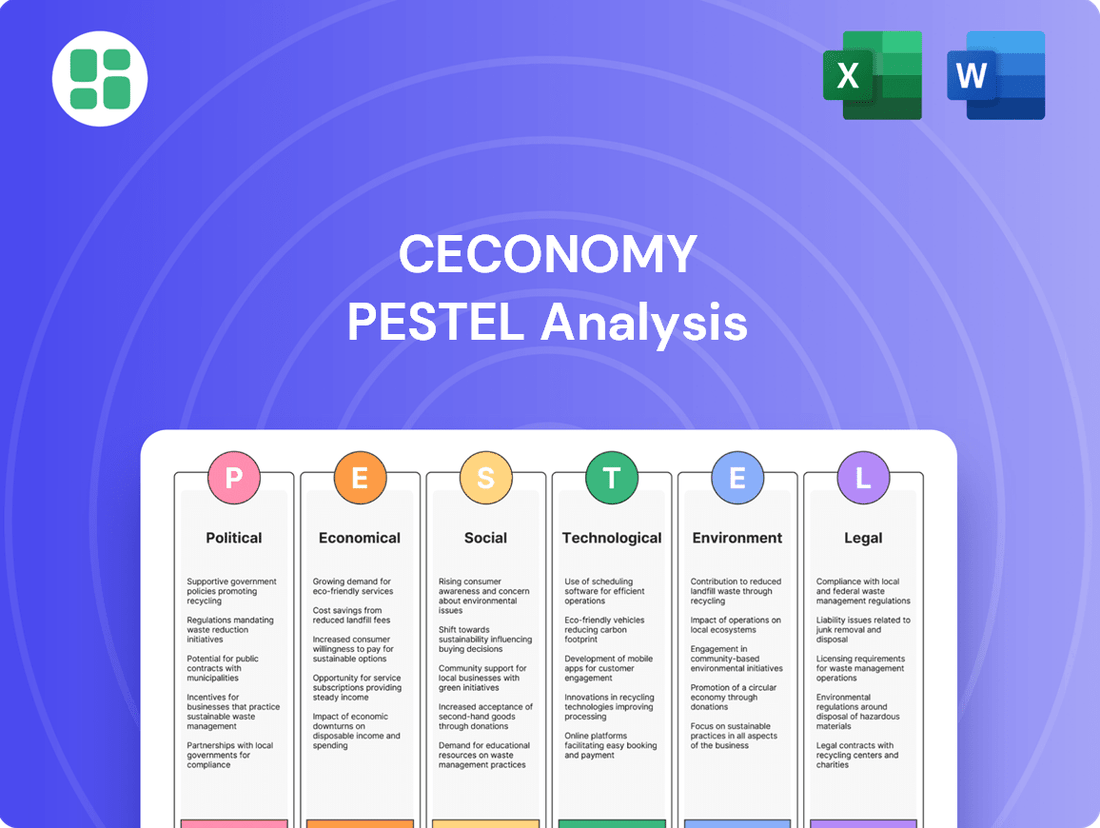

Ceconomy PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ceconomy Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Ceconomy's trajectory. Our comprehensive PESTLE analysis provides the strategic foresight you need to anticipate market shifts and capitalize on emerging opportunities. Download the full report to gain actionable intelligence and empower your decision-making.

Political factors

Ceconomy AG navigates a complex web of government policies and trade regulations across its European operating regions. For instance, the EU's Digital Single Market strategy aims to harmonize digital services, potentially streamlining Ceconomy's online operations, but also introduces new data protection mandates like GDPR. Changes in import tariffs, such as those potentially affecting consumer electronics from Asia, could directly impact sourcing costs and pricing strategies for its MediaMarkt and Saturn brands.

Trade agreements, or their absence, play a crucial role. The UK's post-Brexit trade relationship with the EU, for example, continues to influence customs procedures and potential regulatory divergence for Ceconomy's operations in the region. Furthermore, government incentives for sustainability, like those promoting energy-efficient appliances, could drive demand for certain product categories while requiring adherence to stricter environmental standards, impacting product development and supply chain choices.

Political stability across Ceconomy's European operating regions is a cornerstone for predictable consumer spending and seamless business operations. Instability, whether from broader geopolitical tensions or specific internal political shifts within key markets like Germany, can significantly sway consumer confidence and impact economic policies, directly affecting sales performance and investor sentiment.

