China Communications Construction Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Communications Construction Bundle

China Communications Construction's industry is shaped by intense rivalry and the significant bargaining power of buyers, particularly government entities. Understanding these dynamics is crucial for navigating the global infrastructure market. The threat of new entrants, while present, is somewhat mitigated by high capital requirements and established relationships.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore China Communications Construction’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

China Communications Construction Company (CCCC) frequently procures specialized heavy machinery, advanced construction materials, and complex components essential for its vast infrastructure projects. The proprietary or highly technical nature of some of these inputs means suppliers can wield considerable bargaining power. For instance, if a project requires a specific type of high-strength concrete or a unique tunneling machine, and only a few companies can provide it, those suppliers are in a strong position to dictate terms.

For highly specialized services crucial to CCCC's operations, such as advanced geotechnical surveys or complex dredging technology, the global supplier pool can be quite restricted. This limited availability of qualified providers grants them significant leverage. For instance, in 2023, the global market for specialized marine engineering equipment, vital for dredging projects, was dominated by a handful of key manufacturers, allowing them to command premium pricing.

The availability of skilled labor significantly impacts the bargaining power of suppliers for China Communications Construction Company (CCCC). A scarcity of qualified engineers, project managers, and specialized construction workers can elevate wage demands, thereby enhancing labor's leverage.

For instance, the construction sector in 2025 is anticipated to face persistent labor shortages in specialized roles across various regions. This dynamic directly translates to increased labor costs for companies like CCCC, as they compete for a limited pool of talent.

Impact of Trade Policies and Regulations

Changes in global trade policies, like tariffs on imported steel, directly affect the cost and availability of essential materials for China Communications Construction Company (CCCC). For instance, in 2024, the ongoing trade tensions and potential tariffs on key commodities could force suppliers to increase prices, thereby enhancing their leverage over CCCC.

Stricter environmental regulations implemented in supplier regions can also elevate production costs or lead to supply chain disruptions. If suppliers face increased compliance burdens, they are more likely to pass these costs onto CCCC or experience limitations in their output, strengthening their bargaining position.

- Tariff Impact: Potential tariffs on construction materials in 2024 could increase raw material costs for CCCC.

- Regulatory Costs: New environmental standards may force suppliers to raise prices or reduce supply availability.

- Supply Chain Vulnerability: Policy shifts create vulnerabilities, giving suppliers more power to dictate terms.

Supplier Integration and Forward Linkages

If key suppliers begin offering design, engineering, or even partial construction services, they could gain leverage by integrating forward into China Communications Construction Company's (CCCC) value chain. This allows them to present bundled solutions and influence project specifications, potentially weakening CCCC's bargaining position. For instance, a supplier providing advanced materials might also offer specialized installation engineering, making it harder for CCCC to source components and services separately.

This forward integration can reduce CCCC's negotiation flexibility, as suppliers might dictate terms for integrated packages. However, CCCC's substantial in-house manufacturing and design capabilities for certain inputs, such as specialized machinery or pre-fabricated components, can serve as a counterbalance. This internal capacity allows CCCC to maintain some control over critical aspects of its projects, mitigating the suppliers' enhanced power in those specific areas.

For example, in 2024, CCCC's investment in its own advanced manufacturing facilities for bridge segments and tunnel boring machines directly reduced its reliance on external suppliers for these core components. This strategic move aimed to secure supply chains and improve cost control, thereby lessening the potential impact of supplier forward integration in these segments.

- Supplier Forward Integration: Suppliers offering design, engineering, or partial construction services can increase their power.

- Impact on CCCC: This integration can lead to bundled solutions and influence over project specifications, potentially reducing CCCC's negotiation flexibility.

- Mitigation by CCCC: CCCC's own manufacturing and design capabilities for key inputs can offset this increased supplier power.

