Ceconomy Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ceconomy Bundle

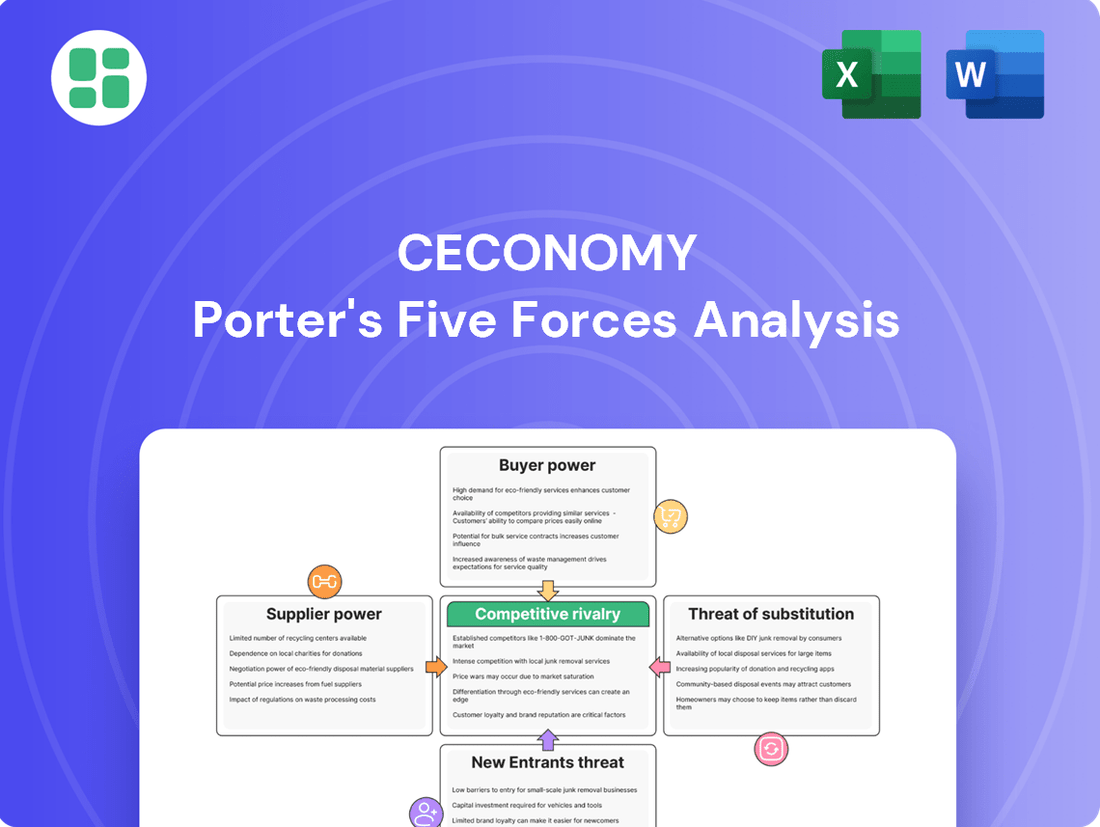

Ceconomy navigates a landscape shaped by intense rivalry and formidable buyer power in the electronics retail sector. Understanding these forces is crucial for any stakeholder looking to grasp the company's strategic positioning.

The complete report reveals the real forces shaping Ceconomy’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The consumer electronics landscape is dominated by a handful of powerful global brands, including giants like Apple, Samsung, Sony, and LG. These brands have cultivated immense consumer loyalty and hold significant market share, which naturally translates into considerable bargaining power when dealing with retailers like Ceconomy.

Ceconomy, like many electronics retailers, is compelled to stock products from these leading brands to remain competitive and attract a broad customer base. This reliance on sought-after products strengthens the suppliers' position, as their offerings are often perceived as non-negotiable components of a compelling retail selection.

Many high-value consumer electronics, like premium smartphones and high-definition televisions, boast unique technologies and robust brand ecosystems. This distinctiveness grants manufacturers significant leverage in setting prices, dictating terms, and managing distribution channels. For instance, in 2024, Apple's iPhone ecosystem continued to command premium pricing due to its integrated hardware, software, and services, demonstrating strong supplier power.

While Ceconomy, a major electronics retailer, benefits from stocking a diverse array of these differentiated products, its dependence on securing consistent access to them can amplify supplier influence during contract negotiations. This reliance means suppliers of these sought-after, unique goods can often dictate terms, impacting Ceconomy's margins and product availability.

