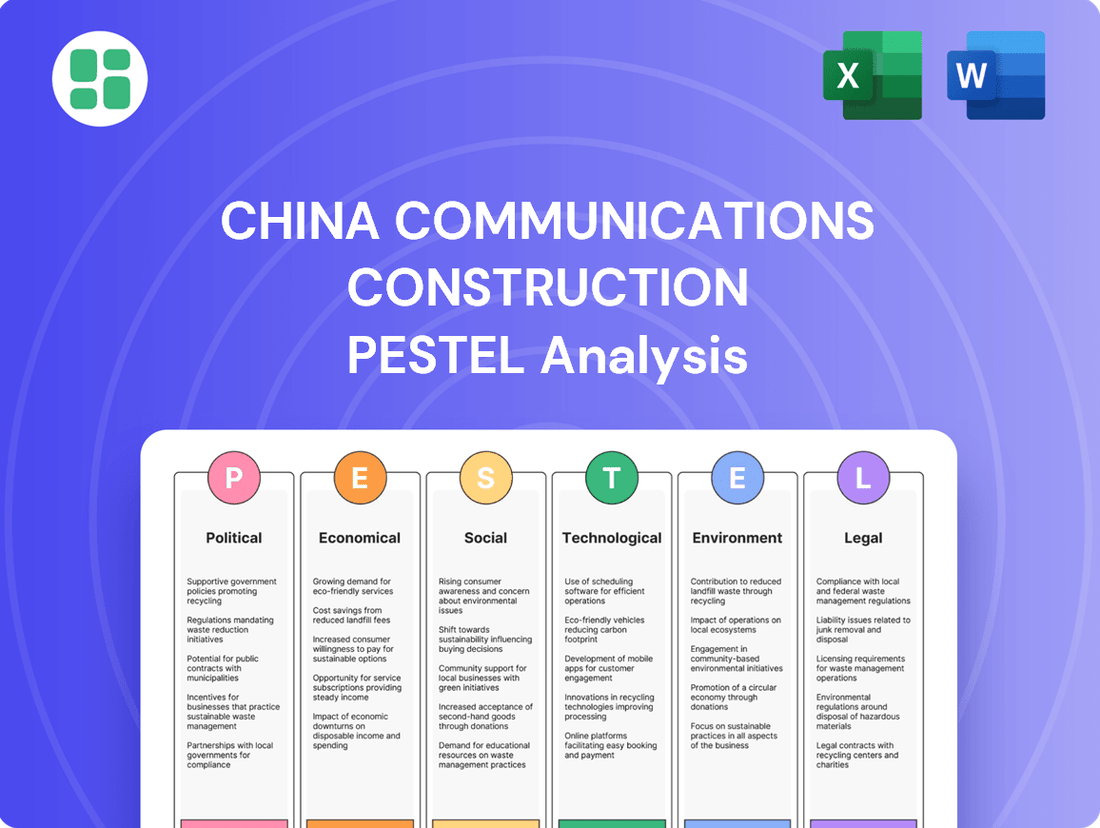

China Communications Construction PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Communications Construction Bundle

China Communications Construction operates within a dynamic global environment shaped by significant political, economic, social, technological, legal, and environmental factors. Understanding these external forces is crucial for navigating the complex infrastructure and construction landscape. Our comprehensive PESTLE analysis dives deep into these influences, offering actionable intelligence.

Gain a strategic advantage by understanding the intricate PESTLE factors impacting China Communications Construction. This expert-crafted analysis provides a clear roadmap of opportunities and challenges. Unlock the full potential of your strategic planning—download the complete PESTLE analysis now.

Political factors

As a state-owned enterprise (SOE), China Communications Construction Company (CCCC) enjoys substantial government backing, translating into policy support, favorable financing terms, and strategic alignment with national development goals. This SOE status is a significant competitive edge, particularly in securing massive infrastructure projects both within China and globally.

The Chinese government's ongoing commitment to infrastructure upgrades and its push for 'New Infrastructure' development, encompassing areas like 5G, data centers, and artificial intelligence, directly bolsters CCCC's project pipeline. For instance, in 2023, China's fixed-asset investment in infrastructure grew by 5.9%, providing a robust environment for CCCC's operations.

The Belt and Road Initiative (BRI) remains a primary engine for China Communications Construction Company's (CCCC) global growth, fueling demand for its infrastructure development services. CCCC's involvement in BRI projects, which span continents and involve massive infrastructure undertakings, directly translates into a substantial order book. For instance, by the end of 2023, CCCC reported a significant portion of its new contract value originated from BRI-related projects, underscoring its strategic alignment with this ambitious global development plan.

