China Communications Construction Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Communications Construction Bundle

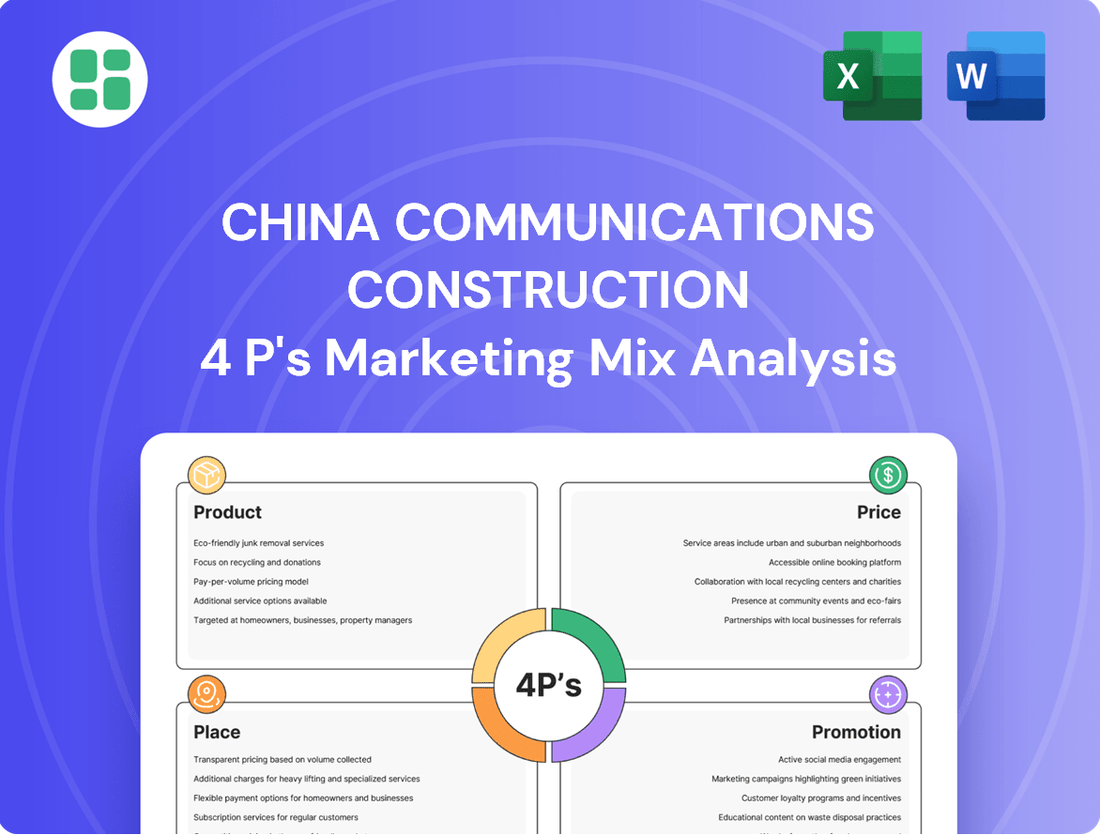

China Communications Construction's marketing prowess lies in its integrated approach to the 4Ps. Discover how their extensive product portfolio, strategic pricing, global reach through established distribution channels, and impactful promotional campaigns contribute to their market dominance.

Go beyond the basics—get access to an in-depth, ready-made Marketing Mix Analysis covering Product, Price, Place, and Promotion strategies for China Communications Construction. Ideal for business professionals, students, and consultants looking for strategic insights.

Product

CCCC's product offering is comprehensive infrastructure solutions, covering everything from the initial design and engineering phases all the way through to construction and ongoing maintenance. This broad scope allows them to tackle massive projects like ports, bridges, roads, railways, and urban transit systems, providing clients with a single point of contact for complex development requirements.

As a dominant force in China's transportation infrastructure, CCCC champions 'big transportation' and 'big city' development strategies. Their core operations revolve around infrastructure construction, design, and dredging, demonstrating a deep expertise across critical sectors. The company's prowess is evident in its completion of significant projects in 2024, including the Shenzhen-Zhongshan Link and the Zhangjiagang-Jingjiang-Rugao Yangtze River Bridge, showcasing their capability in delivering high-profile infrastructure.

