China Communications Construction Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Communications Construction Bundle

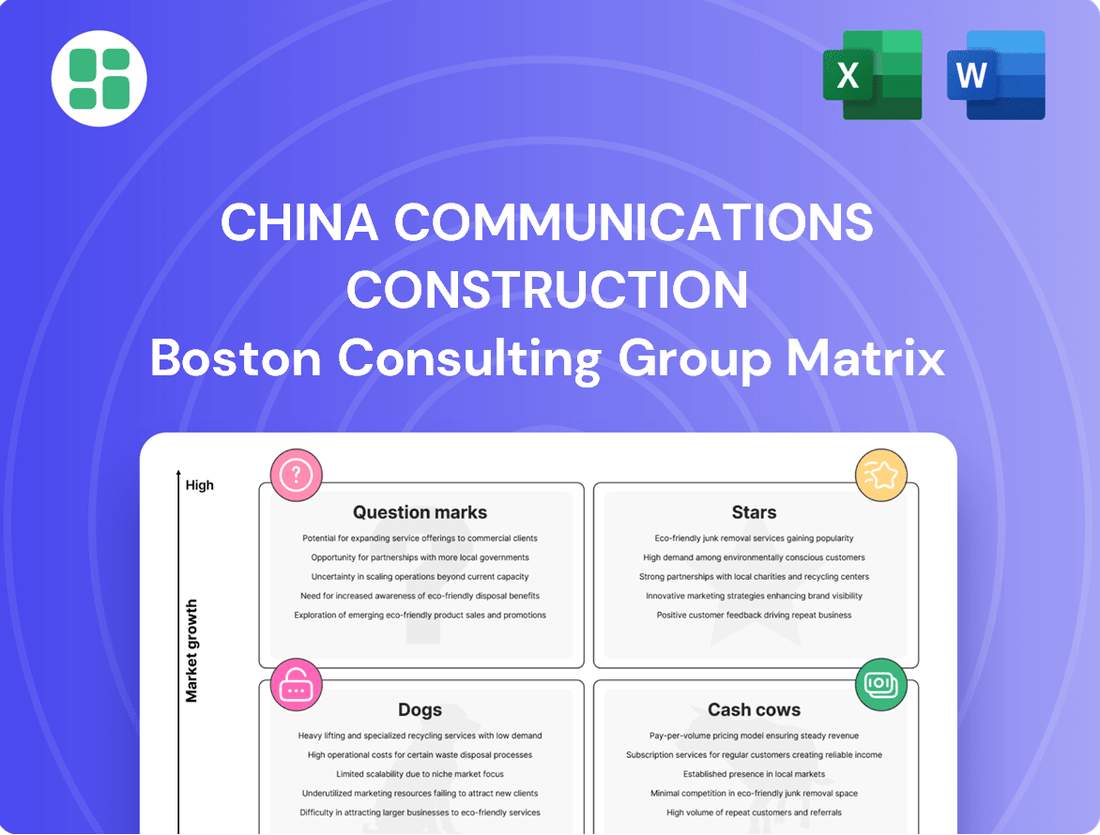

China Communications Construction's strategic positioning is laid bare in its BCG Matrix. Understand which of its vast projects are market leaders and which might be draining resources. This is your chance to unlock actionable insights into their portfolio's performance.

Don't miss out on the complete BCG Matrix analysis that reveals the true potential and challenges within China Communications Construction's diverse business units. Purchase the full report to gain a competitive edge and make informed strategic decisions.

Get the full BCG Matrix for China Communications Construction and see exactly where their investments should be focused. This comprehensive report provides the clarity needed to navigate their complex market landscape and drive future growth.

Stars

China Communications Construction Company (CCCC) is deeply involved in the Belt and Road Initiative (BRI), undertaking substantial infrastructure projects in numerous countries. These projects often serve as vital catalysts for economic growth in host nations, translating into significant and promising revenue for CCCC. For instance, by the end of 2023, CCCC had secured over 1,000 BRI-related projects, contributing to its robust order book.

The ongoing expansion and strategic emphasis on the BRI inherently drive a high market growth rate for the construction services CCCC provides. As of the first half of 2024, CCCC reported a 15% year-on-year increase in revenue from its international business, largely fueled by BRI projects, underscoring its strong position in this high-growth sector.

