastructure is economically inefficient and often prohibited.

Established players like CenterPoint benefit from decades of infrastructure development and economies of scale, making it difficult for newcomers to compete on cost. This entrenched advantage, coupled with high upfront costs and regulatory complexity, effectively shields CenterPoint's core regulated operations from significant new competition.

| Barrier Type | Description | Impact on New Entrants |

| Capital Requirements | Building and maintaining extensive utility networks demands billions in investment. CenterPoint's 2024 capex was around $3.1 billion. | Extremely High Barrier |

| Regulatory Hurdles | Complex and lengthy approval processes for permits and licenses. Obtaining permits can take 3-5 years in 2024. | Very High Barrier |

| Natural Monopoly | Duplicating infrastructure is inefficient and costly, favoring single providers. | High Barrier |

| Economies of Scale | Established firms have cost advantages in operations and procurement. | High Barrier |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for CenterPoint Energy is built upon a foundation of comprehensive data, including their annual reports, SEC filings, and industry-specific market research from sources like IBISWorld. We also incorporate regulatory filings and macroeconomic data to provide a robust understanding of the competitive landscape.