The bargaining power of suppliers for China Communications Construction Company (CCCC) is influenced by the concentration of suppliers for specialized equipment and materials. When few suppliers can provide critical inputs, like advanced tunneling machines or high-strength concrete, they can command higher prices. For instance, in 2023, the global market for specialized marine engineering equipment saw a limited number of manufacturers dictating terms, directly impacting project costs for large infrastructure firms.

Furthermore, global trade policies and regulatory changes in 2024, such as potential tariffs on steel or stricter environmental standards, can increase supplier costs. These increased costs are often passed on to CCCC, enhancing supplier leverage. The scarcity of skilled labor in specialized construction roles also contributes to this power, as higher wage demands become a factor. For example, anticipated labor shortages in 2025 for skilled engineers will likely drive up costs for companies like CCCC.

| Factor | Impact on Supplier Bargaining Power | Example/Data Point |

|---|---|---|

| Supplier Concentration | High for specialized inputs | Limited global manufacturers for marine engineering equipment (2023) |

| Trade Policies & Regulations | Increases supplier costs, thus leverage | Potential tariffs on steel (2024) |

| Labor Scarcity | Drives up labor costs for suppliers | Anticipated shortages in skilled construction roles (2025) |

| Supplier Forward Integration | Can reduce CCCC's negotiation flexibility | Suppliers offering integrated design and construction services |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to China Communications Construction's global infrastructure development operations.

Understand the competitive landscape of China's infrastructure sector with a clear, one-sheet summary of all five forces—perfect for quick decision-making.

Easily assess the impact of new government policies or emerging competitors by customizing pressure levels based on evolving market trends.

Customers Bargaining Power

China Communications Construction Company (CCCC) frequently deals with powerful customers like national governments and large state-owned enterprises for its major infrastructure projects. These clients possess significant financial clout and extensive experience in procurement, which translates into considerable leverage during contract negotiations and competitive bidding. For instance, in 2024, many Belt and Road Initiative projects, a key area for CCCC, involved large government-to-government agreements where client nations dictated terms and pricing to a degree.

Infrastructure projects in China are frequently awarded through extensive tender processes. In 2024, the sheer volume of these competitive bidding events for major infrastructure developments, such as high-speed rail and urban transit systems, means customers, often government entities or large state-owned enterprises, can leverage this competition to their advantage.

This competitive landscape empowers customers to negotiate aggressively on pricing, demanding the most cost-effective solutions. For instance, in 2024, winning bids for large-scale construction projects often saw profit margins squeezed as clients secured highly competitive rates due to the presence of numerous qualified bidders, including giants like China Communications Construction Company (CCCC).

Furthermore, customers can impose stringent quality specifications and enforce strict adherence to project timelines. The ability to switch between multiple capable contractors if terms are not met gives clients significant leverage, ensuring that projects are delivered to exacting standards and on schedule, a crucial factor in public infrastructure delivery.

The bargaining power of customers for China Communications Construction Company (CCCC) is significantly influenced by government investment cycles, particularly in China. CCCC's revenue is heavily tied to public infrastructure spending, meaning shifts in government fiscal policy or project prioritization directly impact demand.

For instance, a pivot in government strategy from broad new construction to targeted modernization projects could reduce the overall volume of work available, thereby increasing customer leverage. In 2023, China's central government continued to emphasize infrastructure investment as a key driver of economic growth, with significant allocations towards transportation and energy projects, but the specific focus areas can change annually, affecting CCCC's project pipeline.

Customer's Ability to Specify Requirements

For complex infrastructure projects, customers often possess significant technical expertise. This allows them to meticulously define project requirements, including specific materials and technologies, which directly impacts China Communications Construction Company (CCCC).

This detailed specification capability by clients limits CCCC's room to maneuver with alternative solutions. Consequently, it shifts more control over project scope and associated costs directly to the customer, amplifying their bargaining power.

- Technical Expertise: Clients in infrastructure often have in-house engineering teams or hire consultants to define precise technical specifications.

- Project Scope Control: Detailed requirements dictate the exact materials, construction methods, and quality standards, leaving less room for supplier discretion.