Advanced Urban Rail Transit Systems represent a star in China Communications Construction's (CCCC) BCG portfolio. As global urbanization intensifies, especially in emerging markets, the need for advanced urban rail solutions is booming. In 2023, global urban rail transit investment reached an estimated $200 billion, a figure projected to grow significantly in the coming years.

CCCC's proficiency in developing intricate systems like metros and high-speed urban connectors positions it firmly within this high-growth sector. The company has a strong history of successful project delivery, evidenced by its involvement in key projects such as the Beijing Subway expansion and the Shanghai Metro network upgrades. These projects underscore its technological prowess and ability to capture a considerable share of this expanding market.

The global smart city initiative, a key driver for digital infrastructure, is fueling demand for intelligent ports. China Communications Construction Company (CCCC) is strategically positioning itself in this high-growth sector, leveraging automation, the Internet of Things (IoT), and artificial intelligence (AI) in its port development projects. This focus on advanced technology is crucial for capturing a significant share of the burgeoning smart port market.

CCCC's investments in digital infrastructure solutions are designed to enhance operational efficiency and connectivity. For instance, in 2024, the company continued to integrate advanced digital systems into its port operations, aiming to streamline logistics and improve cargo handling. These efforts are part of a broader trend where ports are becoming sophisticated digital hubs, facilitating seamless global trade.

Next-Generation Bridge and Tunnel Engineering

Next-generation bridge and tunnel engineering is a star in China Communications Construction Company's (CCCC) BCG matrix. This segment thrives on the persistent global demand for advanced and durable infrastructure, from immense bridges to intricate tunnel networks. CCCC's leading edge in this field, supported by its unique technologies, consistently wins major international contracts, reflecting its strong market position and high growth potential.

The sector's dynamism is fueled by continuous technological progress and a growing need for sophisticated engineering solutions. For instance, CCCC's involvement in projects like the Hong Kong-Zhuhai-Macao Bridge, a marvel of modern engineering, showcases its capability in handling complex, large-scale ventures. By 2024, global infrastructure spending is projected to reach trillions, with a significant portion allocated to transportation projects that require specialized expertise like that offered by CCCC.

- Market Dominance: CCCC holds a commanding position in the high-growth niche of advanced bridge and tunnel construction, driven by its technological prowess.

- Project Pipeline: The company consistently secures high-profile, globally significant infrastructure projects, underscoring its strong order book and future revenue streams.

- Technological Edge: Proprietary technologies and world-renowned expertise in complex engineering solutions differentiate CCCC and attract premium projects.

- Growth Drivers: Increasing global infrastructure investment, coupled with the demand for resilient and innovative transportation networks, ensures sustained growth for this segment.

International Renewable Energy Infrastructure

China Communications Construction Company (CCCC) is increasingly investing in international renewable energy infrastructure, signaling a strategic shift towards a high-growth sector. This expansion leverages their core civil engineering expertise in projects like offshore wind farm foundations and hydroelectric power stations. By 2024, CCCC's involvement in global sustainable energy projects reflects a significant commitment to this expanding market.

- Global Renewable Energy Market Growth: The renewable energy sector is projected to see substantial growth through 2025, driven by climate initiatives and technological advancements.

- CCCC's Project Pipeline: CCCC has secured key contracts for large-scale renewable projects, demonstrating their capability to execute complex infrastructure development.

- Strategic Importance: This diversification into renewables positions CCCC to capitalize on the global energy transition, a market with strong future potential.

- Financial Outlook: While specific 2024 revenue figures for this segment are still emerging, the trend indicates a growing contribution to CCCC's overall portfolio.

Advanced Urban Rail Transit Systems, intelligent ports, and next-generation bridge and tunnel engineering are all identified as Stars for China Communications Construction Company (CCCC) within the BCG matrix. These segments are characterized by high market growth and CCCC's strong competitive position, leveraging its expertise in complex infrastructure development and technological innovation.

| Segment | Market Growth | CCCC's Position | Key Strengths | 2024 Outlook |

|---|---|---|---|---|

| Advanced Urban Rail Transit | High | Strong | Technological expertise, project execution | Continued demand from urbanization |

| Intelligent Ports | High | Strong | Digitalization, automation integration | Growth driven by global trade efficiency |

| Next-Gen Bridge & Tunnel Engineering | High | Dominant | Proprietary technologies, complex project handling | Robust global infrastructure spending |

What is included in the product

This BCG Matrix overview provides a tailored analysis of China Communications Construction's business units, highlighting strategic insights for each quadrant.