While Ceconomy doesn't face explicit financial penalties for switching suppliers, the indirect costs are considerable. The real impact comes from the potential loss of sales and reduced customer traffic if popular brands are removed from its shelves, a significant concern for a retailer like Ceconomy.

This reliance on a broad and appealing brand assortment inherently limits Ceconomy's negotiation leverage. For instance, in 2024, the consumer electronics market saw continued consolidation among major brands, meaning fewer alternatives for retailers like Ceconomy, thereby bolstering the bargaining power of these key suppliers.

Importance of Ceconomy to Suppliers

Ceconomy's position as Europe's largest consumer electronics retailer makes it a vital partner for many suppliers, offering significant market access through its vast network. In 2023, Ceconomy operated over 1,000 physical stores and maintained a strong online presence, facilitating substantial sales volumes for its suppliers.

This extensive reach translates into considerable purchasing power for Ceconomy, which can be leveraged during negotiations. For instance, during the fiscal year 2022/23, Ceconomy reported a revenue of approximately €18.4 billion, underscoring its capacity to influence supplier terms.

The bargaining power of suppliers towards Ceconomy is somewhat mitigated by Ceconomy's scale. However, suppliers of unique or highly sought-after products might still command better terms. Conversely, suppliers of more commoditized electronics may face greater pressure from Ceconomy's buying power.

- Market Access: Ceconomy's over 1,000 stores and online platform provide suppliers with a broad customer base.

- Purchasing Power: With revenues in the billions, Ceconomy can negotiate favorable terms, especially for high-volume purchases.

- Supplier Dependence: For many smaller or specialized electronics manufacturers, Ceconomy represents a critical sales channel, potentially limiting their own bargaining leverage.

- Brand Strength: The bargaining power of a supplier is often directly correlated with the strength and consumer demand for their specific brands.

Forward Integration by Suppliers

A significant trend is the increasing adoption of direct-to-consumer (D2C) sales by major electronics manufacturers. For instance, in 2024, many leading brands expanded their own online storefronts and physical flagship stores, aiming to capture more of the retail margin and customer relationship. This shift directly impacts retailers like Ceconomy by reducing the manufacturers' dependence on them, thereby potentially strengthening the suppliers' bargaining power.

This forward integration by suppliers means manufacturers can bypass traditional retail channels, directly engaging with end customers. This allows them to control the customer experience and gather valuable data. For example, some consumer electronics giants reported a substantial percentage increase in their D2C sales revenue in the first half of 2024 compared to the previous year.

To counter this, Ceconomy must reinforce its unique selling points. These include offering a superior customer experience through expert advice and personalized service, providing bundled solutions and comprehensive after-sales support, and leveraging its extensive market reach and brand recognition. Demonstrating these advantages is crucial for maintaining strong relationships with manufacturers who might otherwise prioritize their own D2C channels.

- D2C Growth: Major electronics manufacturers are increasingly selling directly to consumers, expanding their own online and physical retail presence.

- Supplier Power: This forward integration by suppliers reduces their reliance on traditional retailers, potentially increasing their bargaining power.

- Ceconomy's Response: Retailers like Ceconomy must emphasize their value-added services, such as enhanced customer experience and broad market reach, to remain attractive partners.

Suppliers of popular, differentiated electronics, such as Apple and Samsung, possess significant bargaining power over Ceconomy due to strong brand loyalty and unique technological offerings. This leverage allows them to influence pricing and terms. In 2024, the continued consolidation of major brands in the consumer electronics market further amplified supplier influence, as retailers like Ceconomy have fewer alternative sourcing options.

While Ceconomy's substantial revenue, approximately €18.4 billion in fiscal year 2022/23, grants it considerable purchasing power, suppliers of highly sought-after products can still dictate terms. The increasing trend of manufacturers adopting direct-to-consumer (D2C) sales models in 2024 also reduces their reliance on retailers, potentially strengthening their negotiating position.

| Factor | Impact on Supplier Bargaining Power | Ceconomy's Counter-Strategy |

|---|---|---|

| Brand Strength & Differentiation | High for brands like Apple, Samsung | Focus on value-added services, expert advice |

| Market Access Provided by Ceconomy | Moderate; Ceconomy offers significant reach | Leverage extensive store network and online presence |

| Supplier D2C Expansion (2024 trend) | Increasing; reduces reliance on retailers | Emphasize unique customer experience and bundled solutions |

| Ceconomy's Purchasing Volume | Moderate; mitigates supplier power for commoditized goods | Negotiate favorable terms for high-volume purchases |

What is included in the product

This analysis dissects Ceconomy's competitive environment by examining the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes.