- Cost Influence: Specific material choices or technology demands can significantly influence project budgets, giving customers leverage in price negotiations.

Potential for In-House Capabilities or Direct Oversight

Large government entities or significant state-owned asset holders may possess their own engineering and construction divisions, or the capability to directly oversee smaller-scale projects. This potential for in-house execution, even if theoretical for CCCC's massive undertakings, grants these customers a measure of negotiating power.

While the sheer scale of China Communications Construction Company's (CCCC) mega-projects makes complete in-house capability unlikely for clients, the underlying threat of developing such capacity cannot be ignored. This theoretical leverage influences customer bargaining power in negotiations.

- Government Clients: Many of CCCC's clients are government bodies, which by their nature often have established engineering departments capable of managing or even executing certain construction tasks.

- State-Owned Enterprises: Similar to government entities, large state-owned enterprises can possess significant internal resources and expertise, potentially reducing their reliance on external contractors for specific project components.

- Project Scope: For smaller or more standardized projects within CCCC's portfolio, the feasibility of clients developing in-house capabilities or directly managing the work increases, thereby enhancing their bargaining position.

China Communications Construction Company (CCCC) faces substantial customer bargaining power, primarily from government entities and large state-owned enterprises. These clients often dictate terms due to their significant financial capacity and extensive experience in managing large-scale infrastructure projects. In 2024, many Belt and Road Initiative contracts involved government-to-government agreements, allowing client nations to heavily influence pricing and project specifications.

The competitive bidding landscape for infrastructure projects in China, a key market for CCCC, further empowers customers. In 2024, numerous large-scale tenders for high-speed rail and urban transit systems meant clients could leverage the presence of multiple qualified bidders to secure highly competitive rates, often squeezing profit margins for contractors like CCCC.

Customers also wield power through stringent quality demands and strict adherence to project timelines. The ability to switch contractors if terms aren't met ensures CCCC must deliver to exacting standards, a critical factor in public infrastructure delivery.

CCCC's reliance on government infrastructure spending means shifts in fiscal policy or project prioritization directly impact demand and customer leverage. For example, while China's 2023 infrastructure investment remained robust, focusing on transportation and energy, specific project types can change annually, affecting CCCC's project pipeline and client negotiation power.

| Customer Segment | Key Leverage Factors | Impact on CCCC |

|---|---|---|

| National Governments | Financial clout, policy control, large project volume | High influence on pricing, terms, and project selection |

| State-Owned Enterprises | Internal expertise, procurement experience, potential for in-house execution | Negotiating power on project scope, specifications, and cost |

| Infrastructure Funds/Investors | Capital availability, return expectations, project viability assessment | Influence on project feasibility and financial structuring |