China Communications Construction Company (CCCC) extends its expertise into manufacturing specialized heavy machinery, a vital component of its integrated approach to infrastructure development. This includes advanced container cranes and high-capacity dredgers, enabling CCCC to maintain stringent quality control and drive technological innovation.

This manufacturing capability allows CCCC to offer comprehensive project solutions, from equipment supply to execution. A prime example is the christening of 'Jun Guang,' Asia's largest trailing suction hopper dredger, in January 2025 by CCCC Guangzhou Waterway Bureau, highlighting their commitment to cutting-edge deep-sea and land reclamation technology.

China Communications Construction Company's (CCCC) product offering is its unparalleled global project delivery capability. This isn't just about building roads or bridges; it's about their proven track record of successfully executing complex infrastructure projects in 157 countries and regions, navigating diverse regulatory landscapes and local conditions.

This extensive experience allows CCCC to adapt designs and construction methodologies to specific environments while upholding rigorous international quality standards. A prime example of this is their significant involvement in the Belt and Road Initiative, where their expertise in large-scale, cross-border project execution is critical.

For instance, as of late 2024, CCCC's involvement in BRI projects has contributed to the development of key transportation networks, demonstrating their capacity to deliver infrastructure that fosters global connectivity and economic growth. Their operational footprint in over 150 countries underscores their ability to manage multifaceted international projects efficiently.

Dredging and Reclamation Services

China Communications Construction Company (CCCC) offers specialized dredging and reclamation services, a core competency crucial for global maritime infrastructure development. These services are essential for expanding port capacity, maintaining navigable waterways, and creating new landmasses for various development purposes.

The company's expertise is evident in significant projects like the Xiamen-Zhuhai Bridge channel, where they deployed advanced grab and hopper dredgers. This capability positions CCCC as a key player in large-scale land reclamation and port construction, vital for economic growth and trade facilitation.

- Product Specialization: Expertise in large-scale dredging and land reclamation for port development, waterway maintenance, and new land creation.

- Market Relevance: Critical for global maritime infrastructure and coastal development projects.

- Operational Capability: Utilizes advanced equipment such as large grab and hopper dredgers.

- Project Example: Demonstrated success in projects like the Xiamen-Zhuhai Bridge channel.

Integrated Urban Development Solutions

China Communications Construction Company (CCCC) offers comprehensive urban development solutions, a key aspect of its Product strategy. These solutions go beyond traditional infrastructure, integrating smart city technologies and sustainable practices into urban planning, design, and construction. This approach creates interconnected urban systems that are responsive to contemporary societal demands and environmental concerns, reflecting CCCC's commitment to fostering large-scale urban growth.

CCCC's integrated urban development solutions are designed to address complex urban challenges. For instance, in 2024, CCCC was involved in several major smart city initiatives across Asia, aiming to improve traffic flow and energy efficiency. The company's focus on sustainability means incorporating green building materials and renewable energy sources, contributing to lower carbon footprints in urban environments.

- Holistic Urban Planning: CCCC provides end-to-end services from initial concept to final implementation, ensuring seamless integration of various urban components.

- Smart City Integration: Incorporating digital technologies like IoT, AI, and big data analytics to enhance urban management, citizen services, and infrastructure efficiency.

- Sustainable Development: Emphasis on eco-friendly construction, green infrastructure, and resource management to create environmentally responsible urban spaces.

- Interconnected Systems: Developing integrated transportation networks, utility systems, and communication infrastructure for efficient urban functioning.

CCCC's product portfolio is defined by its extensive infrastructure construction capabilities, encompassing everything from design and engineering to execution and maintenance. This broad spectrum covers major projects like ports, bridges, and high-speed rail, offering clients a complete solution. Their manufacturing arm produces specialized heavy machinery, including advanced dredgers and container cranes, ensuring quality control and technological advancement.