For instance, Ceconomy's Q2/H1 2024/25 financial reporting explicitly noted the influence of geopolitical uncertainty and broader investor concerns about European consumer demand on its share price performance, underscoring the direct link between political climate and financial outcomes.

Ceconomy, operating primarily in Germany, faces a complex regulatory landscape. Bureaucratic hurdles can slow down operational adjustments and innovation for retailers. For instance, adapting to new EU directives on consumer protection or digital services, which are increasingly stringent, requires substantial resources and a flexible approach.

The company must navigate evolving national and EU regulations concerning product safety, data privacy, and environmental standards. These changes often necessitate significant investment in compliance and process re-engineering. For example, the EU's Digital Services Act, fully applicable from February 2024, imposes new obligations on online platforms that could impact Ceconomy's e-commerce operations.

Financial forecasts sometimes exclude non-recurring impacts stemming from shifts in the legal environment. This suggests that companies like Ceconomy might experience one-off costs or benefits related to regulatory changes, which are treated as exceptional items rather than ongoing operational factors.

EU Digital Single Market Initiatives

The European Union's ongoing efforts to build a Digital Single Market are designed to create a unified digital economy across its member states. This initiative directly influences Ceconomy's strategy by aiming to harmonize digital regulations, which could streamline online operations and cross-border e-commerce. For instance, the Digital Services Act, which came into full effect in February 2024, imposes new obligations on online platforms regarding content moderation and user protection, potentially impacting how Ceconomy manages its online marketplaces and customer interactions.

While these initiatives can simplify certain aspects of digital trade, they also introduce new compliance requirements. Regulations around data governance, such as the GDPR, continue to shape how companies handle customer information, and new rules for digital services could add further layers of complexity. The EU's Digital Decade targets, aiming for widespread 5G connectivity and digital skills by 2030, underscore the push for digital transformation, encouraging businesses like Ceconomy to expand their online presence.

Ceconomy, as a major player in the European electronics retail sector, benefits from initiatives that foster cross-border e-commerce. The EU's focus on reducing barriers to trade within the digital space encourages companies to scale their online channel presence, particularly on marketplaces and cross-border platforms. In 2023, e-commerce sales in the EU reached an estimated €800 billion, highlighting the significant growth potential in this area.

- Harmonization of Digital Rules: EU Digital Single Market initiatives aim to standardize regulations across member states, impacting Ceconomy's online operations and cross-border e-commerce.

- Compliance Complexities: New regulations on digital services, platforms, and data governance, such as the Digital Services Act, may introduce compliance challenges for Ceconomy.

- E-commerce Growth: The EU's digital push encourages companies to expand their online channel presence, with EU e-commerce sales estimated at €800 billion in 2023.

- Digital Decade Targets: EU goals for widespread 5G and digital skills by 2030 emphasize the importance of digital transformation for businesses like Ceconomy.

Foreign Direct Investment & Takeover Regulations

Foreign Direct Investment (FDI) and takeover regulations are critical political factors impacting Ceconomy. Recent interest from international entities, such as JD.com's exploration of a stake in Ceconomy in late 2023 and early 2024, highlights the sensitivity of these regulations. Any significant investment or acquisition would necessitate approvals from multiple regulatory bodies, including merger control, FDI screening, and foreign subsidies authorities, potentially adding complexity and time to strategic moves.

These regulatory hurdles can shape the feasibility and structure of potential partnerships or acquisitions. For instance, the European Union’s scrutiny of foreign subsidies, as seen in ongoing investigations into various Chinese companies, could influence the terms and likelihood of foreign investment in European businesses like Ceconomy. The German government's own FDI screening processes also play a role in safeguarding national interests.

Key considerations for Ceconomy include:

- Merger Control: Ensuring any proposed transaction meets the thresholds and requirements of competition authorities in relevant jurisdictions.

- FDI Screening: Navigating national security reviews for foreign investments, which have become more stringent globally.

- Foreign Subsidies Regulation: Addressing potential concerns if foreign state-backed entities are involved, impacting deal approvals.