It clarifies which units to invest in, hold, or divest, offering a clear roadmap for portfolio management.

The China Communications Construction BCG Matrix simplifies complex portfolios, acting as a pain point reliever by clearly identifying growth opportunities and underperforming assets.

Cash Cows

China Communications Construction Company (CCCC) benefits significantly from its strong presence in the domestic road and bridge construction sector. This mature market, though seeing slower growth, acts as a reliable cash cow for CCCC.

The company's extensive experience and established infrastructure within China's existing road and bridge network allow it to maintain a high market share. This translates into consistent revenue streams, essential for funding other, more growth-oriented ventures.

For 2024, CCCC's domestic infrastructure segment continues to be a cornerstone of its financial stability. The ongoing need for infrastructure maintenance and upgrades across China ensures a steady demand for CCCC's services, contributing substantially to its overall cash flow.

Established port and terminal development in China represents a significant Cash Cow for China Communications Construction Company (CCCC). These mature assets, a result of decades of investment and expansion, consistently deliver predictable and substantial revenue. CCCC's deep-rooted presence and critical involvement in China's maritime infrastructure solidify its high market share in this stable, albeit low-growth, sector.

This segment's profitability provides a vital and reliable source of funding for CCCC's other strategic initiatives and growth areas. For instance, as of the end of 2023, CCCC's port construction segment reported revenues contributing significantly to its overall financial health, underscoring its role as a dependable cash generator.

Standard dredging operations for China Communications Construction Company (CCCC) represent a classic Cash Cow. Despite a mature market, CCCC's dominant global position in dredging, evidenced by its vast fleet and extensive project history, secures a substantial market share. This segment consistently generates robust cash flow, requiring minimal investment to maintain its strong standing.

Heavy Machinery Manufacturing (Container Cranes)

CCCC's heavy machinery manufacturing, particularly container cranes, operates as a Cash Cow. ZPMC, a key subsidiary, dominates the global market, with reports indicating it holds over 70% of the world's market share for quay cranes. This segment benefits from stable demand from ports worldwide, ensuring consistent revenue streams.

The mature nature of this industry, coupled with CCCC's strong competitive advantage, translates into reliable profit margins. These consistent cash flows are vital for funding other business units within the company.

- Market Dominance: ZPMC's leading global market share in quay cranes provides a stable revenue base.

- Stable Demand: Essential port infrastructure ensures consistent, albeit not rapidly growing, demand for container cranes.

- Profitability: Established market position and product quality contribute to steady profit margins.

- Cash Generation: This segment reliably generates cash flow to support CCCC's broader operations.

Domestic Urban Infrastructure Maintenance

China Communications Construction Company's (CCCC) domestic urban infrastructure maintenance segment is a quintessential Cash Cow. This business line focuses on the ongoing upkeep, repair, and modernization of China's vast existing urban infrastructure, encompassing everything from roads and bridges to essential municipal services. The demand here is consistent, driven by the sheer necessity of keeping these vital systems operational.

This segment operates within a mature, low-growth market, yet CCCC's deep-rooted presence and established network grant it a commanding market share. This translates into a predictable and stable stream of recurring revenue, minimizing financial risk. For instance, by the end of 2023, CCCC reported significant ongoing maintenance contracts that underpin its revenue stability.

- Stable Revenue: The continuous need for infrastructure upkeep ensures a reliable revenue flow, unaffected by economic cycles.

- High Market Share: CCCC's extensive experience and established relationships in China provide a dominant position in this segment.

- Low Risk Profile: The nature of maintenance work, coupled with long-term contracts, reduces the inherent risks associated with infrastructure projects.

- Recurring Demand: Unlike new construction, maintenance is an ongoing requirement, offering predictable business volume.

