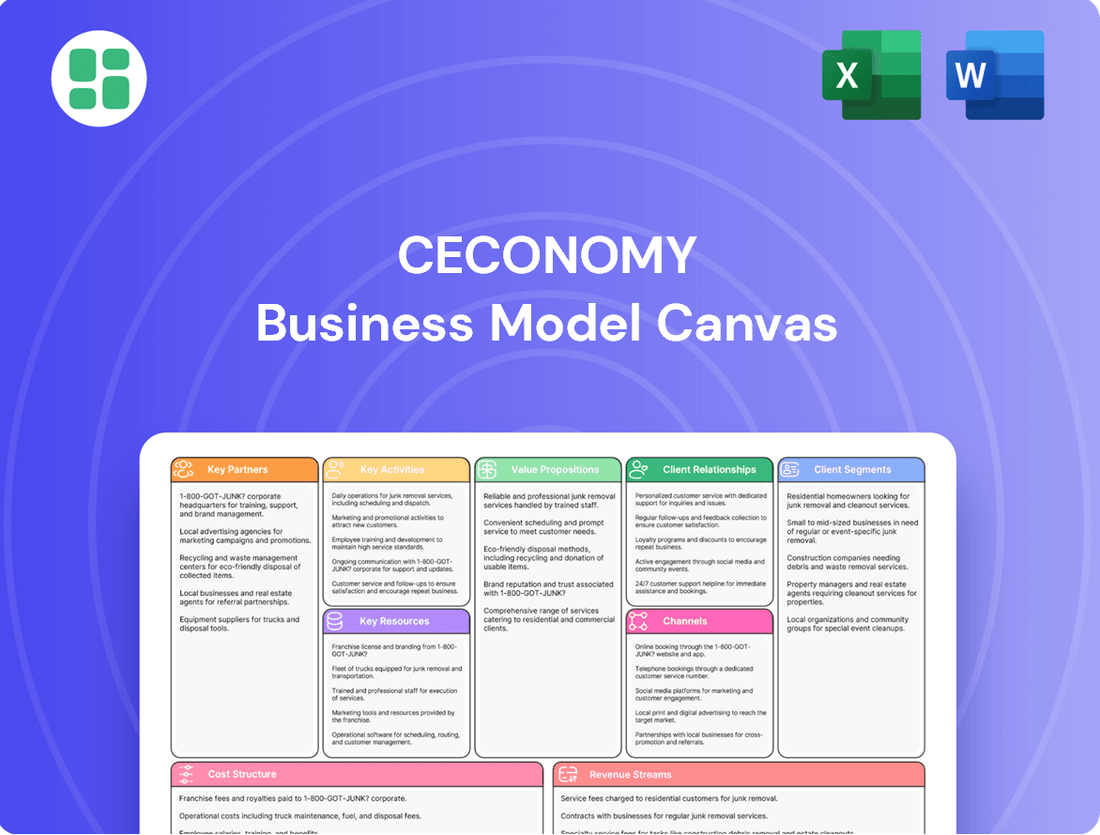

Ceconomy Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ceconomy Bundle

Unlock the strategic blueprint behind Ceconomy's success with our comprehensive Business Model Canvas. This detailed analysis breaks down their customer relationships, revenue streams, and key resources, offering invaluable insights for anyone looking to understand their competitive edge. Dive into the actionable strategies that drive Ceconomy's market position.

Partnerships

Ceconomy's success hinges on its alliances with major technology manufacturers like Samsung, Apple, Sony, and appliance giants such as Bosch and Siemens. These partnerships are crucial for securing a diverse and up-to-date product portfolio, from the newest smartphones to essential home appliances.

These collaborations often come with advantageous purchasing agreements and co-marketing initiatives. For instance, in 2024, Ceconomy actively promoted exclusive bundles and early access to new product releases from these key brands, driving foot traffic and online engagement.

Ceconomy relies heavily on logistics and supply chain partners to manage its extensive network of physical stores and online operations. These partnerships are vital for ensuring products reach customers efficiently, whether through direct delivery or to brick-and-mortar locations. In 2023, for instance, the company continued to optimize its warehousing and distribution, a critical component given the high volume of electronics handled.

Ceconomy collaborates with service and solution providers to enrich its customer offerings. These partnerships extend beyond product sales, encompassing extended warranties, insurance, and telecommunication services. For instance, in 2024, Ceconomy continued to strengthen its ties with providers like Wertgarantie for product protection, aiming to capture a larger share of the growing service contract market.

These alliances are crucial for generating additional revenue streams and fostering customer loyalty. By bundling services such as installation and repair with product purchases, Ceconomy provides a more complete and convenient customer experience. This strategy is designed to differentiate its retail operations, particularly in its MediaMarkt and Saturn brands, by offering end-to-end solutions rather than just individual products.

Marketplace Sellers & Retail Media Partners

Ceconomy's MediaMarktSaturn marketplace thrives through strategic alliances with third-party sellers, significantly broadening its product catalog and creating new revenue streams via commission fees. By the end of fiscal year 2023, the marketplace had onboarded over 3,000 sellers, contributing to a substantial increase in product availability.

Retail media partnerships are also crucial, allowing Ceconomy to monetize its substantial customer base. In 2024, the company expanded its retail media offerings, collaborating with over 150 brands for targeted advertising campaigns across its digital channels and physical stores, generating an estimated €100 million in advertising revenue.

- Marketplace Growth: Partnerships with third-party sellers are key to expanding product assortment and driving commission-based revenue.

- Retail Media Monetization: Collaborations with brands leverage MediaMarktSaturn's extensive customer reach for advertising income.

- New Revenue Streams: These partnerships create diversified income opportunities beyond traditional retail sales margins.

- 2024 Focus: Continued expansion of seller base and deepening of retail media collaborations are central to strategic growth.