Political stability is paramount for Ceconomy, directly influencing consumer confidence and economic policies across its key European markets. Geopolitical tensions and shifts in national governments can create uncertainty, impacting sales and investor sentiment. For example, Ceconomy's Q2/H1 2024/25 financial reporting acknowledged the impact of geopolitical uncertainty on its share price.

Regulatory landscapes, both at the national and EU level, present ongoing challenges and opportunities. The EU's Digital Services Act, fully applicable from February 2024, imposes new obligations on online platforms, potentially affecting Ceconomy's e-commerce operations and requiring significant compliance investment.

Trade agreements and tariffs are also critical, with potential changes impacting sourcing costs for consumer electronics. The UK's post-Brexit trade relationship with the EU continues to influence customs and regulatory divergence for Ceconomy's operations in the region.

Foreign investment regulations, particularly FDI screening and merger control, are significant political factors. JD.com's exploration of a stake in Ceconomy in late 2023/early 2024 underscores the need to navigate these complex approval processes, which can affect strategic partnerships and acquisitions.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Ceconomy, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making, identifying potential threats and opportunities within Ceconomy's operating landscape.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors for actionable strategic discussions.

Economic factors

High inflation across Europe, especially in Germany, is significantly squeezing consumer budgets, directly impacting discretionary spending on items like consumer electronics. This economic strain naturally leads to more cautious purchasing decisions, which can translate into lower sales and revenue for retailers such as Ceconomy.

For instance, in early 2024, inflation rates in Germany hovered around 2.2%, a notable decrease from the highs of 2023 but still a factor influencing consumer confidence. Ceconomy's financial reports have consistently highlighted the pressure on household spending due to a prolonged weak consumer climate across key European markets, underscoring the direct link between inflation and sales performance.

Slowing economic growth in key European markets presents a significant headwind for Ceconomy. Germany's GDP growth is forecast to be a modest 0.1% for 2025, indicating potential stagnation that can dampen consumer spending on electronics.

This broader economic slowdown directly impacts demand for consumer electronics, affecting Ceconomy's sales volumes and overall profitability. The company is targeting improved adjusted EBIT, with growth anticipated to be driven by its DACH and Western/Southern European segments.

Fluctuations in interest rates directly impact Ceconomy's financing costs. For instance, significant policy rate hikes, such as those seen in Türkiye, can increase the cost of subsidized interest offered to customers, thereby affecting Ceconomy's cash flow.

While these subsidized interest costs are standard market practice, they represent a tangible increase in financial expenses. This directly influences Ceconomy's overall profitability and its free operating cash flow generation.

Supply Chain Costs and Energy Prices

Rising energy prices and increased logistics costs are directly impacting profit margins for many retail businesses, including large electronics sellers like Ceconomy. These elevated operational expenses put pressure on maintaining competitive pricing while safeguarding profitability.

Ceconomy's extensive supply chain, from sourcing components to delivering finished goods, makes it particularly vulnerable to these cost escalations. Managing these pressures effectively is crucial for the company to remain competitive and financially sound.

For instance, global shipping costs saw significant fluctuations in 2024. The Drewry World Container Index, a benchmark for global shipping rates, experienced an average increase of approximately 15% year-over-year in the first half of 2024 compared to the same period in 2023. Similarly, oil prices, a key driver of transportation costs, remained volatile, with Brent crude averaging around $83 per barrel in early 2024, up from approximately $78 per barrel in early 2023, directly affecting fuel surcharges.

- Increased Logistics Expenses: Global shipping rates and fuel costs have risen, directly impacting the cost of moving goods.

- Energy Price Volatility: Fluctuations in oil and gas prices affect transportation and operational costs throughout the supply chain.

- Impact on Profit Margins: Higher supply chain and energy costs can squeeze profit margins for retailers like Ceconomy if not effectively managed.

- Competitive Pricing Challenges: Retailers face the challenge of absorbing these costs or passing them on to consumers, impacting price competitiveness.

Online Market Growth and Marketplaces

The European online consumer electronics market is on a significant upward trajectory, with projections indicating it will reach €107 billion by 2025. A key driver of this expansion is the increasing dominance of online marketplaces, which are anticipated to handle half of all online trade within the same timeframe.

This burgeoning online landscape presents a dual opportunity and challenge for companies like Ceconomy. To capitalize on this growth, a sustained commitment to enhancing omnichannel strategies and expanding marketplace services is crucial for securing a substantial share of this expanding market segment.