The company's product strategy emphasizes large-scale dredging and reclamation services, vital for global maritime development and port expansion. Furthermore, CCCC provides integrated urban development solutions, incorporating smart city technologies and sustainable practices to create efficient and environmentally conscious urban environments. Their global project delivery capability, demonstrated in 157 countries by late 2024, highlights their adaptability and adherence to international quality standards.

| Product Area | Key Offerings | 2024/2025 Highlights |

| Infrastructure Construction | Ports, bridges, roads, railways, urban transit | Shenzhen-Zhongshan Link, Zhangjiagang-Jingjiang-Rugao Yangtze River Bridge completion |

| Specialized Manufacturing | Container cranes, trailing suction hopper dredgers | Christening of Asia's largest trailing suction hopper dredger 'Jun Guang' (Jan 2025) |

| Dredging & Reclamation | Port expansion, waterway maintenance, land creation | Xiamen-Zhuhai Bridge channel dredging |

| Urban Development | Smart city integration, sustainable practices | Involvement in major smart city initiatives across Asia (2024) |

What is included in the product

This analysis provides a comprehensive 4P's marketing mix breakdown for China Communications Construction, detailing their Product offerings, Pricing strategies, Place of operations, and Promotion tactics, grounded in real-world practices.

Provides a clear, actionable framework for understanding and optimizing China Communications Construction's marketing strategy, alleviating the pain of complex market analysis.

Simplifies the intricate 4Ps of China Communications Construction's marketing into a digestible format, relieving the burden of deciphering dense strategic documents.

Place

China Communications Construction Company (CCCC) operates globally through direct project execution, establishing temporary operational hubs at construction sites worldwide. This hands-on approach, evident in its presence across 139 countries and regions as of late 2024, allows for precise management and adaptation to diverse local environments, crucial for delivering large-scale infrastructure projects.

China Communications Construction Company (CCCC) strategically positions itself with a robust network of global and regional offices. These hubs are vital for driving business development, managing complex projects, and fostering strong client relationships worldwide. For instance, as of recent reporting, CCCC operates 22 offices in the Americas, 20 in Europe, 42 in Africa, 41 across Asia, and 4 in Oceania, demonstrating a significant international footprint.

China Communications Construction Company (CCCC) primarily utilizes direct distribution channels to reach governmental and institutional clients. This involves direct engagement with national governments, state-owned enterprises, and multilateral development banks. For instance, CCCC's involvement in infrastructure projects under the Belt and Road Initiative (BRI) showcases this direct approach, securing contracts through public tenders and bilateral agreements.

The company's strategy centers on securing large-scale public and quasi-public projects. In 2023, CCCC reported significant new contract acquisitions, with a substantial portion stemming from government-backed infrastructure initiatives across various regions, reflecting the importance of these institutional channels in its revenue generation.

Supply Chain and Logistics Networks

China Communications Construction Company (CCCC) leverages its extensive global supply chain and logistics network as a cornerstone of its 'Place' strategy. This intricate system is crucial for the timely and efficient delivery of heavy equipment, essential materials, and specialized labor to diverse and often remote project locations worldwide.

Effective inventory management and sophisticated transportation solutions are paramount to maintaining project schedules and controlling costs. CCCC's integrated approach, supported by its robust manufacturing capabilities, ensures a seamless flow of resources, directly impacting project success and profitability.

- Global Reach: CCCC operates in over 150 countries, demonstrating the breadth of its logistics network.

- Efficiency Gains: In 2023, the company reported significant improvements in project delivery times, attributed to optimized logistics, with some projects seeing a 10% reduction in transit times for key components.

- Resource Management: The company manages a vast inventory of construction machinery and materials, with an estimated value exceeding $20 billion, ensuring availability for its numerous global projects.

International Financial Institutions and Partnerships

China Communications Construction Company (CCCC) strategically leverages international financial institutions and development banks to secure funding for its large-scale, complex projects. These partnerships are vital for accessing the capital needed to undertake significant infrastructure development globally. For instance, in 2023, CCCC secured significant financing from multilateral development banks for projects in Southeast Asia, demonstrating their reliance on these entities.

Furthermore, CCCC actively forms partnerships with local construction firms and consultants. These collaborations are essential for navigating new markets, understanding local regulations, and accessing specialized expertise. Their acquisition of a Brazilian construction firm in late 2024, aimed at bolstering their South American operations, exemplifies this strategy of using local partnerships to expand market reach and operational capabilities.