Financial Institutions & Payment Processors

Ceconomy relies heavily on partnerships with financial institutions and payment processors to ensure smooth operations across its diverse European markets. These collaborations are critical for enabling customer transactions, providing flexible financing solutions like installment plans, and effectively managing the company's cash flow. For instance, in fiscal year 2023/24, Ceconomy continued to leverage these relationships to support its retail operations and strategic initiatives.

These partnerships are not just about day-to-day transactions; they also involve securing vital financial resources. Ceconomy has actively worked on strengthening its credit lines with banking partners to maintain financial flexibility. Furthermore, the company has demonstrated a commitment to sustainable finance by issuing sustainability-linked bonds, a move that aligns with broader ESG (Environmental, Social, and Governance) objectives and appeals to a growing segment of investors.

- Facilitating Transactions: Partnerships with providers like PayPal, Klarna, and major banks are crucial for offering a wide range of payment options to customers, from immediate payments to buy-now-pay-later schemes.

- Securing Financing: Access to credit lines from financial institutions is essential for working capital, inventory management, and funding expansion or restructuring efforts.

- Sustainability-Linked Bonds: Issuing such bonds, as Ceconomy has explored, links borrowing costs to achieving specific sustainability targets, reinforcing responsible financial practices.

- Cross-Border Operations: Managing payments and financing across multiple European countries requires robust relationships with international financial entities and payment networks.

Ceconomy's strategic alliances with tech and appliance manufacturers are fundamental to its product sourcing and market presence. These partnerships ensure access to the latest innovations and a broad selection of goods, from consumer electronics to home appliances. In 2024, Ceconomy continued to leverage these relationships for exclusive product launches and co-branded marketing efforts, driving customer engagement.

The company also relies on a robust network of logistics and supply chain partners to manage its extensive retail and online operations efficiently. These collaborations are vital for timely product delivery and inventory management, supporting Ceconomy's expansive European footprint.

Furthermore, Ceconomy cultivates partnerships with service providers to enhance its customer value proposition, offering extended warranties, insurance, and installation services. These collaborations aim to generate recurring revenue and increase customer loyalty by providing comprehensive solutions beyond product sales.

The MediaMarktSaturn marketplace's growth is significantly fueled by its partnerships with third-party sellers, which dramatically expands product variety and creates new commission-based revenue streams. By the close of fiscal year 2023, the marketplace had integrated over 3,000 external vendors, a key factor in its expanding product catalog.

Retail media partnerships are also a critical component, enabling Ceconomy to monetize its vast customer base through targeted advertising. In 2024, the company amplified its retail media initiatives, working with more than 150 brands for advertising campaigns across its digital and physical platforms, contributing an estimated €100 million in advertising revenue.

Ceconomy's financial operations are underpinned by strong relationships with financial institutions and payment processors, facilitating seamless transactions and offering flexible customer financing options. These partnerships are essential for managing cash flow and supporting strategic financial maneuvers, including exploring sustainability-linked bonds to align with ESG goals.

| Key Partnership Area | Examples of Partners | Strategic Importance | 2023/2024 Impact |

| Technology & Appliance Manufacturers | Samsung, Apple, Sony, Bosch, Siemens | Product portfolio diversity, access to new tech | Exclusive launches, co-marketing initiatives |

| Logistics & Supply Chain | Various logistics providers | Efficient product distribution, inventory management | Network optimization for high-volume electronics |

| Service & Solution Providers | Wertgarantie, telecommunication companies | Enhanced customer offerings, recurring revenue | Strengthened product protection services |

| Marketplace Sellers | 3,000+ third-party vendors (as of FY2023) | Expanded product selection, commission revenue | Significant increase in marketplace product availability |

| Retail Media Advertisers | 150+ brands (in 2024) | Monetization of customer base, advertising revenue | Estimated €100 million in advertising revenue |

| Financial Institutions & Payment Processors | Major banks, PayPal, Klarna | Transaction facilitation, customer financing, financial flexibility | Support for retail operations and strategic initiatives |

What is included in the product

This Business Model Canvas provides a detailed overview of Ceconomy's strategy, outlining its customer segments, value propositions, and channels, and reflecting its real-world operations.

Ceconmy's Business Model Canvas offers a structured way to visualize and refine strategic approaches, alleviating the pain of unstructured planning.

It provides a clear, actionable framework that simplifies complex business strategies, reducing the pain of information overload.

Activities

Retail Operations Management is the engine driving Ceconomy's extensive European presence, overseeing more than 1,000 physical stores daily. This includes critical functions like merchandising, keeping shelves stocked and appealing, managing inventory to meet demand efficiently, driving sales through effective strategies, and ensuring excellent customer service to build loyalty.

A key aspect of this activity is the ongoing evolution of store formats. Ceconomy actively modernizes its retail spaces to create more engaging customer experiences. Examples include the development of 'Smart' stores, offering a curated selection and advanced digital integration, and 'Xpress' concepts designed for speed and convenience, each with tailored product assortments to suit local market needs.

Ceconomy's core activities revolve around building and maintaining its omnichannel platform. This involves continuous development of its e-commerce sites, ensuring they are user-friendly and feature-rich. In 2024, the company continued to invest in these digital assets to improve customer experience and expand its online presence.

A significant part of this is the seamless integration of online and offline channels. Think of services like click-and-collect, which were a key focus for enhancing convenience. This strategy aims to bridge the gap between digital browsing and physical purchasing, making it easier for customers to shop how they prefer.

Furthermore, Ceconomy is actively growing its marketplace by onboarding third-party sellers. This expansion broadens the product assortment available to customers and increases the platform's overall appeal. By offering a wider selection, Ceconomy aims to become a go-to destination for electronics and related services.

Ceconomy's product sourcing and category management are crucial for its retail success. In 2024, the company continued to focus on procuring a broad range of consumer electronics and appliances from a diverse supplier base.