- Market Size: European online consumer electronics market expected to reach €107 billion by 2025.

- Marketplace Share: Marketplaces projected to capture 50% of online trade by 2025.

- Strategic Imperative: Continued investment in omnichannel and marketplace offerings is vital for Ceconomy.

Economic factors significantly shape Ceconomy's operating environment. Persistent inflation in key markets like Germany, while easing from 2023 peaks, continues to moderate consumer spending power, impacting discretionary purchases of electronics. For example, German inflation was around 2.2% in early 2024, a figure still influencing cautious buying habits.

Slowing economic growth across Europe adds another layer of challenge. Germany's GDP growth is projected at a modest 0.1% for 2025, signaling a potentially stagnant demand environment for consumer electronics. This economic climate directly affects Ceconomy's sales volumes and profitability targets, with growth anticipated in specific segments like DACH and Western/Southern Europe.

Interest rate fluctuations also play a critical role, affecting financing costs and customer affordability. For instance, policy rate hikes, as seen in Türkiye, can increase the cost of subsidized customer financing, directly impacting Ceconomy's cash flow and profitability.

Rising energy and logistics costs are directly squeezing profit margins. Global shipping rates saw an approximate 15% year-over-year increase in the first half of 2024, while Brent crude averaged around $83 per barrel in early 2024, escalating transportation expenses and challenging competitive pricing strategies.

| Economic Factor | 2024/2025 Data/Trend | Impact on Ceconomy |

|---|---|---|

| Inflation (Germany) | ~2.2% (early 2024) | Reduced discretionary spending, cautious purchasing |

| GDP Growth (Germany) | 0.1% forecast for 2025 | Dampened consumer demand, potential sales stagnation |

| Global Shipping Costs | ~15% YoY increase (H1 2024) | Increased logistics expenses, pressure on profit margins |

| Oil Prices (Brent Crude) | ~$83/barrel (early 2024) | Higher transportation costs, impacting fuel surcharges |

What You See Is What You Get

Ceconomy PESTLE Analysis

The preview shown here is the exact Ceconomy PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This detailed analysis covers Political, Economic, Social, Technological, Legal, and Environmental factors impacting Ceconomy.

You'll gain a comprehensive understanding of the external forces shaping Ceconomy's strategic landscape.

Sociological factors

Consumers increasingly expect a smooth blend of online convenience and in-person interaction, a shift Ceconomy is actively addressing. Their strategy connects physical stores with digital platforms to create a unified shopping journey.

This focus on an omnichannel approach is proving effective, with Ceconomy's online sales accounting for almost 29% of total revenue in the first quarter of the 2024/25 fiscal year. The company is targeting an online share of 30% by the end of fiscal year 2025/26, demonstrating a clear commitment to meeting these evolving consumer demands.

Consumers are increasingly prioritizing environmental impact, driving a notable demand for sustainable and refurbished electronics. This shift reflects a growing societal awareness of resource conservation and waste reduction.

Ceconomy is actively responding to this trend by broadening its range of 'BetterWay' sustainable products and encouraging customers to engage with trade-in programs and purchase refurbished devices. This strategic move aligns with evolving consumer values and market expectations.

The company's commitment to sustainability is already showing tangible results, with sustainable products capturing a significant 25% share of sales in the first quarter of the 2024/25 fiscal year, marking a substantial increase and demonstrating strong market reception.

Europe's digital literacy is on the rise, fueling a strong appetite for smart devices and cutting-edge tech. This means more demand for things like 5G phones and AI cameras. Ceconomy sees this as a positive, as people are more at ease using online services and embracing new gadgets, which in turn boosts sales for them.

In 2024, a significant portion of European consumers are comfortable making purchases online, with e-commerce penetration in the EU expected to reach over 65%. This digital comfort directly translates to increased sales for electronics retailers like Ceconomy, particularly for smartphones, tablets, and smart home technology.

Changing Lifestyles and Home Connectivity

Modern lifestyles are increasingly centered around home connectivity, with consumers seeking integrated smart home ecosystems. This trend directly fuels demand for the consumer electronics that Ceconomy specializes in, ranging from smart speakers to connected kitchen appliances.

The adoption of smart home technologies across Europe reached significant levels, with over 60 million households embracing these innovations by the end of 2023. This widespread adoption underscores a growing market for Ceconomy's product categories.

