Ceconomy SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ceconomy Bundle

Ceconomy faces significant competitive pressures and evolving consumer electronics market dynamics, but its strong brand recognition and extensive retail network offer solid foundations. Understanding these internal capabilities and external threats is crucial for navigating its future.

Want the full story behind Ceconomy’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Ceconomy AG stands as Europe's largest consumer electronics retailer, a position solidified by its powerful MediaMarkt and Saturn brands. This extensive market leadership, spanning numerous European nations, translates into significant customer trust and loyalty. In fiscal year 2023, Ceconomy reported total sales of €21.4 billion, underscoring its substantial reach and influence.

Ceconomy's robust omnichannel strategy is a significant strength, effectively blending its substantial online presence with a vast network of over 1,000 European physical stores. This integration creates a fluid customer journey, enabling seamless transitions between online research, in-store product interaction, and flexible fulfillment choices. The success of this approach is underscored by online sales growth of 7.4% in Q2 2024/25, representing a notable 24.9% of total revenue.

Ceconomy boasts a broad spectrum of offerings, encompassing consumer electronics, household appliances, and a growing array of services. This diversification extends to areas like extended warranties and installation, catering to a wide customer base.

The company's marketplace platform is a significant asset, featuring over 1,600 sellers and approximately 2.3 million products, further broadening its market reach and product accessibility.

The strategic focus on Services & Solutions is proving fruitful, as evidenced by a 7.0% sales increase in Q2 2024/25 for this segment, highlighting its importance to gross profit and overall business growth.

Strong Financial Performance and Strategic Growth Areas

Ceconomy has shown robust financial performance, marked by its ninth consecutive quarter of sustainable growth as of Q2 2024/25. This consistent upward trend is a significant strength, indicating operational efficiency and market resilience.

The company's financial outlook for the 2024/25 business year is promising, with an expected clear improvement in adjusted EBIT, projected to reach approximately 375 million euros. This forecast highlights strong earnings potential and effective cost management.

Strategic growth initiatives are yielding positive results, particularly in areas such as Retail Media, Private Label products, and the Marketplace. These segments are not only expanding but are also contributing to a healthier gross margin, demonstrating successful diversification and value creation.

- Ninth consecutive quarter of sustainable growth (Q2 2024/25).

- Projected adjusted EBIT of around 375 million euros for FY 2024/25.

- Positive development in Retail Media, Private Label, and Marketplace driving gross margin improvements.

Commitment to Sustainability and Circular Economy

Ceconomy is demonstrating a strong commitment to sustainability and the principles of a circular economy. This focus is not just aspirational; it's translating into tangible sales growth. In the second quarter of the 2024/25 fiscal year, the company's more sustainable 'BetterWay' products accounted for a significant 26% of total sales, a milestone that actually outpaced their original target for the 2025/26 fiscal year.

This proactive approach to environmental responsibility is also evident in Ceconomy's emphasis on repair services and the sale of refurbished products. These initiatives are crucial for resource conservation and directly address a rising consumer preference for environmentally conscious purchasing options.

- Sales Growth: BetterWay products reached 26% of sales in Q2 2024/25, exceeding the 2025/26 target.

- Circular Economy Focus: Investment in repair services and refurbished goods aligns with circular economy principles.

- Customer Demand: The strategy caters to the increasing market demand for eco-friendly electronics.

Ceconomy's market leadership, particularly through its MediaMarkt and Saturn brands, provides a significant competitive advantage. This established presence, supported by €21.4 billion in total sales for fiscal year 2023, translates into strong brand recognition and customer loyalty across Europe.

The company's integrated omnichannel strategy, combining over 1,000 physical stores with a robust online platform, facilitates a seamless customer experience. This approach saw online sales grow by 7.4% in Q2 2024/25, contributing 24.9% to total revenue, and the marketplace platform lists over 1,600 sellers and 2.3 million products.

Ceconomy's diversification into Services & Solutions, which grew 7.0% in Q2 2024/25, alongside its focus on Retail Media and Private Label products, is enhancing gross margins and driving sustainable growth. This strategic direction is further bolstered by a projected adjusted EBIT of approximately €375 million for FY 2024/25, marking the ninth consecutive quarter of growth.