Preview the Actual Deliverable

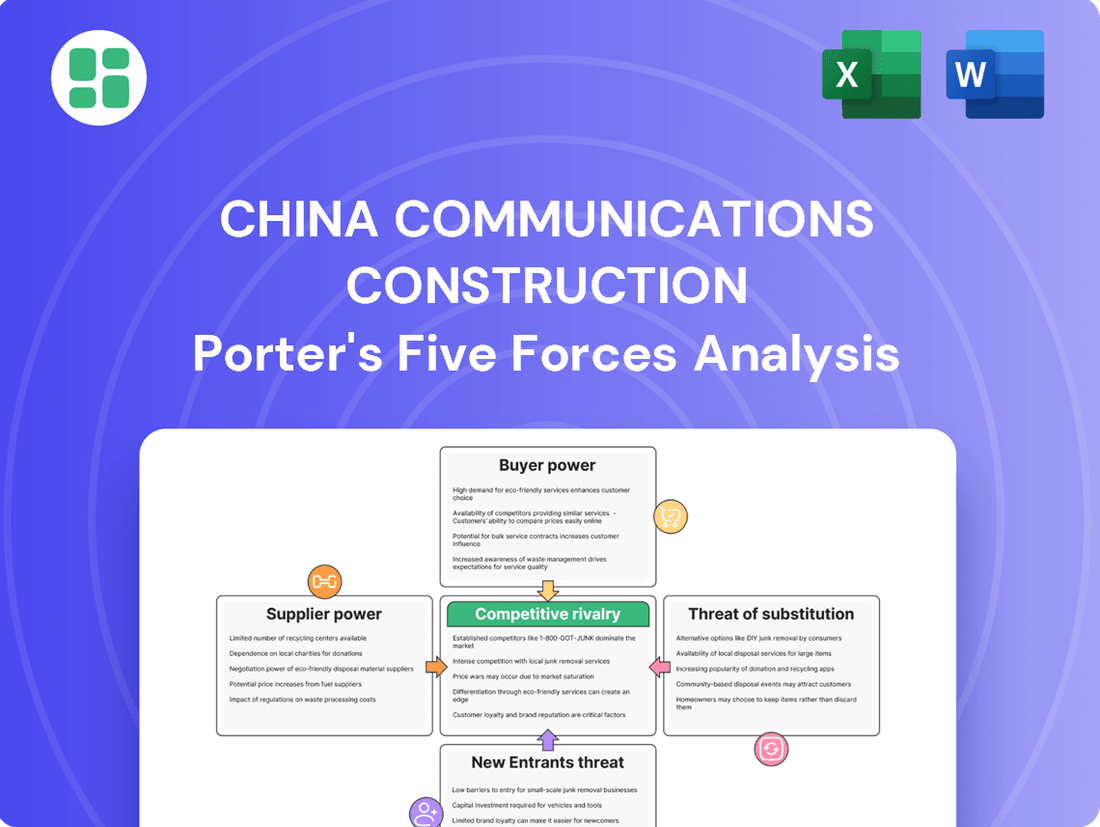

China Communications Construction Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis of China Communications Construction Company (CCCC), detailing the competitive landscape and strategic positioning within the infrastructure and construction sector. The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy, offering a complete picture of the industry's dynamics affecting CCCC. You'll gain insights into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry, all presented in a professionally formatted report. This exact analysis will be yours immediately after purchase, providing actionable intelligence for your strategic decision-making.

Rivalry Among Competitors

China Communications Construction Company (CCCC) faces significant competitive rivalry, particularly within its home market, due to the dominance of large state-owned enterprises (SOEs). Giants like China State Construction Engineering and China Railway Group command substantial resources, financial muscle, and governmental backing, creating a fiercely competitive landscape for major infrastructure projects both domestically and internationally.

These SOEs leverage their scale and government relationships to secure lucrative contracts, often at highly competitive pricing. For instance, in 2023, China State Construction Engineering reported revenues exceeding $200 billion, highlighting the sheer size and market penetration of these key competitors, which directly impacts CCCC's market share and profitability.

China Communications Construction Company (CCCC) navigates a fiercely competitive global landscape for major infrastructure projects. Beyond its domestic rivals, CCCC contends with established international players from Europe, North America, and other Asian nations, all vying for lucrative contracts worldwide.

This intense global rivalry is a multi-faceted battle. Companies compete not only on aggressive pricing but also on their technological prowess, demonstrated project execution speed, and the attractiveness of their financing packages. For instance, in 2023, the global construction market saw significant activity, with major projects in areas like renewable energy and transportation infrastructure attracting bids from a diverse range of international firms, underscoring the breadth of competition.

The infrastructure construction sector, where China Communications Construction Company (CCCC) operates, is inherently burdened by substantial fixed costs. These include significant investments in heavy machinery, specialized labor, and robust project management systems. In 2023, global infrastructure spending was projected to reach trillions, yet the capital intensity of projects means companies like CCCC must achieve high capacity utilization to remain profitable.

This drive for high capacity utilization often fuels intense competition. When market demand softens or growth slows, companies are pressured to bid aggressively on projects to keep their equipment and workforce engaged. This can lead to price wars, squeezing profit margins for all players in the industry, including CCCC.