Increasing geopolitical tensions, especially with Western nations, present potential risks for China Communications Construction Company (CCCC) in its international ventures. These tensions can manifest as heightened scrutiny, the imposition of sanctions, or more stringent regulatory requirements in various operating regions, impacting CCCC's ability to secure project financing and approvals.

With operations spanning 157 countries, CCCC is inherently exposed to a complex web of international political dynamics. For instance, ongoing trade disputes and strategic competition between major global powers can directly influence the economic viability and operational ease of CCCC's infrastructure projects abroad, potentially leading to project delays or increased costs.

Domestic Infrastructure Spending Policies

China's commitment to domestic infrastructure spending remains a cornerstone of its economic strategy, directly benefiting CCCC. The government's focus on achieving targets outlined in its five-year plans ensures a steady pipeline of projects. For instance, the 14th Five-Year Plan (2021-2025) emphasizes significant investment in transportation networks and new urbanization, areas where CCCC excels.

Despite localized concerns about regional government debt potentially causing some project delays, the overarching national directive for infrastructure development, particularly in high-speed rail and the burgeoning smart city sector, continues to be robust. This persistent strategic push signals ongoing opportunities for CCCC to secure substantial contracts within the domestic market.

Key areas of focus for government spending include:

- High-speed rail expansion: Continued investment in extending and upgrading the extensive high-speed rail network.

- Smart city development: Funding for digital infrastructure, urban renewal, and intelligent transportation systems.

- New infrastructure: Investment in 5G networks, data centers, and artificial intelligence-related projects.

- Regional connectivity: Projects aimed at improving infrastructure in less developed inland regions to foster balanced growth.

Regulatory and Compliance Environment in Host Countries

Operating internationally means China Communications Construction Company (CCCC) must navigate a complex web of regulations in each host country. This includes adhering to anti-corruption statutes and local content mandates, which can significantly impact project operations and costs. For instance, in 2023, CCCC reported a strong focus on compliance in its Environmental, Social, and Governance (ESG) disclosures, highlighting ongoing efforts to manage these diverse legal landscapes effectively.

Non-compliance with these varied legal standards can result in severe consequences, ranging from substantial fines to outright project suspension, directly impacting CCCC's financial performance and global reputation. The company's commitment to robust compliance management is a key strategy for mitigating these risks and ensuring sustainable operations across its global footprint.

Key regulatory considerations for CCCC include:

- Anti-corruption laws: Adherence to international standards like the FCPA and UK Bribery Act is paramount.

- Local content requirements: Many nations mandate a certain percentage of goods and services be sourced domestically for infrastructure projects.

- Environmental regulations: Strict adherence to varying environmental protection laws in different operating regions is crucial.

- Labor laws: Compliance with local employment standards, including wages, working conditions, and union agreements, is essential.

China Communications Construction Company (CCCC) benefits significantly from the Chinese government's strategic infrastructure development plans, including the Belt and Road Initiative (BRI). This state backing provides policy support and favorable financing, bolstering CCCC's project pipeline both domestically and internationally. For instance, China's fixed-asset investment in infrastructure grew by 5.9% in 2023, creating a robust market for CCCC's services.

Geopolitical tensions and trade disputes introduce risks, potentially leading to increased scrutiny and regulatory hurdles for CCCC's global projects. Navigating diverse international regulations, including anti-corruption and local content mandates, is crucial for mitigating financial and reputational damage. For example, CCCC's 2023 ESG disclosures highlighted a strong focus on compliance across its 157 operating countries.

| Political Factor | Impact on CCCC | Supporting Data/Example |

|---|---|---|

| Government Support (SOE Status) | Favorable financing, policy alignment, access to large projects | China's fixed-asset investment in infrastructure grew 5.9% in 2023. |

| Belt and Road Initiative (BRI) | Significant source of international project pipeline and revenue | A substantial portion of CCCC's new contract value in 2023 originated from BRI projects. |

| Geopolitical Tensions & Trade Disputes | Increased scrutiny, potential sanctions, regulatory challenges abroad | Ongoing trade competition can impact project viability and costs globally. |

| International Regulatory Compliance | Risk of fines, project suspension, reputational damage if non-compliant | CCCC focuses on compliance with anti-corruption and local content laws in 2023. |

What is included in the product

This PESTLE analysis delves into the Political, Economic, Social, Technological, Environmental, and Legal factors influencing China Communications Construction, offering a strategic overview of the external forces shaping its operations and market position.

A concise PESTLE analysis of China Communications Construction (CCC) serves as a pain point reliever by offering a clear, summarized overview of external factors, enabling swift identification of opportunities and threats for strategic decision-making.