Quickly identify and mitigate competitive threats by visualizing the intensity of each of Porter's Five Forces for Ceconomy.

Customers Bargaining Power

Customers in the European consumer electronics market are highly sensitive to price, actively searching for deals and discounts. This price consciousness is intensified by readily available online price comparison tools and fierce retail competition, forcing companies like Ceconomy to maintain competitive pricing to secure and keep customers, potentially impacting their profitability.

Customers can easily switch between Ceconomy's MediaMarkt and Saturn brands, or to competitors like Amazon or local electronics stores, with very few hurdles. This means if a customer isn't happy with pricing or service, they can quickly move to another retailer. For instance, in 2023, the online retail sector saw significant growth, with e-commerce sales in Germany reaching approximately 87 billion euros, highlighting the vast array of choices available to consumers.

The digital age has significantly empowered customers, giving them unprecedented access to information. Consumers can now easily find product reviews, compare detailed specifications, and check prices across multiple retailers in real-time. This transparency allows them to make more informed purchasing decisions, which in turn strengthens their bargaining power. For instance, in 2024, online price comparison tools are widely used, making it harder for retailers to maintain price discrepancies.

Availability of Alternative Channels

Customers today have a vast array of choices for purchasing electronics and appliances, extending far beyond traditional brick-and-mortar stores. Online retailers such as Amazon, direct-to-consumer websites from manufacturers, and burgeoning online marketplaces offer significant alternatives. This proliferation of channels diminishes customer reliance on any single retailer, putting pressure on pricing and service offerings.

Ceconomy's strategic imperative lies in its robust online presence and its marketplace approach. These initiatives are crucial for maintaining competitiveness in this fragmented, multi-channel retail landscape. For instance, in 2023, the global e-commerce market reached an estimated $6.3 trillion, highlighting the significant shift in consumer purchasing behavior towards online platforms.

- Increased Channel Options: Consumers can buy through online retailers, manufacturer sites, and marketplaces, fragmenting sales.

- Reduced Retailer Dependence: This variety of channels lessens customer loyalty to specific stores, increasing their bargaining power.

- Ceconomy's Digital Strategy: A strong online presence and marketplace participation are essential for Ceconomy to counter this trend.

- Market Data: The global e-commerce market's growth to $6.3 trillion in 2023 underscores the importance of diverse sales channels.

Standardized Product Offerings

The bargaining power of customers is significantly influenced by standardized product offerings in the consumer electronics sector. When products are largely identical across different sellers, customers can easily switch, driving down prices. For instance, a common smartphone model from a major brand offers similar core functionality regardless of where it's purchased. This commoditization forces companies like Ceconomy to compete on factors beyond the product itself.

This shift means that customer loyalty is often built on elements like:

- Customer service quality: Responsive and helpful support can be a key differentiator.

- Delivery speed and convenience: Fast and reliable shipping options are highly valued.

- Financing and payment options: Flexible payment plans can attract price-sensitive buyers.

- Overall shopping experience: A pleasant and easy-to-navigate store or website enhances customer satisfaction.

In 2024, the intense competition in electronics retail, with players like MediaMarkt (part of Ceconomy) and online giants, means that even small differences in these value-added services can sway purchasing decisions. For example, a survey in early 2024 indicated that over 60% of consumers consider delivery speed a critical factor when choosing an online electronics retailer.

Customers possess significant bargaining power due to the highly competitive nature of the consumer electronics market. Their ability to easily compare prices and switch between retailers, both online and offline, forces companies like Ceconomy to be price-competitive. This is further amplified by the availability of numerous alternative sellers, from e-commerce giants to direct-to-consumer brands, diminishing customer reliance on any single retailer.