The company's commitment to sustainability, with 'BetterWay' products reaching 26% of sales in Q2 2024/25, exceeding its 2025/26 target, taps into growing consumer demand for eco-friendly options and aligns with circular economy principles through repair services and refurbished goods.

| Metric | Value | Period |

|---|---|---|

| Total Sales | €21.4 billion | FY 2023 |

| Online Sales Growth | 7.4% | Q2 2024/25 |

| Online Sales Contribution | 24.9% | Q2 2024/25 |

| Marketplace Sellers | 1,600+ | Current |

| Marketplace Products | 2.3 million+ | Current |

| Services & Solutions Growth | 7.0% | Q2 2024/25 |

| Consecutive Growth Quarters | 9 | As of Q2 2024/25 |

| Projected Adjusted EBIT | ~€375 million | FY 2024/25 |

| 'BetterWay' Product Sales | 26% | Q2 2024/25 |

What is included in the product

This analysis provides a comprehensive overview of Ceconomy's internal capabilities and external market dynamics, highlighting key strengths, weaknesses, opportunities, and threats to inform strategic decision-making.

Uncovers critical strategic vulnerabilities and opportunities for targeted improvement.

Weaknesses

Ceconomy's extensive physical store network, exceeding 1,000 locations across Europe, presents a significant weakness due to high operational costs. These expenses, encompassing rent, utilities, and staffing, directly impact profitability, particularly when contrasted with online-only competitors. For instance, in fiscal year 2023, Ceconomy reported selling, general, and administrative expenses of €3.4 billion, a substantial portion of which is attributable to its physical footprint.

This substantial brick-and-mortar presence can hinder margin competitiveness. While Ceconomy is actively pursuing strategies to optimize location costs and boost retail space productivity, the inherent overhead of such a large physical network remains a considerable challenge in the current retail landscape.

Ceconomy faces a significant challenge from online retailers and marketplaces, which are known for their aggressive pricing. Platforms like Amazon continue to dominate, forcing traditional players to adapt quickly.

By 2025, marketplaces are expected to capture an even larger share of consumer electronics sales online, amplifying the competitive pressure. This trend demands constant innovation and operational efficiency from Ceconomy to hold its ground.

Ceconomy's reliance on consumer electronics makes it particularly vulnerable to economic downturns. As these items are often discretionary, a slowdown in the economy, coupled with rising inflation, directly impacts consumer purchasing power. For instance, high inflation in Germany, a key market, and broader European economic growth forecasts for 2025 suggest consumers may curb spending on non-essential goods, potentially hitting Ceconomy's sales and revenues hard.

Challenges in Rapid Digital Transformation and Legacy Infrastructure

Ceconomy faces significant hurdles in its digital transformation due to its extensive legacy infrastructure. The sheer size of its operations, encompassing numerous physical stores and online channels, complicates the rapid integration of new digital technologies. This can lead to a slower adaptation compared to newer, digitally-native competitors who lack such inherited complexities.

The company’s ongoing efforts to modernize are hampered by the need for substantial investment to bridge the gap between existing systems and advanced digital capabilities. For instance, in 2024, Ceconomy continued its strategic focus on enhancing its digital offerings, but the integration across its broad European footprint presents a complex and costly undertaking. This integration pace is critical in a retail landscape that demands constant and swift technological evolution.

- Legacy Systems: Existing IT infrastructure can be outdated and difficult to integrate with modern digital solutions, slowing down innovation.

- Integration Complexity: Merging digital capabilities across a vast network of physical stores and diverse online platforms is a resource-intensive process.

- Investment Requirements: Significant capital is needed to upgrade infrastructure and implement new digital tools, impacting agility.

- Competitive Lag: Slower adaptation due to infrastructure challenges can put Ceconomy at a disadvantage against more agile, digitally-native retailers.

Inventory Management Complexity

Ceconomy faces significant hurdles in managing its extensive and varied product range across its numerous brick-and-mortar stores and its growing online presence. This multi-channel distribution model inherently complicates inventory tracking and replenishment.