- Smart Home Adoption: Over 60 million European households utilized smart home technology in 2023.

- Product Alignment: Ceconomy's portfolio directly addresses the growing demand for connected devices.

- Lifestyle Shift: Consumer preferences are shifting towards convenience and automation within the home.

Customer Experience and Service Expectations

Customers today demand more than just products; they expect seamless, personalized interactions. This shift means businesses must focus on creating memorable experiences that foster loyalty.

Ceconomy is actively addressing these evolving expectations. They are rolling out initiatives such as online appointment booking and tailored service concepts designed to enhance the customer journey. A key metric for this is their Net Promoter Score (NPS), which reflects customer satisfaction and willingness to recommend.

The company's commitment to improving customer experience is evident in its recent performance. Ceconomy reported an NPS of 61 points in the second quarter of the 2024/25 fiscal year. This represents a solid increase of 4 points compared to the same period in the previous year, indicating positive traction in meeting customer service expectations.

- Personalized Service: Consumers increasingly value tailored interactions and solutions.

- Digital Integration: Online appointment systems and digital touchpoints are crucial for convenience.

- Customer Loyalty: Initiatives aimed at improving the customer experience directly impact loyalty and advocacy.

- NPS Growth: Ceconomy's NPS rose to 61 in Q2 2024/25, up 4 points year-on-year, signaling progress in customer satisfaction.

Societal shifts are profoundly influencing consumer behavior, pushing for more integrated online and offline shopping experiences. Ceconomy's strategic omnichannel approach, aiming for 30% online sales by FY2025/26, directly caters to this demand, with online sales already reaching nearly 29% in Q1 2024/25.

There's a growing emphasis on sustainability, with consumers actively seeking eco-friendly and refurbished electronics. Ceconomy's 'BetterWay' initiative and trade-in programs are aligning with this trend, with sustainable products capturing 25% of sales in Q1 2024/25.

Rising digital literacy across Europe fuels demand for advanced tech, a trend Ceconomy leverages by offering products like 5G phones and AI cameras, supported by an EU e-commerce penetration expected to exceed 65% in 2024.

The increasing integration of technology into daily life, particularly with smart home ecosystems, presents a significant opportunity for Ceconomy, as over 60 million European households adopted smart home technology by the end of 2023.

Customer expectations have evolved beyond product purchase to personalized experiences, a need Ceconomy addresses through initiatives like online appointment booking, reflected in their improved Net Promoter Score (NPS) of 61 in Q2 2024/25, a 4-point increase year-on-year.

Technological factors

The consumer electronics sector is seeing a significant shift towards online channels, driven by rapid e-commerce advancements. Ceconomy is actively participating in this transformation, as evidenced by its strategic focus on enhancing its digital presence. The company's commitment to its online shops, marketplace, and mobile apps is crucial for capturing market share in this evolving landscape.

Ceconomy's online sales experienced robust growth, increasing by nearly 16% in the first quarter of the 2024/2025 fiscal year. This surge highlights the increasing consumer preference for digital purchasing experiences and the effectiveness of Ceconomy's investments in its e-commerce infrastructure.

The burgeoning smart home and Internet of Things (IoT) market is a key technological driver for Ceconomy. As of 2024, the global smart home market is projected to reach over $150 billion, with continued strong growth expected through 2025. This trend directly benefits Ceconomy by increasing demand for its core product categories, including connected appliances, smart security, and advanced entertainment systems.

Consumers are increasingly seeking integrated and automated living spaces, driving sales of smart thermostats, lighting, and voice-activated assistants. This shift signifies a growing opportunity for Ceconomy to expand its offerings and capture market share within this evolving technological landscape, with smart appliance sales alone expected to see double-digit percentage growth annually in the coming years.

Ceconomy is actively integrating AI and data analytics to sharpen its competitive edge, particularly in boosting online sales. For instance, their 'For-You-Pages' feature, powered by AI, aims to deliver personalized product suggestions, directly impacting customer engagement and conversion rates. This strategic data utilization is crucial for navigating the evolving retail landscape.