CCCC's domestic road and bridge construction, along with established port development, are key cash cows. These segments benefit from consistent demand for maintenance and upgrades, ensuring stable revenue streams. For example, CCCC's port construction segment contributed significantly to its financial health by the end of 2023, highlighting its role as a dependable cash generator.

Standard dredging operations and heavy machinery manufacturing, particularly ZPMC's quay cranes, also act as cash cows. ZPMC's dominant global market share, exceeding 70% for quay cranes, ensures stable demand and consistent profit margins. This segment reliably generates cash flow to support CCCC's broader operations.

The domestic urban infrastructure maintenance segment is another prime cash cow, driven by the continuous need for upkeep. CCCC's dominant market share in this low-growth sector provides a predictable and stable revenue stream, with significant ongoing maintenance contracts reported by the end of 2023.

| Segment | Market Position | Cash Flow Contribution | Key Driver |

| Domestic Road & Bridge Construction | High Market Share | Significant | Ongoing Maintenance & Upgrades |

| Established Port Development | Deep-Rooted Presence | Substantial & Predictable | Critical Maritime Infrastructure |

| Standard Dredging Operations | Global Dominance | Robust | Mature Market, Minimal Investment |

| Heavy Machinery (Quay Cranes) | >70% Global Market Share (ZPMC) | Consistent | Stable Port Demand |

| Domestic Urban Infrastructure Maintenance | Commanding Market Share | Reliable & Recurring | Necessity of System Operation |

Preview = Final Product

China Communications Construction BCG Matrix

The China Communications Construction BCG Matrix preview you are viewing is the identical, fully polished document you will receive upon purchase. This means no watermarks, no demo content, and no alterations – just the complete, professionally formatted BCG Matrix analysis ready for your strategic decision-making. You can be confident that the insights and visualizations presented here are precisely what you will download and utilize immediately after completing your transaction.

Dogs

Certain small-scale regional infrastructure projects within China Communications Construction Company's (CCCC) portfolio may fall into the category of "Dogs" in the BCG Matrix. These often involve older construction techniques or are situated in areas experiencing slow economic growth, leading to both low market share and limited growth potential.

These projects can be particularly problematic as they might demand a significant portion of CCCC's resources, including capital and management attention, without yielding substantial returns or offering promising future prospects. For instance, a regional road upgrade project in a sparsely populated province with declining industry might fit this description.

In 2023, CCCC reported that while its overall revenue grew, certain smaller, legacy projects contributed minimally to this growth, highlighting the potential for such segments to become cash traps. The strategy for these "Dog" segments typically involves minimizing further investment or considering divestment to free up capital for more lucrative ventures.

China Communications Construction Company (CCCC) may possess legacy non-core asset holdings. These are investments or business units that no longer align with CCCC's primary strategic focus or operate in industries with limited future prospects.

These legacy assets likely exhibit a low market share within their sectors and possess minimal growth potential, characteristic of 'Dogs' in a BCG matrix. For instance, if CCCC holds a stake in an older, less efficient manufacturing facility in a declining industry, it would fit this category.

Such holdings typically generate little cash flow and may even require ongoing investment to maintain. In 2023, CCCC reported a total asset value of approximately ¥1.2 trillion, and identifying and potentially divesting these underperforming legacy assets could free up significant capital for reinvestment into more promising core businesses.

Within China Communications Construction Company (CCCC), specialized niche construction with limited demand falls into the Dogs category. These are segments where CCCC likely holds a small market share, and the overall market isn't growing. For example, think of highly specific, perhaps outdated, construction techniques or product lines that are no longer in high demand due to technological advancements or changing infrastructure needs.

Consider areas like certain types of traditional bridge construction that have been largely replaced by more modern, efficient methods, or perhaps very specific types of tunneling equipment that are now obsolete. In 2023, CCCC's revenue from its infrastructure construction segment was approximately 663.9 billion yuan, but a small fraction of this might be tied to these declining niche areas.

Continued investment in these low-demand, low-market-share areas would be a drain on resources, offering minimal returns. CCCC's strategy here would typically involve minimizing investment, divesting if possible, or phasing out these operations to reallocate capital to more promising growth areas.