This involves strategic negotiation to secure competitive pricing, a key factor in the highly competitive electronics market. For instance, in the fiscal year 2023, Ceconomy emphasized optimizing its supply chain to improve cost efficiency.

Expanding the product portfolio with new subcategories and sustainable options is also a priority. This strategy aims to attract a wider customer base, including environmentally conscious consumers, and stay ahead of market trends in 2024.

Services & Solutions Provision

Ceconomy's core strategy heavily relies on providing a robust suite of value-added services alongside its product offerings. This includes crucial elements like extended warranties, professional installation, and reliable repair services, all designed to bolster customer trust and product longevity.

These services are not just add-ons; they are integral to Ceconomy's revenue diversification and customer retention strategy. For instance, trade-in programs for used devices not only encourage new purchases but also provide a source of refurbished inventory. In the fiscal year 2023, Ceconomy reported significant revenue streams from its service segments, contributing to overall profitability and customer loyalty.

- Extended Warranties and Protection Plans: These offer customers peace of mind and generate recurring revenue for Ceconomy.

- Installation and Setup Services: Facilitating the seamless integration of new electronics, particularly for complex home entertainment or smart home systems.

- Repair and Maintenance: Providing in-house or partnered repair services to extend the lifespan of products and maintain customer satisfaction.

- Trade-in Programs and Telecommunication Contracts: Encouraging device upgrades and securing long-term customer relationships through bundled services.

Marketing, Sales & Customer Engagement

Ceconomy actively pursues robust marketing and sales strategies to capture and hold customer interest throughout its European operations. This involves a mix of advertising, special offers, and customer retention initiatives.

A key aspect of their approach is delivering tailored advice and utilizing customer data to craft personalized promotions, aiming to boost satisfaction and build lasting relationships. In 2024, Ceconomy continued to invest in digital marketing channels, with online sales contributing a significant portion of their revenue growth, reflecting a broader trend in the retail sector.

- Targeted Advertising: Campaigns are designed to reach specific customer segments across various media platforms.

- Promotional Campaigns: Regular sales events and discounts are used to drive traffic and purchase volume.

- Loyalty Programs: Initiatives like membership cards and exclusive offers encourage repeat business.

- Personalized Offers: Leveraging customer data to provide tailored product recommendations and discounts.

Ceconomy's key activities center on managing its extensive retail operations, which span over 1,000 physical stores across Europe, ensuring efficient inventory and compelling merchandising. They are also heavily invested in developing and integrating their omnichannel platform, enhancing e-commerce capabilities and services like click-and-collect to bridge online and offline shopping experiences.

Furthermore, Ceconomy focuses on strategic product sourcing and category management, negotiating competitive pricing and expanding its portfolio with new and sustainable options to meet evolving consumer demands. The company also prioritizes offering a robust suite of value-added services, including warranties, installation, and repairs, to foster customer loyalty and diversify revenue streams.

Finally, Ceconomy employs targeted marketing and sales strategies, leveraging customer data for personalized promotions and investing in digital channels to drive growth and maintain customer engagement.

| Key Activity | Description | 2023/2024 Focus/Data |

|---|---|---|

| Retail Operations | Managing physical stores, inventory, merchandising, and customer service. | Over 1,000 stores; focus on store format evolution (e.g., 'Smart' and 'Xpress' stores). |

| Omnichannel Platform Development | Building and integrating e-commerce, click-and-collect, and marketplace features. | Continued investment in digital assets; growth of third-party seller marketplace. |

| Product Sourcing & Category Management | Procuring diverse electronics, negotiating prices, and expanding product lines. | Focus on supply chain optimization for cost efficiency; expanding into sustainable options. |

| Value-Added Services | Offering warranties, installation, repairs, trade-ins, and telecom contracts. | Significant revenue contribution from services; trade-in programs encourage upgrades. |

| Marketing & Sales | Targeted advertising, promotions, loyalty programs, and personalized offers. | Investment in digital marketing; online sales contributing significantly to revenue growth. |

Delivered as Displayed

Business Model Canvas

The Ceconomy Business Model Canvas preview you're viewing is the exact document you will receive upon purchase. This is not a mockup or a sample; it's a direct snapshot of the complete, professionally formatted file, ready for your immediate use. You'll gain full access to this same comprehensive Business Model Canvas, allowing you to implement its insights without any discrepancies.

Resources

Ceconomy's extensive retail network, comprising over 1,000 MediaMarkt and Saturn stores across Europe, is its most significant physical asset. This widespread presence acts as a crucial interface for customer interaction, enabling sales, product showcases, and essential after-sales support.

These physical locations are vital for Ceconomy's omnichannel strategy, facilitating services like click-and-collect and returns, thereby enhancing customer convenience and reinforcing brand loyalty. In 2023, MediaMarktSaturn reported a significant portion of its sales still originated from its physical stores, underscoring their continued importance.

Ceconomy's robust e-commerce platforms and IT infrastructure are the bedrock of its omnichannel approach. This includes sophisticated online shops and the essential backend systems like inventory management, CRM, and data analytics. For instance, in fiscal year 2023, Ceconomy reported a significant portion of its sales originating from online channels, underscoring the critical role of its digital capabilities in driving revenue and customer engagement.

Ceconomy's MediaMarkt and Saturn brands are powerful intangible assets, fostering trust and authority within Europe's consumer electronics sector. This established brand equity significantly aids in attracting customers, potential partners, and skilled employees, thereby lowering marketing expenditures and cultivating enduring customer loyalty.

Skilled Workforce & Retail Expertise

Ceconomy's skilled workforce is a cornerstone of its operations, with roughly 50,000 employees bringing extensive knowledge in consumer electronics. This expertise is crucial for providing tailored customer advice and managing the intricacies of their product offerings.