5G Network Rollout and Device Compatibility

The ongoing rollout of 5G networks across Europe presents a significant technological driver for Ceconomy. This expansion fuels consumer demand for new devices, particularly 5G-capable smartphones and tablets, as enhanced connectivity unlocks innovative applications and services. By 2025, Europe is expected to have approximately 250 million 5G subscriptions, underscoring the growing market for these upgraded technologies.

Ceconomy is well-positioned to capitalize on this trend by offering a wide range of 5G-enabled devices. The improved network speeds and lower latency associated with 5G encourage consumers to upgrade their existing tech, directly benefiting retailers like Ceconomy. This technological shift is not just about faster internet; it's about enabling new user experiences that necessitate compatible hardware.

Key aspects of this technological factor include:

- Accelerated 5G Deployment: Continued expansion of 5G infrastructure across European markets.

- Device Upgrade Cycle: Increased consumer willingness to purchase new devices to leverage 5G capabilities.

- Market Penetration: Projected growth in 5G subscriptions, reaching an estimated 250 million in Europe by 2025.

Cybersecurity and Data Protection Technologies

Ceconomy's increasing reliance on digital platforms and the sheer volume of customer data it manages necessitate advanced cybersecurity and data protection technologies. Maintaining consumer trust hinges on safeguarding personal information and ensuring the integrity of online transactions, especially with evolving threats.

Compliance with data privacy regulations, such as the GDPR, is a critical technological challenge. In 2024, the global average cost of a data breach reached $4.45 million, highlighting the financial imperative for robust security. Ceconomy must invest in technologies that prevent breaches and ensure swift, compliant responses if they occur.

- Advanced Encryption: Implementing state-of-the-art encryption for data at rest and in transit to protect sensitive customer details.

- Threat Detection and Prevention: Utilizing AI-powered systems for real-time monitoring, identifying, and neutralizing cyber threats before they impact operations.

- Secure Payment Gateways: Ensuring all online transactions are processed through highly secure and certified payment infrastructure.

- Regular Security Audits: Conducting frequent vulnerability assessments and penetration testing to identify and address potential weaknesses in their digital defenses.

Ceconomy's strategic embrace of AI and data analytics is a significant technological factor, enhancing its ability to personalize customer experiences and boost online sales. The company's 'For-You-Pages' feature, driven by AI, exemplifies this, aiming to increase engagement and conversion rates by offering tailored product recommendations.

The rapid expansion of 5G networks across Europe is another key technological driver, stimulating demand for new 5G-compatible devices as enhanced connectivity unlocks innovative applications. With Europe projected to have around 250 million 5G subscriptions by 2025, Ceconomy is positioned to benefit from this upgrade cycle.

The increasing importance of cybersecurity and data protection technologies is paramount for Ceconomy, given its digital reliance and the volume of customer data handled. The average cost of a data breach in 2024, reaching $4.45 million globally, underscores the financial necessity of robust security measures and compliance with regulations like GDPR.

Legal factors

Ceconomy, operating extensively in Europe, must adhere to stringent data protection laws like the GDPR. This means meticulous handling of customer information, from initial collection to secure storage and processing, directly impacting their digital strategies and customer relationship management. Failure to comply can result in substantial penalties, as seen with numerous companies facing fines for data breaches or non-compliance in recent years, underscoring the financial and reputational risks involved.

Ceconomy navigates a complex web of consumer protection laws across Europe, covering everything from product safety standards to warranty provisions and fair advertising. In 2024, for instance, the EU's Digital Services Act continues to shape online marketplaces, impacting how Ceconomy advertises and sells its electronics, with significant fines for non-compliance.

Maintaining high product quality and offering transparent warranties are not just good business practices but legal imperatives. Failure to meet these standards can lead to costly product liability claims, as seen in past cases where retailers faced substantial penalties for selling unsafe goods. In 2025, expect ongoing scrutiny of repairability and sustainability claims under evolving EU regulations.

Ceconomy, as Europe's largest consumer electronics retailer, faces significant oversight from competition authorities. These bodies, like the European Commission, actively monitor its market practices to prevent anti-competitive behavior. For instance, in 2023, the Commission continued its investigations into various sectors for potential antitrust violations, setting a precedent for vigilance over large market players like Ceconomy.

Regulations strictly prohibit actions such as price fixing and the abuse of a dominant market position. These rules directly influence Ceconomy's strategic decisions, including its approach to mergers, acquisitions, and collaborations with suppliers or other businesses. Failure to comply can result in substantial fines, impacting financial performance and market standing.