Underperforming Foreign Ventures

China Communications Construction Company (CCCC) may have certain international projects or regional subsidiaries that are not performing as well as expected. These underperforming ventures could be due to insufficient market research before launch or operating in areas with significant political or economic uncertainty. For instance, projects in regions experiencing high inflation or political unrest might struggle to gain traction and become a financial burden.

These ventures may not have captured substantial local market share and are situated in markets with limited growth potential. This can lead to them consuming company resources without generating adequate returns. For example, a subsidiary in a country with a declining infrastructure development budget might represent such a challenge.

- Underperforming International Ventures: Some of CCCC's overseas operations might be struggling, potentially impacting overall profitability.

- Market Share and Growth Challenges: These ventures may face difficulties in securing significant local market share and operate within low-growth economic environments.

- Resource Drain: Underperforming subsidiaries can act as drains on the company's financial and operational resources.

- Strategic Review: A thorough review of these ventures is crucial to determine the best course of action, which could include divestment or restructuring.

Obsolete Equipment Manufacturing Lines

Within China Communications Construction Company's (CCCC) heavy machinery manufacturing, certain production lines are likely categorized as Dogs. These are lines producing equipment that is becoming obsolete. For example, older models of road pavers or dredging equipment might fall into this category, struggling to compete with newer, more efficient technologies.

These obsolete equipment manufacturing lines would exhibit a low market share for their specific products. The market for these older machines is also likely experiencing low growth or even a decline. For instance, the demand for analog surveying equipment has significantly diminished with the advent of digital GPS systems.

Continuing to operate these lines without substantial investment in retooling or product development would be economically unviable. Such operations tie up capital, labor, and factory space that could be better allocated to more profitable or growing segments of CCCC's business. In 2024, the global construction equipment market saw a shift towards automation and electric power, further marginalizing older, less efficient machinery.

- Low Market Share: Production lines for outdated machinery, like older generation excavators, have seen their market share erode significantly.

- Low-Growth/Shrinking Market: The demand for equipment that doesn't meet current environmental or efficiency standards is in sharp decline.

- Unprofitability: Without modernization, these lines struggle to generate profits, especially when compared to investments in advanced manufacturing.

- Resource Drain: Continued operation diverts crucial resources from more promising business units within CCCC.

Certain niche, legacy construction materials or specialized equipment manufacturing within CCCC might be classified as Dogs. These are likely segments where CCCC holds a small market share, and the overall market is not expanding, or is even shrinking due to technological obsolescence.

For example, production lines for older, less efficient types of concrete additives or specialized tunneling equipment that has been superseded by newer technology could fit this description. In 2024, the push for sustainable construction materials and advanced tunneling techniques further diminishes the viability of these legacy offerings.

These segments often require ongoing maintenance or operational costs without generating significant returns, acting as a drain on resources. CCCC's strategy would involve minimizing further investment, seeking divestment opportunities, or phasing out these operations to reallocate capital towards more innovative and profitable areas.

| Segment Example | BCG Category | Market Share | Market Growth | Strategic Implication |

| Legacy Concrete Additives | Dog | Low | Low/Declining | Divest or Phase Out |

| Obsolete Tunneling Equipment | Dog | Low | Low/Declining | Minimize Investment |

Question Marks

China Communications Construction Company's (CCCC) emerging market digital infrastructure initiatives, like data centers and smart city platforms, represent a classic 'Question Mark' in the BCG matrix. These ventures operate in a high-growth sector with substantial global expansion potential. For instance, the global smart city market was projected to reach $2.5 trillion by 2026, indicating robust growth, yet CCCC's current market share in this specific niche remains modest.

These projects are inherently capital-intensive, demanding significant upfront investment in technology and deployment, which can strain immediate profitability. The return on investment is often realized over the long term as these digital ecosystems mature. To transition from a Question Mark to a Star, CCCC must rapidly increase its market penetration and operational scale within these developing digital economies.

The global construction sector is experiencing a significant shift towards sustainability, with green building technologies emerging as a high-growth segment. China Communications Construction Company (CCCC) is actively exploring and beginning to implement these advanced technologies in its projects. For instance, in 2023, CCCC reported a growing emphasis on eco-friendly materials and energy-efficient designs across its international ventures, though specific figures for green building revenue remain a small fraction of its overall business.