The retail expertise within this large employee base underpins Ceconomy's ability to deliver high-quality customer service and technical support across its omnichannel presence. This human capital is directly tied to the effectiveness of their sales strategies and customer engagement efforts.

- Employee Count: Approximately 50,000 staff.

- Core Competencies: Deep expertise in consumer electronics sales, customer service, and technical support.

- Strategic Importance: Essential for personalized advice, managing complex product portfolios, and operating an efficient omnichannel network.

Supplier Relationships & Product Assortment

Ceconomy's supplier relationships are a cornerstone of its business model, providing access to a vast and varied range of consumer electronics. These established partnerships with both global manufacturers and local distributors are key to maintaining a competitive and current product assortment that meets diverse customer demands. For instance, in fiscal year 2023, Ceconomy's MediaMarkt and Saturn brands offered an extensive selection, reflecting the strength of these supplier networks.

The ability to source a wide array of products, including those with a focus on sustainability, at favorable price points is critical for Ceconomy's market standing. This strategic sourcing allows the company to offer compelling value propositions to its customers. In 2024, the company continued to emphasize its commitment to offering a broad product selection, including an increasing number of energy-efficient and eco-friendly devices.

- Global and Local Supplier Network: Access to a broad spectrum of consumer electronics manufacturers and distributors worldwide and within local markets.

- Comprehensive Product Assortment: Ensuring a wide and up-to-date selection of electronics, from the latest gadgets to essential home appliances.

- Competitive Sourcing: Negotiating favorable terms to offer products at attractive prices, enhancing customer value.

- Sustainable Product Sourcing: Increasing the availability of environmentally conscious and sustainable electronic options for consumers.

Ceconomy's key resources extend beyond its physical stores and robust online infrastructure to include its strong brand equity and dedicated workforce. The MediaMarkt and Saturn brands are recognized across Europe, fostering customer trust and reducing acquisition costs. This brand recognition is crucial for attracting customers in a competitive market.

The company’s approximately 50,000 employees are a vital resource, bringing deep expertise in consumer electronics. This human capital is essential for delivering personalized customer advice and technical support, which are key differentiators in their service offering.

Furthermore, Ceconomy's extensive supplier relationships are critical for maintaining a diverse and up-to-date product portfolio. In 2024, the company continued to focus on sourcing a wide range of electronics, including an increasing number of sustainable options, ensuring competitive pricing and product availability.

Value Propositions

Ceconomy provides customers with an extensive and diverse selection of consumer electronics, household appliances, and accessories. This broad assortment includes the latest technological innovations and a wide array of brands, ensuring customers can find products that meet their specific needs and preferences, solidifying its position as a go-to destination for category expertise.

Customers enjoy a flexible shopping journey that seamlessly blends online and physical store interactions. They can research products online, touch and feel them in-store, and complete purchases through whichever channel is most convenient, with options like click-and-collect or home delivery readily available. This integrated approach caters to diverse consumer preferences and enhances overall convenience.

Ceconomy distinguishes itself by providing expert advice and personalized service, guiding customers through their purchase journey both in physical stores and online. This tailored approach, which includes customized recommendations and dedicated support, fosters strong customer relationships and trust.

This commitment to personalized assistance, including help with installation and comprehensive after-sales care, directly addresses a key differentiator against purely online competitors. For instance, in fiscal year 2023, Ceconomy's MediaMarkt and Saturn brands reported significant customer engagement through their advisory services, contributing to a 4% year-over-year increase in customer satisfaction scores in key European markets.

Value-Added Services & Solutions

Ceconomy's value proposition extends significantly beyond just selling electronics. They offer a robust ecosystem of services designed to enhance the customer experience and product utility. This includes options like extended warranties for added product protection, and comprehensive repair services to address any technical issues, ensuring customers can rely on their devices for longer.

Furthermore, Ceconomy facilitates a circular economy approach through its trade-in programs, allowing customers to upgrade their devices while giving old electronics a new life. Coupled with flexible financing options, these services simplify the adoption of new technology and make purchases more accessible. In fiscal year 2023, Ceconomy reported a significant contribution from its services segment, which is crucial for customer retention and increasing the average revenue per user.

These value-added services are key differentiators, simplifying customers' digital lives and fostering loyalty. They also contribute to resource conservation by extending product lifecycles. For instance, in 2023, MediaMarkt and Saturn, key Ceconomy brands, saw increased uptake in their repair and extended warranty offerings, indicating a growing customer preference for these support solutions.

- Extended Warranties: Providing long-term product protection and peace of mind.

- Repair Services: Offering expert technical support to maintain device functionality.

- Trade-in Programs: Facilitating upgrades and promoting sustainable device management.

- Financing Options: Making technology more accessible through flexible payment plans.

Competitive Pricing & Promotions

Ceconomy actively pursues competitive pricing strategies, often featuring attractive promotions across its extensive product range. This dual approach seeks to capture market share by appealing to budget-conscious consumers while simultaneously reinforcing its value proposition for customers who prioritize service and an integrated shopping experience.

In 2024, Ceconomy continued to leverage targeted promotions, such as seasonal sales and bundle offers, to drive foot traffic and online engagement. For example, MediaMarkt’s Black Friday 2024 event saw significant discounts on electronics, contributing to a notable uplift in sales volume during the promotional period.

- Competitive Pricing: Ceconomy aims to be price-competitive, especially in high-volume electronics categories.

- Promotional Activities: Regular sales events and discounts are key drivers for customer acquisition and sales.

- Balancing Price and Service: The strategy is to attract price-sensitive buyers without alienating those who value the overall Ceconomy experience.

- Omnichannel Integration: Promotions are often integrated across online and physical store channels to enhance customer convenience.

Ceconomy's value proposition centers on offering a vast selection of consumer electronics and appliances, coupled with a seamless omnichannel shopping experience. They emphasize expert advice and personalized service, extending beyond the sale with services like repairs and extended warranties. This holistic approach aims to build customer loyalty and differentiate from online-only retailers.