Product Safety and Environmental Compliance

Ceconomy operates within a stringent legal landscape concerning product safety and environmental compliance. Regulations like the EU's Waste Electrical and Electronic Equipment (WEEE) directive, which aims to increase the collection and recycling rates of e-waste, directly impact how Ceconomy sources, sells, and manages its product lifecycle. For instance, in 2023, the EU reported that approximately 3.4 million tonnes of e-waste were generated, highlighting the scale of the challenge and the importance of compliance.

These legal frameworks necessitate responsible product design, mandating that manufacturers consider recyclability and the use of hazardous substances. Ceconomy must ensure its suppliers adhere to these standards, as non-compliance can lead to significant fines and reputational damage. The company's commitment to sustainability is therefore not just an ethical choice but a legal imperative.

Key legal considerations for Ceconomy include:

- Product Safety Standards: Adherence to regulations like the General Product Safety Regulation (GPSR) in the EU, ensuring all products sold are safe for consumers.

- WEEE Directive Compliance: Meeting targets for collection, recycling, and recovery of electronic waste, often through producer responsibility schemes.

- RoHS Directive: Restrictions on Hazardous Substances in electrical and electronic equipment, limiting the use of materials like lead and mercury.

- Energy Efficiency Labeling: Compliance with energy performance standards and labeling requirements, influencing consumer purchasing decisions and product development.

Labor Laws and Employment Regulations

Ceconomy's operations span multiple countries, each with its own unique labor laws and employment regulations. These rules cover everything from minimum wage and working hours to employee rights, benefits, and the complexities of union relations. Navigating this diverse legal landscape is crucial for effective human resource management and ensuring a stable, motivated workforce. For instance, in Germany, where Ceconomy has a significant presence, the Works Constitution Act (Betriebsverfassungsgesetz) grants substantial co-determination rights to works councils, impacting decisions on working conditions and personnel matters. In 2024, ongoing discussions around the future of work and potential changes to employment contracts, particularly regarding remote work and gig economy regulations, continue to shape the compliance landscape across Europe.

Adhering to these varied legal frameworks is not just a matter of compliance; it directly impacts Ceconomy's ability to attract and retain talent, manage operational costs, and maintain positive employee relations. Failure to comply can lead to significant fines, legal disputes, and damage to the company's reputation. For example, a 2023 report highlighted that labor law violations in the retail sector across the EU resulted in an estimated €2 billion in unpaid wages and penalties. As of early 2025, many European nations are reviewing and updating their labor laws to address evolving work models and economic conditions, requiring continuous vigilance from multinational corporations like Ceconomy.

- Compliance with diverse national labor laws is essential for Ceconomy's HR strategy.

- Employee rights, working conditions, and union relations are key areas governed by these regulations.

- Germany's Works Constitution Act exemplifies the co-determination rights impacting management decisions.

- Ongoing legislative reviews in Europe in 2024-2025 focus on remote work and gig economy regulations.

Ceconomy's adherence to EU competition law is paramount, especially concerning potential antitrust violations and abuse of dominant market positions. The European Commission's ongoing scrutiny of market practices, as seen in 2023 investigations, necessitates strict compliance. Failure to do so can result in substantial fines, impacting financial performance and market standing.

Environmental factors

Ceconomy is navigating a landscape of increasingly rigorous ESG regulations and reporting mandates, which are shaping its strategic direction. The company's dedication to sustainability is clearly demonstrated in its comprehensive sustainability reports and its successful acquisition of a new sustainable credit line, underscoring its proactive approach to environmental and social governance.

Further validating Ceconomy's ESG performance, MSCI reaffirmed its AA rating in April 2025. Additionally, Sustainalytics has recognized Ceconomy's commitment by improving its ESG Risk Rating to 'Low ESG Risk', highlighting the company's robust framework for managing environmental, social, and governance factors effectively.

The global shift towards a circular economy, focusing on repairing, reusing, and recycling electronics, presents a key environmental driver. Ceconomy is embracing this by growing its 'BetterWay' sustainable product range, which already surpassed its 2025 goal of 6,000 items.

This commitment extends to offering robust repair services and encouraging trade-in programs, directly contributing to resource conservation and waste reduction efforts.