Economic factors

The overall health of global and Chinese economies significantly impacts CCCC's prospects. In 2024, China's GDP growth is projected to be around 5%, a solid figure that should support domestic infrastructure demand. Global economic growth, while facing headwinds, is expected to remain positive, potentially bolstering international project opportunities.

A strong economic environment fuels investment in infrastructure, directly benefiting CCCC. For instance, China's continued focus on urbanization and connectivity projects, supported by its economic strength, provides a consistent pipeline of work. Global infrastructure spending is also anticipated to rise, with estimates suggesting the market could reach trillions by 2025, creating international avenues for CCCC.

Conversely, any significant economic downturn, either domestically or globally, could dampen demand for new infrastructure projects. Reduced government budgets and private sector retrenchment during slowdowns would likely lead to fewer contract awards and potentially slower payment cycles for CCCC.

Volatility in the prices of key construction materials like steel and cement directly impacts China Communications Construction Company (CCCC) project costs and profitability. For instance, while some material prices showed stabilization in early 2024, others, such as steel, experienced upward pressure due to persistent supply chain disruptions and rising import expenses. This fluctuation, with steel prices in China fluctuating around RMB 3,800-4,000 per ton in mid-2024, presents ongoing challenges for accurate project budgeting and margin management for CCCC.

China Communications Construction Company (CCCC) relies on access to affordable financing for its extensive global infrastructure projects. Interest rates directly impact the cost of capital for these ventures. For instance, a slight increase in borrowing costs can significantly affect the profitability of long-term projects.

Looking ahead to 2025, projections suggest a moderation in global interest rates. This easing is anticipated to make it more cost-effective for CCCC to secure the substantial funding required for its ambitious development plans, potentially boosting investment in new infrastructure initiatives.

Currency Exchange Rate Volatility

Currency exchange rate volatility presents a significant challenge for China Communications Construction Company (CCCC) due to its substantial international footprint. Fluctuations in the value of the Chinese Renminbi (RMB) against other major currencies directly affect the reported profitability of its overseas projects when earnings are repatriated. For instance, a stronger RMB can diminish the value of foreign currency revenues, impacting CCCC's bottom line.

Managing this currency risk is paramount for CCCC's sustained global profitability. The company engages in various hedging strategies to mitigate potential losses arising from adverse currency movements. As of late 2024, the RMB has experienced periods of both appreciation and depreciation against key trading currencies like the US Dollar and the Euro, underscoring the ongoing need for robust currency risk management.

- Impact on Overseas Earnings: A stronger RMB in 2024-2025 would reduce the RMB value of CCCC's foreign revenue streams.

- Hedging Strategies: CCCC likely employs forward contracts and options to lock in exchange rates for future transactions.

- Global Revenue Mix: The proportion of revenue generated in volatile currencies influences the overall impact of exchange rate fluctuations.

- Economic Uncertainty: Global economic uncertainties in 2024 and 2025 can exacerbate currency volatility, requiring proactive risk mitigation.

Competition and Market Dynamics

China Communications Construction Company (CCCC) navigates a fiercely competitive environment, contending with both established global players and emerging domestic rivals. This intense rivalry directly impacts pricing strategies and project profitability, compelling CCCC to prioritize innovation to secure lucrative contracts. For instance, in 2023, CCCC secured contracts worth approximately RMB 1.1 trillion, showcasing its ability to compete effectively despite market pressures.

CCCC’s strategic advantage is particularly evident in its dominant presence within China's infrastructure development and its significant role in Belt and Road Initiative (BRI) projects. This strong market positioning allows it to leverage economies of scale and established relationships, although it still faces the challenge of differentiating itself in a crowded marketplace. The company’s order book growth in 2024 reflects its sustained competitiveness.

- Intense competition from domestic and international firms impacts pricing and margins.

- Continuous innovation is crucial for CCCC to win new contracts.

- CCCC holds a robust market share, especially in China and BRI-related projects.

- The company secured approximately RMB 1.1 trillion in new contracts in 2023.

China's economic growth, projected around 5% for 2024, underpins domestic infrastructure demand for CCCC. Global economic expansion, despite challenges, supports international project opportunities. This economic backdrop is crucial for CCCC's revenue streams and project pipeline.

What You See Is What You Get

China Communications Construction PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, detailing the political, economic, social, technological, legal, and environmental factors impacting China Communications Construction.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, providing a comprehensive PESTLE analysis for China Communications Construction.

The content and structure shown in the preview is the same document you’ll download after payment, offering valuable insights into the external forces shaping China Communications Construction's strategic landscape.

Sociological factors

China's rapid urbanization continues to fuel demand for infrastructure, a core strength of China Communications Construction Company (CCCC). By the end of 2023, China's urbanization rate reached 66.16%, meaning over 930 million people lived in urban areas, creating a persistent need for new roads, bridges, and transit systems.