Customer Relationships

Ceconomy cultivates strong customer bonds through personalized service and expert advice, available both in its physical stores and growing online channels. This approach emphasizes building lasting trust over simple transactions.

In 2024, Ceconomy continued to invest in its sales associates, recognizing that knowledgeable staff are key to delivering tailored product recommendations and effective demonstrations. This focus on human interaction aims to differentiate the brand in a competitive market.

Ceconomy prioritizes customer relationships through an omnichannel support strategy, ensuring a consistent and seamless experience across all touchpoints. This means whether a customer browses online, visits a MediaMarkt or Saturn store, or contacts their service team, the interaction feels connected and familiar.

This integrated approach allows for effortless transitions between channels. For instance, a customer might start researching a product online, then visit a physical store to see it, and later call customer service with a question, all while their journey is recognized and supported. This convenience is key to fostering loyalty.

In 2024, Ceconomy continued to invest in digitalizing its customer service. For example, their app and website offer personalized recommendations and order tracking, complementing in-store assistance. This focus on a unified customer journey aims to boost satisfaction and repeat business.

Ceconomy leverages loyalty programs to foster repeat business and collect valuable customer insights. These programs allow for personalized offers, timely product information, and special services, all designed to deepen customer relationships and drive ongoing sales.

In 2024, for instance, MediaMarkt and Saturn, key Ceconomy brands, saw significant engagement through their loyalty initiatives, with members accounting for a substantial portion of total sales. This data-driven approach allows for highly relevant communications, boosting customer retention.

After-Sales Services & Support

Ceconomy enhances customer loyalty through comprehensive after-sales services, extending support well beyond the initial purchase. This commitment includes professional installation, efficient repair services, and the management of extended warranties, all designed to foster trust and ensure a positive product ownership experience.

For instance, in fiscal year 2023, MediaMarktSaturn, a key Ceconomy brand, reported a significant portion of its revenue stemming from services, including installation and repair, indicating the financial importance of these customer relationships. This focus on post-purchase support directly contributes to customer satisfaction and repeat business, solidifying Ceconomy's market position.

- Installation Services: Offering professional setup for electronics and appliances, ensuring immediate customer satisfaction.

- Repair and Maintenance: Providing reliable repair services to address issues and extend product lifespan.

- Extended Warranties: Offering peace of mind through extended warranty programs, covering products beyond the standard manufacturer warranty.

- Customer Support Channels: Maintaining accessible support through various channels like phone, online chat, and in-store assistance.

Community Building & Experience Zones

Ceconomy actively cultivates community by establishing dedicated 'Experience Zones' within its retail spaces. These zones are designed to immerse customers in trending technology areas, such as gaming or electromobility, fostering hands-on interaction with products.

This strategy goes beyond a typical sales encounter, aiming to forge a stronger connection with customers by offering engaging, experiential touchpoints. For instance, MediaMarkt's focus on electromobility allows customers to explore electric bikes and scooters, often with opportunities for test rides.

- Community Engagement: Experience Zones create a hub for tech enthusiasts, fostering a sense of belonging.

- Product Interaction: Customers can directly engage with and test products in a low-pressure environment.

- Brand Loyalty: Immersive experiences build stronger customer relationships and encourage repeat visits.

- Trend Adoption: Showcasing trending technologies positions Ceconomy as a forward-thinking retailer.

Ceconomy prioritizes building lasting customer relationships through personalized service, expert advice, and a seamless omnichannel experience. In 2024, the company continued to invest in its sales associates and digital customer service tools to enhance customer satisfaction and loyalty.

Loyalty programs and comprehensive after-sales services, including installation and repair, are key to fostering repeat business and trust. For instance, in fiscal year 2023, MediaMarktSaturn reported a significant portion of its revenue from services, underscoring the value of these customer touchpoints.

Ceconomy also cultivates community and brand loyalty through in-store 'Experience Zones' that allow for hands-on product interaction with trending technologies, further strengthening customer connections.

Channels

Ceconomy's extensive physical store network, boasting over 1,000 MediaMarkt and Saturn locations across Europe, acts as a crucial touchpoint for customers. These stores facilitate product interaction, immediate purchases, and personalized customer support, reinforcing brand presence and trust. In fiscal year 2023, MediaMarktSaturn generated approximately 21.7 billion euros in revenue, with a significant portion attributable to these brick-and-mortar operations.

The company is actively evolving its retail footprint, introducing innovative store concepts such as 'Smart' and 'Xpress' formats. These adaptations aim to enhance customer convenience and accessibility, catering to diverse shopping preferences and urban environments. This strategic modernization ensures the physical stores remain relevant and competitive in an increasingly digital marketplace.

Ceconomy's extensive online shops, primarily MediaMarkt and Saturn, are cornerstones of its business model, offering a vast selection of electronics and related products. These platforms are not just digital storefronts but integral components of their omnichannel approach, allowing customers to browse, research, and purchase goods conveniently. In fiscal year 2023, Ceconomy reported that its digital business continued to grow, with online sales representing a substantial portion of its overall revenue, underscoring the critical role these channels play in customer engagement and sales.

Integrated mobile applications are a cornerstone of Ceconomy's customer engagement strategy, acting as a central hub for product discovery, price comparisons, and loyalty program management. These apps facilitate seamless purchasing and allow customers to schedule personalized service appointments, thereby enhancing the overall convenience.

By offering a robust mobile presence, Ceconomy effectively bridges the gap between its digital and physical retail environments, creating a truly omnichannel experience. This integration ensures customers can interact with the brand consistently across all touchpoints. For instance, in 2024, a significant portion of retail sales are increasingly influenced by mobile interactions, with many customers using apps for pre-purchase research even when intending to buy in-store.