The digital landscape has undeniably empowered consumers, providing them with extensive product information and real-time price comparisons. In 2024, the widespread use of online comparison tools means customers can readily identify the best deals, putting pressure on retailers to offer attractive pricing and value-added services. For instance, a 2024 survey revealed that 70% of German consumers use price comparison websites before making significant electronics purchases.

| Factor | Impact on Ceconomy | Supporting Data (2024 Estimates/Trends) |

|---|---|---|

| Price Sensitivity | High | Consumers actively seek discounts; online price wars are common. |

| Availability of Substitutes | High | Numerous online and physical retailers offer similar products. |

| Information Availability | High | Online reviews and comparison tools empower informed choices. |

| Switching Costs | Low | Minimal barriers for customers to move between retailers. |

Same Document Delivered

Ceconomy Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces Analysis of Ceconomy, detailing the competitive landscape and strategic implications. The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy, providing actionable insights into industry rivalry, buyer and supplier power, and the threat of new entrants and substitutes.

Rivalry Among Competitors

The European consumer electronics retail sector is a battleground with numerous players. Ceconomy, with its MediaMarkt and Saturn brands, contends with a wide array of competitors, from global giants and strong national retailers to agile online-only businesses.

This intense rivalry means Ceconomy must constantly adapt. In 2024, the market continues to see significant activity from both brick-and-mortar stores and e-commerce platforms, forcing continuous innovation in product offerings, pricing, and customer experience to stay ahead.

Consumers are highly sensitive to price, and with many retailers offering comparable products, the competition to offer the lowest price is fierce. This often leads to frequent sales and deep discounts across the market, directly affecting profit margins for companies like Ceconomy.

In 2024, the consumer electronics retail sector continued to see aggressive pricing strategies. For instance, major online retailers frequently offered price matching and flash sales, with some reports indicating average discounts of 10-15% on popular electronics during peak shopping seasons, putting pressure on brick-and-mortar stores to keep pace.

This intense price competition forces Ceconomy to focus on efficient operations and cost control. To stand out, the company must also differentiate itself through superior customer service, expert advice, and unique in-store experiences, rather than solely relying on price to attract shoppers.

The competitive rivalry within the consumer electronics retail sector is intensifying, largely driven by the significant investments companies are making to perfect their omnichannel strategies. This means creating a smooth, connected experience for customers whether they shop online, in-store, or via mobile. For instance, many retailers are enhancing click-and-collect services and improving in-store digital integration to meet evolving consumer expectations.

Ceconomy, a major player with its well-known MediaMarkt and Saturn brands, is actively participating in this omnichannel race. In 2024, the company continued to focus on digital transformation and optimizing its physical store network. Maintaining a strong competitive position requires ongoing, substantial investment in these areas, alongside a relentless focus on enhancing the overall customer journey across all touchpoints.

Diversification into Services and New Business Models

Competitors are actively diversifying beyond just selling products, moving into services like extended warranties, installation, and financing to create new revenue streams and differentiate themselves. This strategic shift intensifies rivalry, compelling companies like Ceconomy to innovate their service offerings. For instance, in 2024, many electronics retailers saw a significant portion of their profit margins coming from these ancillary services, highlighting their growing importance in a competitive landscape.

The rise of online marketplaces and the increasing sophistication of retail media networks further escalate competitive pressures. These platforms offer new avenues for rivals to reach customers and generate revenue, forcing Ceconomy to continuously refine its own service portfolio and explore emerging business models to maintain its market position. In 2023, retail media networks generated billions in advertising revenue, demonstrating their impact on the retail ecosystem.

- Service Expansion: Competitors are increasingly offering value-added services such as extended warranties, installation, and financing to capture additional revenue and differentiate.

- Marketplace Growth: The proliferation of online marketplaces intensifies rivalry by providing new sales channels and customer access points for competitors.

- Retail Media Impact: The development of retail media networks creates new competitive dynamics, influencing advertising strategies and customer engagement.

- Ceconomy's Response: To remain competitive, Ceconomy must continuously enhance its service portfolio and explore new business models to counter these evolving industry trends.

Market Consolidation and Strategic Shifts

Competitive rivalry within the consumer electronics retail sector is intensifying due to ongoing market consolidation and strategic realignments. Ceconomy itself has engaged in brand optimization, notably by integrating Saturn stores into its MediaMarkt brand in Germany, a move that streamlines operations and enhances brand focus.

This trend of consolidation is mirrored across the European retail landscape, with competitors actively pursuing mergers, acquisitions, or expansions. For instance, in 2023, MediaMarktSaturn, a subsidiary of Ceconomy, continued its strategic focus on optimizing its store portfolio, though specific figures for Saturn store conversions were part of ongoing operational adjustments. These moves create larger, more resource-rich entities capable of exerting greater market influence and potentially entering new geographical territories, thereby heightening the competitive pressure on all players.