While CCCC's foray into advanced green building technologies is a strategic move to align with market trends, it currently represents a nascent part of its extensive portfolio. The company's substantial investments in research and development for these innovative solutions are crucial for building a strong market presence. By 2024, CCCC aims to increase its green building project pipeline by 15%, signaling a commitment to capturing a larger share of this expanding market.

China Communications Construction Company (CCCC) actively participates in Public-Private Partnerships (PPPs), a core element of its infrastructure development strategy. However, the company's foray into novel, intricate PPP structures, especially in emerging international arenas or for unconventional infrastructure projects, presents a potential question mark.

These advanced PPP models offer significant growth prospects but can also entail elevated risks and a nascent market presence as CCCC refines its approach. For instance, in 2023, CCCC reported a substantial portion of its revenue derived from infrastructure construction, highlighting the importance of successful PPPs in its portfolio. Strategic investments and the execution of successful pilot projects will be paramount to unlocking future growth in these innovative PPP ventures.

High-Tech Water Management and Environmental Engineering

As environmental concerns intensify globally, the demand for sophisticated water management, wastewater treatment, and broader environmental engineering solutions is experiencing significant growth. China Communications Construction Company (CCCC) is strategically positioning itself within these expanding high-tech segments. While CCCC possesses a strong foundation in civil engineering, its current market share in these specialized, high-growth environmental niches may be relatively low.

Capturing a more substantial portion of this evolving market necessitates dedicated investment and focused development. For example, the global water and wastewater treatment market was valued at approximately $620 billion in 2023 and is projected to reach over $1 trillion by 2030, indicating substantial growth potential.

- Market Expansion: The global market for environmental engineering solutions, particularly in water management and wastewater treatment, is seeing robust expansion due to increasing environmental regulations and public awareness.

- CCCC's Position: CCCC's entry into high-tech water management and environmental engineering leverages its existing civil engineering expertise but may represent a nascent presence in these specialized, high-growth segments, implying a currently low market share within them.

- Investment Needs: To effectively compete and gain significant traction, dedicated capital investment is crucial for research, development, and the acquisition of advanced technologies in these specialized areas.

- Growth Potential: The sector offers substantial future growth opportunities, with projections indicating continued strong demand for innovative environmental solutions worldwide.

Modular and Prefabricated Construction Solutions

Modular and prefabricated construction is a rapidly expanding segment within the global construction sector, driven by the demand for faster project completion and enhanced cost-efficiency. This trend positions it as a potential star in China Communications Construction's (CCCC) BCG matrix, representing a high-growth market where CCCC is likely investing and building expertise, though not yet a clear market leader.

For CCCC to capitalize on this burgeoning market, strategic investments are crucial. This includes dedicating significant resources to research and development for innovative building techniques and materials, establishing specialized manufacturing facilities for prefabricated components, and actively promoting the adoption of these modern construction methods.

- Market Growth: The global modular construction market was valued at approximately USD 100 billion in 2023 and is projected to grow at a CAGR of over 7% through 2030, indicating substantial potential.

- CCCC's Position: While CCCC has a strong presence in traditional construction, its market share in specialized modular solutions is still developing, suggesting a need for focused expansion.

- Investment Focus: Key areas for CCCC's investment should include advanced manufacturing technologies, design optimization for prefabrication, and building a robust supply chain for modular components.

- Future Leadership: By prioritizing innovation and scaling its modular capabilities, CCCC can transition this segment from a question mark to a dominant star in its portfolio.

Emerging market digital infrastructure, such as data centers and smart city platforms, represents a 'Question Mark' for CCCC. These ventures are in a high-growth sector, with the global smart city market projected to reach $2.5 trillion by 2026. However, CCCC's current market share in these specific niches remains modest, requiring significant capital investment and a focus on increasing market penetration to evolve into a 'Star'.

BCG Matrix Data Sources

Our China Communications Construction BCG Matrix is built on a foundation of comprehensive market intelligence, integrating financial statements, industry research, and official government reports.

This analysis draws from credible sources including company filings, sector-specific growth forecasts, and expert industry commentary to ensure strategic accuracy.