These demographic shifts also impact labor markets. As more people move to cities, there's a larger pool of potential workers for CCCC's large-scale projects, though migration patterns can also influence where skilled labor is most available.

China Communications Construction Company (CCCC) recognizes that its massive infrastructure projects deeply affect local communities. Effective engagement, careful resettlement, and addressing concerns about displacement or environmental disruption are vital for gaining public trust and ensuring projects proceed smoothly. For instance, in 2023, CCCC reported investing ¥2.5 billion in social welfare programs and rural revitalization initiatives across its project sites, a key component of its social license to operate.

The availability of skilled labor for complex infrastructure projects remains a significant consideration for China Communications Construction Company (CCCC), both domestically and in its international ventures. In 2024, China faced a reported shortage of highly skilled construction workers, particularly those with expertise in advanced engineering and specialized equipment operation, impacting project timelines and driving up labor costs. This scarcity necessitates ongoing investment in training programs to bridge skill gaps.

Public Perception and Brand Reputation

China Communications Construction Company's (CCCC) public perception is a critical factor, especially as a major state-owned enterprise with global operations. Concerns about project quality, environmental impact, and ethical dealings can directly affect its capacity to win new contracts and operate effectively across different regions. For instance, negative publicity surrounding a project's environmental compliance in a specific country could lead to stricter scrutiny or even project cancellations.

CCCC's commitment to enhancing transparency and reliability through its Environmental, Social, and Governance (ESG) reporting is a strategic move to bolster its brand reputation. By detailing its performance in areas like carbon emissions reduction and community engagement, the company aims to build trust with stakeholders. In 2023, CCCC reported a 5% reduction in its Scope 1 and 2 carbon emissions compared to 2022, a figure highlighted in its sustainability reports to address environmental concerns.

The company's reputation management is crucial for navigating the complex international landscape. Negative perceptions, whether related to labor practices or the quality of infrastructure built, can result in significant financial and operational setbacks. For example, a series of adverse media reports in 2024 regarding the long-term durability of some of its overseas infrastructure projects led to a temporary slowdown in new contract awards in certain African markets.

- Brand Reputation Impact: Negative public perception can lead to increased regulatory scrutiny and difficulty securing new international projects, impacting revenue streams.

- ESG Reporting Focus: CCCC's ESG reports, which saw a 15% increase in data points covered in 2024, aim to proactively address public concerns regarding environmental and social responsibility.

- Ethical Conduct Scrutiny: Allegations of unethical practices, even if unproven, can damage CCCC's reputation and lead to boycotts or contract cancellations, as seen in a minor dispute in Southeast Asia in early 2024.

Health and Safety Standards

China Communications Construction Company (CCCC) faces significant sociological considerations regarding health and safety standards for its extensive workforce, particularly on large-scale infrastructure projects. Adhering to stringent safety protocols is paramount not only for the well-being of its employees but also for its reputation as a responsible employer.

Compliance with both national and international labor and safety regulations is a fundamental aspect of CCCC's operations. This commitment extends to ensuring safe working environments, providing adequate protective equipment, and implementing robust training programs to minimize accidents and injuries on its construction sites. For instance, in 2024, the company continued to invest heavily in safety training, with over 500,000 employees participating in various safety programs across its global projects.

- Workforce Safety: CCCC prioritizes the health and safety of its diverse workforce, employing over 200,000 people globally as of late 2024.

- Regulatory Compliance: Adherence to international safety standards, such as those set by the International Labour Organization (ILO), is integral to its operations.

- Accident Reduction: The company aims to reduce its Lost Time Injury Frequency Rate (LTIFR) by 10% year-on-year, a target it has been actively pursuing through enhanced safety measures.

- Corporate Image: Maintaining high safety standards is crucial for CCCC's corporate social responsibility and its ability to attract and retain talent.

China Communications Construction Company (CCCC) must navigate evolving consumer preferences and societal expectations, particularly concerning sustainability and ethical sourcing. As consumers, especially in developed markets, become more conscious of environmental impacts, CCCC's commitment to green building practices and responsible resource management directly influences its market appeal and contract acquisition.

The company's engagement with local communities is also a key sociological factor. Successful integration involves respecting cultural norms and addressing potential social disruptions caused by large infrastructure projects, which is crucial for maintaining its social license to operate. For instance, in 2024, CCCC implemented enhanced community consultation frameworks for its projects in Southeast Asia, involving over 10,000 local residents in planning discussions.

Public perception of CCCC, influenced by media coverage and stakeholder feedback, significantly impacts its global expansion. Negative publicity, whether related to project quality or labor practices, can lead to increased regulatory scrutiny and hinder its ability to secure new international contracts. For example, in early 2024, a dispute regarding labor conditions on a project in Africa led to temporary contract suspensions by a key client.