- Market Consolidation: Retailers are merging or acquiring to gain scale, as seen with Ceconomy’s integration of Saturn stores into MediaMarkt in Germany.

- Brand Optimization: Companies are rationalizing brands and store formats to improve efficiency and market presence.

- Competitor Expansion: Rivals are seeking growth through mergers, acquisitions, or entering new markets, increasing overall competitive intensity.

- Intensified Rivalry: These strategic shifts lead to a more concentrated market with fewer, but stronger, competitors vying for market share.

Competitive rivalry in consumer electronics retail is fierce, with Ceconomy facing pressure from global players, national chains, and online specialists. Price sensitivity is high, driving frequent discounts, with average discounts of 10-15% on popular items observed in 2024 during peak seasons. This necessitates a focus on cost efficiency and differentiation through service and experience.

Companies are expanding into value-added services like warranties and financing, which accounted for a significant portion of profit margins in 2024 for many retailers. The growth of online marketplaces and retail media networks, which generated billions in advertising revenue in 2023, further intensifies competition, requiring Ceconomy to innovate its service offerings and business models.

Market consolidation, such as Ceconomy's integration of Saturn stores into MediaMarkt in Germany, is a key trend. This creates larger, more influential competitors and heightens overall market rivalry as companies seek scale and market presence through mergers and acquisitions.

| Competitive Factor | Description | 2024 Impact/Observation |

|---|---|---|

| Price Competition | High consumer price sensitivity leads to frequent sales and discounts. | Average discounts of 10-15% on popular electronics during peak seasons. |

| Service Diversification | Expansion into warranties, installation, and financing. | Ancillary services contributed significantly to profit margins in 2024. |

| Digital Channels | Growth of online marketplaces and retail media networks. | Retail media networks generated billions in advertising revenue in 2023. |

| Market Consolidation | Mergers and acquisitions to gain scale and efficiency. | Ceconomy integrated Saturn stores into MediaMarkt in Germany. |

SSubstitutes Threaten

Major electronics manufacturers are increasingly bypassing traditional retailers like Ceconomy by selling directly to consumers online. This direct-to-consumer (D2C) approach, seen with brands like Samsung and Apple, offers customers potentially exclusive deals or product bundles not available through third-party sellers. For instance, in 2024, many manufacturers reported significant growth in their D2C channels, with some seeing over 30% of their sales originating from these platforms.

The expanding market for refurbished and second-hand electronics presents a significant threat of substitutes for Ceconomy. These pre-owned devices, often certified, provide a more affordable alternative for consumers, directly impacting the demand for new products. For instance, the global refurbished electronics market was valued at approximately $55 billion in 2023 and is projected to grow substantially, highlighting the scale of this competitive force.

The rise of subscription and rental models presents a significant threat of substitutes for traditional retail. Consumers are shifting from ownership to access, particularly in areas like digital content, where streaming services have largely replaced physical media purchases. This trend is mirrored in software, with SaaS models becoming dominant, and even in hardware, with hardware-as-a-service gaining traction.

This evolving consumer preference directly impacts the demand for outright purchases of new devices and products. For instance, the global subscription management market was valued at approximately $7.8 billion in 2023 and is projected to grow substantially, indicating a clear move away from one-time purchases. This sustained growth in subscription services signals a long-term substitution threat to traditional retail sales channels.

Cloud-Based Solutions and Services

The rise of cloud-based solutions presents a significant threat of substitutes for traditional hardware sales, particularly for companies like Ceconomy. As more computing tasks, from data storage to sophisticated software applications, move to the cloud, the demand for high-specification, locally installed hardware diminishes. This means consumers and businesses can potentially achieve similar functionality with less powerful, more affordable devices, directly impacting sales of premium laptops, desktops, and servers.

This shift is evident in the growing adoption of Software as a Service (SaaS) and Infrastructure as a Service (IaaS) models. For instance, the global cloud computing market was valued at approximately $597 billion in 2023 and is projected to reach over $1.5 trillion by 2030, showcasing a substantial move away from on-premise solutions. This trend directly substitutes the need for businesses to purchase and maintain their own IT infrastructure, a core market for many electronics retailers.