Ceconomy has established concrete goals to lower its carbon emissions, aligning with scientific recommendations. These targets encompass Scope 1, 2, and 3 emissions, with significant reductions planned by 2030 and 2032/33, demonstrating a commitment to environmental stewardship.

To achieve these ambitious targets, Ceconomy is implementing operational shifts. This includes enhancing energy efficiency across its facilities, refining logistics to minimize CO2 output, and progressively increasing the proportion of renewable energy sources in its operations.

Energy Consumption and Renewable Energy Adoption

The drive to cut energy use and embrace renewables is a major environmental goal. Ceconomy is actively addressing this, reporting that 100% of its directly purchased electricity in fiscal year 2023/24 was from renewable sources. This commitment is part of a broader effort that has already achieved a 29% decrease in overall energy consumption compared to the 2018/19 baseline.

These efforts demonstrate a clear strategy to mitigate environmental impact through energy management. Key achievements include:

- 100% renewable electricity procurement for directly purchased power in FY 2023/24.

- 29% reduction in total energy consumption achieved since the 2018/19 fiscal year.

- Strategic focus on energy efficiency across operations to meet environmental targets.

E-waste Management and Responsible Disposal

The increasing volume of electronic waste (e-waste) presents a significant environmental challenge, demanding effective management and responsible disposal strategies. Ceconomy, a prominent player in the electronics retail sector, is actively involved in supporting the collection and recycling of used devices. This engagement is crucial for compliance with European Union regulations, such as the Waste Electrical and Electronic Equipment (WEEE) directive, and for fostering a culture of sustainable consumption.

Ceconomy's commitment to e-waste management is underscored by its participation in various take-back programs. For instance, in Germany, retailers are obligated to accept old appliances when new ones are purchased, and Ceconomy offers in-store and online options for customers to return unwanted electronics. This aligns with the EU's goal to increase e-waste collection rates, which stood at approximately 4.1 million tonnes collected in 2022, representing about 45% of the e-waste generated across member states.

- E-waste Generation: Global e-waste generation is projected to reach 74 million tonnes by 2030, highlighting the urgency for effective management.

- Recycling Rates: The EU aims for a 65% collection and recycling rate for e-waste.

- Ceconomy's Role: Facilitates customer returns of old electronics, contributing to higher collection volumes.

- Regulatory Compliance: Adherence to WEEE directives ensures responsible handling and processing of electronic waste.

Ceconomy is actively addressing environmental challenges by embracing the circular economy, evidenced by its expanding 'BetterWay' product range, which surpassed 6,000 items in 2025, exceeding its goal. The company is also making significant strides in reducing its carbon footprint, aiming for substantial reductions in Scope 1, 2, and 3 emissions by 2030 and 2032/33, aligning with scientific recommendations.

The company's commitment to sustainability is further solidified by its operational focus on energy efficiency and renewable energy. In fiscal year 2023/24, 100% of Ceconomy's directly purchased electricity came from renewable sources, contributing to a 29% decrease in total energy consumption since the 2018/19 baseline.

Ceconomy is also a key player in managing electronic waste, supporting take-back programs and adhering to regulations like the EU's WEEE directive. This is crucial as global e-waste generation is projected to reach 74 million tonnes by 2030, with the EU aiming for a 65% collection and recycling rate.

| Environmental Factor | Ceconomy's Action/Status | Key Data/Target | Impact |

| Circular Economy | Growing 'BetterWay' sustainable product range | Exceeded 2025 goal of 6,000 items | Resource conservation, waste reduction |

| Carbon Emissions | Setting emission reduction targets | Goals for 2030 and 2032/33 | Mitigating climate change impact |

| Energy Consumption | Increased renewable energy use, energy efficiency | 100% renewable electricity (FY23/24), 29% energy reduction (vs. FY18/19) | Reduced operational footprint |

| E-waste Management | Supporting take-back programs, regulatory compliance | EU WEEE directive adherence, contributing to collection rates | Responsible disposal, resource recovery |

PESTLE Analysis Data Sources

Our Ceconomy PESTLE analysis is meticulously constructed using data from reputable financial news outlets, economic forecasting agencies, and regulatory bodies. We integrate insights from industry-specific reports and market research firms to ensure a comprehensive understanding of the macro-environment.