The electronics sector is characterized by rapidly changing consumer tastes and swift technological advancements. This volatility means Ceconomy must constantly adapt to avoid either having too much stock of outdated goods, or conversely, experiencing stockouts of popular, in-demand items. For instance, in early 2024, the rapid adoption of new smartphone models and evolving smart home technology created dynamic demand shifts.

Optimizing inventory levels is paramount for Ceconomy's financial health, especially given the inflationary pressures experienced throughout 2023 and into 2024. Holding excessive inventory ties up capital and increases storage costs, while insufficient stock directly translates to lost sales opportunities. Effective inventory management is therefore a critical lever for mitigating financial strain and maintaining profitability in a challenging economic climate.

- Complex Multi-Channel Inventory: Managing stock across physical stores and e-commerce platforms presents logistical challenges.

- Product Obsolescence Risk: Rapid tech changes can quickly devalue inventory, leading to potential write-downs.

- Demand Volatility: Fluctuating consumer preferences require agile inventory planning to prevent stockouts or overstocking.

- Inflationary Impact: High inventory holding costs and the need to maintain sufficient stock in an inflationary environment strain financial resources.

Ceconomy's substantial physical store footprint, exceeding 1,000 locations across Europe, represents a significant weakness due to high operational costs. These expenses, including rent, utilities, and staffing, directly impact profitability, especially when compared to online-only competitors. In fiscal year 2023, Ceconomy reported selling, general, and administrative expenses of €3.4 billion, with a considerable portion tied to its physical presence, hindering margin competitiveness.

The company also faces intense competition from online retailers and marketplaces, which often employ aggressive pricing strategies. Platforms like Amazon continue to gain market share, compelling traditional players like Ceconomy to adapt rapidly. By 2025, it is anticipated that marketplaces will capture an even larger segment of online consumer electronics sales, intensifying competitive pressure and necessitating continuous innovation and operational efficiency from Ceconomy.

Ceconomy's reliance on consumer electronics makes it particularly susceptible to economic downturns and inflation. As these products are often discretionary, a weakening economy and rising prices directly affect consumer purchasing power. For instance, persistent high inflation in key markets like Germany and subdued European economic growth forecasts for 2025 suggest consumers may reduce spending on non-essential items, potentially impacting Ceconomy's sales and revenue negatively.

The company's digital transformation is hampered by its extensive legacy infrastructure. Integrating new digital technologies across its vast network of physical stores and online channels is complex and slower than for digitally-native competitors. This requires substantial investment to bridge the gap between existing systems and advanced digital capabilities, a critical factor in a rapidly evolving retail landscape. For example, ongoing efforts in 2024 to enhance digital offerings across its European footprint are a complex and costly undertaking.

| Weakness Area | Description | Impact | Example Data/Context |

|---|---|---|---|

| High Operational Costs (Physical Stores) | Extensive brick-and-mortar network leads to significant overheads. | Reduced profitability and margin competitiveness. | FY2023 SG&A expenses: €3.4 billion. |

| Intense Online Competition | Aggressive pricing and market dominance by online platforms. | Pressure to match prices, potential loss of market share. | Projected increase in marketplace share of online CE sales by 2025. |

| Economic Sensitivity | Vulnerability to economic downturns and inflation impacting discretionary spending. | Reduced consumer purchasing power, lower sales volumes. | High inflation in Germany, subdued European economic growth forecasts for 2025. |

| Legacy Infrastructure | Outdated IT systems hinder rapid digital integration and innovation. | Slower adaptation compared to digital-native competitors, integration complexity. | Ongoing investment required for digital transformation across European operations (2024). |