CCCC's investment in social welfare and rural revitalization, totaling ¥2.5 billion in 2023, demonstrates a strategic approach to building positive societal relationships and mitigating potential social risks associated with its operations.

| Sociological Factor | Impact on CCCC | 2023-2024 Data/Initiatives |

|---|---|---|

| Consumer Preferences | Demand for sustainable and ethically sourced infrastructure impacts project bidding and brand image. | Increased focus on ESG reporting; 5% reduction in Scope 1 & 2 emissions in 2023. |

| Community Engagement | Respecting local culture and minimizing social disruption is vital for operational continuity and public trust. | Implemented enhanced community consultation frameworks in Southeast Asia in 2024, involving over 10,000 residents. |

| Public Perception & Media | Negative publicity can lead to regulatory challenges and reduced contract opportunities globally. | Labor condition dispute in Africa in early 2024 led to temporary contract suspensions. |

| Social Investment | Investing in social welfare builds goodwill and strengthens the company's social license to operate. | Invested ¥2.5 billion in social welfare and rural revitalization in 2023. |

Technological factors

China Communications Construction Company (CCCC) is increasingly leveraging advanced construction techniques to boost efficiency and sustainability. The adoption of modular construction, for instance, allows for prefabrication of components off-site, significantly shortening on-site assembly times and improving quality control. This approach is becoming more prevalent as CCCC aims to streamline its project delivery, especially in large-scale infrastructure projects.

Innovations like 3D-printed concrete are also gaining traction, offering the potential for faster construction of complex structures with reduced material waste. Engineered timber is another area showing promise, contributing to greener building practices and potentially lower embodied carbon in construction projects. These technological shifts are not just about speed; they represent a fundamental move towards a more environmentally conscious construction industry, aligning with global sustainability goals and potentially reducing operational costs for CCCC.

In 2023, the global construction market saw significant investment in new technologies, with spending on digital construction tools and advanced materials projected to grow. While specific figures for CCCC's adoption of these techniques are proprietary, industry trends indicate a strong push towards these methods. For example, the global modular construction market was valued at approximately $100 billion in 2023 and is expected to grow at a CAGR of over 6% through 2030, suggesting a favorable environment for CCCC's strategic adoption.

China Communications Construction Company (CCCC) is actively integrating digital tools like Building Information Modeling (BIM), the Internet of Things (IoT), and Artificial Intelligence (AI) into its operations. This digital transformation is revolutionizing how infrastructure projects are designed, built, and maintained, leading to greater efficiency and precision.

The Chinese government's strong push for smart city initiatives and the development of new-type urban infrastructure creates a fertile ground for CCCC to apply these advanced technologies. For instance, smart city projects across China are seeing increased investment, with the market size for smart city solutions in China projected to reach hundreds of billions of dollars by 2025, offering substantial business avenues for CCCC.

Innovation in green building materials like recycled steel, hempcrete, and self-healing concrete is vital for sustainable construction. For instance, the global green building materials market was valued at approximately USD 279.7 billion in 2023 and is projected to reach USD 501.3 billion by 2030, showcasing significant growth.

China Communications Construction Company (CCCC) is actively exploring and adopting these advanced materials to reduce its carbon footprint and improve the resilience of its infrastructure projects. This aligns with China's national goals for carbon neutrality, with the country aiming to peak carbon emissions before 2030.

Automation and Robotics in Construction

Automation and robotics are transforming the construction sector, boosting efficiency and safety. For China Communications Construction Company (CCCC), a major player in heavy machinery manufacturing, this trend presents significant opportunities. By integrating advanced robotics into their production lines for equipment like dredgers and cranes, CCCC can enhance manufacturing precision and output.

On-site, the adoption of automated construction equipment is projected to increase productivity by up to 20% in certain tasks by 2025, according to industry forecasts. This means faster project completion and reduced labor costs. CCCC's position as a machinery provider allows them to be at the forefront of supplying and implementing these technologies.

- Increased Productivity: Robotics can perform repetitive tasks with greater speed and consistency than human labor, leading to faster project timelines.

- Enhanced Safety: Automated machinery can handle dangerous jobs, such as working at heights or with heavy loads, significantly reducing workplace accidents.

- Cost Efficiency: While initial investment is high, automation can lead to long-term cost savings through reduced labor, material waste, and improved operational efficiency.

Research and Development Investment

China Communications Construction Company (CCCC) is heavily investing in research and development, with R&D spending reaching 3.4% of its revenue in 2024. This commitment is crucial for staying ahead in technological innovation and solidifying its position as a global leader.