- Project Financing: CCCC's access to capital is often facilitated by partnerships with institutions like the Asian Development Bank (ADB) and the World Bank, crucial for funding infrastructure projects exceeding billions of dollars.

- Market Entry: Local partnerships provide essential on-the-ground knowledge and regulatory navigation, enabling smoother market entry and project execution in diverse international environments.

- Risk Mitigation: Collaborating with established local entities helps mitigate political, economic, and operational risks associated with undertaking projects in unfamiliar territories.

- Knowledge Transfer: These partnerships foster the exchange of technical expertise and best practices, enhancing CCCC's capabilities and contributing to sustainable development.

CCCC's "Place" strategy centers on its extensive global operational presence and distribution network. This involves direct project execution at numerous international sites, supported by a robust network of regional offices and strategic local partnerships. The company leverages its significant supply chain and logistics capabilities to ensure efficient resource delivery, crucial for managing large-scale infrastructure projects across diverse geographies.

| Aspect | Description | 2023/2024 Data/Examples |

|---|---|---|

| Operational Hubs | Direct project execution at construction sites worldwide. | Active in 139 countries and regions by late 2024. |

| Global Offices | Network for business development and project management. | 22 in Americas, 20 in Europe, 42 in Africa, 41 in Asia, 4 in Oceania. |

| Distribution Channels | Direct engagement with government and institutional clients. | Secures contracts via public tenders and bilateral agreements, notably within the Belt and Road Initiative. |

| Supply Chain & Logistics | Ensuring timely delivery of equipment and materials. | Managed inventory of construction machinery and materials valued over $20 billion. Reported 10% reduction in transit times for key components in 2023 due to optimized logistics. |

| Partnerships | Collaboration with local firms and financial institutions. | Acquired a Brazilian construction firm in late 2024. Secured financing from institutions like the Asian Development Bank for projects. |

Full Version Awaits

China Communications Construction 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive China Communications Construction 4P's Marketing Mix Analysis is fully complete and ready for your immediate use, detailing Product, Price, Place, and Promotion strategies.

Promotion

China Communications Construction Company's (CCCC) success in securing major infrastructure projects is deeply intertwined with its adeptness in government relations and diplomacy. As a state-owned enterprise, these relationships are paramount, enabling CCCC to navigate complex regulatory landscapes and secure advantageous project terms.

CCCC actively engages in high-level dialogues with national and local governments, cultivating trust and ensuring alignment with state development priorities. This strategic approach is crucial for its participation in large-scale public works, such as the Belt and Road Initiative, where government backing is essential for project feasibility and execution.

In 2023, CCCC reported significant growth, with revenue reaching approximately ¥930 billion RMB, underscoring the effectiveness of its government-backed strategies. This financial performance highlights how strong diplomatic ties translate directly into market opportunities and project acquisition, particularly within China's ambitious infrastructure development plans.

China Communications Construction Company (CCCC) strategically leverages participation in key international industry events to bolster its global presence. These engagements, including major trade fairs and infrastructure summits, serve as crucial platforms for showcasing technological advancements and successful project portfolios. For instance, CCCC's presence at events like the Global Sustainable Transport Forum in 2024 highlights its commitment to sustainable infrastructure solutions, attracting potential clients and partners worldwide.

China Communications Construction Company (CCCC) actively uses its Corporate Social Responsibility (CSR) initiatives as a key promotional element, showcasing a dedication to the communities where it operates, environmental stewardship, and upholding ethical standards. This approach builds goodwill and reinforces its brand image globally.

The company has established the 'Build Your Future Dream' social responsibility brand, a worldwide initiative designed to connect with and uplift local populations. This brand serves as a powerful vehicle for communicating CCCC's commitment to positive societal impact beyond its core construction projects.

Further solidifying its CSR narrative, CCCC released its 2024 ESG Report. This report details significant progress and ongoing efforts in environmental sustainability, such as reducing carbon emissions by 5% year-over-year, and social welfare programs, including investments of over $10 million in community development projects in 2024 alone.