Consider these implications:

- Reduced Demand for High-End Devices: Cloud-based productivity suites like Microsoft 365 or Google Workspace allow users to perform complex tasks on basic hardware, lessening the appeal of expensive, high-performance laptops.

- Subscription Models as Substitutes: Instead of buying software outright and requiring powerful hardware to run it, consumers can opt for cloud-based subscriptions that offer accessibility across various devices.

- Gaming and Entertainment Shifts: Cloud gaming services, such as Xbox Cloud Gaming and NVIDIA GeForce NOW, offer high-fidelity gaming experiences without the need for powerful gaming consoles or PCs, directly competing with hardware sales.

Digitalization and Software Alternatives

The increasing sophistication of software and mobile technology presents a significant threat of substitutes for Ceconomy. Many functions once requiring specialized electronic devices are now seamlessly integrated into smartphones or accessible via versatile applications, directly impacting the demand for standalone gadgets.

For instance, the widespread adoption of high-quality smartphone cameras has substantially eroded the market for entry-level and mid-range dedicated digital cameras. In 2024, smartphone shipments are projected to reach over 1.17 billion units globally, with camera capabilities being a key selling point, further diminishing the need for separate camera purchases for many consumers.

This broad digitalization trend means that consumers can often achieve similar outcomes with a single, multi-functional device, thereby reducing the overall demand for certain specialized electronic products that Ceconomy offers.

- Smartphone camera capabilities are increasingly competitive with dedicated digital cameras.

- Global smartphone shipments are expected to exceed 1.17 billion units in 2024.

- Versatile software applications can replace the functionality of specialized electronic devices.

- Digitalization reduces the perceived need for multiple single-purpose electronic gadgets.

The threat of substitutes for Ceconomy is multifaceted, encompassing direct-to-consumer sales by manufacturers, the growing refurbished market, and the shift towards subscription and rental models. Furthermore, cloud-based solutions and the increasing capabilities of smartphones directly challenge the demand for traditional hardware sales.

Manufacturers like Samsung and Apple are increasingly selling directly to consumers, a trend that saw significant growth in 2024, with some brands reporting over 30% of sales from these channels. The refurbished electronics market, valued at approximately $55 billion in 2023, offers a more affordable alternative. Additionally, the global subscription management market, projected for substantial growth from its 2023 valuation of $7.8 billion, signals a move away from outright ownership.

The cloud computing market, valued at $597 billion in 2023, is rapidly expanding, reducing the need for high-end on-premise hardware. Simultaneously, smartphones, with over 1.17 billion units projected for shipment in 2024, are integrating more functions, diminishing the demand for specialized devices like entry-level digital cameras.

| Substitute Type | Key Trend/Data Point | Impact on Ceconomy |

|---|---|---|

| Direct-to-Consumer (D2C) | Manufacturer D2C sales grew significantly in 2024; some brands saw over 30% of sales via D2C. | Bypasses traditional retail, potentially impacting Ceconomy's sales volume and margins. |

| Refurbished/Second-Hand Market | Global refurbished electronics market valued at ~$55 billion in 2023, with strong projected growth. | Offers a lower-cost alternative, diverting price-sensitive customers from new product purchases. |

| Subscription/Rental Models | Global subscription management market valued at ~$7.8 billion in 2023, with substantial projected growth. | Shifts consumer preference from ownership to access, reducing demand for outright product purchases. |

| Cloud Computing | Global cloud computing market valued at ~$597 billion in 2023, projected to exceed $1.5 trillion by 2030. | Reduces demand for high-specification hardware as computing tasks move to the cloud. |

| Smartphone Integration | Over 1.17 billion smartphone units projected for shipment in 2024; enhanced camera capabilities. | Diminishes the need for single-purpose devices like basic digital cameras, consolidating functionality. |

Entrants Threaten

The sheer cost of setting up and expanding a widespread physical electronics retail presence is a major hurdle. Think about acquiring prime real estate, stocking numerous stores with diverse products, and designing appealing store layouts; these all require significant upfront cash.

For instance, establishing a new large-format electronics store in a prime European location can easily run into millions of euros for just the initial setup, not to mention ongoing operational costs. This high capital requirement effectively deters many potential new competitors from entering the market.

Furthermore, building and maintaining a robust supply chain and distribution network to support a physical retail footprint adds another layer of substantial investment. This makes it incredibly difficult for smaller, less capitalized entities to compete with established players like Ceconomy.