Online Marketplace Platform

The online marketplace platform is a crucial channel for MediaMarktSaturn, enabling third-party sellers to list their goods. This expansion diversifies Ceconomy's product range, offering customers a wider selection beyond what the company directly stocks. For instance, by the end of fiscal year 2023, MediaMarkt and Saturn’s online platforms saw significant growth in seller participation.

This strategy generates new revenue streams through commission fees on sales and potential listing fees from these external vendors. In 2024, the company continued to invest in enhancing its marketplace capabilities to attract more sellers and improve the customer experience.

- Expanded Product Assortment: Allows third-party sellers to offer a broader selection of electronics and related goods.

- New Revenue Streams: Generates income via commissions on sales and potential seller fees.

- Increased Customer Reach: Attracts a wider customer base by offering a more comprehensive marketplace.

- Platform Growth: By early 2024, the marketplace had onboarded hundreds of new sellers, contributing to a double-digit percentage increase in marketplace GMV.

Retail Media

Retail Media is a crucial channel for Ceconomy, enabling brands to connect with consumers across its extensive physical and digital touchpoints. This includes innovative in-store advertising solutions like InStoreAds, alongside sponsored product placements and other targeted promotional opportunities. These services allow brand partners to directly influence purchasing decisions at the point of sale, leveraging Ceconomy's significant customer reach.

In 2024, Ceconomy's retail media offerings provide brands with a unique avenue to engage with a highly relevant audience. For instance, MediaMarkt and Saturn, key Ceconomy brands, attract millions of shoppers annually, presenting substantial opportunities for advertisers. The channel is designed to deliver measurable results for partners by facilitating direct engagement with a motivated customer base.

- In-store Advertising: Leveraging physical store presence for brand visibility and promotions.

- Digital Advertising: Sponsored product listings and targeted campaigns on e-commerce platforms.

- Customer Reach: Access to a broad and engaged customer base across multiple brands.

- Data-Driven Insights: Opportunities for brands to gain valuable consumer insights through campaign performance.

Ceconomy's omnichannel strategy is reinforced by its integrated mobile applications, serving as a central hub for product discovery, price comparisons, and loyalty programs. These apps enhance customer convenience by allowing for seamless purchasing and personalized service appointments, bridging the gap between digital and physical retail.

The online marketplace is a vital channel, expanding product assortment through third-party sellers and generating new revenue streams via commissions. By early 2024, this marketplace had successfully onboarded hundreds of new sellers, contributing to a double-digit percentage increase in Gross Merchandise Volume (GMV).

Retail Media offers brands targeted advertising opportunities across Ceconomy's extensive physical and digital touchpoints. In 2024, this channel leverages the millions of annual shoppers across MediaMarkt and Saturn to provide measurable results for brand partners through direct engagement.

| Channel | Key Features | 2023/2024 Data/Insights |

|---|---|---|

| Physical Stores | Product interaction, immediate purchase, customer support | Over 1,000 MediaMarkt/Saturn locations; FY23 revenue ~€21.7 billion |

| Online Shops | Vast product selection, omnichannel integration | Continued digital business growth in FY23 |

| Mobile Applications | Product discovery, loyalty management, service appointments | Significant influence on retail sales in 2024 |

| Online Marketplace | Expanded assortment via third-party sellers, commission revenue | Double-digit % GMV increase by early 2024 |

| Retail Media | In-store and digital advertising, brand reach | Leverages millions of annual shoppers for targeted campaigns |

Customer Segments

Mass market consumers represent a vast group seeking everyday electronics and appliances. In 2024, this segment prioritizes value, with many actively comparing prices across various retailers. They appreciate a wide product selection, whether shopping online or in brick-and-mortar stores, valuing the convenience of both avenues.

Tech Enthusiasts and Early Adopters are a core customer group for Ceconomy, actively seeking out the newest and most advanced electronic devices. This segment is characterized by a strong desire for high-performance gadgets and specialized equipment, often driving demand for premium products. For instance, in 2024, the global market for consumer electronics continued its upward trajectory, with a significant portion of growth attributed to these forward-thinking consumers eager to upgrade their tech portfolios.

Service-Oriented Customers seek more than just a product; they're looking for a complete solution. This includes services like extended warranties, professional installation, and reliable repair options. These customers understand that paying a bit extra for these conveniences provides significant value and peace of mind.

In 2024, the demand for these value-added services remained strong. For instance, a significant portion of electronics retailers reported that a substantial percentage of their revenue, often upwards of 20%, came from service contracts and installation fees, demonstrating a clear willingness to pay for these offerings.

Sustainable & Eco-Conscious Buyers

Ceconomy recognizes a significant and expanding group of consumers prioritizing sustainability. These buyers actively seek out energy-efficient electronics, are open to purchasing refurbished devices, and value services that support a circular economy, such as trade-in options and repair services.

Through initiatives like its 'BetterWay' program, Ceconomy is actively addressing this demand. This includes expanding its range of sustainable products and offering services that align with eco-conscious consumer preferences. For example, in fiscal year 2023, Ceconomy reported a notable increase in customer engagement with its trade-in programs, indicating a strong market appetite for extending product lifecycles.

- Growing Demand: A substantial and increasing number of consumers are demonstrating a preference for environmentally responsible purchasing decisions in the electronics sector.

- Circular Economy Focus: Customers are increasingly interested in products and services that promote reuse, repair, and recycling, moving away from a disposable consumption model.

- Ceconomy's Response: The company is actively cultivating this segment through its 'BetterWay' initiative, which encompasses a broader selection of sustainable products and enhanced circular economy services.

- Market Traction: Evidence of this segment's impact is seen in the growing participation in Ceconomy's trade-in programs, reflecting a positive market response to sustainability efforts.