Full Version Awaits

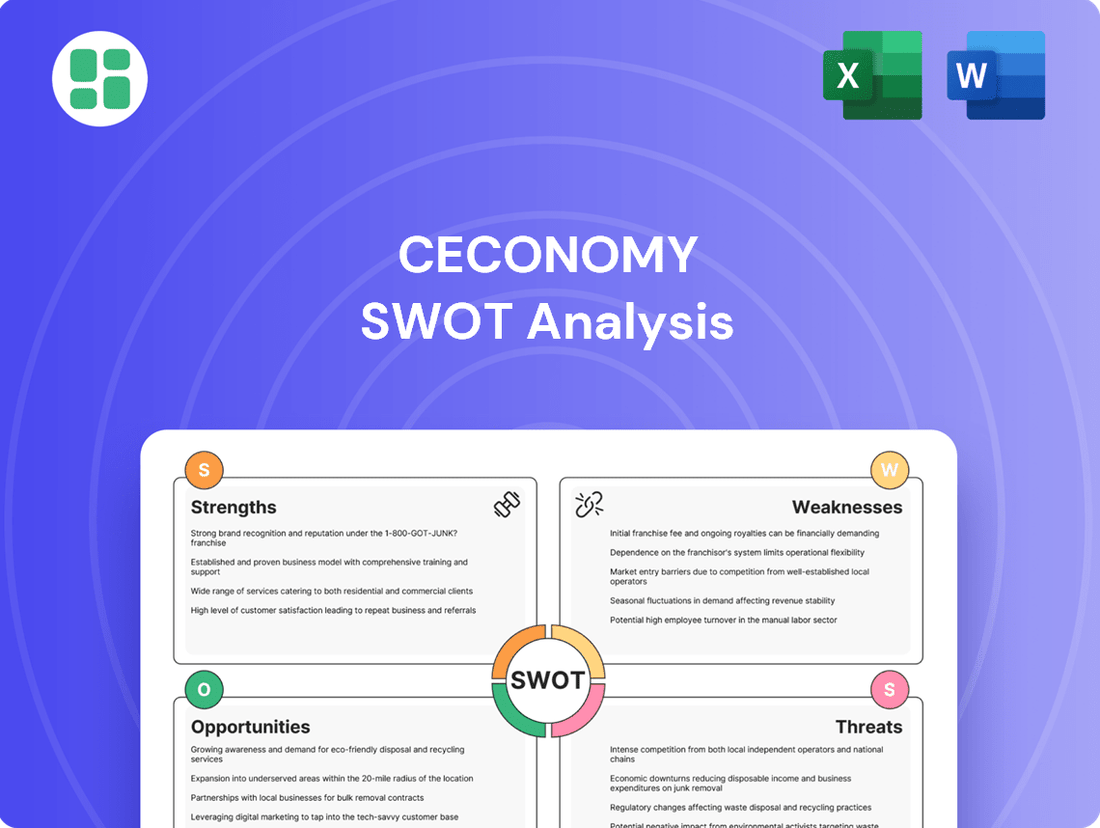

Ceconomy SWOT Analysis

This is the actual Ceconomy SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of the company's internal Strengths and Weaknesses, alongside external Opportunities and Threats.

The preview below is taken directly from the full Ceconomy SWOT report you'll get. Purchase unlocks the entire in-depth version, detailing key strategic considerations for the electronics retailer.

Opportunities

Ceconomy has a prime opportunity to broaden its Services & Solutions segment, which is already a high-margin area. By expanding offerings like extended warranties, installation, and repair services, the company can tap into recurring revenue streams. For instance, in fiscal year 2023, MediaMarktSaturn's services and accessories revenue saw a notable increase, contributing to overall profitability.

The smart home market is experiencing robust expansion, with projections indicating continued strong growth through 2025 and beyond. For instance, the global smart home market was valued at approximately $103.5 billion in 2023 and is anticipated to reach over $200 billion by 2028, according to various market research reports.

Ceconomy is well-positioned to leverage the increasing consumer interest in connected living by broadening its smart home and IoT product offerings. Expanding into areas like AI-powered assistants, advanced security systems, and energy management solutions can attract new customer segments.

Furthermore, offering specialized installation and consultation services for these complex technologies can create a significant competitive advantage. This approach not only drives sales of hardware but also generates recurring revenue and enhances customer loyalty, solidifying Ceconomy's role in enabling the future of connected households.

Ceconomy's immense volume of over two billion annual customer interactions presents a significant opportunity to craft deeply personalized shopping journeys. By harnessing this data through advanced analytics, the company can deliver bespoke offers, precisely targeted promotions, and customized product recommendations, directly boosting customer satisfaction and driving higher conversion rates.