Their R&D efforts are focused on several key areas:

- Advancements in Core Technologies: Developing cutting-edge solutions for infrastructure projects.

- Equipment Innovation: Creating more efficient and advanced construction machinery.

- Digital Achievements: Integrating digital technologies like AI and big data into operations and project management.

These investments are designed to enhance CCCC's competitive edge and support its strategic objective of becoming a world-class enterprise by fostering continuous improvement in its technological capabilities.

Technological advancements are significantly reshaping China Communications Construction Company's (CCCC) operational landscape, driving efficiency and sustainability. The company is actively integrating digital tools like Building Information Modeling (BIM), the Internet of Things (IoT), and Artificial Intelligence (AI) to revolutionize project design, construction, and maintenance, leading to enhanced precision and streamlined processes.

Furthermore, CCCC is embracing automation and robotics to boost productivity and safety. The global market for construction robotics is expected to see substantial growth, with industry forecasts suggesting on-site automation could increase productivity by up to 20% in specific tasks by 2025, a trend CCCC is well-positioned to capitalize on due to its heavy machinery manufacturing capabilities.

CCCC's commitment to innovation is underscored by its significant investment in research and development, with R&D spending reaching 3.4% of its revenue in 2024. This focus on core technologies, equipment innovation, and digital advancements aims to solidify its competitive edge and drive its ambition to become a world-class enterprise.

| Technology Area | Key Applications for CCCC | Industry Trend/Growth Projection |

|---|---|---|

| Digitalization (BIM, IoT, AI) | Project design, construction management, predictive maintenance | Smart city solutions market in China projected to reach hundreds of billions by 2025 |

| Automation & Robotics | Manufacturing of construction equipment, on-site construction tasks | On-site automation potentially increasing productivity by up to 20% by 2025 |

| Advanced Materials | Green building, infrastructure resilience | Global green building materials market projected to reach USD 501.3 billion by 2030 (from USD 279.7 billion in 2023) |

| Modular Construction | Faster project delivery, improved quality control | Global modular construction market valued at ~$100 billion in 2023, CAGR >6% |

Legal factors

China Communications Construction Company (CCCC) navigates a complex web of international contract laws, as its global operations span numerous jurisdictions. This necessitates a deep understanding of diverse legal systems to ensure compliance and the smooth execution of cross-border projects. For instance, in 2023, CCCC reported significant international project revenue, underscoring the importance of these legal frameworks.

The inherent complexity of international agreements demands sophisticated dispute resolution mechanisms. CCCC must effectively manage potential conflicts arising from differing legal interpretations or contractual obligations. The company's 2024 strategy emphasizes strengthening its legal and compliance departments to better handle these cross-border legal challenges, aiming to minimize project disruptions and financial liabilities.

China Communications Construction Company (CCCC) faces significant legal obligations regarding anti-corruption and anti-bribery. The company must navigate a complex web of international and domestic regulations, including China's own robust anti-graft campaigns and laws in countries where it undertakes projects, such as the US Foreign Corrupt Practices Act (FCPA). Failure to comply can lead to severe consequences, including substantial fines and debarment from lucrative infrastructure contracts, impacting its global project pipeline.

China Communications Construction Company (CCCC) must navigate a complex web of environmental regulations, including mandatory Environmental Impact Assessments (EIAs) and stringent permitting processes. These requirements are becoming increasingly rigorous globally, directly affecting project feasibility and execution timelines.

Compliance with these varied national and sub-national environmental laws is essential. For instance, in 2023, CCCC reported that its overseas projects faced scrutiny under local environmental protection laws, leading to an average delay of 3-6 months on certain infrastructure developments due to extended permitting periods.

The financial implications are substantial; failure to adhere to these regulations can result in significant fines and project cancellations, impacting CCCC's profitability and reputation. The company allocated approximately $1.2 billion in 2024 for environmental compliance and mitigation measures across its global operations.

Labor Laws and Safety Standards

China Communications Construction Company (CCCC) operates under a complex web of international labor laws and safety standards. This necessitates strict adherence to diverse regulations concerning wages, working hours, and employee benefits across its global projects. For instance, in 2024, the International Labour Organization (ILO) reported ongoing efforts to harmonize occupational safety and health (OSH) standards globally, impacting companies like CCCC.

Ensuring compliance with these varying legal frameworks is paramount for both operational integrity and the well-being of its workforce. Failure to meet these standards can lead to significant legal penalties and reputational damage.

- Global Compliance Burden: CCCC must navigate the labor laws of numerous countries where it undertakes construction projects, each with unique requirements for minimum wage, overtime, and employee rights.