Project-Based Nature and Bid Intensity

The project-based nature of the infrastructure sector creates a highly competitive environment for China Communications Construction Company (CCCC). Each major infrastructure project represents a unique bidding opportunity, leading to intense rivalry among a select group of qualified contractors. This dynamic means companies like CCCC must constantly refine their capabilities to stand out.

The winner-take-all characteristic of these large-scale bids compels firms to make significant, ongoing investments. These investments are crucial for developing and maintaining competitive advantages. For instance, advancements in construction technology and operational efficiency become paramount for securing future contracts in this demanding market.

- Project-Specific Bidding: Each major infrastructure project functions as an independent bidding event, intensifying competition among a concentrated group of capable contractors.

- Winner-Take-All Dynamics: The outcome of these bids often results in a single contractor winning the entire project, driving the need for continuous investment in competitive strengths.

- Investment in Advantages: Companies must prioritize investments in areas like technological innovation, cost efficiency, and specialized expertise to enhance their chances of winning bids and securing new projects.

Strategic Importance and Government Support

The Chinese government views infrastructure development as critical for national growth, often channeling significant support to major construction firms like China Communications Construction Company (CCCC). This strategic backing, which can include favorable financing and direct project assignments, intensifies competition among these large entities. For instance, in 2024, the Chinese government continued its robust investment in infrastructure, with total fixed asset investment in the sector projected to grow by approximately 3.5% year-on-year, according to various economic forecasts. This sustained government emphasis fuels the competitive landscape.

Government support often manifests as preferential financing terms, policy advantages, and direct allocation of lucrative projects. These advantages allow major players to undertake large-scale, capital-intensive projects, thereby increasing the intensity of rivalry. In 2023, CCCC secured a significant portion of these state-backed projects, contributing to its substantial revenue growth.

- Government Prioritization: Infrastructure is a cornerstone of China's economic strategy, ensuring continuous government backing for key players.

- Financial Advantages: Preferential financing and access to capital from state-owned banks provide a competitive edge.

- Policy Support: Favorable regulations and policy directives often favor established, strategically important companies.

- Project Allocation: Direct allocation of major national projects reduces reliance on competitive bidding for large contracts.

Competitive rivalry is a defining characteristic for China Communications Construction Company (CCCC), with both domestic state-owned enterprises (SOEs) and international firms fiercely contesting major infrastructure projects. Giants like China State Construction Engineering, with over $200 billion in 2023 revenues, and China Railway Group, backed by substantial government support, create a highly competitive environment. This rivalry extends globally, where CCCC competes on price, technology, and financing packages, especially evident in the trillions spent on global infrastructure in 2023.

| Competitor Type | Key Characteristics | Impact on CCCC |

|---|---|---|

| Domestic SOEs | Large scale, government backing, financial strength | Intense price competition, market share pressure |

| International Firms | Technological expertise, diverse financing options | Global contract competition, need for innovation |

| Industry Structure | High fixed costs, project-based bidding | Pressure for high capacity utilization, potential price wars |

SSubstitutes Threaten

For China Communications Construction Company (CCCC), the threat of substitutes for its core business in large-scale transportation infrastructure like ports, bridges, and railways is generally low. While alternative transport methods exist, such as air travel competing with high-speed rail, the fundamental need for physical infrastructure to move goods and people remains, limiting direct functional substitution for these massive projects.

The rise of modular and prefabricated construction presents a potential threat, not as a direct replacement for all of CCCC's work, but by changing the landscape of traditional building. These off-site manufacturing techniques allow for faster assembly on-site, potentially diverting demand for certain types of projects if they gain significant traction.

For instance, the global modular construction market was valued at approximately $95.5 billion in 2023 and is projected to grow substantially. This growing preference for efficiency and speed in construction could influence the demand for CCCC's conventional, on-site labor-intensive services, especially in sectors like residential and commercial building where these methods are increasingly viable.