This strategic focus on data-driven personalization is crucial for staying ahead in the evolving retail landscape. For instance, in 2023, retailers leveraging AI for personalization saw an average increase of 10-15% in sales conversion. Ceconomy's ability to effectively utilize its data will be a key differentiator, solidifying its competitive standing.

Further Development of Sustainability and Circular Economy Initiatives

Ceconomy can capitalize on the surging consumer preference for sustainable and eco-friendly goods. Growing environmental regulations also present a chance for the company to bolster its circular economy efforts.

By expanding its range of refurbished items, repair services, and recycling initiatives, Ceconomy can tap into conscientious consumerism, generating new income streams and enhancing its reputation as an environmentally responsible retailer. The recommerce market is experiencing substantial growth, with global sales projected to reach $350 billion by 2027, according to ThredUp's 2023 Resale Report.

- Growing Consumer Demand: Increased consumer awareness of environmental impact drives preference for sustainable options.

- Regulatory Tailwinds: Stricter environmental laws encourage businesses to adopt circular economy practices.

- New Revenue Streams: Refurbished products, repair services, and recycling programs offer profitable avenues.

- Brand Enhancement: Demonstrating commitment to sustainability strengthens brand loyalty and positive public image.

Strategic Partnerships and Marketplace Growth

Ceconomy can significantly bolster its marketplace platform by onboarding a wider array of sellers and product categories. This expansion is projected to diversify revenue streams and enrich its product assortment, building on the platform's already substantial growth trajectory. For instance, in fiscal year 2023, Ceconomy's MediaMarkt and Saturn online sales saw a notable increase, indicating strong consumer adoption of its digital channels.

Strategic alliances are crucial for accelerating Ceconomy's market penetration and operational efficiencies. The previously explored investment agreement with JD.com, for example, highlighted the potential for enhancing supply chain management and broadening market access. Such collaborations can also unlock access to cutting-edge technologies and previously untapped customer demographics.

- Marketplace Expansion: Aim to attract a greater number of third-party sellers to broaden product diversity and appeal.

- Strategic Alliances: Forge partnerships to enhance supply chain logistics and gain access to new customer bases.

- Technology Integration: Leverage collaborations to adopt new technologies that improve customer experience and operational effectiveness.

- Revenue Diversification: Utilize the growing marketplace to create multiple income sources beyond direct sales.

Ceconomy has a significant opportunity to expand its Services & Solutions segment, focusing on recurring revenue through services like extended warranties and installation. The company can also capitalize on the rapidly growing smart home market by broadening its IoT product offerings and providing specialized installation services for these complex technologies.

Leveraging its vast customer interaction data, Ceconomy can create personalized shopping experiences, boosting satisfaction and conversion rates, as retailers using AI for personalization saw an average 10-15% sales increase in 2023. Furthermore, the company can tap into the growing consumer demand for sustainability by expanding its refurbished goods, repair services, and recycling initiatives, aligning with the projected $350 billion recommerce market by 2027.

Expanding the marketplace platform by onboarding more sellers and product categories is another key opportunity, aiming to diversify revenue and enhance product assortment, building on the strong digital channel growth seen in fiscal year 2023. Strategic alliances, such as the previous investment agreement with JD.com, offer potential for improved supply chain management, broader market access, and adoption of new technologies.

Threats

Ceconomy operates in a fiercely competitive consumer electronics retail landscape. The rise of online-only retailers, often with leaner operational models, intensifies this pressure, driving down prices and squeezing profit margins for established players.

This constant price competition necessitates significant investment in maintaining competitive pricing and exploring cost efficiencies. For instance, during the 2023 fiscal year, MediaMarktSaturn, Ceconomy's primary operating segment, faced challenges in maintaining gross profit margins amidst promotional activities and increased marketing spend to counter competitive pressures.

Global and European economic volatility remains a significant concern, with high inflation and slowing GDP growth projections impacting consumer confidence. For instance, Eurozone inflation was 2.4% in April 2024, a decrease from previous months but still a factor in purchasing power. This economic climate directly threatens Ceconomy's sales volumes and revenue by curbing discretionary spending on non-essential goods like electronics.