Ceconomy benefits from substantial brand recognition and deep customer loyalty, a result of decades of effort with its MediaMarkt and Saturn brands. This established trust is a significant barrier; new entrants would need to pour vast sums into marketing to even approach this level of consumer confidence in Europe, where shoppers often favor established names for high-value electronics purchases.

Ceconomy faces a significant threat from new entrants due to the inherent complexity of managing its vast supply chain and intricate logistics. Successfully navigating the procurement and distribution of thousands of electronic products from global manufacturers across diverse European markets requires substantial investment in infrastructure and expertise.

The established warehousing and distribution networks Ceconomy has built over time represent a substantial barrier. For instance, in 2024, Ceconomy operated a network of over 800 stores and numerous logistics hubs across Europe, a scale that would be exceedingly costly and time-consuming for a new player to replicate. This deep-seated operational advantage makes it difficult for newcomers to quickly match Ceconomy's reach and efficiency.

Economies of Scale in Purchasing and Marketing

Ceconomy, as Europe's largest consumer electronics retailer, benefits immensely from economies of scale in purchasing. This allows them to secure better prices and terms from suppliers, a significant hurdle for any new competitor. For instance, in 2023, Ceconomy's procurement volume allowed for substantial discounts, making it challenging for smaller players to match their cost structure.

Furthermore, Ceconomy commands extensive marketing budgets, enabling widespread brand visibility and customer reach. New entrants would find it prohibitively expensive to replicate this level of market penetration, especially when competing against established promotional activities. In 2024, Ceconomy's advertising spend was estimated to be over €100 million, dwarfing what a nascent competitor could realistically allocate.

- Economies of Scale in Purchasing: Ceconomy negotiates favorable terms due to its large order volumes.

- Marketing Budget Advantage: Significant spending on marketing creates a barrier to entry for new players.

- Cost Competitiveness: New entrants struggle to match Ceconomy's price points and promotional intensity.

Regulatory and Compliance Hurdles

Operating across multiple European countries means dealing with a patchwork of consumer protection, environmental, tax, and labor laws. For instance, the WEEE directive on electronic waste requires significant compliance efforts. New entrants face substantial costs and complexities in understanding and adhering to these varied regulations, a challenge Ceconomy has already mastered.

- Regulatory Complexity: Navigating diverse EU consumer protection, environmental (e.g., WEEE directive), tax, and labor laws presents a significant barrier.

- Compliance Costs: Meeting multi-jurisdictional regulatory requirements is expensive and time-consuming for new market entrants.

- Established Expertise: Ceconomy benefits from existing knowledge and infrastructure to manage these complex compliance demands.

The threat of new entrants for Ceconomy is moderate. While the high capital investment for physical retail and complex supply chains present significant barriers, the growing online retail segment offers a lower entry point for digital-first competitors. However, the established brand recognition and economies of scale enjoyed by Ceconomy still provide a considerable advantage.

In 2024, Ceconomy's extensive network of over 800 stores across Europe, coupled with its sophisticated logistics infrastructure, represents a substantial capital investment that new brick-and-mortar entrants would struggle to match. This physical presence, combined with a 2023 procurement volume that secured significant supplier discounts, creates a strong cost advantage.

Furthermore, Ceconomy's estimated €100 million advertising spend in 2024 highlights a significant marketing barrier. New entrants would need to invest heavily to build comparable brand awareness and customer loyalty, especially given the regulatory complexities across various European markets, such as compliance with the WEEE directive.

| Barrier Type | Description | Impact on New Entrants | Ceconomy's Advantage |

|---|---|---|---|

| Capital Requirements | High cost of establishing physical retail and logistics networks. | Significant deterrent for new players. | Established infrastructure and scale. |

| Economies of Scale | Favorable purchasing terms due to large order volumes. | Difficulty matching Ceconomy's cost structure. | Superior negotiation power with suppliers. |

| Brand Recognition | Decades of building trust with MediaMarkt and Saturn. | Requires substantial marketing investment to compete. | Deep customer loyalty and established reputation. |

| Regulatory Compliance | Navigating diverse European laws (consumer, environmental, tax). | Adds complexity and cost for new entrants. | Existing expertise and compliance systems. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Ceconomy is built upon a robust foundation of data, incorporating annual reports, investor presentations, and industry-specific market research from reputable firms.