The increasing adoption of smart city technologies presents a potential threat of substitutes for China Communications Construction Company (CCCC). As cities invest more in digital infrastructure, the demand for purely physical construction projects might see a relative decline. For instance, advancements in traffic management software and autonomous vehicle infrastructure could reduce the need for extensive new road or rail construction in some urban areas.

While CCCC's involvement in urban rail transit is significant, a greater focus on optimizing existing systems through digital solutions rather than building new lines could represent a substitution. For example, the development of advanced transit scheduling and passenger flow management systems, powered by AI and IoT, might offer a more cost-effective alternative to expanding physical rail networks, impacting CCCC's traditional revenue streams.

Maintenance, Repair, and Upgrade Over New Builds

A significant shift in government and client priorities towards maintaining, repairing, and upgrading existing infrastructure rather than commissioning new large-scale projects poses a threat of substitution for China Communications Construction Company (CCCC). This trend could reduce the demand for CCCC's traditional new build services. For instance, in 2024, many developed nations continued to allocate substantial budgets towards infrastructure renewal and modernization programs, often prioritizing these over entirely new mega-projects. This focus on refurbishment means that while CCCC may still be involved in these projects through its maintenance and repair divisions, the overall revenue potential from large-scale new construction could be diminished.

This pivot in infrastructure investment strategy directly impacts CCCC's project pipeline and revenue diversification. While the company is equipped to handle maintenance and repair work, a substantial reduction in new build opportunities would necessitate a strategic rebalancing of its business model. For example, if a significant portion of a nation's infrastructure budget, say 60% in 2024, is directed towards repairs and upgrades rather than new builds, it directly impacts the types of contracts CCCC can pursue and the scale of its involvement.

- Reduced Demand for New Construction: A focus on infrastructure upkeep rather than expansion directly curtails opportunities for large-scale new build projects, a core area for CCCC.

- Revenue Stream Alteration: While CCCC offers maintenance and repair, a sustained shift away from new builds would alter its revenue mix, potentially impacting overall growth if repair revenues don't fully compensate.

- Strategic Portfolio Adjustments: The company may need to reallocate resources and expertise to capitalize on the growing repair and upgrade market, potentially at the expense of its new construction capabilities.

Alternative Investment Priorities for Public Funds

Public funds, a critical revenue stream for China Communications Construction Company (CCCC), face a significant threat from substitutes. Governments worldwide, including China's, are increasingly prioritizing investments in other vital sectors. For instance, in 2024, global government spending on healthcare and education saw substantial increases, potentially diverting funds away from large-scale infrastructure projects that CCCC typically undertakes. This reallocation directly impacts the demand for CCCC's services.

The shift in public spending priorities acts as a substitute for traditional infrastructure development. As governments focus on immediate societal needs, the appetite for massive, long-term construction projects may diminish. This could mean fewer new highways, bridges, or ports being commissioned, directly impacting CCCC's order books. For example, a projected 15% increase in global public health expenditure for 2024 highlights this trend.

- Shifting Public Priorities: Governments may reallocate funds from infrastructure to healthcare, education, or social welfare programs.

- Reduced Infrastructure Demand: This reallocation can lead to a decrease in the number and scale of new infrastructure projects.

- Impact on CCCC: Fewer projects directly translate to reduced revenue and opportunities for CCCC.

The threat of substitutes for China Communications Construction Company (CCCC) is generally low for its core large-scale transportation infrastructure projects, as physical infrastructure remains essential for moving goods and people. However, alternative construction methods like modular building, which offer speed and efficiency, present a growing challenge, especially in sectors where traditional on-site construction is less critical. For example, the global modular construction market reached approximately $95.5 billion in 2023, indicating a significant and expanding alternative.

Furthermore, advancements in digital infrastructure and smart city technologies can act as substitutes by potentially reducing the need for extensive new physical construction, favoring optimized existing systems. A notable trend in 2024 saw governments increasingly prioritize infrastructure maintenance and upgrades over entirely new mega-projects, with some nations allocating up to 60% of their infrastructure budgets to repairs and modernization. This shift directly impacts CCCC's new build opportunities.