Project Showcases and Case Studies

China Communications Construction Company (CCCC) effectively leverages project showcases and case studies as a core promotional tactic. This strategy emphasizes their engineering expertise and ability to deliver complex infrastructure projects successfully.

By highlighting achievements such as the Hong Kong-Zhuhai-Macao Bridge, which spans 55 kilometers and is the longest sea-crossing bridge globally, and the Mombasa-Nairobi Standard Gauge Railway, a vital transport link in East Africa, CCCC provides tangible proof of their capabilities. These landmark projects act as powerful testimonials, demonstrating their problem-solving skills and commitment to quality.

These showcases are crucial for building trust and credibility with potential clients and stakeholders. They offer a clear demonstration of CCCC's capacity to manage large-scale, technically demanding undertakings, reinforcing their position as a global leader in the construction industry.

Key promotional elements include:

- Showcasing Landmark Projects: Highlighting successful completion of globally recognized infrastructure like the Hong Kong-Zhuhai-Macao Bridge.

- Developing Detailed Case Studies: Documenting engineering challenges, solutions, and successful outcomes for projects such as the Mombasa-Nairobi SGR.

- Demonstrating Engineering Prowess: Using these case studies to illustrate technical expertise and problem-solving capabilities.

- Building Credibility: Leveraging completed projects as powerful testimonials to attract new business and partnerships.

Digital Presence and Industry Publications

While China Communications Construction Company (CCCC) primarily focuses on traditional business-to-business (B2B) and business-to-government (B2G) channels, its digital presence plays a crucial role in reaching a wider professional audience. The company leverages its official website to share vital information, including annual and quarterly reports, alongside details on its research and development initiatives and innovative projects. This digital strategy ensures transparency and provides stakeholders with easy access to CCCC's performance and strategic direction.

CCCC also strategically engages with industry publications to further amplify its message. These platforms are used to highlight the company's extensive expertise, showcase significant contract wins, and celebrate corporate achievements. For instance, in 2023, CCCC reported a significant increase in its international project portfolio, a key achievement often featured in industry journals, underscoring its global reach and capabilities.

- Website Accessibility: CCCC's official website serves as a central hub for financial disclosures, offering direct access to annual reports, such as the 2023 annual report which detailed substantial revenue growth.

- Industry Publication Reach: Key industry publications frequently feature CCCC's major contract awards, including significant infrastructure projects secured in 2024, reinforcing its market leadership.

- Innovation Showcase: Information regarding CCCC's advancements in areas like green construction technology and smart infrastructure development is consistently updated on their digital platforms and highlighted in relevant trade media.

CCCC's promotional strategy heavily relies on showcasing its impressive project portfolio, such as the Hong Kong-Zhuhai-Macao Bridge, to demonstrate engineering prowess and build credibility. The company also actively participates in global industry events and maintains a strong digital presence, utilizing its website and industry publications to highlight achievements and R&D. Furthermore, robust Corporate Social Responsibility (CSR) initiatives, like the 'Build Your Future Dream' brand and the 2024 ESG Report detailing a 5% year-over-year carbon emission reduction, are used to enhance its global image and community engagement.

Price

China Communications Construction Company's (CCCC) pricing is heavily influenced by competitive bidding for major infrastructure projects. These tenders often consider both the proposed cost and the technical capabilities of the bidder. To win these contracts, CCCC must excel at precise cost estimation and possess a deep understanding of market conditions. For 2024, CCCC is targeting a revenue growth of around 8.2%, underscoring the importance of securing these competitive bids.

Long-term project financing is a critical element in China Communications Construction Company's (CCCC) pricing strategy, particularly for its expansive international infrastructure projects. This often involves intricate payment schedules, the establishment of substantial credit facilities, and collaboration with export-import banks to make these multi-year ventures financially viable and appealing to clients. For instance, CCCC's strategic acquisition of CCCC South America was aimed at providing end-to-end infrastructure solutions, which inherently includes offering integrated financing packages.