Small Business & Professional Clients (B2B)

Ceconomy extends its reach beyond individual consumers to cater to small businesses and professional clients, recognizing their distinct needs for electronic equipment to support operations. This B2B segment often looks for advantages like bulk purchasing discounts, tailored solutions designed for business environments, and specialized customer support. Reliability and operational efficiency are key drivers for these professional clients.

For instance, in 2024, Ceconomy's MediaMarkt and Saturn brands likely continued to offer business-specific product bundles and services. These could include extended warranties, on-site installation, or dedicated account management, aiming to foster long-term relationships with businesses. The company's strategy would involve understanding the specific technological requirements of various professional sectors, from IT equipment for startups to audiovisual solutions for meeting rooms.

- Bulk Purchasing Power: Small businesses can leverage Ceconomy's scale for cost-effective acquisition of multiple devices, such as laptops, printers, or display screens, essential for their daily operations.

- Business-Specific Solutions: Offering tailored packages, like IT infrastructure setups or specialized software integration, addresses the unique operational demands of professional clients.

- Dedicated Support & Service: Providing priority customer service, extended repair options, and potentially on-site technical assistance ensures minimal disruption to business continuity.

- Focus on Efficiency and Reliability: Small business clients prioritize dependable technology and efficient procurement processes, making Ceconomy's ability to deliver on these fronts crucial for segment growth.

Ceconomy serves a broad spectrum of customers, from everyday consumers seeking value and selection to tech enthusiasts desiring the latest innovations. The company also caters to service-oriented individuals who prioritize convenience and support, as well as a growing segment focused on sustainability and circular economy principles. Additionally, Ceconomy supports small businesses and professional clients with tailored solutions and dedicated service.

Cost Structure

The Cost of Goods Sold (COGS) represents Ceconomy's most significant expense, directly tied to acquiring its extensive range of consumer electronics and home appliances from various manufacturers and suppliers. For instance, in fiscal year 2023, Ceconomy reported a COGS of €16.4 billion, highlighting the sheer volume of products it handles.

Effectively managing this cost hinges on Ceconomy's ability to secure advantageous purchasing agreements and maintain lean, efficient inventory levels. These operational efficiencies are crucial for maintaining competitive pricing and profitability in the dynamic retail landscape.

Ceconomy's operating expenses are substantial, driven by its expansive physical retail footprint. In 2024, the company continued to invest in its over 1,000 stores, covering costs like rent, utilities, and employee salaries. Modernizing these locations also represents a significant expenditure to maintain a competitive customer experience.

Beyond physical stores, online operations contribute to the cost structure. This includes ongoing website development and maintenance, essential digital marketing campaigns to drive traffic, and the operational costs associated with managing fulfillment centers to ensure efficient delivery of online orders.

Ceconomy's logistics and supply chain represent a significant expense. This encompasses warehousing, the movement of goods to their retail locations, and the final delivery to customers' doorsteps. For instance, in fiscal year 2023, Ceconomy invested heavily in optimizing its distribution networks across Europe to manage efficient inbound and outbound flows.

The complexity of operating across numerous European markets means substantial costs are associated with transportation. This includes managing fleets, third-party logistics providers, and the intricate process of last-mile delivery, which is crucial for customer satisfaction and often the most expensive leg of the journey.

Furthermore, Ceconomy must account for reverse logistics – handling product returns, repairs, and recycling. These operations, while necessary for customer service and sustainability, add another layer of cost to their supply chain operations, impacting overall profitability.

Marketing & Sales Expenses

Ceconomy dedicates significant resources to marketing and sales, crucial for driving customer acquisition and brand visibility for its prominent brands, MediaMarkt and Saturn. This investment spans a wide array of channels to reach a broad customer base.

The marketing and sales expenses include substantial outlays for advertising campaigns, both online and offline, designed to highlight product offerings and promotions. Furthermore, costs associated with sales commissions for staff and the operational expenses of customer loyalty programs are integral to this cost structure.

- Advertising and Promotion: Ceconomy invests heavily in advertising across digital and traditional media to attract customers.

- Sales Force Costs: This includes commissions paid to sales personnel, incentivizing them to drive revenue.

- Loyalty Programs: Costs associated with maintaining and operating customer loyalty schemes to foster repeat business.

- Promotional Activities: Expenses related to special offers, discounts, and events designed to boost sales volume.

Personnel Costs

Personnel costs are a significant component of Ceconomy's business model, given its substantial workforce. In fiscal year 2023, Ceconomy employed approximately 50,000 individuals across its various brands, such as MediaMarkt and Saturn. These costs encompass wages, social security contributions, and employee benefits, forming a substantial portion of operating expenses.

Investing in staff development is paramount for Ceconomy's strategy of offering expert advice and a high-quality customer experience. This includes ongoing training programs focused on product knowledge, sales techniques, and customer service. For instance, in 2023, the company continued its efforts to enhance employee skills to meet evolving consumer demands in the electronics retail sector.

- Employee Numbers: Approximately 50,000 employees as of fiscal year 2023.

- Key Cost Drivers: Wages, social security, benefits, and training programs.

- Strategic Importance: Crucial for delivering expert advice and personalized customer service.

- Investment Focus: Continuous training in product knowledge and customer engagement techniques.

Ceconomy's cost structure is heavily influenced by its extensive retail operations and the inherent costs of selling consumer electronics. The Cost of Goods Sold (COGS) is the largest single expense, reflecting the wholesale prices of the vast array of products offered by MediaMarkt and Saturn. In fiscal year 2023, COGS stood at €16.4 billion, underscoring the scale of their procurement. This necessitates efficient supply chain management and strong supplier relationships to maintain competitive pricing and margins.

Operating expenses are also considerable, driven by the maintenance of over 1,000 physical stores across Europe. These costs include rent, utilities, and staff salaries, with ongoing investments in store modernization to enhance customer experience. Digital operations, including website upkeep, online marketing, and fulfillment center management, add further expenses to support their omnichannel strategy.