Public funding priorities also pose a substitution threat, as governments increasingly allocate resources to sectors like healthcare and education. For instance, a projected 15% increase in global public health expenditure for 2024 highlights this diversion of funds away from large infrastructure investments, potentially reducing the demand for CCCC's services.

| Threat of Substitutes | Description | Impact on CCCC | Example/Data (2023-2024) |

|---|---|---|---|

| Alternative Construction Methods | Modular and prefabricated building techniques offering speed and efficiency. | Potential diversion of demand from traditional on-site construction. | Global modular construction market valued at ~$95.5 billion in 2023. |

| Digital Infrastructure & Smart Cities | Technological solutions optimizing existing infrastructure, reducing need for new builds. | May lessen demand for new physical transport links. | Focus on AI/IoT for transit management vs. new rail lines. |

| Infrastructure Maintenance & Upgrades | Prioritization of repairing and modernizing existing assets over new construction. | Reduces opportunities for large-scale new build projects. | Developed nations allocated significant budgets to renewal in 2024, potentially 60% of budgets. |

| Shifting Public Spending Priorities | Government reallocation of funds to sectors like healthcare and education. | Decreased availability of public funds for large infrastructure projects. | Projected 15% increase in global public health expenditure for 2024. |

Entrants Threaten

The infrastructure construction sector, particularly for large-scale projects, necessitates substantial capital outlays for heavy machinery, advanced technology, and skilled personnel. For instance, a single major bridge or high-speed rail line can easily cost billions of dollars, a sum prohibitive for many newcomers.

New entrants face immense difficulty in replicating the cost advantages derived from economies of scale that established players like China Communications Construction Company (CCCC) enjoy. CCCC's sheer volume of operations allows them to negotiate better prices for materials and equipment, significantly lowering their per-unit costs and creating a formidable barrier.

Successfully executing complex infrastructure projects demands decades of accumulated experience and specialized engineering knowledge. New entrants often lack this deep institutional knowledge and proven track record, making it incredibly challenging to compete for high-value, high-risk contracts that are the lifeblood of companies like China Communications Construction Company (CCCC).

CCCC’s extensive portfolio, including major projects like the Hong Kong-Zhuhai-Macau Bridge, demonstrates a level of operational expertise and risk management that is not easily replicated. For instance, in 2023, CCCC reported revenue of approximately $100 billion, a testament to its capacity to handle large-scale endeavors that deter less experienced competitors.

The infrastructure sector, where China Communications Construction Company (CCCC) operates, is characterized by significant regulatory hurdles and licensing requirements. These stringent rules, covering safety, environmental compliance, and project approvals, act as a substantial barrier to entry for new companies. For instance, in 2024, many major infrastructure projects globally require extensive environmental impact assessments and adherence to national safety standards, which can take years and substantial investment to navigate.

For potential new entrants, understanding and complying with these complex regulatory frameworks, particularly for international projects, represents a formidable challenge. CCCC, with its established experience and resources, is better positioned to manage these demands. The sheer complexity and cost associated with obtaining necessary permits and licenses in diverse jurisdictions deter many smaller or less experienced firms from entering the market.

Established Client Relationships and Government Ties

China Communications Construction Company (CCCC), as a prominent state-owned enterprise, leverages its deeply rooted connections with Chinese government entities and other state-backed organizations. These established relationships, cultivated over many years, translate into significant trust and preferential access to major projects. For instance, CCCC's involvement in numerous national infrastructure initiatives, such as the Belt and Road Initiative, underscores these government ties. In 2023, CCCC secured contracts worth approximately RMB 1.1 trillion, a substantial portion of which are likely linked to these strategic government partnerships.

These long-standing relationships act as a formidable barrier to entry for new competitors. New entrants find it exceptionally challenging to replicate the level of trust and access that CCCC enjoys with key decision-makers and funding bodies. This makes it difficult for them to secure the large-scale, high-value contracts that are crucial for establishing a foothold in the market. The inherent advantage of incumbency and pre-existing networks significantly deters potential new entrants from challenging CCCC's market position.