The consumer electronics market moves at lightning speed. This means new gadgets are constantly hitting the shelves, making older models quickly feel outdated. For Ceconomy, this rapid technological obsolescence poses a significant threat, as it can lead to substantial inventory depreciation. For instance, in the fiscal year 2023, the electronics retail sector globally saw increased pressure from unsold inventory due to faster product cycles, impacting profit margins.

Effectively managing inventory is crucial to mitigate this risk. Holding onto older stock ties up valuable capital that could be used for newer, more profitable items. Ceconomy faces the ongoing challenge of forecasting demand accurately and optimizing its stock levels to avoid significant markdowns. This balancing act is essential for maintaining profitability in a highly competitive and fast-changing industry.

Supply Chain Disruptions and Geopolitical Risks

Global supply chains continue to be a significant vulnerability for retailers like Ceconomy, with ongoing geopolitical tensions and the potential for natural disasters posing a constant threat. These disruptions can manifest as product shortages and increased logistics expenses, directly hindering Ceconomy's capacity to satisfy customer demand and remain competitive in the fast-paced electronics market.

The lingering effects of global events, such as the semiconductor shortages that impacted the automotive and electronics sectors throughout 2023 and into early 2024, highlight the fragility of these supply networks. For instance, reports indicated that certain high-demand electronic components experienced lead time extensions of up to 52 weeks during peak disruption periods, a challenge Ceconomy would have had to navigate. Geopolitical uncertainties also play a role in dampening consumer confidence, which can indirectly affect sales and market stability for durable goods.

- Supply Chain Vulnerability: Continued reliance on complex global networks makes Ceconomy susceptible to disruptions from geopolitical events, natural disasters, and trade disputes.

- Increased Costs & Delays: Disruptions lead to higher shipping costs and extended lead times for inventory, impacting profitability and product availability.

- Market Instability: Geopolitical risks can negatively influence consumer spending patterns and overall market sentiment, affecting demand for Ceconomy's product offerings.

Shifting Consumer Shopping Habits and Store Relevance

Ceconomy faces the persistent threat of evolving consumer preferences, with a significant migration towards online shopping channels. Despite its omnichannel approach, the company must continually address the challenge of maintaining the allure and footfall of its extensive physical store footprint in an era prioritizing digital convenience.

This shift directly impacts store relevance, as consumers increasingly bypass brick-and-mortar locations for many electronics purchases. For instance, in 2024, online sales in the consumer electronics sector continued to grow, with reports indicating a substantial percentage of consumers now preferring to research and purchase electronics online, making it harder for physical stores to compete solely on accessibility.

- Online Dominance: The ongoing trend of consumers favoring online purchasing for electronics poses a direct challenge to Ceconomy's physical retail strategy.

- Store Footfall: Ensuring that Ceconomy's large store network remains relevant and attracts sufficient customer traffic is a critical concern.

- Digital Convenience: The inherent convenience of e-commerce continues to draw customers away from traditional retail experiences, pressuring physical store performance.

Intensifying competition from online retailers and the rapid pace of technological change pose significant threats to Ceconomy. Economic volatility, including inflation and potential recessions in key European markets, directly impacts consumer spending on discretionary items like electronics. Furthermore, ongoing supply chain vulnerabilities, exacerbated by geopolitical instability, can lead to stock shortages and increased operational costs.

| Threat Category | Specific Risk | Impact on Ceconomy | Relevant Data/Example |

|---|---|---|---|

| Competition | Online Retailer Growth | Price pressure, margin erosion | Online sales in consumer electronics projected to grow by 10-15% annually through 2025. |

| Technology | Rapid Product Obsolescence | Inventory depreciation, markdown risk | Average product lifecycle for smartphones shortened to 18-24 months. |

| Economic Environment | Inflationary Pressures | Reduced consumer purchasing power, lower sales volumes | Eurozone inflation averaged 5.5% in 2023, impacting disposable income. |

| Supply Chain | Geopolitical Disruptions | Product shortages, increased logistics costs | Semiconductor lead times extended by up to 52 weeks during 2023-2024. |

SWOT Analysis Data Sources

This Ceconomy SWOT analysis is built upon a robust foundation of data, including official financial reports, comprehensive market research, and insights from industry experts. These sources ensure a well-rounded and accurate assessment of the company's strategic position.