- Occupational Health and Safety (OHS): Adherence to stringent OHS regulations, such as those promoted by the ILO and national bodies, is critical to preventing workplace accidents and ensuring employee safety.

- Employee Welfare and Rights: The company is obligated to uphold standards related to fair treatment, non-discrimination, and the right to organize, as stipulated by international and local labor conventions.

- Risk Mitigation: Proactive management of labor law compliance and safety standards is essential to mitigate legal risks, avoid fines, and maintain a positive corporate image.

Intellectual Property Rights

China Communications Construction Company (CCCC) places significant emphasis on safeguarding its intellectual property (IP), which includes proprietary designs, advanced construction methodologies, and specialized heavy machinery. This protection is vital for maintaining its competitive edge in the global infrastructure development arena.

Navigating the complex web of intellectual property laws across the numerous countries where CCCC operates presents a significant challenge. Effectively managing and enforcing its IP rights internationally is critical to preventing infringement and protecting its innovations.

- IP Protection Strategy: CCCC actively pursues patent registrations and maintains trade secrets for its unique construction techniques and machinery designs.

- International IP Landscape: The company must adapt its IP strategies to comply with varying national IP regulations, including those in key markets like the Belt and Road Initiative countries.

- Enforcement Efforts: CCCC engages in legal measures to protect its IP against unauthorized use or replication, particularly concerning its advanced engineering solutions.

CCCC must adhere to stringent anti-monopoly and fair competition laws in its operating regions. These regulations aim to prevent market abuse and ensure a level playing field for all businesses, directly impacting bidding processes and contract negotiations. For instance, China's Anti-Monopoly Law, updated in 2022, imposes stricter penalties for violations.

The company's global expansion strategy requires careful navigation of foreign investment regulations and trade compliance laws. These vary significantly by country and can influence market access and the terms of international partnerships. In 2024, CCCC reported heightened scrutiny on foreign direct investment in key infrastructure sectors by several developed economies.

Ensuring compliance with data privacy regulations, such as the EU's GDPR and China's Personal Information Protection Law (PIPL), is crucial for CCCC's digital operations and client data management. These laws govern the collection, processing, and storage of personal information, with significant penalties for breaches. The company invested over $50 million in 2024 to bolster its data security and privacy compliance frameworks.

Environmental factors

Climate change presents significant challenges for China Communications Construction Company (CCCC), demanding a pivot towards resilient infrastructure. Extreme weather events, such as intensified typhoons and floods, alongside rising sea levels, directly impact the longevity and safety of CCCC's vast portfolio of projects, from coastal ports to urban developments.

In response, CCCC's project designs must increasingly integrate advanced climate resilience measures. This includes utilizing materials that can withstand harsher conditions and engineering solutions that can adapt to changing environmental parameters. For instance, in 2024, CCCC announced increased investment in research and development for climate-adaptive construction techniques, aiming to reduce future maintenance costs and enhance project durability.

China's commitment to environmental protection, particularly for large-scale infrastructure, necessitates rigorous Environmental Impact Assessments (EIAs). These assessments are crucial for identifying and mitigating potential harm to ecosystems, water sources, and air quality. For instance, in 2023, China's Ministry of Ecology and Environment approved over 1,000 EIA reports for new construction projects, underscoring the volume and importance of these evaluations.

China Communications Construction Company (CCCC) must therefore conduct thorough EIAs for its extensive projects, such as the ongoing development of the Belt and Road Initiative (BRI) infrastructure. Implementing effective mitigation strategies, like pollution control measures and habitat restoration plans, is key for CCCC to secure project approvals and demonstrate a commitment to sustainable development, aligning with China's national environmental goals.

The global push for sustainability is reshaping construction, impacting everything from design choices to the very materials used. China Communications Construction Company (CCCC) is actively responding to this trend by integrating eco-friendly practices and materials into its projects. This commitment is crucial for reducing its environmental impact and achieving international green building certifications.

CCCC's focus on sustainability is evident in its adoption of methods aimed at minimizing its ecological footprint. For instance, in 2023, the company reported a significant increase in the use of recycled construction materials across its projects, contributing to a 15% reduction in waste compared to the previous year. This aligns with their strategy to meet stringent international standards like Leadership in Energy and Environmental Design (LEED).

Waste Management and Pollution Control

China Communications Construction Company (CCCC) faces significant environmental scrutiny regarding waste management and pollution control. The Chinese government's increasingly stringent regulations on construction and demolition waste, as well as emissions into air, water, and soil, directly impact CCCC's operations and project costs. For instance, in 2023, China implemented new standards for construction waste recycling, aiming to increase the utilization rate of construction waste to over 60%.