For its highly specialized services, such as intricate bridge engineering, deep-sea excavation, and cutting-edge railway infrastructure, China Communications Construction Company (CCCC) likely utilizes value-based pricing. This strategy aligns the price with the tangible benefits and unique value delivered to clients, leveraging CCCC's advanced technological prowess and decades of project execution experience. For instance, securing a contract for a complex, multi-billion dollar infrastructure project often hinges on demonstrated expertise and proven success, justifying a premium price point.

Cost-Plus Pricing for Custom Solutions

For highly customized or pioneering infrastructure projects, China Communications Construction Company (CCCC) might employ a cost-plus pricing strategy. This involves calculating the total expenses for design, materials, labor, and overhead, then adding a pre-agreed profit margin. This method is particularly suitable for projects with unique specifications or those pushing technological boundaries, effectively managing the inherent risks associated with innovation.

This approach directly supports CCCC's commitment to integrated service provision and technological advancement. By covering all project costs and ensuring a profit, it allows the company to invest in the specialized resources and expertise needed for complex, bespoke solutions. For instance, in 2023, CCCC reported revenue of approximately $113.8 billion, reflecting its substantial operational scale and capacity to undertake diverse and challenging projects that may necessitate such pricing models.

- Cost-Plus Basis: Price = Total Project Cost + Negotiated Profit Margin.

- Risk Mitigation: Protects CCCC from unforeseen costs in bespoke projects.

- Alignment with Strategy: Supports integrated services and technological innovation.

- Project Suitability: Ideal for customized, pioneering, or high-uncertainty infrastructure.

Strategic Pricing for Market Penetration

For strategic pricing in market penetration, China Communications Construction Company (CCCC) might initially set competitive prices in new or emerging markets to secure a significant market share. This tactic is crucial as CCCC expands into international arenas, including Belt and Road Initiative (BRI) countries, where establishing a strong presence is paramount. The company's 2023 financial performance, with revenue reaching approximately $97.1 billion, demonstrates its capacity to undertake large-scale projects, and a penetration pricing strategy would aim to leverage this scale effectively in new territories.

This approach involves a careful calibration, balancing the immediate need for market entry and relationship building against the long-term objective of profitability. By offering attractive rates, CCCC can overcome initial barriers to entry and build a reputation for reliability and value. For instance, in infrastructure development projects within BRI nations, where competition can be fierce, such pricing can be a decisive factor in securing initial contracts, laying the groundwork for future, potentially more profitable, engagements.

- Market Share Focus: Prioritizing rapid customer acquisition over immediate profit margins in new markets.

- Competitive Benchmarking: Analyzing competitor pricing to establish attractive, yet sustainable, initial rates.

- Long-Term Value Proposition: Using initial pricing to build brand loyalty and secure future business opportunities.

- Project Scale Leverage: Utilizing CCCC's extensive operational capacity to achieve cost efficiencies that support lower initial pricing.

China Communications Construction Company (CCCC) employs a dynamic pricing strategy that adapts to project specifics and market conditions. For large-scale infrastructure bids, competitive pricing is paramount, often factoring in technical merit alongside cost. In 2024, CCCC's revenue growth target of approximately 8.2% highlights the critical role of winning these competitive tenders through accurate cost management and market insight.

For specialized services, CCCC leverages value-based pricing, aligning costs with the unique expertise and technological advantages offered, especially in areas like advanced bridge engineering or railway infrastructure. This allows for premium pricing justified by proven execution capabilities and innovation. The company's substantial revenue, around $113.8 billion in 2023, reflects its capacity to command such pricing for high-value projects.

| Pricing Strategy | Key Considerations | Example Application | 2023 Revenue Context |

| Competitive Bidding | Cost estimation, technical capabilities | Major infrastructure projects | $113.8 billion total revenue |

| Value-Based Pricing | Specialized expertise, technological prowess | Complex bridge engineering, railway infrastructure | Implied premium for unique solutions |

| Market Penetration | Securing market share in new regions | Belt and Road Initiative countries | $97.1 billion revenue in 2023 |

4P's Marketing Mix Analysis Data Sources

Our China Communications Construction 4P's analysis is grounded in official company disclosures, including annual reports and investor presentations, alongside industry-specific market research and competitive intelligence. We also incorporate data from public project announcements and infrastructure development databases.