Logistics and transportation form another significant cost center, covering warehousing, inbound and outbound freight, and the crucial last-mile delivery. Ceconomy's commitment to customer service also extends to reverse logistics, managing product returns and repairs, which adds to operational complexity and cost.

| Cost Category | Fiscal Year 2023 (€ billions) | Key Drivers |

|---|---|---|

| Cost of Goods Sold (COGS) | 16.4 | Product acquisition costs, supplier agreements |

| Personnel Costs | (Estimated) ~5.0-6.0 (based on ~50,000 employees and industry averages) | Wages, social security, benefits, training |

| Marketing & Sales | (Estimated) ~1.0-1.5 (based on revenue and industry benchmarks) | Advertising, promotions, sales commissions, loyalty programs |

| Store Operations | (Estimated) ~1.5-2.0 (based on store count and typical retail overhead) | Rent, utilities, store maintenance |

Revenue Streams

Ceconomy's core revenue comes from selling a wide variety of consumer electronics like TVs and smartphones, alongside household appliances, both in its physical stores and online. This direct sales model forms the backbone of its business.

In fiscal year 2023, Ceconomy reported net sales of €21.7 billion, with a significant portion generated through these product categories. The company also leverages its online marketplace for both its own products and those from third-party sellers, broadening its sales reach.

Ceconomy's Services & Solutions Income is a significant and increasingly profitable revenue source. This segment includes offerings like extended warranties, insurance, installation, and repair services, all contributing to a robust income stream.

For the fiscal year 2023, Ceconomy reported a notable increase in its services and solutions business. This growth underscores its strategic importance as a key area for expansion and enhanced profitability, demonstrating a clear commitment to developing these value-added offerings.

As MediaMarktSaturn grows its online marketplace, it earns revenue by taking a commission from sales made by external sellers on its platform. This adds a valuable income source that benefits from Ceconomy's large customer base.

In fiscal year 2023, Ceconomy reported that its marketplace, particularly MediaMarkt and Saturn, saw significant growth in third-party sales, contributing positively to overall revenue. While specific commission percentages vary, this model effectively monetizes the platform's traffic and trust.

Retail Media & Advertising Income

Ceconomy leverages its significant customer footfall and digital engagement to generate substantial revenue through its retail media and advertising offerings. By providing brands with direct access to a highly engaged consumer base, Ceconomy facilitates targeted marketing campaigns.

This segment is crucial for manufacturers seeking to enhance product visibility and drive sales within Ceconomy's retail environment. In fiscal year 2023/24, Ceconomy reported a notable increase in its retail media segment, with initial figures suggesting a growth trajectory driven by increased brand partnerships and expanded digital advertising capabilities across its MediaMarkt and Saturn platforms.

- Sponsored Product Listings: Brands pay to have their products featured prominently in search results and category pages on Ceconomy's e-commerce platforms.

- In-Store Digital Signage: Opportunities exist for brands to advertise on digital screens located within MediaMarkt and Saturn stores, reaching shoppers at the point of purchase.

- Targeted Email and App Campaigns: Ceconomy offers brands the ability to reach specific customer segments through personalized marketing communications.

- Data-Driven Insights: Brands gain access to anonymized data and analytics to better understand consumer behavior and campaign effectiveness.

Space-as-a-Service & Rental Income

Ceconomy is actively developing Space-as-a-Service models, transforming its extensive physical retail footprint into a valuable asset. This involves leasing dedicated areas within its MediaMarkt and Saturn stores to third-party brands for product launches, demonstrations, and interactive customer experiences.

This strategic shift aims to generate incremental revenue streams beyond traditional product sales, leveraging underutilized retail space. For instance, a tech brand might rent an 'Experience Zone' to showcase its latest innovations, directly engaging potential customers in a high-traffic environment.

In 2024, Ceconomy continued to pilot these initiatives across select markets, seeking to enhance store traffic and create new partnership opportunities. The company views this as a key strategy to adapt to evolving retail landscapes and diversify its income sources.

- Space-as-a-Service: Renting dedicated retail space to partner brands for product showcases and demonstrations.

- Experience Zones: Creating specialized areas within stores designed for immersive brand and product engagement.

- Revenue Diversification: Generating income beyond direct product sales by monetizing physical retail assets.

- Optimized Space Utilization: Maximizing the value of existing store locations through strategic partnerships.

Ceconomy's revenue streams are diverse, encompassing direct product sales, valuable services, marketplace commissions, and innovative retail media and space-as-a-service models. The company's strategic focus on expanding these offerings is designed to create multiple avenues for income generation and enhance overall profitability.

In fiscal year 2023, Ceconomy's net sales reached €21.7 billion, with a significant portion derived from its core electronics and appliance sales. The growth in services and solutions, alongside marketplace and retail media, indicates a successful diversification strategy.

| Revenue Stream | Description | Fiscal Year 2023 Relevance |

| Direct Product Sales | Sale of consumer electronics and appliances in physical stores and online. | Core business, forming the largest portion of €21.7 billion net sales. |

| Services & Solutions | Extended warranties, insurance, installation, and repair services. | Reported notable increase, highlighting strategic importance and profitability. |

| Marketplace Commissions | Commissions earned from third-party sellers on Ceconomy's online platforms. | Significant growth in third-party sales contributed positively to revenue. |

| Retail Media & Advertising | Targeted marketing and advertising opportunities for brands on Ceconomy's platforms. | Notable increase reported, driven by brand partnerships and expanded digital capabilities. |

| Space-as-a-Service | Leasing retail space within stores for brand product launches and experiences. | Piloted in 2024, aiming to diversify income and optimize retail footprint. |

Business Model Canvas Data Sources

The Ceconomy Business Model Canvas is informed by a blend of internal financial data, comprehensive market research reports, and strategic analysis of competitor activities. These diverse sources ensure a robust and data-driven representation of the business.