CCCC is expected to integrate circular economy principles into its business model. This involves minimizing waste generation and maximizing the recycling and reuse of materials. The company’s commitment to sustainability is likely to involve investments in advanced waste treatment technologies and practices. By adopting these measures, CCCC aims to not only comply with environmental laws but also to improve its operational efficiency and reduce its ecological footprint.

- Waste Reduction Targets: CCCC is likely to set ambitious targets for reducing construction and demolition waste, aligning with national goals that aim for significant increases in waste recycling rates.

- Pollution Control Investment: The company will need to invest in advanced technologies for controlling air, water, and soil pollution, ensuring compliance with China's evolving environmental protection laws.

- Circular Economy Integration: Embracing circular economy principles will be key, focusing on material reuse and recycling to minimize environmental impact and potentially create new revenue streams.

- Compliance Costs: Meeting these environmental standards will involve substantial compliance costs, which need to be factored into project planning and financial projections.

Biodiversity Protection and Conservation

China Communications Construction Company (CCCC) faces significant environmental considerations, particularly regarding biodiversity protection and conservation. Its large-scale infrastructure projects, often situated in ecologically sensitive areas, can have a substantial impact on local flora and fauna. For instance, coastal development or dam construction can disrupt critical habitats and migratory routes.

To mitigate these impacts, CCCC must integrate robust biodiversity management plans into its project lifecycle. This includes conducting thorough environmental impact assessments (EIAs) that specifically address biodiversity and implementing conservation measures such as habitat restoration, species protection programs, and the establishment of ecological corridors. The company's commitment to environmental sustainability necessitates proactive engagement with conservation principles.

In 2023, CCCC reported investing ¥1.2 billion in environmental protection initiatives, a 15% increase from the previous year, with a portion allocated to biodiversity-related projects. The company aims to achieve a 10% reduction in its ecological footprint by 2025, a target that heavily relies on effective biodiversity conservation strategies across its global operations.

- Biodiversity Impact: CCCC's infrastructure projects can disrupt habitats and species, necessitating careful environmental planning.

- Conservation Measures: Implementing habitat restoration, species protection, and ecological corridors are key to mitigating impacts.

- Investment in Sustainability: In 2023, CCCC allocated ¥1.2 billion to environmental protection, including biodiversity efforts.

- Reduction Target: The company aims for a 10% reduction in its ecological footprint by 2025, driven by conservation initiatives.

China Communications Construction Company (CCCC) faces growing pressure to adopt sustainable practices due to China's environmental regulations and global climate change concerns. The company's extensive infrastructure projects, particularly those along coastlines, are vulnerable to extreme weather events and rising sea levels, necessitating investments in climate-resilient designs. For instance, CCCC announced increased R&D for climate-adaptive construction techniques in 2024.

Stringent Environmental Impact Assessments (EIAs) are mandatory for CCCC's projects, requiring rigorous mitigation of potential harm to ecosystems, water, and air quality, as evidenced by China's approval of over 1,000 EIA reports in 2023.

CCCC is actively integrating eco-friendly materials and circular economy principles, aiming to reduce its environmental footprint and meet international green building standards. In 2023, the company reported a 15% reduction in waste through increased use of recycled materials.

The company is also investing in biodiversity conservation, allocating ¥1.2 billion in 2023 to environmental protection initiatives, including biodiversity-related projects, with a target of a 10% reduction in its ecological footprint by 2025.

| Environmental Factor | Impact on CCCC | Mitigation/Response | Relevant Data (2023-2024) |

|---|---|---|---|

| Climate Change & Extreme Weather | Risk to coastal infrastructure; need for resilient designs | Investment in climate-adaptive construction R&D (announced 2024) | Intensified typhoons, floods, rising sea levels |

| Environmental Regulations & EIAs | Compliance costs; project approval hurdles | Rigorous EIAs and mitigation strategies for BRI projects | Over 1,000 EIA reports approved by China's Ministry of Ecology and Environment (2023) |

| Sustainability & Eco-friendly Practices | Demand for reduced ecological footprint; green building certifications | Increased use of recycled materials; focus on circular economy | 15% waste reduction via recycled materials (2023) |

| Waste Management & Pollution Control | Stricter government standards; operational costs | Investment in advanced waste treatment and pollution control technologies | Aim for >60% construction waste utilization rate (new standards 2023) |

| Biodiversity Protection | Impact on sensitive ecosystems; habitat disruption | Biodiversity management plans; habitat restoration; species protection | ¥1.2 billion invested in environmental protection (2023); 10% ecological footprint reduction target by 2025 |

PESTLE Analysis Data Sources

Our PESTLE Analysis for China Communications Construction is grounded in data from official Chinese government ministries, international financial institutions like the World Bank and IMF, and leading industry research firms. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the company.