- Established Government Relationships: CCCC's status as a state-owned enterprise facilitates strong, enduring ties with Chinese government agencies.

- Trust and Preferential Access: Years of successful project delivery have built significant trust, granting CCCC preferential access to major infrastructure contracts.

- Barrier to New Entrants: The difficulty in replicating these entrenched relationships and securing government backing presents a substantial hurdle for new companies entering the market.

- Impact on Market Entry: New companies face significant challenges in competing for large contracts against CCCC due to its established network and government support.

Brand Reputation and Project Track Record

China Communications Construction Company (CCCC) benefits significantly from its established brand reputation and a robust project track record. This is a major barrier for potential new entrants in the infrastructure sector.

Building a comparable reputation for successful project delivery, adherence to safety standards, and consistent quality takes substantial time and investment. For instance, CCCC's involvement in major global projects, such as the Mombasa-Nairobi Standard Gauge Railway in Kenya, showcases its capability and reliability, making it difficult for newcomers to compete for high-value contracts.

New entrants would need to overcome significant hurdles to gain the trust required to win bids and attract skilled personnel. This includes demonstrating a history of delivering complex projects on time and within budget, a feat that often takes years of experience and successful execution. The infrastructure industry heavily relies on proven performance, making brand equity a critical differentiator.

- Brand Equity: CCCC's long history and successful project completions create strong brand loyalty and trust among clients and stakeholders.

- Project Track Record: A demonstrable history of delivering large-scale, complex infrastructure projects globally is a key deterrent for new market entrants.

- Talent Acquisition: A strong reputation makes it easier for established players like CCCC to attract and retain top engineering and management talent, further disadvantaging new firms.

- Client Confidence: Clients in the infrastructure sector often prioritize proven experience and reliability, making it challenging for unproven new entrants to secure contracts.

The threat of new entrants for China Communications Construction Company (CCCC) remains relatively low due to the immense capital requirements and specialized expertise needed in the global infrastructure sector. For example, securing financing for a single large-scale project can easily run into billions of dollars, a significant barrier for any new player.

Economies of scale enjoyed by CCCC, stemming from its vast operational capacity, further solidify this barrier. In 2023, CCCC's revenue exceeded $100 billion, allowing it to negotiate better terms for materials and equipment, thereby lowering its per-unit costs and making it difficult for smaller competitors to match its pricing.

Furthermore, the complex regulatory landscape and stringent licensing processes in many countries, including those for major infrastructure projects in 2024, demand extensive experience and resources to navigate. This, coupled with CCCC's established brand reputation and decades of successful project delivery, like the Hong Kong-Zhuhai-Macau Bridge, creates a formidable challenge for any aspiring competitor seeking to enter the market.

| Barrier to Entry | Description | Impact on New Entrants | CCCC's Advantage |

|---|---|---|---|

| Capital Requirements | Massive upfront investment needed for machinery, technology, and personnel. | Prohibitive for most new firms. | Ability to finance large-scale projects due to financial strength and access to capital. |

| Economies of Scale | Lower per-unit costs achieved through high-volume operations. | New entrants struggle to compete on price. | Negotiating power for materials and equipment, leading to cost efficiencies. |

| Experience and Expertise | Decades of accumulated knowledge in executing complex projects. | Lack of proven track record deters clients. | Demonstrated success in high-risk, high-value projects globally. |

| Brand Reputation | Trust and credibility built through consistent project delivery. | Difficulty in gaining client confidence. | Strong global brand recognition and client loyalty. |

| Regulatory Hurdles | Complex licensing, safety, and environmental compliance. | Lengthy and costly process to obtain approvals. | Established processes and resources to navigate regulatory frameworks efficiently. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for China Communications Construction Company (CCCC) leverages data from CCCC's annual reports, industry-specific publications on infrastructure and construction, and government reports on Chinese economic development and infrastructure spending.